What is the Medical Display Market Size?

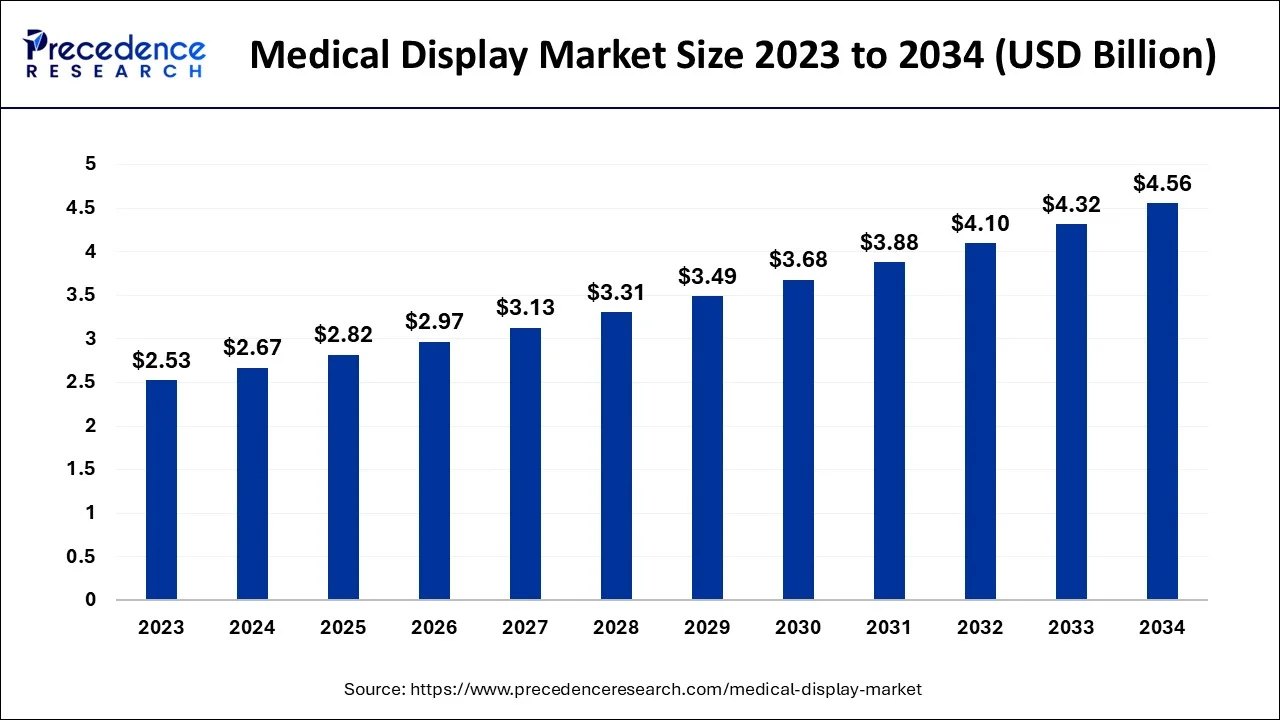

The global medical display market size is calculated at USD 2.82 billion in 2025 and is predicted to increase from USD 2.97 billion in 2026 to approximately USD 4.79 billion by 2035, expanding at a CAGR of 5.44% from 2026 to 2035.

Medical Display Market Key Takeaways

- North America dominated medical display market in 2025.

- By device, the desktop dominated the market in 2025.

- By application, multi-modality segment led the market in 2025.

What is Medical Display and its Potential Value?

A medical display is a monitor that can meet the demanding requirements of medical imaging. It frequently includes specific image-enhancement technologies to provide even brightness throughout the display, noise-free images, comfortable reading, and automated compliance with other medical standards and digital imaging and communications in medicine (DICOM) as well. By providing powerful diagnostic tools, permitting non-invasive evaluation of wounds and internal issues, and enabling the early detection of diseases, medical imaging technologies have advanced healthcare. Medical screens are preferred to consumer displays when utilized for medical imaging. The simple solution is that medical displays abide by visual quality, medical laws, and quality assurance standards.

The global rise in the frequency of various diseases has caused a great evolution in the healthcare industry in recent years. Lifesaving technologies and discoveries have been made in the healthcare industry as a result of the rapid growth of technology. People's confidence in seeking medical care has increased, thanks to the introduction of new and improved equipment and treatments. One such invention that has aided and enhanced the effectiveness of diagnostic and therapeutic procedures is the medical display. The market for medical displays has grown as people are turning more and more toward imaging technologies to treat both serious and routine medical conditions. More people are coming in as a result of increased public awareness of new medical technology and treatments, thereby contributing to the expansion of the market of medical displays. Globally rising disposable income and government efforts to boost the healthcare industry have helped the market to reach new heights.

How AI Support Bolsters the Medical Display Industry?

AI's support to this industry is its push to the medical display spectrum to play the role of active clinical assistants to perform diversified responsibilities as a monitor to the timely diagnosis, an engineer to the maintenance support, and an image refiner. AI holds the potential to identify particular image modality and adjust the features needed to learn a respective medical display.

Most of the modern display makes good use of AI by unifying it with the sensors, enabling independent monitoring, alongside it automates DICOM calibration. Nonetheless, the AI software is another hype for arranging pre-screening of the studies that are prioritised.

Market Outlook

- Start-up Ecosystem: The startups are accelerating due to the growing number of diagnoses and the need for displays in the healthcare sector. The tech-based intellect minds are entering the healthcare business with an advanced deal through partnerships and acquisitions.

- Industry Growth Overview: The industry growth is rising with the growing number of robotic and laparoscopic surgeries. More modernised therapies elevate the use of displays. Most of the digital pathologies and hospitals have already adopted ultra-advanced activities, to which advanced displays are prior.

Market Scope

| Report Coverage | Details |

| Market Size by 2035 | USD 4.79 Billion |

| Market Size in 2025 | USD 2.82 Billion |

| Market Size in 2026 | USD 2.97 Billion |

| Growth Rate from 2026 to 2035 | CAGR of 5.44% |

| Dominated Region | North America |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered |

Device, Panel Size,Resolution,Application, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East & Africa |

Market Dynamics

The use of hybrid operating rooms, the short replacement cycles for medical displays, and the rise in popularity of less invasive procedures are some of the drivers driving the market's expansion. Endovascular and vascular procedures, spinal and neurological operations, orthopedic trauma procedures, and cardiac procedures are all done in hybrid operating rooms. This ability makes it possible for hospitals to do sophisticated surgical procedures, which raises the demand for medical displays. On the other hand, market saturation in developed nations and a rise in the adoption of reconditioned medical displays are expected to hinder the market growth during the projection period.

Segment Insights

Device Insights

The market is divided into three categories based on the kind of device: desktop, mobile, and all-in-one. Desktop medical displays are seen to be ideal for the visualization of several crucial procedures like surgeries, diagnostics, and medical imaging.

Expanding the use of medical software imaging and electronic medical records (EMR) during the research period, the all-in-one segment will trail the desktop segment in terms of value.

Panel Size Insights

The global market of medical display is divided into four categories based on panel size: 23.0-26.9-inch panels, 27.0-41.9-inch panels, over 42-inch panels, and up to 22.9-inch panels. The 27.0-41.9-inch panel segment is anticipated to dominate the market because they are often utilized in radiology, computed tomography (CT), magnetic resonance imaging (MRI), and ultrasound.

Resolution Insights

The global market of the medical display is divided into four segments based on resolution: displays with a resolution of 2.1-4MP, displays with a resolution of up to 2MP (megapixels), displays with a resolution of 4.1-8MP, displays with a resolution of over 8MP. The 2.1-4MP resolution display is mostly used due to its acceptable setup, which is suited for surgical and diagnostic applications.

Application Insights

Digital pathology, surgical, radiology, multi-modality, mammography, and other segments are included in the global market of medical display classification according to application. As many modalities give healthcare institutions freedom to deploy medical displays for different departments by their demands, the multi-modality application segment is predicted to keep the second position during the evaluation period.

Regional Insights

The market of the medical display is examined globally, taking into account North America, Europe, Asia-Pacific, and LAMEA. The market of the medical display is examined in each of the following regions: North America, Europe, Asia-Pacific, and LAMEA. This is a result of rising medical technology awareness, a boom in medical tourism, growing demand for sophisticated surgical display equipment in developing nations like China and India, and an increase in healthcare spending in the area.

The organic light-emitting diode (OLED) usage in medical treatments by several hospitals and significant industry players like Quest International, Novanta Inc., Dell Inc, and Double Black Imaging are driving the market growth in North America. The market of the medical display is quite cutthroat, with leading players in this industry concentrating on growth methods such as product launches, mergers and acquisitions (M&As), product developments, collaborations, and distributor agreements to enhance their presence in the cutthroat industry.

Asia Pacific Accelerate Medical Device Market with rising demand and innovation

The medical device market in the Asia-Pacific region is robustly developing due to increased investments in healthcare, growing middle-class populations, and increasing need for advanced diagnostics and treatments. In 2024, India saw a greater than 15% increase in medical device imports, providing further evidence of expectations for modern healthcare tools to improve the general state of health. As Japan approved over 300 new medical devices in the past year, it is clear that the regulatory environment is supporting growth, and there is an immediate need for innovation in this part of the world for improved health outcomes.

Europe's Advance Moves in Medical Display Industry

Europe operates its medical display unit with high resolution, an expert level of imaging, along with the 3D touch to meet perfection and clarity without any compromise in medical reading. Apart from the integration of machine learning and AI, Europe has a transition in its 4 K, 8K, etc., potential value that brings the display quality up to contribute to the mammography and radiology diagnosis sector.

The modern visualization, like mixed reality platforms and 3D medical imaging are massively seen ruling in pre-surgical planning. The LED-backlit LCD has always been a flagship for the regional medical display sector.

North America's Development in the Medical Display Industry

North America's development so far in this industry can be measured by its unmatched 4k and 8k standards, which have moved the grounds of 8-megapixel calibrated screens. The hybrid operating rooms are creating demand chaos for 4k-over-IP surgical panels to fetch a fusion of various data on one huge screen.

Moreover, the growth of diagnosis and digital pathology is helping meet new ends of development in this industry. The FDA's tightened cybersecurity and DICOM calibration standards are introducing more value and morals to the medical display sector.

Latin America's Support to Medical Display Industry

Latin America's support for the medical display is quite complementary to the modernised era and ecosystem of this industry. The investment in the hospital infrastructure, mainly in surgical and ICU space are indirectly accelerating the demand for displays. Eventually, the transformation to the 4K surgical display is defined and complementary to the investment. The regional digital health initiatives are promoting the use of advanced medical displays.

Value Chain Analysis of the Medical Display Market

- Raw Material Sourcing: The raw material sourcing is a primary and crucial step in medical display manufacturing to meet compliant components and commendable quality for devices with a long-life span, performance, and safety.

Key Players – LG Display, Samsung Display, and AU Optronics. - Testing and Certification: The testing part is obvious for any hospital or clinic to avoid delay and harm to the hospital's prestige. It's a starting point for analysing each establishment, manufacturing, and deployment stages of the medical displays, after which the certification is granted.

Key Players – UL Solutions, SGS SA, and Eurofins Scientific. - Distribution and Sales: The distribution of the medical display and its profit calculates the point of sale. The surgical displays, diagnostic monitors, and PACS workstations sector aims to serve a high-quality uniformed imaging technology to the suitable healthcare space.

Key Players – EIZO Corporation, Barco NV, and Sony Electronics Inc.

Medical Display Market Companies

- LG Display

- FSN Medical

- EIZO

- Sony

- Double Black Imaging

- Barco

- STERIS

- Jusha Medical

- Advantech

- Quest International

Recent Developments

- In January 2025, Sony launched the LMD-32M1MD 4K Mini-LED medical monitor. With its advanced features and superior picture quality, the LMD-32M1MD sets a new standard for clarity and precision. This enables superior color reproduction, resulting in more realistic visualization of surgical images.

- In January 2025, the Pan American Health Organization (PAHO) launched an interactive dashboard to monitor avian influenza A(H5N1) cases in the Americas. This is designed to improve access to data on outbreaks of this disease in birds, mammals, and humans, providing key information for public and animal health authorities.

- In February 2025, Lava's sub-brand Prowatch introduced its first-ever X-series smartwatch in the Indian market. The new Prowatch X features an AMOLED display, Bluetooth calling, and built-in GPS. Equipped with a high-precision sensor, the Prowatch X delivers accurate heart rate and SpO? readings, sports activities, and Bluetooth calling.

- In April 2024, Schiller India announced the launch of our latest monitor, TRUSCOPE P Series High-End Modular Patient Monitors. These monitors offer adaptability, efficiency, and advanced patient care solutions, catering to the diverse needs of healthcare professionals.

- In July 2024, LG Electronics (LG) expanded its lineup of diagnostic monitors with the new 21HQ613D-B, which was recently cleared by the U.S. Food and Drug Administration for sale in the U.S., also launched 21.3-inch 5-megapixel (MP) IPS diagnostic monitor designed to deliver high-definition radiological images and maintains consistent image quality through its internal front calibration sensor and calibration software.

- EIZO Corporation introduced RadiForce MX243W, a 24.1-inch, 2.3 megapixels (1920 x 1200 pixels) monitor, in June 2022. The 24.1-inch, 2.3-megapixel (1920 x 1200 pixel) monitor was created to observe and diagnose the entire physiology of patient systems in clinics and hospitals. The launch added a fresh medical device to the line-up and provided exceptional market purity.

- Barco introduced the Nio Fusion 12MP medical display in May 2021. As a result of the product launch, the medical display product line was expanded across North America and Europe, and its product portfolio was improved.

- The organic light-emitting diode (OLED) usage in medical treatments by several hospitals, along with the existence of significant industry players like Novanta Inc., Quest International, Double Black Imaging, and Dell Inc.

Segments Covered in the Report

By Device

- Desktop

- Mobile

- All in one

By Panel Size

- Up to 22.9

- 23.0 to 26.9

- 27.0 to 41.9

- Above 42

By Resolution

- Up to 2Mp

- 2.1 to 4Mp

- 4.1 to 8Mp

- Above 8Mp

By Application

- Multi-Modality

- Digital Pathology

- Radiology

- Surgical

- Mammography

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa (MEA)

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Tags

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting