What is Medical Washers Disinfectors Market?

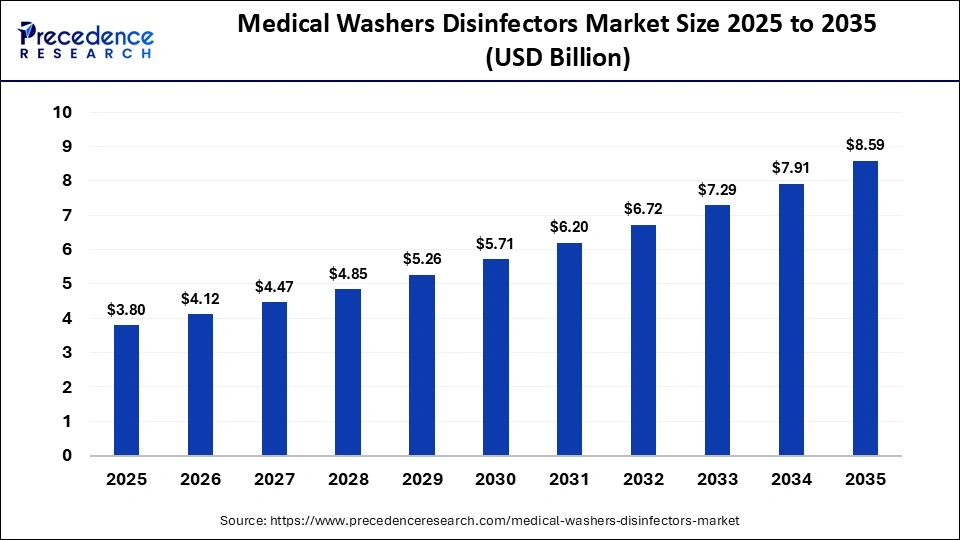

The global medical washers disinfectors market size was calculated at USD 3.80 billion in 2025 and is predicted to increase from USD 4.12 billion in 2026 to approximately USD 8.59 billion by 2035, expanding at a CAGR of 8.50% from 2026 to 2035. The market is rapidly growing due to rising focus on patient safety, the necessity to meet strict hygiene regulations, rising worldwide surgical procedures, and the expansion of centralized sterile supply departments.

Market Highlights

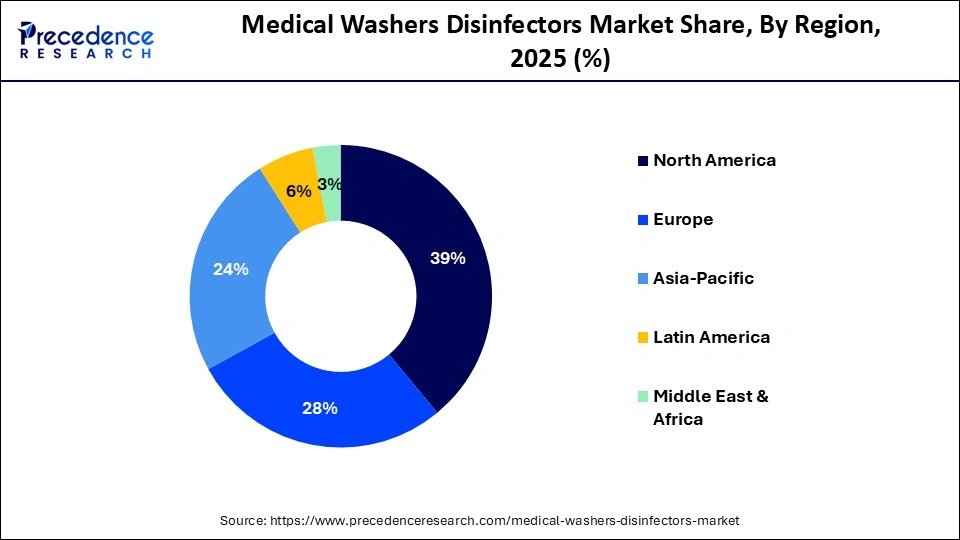

- North America held the largest market share of nearly 39% in 2025.

- Asia-Pacific is expected to grow at the fastest CAGR in the medical washers disinfectors market during the foreseeable period.

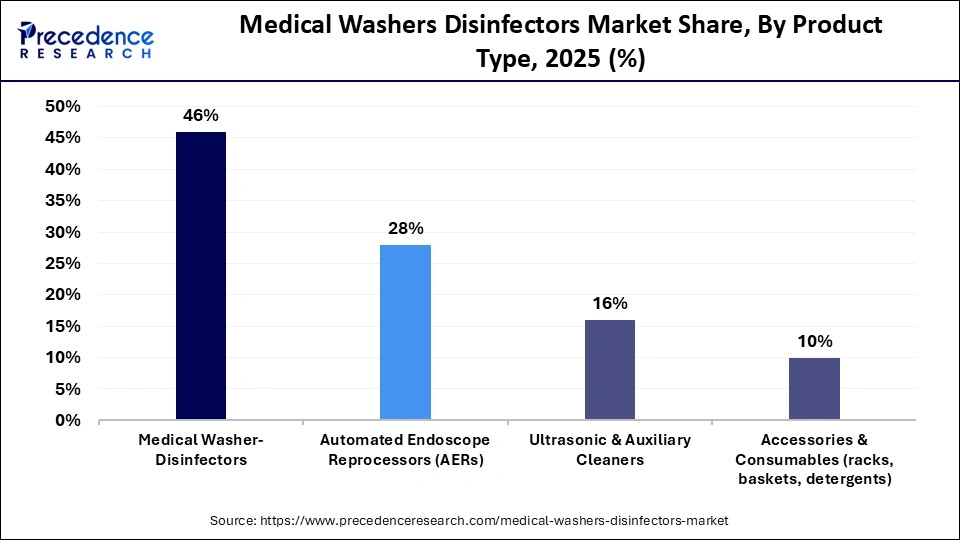

- By product type, the medical washer-disinfectors segment held the largest market share of nearly 46% in 2025.

- By product type, the automated endoscope reprocessors (AERs) segment is expected to grow at the fastest CAGR during the forecast period.

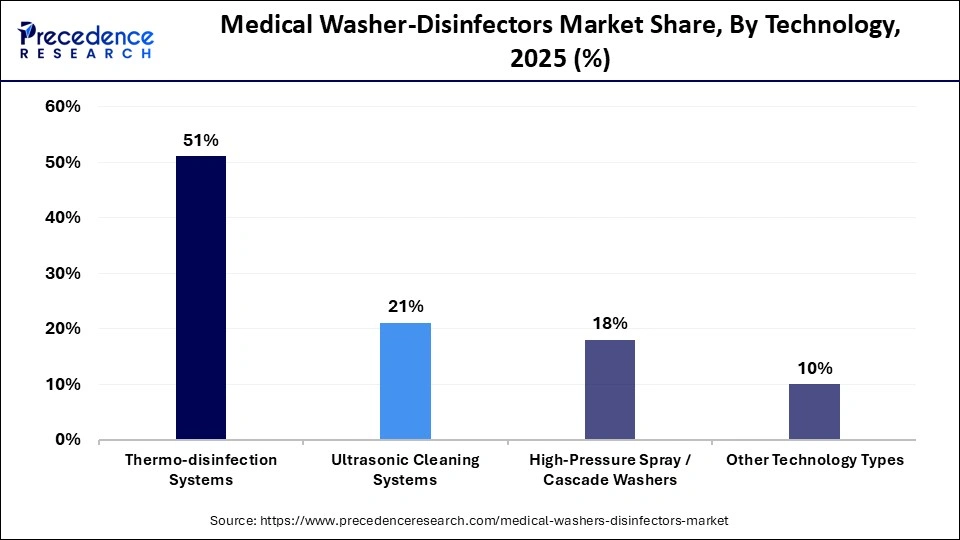

- By technology, the thermo-disinfection systems segment held the largest market share of nearly 51% in 2025.

- By technology, the ultrasonic cleaning systems segment is expected to grow at the fastest CAGR during the foreseeable period.

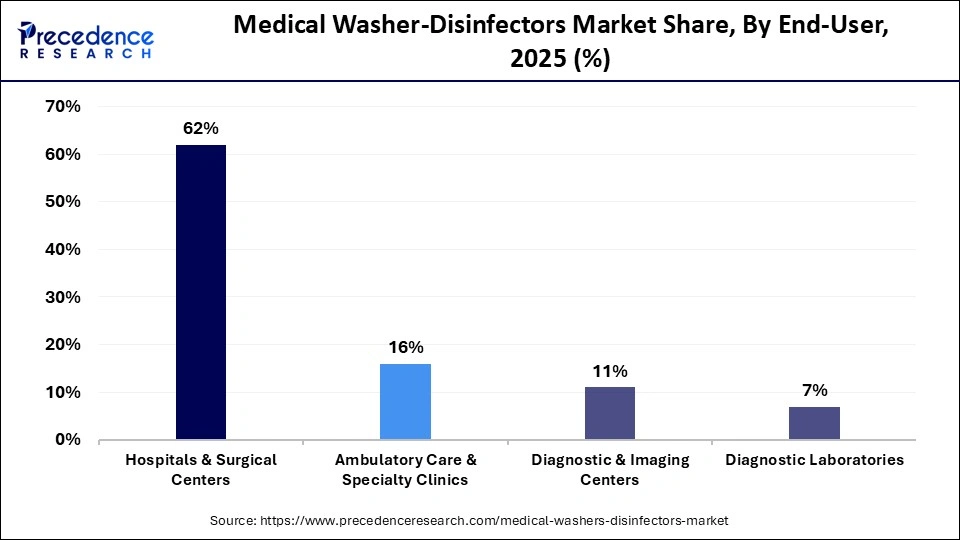

- By end-user, the hospitals & surgical centers segment held the largest market share of nearly 62% in 2025.

- By end user, the ambulatory care & specialty clinics segment is expected to grow at the fastest CAGR in the medical washers disinfectors market between 2026 and 2035.

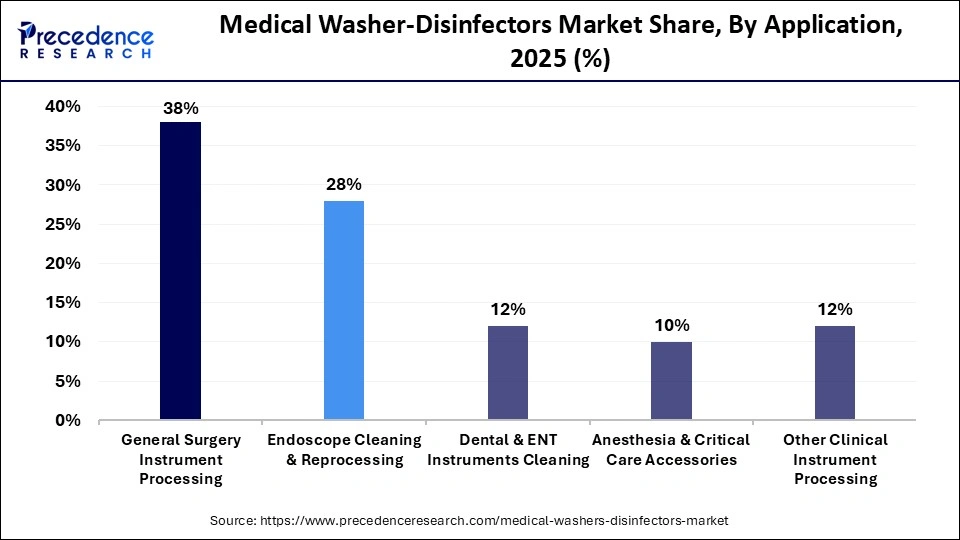

- By application, the general surgery instrument processing segment held the largest market share of nearly 38% in 2025.

- By application, the endoscope cleaning & reprocessing segment is expected to grow at the fastest CAGR during the foreseeable period.

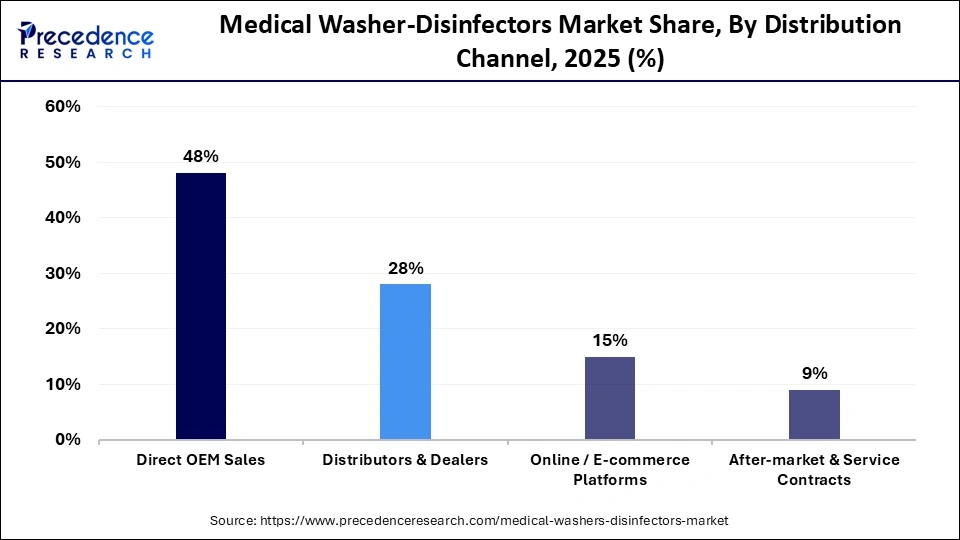

- By distribution channel, the direct OEM sales segment held the largest market share of nearly 48% in 2025.

- By distribution channel, the online/e-commerce platforms segment is expected to grow at the fastest CAGR in the coming years.

Market Overview

The medical washers disinfectors market comprises automated cleaning, disinfection, and decontamination systems used to process reusable medical devices, surgical instruments, endoscopes, trays, and anesthesia components. Products include washer-disinfectors, ultrasonic cleaners, automated endoscope reprocessors (AERs), and related systems that improve cleaning efficacy, standardize infection prevention, reduce manual labor, and ensure compliance with sterilization protocols across hospitals, ambulatory surgical centers, diagnostic centers, and specialty clinics.

How is AI Influencing the Medical Washers Disinfectors Market?

The integration of artificial intelligence (AI), specifically machine learning (ML), holds immense potential from manual, scheduled routines to automated, intelligent, and data-driven systems that significantly reduce human error and enhance safety. The integration of AI and IoT enables real-time monitoring of wash cycles, water temperatures, and detergent usage, facilitating predictive maintenance to avoid costly downtime. These advanced systems use ML to adapt sterilization parameters based on specific load types and contamination levels, ensuring consistent, high-level disinfection of surgical instruments and endoscopes.

Medical Washers Disinfectors Market Trends

- The integration of IoT-enabled platforms is redefining operational transparency. By leveraging real-time telemetry, tracking cycle parameters, chemical consumption, and thermal accuracy, providers can implement predictive maintenance and generate automated, audit-ready compliance documentation that mitigates legal and clinical risk.

- Manufacturers are prioritizing environmental, social, and governance (ESG) criteria by engineering high-efficiency systems. Innovations such as closed-loop water recycling and biodegradable chemical integration enable healthcare facilities to reduce utility costs while meeting corporate sustainability requirements.

- Decentralized care & scalability, the rise of ambulatory surgical centers (ASCs) and specialized clinics, pivot the market towards high-performance benchtop units.

- Increased focus on specialized cleaning for robotic and minimally invasive tools. The proliferation of robotic-assisted and minimally invasive surgery (MIS) tools necessitates advanced reprocessing.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 3.80 Billion |

| Market Size in 2026 | USD 4.12 Billion |

| Market Size by 2035 | USD 8.59 Billion |

| Market Growth Rate from 2026 to 2035 | CAGR of 8.50% |

| Dominating Region | Europe |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | ByType,Application,Form,Grade, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Segmental Insights

Product Type Insights

Which Product Type Segment Led the Medical Washers Disinfectors Market?

The medical washer-disinfectors segment led the market by holding the largest share of nearly 46% in 2025. This is because of the critical need to mitigate healthcare-associated infections (HAIs) and manage the global surge in surgical volumes through high-throughput, continuous-flow processing. By replacing manual cleaning with validated, ISO-compliant automation, facilities ensure superior risk management, staff safety, and comprehensive audit trails.

The automated endoscope reprocessors (AERs) segment is expected to show the fastest growth over the forecast period due to the imperative to eliminate human error and ensure validated, high-level disinfection amidst surging procedural volumes. By replacing variable manual methods with digitalized, FDA-compliant automation, facilities achieve superior risk mitigation, rigorous infection control, and seamless audit readiness.

Technology Insights

Which Technology Segment Dominated the Medical Washers Disinfectors Market?

The thermo-disinfection systems segment dominated the market with a major share of nearly 51% in 2025, as their ability to deliver validated, high-level disinfection using moist heat effectively penetrates biofilms. These systems enhance operational efficiency through automation for high-volume surgical loads and ensure compliance with international regulatory standards (ISO/FDA). They also offer a lower total cost of ownership and a sustainable environmental profile by reducing the need for chemical disinfectants.

The ultrasonic cleaning systems segment is expected to gain the highest share of the market between 2026 and 2035 due to reduced cycle times and the elimination of variability and injury risks associated with manual scrubbing. By leveraging advanced cavitation technology, facilities achieve a sustainable, low-consumption cleaning process that aligns with ISO-validated compliance standards. Ultimately, ultrasonic systems serve as a critical component in protecting surgical investments while maintaining the highest levels of clinical safety.

End-User Insights

Why Did the Hospitals & Surgical Centers Segment Dominate the Market?

The hospitals & surgical centers segment held the largest medical washers disinfectors market share of nearly 62% in 2025, as rapid integration of robotic-assisted technologies and the expansion of multispecialty infrastructure necessitated high-capacity, automated decontamination. As providers transition toward ambulatory surgical centers (ASCs) and outpatient models, the demand for optimized throughput and compact, high-performance disinfection solutions has intensified.

The ambulatory care & specialty clinics segment is expected to witness the fastest growth in the market over the forecast period due to the adoption of automated, traceable decontamination technologies. These facilities ensure rigorous compliance with intensifying regulatory standards while optimizing instrument turnaround for same-day procedures. This shift effectively mitigates HAI risks and enhances fiscal efficiency in increasingly decentralized healthcare environments.

Application Insights

How the General Surgery Instrument Processing Segment Led the Market?

The general surgery instrument processing segment led the medical washers disinfectors market with a share of approximately 38% 2025 due to transitioning to CSSD-centralized, IoT-enabled systems. Healthcare providers ensure rigorous adherence to ISO 15883 and FDA standards through validated, traceable decontamination cycles. Furthermore, the rapid expansion of ASCs is driving the adoption of high-performance, compact units that optimize instrument turnover for same-day procedures.

The endoscope cleaning & reprocessing segment is expected to expand rapidly in the market in the coming years due to increasing procedures, such as colonoscopies, endoscopies, and bronchoscopies, stringent infection control regulations, and the complexity of endoscope reprocessing. The shift towards automated endoscope reprocessors and rapidly developing healthcare infrastructure in the region are fueling market growth.

Distribution Channel Insights

What Made Direct OEM Sales the Dominant Segment in the Market?

The direct OEM sales segment held a major revenue share of approximately 48% in the medical washers disinfectors market in 2025 due to rising consumer trust, safety, strict international integration, providing verified, high-performance cleaning. By bypassing third-party intermediaries, healthcare providers gain direct access to specialized OEM validation and qualification services, which are essential for meeting the precise temperature and lethality requirements of ISO 15883 and FDA standards.

The online/e-commerce platforms segment is expected to expand at the fastest CAGR during the foreseeable period due to the need for providing healthcare administrators with transparent pricing, AI-driven personalization, and real-time ERP integration for seamless inventory management. These platforms facilitate the rapid acquisition of validated, high-efficiency washer-disinfectors, allowing facilities to bypass traditional procurement bottlenecks and respond swiftly to increasing procedural demands.

Regional Analysis

How Big is the North America Medical Washers Disinfectors Market Size?

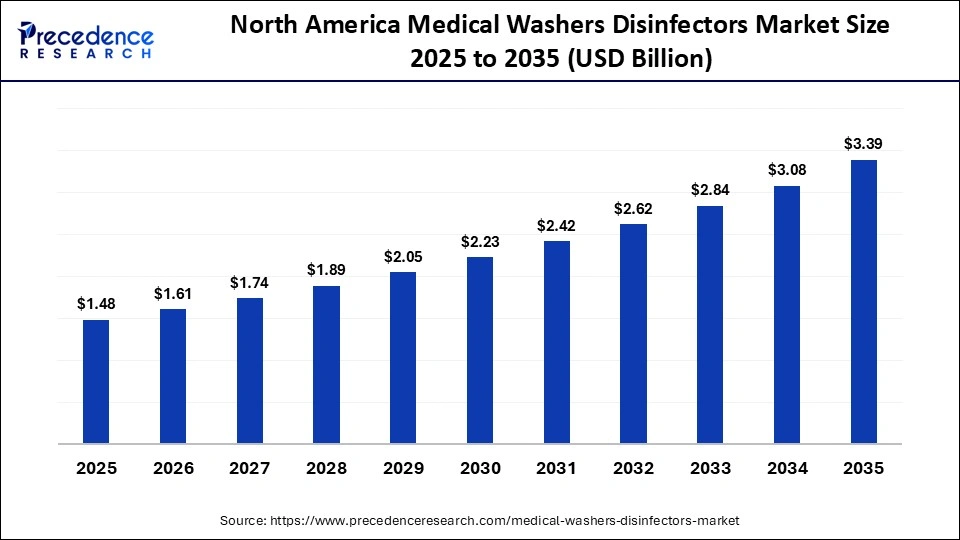

The North America medical washers disinfectors market size is estimated at USD 1.48 billion in 2025 and is projected to reach approximately USD 3.39 billion by 2035, with a 8.64% CAGR from 2026 to 2035.

What Made North America the Dominant Region in the Market?

North America registered dominance in the medical washers disinfectors market by holding the largest share of nearly 39% in 2025. This is mainly due to a rigorous regulatory landscape and a strategic imperative to mitigate high clinical costs associated with healthcare-associated infections (HAIs). With the U.S. executing over 50 million annual surgeries, healthcare providers are prioritizing high-capacity, IoT-enabled automation to ensure standardized, validated decontamination that meets stringent FDA and OSHA mandates.

The rapid proliferation of ASCs is further accelerating the demand for compact, energy-efficient units designed for high-turnover outpatient environments. Ultimately, this integration of advanced infrastructure and smart technology positions the region as the global leader in operational scalability and clinical safety.

What is the Size of the U.S. Medical Washers Disinfectors Market?

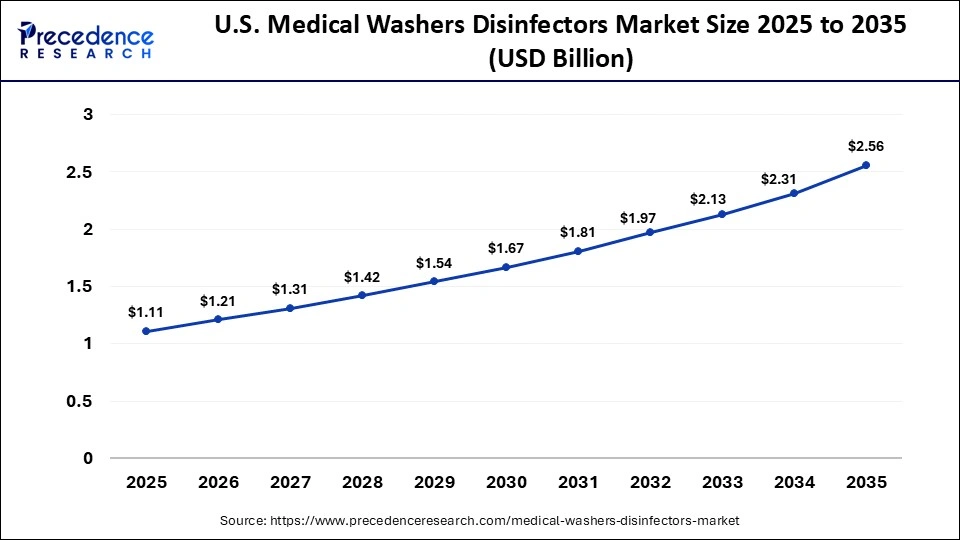

The U.S. medical washers disinfectors market size is calculated at USD 1.11 billion in 2025 and is expected to reach nearly USD 2.56 billion in 2035, accelerating at a strong CAGR of 8.72% between 2026 to 2035.

U.S. Medical Washers Disinfectors Market Analysis

The U.S. market is growing due to a shift toward AI-powered and IoT-integrated decontamination ecosystems, eliminating the variability of manual processes and mitigating the rising burden of HAIs. This evaluation is driven by stringent CDC and AAMI compliance mandates, requiring validated, data-rich documentation for every disinfection cycle.

The Centers for Disease Control and Prevention (CDC) reported that HAIs are a major concern among patients in healthcare organizations. Approximately 1 in 31 U.S. patients and 1 in 43 nursing home residents contract at least one infection each day.

Why is the Asia-Pacific Region Rapidly Expanding in the Market?

Asia-Pacific is expected to witness the fastest growth during the predicted timeframe due to surging surgical volumes and the region's expanding medical tourism sectors, which necessitate high throughput, ISO-compliant decontamination systems to replace variable manual methods. Furthermore, the integration of IoT-enabled "smart" technologies is allowing facilities to scale operations while ensuring the rigorous hygiene standards required for complex, robotic-assisted procedures.

India Medical Washers Disinfectors Market Analysis

In India, the market is evolving due to the transition from manual reprocessing to IoT-integrated automated ecosystems to ensure consistent, validated disinfection. These smart systems mitigate human error through real-time telemetry and compliance tracking, providing data-rich audit trails required by modern regulatory frameworks. Furthermore, the market is prioritizing high-capacity and specialized architectures that maximize operational throughput while adhering to aggressive institutional sustainability and water-conservation targets.

Value Chain Analysis - Medical Washers Disinfectors Market

- Research & Development (R&D) and Design: This initial stage focuses on creating innovative, energy-efficient, and IoT-enabled washers that comply with international, high-level disinfection standards.

Key Players: STERIS, Getinge AB, Steelco S.p.A. (SteelcoBelimed), Olympus Corporation. - Raw Material Sourcing and Components Supply: Manufacturers source high-grade stainless steel, sensors, PLC controllers, pumps, and water-heating components to build robust cleaning systems.

Key Players: Stainless steel providers and Ecolab Inc. - Regulatory Compliance: Medical washers disinfectors must comply with the stringent regulations of international standards (ISO 15883) for performance, validation, and testing.

Key Players: FDA, EMA, NMPA, ISO - Distribution and Marketing; Products are distributed through direct sales to hospitals and through authorized distributors to clinics and laboratories, with a focus on supplying Central Sterile Supply Departments (CSSDs).

Key Players: STERIS, Getinge

Who are the major players in the global medical washers disinfectors market?

The major players in the medical washers disinfectors market include MELAG Medizintechnik GmbH & Co. KG, STERIS, Tuttnauer, ECOLAB, Olympus Corporation, Getinge, SHINVA MEDICAL INSTRUMENT CO., LTD., Skytron, LLC, COLTENE Group, AT-OS S.r.l., and Map Industries

Recent Developments

- In November 2025, Getinge launched its washer-disinfector, Aquadis 44. This model emphasizes utility efficiency and sustainability, utilizing features like dynamic water filling and heat recovery to minimize resource consumption and operational costs. (Source:https://www.getinge.com)

- In April 2024, SHINVA Medical Instrument Co., Ltd. signed a Memorandum of Understanding (MOU) with the South Korean imaging company Genoray to expand cooperation and market presence in the Chinese healthcare market.(Source:https://www.shinva.com)

- In June 2024, Getinge launched Aquadis Index. This multi-chamber washer-disinfectant offers a high capacity of up to 18 DIN trays per load and features a unique, intuitive user interface that is easy for staff of all experience levels to operate. It is fully connected for data access and real-time monitoring.(Source:https://www.getinge.com)

Segments Covered in the Report

By Product Type

- Medical Washer-Disinfectors

- Automated Endoscope Reprocessors (AERs)

- Ultrasonic & Auxiliary Cleaners

- Accessories & Consumables (racks, baskets, detergents)

By Technology

- Thermo-disinfection Systems

- Ultrasonic Cleaning Systems

- High-Pressure Spray / Cascade Washers

- Other Technology Types

By End-User

- Hospitals & Surgical Centers

- Ambulatory Care & Specialty Clinics

- Diagnostic & Imaging Centers

- Diagnostic Laboratories

- Other End-Users

By Application

- General Surgery Instrument Processing

- Endoscope Cleaning & Reprocessing

- Dental & ENT Instruments Cleaning

- Anesthesia & Critical Care Accessories

- Other Clinical Instrument Processing

By Distribution Channel

- Direct OEM Sales

- Distributors & Dealers

- Online / E-commerce Platforms

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting