Logistics Robotics Market Size and Forecast 2025 to 2034

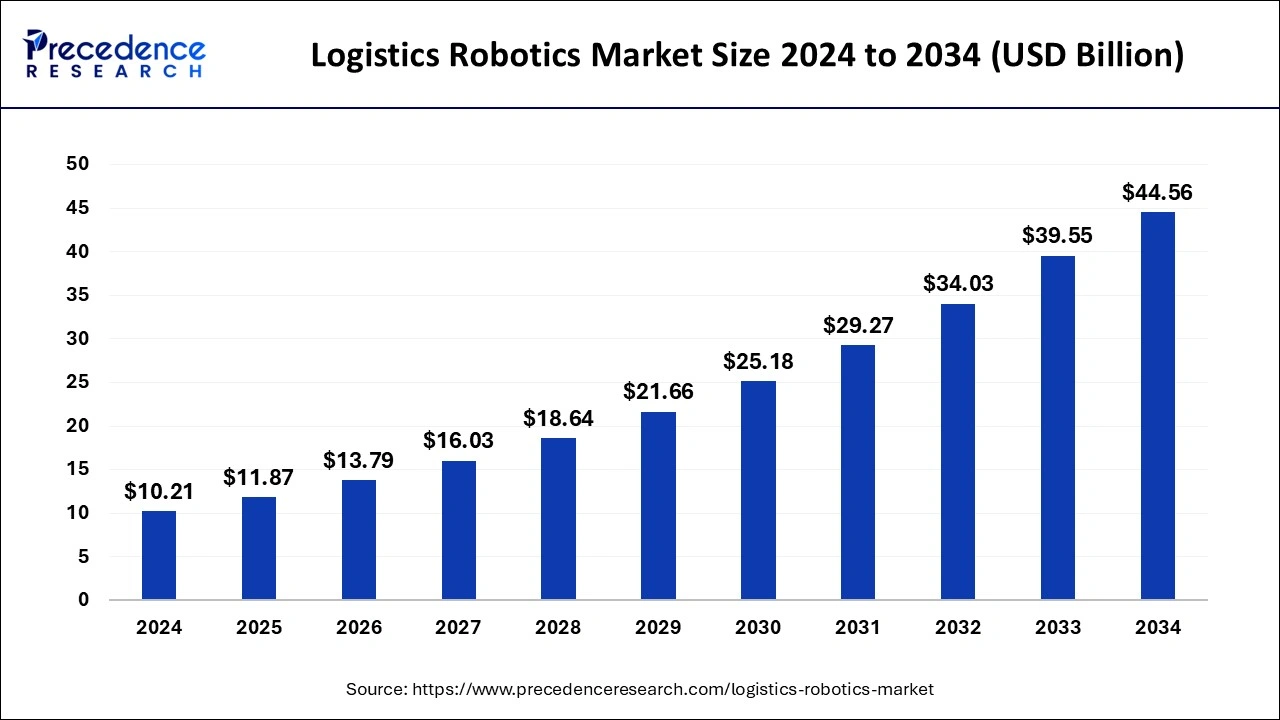

The global logistics robotics market size was calculated at USD 10.21 billion in 2024 and is predicted to increase from USD 11.87 billion in 2025 to approximately USD 44.56 billion by 2034, expanding at a CAGR of 15.88% from 2025 to 2034.

Logistics Robotics MarketKey Takeaways

- The global logistics robotics market was valued at USD 10.21 billion in 2024.

- It is projected to reach USD 44.56 billion by 2034.

- The logistics robotics market is expected to grow at a CAGR of 15.88% from 2025 to 2034.

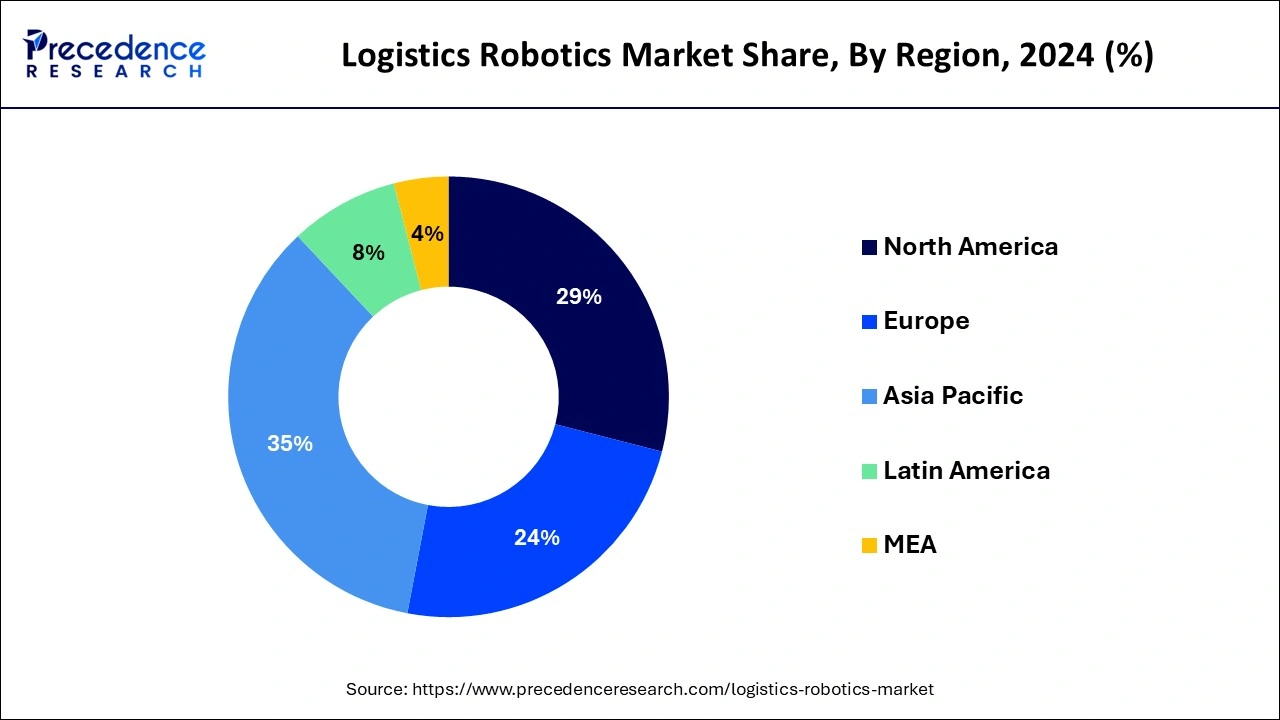

- Asia Pacific held the dominating share of the market with 35% in 2024.

- North America is projected to grow with the highest CAGR during the forecast period.

- By robot type, the automated guided vehicles segment held the largest share of the market in 2024.

- By robot type, the robot arm segment is observed to experience significant growth at a notable CAGR over the forecast period.

- By application, the pick and place segment dominated the market with the largest share in 2024.

- By application, the transportation segment is the fastest-growing segment during the forecast period.

- By end-users, the e-commerce segment held the dominating share of the market in 2024.

- By end-users, the healthcare segment is the fastest-growing segment during the forecast period.

Asia PacificLogistics Robotics Market Size and Growth 2025 to 2034

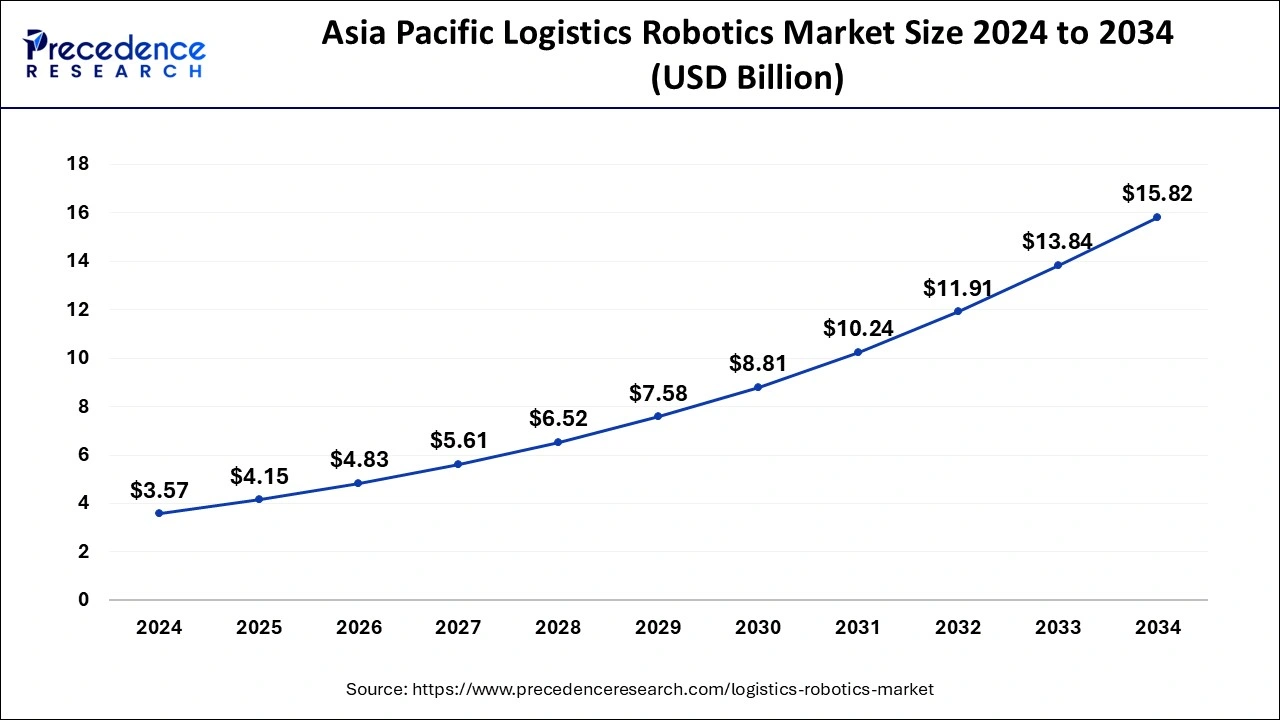

The Asia Pacific logistics robotics market size was exhibited at USD 3.57 billion in 2024 and is projected to be worth around USD 15.82 billion by 2034, growing at a CAGR of 16.05% from 2025 to 2034.

Asia Pacific held the largest market share of 35% in 2024, owing to factors such as urbanization, industrialization, and the increasing adoption of automation across various industries. Asia offers significant opportunities for the deployment ofrobotics technology in logistics operations, with its vast manufacturing base, burgeoning e-commerce sector, and expanding logistics networks. Countries like China, Japan, South Korea, and Singapore are leading the way in the adoption and development of logistics robotics solutions in Asia Pacific.

Chinese Robust E-commerce Sector: Drives Demand for Logistics Robotics

China has emerged as a major player in the global logistics robotics market owing to its massive e-commerce market and ambitious initiatives to modernize its logistics infrastructure.E-commerce giants in Asia Pacific are investing heavily in robotics and automation to enhance warehouse efficiency, speed up order fulfillment, and cope with the growing volume of online orders. Manufacturers in the region are also embracing robotics technology to improve productivity, quality, and safety in production processes. Additionally, the government initiatives, including ‘Made in China', foster the development of high-technology-enabled logistic robotics.

- In November 2024, JD Logistics introduced its "Zhilang" automated warehousing solution at CeMAT ASIA 2024. Zhilang is designed to improve picking efficiency by over three times compared to traditional methods and support operations during the Singles Day Grand Promotion.

The logistics robotics market in North America is observed to expand at a robust pace owing to the region's robust adoption of automation and robotics technology. This is due to the presence of numerous technology companies, a well-established logistics infrastructure, and a focus on enhancing productivity and efficiency. Logistics robotics are extensively used in various sectors, such as e-commerce, manufacturing, retail, and healthcare.

For example, e-commerce companies use robotics solutions to optimize their warehouse operations, accelerate order fulfillment, and cope with high online demand. In manufacturing, robotics technology automates material handling, assembly, and packaging processes, thereby improving productivity. Retailers also rely on robotics for inventory management, order picking, and customer service.

North America is also witnessing substantial investments in research and development to drive innovation in logistics robotics technology. Many companies are creating cutting-edge robotics systems that leverage artificial intelligence, machine learning, and sensor technology to enhance performance, adaptability, and safety in logistics operations.

United States Logistics Robotics Market & Trends

The United States is the home of technological developments. Early adoption id logistic robotics and companies' investments in automation and robotics to improve efficiency and cost-effectiveness are the key factors driving market growth. Additionally, Government support and funding for research and development foster the development of innovative logistics robotics in the country. For example, government programs like the Manufacturing USA institutes and the CHIPS and Science Act are encouraging the adoption of logistics robotics in the manufacturing industry.

Industrial Automation Growth: High Adoption of Logistics Robotics in Europe

Europe is anticipated to witness notable growth in the forecast period due to the region's strong industrial automation tradition, robust manufacturing industry, and e-commerce growth. Industrial automation is driving the adoption of logistic robotics to enhance efficiency and productivity in warehouses, manufacturing facilities, and logistics centers. European sustainability trends further contribute to the adoption of logistics robotics, as this robotics can reduce energy consumption and waste.

Germany is the major player in the regional market, growth driven by increased focus on efficiency and automation. Germany is the leader in industrial automation and logistics robotics. Several key vendors are investing heavily in innovative solutions to improve automation and sustainable practices. The high demand for automation in the strong manufacturing sector of Germany is driving the adoption of logistics robotics.

Market Overview

The logistics robotics market encompasses the development, production, and implementation of robotic systems and automation technology designed to optimize various aspects of logistics operations, such as warehouse management, material handling, order fulfillment, and transportation. These robotics solutions consist of advanced technologies like autonomous mobile robots, robotic arms, and automated guided vehicles (AGVs) that improve the efficiency, accuracy, and speed of moving and handling goods throughout the supply chain.

Logistics Robotics MarketGrowth Factors

- The exponential rise in e-commerce has necessitated the deployment of advanced logistics systems that can efficiently manage and process large volumes of orders and deliveries.

- The logistics industry is witnessing a significant rise in labor costs and a shortage of skilled labor in certain regions. To address this issue, many logistics companies are adopting robotics and automation solutions to automate repetitive and labor-intensive tasks.

- Technological advancements in robotics, particularly in artificial intelligence, machine learning, and sensor technology, have paved the way for the development of more sophisticated and capable robotics solutions for logistics applications.

- The logistics robotics market is gaining popularity among businesses looking to enhance their operations. These robots offer numerous advantages over traditional manual processes, including improved efficiency, accuracy, and productivity.

- The expanding reach of supply chains across the globe and the growing intricacy of logistics networks necessitate the use of versatile and adjustable robotics solutions that can perform a wide range of tasks and operate in diverse environments.

- Efforts by the government to provide support for automation, along with investment incentives and regulatory measures aimed at enhancing safety and efficiency, can play a vital role in driving the widespread adoption of robotics technology in the logistics industry.

Market Scope

| Report Coverage | Details |

| Growth Rate from 2025 to 20344 | CAGR of 15.88% |

| Market Size in 2025 | USD 11.87 Billion |

| Market Size by 2034 | USD 44.56 Billion |

| Largest Market | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Robot Type, Application, and End User |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Driver

Rapid expansion of e-commerce

The e-commerce industry has experienced a remarkable surge in online orders and deliveries in recent years, leading to an enormous demand for efficient and dependable logistics solutions that can manage the ever-increasing volume of orders. The logistics robotics market has emerged as a game-changing technology that offers adaptable and scalable automation solutions to meet the evolving needs of e-commerce businesses. With the use of robotics, e-commerce companies can optimize their logistics operations, reduce errors, and expedite the delivery process. By leveraging robotics technology, they can ensure that their customers receive their orders promptly and accurately, thereby enhancing customer loyalty and sales.

- In May 2023, Shopify announced its plan to divest its logistics business to Flexport and lay off 20% of its workforce. This strategic move will enable Shopify to focus on its core e-commerce platform and streamline its operations. The divestiture will also allow Flexport to expand its logistics services and enhance its offerings with the addition of Shopify's logistics capabilities. The workforce reduction is part of Shopify's efforts to optimize its resources and improve its profitability amid a rapidly changing e-commerce landscape.

Restraint

High initial investment

Implementing automation and robotics systems in logistics operations can be a major challenge for businesses, particularly for small and medium-sized enterprises (SMEs), due to the high upfront costs involved. The purchase and installation of such systems require significant financial resources, including hardware and software, installation, maintenance, and personnel training. Although the long-term benefits of automation and robotics systems are undeniable, such as improved efficiency, accuracy, and speed, many businesses find it difficult to justify the initial investment required. As a result, it is essential to find ways to reduce the upfront costs and make these technologies more accessible to SMEs, which is crucial for achieving wider adoption and success in the logistics industry. Thereby, such high initial investment is observed to act as a restraint for the logistics robotics market.

Opportunity

Government support and incentives

Governments worldwide have launched initiatives to promote automation and robotics technology in the logistics industry. These initiatives include investment incentives and regulations that aim to enhance safety and efficiency in logistics operations. By adopting robotics technology, logistics companies can significantly increase their productivity and streamline their operations, which can help them expand their market presence by providing a competitive edge over their rivals. Companies that embrace robotics technology can gain significantly from these government initiatives, which can help them achieve their business objectives and stay ahead of the curve in the ever-evolving logistics industry.

- In May 2023, Beijing announced the establishment of a US$1.4 billion robotics fund aimed at promoting the development and growth of the robotics industry in the city. The fund is part of Beijing's ambitious plan to position itself as an 'international industrial highland' for robotics, with a focus on advanced robotics technologies and their application in various sectors such as manufacturing, healthcare, and transportation. The move is expected to attract investment and talent to Beijing, as well as accelerate the city's progress towards becoming a leading global hub for robotics innovation and development.

Robot Type Insights

Automated guided vehicles (AGVs) is the largest segment in the logistics robotics market as they provide an efficient and safe way of transporting goods within a facility. AGVs are equipped with advanced sensors and control systems that enable them to move autonomously, following a pre-defined path or markers. These vehicles use various navigation technologies like laser, magnetic tape, and vision systems to determine their location and direction accurately.They also can communicate with other devices in the facility to coordinate their movements, making them a reliable and efficient solution for material handling automation. AGVs are widely used in industries such as manufacturing, logistics, and warehousing, where they help reduce labor costs and improve productivity. Moreover, AGVs can operate in a variety of environments and can be customized to suit specific applications, making them a versatile and cost-effective solution for businesses.

The robotic arms are accounted for as the fastest-growing segment of the market. Robotic arms are manipulator arms equipped with grippers or tools to perform various tasks such as picking, packing, and palletizing. These arms are highly versatile and efficient as they can be programmed to perform different functions. They are extensively used in warehouses and distribution centers to automate the process of handling goods, which saves time and reduces the risk of human error and injury. With the rising demand for faster and more accurate logistics operations, the popularity of robotic arms is increasing, and they are expected to witness continued growth in the coming years.

Applications Insights

The pick & place segment is the largest segment within the logistics robotics market and is primarily used in warehouse automation and manufacturing environments. This segment involves the deployment of robots to efficiently pick up items from one location and place them in another, often requiring precision and speed in repetitive tasks. In warehouse settings, pick & place robots are used for tasks such as order picking, where they navigate aisles to select items from shelves and place them into containers or onto conveyors for further processing. These robots are essential in improving order fulfillment accuracy and reducing the time required to assemble customer orders.

The transportation segment is expected to witness significant growth in the forecast period. Robotics technology is increasingly being adopted in transportation logistics, providing innovative solutions to optimize the movement of goods and materials across various stages of the supply chain. Automated guided vehicles (AGVs) are another form of robotics technology widely used in warehouses and factories. These vehicles are equipped to follow predefined routes to transport materials and products, reducing the risk of accidents and streamlining material handling processes. As the transportation sector continues to evolve with advancements in robotics technology, businesses can reap the benefits of increased automation, cost savings, and improved supply chain agility.

End-users Insights

The e-commerce segment held the largest share of the logistics robotics market in 2024. The logistics robotics industry is currently experiencing a notable increase in demand, which is predominantly driven by the e-commerce segment. Due to the high volume of incoming orders and the need to optimize their order fulfillment process, online retail companies require advanced robotics solutions that can manage their logistics operations. Consequently, there has been a surge in demand for robotics technology in this industry. The automation capabilities of robotics technology provide e-commerce businesses with an opportunity to streamline their operations, reduce costs, and enhance the overall efficiency of their logistics processes. This trend is expected to continue as more businesses adopt robotics technology to cater to the growing e-commerce market.

The healthcare is the second largest segment leading the market. Hospitals and medical institutions are increasingly adopting robotics technology to manage a wide range of tasks, including medication delivery, logistics management, and patient care assistance. The use of robotics in healthcare has proven to be highly effective in improving patient safety, enhancing medication delivery accuracy and speed, and reducing the workload of healthcare personnel. By automating routine tasks such as inventory management and supply transportation, healthcare facilities can optimize staff time and resources to focus on more complex and critical tasks.

Recent Developments

- In December 2023, Helsinki launched the second phase of its delivery robot pilot program. The program is to test the effectiveness of autonomous robots in delivering goods within the city. This phase will focus on evaluating the robots' ability to navigate through varied terrains, handle unexpected obstacles, and optimize delivery routes for maximum efficiency. The data collected from this pilot program will be used to improve the design and functionality of the robots, paving the way for the widespread adoption of autonomous delivery systems in the future.

- In September of 2023, Stow Robotics underwent a rebranding as Movu Robotics and released a new generation of their picking robot. The updated robot boasts several technical improvements, including enhanced accuracy and speed, as well as improved machine learning algorithms to better handle a wider variety of items. These enhancements have enabled Movu Robotics to provide a more efficient and adaptable solution for automated warehouse order fulfillment.

- In March 2023, Unbox Robotics will be introducing UnboxSort, a new automated sorting system, to the US market. The system is designed to efficiently sort items based on their size, shape, and weight, using advanced computer vision and machine learning algorithms. With its modular design and flexible configuration options, UnboxSort can be easily integrated into existing warehouse operations, allowing for faster and more accurate processing of orders.

Logistics Robotics Market Companies

- KUKA AG

- Kawasaki Heavy Industries, Ltd.

- Yaskawa America, Inc.

- FANUC CORPORATION

- Toshiba Corporation

- Vecna Robotics

- Omron Corporation

- Dematic

Segments Covered in the Report

By Robot Type

- Autonomous Mobile Robots

- Robot Arms

- Others

- Automated Guided Vehicles

By Application

- Pick and Place

- Palletizing and Depalletizing

- Transportation

- Packaging

By End User

- E-commerce

- Healthcare

- Warehouse

- Hospitality

- Others

By Geography

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting