What is the Medical Tapes and Bandages Market Size?

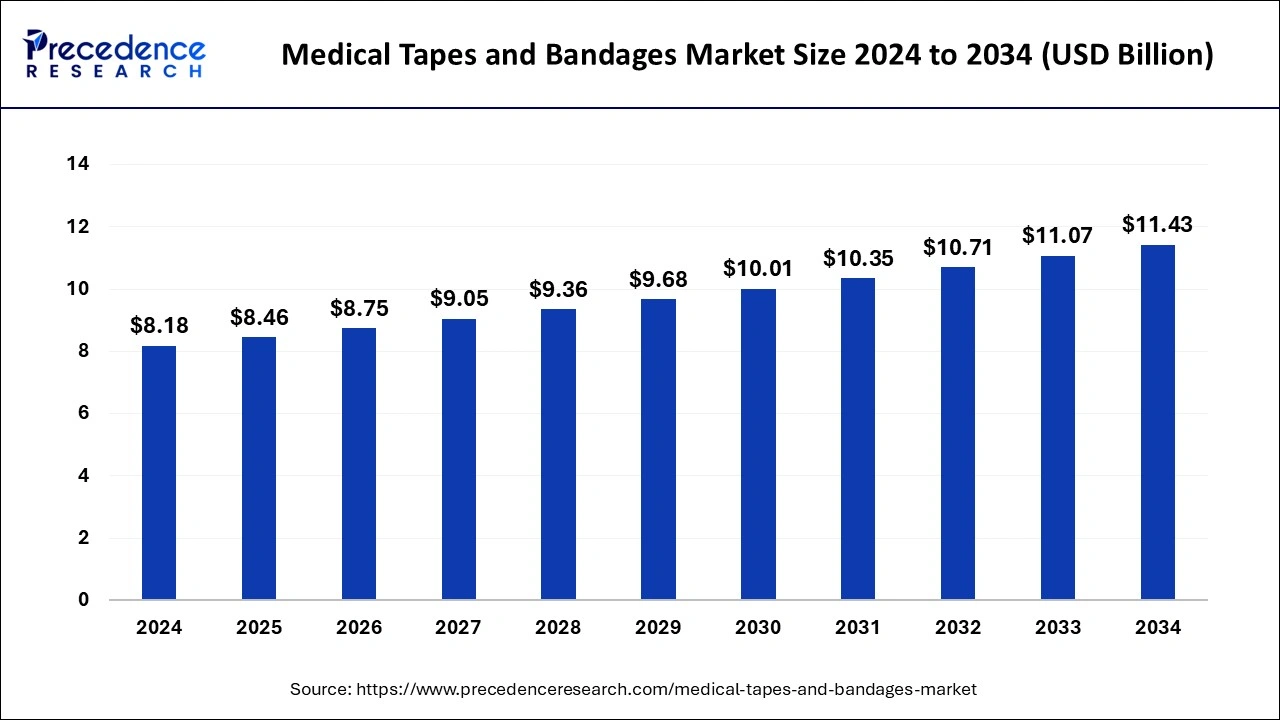

The global medical tapes and bandages market size is calculated at USD 8.46 billion in 2025 and is predicted to increase from USD 8.75 billion in 2026 to approximately USD 11.79 billion by 2035, expanding at a CAGR of 3.37% from 2026 to 2035. The increasing number of cases like accidents, chronic wound infections, and others is driving the growth of the market.

Medical Tapes and Bandages Market Key Takeaways

- The global medical tapes and bandages market was valued at USD 8.18 billion in 2025.

- It is projected to reach USD 11.43 billion by 2035.

- The medical tapes and bandages market is expected to grow at a CAGR of 3.40% from 2026 to 2035.

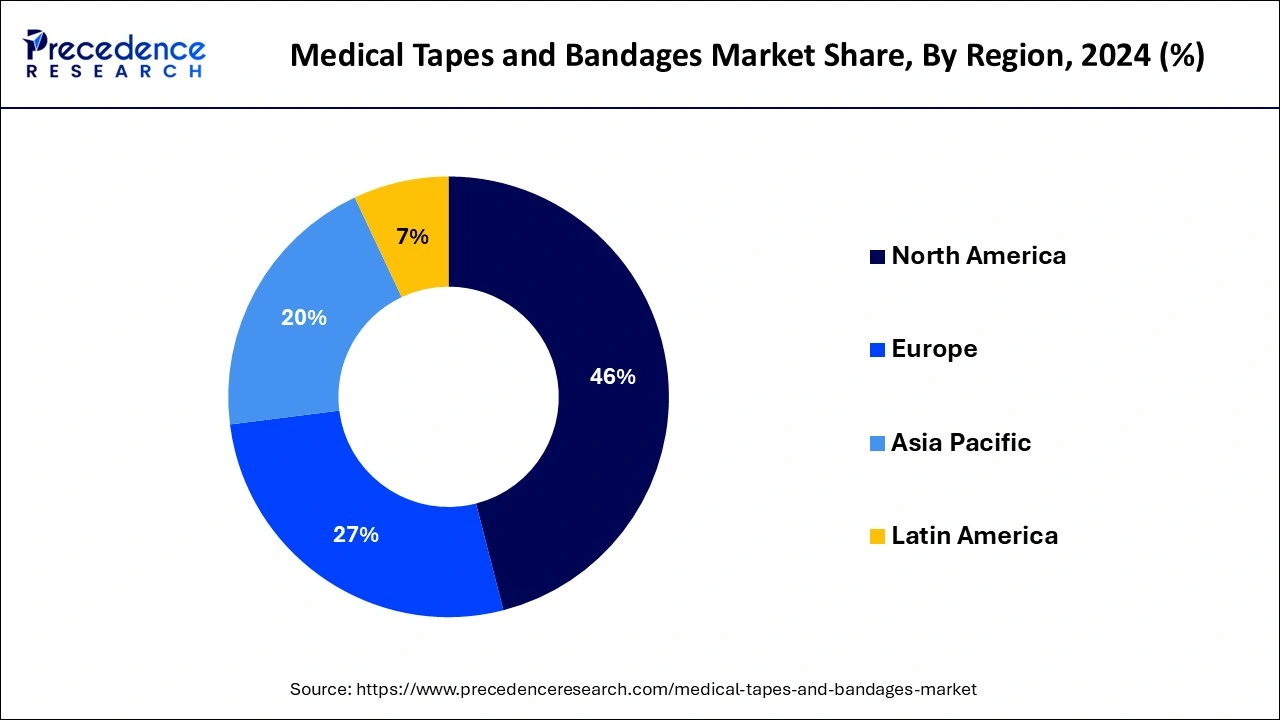

- North America dominated the medical tapes and bandages market with the largest revenue share of 46% in 2025.

- Asia Pacific is expected to witness the fastest growth during the forecast period.

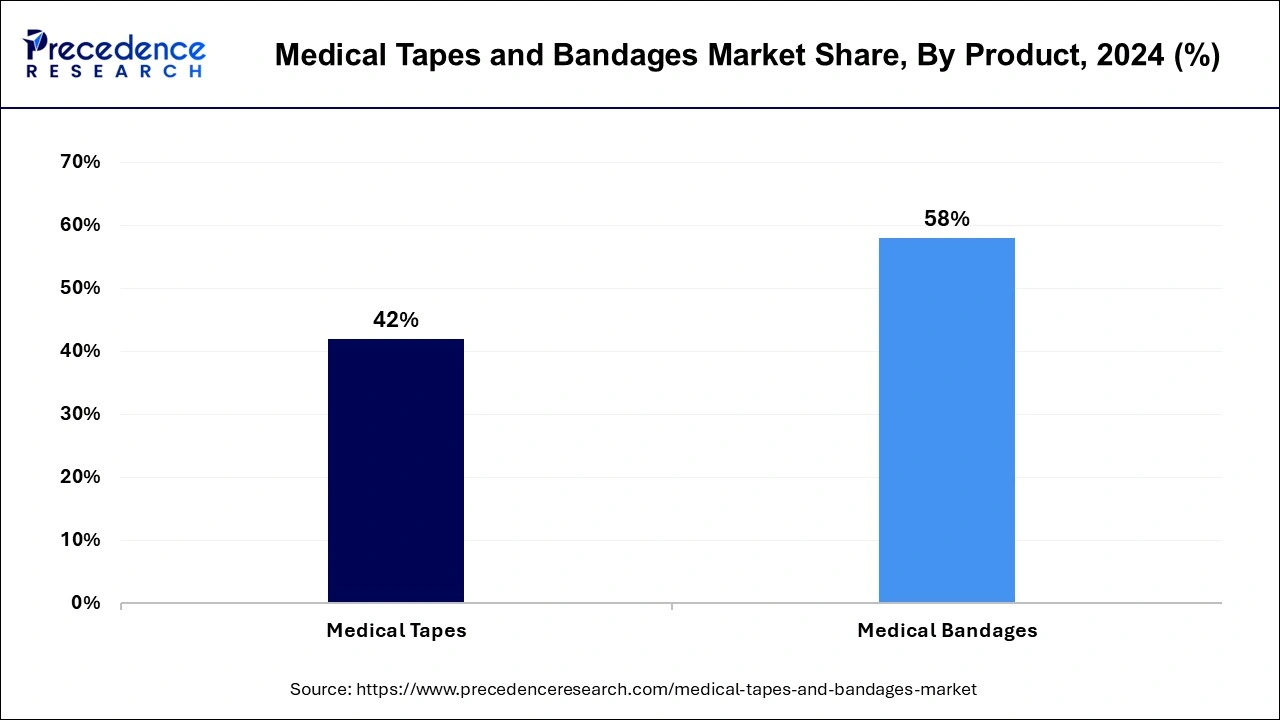

- By product, the medical bandages segment has held the major revenue share of 58% in 2025.

- By application, the surgical wound segment has contributed more than 59% of revenue share in 2025.

- By end-use, the hospital segment has held the biggest revenue share of 29% of revenue share in 2025.

Impact of Artificial Intelligence on the Medical Tapes and Bandages Market

AI technologies help researchers develop new formulations by analyzing material properties and adhesion characteristics. This further helps to develop customized wound care solutions. Manufacturers use AI technologies to create medical bandages and tapes that stick well, breathe well, and control moisture better. Using AI in wound monitoring tools helps doctors monitor wound healing and get better treatment information. Moreover, AI helps develop smart wound care solutions by analyzing wound conditions and skin types.

Market Overview

Medical tapes and bandages are medical-grade products that are used to hold the dressing on the wound in place. These products are also used for securing catheters and medical devices. Medical tapes and bandages are available in various types of materials such as cloth, paper, and plastics. It is used to protect the infectious areas of the body from exposure to hazardous materials. It is basically made from a flexible and thin material that can be easily applied and removed from the skin.

The medical tapes and bandages are available at drugstores, online retailers, and supermarkets without a prescription. There are several types of medical tapes available in the market, such as micropore paper tapes, transpore medical tapes, zinc oxide medical tapes, durapore cloth surgical tapes, clear medical tapes, microfoam surgical tapes, waterproof surgical tapes, and others. The increasing cases of infections and wounds are driving the growth of the market.

Medical Tapes and Bandages Market Growth Factors

- The increasing prevalence of chronic diseases like diabetes causes higher chances of getting ulcers, and diabetic foot ulcers are driving the demand for medical tapes and bandages for treating the infection of wounds caused by diseases.

- The rising cases of road accidents, wound infections, and increasing patient safety concerns are driving the growth of the medical tapes and bandages market.

- The rising prevalence of chronic diseases and road accidents are driving the chances of surgeries and operations for treating illness, wounds, and cuts by the surgical procedures that drive the growth of the medical tapes and bandages market.

- The rising inclination of youth to sports and physical activities is causing the chances of sports injury that further contributed to the growth of the market.

- The rising population and the demand for healthcare infrastructure for the treatment of different diseases and conditions are driving the growth of the market.

- The higher investments in the healthcare and pharmaceutical industry and the ongoing research on medical product innovations are driving the growth of the medical tapes and bandages market.

Market Scope

| Report Coverage | Details |

| Market Size by 2025 | USD 8.46 Billion |

| Market Size by 2026 | USD 8.75 Billion |

| Market Size in 2035 | USD 11.79 Billion |

| Market Growth Rate from 2026 to 2035 | CAGR of 3.37% |

| Largest Market | North America |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | Product, Application, End-use, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and the Middle East & Africa |

Market Dynamics

Driver

The increase in diabetes cases

The increasing prevalence of diabetes patients worldwide due to the increasing geriatric population, changing lifestyles, and accepting sedentary lifestyles such as rising consumption of alcohol, smoking, and eating junk are the major factors for the increasing number of diabetes patients. The increasing prevalence of diabetes in people is causing higher chances of getting affected by diabetes ulcers. Diabetic ulcer is most commonly affected by the weight-bearing areas of food, like the ball of the foot and tips of the bent toes. The ulcer is an open wound that is well deep enough to be able to see the underlying tissues and sometimes bone.

Hardening of the skin, swelling, redness around the lesion, presence of pus and drainage, and local pain are some of the signs of diabetes ulcers. Most of the time, doctors prescribe antibiotics for the treatment and healing of wounds, but in some severe cases, surgical treatment should be suggested for the treatment. Thus, the increasing chances of surgical treatment for wound or ulcer healing are driving the demand for medical tapes and bandages in the market.

Restraint

Higher competition

The rising competition in the pharmaceutical products companies and the increasing participation of new market entrants as well as increasing burden of price sensitivity are restraining the growth of the market.

Opportunity

Technological advancements

Technological integration in healthcare is revolutionizing healthcare products and treatment. The integration of smart technologies in medical tapes and bandages is driving the growth opportunity in the medical tapes and bandages market. The smart bandages use microprocessors, microelectronic sensors, and wireless communication radios to enhance wound treatment and therapies. Smart bandages use various sensors for recording, detecting, and managing physical and chemical elements that affect the speed of wound healing. It uses technology that helps in wound healing and tissue-restoring processes. It also help the physician to remotely diagnose the wound healing by the telehealth features. Moreover, the rising investment in research and development activities in the further innovations and development of medicine and pharmaceutical products are driving the opportunity for the growth of the market.

Product Insights

The medical bandages segment dominated the market with the largest share in 2024. Medical bandages are one of the highly used segments in the medical tapes and bandages market. It is a soft, highly absorbent material that is used to hold the dressing on the wound or infection. It helps in immobilizing the wounded body part and compresses a soft tissue injury. There are different types of bandages available as per the requirement and wound, which can easily be applied and removed from the body.

Some of the types of bandages include crepe bandages, compression bandages, snake bit bandages, triangular bandages, tubular bandages, cohesive bandages, and others. The increasing accidental cases and the rising interest of youth towards sports and physical activities have chances of sprain and fracture in the body parts that drive the demand for the medical bandages segment in the medical tapes and bandages market.

Applications Insights

The surgical wound segment held the largest revenue share in 2024. The rising demand for medical tapes and bandages in surgical wounds is highly contributing to the increased demand for the medical tapes and bandages market. The increasing prevalence of chronic illnesses or diseases that drive the demand for surgical procedures, as well as the rising cases of road accidents, are contributing to the higher number of surgical operations that cause surgical wounds in the surgical process, which fuels the demand for medical tapes and bandages. There are different types of surgical tape available in the market, including microfoam surgical tape, waterproof surgical tape, and others.

- For instance, over 6 million people in the U.S. alone get over $25 billion in treatment for chronic wounds each year. The yearly wound care costs to the NHS in the UK are £8.3 billion, of which £2.7 billion and £5.6 billion are related to managing wounds that have healed and unhealed, respectively. Wound care costs in Europe account for 2-4% of yearly health expenditures. While the Malaysian Ministry of Health spends up to $5 million annually on wound care, and other Southeast Asian countries are in a similar situation, in developing nations such as India, 3–4% of the diabetic population suffers from foot problems, using up 12–15% of healthcare resources.

End-User Insights

The hospital segment dominated the market in 2024. The growth of the segment is attributed to the higher presence of healthcare facilities like hospitals, clinics, and other diagnostics centers for the treatment of diseases, infections, and other health conditions and the higher preference of the population for hospitals to treat any kind of diseases, wounds, etc. by the healthcare physician. The hospital includes well-trained healthcare professionals with technologically equipped diagnostics equipment, medication, and drugs that drive the demand for wound management in the hospital segment.

Regional Insights

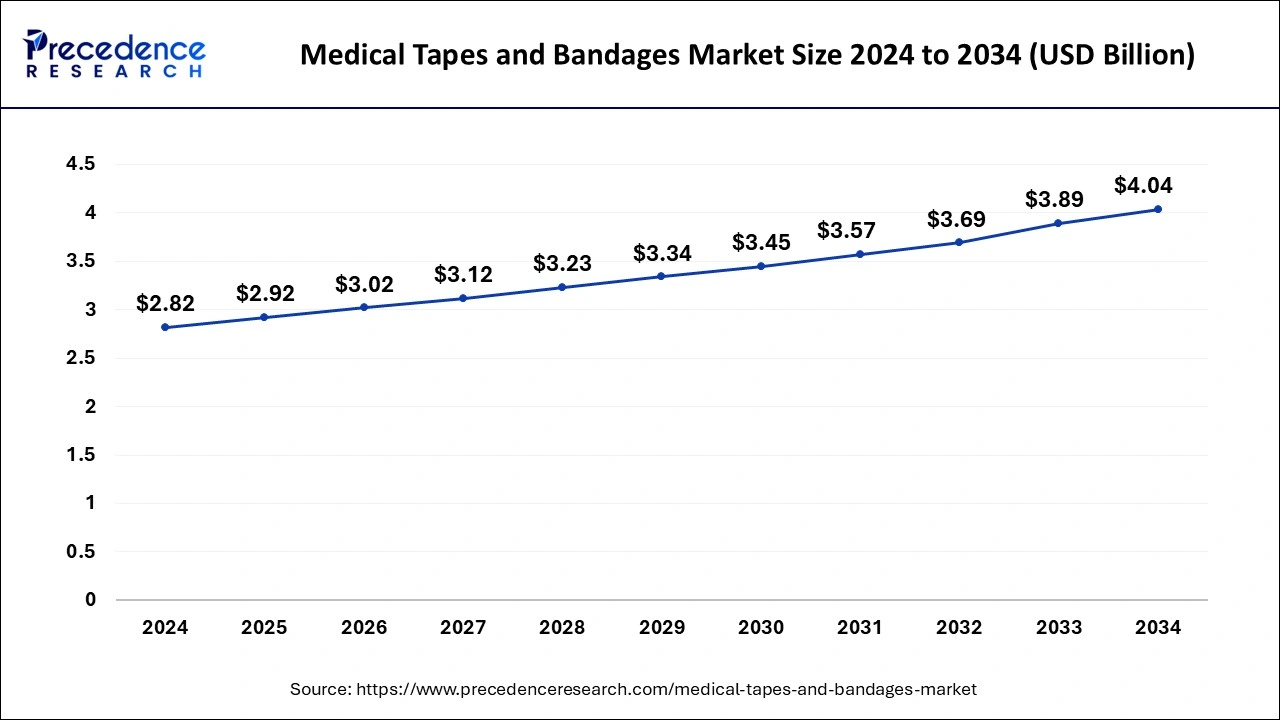

What is the U.S. Medical Tapes and Bandages Market Size?

The U.S. medical tapes and bandages market size was exhibited at USD 2.92 billion in 2025 and is projected to be worth around USD 4.22 billion by 2035, poised to grow at a CAGR of 3.75% from 2026 to 2035.

North America led the medical tapes and bandages market with the largest market share in 2024. The growth of the market is attributed to the higher availability of well-developed healthcare infrastructure, and pharmaceutical companies in countries like the U.S. and Canada are driving the growth of the market. The rising prevalence of road accidents is driving the increasing number of surgeries in the region, positively impacting the growth of the market. Additionally, the rising number of diabetes cases in the population due to the changing lifestyle and aging factors that cause ulcers influenced the growth of the medical tapes and bandages market in the region.

- According to a report published in 2023, the Indian Department of Pharmaceuticals, the U.S. (59.75%), Japan (45.49%), Singapore (18.91%), and Germany (9.68%) all saw notable increases. The U.S. assumed the top spot as a destination for imports. Increased imports of ice bags, sticky gauze bandages, adhesive tapes, and other related items were the cause of the positive growth rate.

The yearly cost of treating injuries in the U.S. is estimated to be over $50 billion.5. Medicare, a health insurance program, reports that the annual cost of wound treatment for its participants ranges from 28.1 to 96.8 billion dollars. The costliest wounds are surgical wounds and diabetic ulcers, at 18.7 billion and 38.3 billion dollars, respectively.

What Makes Asia Pacific the Fastest-Growing Region in the Market?

Asia Pacific is expected to witness the fastest growth during the forecast period. The growth of the market in the region is expected to rise due to the rising population and increasing demand for healthcare infrastructure. The rising geriatric population that is more likely to get infected by some infections drives the demand for efficient treatment and medication that positively impacts the growth of the market. Additionally, the rising cases of diabetes in the population of the region, especially in countries like India and China, is anticipated to contribute significantly to the expansion of the medical tapes and bandages market.

What Potentiates the Medical Tapes and Bandages Market in Europe?

The market in Europe is expected to grow at a significant rate throughout the forecast period. This growth is driven by the region's mature healthcare systems, strong regulatory oversight, and high volumes of surgical wound care, trauma treatment, and ulcer management. The regional market growth is further driven by a rapidly aging population and rising chronic wound cases, prompting healthcare providers to invest in advanced dressings and adhesives. Manufacturers are also targeting European tenders with innovations such as antimicrobial bandages and skin-friendly tapes, sustaining consistent demand across the region.

How is the Opportunistic Rise of Latin America in the Medical Tapes and Bandages Market?

Latin America is experiencing lucrative growth in the market. This growth is driven by expanding surgical interventions and trauma care. The region's market is also driven by factors such as increasing healthcare expenditure, improving access to wound‑care products, and rising awareness of chronic wound management. Hospitals and ambulatory care centers in Brazil are increasingly adopting advanced bandages and medical tapes, creating growth opportunities.

What Opportunities Exist in the Middle East & Africa for the Market?

The Middle East & Africa (MEA) presents immense opportunities for the market, as the region's healthcare infrastructure improves, and surgical volumes increase. Regional demand is further being supported by expanding hospital networks, rising incidence of diabetes‑related ulcers, and an enhanced focus on wound care services in emerging markets. Various international players are increasingly engaging with regional distributors and government hospital systems in order to gain a competitive edge, helping the region maintain its steady growth trajectory.

Value Chain Analysis

- Raw Material Sourcing

Raw material for medical tapes and bandages mainly includes medical-grade textiles, polymers, adhesives, and absorbent materials that are specifically designed for skin contact and wound management.

Key Players: Avery, Dupont, Berry Global - Manufacturing Process

This stage involves coating adhesives onto backing materials, lamination, cutting, and conversion into tapes, rolls, strips, and bandage formats.

Key Players: Paul Hartman, Johnson and Johnson, Convatec - Distribution Process

The distribution stage occurs through hospital procurement systems, pharmacies, clinics, home healthcare providers, and medical supply distributors.

Key Players: Medline, Cardinal Health, McKesson

Major Players in the Medical Tapes and Bandages Market

- Smith & Nephew PLC

- Mölnlycke Health Care AB

- 3M

- McKesson Corporation

- Ethicon Inc. (JOHNSON & JOHNSON)

- B. Braun Melsungen AG

- Paul Hartmann AG

- Coloplast

- Integra Lifesciences

- Medtronic Industries

Latest Announcement by Industry Leader

In January 2025, MedicosBiotech has been honored with the prestigious CES Innovation Award in the Digital Health category at CES 2025. This accolade highlights the company's groundbreaking chronic wound care solution, Cure Silk, which combines AI and biotechnology to address critical healthcare needs. "This award reflects MedicosBiotech's commitment to innovation in healthcare," said Soon Cheol Daniel Kim, COO of MedicosBiotech. Cure Silk offers an affordable, easy-to-use solution that improves access to chronic wound care, contributing to a more inclusive and accessible global healthcare system.

Recent Developments

- In January 2025, a master's student from the University of Wolverhampton, Khabat Jamel, developed a groundbreaking biodegradable wound dressing with potential to revolutionize wound care. Combining thyme and ginger's natural healing properties with the antimicrobial strength of silver nanoparticles, this innovative hydrogel offers a sustainable and effective alternative for wound management.

- In October 2024, Solventum introduced its Double-Coated Medical Tape with Hi-Tack Silicone and Acrylate Adhesives on Liner (2487 Hi-Tack Silicone Tape), an innovative adhesive solution designed for sensitive skin. This advancement allows medical wearable manufacturers to broaden their device accessibility for a wider patient demographic.

- In June 2024, researchers have created a dissolvable, ultra-elastic adhesive patch to deliver therapeutics that promote healing. Designed for diverse medical applications, from chronic wounds to battlefield triage and heart surgery, this self-sticking bandage adapts to various body surfaces, creating a bond stronger than current FDA-approved adhesives. The details of this breakthrough are outlined in Nature Communications.

Segments Covered in the Report

By Product

- Medical Tapes

- Fabric Tapes

- Acetate

- Viscose

- Cotton

- Silk

- Polyester

- Other Fabric Tape

- Paper Tapes

- Plastic Tapes

- Propylene

- Other Plastic Tapes

- Other Tapes

- Fabric Tapes

- Medical Bandages

- Muslin Bandage Rolls

- Elastic Bandage Rolls

- Triangular Bandage Rolls

- Orthopedic Bandage Rolls

- Elastic Plaster Bandages

- Other Bandages

By Application

- Surgical Wound

- Traumatic Wound

- Ulcer

- Sports Injury

- Burn Injury

- Others Injury

By End-use

- Hospitals

- Ambulatory Surgery Center

- Clinics

- Retail

- Others

By Geography

- North America

- Asia Pacific

- Europe

- Latin America

- Middle East & Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting