Medical Device Cleaning Market Size and Forecast 2025 to 2034

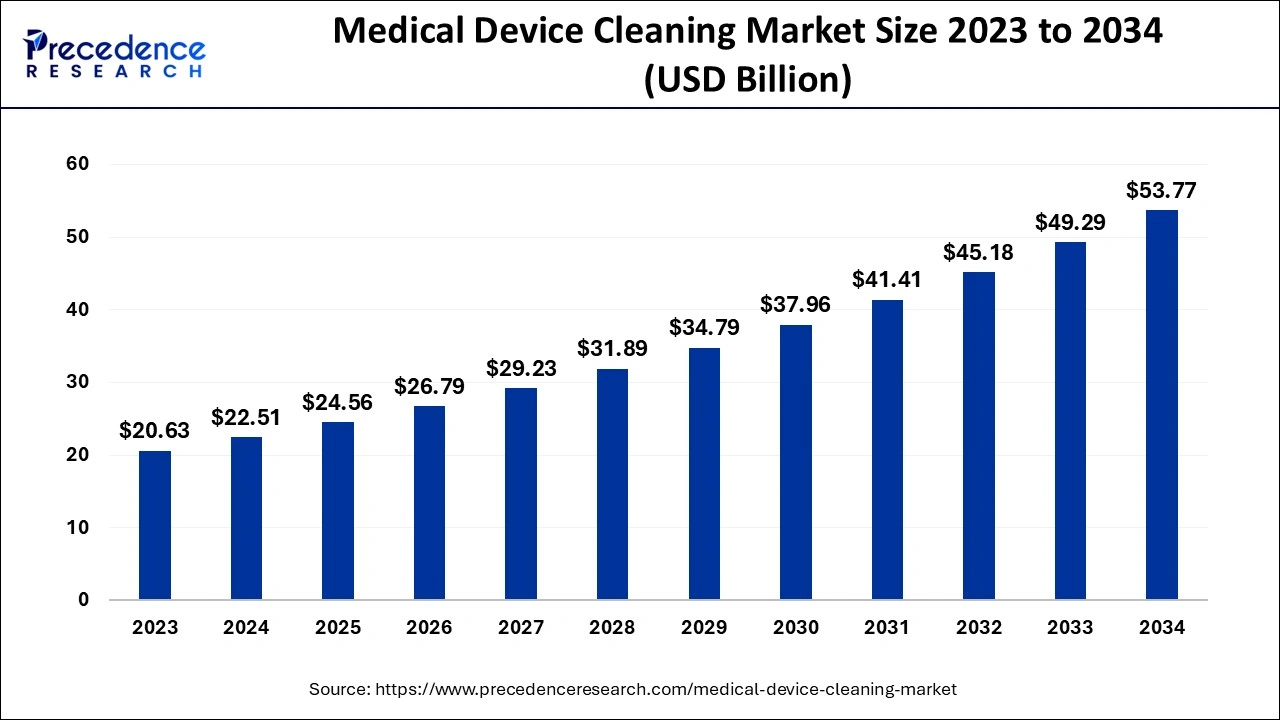

The global medical device cleaning market size was estimated at USD 22.51 billion in 2024 and is anticipated to reach around USD 53.77 billion by 2034, expanding at a CAGR of 9.10% from 2025 to 2034.

Medical Device Cleaning Market Key Takeaways

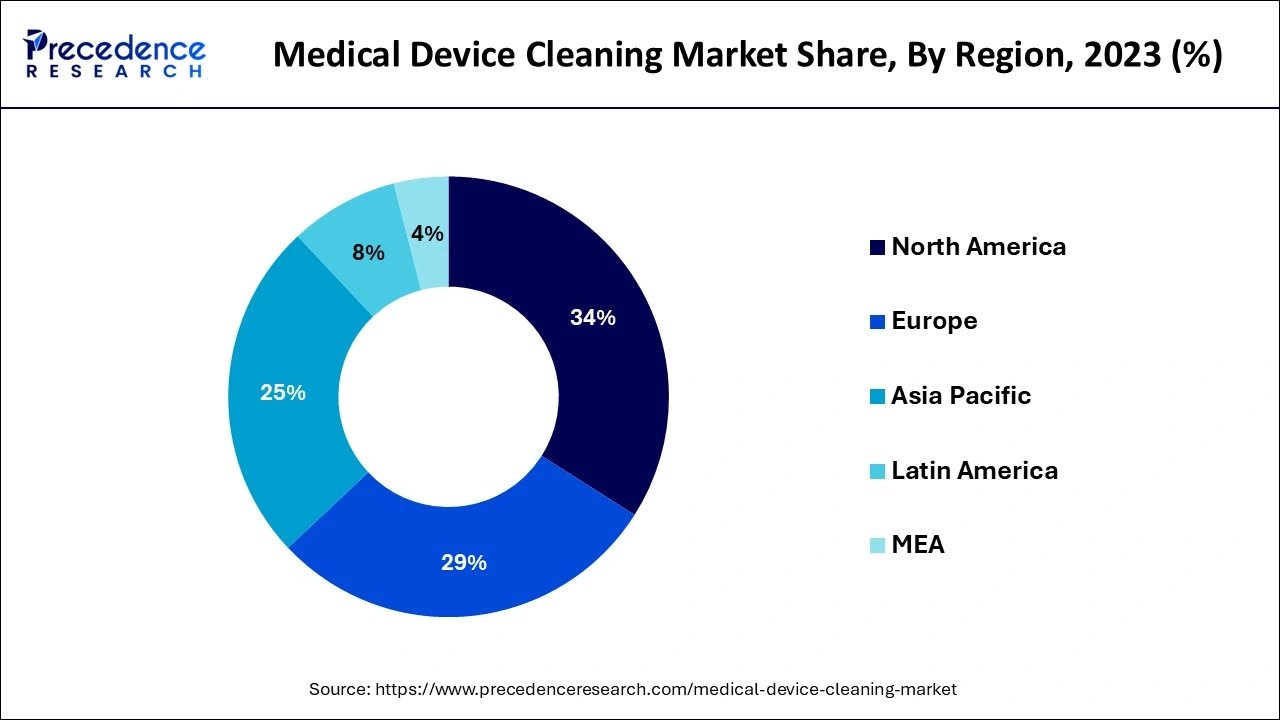

- North America led the global market with the highest market share of 34% in 2024.

- By Device, the semi-critical segment has held the largest market share of 47% in 2024.

- By Technique, the disinfection segment captured the biggest revenue share of 53% in 2024.

- By EPA, the intermediate-level segment generated over 53% of the revenue share in 2024.

U.S. Medical Device Cleaning Market Size and Growth 2025 to 2034

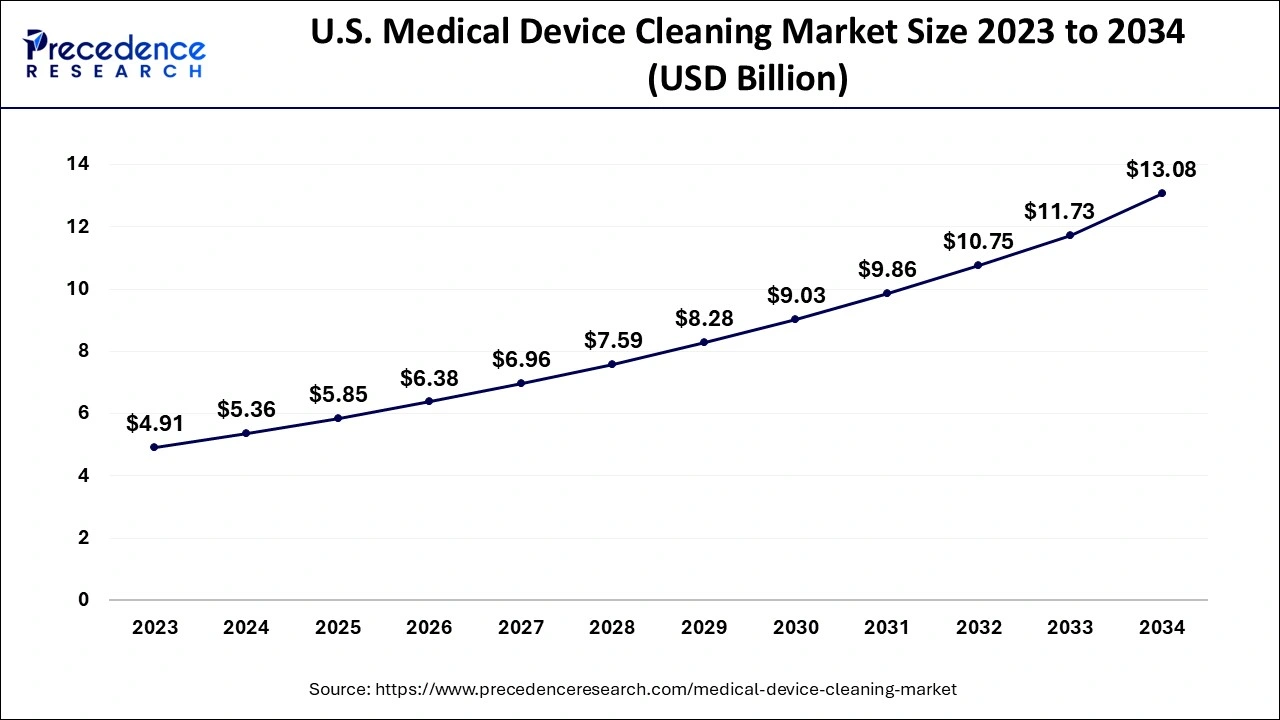

The U.S. medical device cleaning market size was evaluated at USD 5.36 billion in 2024 and is predicted to be worth around USD 13.08 billion by 2034, rising at a CAGR of 9.33% from 2025 to 2034.

In terms of revenue in 2024, North America represented a decisive 34% of the market for cleaning medical devices. The greater market share that the area is expected to capture is attributed to the major market players' consistent implementation of strategic collaborations to increase their product offerings and infection prevention and control capabilities. Throughout the course of the forecast period, tight government regulations governing the disinfecting and cleaning of medical equipment as well as favorable reimbursement policies are also projected to boost the market in the region for medical device cleaning. Two key factors driving the growth of sterile procedures are the increased usage of non-disposable medical equipment and the increasing desire to reduce costs related to hospital-acquired illnesses.

Due to the region's substantial outsourcing presence, rising healthcare spending, and impressive growth of healthcare infrastructure and standards, it is estimated that the market for cleaning medical devices would grow significantly in Asia Pacific over the projected period. Additionally driving market development in this sector are the Covid-19 pandemic and the spread of infectious infections. One of the primary drivers of market growth is the existence of several nonprofit and governmental organizations dedicated to raising infection control standards.

Asia Pacific is the fastest growing market for the medical device cleaning market with a significant CAGR during the forecast period, fueled by increasing healthcare spending, heightened awareness of infection control, and the development of healthcare infrastructure. Countries such as India, China, and Japan are experiencing a surge in demand for sophisticated cleaning solutions due to the high incidence of hospital-acquired infections and the use of reusable medical devices. Innovations, including automated cleaning systems and environmentally friendly disinfectants, are also driving market growth. Additionally, government initiatives advocating strict hygiene standards and the burgeoning medical tourism sector are contributing to the region's strong market development.

Japan

Japan's market for medical device cleaning is growing swiftly, driven by an aging population and the increasing prevalence of chronic illnesses. The nation's commitment to infection control has encouraged the deployment of advanced cleaning technologies and strict hygiene standards. Investments in the manufacturing of medical devices and the advancement of reusable instruments are propelling the growth of the market. Collaborations between healthcare institutions and manufacturers are encouraging innovation in cleaning solutions.

Europe is observed to grow at a considerable growth rate in the upcoming period, supported by rigorous regulatory standards and a significant focus on patient safety. The region's dedication to infection control has resulted in the broad implementation of cutting-edge cleaning technologies within healthcare establishments. Nations like France, Germany, and the UK are making investments in modern sterilization equipment and sustainable cleaning solutions. Partnerships between healthcare organizations and industry stakeholders are promoting innovation, leading to the creation of effective and eco-friendly cleaning practices. This proactive stance positions Europe at the forefront of advanced medical device cleaning protocols.

France

France plays a vital role in Europe's medical device cleaning market, with a strong focus on patient safety and adherence to regulations. The healthcare facilities in the country are increasingly adopting advanced cleaning and sterilization technologies to reduce infection risks. Investments in research and development are resulting in the emergence of effective and environmentally friendly cleaning agents. France's proactive measures in infection control are driving its medical device cleaning market's growth.

Market Overview

There will be lucrative opportunities for market expansion as physicians and patients become more aware of the benefits of medical device cleaning. In addition, the prevalence of chronic illnesses, growing surgery rates, as a result, an increase in accidents, and a rise in the senior population are all driving market growth.

During the anticipated period, it is expected that the steady expansion of the total market will be the rising incidence of hospital-acquired infections. One of the main concerns for clinics is the high risk of infection from bloodborne infections, drug-resistant micro-organisms, and other infectious agents in operating rooms. A study that was published in NCBI states that 25% of all bacterial illnesses are UTIs. The majority of hospital-acquired UTIs are linked to CA-bacteriuria, and catheterization is the most common healthcare-associated infection worldwide, accounting for up to 40% of hospital-acquired infections in the U.S. each year, according to a report from the National Nosocomial Infection Surveillance (NNIS) System. The market for cleaning medical devices is anticipated to expand as a result. Additionally, it is predicted that an increase in the occurrence of SSIs will enhance the uptake of infection control methods. According to a study that was published by the NIH in 2018, 40% to 60% of infections are thought to be SSIs.

COVID-19 is anticipated to have a favorable effect on the market for cleaning medical devices. The COVID-19 virus is more likely to be present on environmental surfaces in healthcare facilities where specific medical procedures are performed. In order to stop further transmission, these surfaces must be thoroughly cleaned and disinfected, especially in locations where COVID-19 patients are hospitalized. This advice also applies to unconventional locations for isolation of COVID-19 patients with mild to moderate illness, such as homes and unconventional facilities, which are expected to spur market expansion.

Local manufacturers now have a lot of chances because of the epidemic. Major players' supply chains were interrupted as a result of travel restrictions at international borders. This gave local businesses the chance to enter the market for cleaning medical devices and fill unmet consumer needs. Key firms are implementing a variety of strategies and programs to increase their market share in order to strengthen their position in the industry. Medical supplies are in short supply because of the increase in COVID-19 cases, thus local manufacturers are increasing manufacturing to meet the escalating demand. To increase their market share, businesses are also implementing a number of techniques, such as partnerships and the introduction of new goods. For instance, Metrex developed surface disinfectant wipes 2.0 CaviWipes in April 2021. These wipes are fully approved for the Emerging Viral Pathogen Claim EPA's and are effective against 42 diseases, including SARS-CoV-2. CaviWipes wipes are perfect for one-step cleaning and disinfection of hard, non-permeable surfaces in healthcare facilities since they have a universal contact length of two minutes. This should aid the business in expanding its global footprint.

Market Scope

| Report Coverage | Details |

| Growth Rate from 2025 to 2034 | CAGR of 9.10% |

| Market Size in 2024 | USD 22.51 Billion |

| Market Size in 2025 | USD 24.56Billion |

| Market Size by 2034 | USD 53.77 Billion |

| Largest Market | North America |

| Fastest Growing Market | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered |

|

| Regions Covered |

|

Market Dynamics

Key Market Drivers

- Rising surgical procedures - The market's expansion is being directly impacted by the rise in surgical operations owing to a variety of factors, including traffic accidents, aesthetic enhancements, surgeries connected to aging, and much more. Additionally, the market's increasing availability of cutting-edge surgical goods is paving the way for expansion.

- Research and development proficiencies - Rising investment in research & development, particularly in established and developing nations, will further open up attractive market expansion potential for medical instruments and technologies. The market growth rate is also being boosted by pharmaceutical and biopharmaceutical firms' research and development capabilities for the integration of cutting-edge technology in healthcare facilities.

Key Market Challenges

- Higher cost - Market expansion is anticipated to be hampered by the high cost of research and development, a lack of adequate infrastructure, and safety concerns over reprocessed instruments. Additionally, in the forecast period of 2022 to 2030, the market is expected to face challenges from an unfavorable reimbursement scenario, a lack of technology penetration in developing economies, a rise in the popularity of single-use instruments, and inadequate infrastructure in low- and middle-income nations.

Key Market Opportunities

Increasing healthcare expenditure and medical tourism in emerging economies

- During the projected period, participants in the medical device cleaning market may expect a wide range of growth possibilities from emerging economies like India, Brazil, China, Russia, and countries in Latin America and Southeast Asia.

- The escalating cost of HAIs to healthcare systems, the rising number of hospitals and clinics, the rise in per capita income, the emergence of multidrug-resistant microorganisms, and increasing government initiatives are all contributing to the market growth for medical device cleaning in these nations.

Government investments in healthcare infrastructure

- The federal government's increased support will likely accelerate market expansion. Additionally, the development and expansion of the healthcare sector, pushed by both public and private actors, particularly in developing nations, will provide an attractive potential for market expansion. The market value is also rising due to the increasing use of preventative strategies to reduce hospital-acquired illnesses. High returns on investments, which are guaranteed by research efforts, would also benefit the market.

- The introduction of technologically advanced goods in hospitals, the onset of serious diseases, as well as the growing interest in surgery, all have a favorable impact on the market growth rate. Government attempts to raise awareness, particularly in emerging nations.

Device Insights

The sector with the biggest revenue share in 2024 was semi-critical (47%). Semi-critical devices are those that come into touch with mucosal membranes. These gadgets include, among other things, endoscopes, dental equipment, and a few surgical tools. Due to the frequent requirement for sterilization, these devices should be sterilized before use, often using a heat or chemical technique. The usage of disposable devices is rising, there is fierce pricing rivalry driving costs down, and the Centers for Disease Control and Prevention have tight regulatory criteria that are affecting the market growth.

The essential category is expected to grow at the fastest rate over the anticipated term. This group of devices punctures biological tissues. Most of these devices are single-use and sanitized before being shipped. Heat sterilization and ethylene oxide sterilization are the most often used sterilizing methods in medical institutions. The majority of commercially available, single-use surgical tools are sterilized using radiation. The method, however, has not been considered for the analysis's aims because it is not employed in hospital settings. Crucial devices no longer need to be cleaned, disinfected, or sterilized as frequently as single-use devices, which is anticipated to limit the market growth.

Technique Insights

The disinfection category dominated the market for cleaning medical equipment in 2024 with a 53% revenue share. Disinfection is an essential step in the processing of critical & semi-critical medical equipment. The three main kinds of disinfectants used at this stage are bactericidal, fungicidal, and virucidal. The type of medical equipment is typically taken into consideration while choosing these materials. The selection of these materials for processing tools like endoscopes may be difficult. The use of disinfectants in combination with detergents is also considered in this section. The sterilizing market is also predicted to develop profitably.

EPA Insights

The intermediate-level category dominated the market for cleaning medical equipment in 2024 with a market share of around 53%. Intermediate-level disinfectants are substances that kill disease-causing bacteria and are tuber colloidal. Some of the most well-known types of intermediate-level disinfectants include bleach, hydrogen peroxide and quat combinations, and water-based phenolics. Both the spread of contagious diseases and the increased incidence of HAIs support sector expansion. On the other hand, the high-level sector is predicted to have the fastest CAGR over the forecast period.

Dental and medical equipment are subjected to high-level disinfection in order to prevent the growth of bacteria. Reprocessing of heat-sensitive semi-critical medical and dental equipment is part of it. Glutaraldehydes, special hydrogen peroxide, and special peracetic acid products are some of the most often utilized high-level disinfectants.

Medical Device Cleaning Market Companies

- Steris plc.

- GetingeAB

- Advanced Sterilization Products

- The Ruhof Corp.

- Sklar Surgical Instruments

- Sterigenics International LLC

- Biotrol

- Metrex Research, LLC

- Oro Clean Chemie AG

- Cantel Medical Corp.

- Ecolab

- 3M

Recent Developments

- In July 2024, Getinge formed a partnership with Medical Bear to integrate its T-DOC sterile supply management solution into Medical Bear's operations. This collaboration seeks to digitize sterile supply workflows, improving efficiency and traceability in the cleaning processes of medical devices.

- In July 2024, Innovative Health revealed a partnership with MC Healthcare to establish a single-use medical device reprocessing program in Japan. This initiative aims to promote sustainable practices and minimize medical waste through efficient cleaning and sterilization methods.

- In May 2023, Terumo Corporation invested around USD 360 million to build a new manufacturing facility for its Medical Care Solutions Company in Japan. This facility will enhance the production capacities for medical devices, which will require advanced cleaning and sterilization solutions to ensure safety and compliance with regulations.

- In Jan 2020, Getinge AB finalized the acquisition of Applikon Biotechnology. Applikon Biotechnology is a producer and developer of cutting-edge bioreactor systems for the production of enzymes and bioplastics for industrial biotechnology as well as vaccines and antibody synthesis.

- In order to collaborate with customers in the medical device industry to create innovative solutions for clinics and surgical centers as well as infection control plans for its cutting-edge surgical equipment, Ecolab inaugurated its Ecolab Healthcare Advanced Innovation Centre in August 2021.

Segments Covered in the Report

By Device

- Non-critical

- Semi-critical

- Critical

By Technique

- Cleaning

- Detergents

- Chelators

- Buffers

- Enzymes

- Others

- Disinfection

- Chemical

- Alcohol

- Aldehydes

- Chlorine & Chorine Compounds

- Phenolics

- Metal

- Ultraviolet

- Others

- Chemical

- Sterilization

- Ethylene Dioxide (ETO) Sterilization

- Heat Sterilization

- Radiation Sterilization

By EPA

- High Level

- Intermediate Level

- Low Level

By Application

- Surgical Instruments

- Cleaning of Endoscopes

- Ultrasound Probes

- Dental Instruments

By End-User

- Hospitals and Clinics

- Diagnostic Centers

- Dental Clinics

- Ambulatory Surgical Centers

By Geography

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa (MEA)

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting