What is Medium Voltage Transformer Market Size in 2026?

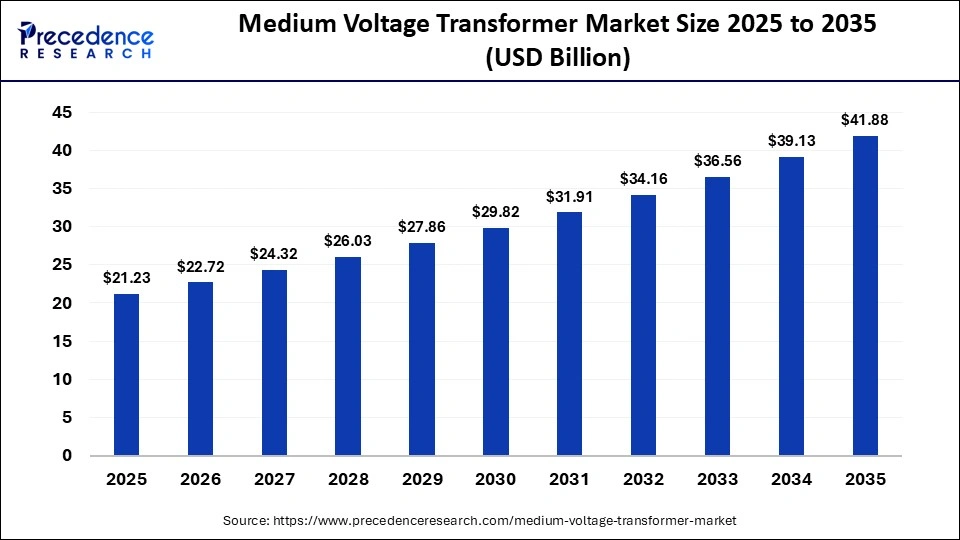

The global medium voltage transformer market size was calculated at USD 21.23 billion in 2025 and is predicted to increase from USD 22.72 billion in 2026 to approximately USD 41.88 billion by 2035, expanding at a CAGR of 7.03% from 2026 to 2035. The market is witnessing substantial growth due to the intense necessity for grid modernization, renewable energy integration, and increasing demand for smart, efficient power distribution infrastructure.

Key Takeaways

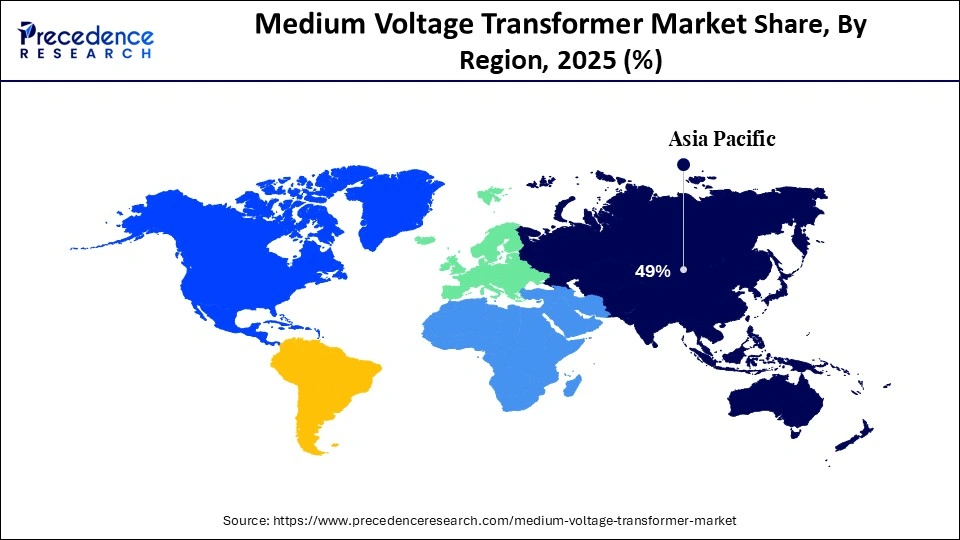

- Asia Pacific dominated the market with a major share in 2025 and is expected to grow at the fastest rate in the coming years.

- By cooling type, the oil-cooled segment contributed the highest market share in 2025.

- By cooling type, the air-cooled segment is expected to grow at a strong CAGR between 2026 and 2035.

- By phase, the three-phase segment generated the biggest market share in 2025.

- By transformer type, the distribution segment accounted for the largest market share in 2025.

- By transformer type, the power segment is projected to grow at a solid CAGR between 2026 and 2035.

- By end-user, the power utilities segment held a major market share in 2025.

- By end-user, the commercial segment is expected to expand at a notable CAGR from 2026 to 2035.

Market Overview

The medium-voltage transformer is an electrical devices that transfer power between circuits while changing voltage levels, typically within the 1 kV to 52 kV range. These transformers are critical components in distribution networks, connecting high-voltage transmission grids to end-user applications. They are primarily used to step down distribution-line voltage for industrial, commercial, and residential use. Market growth is driven by renewable energy integration, grid modernization, and urbanization, along with strong demand for efficient, smart-grid-compatible units.

How is AI Transforming the Medium Voltage Transformer Market?

Artificial intelligence is transforming the medium voltage transformer market by enhancing operational efficiency, predictive maintenance, and design through digital twin technology and sensor data analysis, reducing downtime. AI-based systems adjust load and voltage levels in real time to manage thermal stress, improve energy efficiency, and support renewable energy integration. AI algorithms also analyze sensor data to detect anomalies and predict failures, significantly reducing unplanned downtime and maintenance costs. AI supports adaptive relay protection and faster fault location in MV switchgear, ensuring higher grid resilience.

Major Trends in the Medium Voltage Transformer Market

- Smart and Digital Transformer Adoption: Integration of IoT-enabled smart transformers enables real-time monitoring, data analytics, and predictive maintenance, ensuring grid stability and reduced downtime.

- Shift Toward Environmental Sustainability: Increased focus on green alternatives, such as ester oils, instead of mineral oil, to minimize environmental risks from leaks and improve fire safety.

- Energy Efficiency and Low-Loss Designs: Rising demand for high-efficiency transformers to reduce energy losses, with a significant share of new installations focused on eco-design standards.

- Emerging Compact and Dry-Type Transformers: Growing demand for dry-type or cast-resin transformers, especially in urban infrastructure and indoor applications, due to their superior fire safety and minimal maintenance needs.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 21.23 Billion |

| Market Size in 2026 | USD 22.72 Billion |

| Market Size by 2035 | USD 41.88 Billion |

| Market Growth Rate from 2026 to 2035 | CAGR of 7.03% |

| Dominating Region | Asia Pacific |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | Cooling Type,Phase,Transformer Type,End-User, and region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Segment Insights

Cooling Type Insights

How Did the Oil-Cooled Segment Lead the Medium Voltage Transformer Market?

The oil-cooled segment led the market with the largest share in 2025, primarily due to its superior thermal efficiency, cost-effectiveness, and reliability in heavy-load applications. Oil-cooled transformers use dielectric oil to dissipate heat more effectively than dry-type or air-cooled alternatives, enabling them to handle higher loads without overheating. The expansion of solar and wind farms necessitates durable, high-capacity transformers capable of managing fluctuating loads, a scenario where oil-cooled systems excel. Heavy industries that require robust transformers to support high-power demands prefer the durability of oil-immersed units.

The air-cooled segment is expected to experience the fastest growth during the forecast period. This is largely attributed to their superior safety, environmental compliance, and compact design, making them ideal for urban infrastructure. Air-cooled transformers are preferred in wildfire-prone regions, as they eliminate the need for oil containment pits, thereby reducing maintenance and ensuring compliance with strict environmental regulations. Modern air-cooled units utilize vacuum-cast coils, amorphous-metal cores, and active fan modules to improve efficiency, reducing the higher historical losses compared to oil-filled alternatives.

Phase Insights

What Made Three-Phase the Dominant Segment in the Medium Voltage Transformer Market?

The three-phase segment dominated the market in 2025 and is expected to sustain its growth during the forecast period. This is mainly due to lower energy losses and the ability to handle high-power loads in industrial and utility applications. The increasing demand for reliable power in data centers, electric vehicle charging infrastructure, and railway electrification is creating the need for three-phase transformers. Furthermore, the expansion of renewable energy sources, such as solar and wind, requires robust, high-capacity three-phase transformers. The integration of digital monitoring, smart sensors, and eco-efficient insulation technologies enhances the performance and lifespan of these transformers, ensuring their market dominance.

The single-phase segment is expected to grow at a notable rate in the coming years because single-phase transformers are widely used in rural electrification, residential, and small commercial applications where compact, cost-effective solutions are preferred. Their simpler design, ease of installation, and lower maintenance requirements make them ideal for distributed energy systems and local grids, driving adoption in regions with expanding power infrastructure.

Transformer Type Insights

Why did the Distribution Segment Dominate the Medium Voltage Transformer Market?

The distribution segment dominated the market in 2025. This leadership is driven by critical infrastructure needs, the intense demand for upgrading urban power grids, rising demand for renewable energy integration, and increasing commercial electrification. As countries invest in updating aging infrastructure, especially in expanding cities, medium-voltage distribution transformers are essential for managing voltage levels for end-users. The rise of solar and wind projects requires flexible and reliable medium-voltage transformers to connect localized power generation to the grid effectively.

The power segment is projected to grow at the fastest rate in the foreseeable period. This growth is mainly driven by urgent infrastructure modernization, rapid industrialization, and the increased integration of renewable energy sources. The rapid expansion and upgrading of transmission networks improve reliability and accommodate rising energy demands, leading to new installations of power transformers. High-energy consumers in the manufacturing sector, alongside the growth of wind and solar farms, are driving demand for specialized, high-capacity transformers with reduced operational downtime.

End-User Insights

What Made Power Utilities the Leading Segment in the Medium Voltage Transformer Market?

The power utilities segment led the global market in 2025. This dominance stems from their essential role in grid modernization, expansion, and the integration of renewable energy sources. The shift toward green energy necessitates new substations, resulting in a high volume of transformers required to connect distributed renewable sources to the main grid. Government initiatives aimed at stabilizing power grids and improving energy efficiency drive consistent investments in new, reliable, and intelligent transformer technologies, necessitating substantial investment in distribution networks.

The commercial segment is expected to grow at the fastest rate during the forecast period. This growth is fueled by rapid urbanization, increased commercial infrastructure development, and the urgent need for modernization of electrical grids. Commercial users are investing in smart grid-compatible and energy-efficient transformers to meet sustainability goals and reduce operational costs. The surge in data center construction necessitates reliable, medium-voltage power systems, which in turn drives the demand for specialized transformers and encourages the adoption of advanced, reliable transformer technologies.

Regional Insights

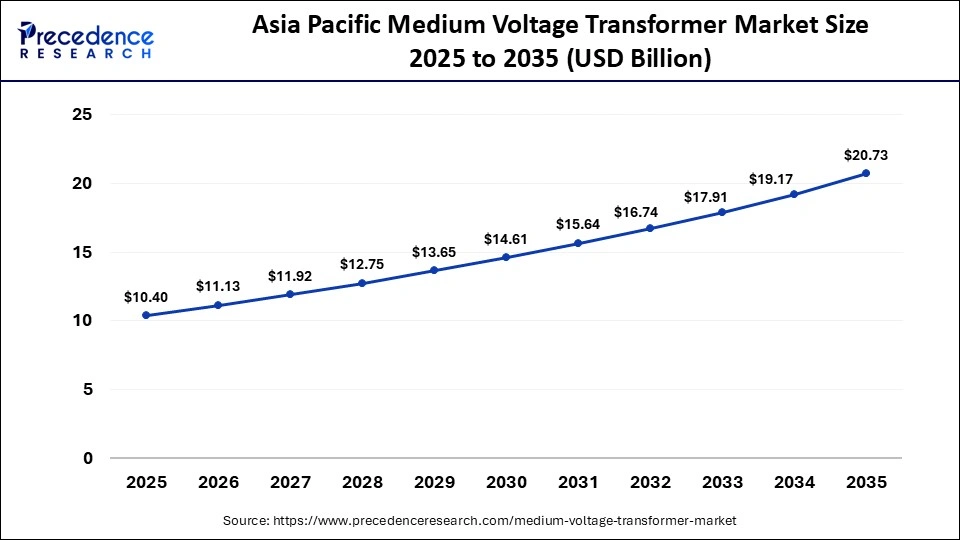

Asia Pacific Medium Voltage Transformer Market Size and Growth 2026 to 2035

The Asia Pacific medium voltage transformer market size is expected to be worth USD 20.73 billion by 2035, increasing from USD 10.40 billion by 2025, growing at a CAGR of 7.14% from 2026 to 2035

How is Asia Pacific Dominating the Medium Voltage Transformer Market?

Asia Pacific dominated the market and is expected to sustain its growth trajectory during the forecast period. This growth is largely attributed to rapid industrialization, aggressive renewable energy integration, and significant grid modernization efforts, particularly in China and India. The proliferation of data centers and the urgent need for electric vehicle charging stations in cities like Shanghai and Beijing are accelerating the demand for reliable distribution transformers. The presence of leading manufacturers with high production capacity, such as TBEA and BHEL, enables competitive pricing, particularly for distribution transformers in developing economies, driving massive investment in transmission and distribution infrastructure.

China Medium Voltage Transformer Market Trends

China plays a distinctive role in the region, driven by aggressive expansion of solar and wind capacity, high-speed rail electrification, and data center growth. The country is heavily investing in UHV corridors and grid digitalization. Chinese manufacturers such as TBEA, China XD Group, and NR Electric are leaders in the industry, with immense domestic capacity and, in some cases, vertically integrated supply chains for essential materials. There is a rapid shift toward gas-insulated switchgear for urban projects and a move toward dry-type transformers for safety.

India Medium Voltage Transformer Market Trends

India is emerging as a high-growth market, driven by strong demand across transmission and distribution networks. Local manufacturers like CG Power, BHEL, and Toshiba Transmission & Distribution Systems India are expanding capacity to serve both domestic and export markets. Key growth drivers include the rising need for energy-efficient transformers, smart transformer adoption, and the modernization of aging urban and rural power infrastructure.

How is the Opportunistic Rise of North America in the Medium Voltage Transformer Market?

North America is expected to grow at a significant rate in the global market, driven by aging power grids in the U.S. and Canada that require large-scale replacement with modern, smart-enabled transformers. Federal initiatives, including funding through the Infrastructure Investment and Jobs Act and DOE efficiency standards, are accelerating demand for energy-efficient, low-loss transformers. Additionally, the rapid expansion of electric vehicle charging infrastructure is creating a need for localized, high-capacity transformer solutions.

Top Companies Operating in the Medium Voltage Transformer Market

- Hitachi Energy Ltd.

- Siemens Energy AG

- Schneider Electric SE

- Eaton Corporation PLC

- General Electric

- Mitsubishi Electric Corporation

- CG Power and Industrial Solutions Limited

- Toshiba Energy Systems and Solutions Corporation

- Hyosung Heavy Industries

- WEG S.A.

- Hammond Power Solutions Inc.

- SGB-SMIT Group

- TBEA Co., Ltd.

- Hyundai Electric and Energy Systems Co., Ltd.

- Voltamp Transformers Ltd.

Recent Developments

- In August 2025, GameChange BOS opened a 180,000 sq. ft. medium voltage transformer facility in Taloja, Maharashtra, with an annual capacity of 1,800 units. The expansion allows the company to produce transformers across 0.5–25 MVA and up to 69 kV, serving high-growth sectors like AI-driven data centers, renewables, BESS, and large-scale electrification projects in India, Europe, and the U.S. (Source: https://www.thehindu.com)

- In October 2024, Hammond Power Solutions launched HPS Smart Transformers for medium and low voltage applications, featuring IIoT-enabled power monitors for real-time data insights. The system allows users to proactively detect equipment stress or potential failures, enhancing operational efficiency and preventing costly downtime. (Source:https://emea.hammondpowersolutions.com)

- In December 2025, U.S.-based Giga Energy announced its 60,000 sq. ft. Houston facility as its primary U.S. site for medium-voltage transformers, set to start production in Q1 2026. The factory will scale to over 3,000 units annually (15 GW), addressing critical transformer shortages that hinder new power capacity deployment. (Source:https://www.bicmagazine.com)

Segments Covered in the Report

By Cooling Type

- Air-cooled

- Oil-cooled

By Phase

- Single-Phase

- Three-Phase

By Transformer Type

- Power

- Distribution

By End-User

- Power Utilities

- Industrial

- Commercial

- Residential

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting