Liposomal Supplements Market Size and Forecast 2025 to 2034

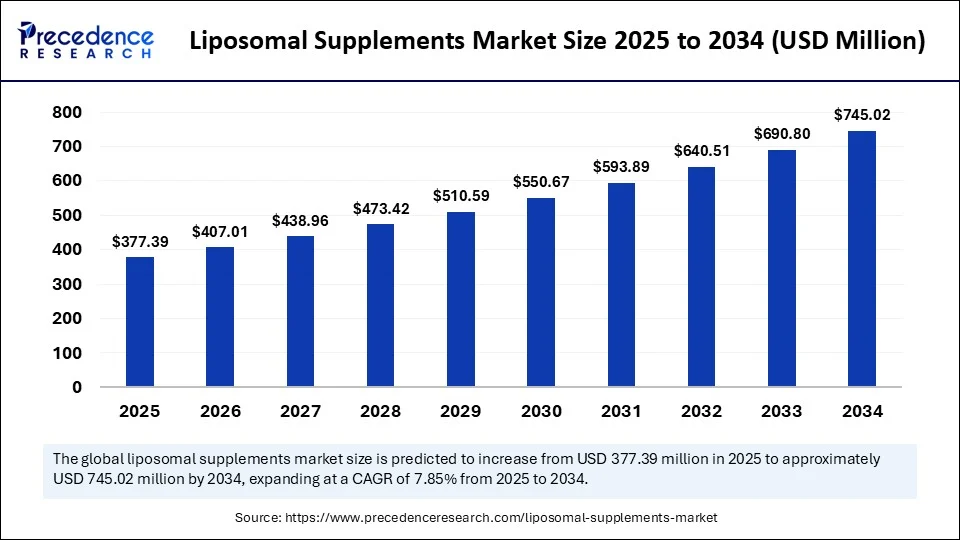

The global liposomal supplements market size was estimated at USD 349.92 million in 2024 and is predicted to increase from USD 377.39 million in 2025 to approximately USD 745.02 million by 2034, expanding at a CAGR of 7.85% from 2025 to 2034. The market growth is attributed to rising consumer demand for high-bioavailability supplements supported by clinical evidence and regulatory validation of liposomal delivery systems.

Liposomal Supplements Market Key Takeaways

- In terms of revenue, the global liposomal supplements market was valued at USD 349.92 million in 2024.

- It is projected to reach USD 745.02 million by 2034.

- The market is expected to grow at a CAGR of 7.85% from 2025 to 2034.

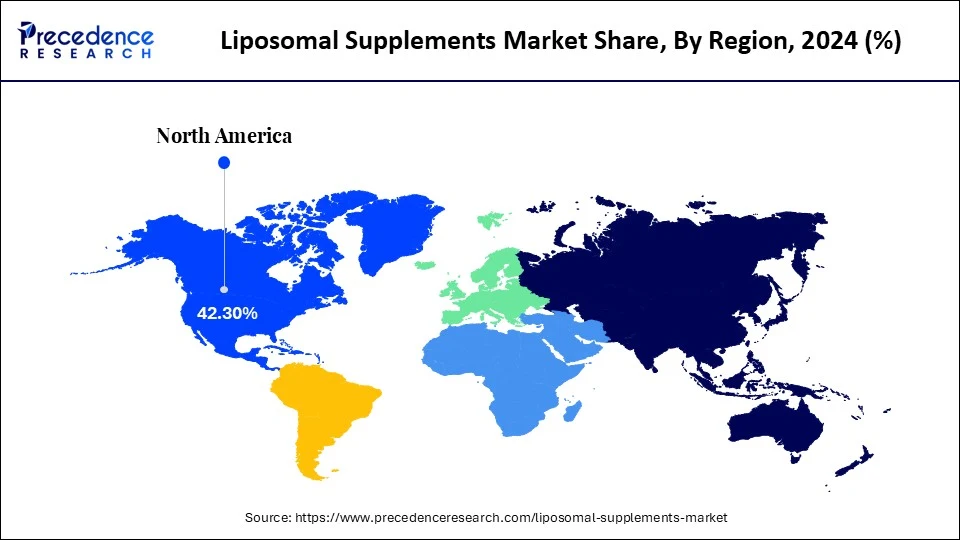

- North America dominated the liposomal supplements market with the largest share of about 42.3% in 2024.

- Asia Pacific is expected to grow at the fastest CAGR from 2025 to 2034.

- By product type, the vitamins segment led the market, under which the vitamin C sub-segment held a 18.7% market share in 2024.

- By product type, the antioxidants segment is expected to grow at the fastest rate, under which the glutathione segment is likely to lead the charge between 2025 and 2034.

- By application, the immune health segment contributed the biggest market share of 24.2% in 2024.

- By application, the cognitive support and brain health segment is expanding at a significant CAGR between 2025 and 2034.

- By formulation type, the liquid segment contributed the highest market share of 41.5% in 2024.

- By formulation type, the capsules/softgels segment is expected to grow at a significant CAGR over the projected period.

- By distribution channel, the online retail (third party) segment held the largest market share of 36.9% in 2024.

- By distribution channel, the direct-to-consumer subscription segment is expected to grow at a notable CAGR from 2025 to 2034.

- By end user, the adults segment generated the major market share of 59.4% in 2024.

- By end user, the athletes/fitness enthusiasts segment is expected to grow at a notable CAGR from 2025 to 2034.

Impact of Artificial Intelligence on the Liposomal Supplements Market

Artificial intelligence (AI) is rapidly transforming the liposomal supplements market by enhancing product development, manufacturing, quality control, and personalization. Companies are increasingly using AI algorithms to review clinical and biochemical indicators. They create the most accurate solutions in the form of liposomal preparations that increase bioavailability and treat a specific health condition. Moreover, brands use AI to create personal supplements, focusing on health data, lifestyle tendencies, and genetic indicators, making products more relevant and consumer-satisfying. AI also accelerates the discovery of new liposomal formulations, leading to increased accessibility to novel products.

U.S. Liposomal Supplements Market Size and Growth 2025 to 2034

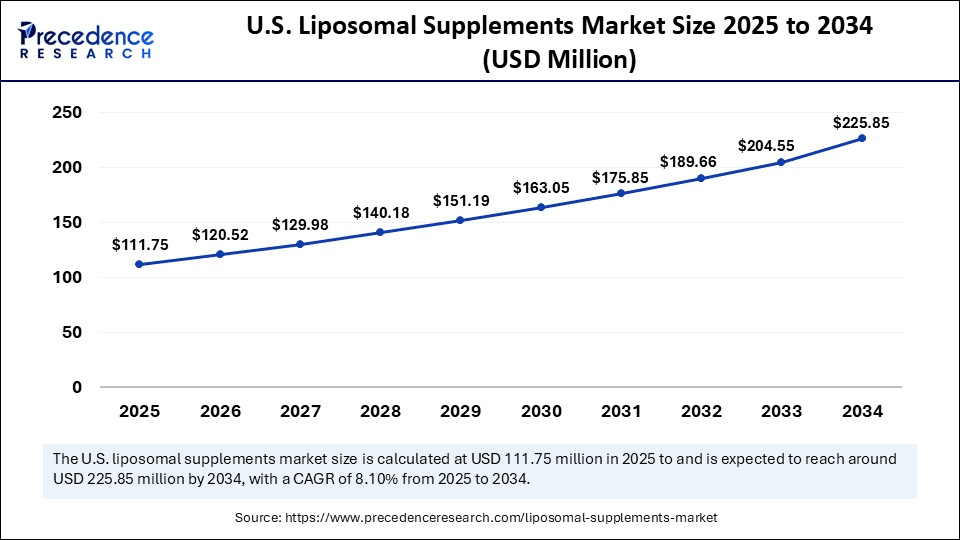

The U.S. liposomal supplements market size was exhibited at USD 103.61 million in 2024 and is projected to be worth around USD 225.85 million by 2034, growing at a CAGR of 8.10% from 2025 to 2034.

How Did North America Maintain Dominance in the Liposomal Supplements Market in 2024?

North America led the liposomal supplements market, capturing the largest revenue share of 42.3% in 2024. This is mainly due to increased consumer awareness, high spending on healthcare, and massive uptake of science-supported nutrition products in the U.S. and Canada. The Council of Responsible Nutrition (CRN), along with the NIH, reported that more than three-quarters of U.S. adult citizens consumed supplements in the year 2024. The region is home to a large number of market players, boosting the development of novel products.

Several market players in the region have expanded their product offerings to meet the increasing consumer demand. Product labeling and transparency on safety also increased, as the regulatory clarity by the U.S. FDA and Health Canada created consumer trust. Furthermore, the North American liposomal products received higher marks in user acceptance, taste stability, and effectiveness, which further supports regional market growth.(Source: https://www.crnusa.org)

Asia Pacific is expected to grow at the fastest rate in the market during the forecast period due to the increasing disposable incomes, rising health awareness, and growing availability of global supplement brands. The advanced formulations saw a rise in demand in countries, including India, China, Japan, and South Korea, as the prevalence of metabolic and digestive wellbeing ailments is on the rise. Additionally, the adoption of liposomal vitamins and antioxidants is higher in Asian populations, which further contributes to market growth. In addition, the rising demand for sports nutrition and personalized nutrition contributes to market growth.

Market Overview

The liposomal supplements market refers to the commercial landscape of dietary and nutraceutical supplements formulated using liposomal encapsulation technology, which enhances the bioavailability and absorption of nutrients. Liposomes are nanoscale spherical vesicles composed of phospholipid bilayers that can encapsulate both water-soluble and fat-soluble compounds, protecting them from degradation in the gastrointestinal tract and ensuring improved cellular delivery. These supplements span a wide range of health categories, including vitamins, minerals, antioxidants, herbal extracts, amino acids, and CBD, among others.

Liposomal formulations are primarily marketed for individuals seeking enhanced absorption, targeted delivery, and superior efficacy in comparison to traditional oral supplements. The market is rapidly expanding due to increased health consciousness, demand for high-efficacy formulations, and growing applications across sports nutrition, preventive health, geriatric care, and functional medicine. The increase in demand for higher nutrient absorption is one of the driving factors in the future market of liposomal supplements. Furthermore, the increasing clinical and regulatory acceptance is also expected to augment market growth, especially with consumers shifting toward formulations with definite health benefits.

Liposomal Supplements Market Growth Factors

- Rising Demand for Personalized Wellness Experiences: Growing consumer preference for AI-driven, interactive platforms is driving adoption of real-time performance tracking and tailored fitness routines.

- Growing Integration of Gamification in Workouts: Fitness brands are fuelling user engagement through immersive gaming elements, boosting workout adherence and long-term platform loyalty.

- Expansion of Virtual Coaching and Remote Training: The shift toward digital personal training is propelling the growth of subscription-based interactive fitness services across global markets.

- Boosting Corporate Wellness Investments: Employers are increasingly investing in interactive wellness solutions to enhance employee productivity and reduce healthcare costs.

Market Scope

| Report Coverage | Details |

| Market Size by 2034 | USD 745.02 Million |

| Market Size in 2025 | USD 377.39 Million |

| Market Size in 2024 | USD 349.92 Million |

| Market Growth Rate from 2025 to 2034 | CAGR of 7.85% |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Product Type, Application, Formulation Type, Distribution Channel, End User, Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

How Is Increasing Demand for Enhanced Bioavailability Supplements Driving Innovation in the Liposomal Supplements Market?

Increasing demand for enhanced bioavailability supplements is expected to drive the growth of the market. The growing interest in using supplements with improved bioavailability contributes to their high demand. Characteristics of formulations are of high importance to consumers and health professionals for effective nutrient absorption. Particularly when the health professionals are dealing with ingredients with low solubility in water, such as vitamin C, glutathione, and curcumin, these nutrients are enclosed with lipid bilayers in liposomal delivery systems and avoid the intense digestive conditions to go directly to the target cells more effectively.(Source: https://www.wbcil.com)

A 2025 study from West Bengal Chemical Industries Limited proved that liposomal vitamin C demonstrated 1.77 times higher bioavailability in comparison to unencapsulated forms. According to a report published in 2024 by the Council for Responsible Nutrition (CRN), more than 75% of adults in the U.S. who take supplements would prefer supplements that have been optimized for absorption. Liposomal formats are coming out as an important innovation in the years to come. Furthermore, the added technological advantage that sets liposomal supplements at a superior level than conventional oral supplements further propels the market in the coming years.(Source:https://www.crnusa.org)

Restraint

Limited Clinical Validation Slows Adoption Among Healthcare Professionals

Limited clinical evidence and long-term studies impede widespread adoption of liposomal supplements among healthcare professionals, thereby hindering the market's growth. Lack of clinical evidence and research on a long-term basis does not allow for wide usage by health care professionals. There has been no clear clinical support to ensure its incorporation in evidence-based treatment regimens, which means its suggested use by physicians and accepted insurance payments are restricted. Furthermore, the high production costs hamper the scalability of liposomal supplement manufacturing and are anticipated to restrict broader market penetration.

Opportunity

How are Surging Investments in Nutraceutical Innovation Advancing Liposomal Supplement Technologies?

Surging investments in nutraceutical innovation are anticipated to drive technological advancement. Multinational organizations are investing tremendous resources in producing the next generation of such liposomal encapsulation methods, such as nanoliposomes and multi-layered vesicles. These innovations are meant to enhance the stability of ingredients, extend the shelf life, and provide controlled release properties. Close tactical alliances among pharmaceutical companies, biotechnology firms, and research organizations are strengthening and expanding the possibility of cross-disciplinary innovations.

- In 2024, Nestle Health Science collaborated with several biotechnology startups to develop lipid-based nanoencapsulation in targeted nutrient delivery, as reported in a publication article by Springer Nature. Furthermore, such advancements point to the widening international support of the necessity of more advanced and clinically proven delivery systems in the science of nutrition.

Product Type Insights

Why Did the Vitamin C Sub-Segment Hold the Major Revenue Share in 2024?

The vitamins segment dominated the liposomal supplements market, in which the vitamin sub-segment held an 18.7% share in 2024. This is mainly due to the heightened consumer awareness of the benefits of vitamin C. The availability of a range of therapeutics and immune supportive products containing vitamin C further bolstered segmental growth. Liposomal vitamin C supplements have excellent bioavailability over traditional ascorbic acid supplements; thus, they promote better absorption and fewer stomach problems.

Scientific evidence endorsed the benefits of liposomal C, as liposomal vitamin C is more effective at raising plasma levels than the standard Vitamin C doses given orally. The Council for Responsible Nutrition (CRN) 2024 report indicated that more than 72% of the users of supplements in the U.S. listed immune health as the top area of concern, and vitamin C was one of the top three most used ingredients. Furthermore, the Larger, well-established brands, including LivOn Labs, Quicksilver Scientific, and NOW Foods, were concentrated on the expansion of their lines of business dealing with liposomal Vitamin C, further facilitating the segment.

The antioxidants segment is expected to grow at the fastest CAGR, under which the liposomal glutathione segment is likely to have a stronghold in the coming years, owing to their oxidative stress, cellular detoxification, and degenerative conditions associated with age, starting to receive increasing attention. Furthermore, the personalized antioxidant therapy with liposomal glutathione, emphasizing its observable increased applicability in the prevention and treatment regimens, thus further fuelling the segment.

Application Insights

How Does the Immune Health Segment Lead the Liposomal Supplements Market in 2024?

The immune health segment led the market while holding the largest revenue share of 24.2% in 2024. This is due to the initiative on a global scale to act on proactive wellness. Consumers preferred supplements that aid immune functionality and contain liposomal vitamin C, elderberry extract, and zinc, which ensures improved absorption and a quick physiological response.

Quicksilver Scientific, livOn Labs, and Nature Bounty brands all noted the rising sales of their liposomal immune support formulas, which also added to good retail results and subscriptions. Moreover, the World Health Organization (WHO) in 2024 confirmed that micronutrient deficiencies have been a problematic issue globally, further facilitating demand for liposomal supplement immune health products in the coming years.

The cognitive support segment is expected to grow at the fastest rate in the coming years, owing to the increasing apprehensions about cognitive decline, mental fatigue, and neurological disorders among aging and high-stress demographics. Liposomes, with their bioavailability and central nervous system availability, benefit the brain and provide better support to memory, focus, and neuroprotection. Furthermore, the Clinical trials to combat early cognitive impairment began in 2024 with liposomal formulations, further boosting the growing utilization of liposomal supplements or products for cognitive support treatment.

Formulation Type Insights

What Made Liquid the Dominant Segment in the Liposomal Supplements Market in 2024?

The liquid segment dominated the liposomal supplements market in 2024, holding a market share of about 41.5%, due to the greater levels of absorption and the fact that users prefer easy-to-swallow formats, especially among the geriatric and pediatric groups. Liquid liposomal products have the advantage of being delivered into the system faster than other nutrients. Such Vitamin C, glutathione, and magnesium attract more health-conscious consumers who want to experience nutrients absorbed into the body fast. Furthermore, the increased preference for liposomal liquids, driven by their taste-neutral forms and the direct effect, is fuelling the segment.

- In 2024, manufacturers such as LivOn Labs, Quicksilver Scientific, and NOW Foods extended their line of liquids in response to consumer demand for convenient on-the-go immune support and energy boosters.

In May 2023, Quicksilver Scientific, Inc. and Ananda Health formed a strategic partnership under which Ananda Health will manufacture Quicksilver Scientific's newly reformulated fast-acting CBD gummies, targeting a June 2023 launch. These advanced CBD gummies integrate Quicksilver Scientific's innovative liposomal ingredient technology with Ananda Health's top-tier manufacturing capabilities to provide consumers with a premium, third-party tested hemp wellness product.

The capsules/softgels segment is expected to grow at the fastest CAGR during the forecast period, owing to the rise of the rising demand for precision dosing, shelf-stable foods, and convenience among working professionals and traveling individuals. Due to their controlled-release capabilities and superior stability, capsules are in high demand. Additionally, rising demand for plant-based capsules supports segmental growth. Higher patient compliance associated with capsules further increases their demand.

Distribution Channel Insights

Why Was Online Retail the Preferred Distribution Channel in 2024?

The online retail segment held the largest revenue share of the liposomal supplements market in 2024 due to the growing preference for online shops, such as Amazon, iHerb, and Vitacost, that provide a wide range of liposomal product offerings with verified customer feedback, affordable costs, and worldwide shipping opportunities. The impact of the COVID-19 pandemic remained, shaping consumer behavior in 2024, as many supplement buyers prefer the online experience and a faster way to compare the products.

Companies have focused on building third-party partnerships, seeking to meet the rising international demand, especially in North America, Western Europe, and Asian countries. According to the 2024 United States Pharmacopeial Convention (USP) report, there was a significant increase in consumer interest in health and wellness products trending on social media. The surge of third-party online shopping platforms, such as Amazon, supports segmental growth. Furthermore, the European Food Safety Authority (EFSA) witnessed that EU-based consumers were more attracted to web-based sources of easily understandable ingredient disorders and certified manufacturing processes.

The direct-to-consumer (DTC) segment is expected to grow at the highest CAGR over the projection period, as more consumers are demanding individualized wellness plans, easy auto-refills, and increased brand transparency. Firms, such as Athletic Greens, Ritual, and Rootine, bypassed DTC in 2024 and offered AI-based health evaluation and monthly shipments of liposomal supplements made to one-on-one health objectives. Additionally, the customized DTC models were leading to much better adherence and long-term retention to supplements, especially in millennials and Gen Z customers, further boosting the segment in the coming years.

End User Insights

What Made Adults the Largest End User Group in the Liposomal Supplements Market in 2024?

The adults segment dominated the liposomal supplements market, accounting for an estimated 59.4% share in 2024, as people become more aware of age-related nutritional gaps, chronic disorders, and immune response support. The health and wellness trend has driven adults' interest toward liposomal supplements, particularly vitamins C, D, B-complex, and magnesium. Furthermore, to meet the health needs of adults, they are shifting toward liposomal supplement products, further facilitating the segmental growth.

The athletes / fitness enthusiasts segment is expected to grow at the fastest rate in the coming years, owing to the growing consumer demand for supplements that are performance-enhancing and that have faster absorption and fewer gastrointestinal incidents. Athletes favored liposomal glutathione, CoQ10, and amino acids to aid with muscle recuperation, mitochondrial and cell recovery functions. Furthermore, the increasing adoption of clinically-based, vegetable-based products, and NSF-certified products in high-performance sports circles further boosts the demand for liposomal supplements in this age group.

Liposomal Supplements Market Companies

- Altrient (by LivOn)

- Amandean

- Aurora Nutrascience

- BioCeuticals

- Core Med Science

- Cymbiotika

- DaVinci Laboratories

- Designs for Health

- Dr. Mercola

- Elyptol

- Empirical Labs

- LipoLife

- LivOn Labs

- Nutrivene

- Pure Encapsulations

- Quicksilver Scientific

- Seeking Health

- SMP Nutra

- Thorne HealthTech

- Valimenta Labs

Recent Developments

- In August 2024, INJA Wellness launched INJA Glow, India's first Liposomal Glutathione Effervescent Tablets, designed to enhance radiant skin, improve immunity, reduce acne scars, and lower oxidative stress. This pioneering product adds to INJA Wellness' legacy, known for debuting India's first Japanese Collagen and Vegetarian Collagen. Glutathione, a powerful antioxidant produced naturally by the body, plays a vital role in detoxification, immune support, and cellular repair. It reduces free radicals and melanin production, helping to even skin tone and boost natural glow. (Source:https://health.economictimes.indiatimes.com)

- In December 2024, TCI Co., Ltd. (“TCI Biotech”), a global CDMO leader in wellness innovation, reintroduced double NUTRI, a cutting-edge liposomal technology that redefines advanced nutritional supplementation. double Nutri offers superior bioavailability and absorption, giving consumers more effective tools to elevate health outcomes.(Source:https://www.tci-bio.com)

- In May 2025, Boots unveiled its new wellness brand, Modern Chemistry, which includes nine ingredient-focused, science-driven supplements now available in stores and on boots.com. Created by an expert in-house team of pharmacists, doctors, and chemists, the line boasts high-potency, naturally sourced extracts with high bioavailability. Some products are formulated for easier digestion and stomach tolerance, appealing to a broad, health-conscious audience.(Source: https://www.boots-uk.com)

Latest Announcement by Industry Leader

- In April 2025, PharmaLinea is set to introduce a new line of private label supplements utilizing advanced liposomal delivery technology. The liposomal delivery technology featured in latest innovations, >Your< Lipo-Mag Orosticks and >Your< Lipo-C Orosticks, ensures superior absorption compared to conventional supplementation, ultimately offering a more enjoyable and effective user experience, stated Veronika Pipan, Head of Scientific Support at PharmaLinea. Moreover, few liposomal magnesium or vitamin C products currently exist in direct stick format. This positions the company's newest innovations as a compelling alternative to capsules or tablets, which are often difficult to consume. Both products are delivered in a flavorful orodispersible powder format and incorporate PharmaLinea's proprietary, branded liposomal ingredients, QlipoMg and QlipoC. This allows brands to pursue unique positioning and stronger differentiation within their respective markets, added Matev� Ambro�i?, Marketing Director at PharmaLinea.(Source: https://www.ingredientsnetwork.com)

Segments Covered in the Report

By Product Type

- Vitamins

- Vitamin C (Ascorbic Acid)

- Vitamin D3

- Vitamin B12

- Multivitamins

- Others

- Minerals

- Magnesium

- Zinc

- Iron

- Others

- Antioxidants

- Glutathione

- Coenzyme Q10 (CoQ10)

- Alpha Lipoic Acid

- Others

- Herbal Extracts

- Curcumin

- Ashwagandha

- Ginseng

- Others

- Fatty Acids & Oils

- Omega-3 (DHA/EPA)

- Phosphatidylcholine

- Others

- Amino Acids & Peptides

- L-Carnitine

- L-Theanine

- Glutamine

- Others

- Cannabinoids

- Liposomal CBD

- Others

- Probiotics & Enzymes

- Others (e.g., Melatonin, NAD+, NMN, Resveratrol)

By Application

- General Health & Wellness

- Immune Health

- Anti-Aging & Skin Health

- Cognitive Support & Brain Health

- Cardiovascular Health

- Sports Nutrition & Recovery

- Stress & Sleep Management

- Digestive Health

- Others

By Formulation Type

- Liquid

- Gel

- Powder (Reconstitutable)

- Capsules / Softgels

- Sprays / Oral Pump Dispensers

- Others

By Distribution Channel

- Online Retail

- Brand-owned E-commerce

- Third-party E-commerce (Amazon, iHerb, etc.)

- Offline Retail

- Health & Wellness Stores

- Pharmacies / Drugstores

- Supermarkets / Hypermarkets

- Others

- Practitioner / Clinic-Based Sales

- Direct-to-Consumer (DTC) Subscriptions

By End User

- Adults

- Geriatric Population

- Pediatrics

- Athletes / Fitness Enthusiasts

- Pregnant & Lactating Women

- Others

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East & Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting