Medical Carts Market Size and Forecast 2025 to 2034

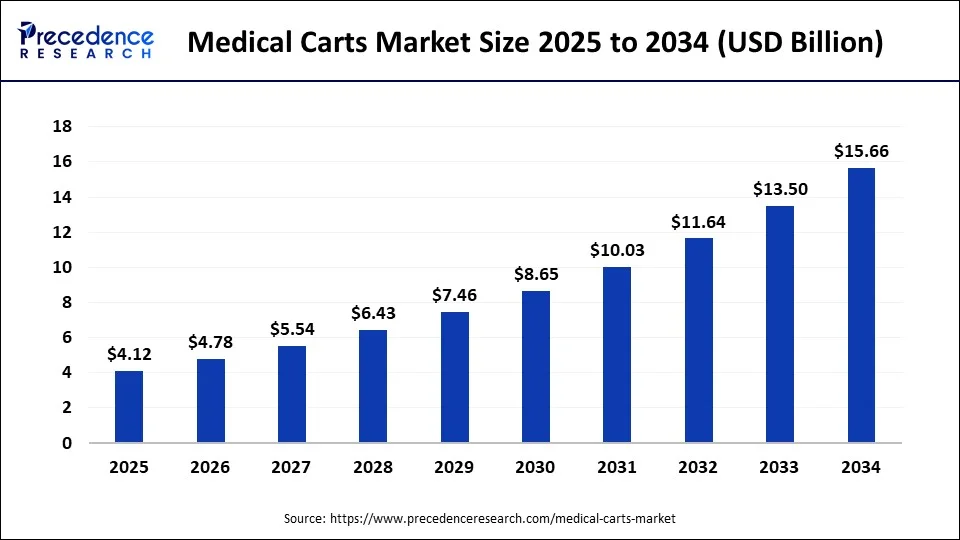

The global medical carts market size is estimated at USD 3.55 billion in 2024 and is anticipated to reach around USD 15.66 billion by 2034, expanding at a CAGR of 16% from 2025 to 2034.

Medical Carts Market Key Takeaways

- By product, the mobile computing carts have held 74% of the total revenue share in 2024.

- By type, the emergency carts segment held a 41.7% revenue share in 2024.

- By end use, the hospital segment has reached a revenue share of 37% in 2024.

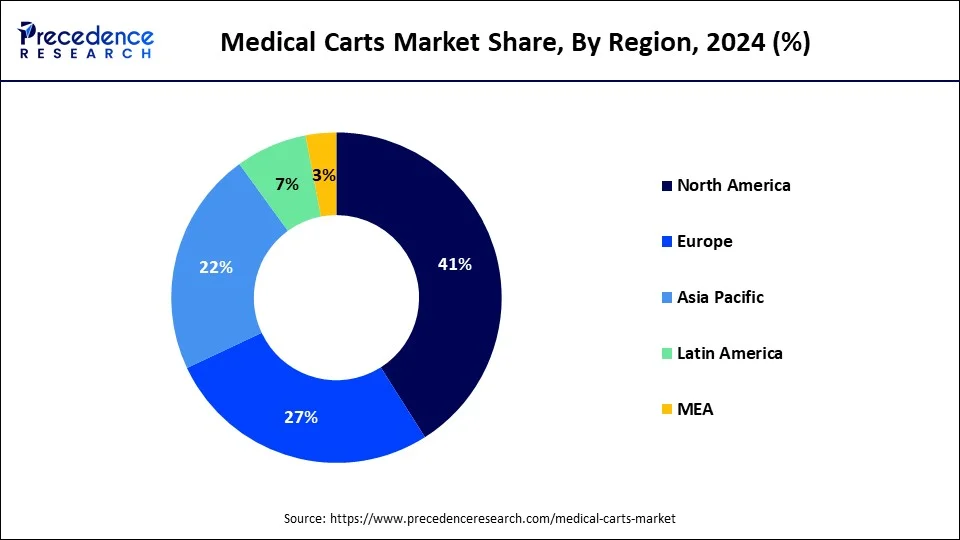

- North America region has held a revenue share of 41% in 2024.

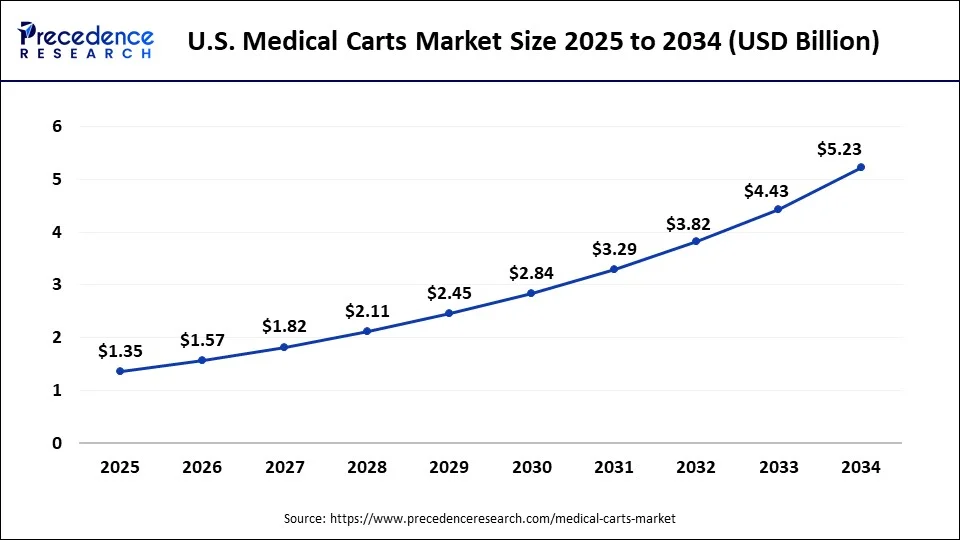

U.S. Medical Carts Market Size and Growth 2025 to 2034

The U.S. medical carts market size is evaluated at USD 1.16 billion in 2024 and is predicted to be worth around USD 5.23 billion by 2034, rising at a CAGR of 16.23% from 2025 to 2034.

North America dominated the medical carts market in 2024. The U.S. dominated the medical carts market in North America region. The growing number of hospitals is driving the growth of medical carts market in North America region. The number of operational hospitals in the U.S. climbed from 5,534 in 2016 to 6,090 in 2019, according to the American Hospital Association. As per the Canadian Institute for Health Information's 2020 report, Canada's hospitalization rate was around 7,883 per 100,000 persons. In addition, the launch of new products by market players are also driving the growth of North America medical carts market. For instance, Altus Inc., a major mobile sit-to-stand workstation maker, introduced the Clio Swap 2.0 powered workstation in September 2019. It's made to last longer thanks to improved battery life and better patient care thanks to improved physician documentation in electronic medical records.

The medical carts market of the United States is advancing due to the rising adoption of EMR in hospitals, the increase in the number of hospitals and urgent care centres, rising hospital admissions, the increase in the geriatric population, and technological advancements. Additionally, the incorporation of telemedicine capabilities into medical carts is anticipated to expand the market.

A recent study by Johns Hopkins asserts that over 250,000 individuals in the U.S. die annually due to medical mistakes. Other reports indicate that the figures could reach as much as 440,000. Medical mistakes rank as the third most common cause of fatalities, following heart disease and cancer. These projections suggest that EMRs can assist in rectifying systemic mistakes.

The relationship between doctors and clients is increasingly dependent on technology. Utilizing sophisticated tools is crucial for a physician when recording invasive surgeries, collecting biometrics, or acquiring data. Consequently, these innovations could enable doctors and nurses to concentrate on identifying diseases, enhance patient care, and eliminate tedious tasks from their responsibilities.

Europe, on the other hand, is expected to develop at the fastest rate during the forecast period. The UK dominates the medical carts market in Europe region. Some of the factors contributing to the Europe region's dominance in the medical cart market include the existence of efficient healthcare processes from hospital admissions to compensations, as well as the availability of integrated healthcare information technology systems to keep electronic health records. To accommodate client demand, medical equipment companies in this region are concentrating on producing innovative medical carts on wheels. As a result, businesses are expanding their product lines to include more technologically advanced items.

The medical carts market in Asia Pacific is anticipated to expand during the forecast period. The increased emphasis on patient safety, enhanced nursing productivity, and streamlined clinical workflow because of medical carts has boosted the need for these trolleys throughout the region. This notable increase in sales volume was credited to the swift growth of the healthcare sector and healthcare reforms in China and India.

Asia Pacific presents significant opportunities for the expansion of medical equipment, which improves medical infrastructure and consequently boosts the growth of the medical carts market in terms of both sales volume and revenue. The swift increase in the use of electronic medical records and electronic health records is a major driving force for market growth. EMRs and EHRs serve as digital channels for the sharing of medical information between patients, healthcare professionals, employers, and insurance companies. They have developed into crucial instruments for healthcare systems across the globe.

Technology Advancement

The medical carts market has also experienced tremendous growth owing to the high rate of technological evolution that has changed the carts into very complex mobile workstations instead of simple storage and transportation objects. Integration of wireless connectivity is one of the main innovations of the cart, which enables healthcare professionals to access medical records, patient diary, and real-time patient alerts through the cart without leaving the point of care.

It includes features like touchscreen, barcode scanners, and RFID readers that comply with proper administration of medication, inventory control, and patient identification, which also leads to enhancement of patient safety and a decrease in the possibility of medical errors. These technological advances have made medical carts a part of the system that assists medical workers in providing patients with timely, efficient, and safer care. The improvement of connectivity, smart design, and ergonomics, leads to further expansion of the medical carts market.

Medical Carts Market Growth Factors

One of the key factors driving the growth of global medical carts market is growing geriatric population as well as rising prevalence of chronic diseases. According to estimates from the United Nations' World Population Prospects: The 2019 Revision, the number of persons aged 65 and more is predicted to more than double by 2050, rising from 703 million in 2019 to 1.5 billion in 2050.In addition, expansion of healthcare sector is also boosting the growth of global medical carts market over the forecast period.

To obtain a competitive advantage, businesses are pursuing methods such as product innovation, mergers and acquisitions, alliances, and regional development. Furthermore, the market is expected to be propelled by rising demand from hospitals for modern healthcare information technology solutions to improve patient care and safety over the forecast period. Companies' product launch strategies are expected to promote competition. Increased collaboration initiatives to increase the array of clinical carts to give cost-effective healthcare are some factors driving market expansion for medical carts.

Market Scope

| Report Coverage | Details |

| Market Size by 2034 | USD 15.66 Billion |

| Market Size in 2025 | USD 4.12 Billion |

| Market Size in 2024 | USD 3.55 Billion |

| Growth Rate from 2024 to 2034 | CAGR of 16% |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Product, Type, Material Type, End Use, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East & Africa |

Market Dynamics

Drivers

Rising emphasis on infection control at hospitals

According to World Health Organization (WHO), out-of every hundred patients at acute-care hospitals, 7 patients (in high-income countries) are observed to acquire at least one healthcare associated infection. This numbers were published in WHO's (2022) first report of infection prevention and control. This element rises the requirement for infection control at hospitals. Infection control measures often involve isolating patients with contagious diseases to prevent the spread of infections. Medical carts equipped with isolation-specific features, such as sealed compartments for contaminated materials or specialized compartments for personal protective equipment (PPE), are in high demand. These carts help healthcare providers maintain a safe environment while attending to patients in isolation. Medical carts are frequently used to transport medical equipment, supplies, and medications between patient rooms and various departments within a hospital. Proper storage and organization of medical supplies are essential for infection control. Medical carts that offer customizable storage solutions, clear labeling, and separate compartments for different types of supplies help healthcare workers quickly access what they need while reducing the risk of contamination. The medical carts market is evolving to provide solutions that prioritize infection prevention, patient safety, and efficient healthcare delivery.

Market Restraint

Maintenance and repairing

When medical carts require maintenance or repairs, they might need to be taken out of service temporarily. This can lead to disruptions in healthcare workflows and patient care. In critical healthcare environments, such as hospitals, any downtime can affect the efficiency and quality of patient care. Maintenance and repairs incur costs. This includes not only the actual cost of fixing the cart but also the potential costs associated with the downtime, such as lost productivity, delayed patient care, and the need for temporary replacements. These costs can impact a healthcare facility's budget and financial planning. Thus, such requirements and hurdles associated with repairing and maintenance create a restraint for the market's growth.

Market Opportunity

Inclination towards home-care settings

The COVID-19 pandemic highlighted the importance of reducing unnecessary hospital visits to prevent the spread of infections. Home-based care, supported by medical carts, became a critical strategy to ensure patients receive necessary care while minimizing exposure risks. The medical cart market has been evolving to meet the demands of various healthcare environments, including home-care settings. Modern medical carts are designed to be compact, lightweight, and easily maneuverable, making them suitable for use in homes. They can be equipped with features like secure storage, adjustable heights, integrated power sources, and ergonomic designs to enhance functionality and ease of use. Home-care settings offer a more personalized approach to healthcare. Medical carts can be customized to meet individual patients' needs, ensuring that the right medications, treatments, and equipment are readily available. This level of personalization enhances patient-centered care and improves treatment adherence. Thus, the inclination towards home-care settings is predicted to present a major opportunity for the market to grow.

Market Challenge

Environmental concerns

The disposal of medical carts at the end of their lifecycle can contribute to electronic waste (e-waste) problems. Electronics contain hazardous materials that can leach into the environment if not disposed of properly. Designing medical carts with easier recyclability and better end-of-life management can help mitigate this issue. Many medical carts are made from materials that have negative environmental impacts during extraction, production, and disposal. For instance, the extraction of metals like aluminum and steel requires significant energy and can result in habitat destruction and pollution. Manufacturers need to find more sustainable materials and production methods to reduce the carbon footprint of medical carts. Thus, such environmental concerns are considered to pose a challenge for the market.

Product Insights

The mobile computing carts segment dominated the medical carts market in 2023. The increased adoption of medical carts in hospitals is attributed to the segment's rise. A lithium iron phosphate battery powers technologically powerful mobile computing cart. In addition, demand for mobile medical carts is predicted to increase throughout the forecast period due to changing ergonomics and enhanced designs. To gain an advantage over their competitors, vendors are concentrating on the development of simple-to-implement technology.

The wall mounted workstations segment is fastest growing segment of the medical carts market in 2023. Increased attention on patient safety, improved nursing efficiency, expanding focus on quick access to key medical equipment and supplies, and rising usage of electronic medication administration record to reduce medication errors are driving category growth. In medical environments, wall-mounted workstations are essential for keeping medical supplies organized and increasing efficiency. These workstations are clinical instruments commonly used in hospitals to improve patient care, increase patient involvement, and reduce staff fatigue while handling the rigors without interruption or technical delay.

Type Insights

The emergency medical carts segment dominated the medical carts market in 2023. This is due to increased use in emergency departments. The demand for these carts is projected to rise in the future years, as patients in emergency rooms are more susceptible to infections. Additionally, technical developments in the market, such as reduced weight, better mobility, and improved ergonomics, have raised healthcare providers' choice for these medical carts and workstations, which is expected to fuel growth throughout the projected period. Midwest Products & Engineering introduced the MACH Series of personalized medical device carts in November 2020, which are excellent for emergency care units due to their ease of modification and configuration.

The procedure medical carts segment is the fastest growing segment of the medical carts market in 2022. The procedure segment is likely to grow in popularity in the approaching years as these carts are increasingly used in various medical settings. These items are extremely useful in procedures such as cardiology and endoscopy, and they enable access to critical medications. These advantages are expected to help the segment flourish in the future.

- In North America, Emergency carts segment was valued at USD 457.4 million in 2023.

- In Asia Pacific, Emergency carts segment was valued at USD 230.6 million in 2023.

End Use Insights

The hospital's segment dominated the medical carts market in 2023. Adoption is being fueled by the availability of technologically advanced and mobile medical workstations. Adjustable, secure, and effective medicine delivery systems are among these breakthroughs.

The physician offices and clinics segment is the fastest growing segment of the medical carts market in 2022. In the future years, the use of these workstations in doctors' offices and independent clinics is likely to grow steadily. This is due to a rise in knowledge and desire for one-stop medical solutions that take up less room and can be utilized for a variety of medical needs. Because these carts can transport drugs, medical equipment, computers, and storage cabinets, their use in clinics is projected to increase significantly over the next few years.

- In North America, hospitals segment was valued at USD 436.9 million in 2024.

- In Asia Pacific, hospitals segment was valued at USD 219.6 million in 2024.

Medical Carts Market Top Companies

- InterMetro Industries Corporation

- Harloff Manufacturing Co.

- Armstrong Medical

- Capsa Solutions LLC.

- ITD GmbH

- Midmark Corporation

- The Bergmann Group

- Lakeside Manufacturing

- Cardinal Scale

- Merino International

Companies positive info

- Capsa Healthcare is a leader in the design and manufacturing of medical carts and technology solutions. They have a wide range of solutions, including medication management carts and pharmacy automation systems that support greater clinical efficiency and patient safety in healthcare settings.

- GCX Corporation manufactures mounting solutions, including medical carts, for healthcare IT applications. They support the enculturation of medical devices and computers into clinical workflows and improve space utilization and patient care within the healthcare facility.

Recent Developments

- In November 2024, Advantech announced the AIM-68H medical tablet, technology that is specific to particular clinical environments and allows for real-time data monitoring, medical imaging, and temperature management of medical devices to ultimately improve healthcare delivery.

(Source: https://www.advantech.com) - In September 2024, Capsa Healthcare unveiled its Tryten P-Series tablet and monitor carts to advance telehealth and patient experience through stability, cable management, and universal adaptability for any healthcare application.

(Source: https://www.capsahealthcare.com) - In March 2024, GCX launched the Tablet Roll Stand, giving healthcare access to the patient and their medical records securely, and they improved healthcare delivery by enhancing tele-health initiatives in hospitals.

(Source: https://www.businesswire.com) - HUI Manufacturing, a firm that creates low-cost medical carts, announced the release of a new standard medical cart in April 2020. The Versa Plus is a compact cart with a wide range of uses.

- Capsa Healthcare, a significant innovator in healthcare delivery systems for hospitals, long-term care, and retail pharmacy providers, purchased Humanscale Healthcare, a New York-based creator and producer of flexible technology solutions and computer workstations, in February 2022. Humanscale Healthcare has built a reputation for creating and delivering ergonomically designed mobile computing and wall-mounted workstations for improved clinical workflow and data management around the world.

- The Joy Factory Inc. released Agile Go, a new line of mobile tablet carts for the healthcare business, in October 2020, to meet the growing demand for telemedicine, patient engagement, and patient clarification.

Segments Covered in the Report

By Product

- Mobile Computing Carts

- By Application

- Medical Documentation

- Medical Equipment

- Medication Delivery

- Telehealth Workstation

- Others

- By Energy Source

- Powered

- Nonpowered

- By Application

- Wall-Mounted Workstations

- Medication Carts

- Medical Storage Columns, Cabinets, & Accessories

- Others

By Type

- Anesthesia Carts

- Emergency Carts

- Procedure Carts

- Others

By Material Type

- Metal Type

- Plastic Type

- Others

By End Use

- Hospitals

- Ambulatory Surgical Centers

- Physician Offices or Clinics

- Others

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa (MEA)

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting