What is the Logistics Software Market Size?

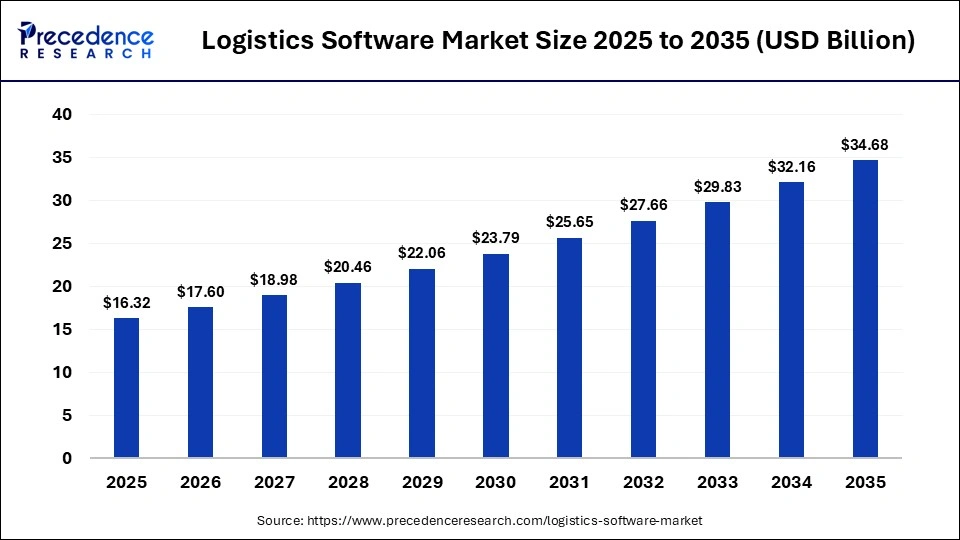

The global logistics software market size accounted for USD 16.32 billion in 2025 and is predicted to increase from USD 17.60 billion in 2026 to approximately USD 34.68 billion by 2035, expanding at a CAGR of 7.83% from 2026 to 2035. This market is growing due to increasing demand for real-time supply chain visibility, route optimization, and cost-efficient transportation management.

Market Highlights

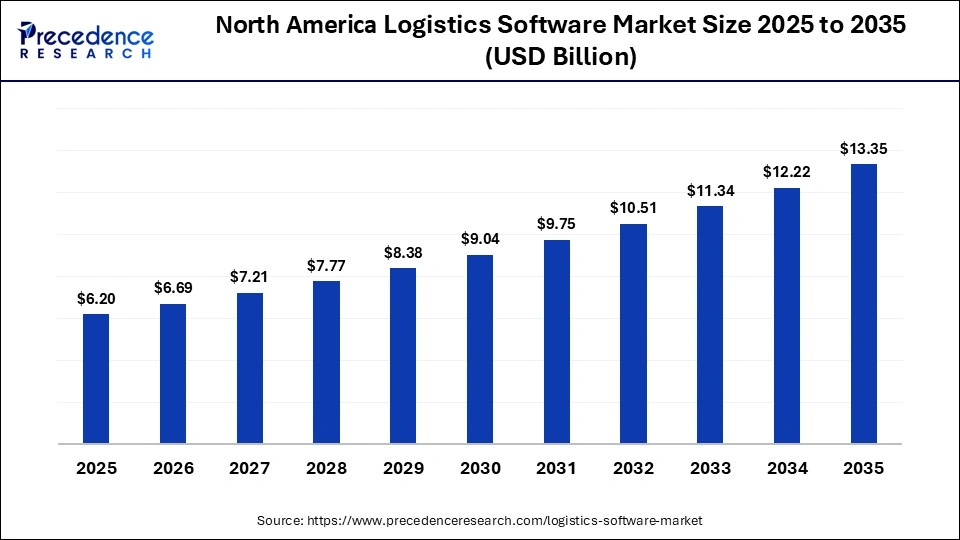

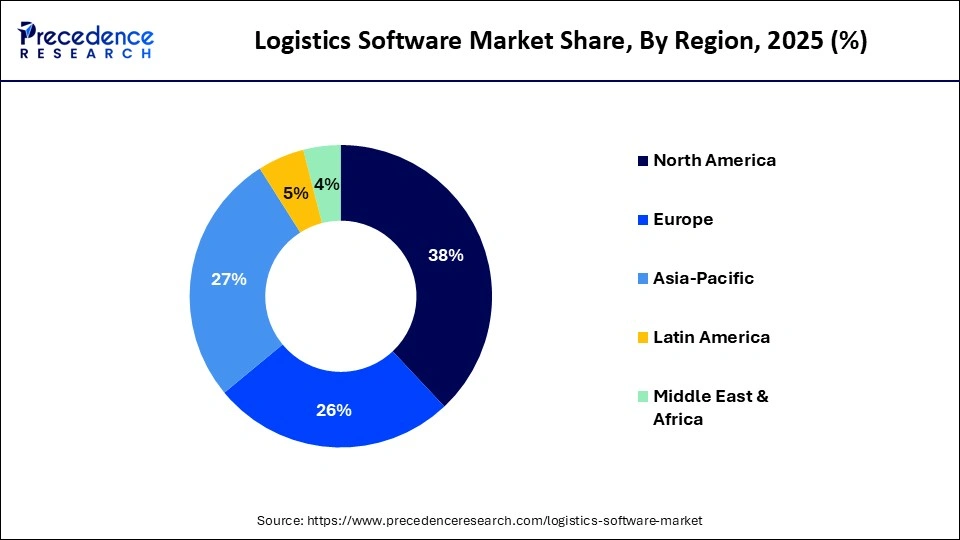

- North America dominated the logistics software market with a revenue share of approximately 38% in 2025.

- Asia Pacific is expected to grow at the fastest CAGR between 2026 and 2035.

- By software type, the transportation management system (TMS) segment held the biggest market share of approximately 27% in 2025.

- By software type, the supply chain visibility & tracking software segment is expected to expand at the fastest CAGR between 2026 and 2035.

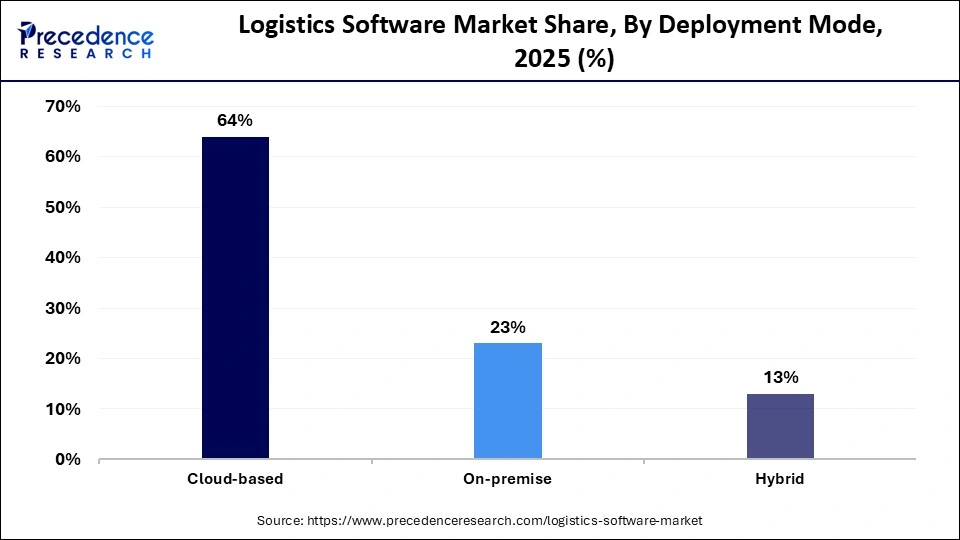

- By deployment mode, the cloud-based segment contributed the highest market share of approximately 64% in 2025.

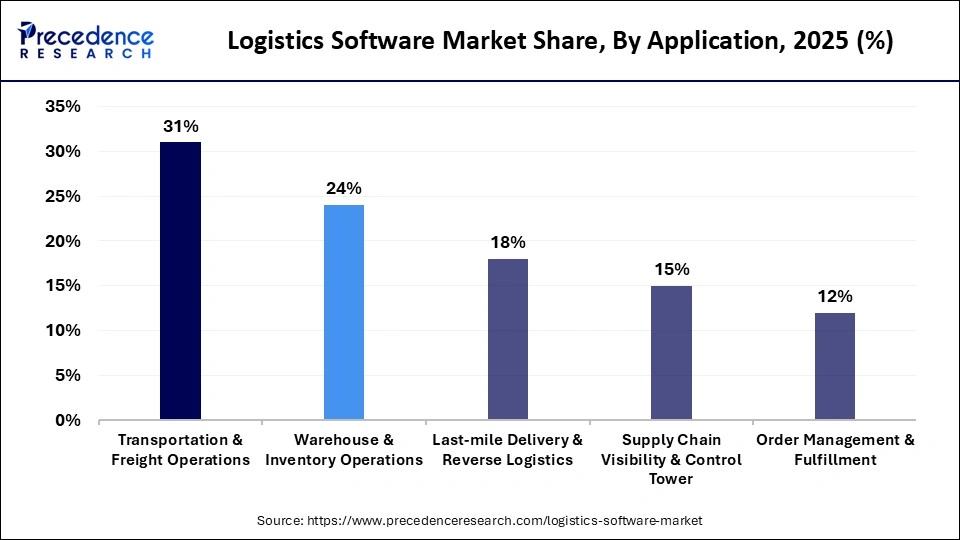

- By application, the transportation & freight operations segment held a major market share of approximately 31% in 2025.

- By application, the last-mile delivery & reverse logistics segment is expected to expand at the fastest CAGR from 2026 to 2035.

- By functionality, the tracking & real-time visibility segment held the biggest market share of approximately 24% in 2025.

- By functionality, the analytics & reporting segment is expected to expand at the fastest CAGR between 2026 and 2035.

Market Overview

The logistics software market is experiencing steady growth as companies increasingly adopt digital platforms to manage order fulfillment, transportation, warehousing, and inventory more efficiently. Businesses are investing in advanced logistics software solutions that enhance visibility, reduce costs, and improve delivery performance. The market growth is also driven by rising e-commerce activity, complex global supply chains, and the growing demand for real-time tracking and data-driven analytics.

Freightos is a real‑world example of a company transforming global logistics through its digital platform. Freightos operates an online marketplace and SaaS platform that connects airlines, ocean liners, trucking carriers, freight forwarders, and importers/exporters, enabling real‑time pricing, booking, and shipment tracking across modes of transport worldwide. By digitalizing freight transactions and providing visibility into pricing and routing, Freightos helps streamline cross‑border logistics, reduce costs, and improve delivery performance for thousands of businesses globally.

How is Logistics Software Reshaping Modern Supply Chains?

Logistics software is reshaping modern supply chains by transforming how businesses plan, execute, and monitor the movement of goods. Advanced platforms provide real-time visibility across inventory, shipments, and transportation, enabling proactive decision-making and reducing delays. Automation and AI-driven analytics optimize routes, warehouse operations, and order fulfillment, lowering costs while improving efficiency.

What are the Major Trends Impacting the Market?

- There is a growing adoption of cloud-based logistics and transportation management solutions. This allows companies to scale operations quickly, reduce IT costs, and access systems remotely.

- The use of AI and machine learning for demand forecasting and route optimization is increasing. These technologies help reduce delivery times, fuel consumption, and operational inefficiencies.

- Rising integration of real-time tracking and visibility tools across supply chains also contributes to the market. Businesses gain better control over shipments, improve customer transparency, and reduce delays.

- Expansion of automation in warehouses and freight management software is another major trend in the market. Automation minimizes manual errors and improves speed in handling high-order volumes.

- There is a strong focus on last-mile delivery optimization, driven by e-commerce growth. Companies are investing in software to manage fast, flexible, and cost-effective final deliveries.

- Adoption of data analytics for cost control and performance monitoring drives the market growth. Advanced analytics support better decision-making and identification of process bottlenecks.

- Integration of logistics software with ERP and e-commerce platforms ensures seamless data flow and end-to-end supply chain coordination.

Future Growth Outlook

- Growing adoption of digital logistics platforms by small and mid-sized enterprises seeking cost-efficient operations.

- Rising demand for AI-powered route planning and predictive analytics to improve delivery performance.

- Expansion opportunities in emerging markets due to increasing trade and infrastructure development.

- Increasing need for integrated logistics software supporting end-to-end supply chain visibility.

- Opportunities for sustainability-focused solutions, including fuel optimization and carbon footprint tracking.

- The growing demand for last-mile delivery software is driven by e-commerce and quick commerce growth.

How is AI Influencing the Logistics Software Market?

AI is significantly influencing the market by enabling smarter, faster, and more predictive supply chain operations. Machine learning algorithms analyze vast amounts of data to optimize routing, forecast demand, and manage inventory with higher accuracy. AI-powered automation also enhances warehouse operations, shipment tracking, and customer service, reducing errors, cutting costs, and improving overall delivery performance.

What ROI Benefits are Driving Investment in the Logistics Software Market?

Logistics software delivers strong ROI by optimizing transportation costs, enhancing real-time visibility across supply chains, and improving route planning. Cutting-edge solutions such as transportation management systems, tracking software, and analytics platforms help lower fuel expenses, reduce delays, and minimize errors from manual processes. By boosting operational efficiency, customer satisfaction, and data-driven decision-making, logistics software enables quicker cost recovery and drives long-term profitability for shippers and logistics providers.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 16.32 Billion |

| Market Size in 2026 | USD 17.60 Billion |

| Market Size by 2035 | USD 34.68 Billion |

| Market Growth Rate from 2026 to 2035 | CAGR of 7.83% |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | Software Type, Deployment Mode, Application, Functionality, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Role of Logistics Software in Driving Sustainability

| Sustainability Area | How Logistics Software Helps | Operational Impact | Measurable Outcomes |

| Route Optimization | Uses intelligent routing to select fuel-efficient paths and avoid congestion hotspots | Reduces unnecessary travel distance and improves delivery planning | Lower fuel consumption & COâ‚‚ emissions across transport networks |

| Load & Capacity Utilization | Optimizes vehicle load planning, consolidation, and shipment sequencing | Minimizes empty or partially filled trips and improves asset usage | Reduced carbon footprint per shipment and better energy efficiency |

| Fuel & Emissions Monitoring | Tracks fuel usage and emission data in real time across fleets and carriers | Improves visibility into environmental impact and operational inefficiencies | Accurate ESG reporting and better emission control |

| Last-Mile Efficiency | Optimize delivery sequencing, drop density, and route planning in urban areas | Reduces delivery time, fuel usage, and urban congestion | Lower emissions and improved sustainability in urban logistics |

| Reverse Logistics Management | Streamlines returns and recycling logistics through centralized systems | Reduces waste generation and unnecessary re-transportation | Improved circular supply chain practices and reduced landfill impact |

| Paperless Operations | Digitizes documentation, invoicing, and compliance records | Cuts paper usage, manual errors, and administrative overhead | Reduced environmental waste and lower indirect emissions |

| Compliance & ESG Reporting | Automates sustainability data collection and reporting workflows | Simplifies regulatory compliance and preparations | Faster, audit-ready sustainability and ESG disclosures |

Segment Insights

Software Type Insights

What Made Transportation Management System (TMS) the Dominant Segment in the Market?

The transportation management system (TMS) segment dominated the logistics software market with a 27% share in 2025 because of its vital role in handling cost control, route optimization, carrier selection, and freight planning. TMS solutions assist logistics companies in ensuring regulatory compliance, cutting fuel costs, and increasing delivery efficiency. The dominance of the segment is further reinforced by the ability of TMS to integrate with enterprise and warehouse systems, boosting its widespread adoption in large-scale logistics operations.

The supply chain visibility & tracking software segment is expected to grow at the fastest CAGR during the forecast period. The growth of the segment is driven by a growing need for transparency and real-time shipment monitoring. Businesses are using these software solutions more frequently in an effort to enhance customer satisfaction and minimize interruptions. The demand for end-to-end visibility solutions has increased due to the growth of e-commerce and international trade, creating the need for supply chain visibility & tracking software.

Deployment Mode Insights

Why Did the Cloud-based Segment Dominate the Logistics Software Market?

The cloud-based segment dominated the market while holding a 64% share in 2025 and is expected to continue its growth trajectory in the coming years. This is because this deployment is more flexible, scalable, and requires less initial investment than on-premises systems. Real-time data access and smooth logistics network collaboration are made possible by cloud platforms. Cloud deployment is now the preferred option for logistics operators due to its compatibility with AI, IoT, and analytics tools.

The hybrid segment is expected to grow at a significant rate in the upcoming period because it combines the scalability and remote access of cloud solutions with the security and control of on-premises systems, offering companies the best of both worlds. This flexibility allows businesses to customize workflows, handle sensitive data securely, and scale operations according to demand, making hybrid solutions particularly attractive for organizations managing complex supply chains.

Application Insights

What Made Transportation & Freight Operations the Leading Segment in the Market?

The transportation & freight operations segment led the logistics software market with a 31% share in 2025, since effective freight movements continue to be the primary goal of logistics operations. Logistics software solutions aid in fleet management, delivery delay reduction, and routing optimizations. Strong demand for transportation-focused software is driven by high freight volumes and the expansion of global trade. Additionally, rising pressure to reduce operational costs and improve transparency has driven widespread adoption of advanced logistics software in transportation and freight management.

The last-mile delivery & reverse logistics segment is expected to grow rapidly, fueled by the rise in product returns and internet shipping. Businesses are spending money on software to optimize route planning, track shipments in real time, and manage returns efficiently, which are critical for customer satisfaction. Additionally, increasing focus on sustainable and cost-effective reverse logistics is driving demand for specialized digital tools in this segment.

Functionality Insights

Why Did the Tracking & Real-time Visibility Segment Dominate the Logistics Software Market?

The tracking & real-time visibility segment dominated the market, accounting for 24% share in 2025, as shipping transparency and operational control become increasingly important to businesses. These solutions make it possible to monitor products in real time and aid in lowering losses and delays. This feature is crucial for contemporary logistics operations because it allows for better decision-making through real-time data access.

The analytics & reporting segment is expected to expand at the fastest rate in the upcoming period, driven by the requirement to make decisions based on data. Advanced analytics is being used by logistics firms to enhance performance monitoring, cost optimization, and demand forecasting. Additionally, the rising complexity of global supply chains and the need for real-time visibility and compliance reporting are driving adoption of robust analytics and reporting tools.

Regional Insights

How Big is the North America Logistics Software Market Size?

The North America logistics software market size is estimated at USD 6.20 billion in 2025 and is projected to reach approximately USD 13.35 billion by 2035, with a 7.97% CAGR from 2026 to 2035.

What Made North America the Dominant Region in the Logistics Software Market?

North America dominated the logistics software market by holding a major share of 38% in 2025. This leadership is supported by cutting-edge digital infrastructure and early adoption of automation technologies. The region's dominance is further reinforced by the presence of major logistics companies and substantial investments in smart supply chain solutions. Additionally, software adoption continues to be driven by a strong focus on operational efficiency and regulatory compliance.

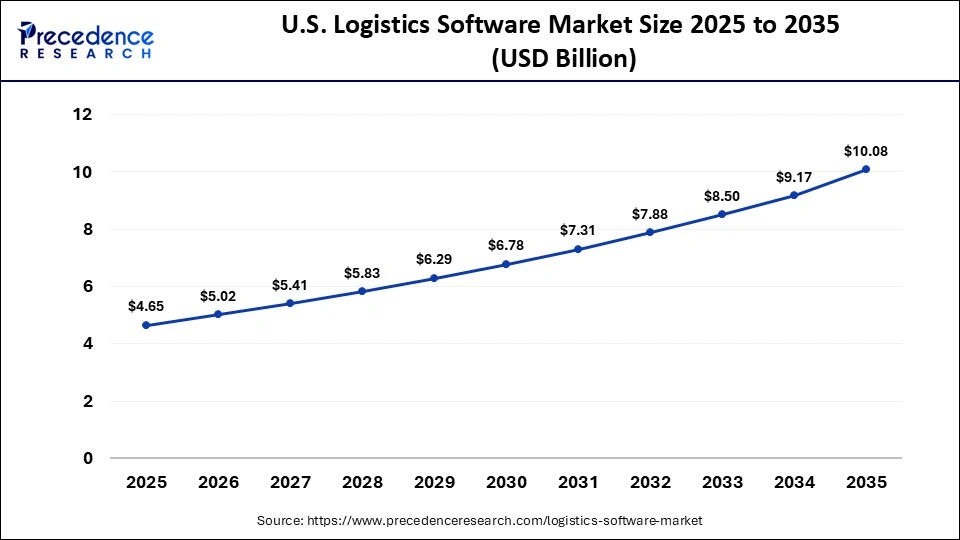

What is the Size of the U.S. Logistics Software Market?

The U.S. logistics software market size is calculated at USD 4.65 billion in 2025 and is expected to reach nearly USD 10.08 billion in 2035, accelerating at a strong CAGR of 8.04% between 2026 and 2035.

U.S. Logistics Software Market Trends

The U.S. leads the market within North America due to its sophisticated digital infrastructure, well-developed logistics ecosystem, and early adoption of cloud-based and AI-driven solutions. Transportation management systems, real-time tracking, and analytics software are widely used by logistics firms nationwide to increase freight efficiency and lower operating costs. The country's leading position in the market is further strengthened by the robust presence of international logistics companies and ongoing investments in automation and intelligent supply chain technologies.

How is the Opportunistic Rise of Asia Pacific in the Market?

Asia Pacific is expected to grow at the fastest rate in the market throughout the forecast period, driven by the rapid expansion of e-commerce and the increasing digitalization of logistics operations. Countries such as China and India are investing heavily in cloud-based and AI-enabled logistics software to enhance efficiency and visibility. Growth is further accelerated by government initiatives supporting infrastructure development and smart logistics solutions across the region.

India Logistics Software Market Trends

India is one of the major contributors to the market within Asia Pacific, driven by the quick expansion of e-commerce and the growing need for last-mile delivery services. To improve visibility, streamline transportation, and effectively manage intricate supply chains, businesses are implementing cloud-based logistics software. The digital transformation of India's logistics industry is being accelerated by government initiatives like modernization programs and increased foreign investments, contributing to the market.

Who are the Major Players in the Global Logistics Software Market?

The major players in the logistics software market include SAP SE, Oracle Corporation, IBM Corporation, Microsoft Corporation, Siemens AG, Manhattan Associates, Blue Yonder, Descartes Systems Group, Infor, WiseTech Global, E2open, Korber AG, Trimble Inc., Locus Robotics, Shipsy, LogiNext, FourKites, and Kinaxis.

Recent Developments

- In January 2026, Freight Technologies launched Zayren Pro, a premium AI-driven platform for automating logistics procurement. The platform targets the U.S.-Mexico nearshoring corridor and uses "agentic AI" and a proprietary carrier portal to support a shift towards recurring SaaS revenue.(Source: https://aimmediahouse.com)

- In June 2024, HERE Technologies launched an AI-powered Fleet Optimization software package designed to automate multi-vehicle tour planning and complex routing. The cloud-native solution, built on AWS, integrates high-fidelity mapping APIs to account for commercial vehicle restrictions and real-time traffic, potentially reducing management costs for mid-sized logistics firms by up to 20%.(Source: https://www.here.com)

Segments Covered in the Report

By Software Type

- Transportation Management System (TMS)

- Route planning & optimization

- Freight rate management

- Warehouse Management System (WMS)

- Inventory management

- Warehouse automation integration

- Fleet Management Software

- Order & Delivery Management Software

- Freight Forwarding & Brokerage Platforms

- Supply Chain Visibility & Tracking Software

By Deployment Mode

- Cloud-based

- On-premise

- Hybrid

By Application

- Transportation & Freight Operations

- Warehouse & Inventory Operations

- Last-mile Delivery & Reverse Logistics

- Supply Chain Visibility & Control Tower

- Order Management & Fulfillment

By Functionality

- Tracking & Real-time Visibility

- Route Optimization & Scheduling

- Freight Audit & Payment

- Warehouse Automation & Labor Management

- Analytics & Reporting

- Other Functionalities

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa

Get a Sample

Get a Sample

Table Of Content

Table Of Content