Medium Voltage AC Power Distribution Units Market Size and Forecast 2025 to 2034

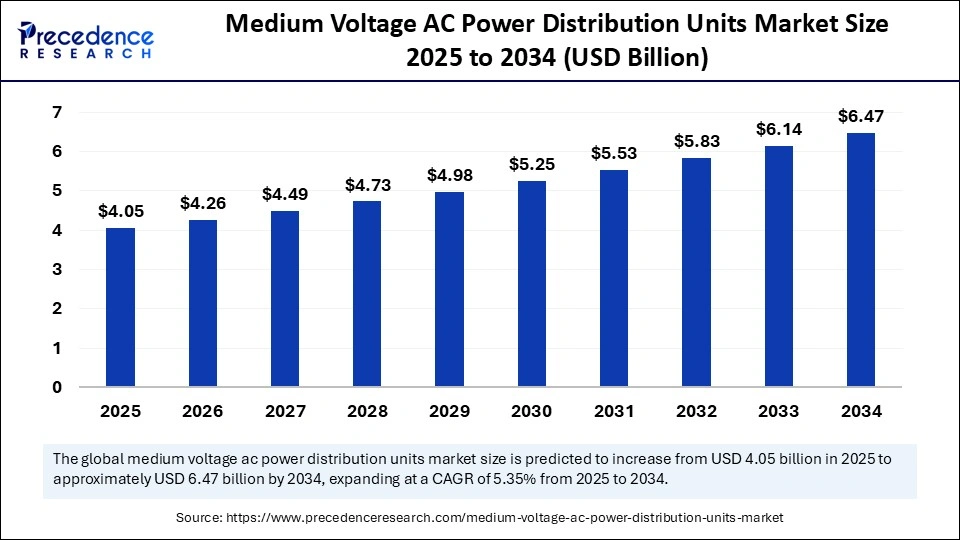

The global medium voltage AC power distribution units market size was calculated at USD 3.84 billion in 2024 and is predicted to increase from USD 4.05 billion in 2025 to approximately USD 6.47 billion by 2034, expanding at a CAGR of 5.35% from 2025 to 2034. The medium voltage AC power distribution units market has experienced significant growth in recent years, reflecting the increasing reliance on digital platforms for freelance and gig-based work. As of 2024, the market size is estimated at USD 3.84 billion and expected to grow at a CAGR of 5.35% during the forecast period between 2025-2034. The global medium voltage AC power distribution unit market has emerged as a cornerstone of modern industrial, commercial, and infrastructure development. These systems are crucial for ensuring reliable and efficient distribution of electricity across data centers, industrial plants, and smart cities.

Medium Voltage AC Power Distribution Units Market Key Takeaways

- In terms of revenue, the global medium voltage AC power distribution units market was valued at USD 3.84 billion in 2024.

- It is projected to reach USD 6.47 billion by 2034.

- The market is expected to grow at a CAGR of 5.35% from 2025 to 2034.

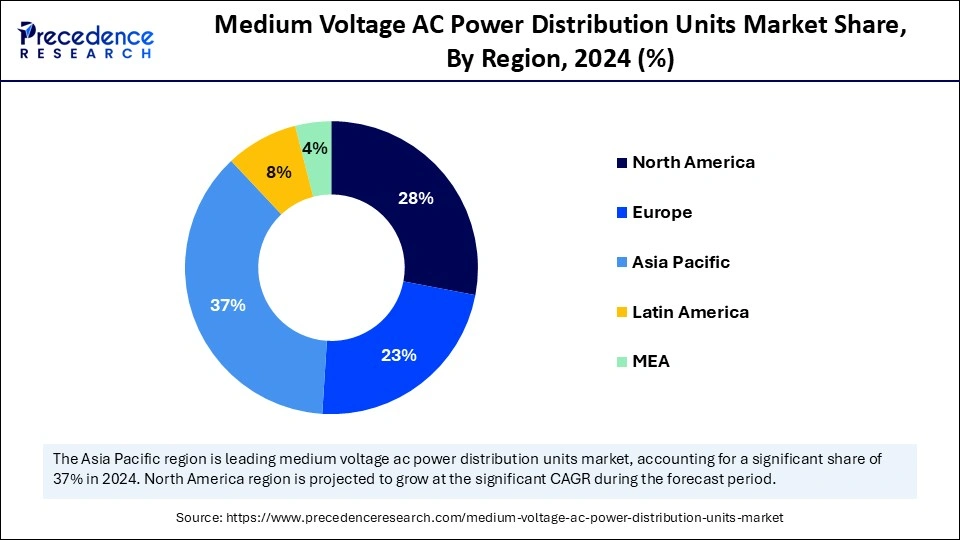

- Asia Pacific dominated the global medium voltage AC power distribution units market with the largest market share of 37% in 2024.

- The Middle East & Africa is anticipated to grow at the fastest CAGR during the forecast period.

- By product type, the medium voltage switchgear segment captured the biggest market share of 36% in 2024.

- By product type, the smart digital PDUs segment is expected to experience the fastest growth CAGR from 2025 to 2034.

- By voltage rating, the 7.2–12 kV segment contributed the highest market share of 34% in 2024.

- By voltage rating, the 12–24 kV segment will gain a significant share over the studied period.

- By installation type, the outdoor PDUs segment held the largest market of 55% share in 2024 and is expected to grow at the highest CAGR during the forecast period.

- By insulation/interruption medium, the air-insulated segment accounted for a considerable share of 58% in 2024.

- By insulation/interruption medium, the gas-insulated segment is projected to experience the highest growth CAGR 2025 and 2034.

- By connectivity/intelligence level, the conventional segment held the largest market share of 60% in 2024.

- By connectivity/intelligence level, the IoT-enabled segment is anticipated to grow with the highest CAGR during the studied years.

- By application/end-use industry, the utilities segment contributed the biggest market share of 30% in 2024.

- By application/end-use industry, the renewable energy segment is predicted to witness significant growth over the forecast period.

- By service offering, the installation & commissioning segment led the market in 2024.

- By service offering, the predictive maintenance segment is projected to expand rapidly in the coming years.

- By sales channel, the direct OEM sales segment generated the major market share of 50% in 2024.

- By sales channel, the system integrators/EPC segment is projected to experience the highest growth rate in the market between 2025 and 2034.

Market Overview

The medium voltage AC power distribution units market deals with prefabricated, modular electrical assemblies rated typically from 1 kV up to 36 kV used to distribute AC power at medium-voltage levels within substations, industrial plants, renewable farms, data center yards and large commercial/utility installations; include switchgear, metering, protection, transformers (when integrated), busbars, monitoring & control and ancillary equipment; designed for indoor/outdoor installation, fixed or modular mounting, and both conventional and smart/grid-interactive operation.

The surge in large-scale infrastructure projects, digital transformation, and the need for an uninterrupted power supply drive the medium voltage AC power distribution units market. From hyperscale data centres to manufacturing hubs, medium voltage PDUs act as the backbone for high-load power management. Technological upgrades, cost efficiency in transmission, and greater emphasis on grid stability further reinforce the market's growth trajectory.

How AI Impacted the Medium Voltage AC Power Distribution Units Market

Artificial Intelligence has transformed the medium voltage AC power distribution units market by enabling real-time monitoring and predictive maintenance, significantly reducing system downtime. AI-driven analytics allow operators to forecast energy demand and optimize load balancing across industrial and commercial facilities. Smart PDUs equipped with AI can detect anomalies in voltage or current flow, preventing equipment failures before they occur. The technology also supports integration with renewable energy sources, automatically adjusting distribution to handle fluctuations in supply. Furthermore, AI enhances energy efficiency by identifying patterns of wastage and recommending corrective measures. This intelligence-driven approach is reshaping PDUs from static devices into dynamic, adaptive systems that align with the future of smart grids.

Market Scope

| Report Coverage | Details |

| Market Size by 2034 | USD 6.47 Billion |

| Market Size in 2025 | USD 4.05 Billion |

| Market Size in 2024 | USD 3.84 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 5.35% |

| Dominating Region | Asia Pacific |

| Fastest Growing Region | Middle East and Africa |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Product Type, Voltage Rating, Installation Type, Insulation / Interruption Medium, Connectivity / Intelligence Level, Application / End-Use Industry, Service Offering, Sales Channel, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

The demand for medium voltage AC power distribution units is primarily driven by the global surge in electricity consumption across industrial, commercial, and residential sectors. Rapid growth in digital infrastructure, especially hyperscale data centers, has created an urgent need for stable and efficient distribution systems. Governments and private players are heavily investing in renewable energy integration, which requires advanced PDU solutions to balance intermittent power sources. Industrial automation and the expansion of smart manufacturing hubs also contribute to the need for reliable distribution systems. The rollout of 5G networks and cloud computing has intensified the demand for energy-efficient PDUs in the telecom and IT sectors. Collectively, these factors ensure a strong and sustained momentum for market growth.

Restraints

Despite its growth potential, the medium voltage AC power distribution units market faces challenges due to high upfront installation costs, which limit adoption among smaller enterprises. Retrofitting advanced PDUs into legacy infrastructure is complex and often requires significant downtime, discouraging modernization. The shortage of skilled technicians capable of maintaining and optimizing these systems further constrains deployment. In addition, regulatory differences across countries complicate standardization and increase costs for global manufacturers. Concerns around cybersecurity in smart PDUs integrated with AI and IoT also pose a barrier to adoption. These restraints slow down the pace of growth despite strong underlying demand.

Opportunities

The medium voltage AC power distribution units market holds immense opportunity in the rising adoption of smart grids, which demand intelligent and automated distribution systems. The emergence of AI has also drastically increased the global electricity demand. Furthermore, emerging economies are investing heavily in electrification, renewable energy, and large-scale infrastructure projects, providing new avenues for expansion. The increasing focus on sustainability and carbon-neutral energy systems is creating demand for PDUs that enhance energy efficiency. Advancements in AI-driven predictive maintenance and modular PDU designs open doors for innovation-driven growth. Sectors such as healthcare, banking, and telecom are rapidly digitalizing, further fuelling demand for reliable power management. Together, these trends represent a vast landscape of untapped potential for manufacturers and service providers.

Product Type Insights

Why Is Medium Voltage Switchgear Dominating the Medium Voltage AC Power Distribution Units Market?

Medium voltage switchgear maintains dominance in the medium voltage AC power distribution units market, holding a 36% share due to its long-standing reliability and proven integration within utility and industrial networks. Its widespread installed base creates a strong preference for continuity, as operators trust its stable performance under heavy loads. These systems provide fault isolation, voltage regulation, and safety, making them indispensable in high-demand environments. Additionally, the established supply chain and mature manufacturing ecosystem ensure cost efficiency and easy availability. Many utilities and industrial users prioritize familiarity and ease of maintenance over newer, less-tested technologies. Thus, medium voltage switchgear remains the backbone of power distribution infrastructure globally.

Smart digital PDUs are rapidly gaining traction as industries shift toward intelligent, connected infrastructure. Equipped with real-time monitoring and AI-driven diagnostics, they enable precise energy tracking and proactive fault prevention. Their compatibility with IoT ecosystems makes them highly attractive for data centers, renewable plants, and advanced manufacturing sites. The ability to optimize power allocation at the rack or node level reduces energy wastage and improves efficiency. Growing regulatory focus on sustainability is also accelerating the adoption of digital PDUs. As industries modernize, these intelligent units are projected to outpace legacy systems in growth and relevance.

Voltage Rating Insights

Why Did the 7.2–12kV Segment Lead the Medium Voltage AC Power Distribution Units Market in 2024?

The 7.2–12 kV segment dominates the medium voltage PDU landscape because it covers the most widely used industrial and utility-scale applications. This range balances cost-effectiveness with sufficient capacity to handle medium-load grids and manufacturing facilities. Its compatibility with traditional distribution networks ensures easy integration without extensive infrastructure overhaul. Manufacturers prioritize this segment due to consistent demand and standardized global compliance. Its versatility makes it suitable for both developing economies and mature industrial markets. As such, the 7.2–12 kV class continues to anchor overall market demand.

The 12–24 kV category is witnessing rapid growth as industries push for higher-capacity grids and renewable energy integration. This range supports large-scale wind, solar, and industrial operations that require stronger voltage resilience. Its ability to reduce line losses over longer distances makes it highly attractive for modern transmission networks. While costs are higher, the benefits in efficiency and scalability outweigh the investment concerns. The rise of smart cities and the electrification of transport infrastructure is further fueling demand for this range. Consequently, the 12–24 kV segment is positioned as the fastest-growing voltage class.

Installation Type Insights

Which Installation Type Held the Largest Share in the Medium Voltage AC Power Distribution Units Market?

The outdoor PDUs segment held the largest share of the market in 2024, due to their necessity in substations, renewable farms, and utility-scale infrastructure. Their rugged design withstands harsh environments, making them critical for remote and grid-level applications. Longstanding reliance on outdoor PDUs has created entrenched procurement patterns across utilities and governments. They offer flexibility in accommodating the expansion of power lines and renewable interconnections. Cost-per-capacity ratio is also more favorable compared to enclosed indoor units. Hence, outdoor PDUs continue to hold the majority share of installations.

While outdoor PDUs already dominate, this segment is also the fastest-growing in the medium voltage AC power distribution units market, with advancements in technology giving way to features such as modular, digitally enabled options. These units are increasingly deployed in smart grid projects where remote monitoring is essential. Their design supports integration with IoT and artificial intelligence-driven predictive maintenance systems. Renewable-heavy regions prefer such PDUs due to reliability in variable load environments. Governments' push for resilient grids is accelerating the adoption of upgraded outdoor units. Thus, the fastest growth is being recorded in advanced outdoor PDU systems.

Insulation/ Interruption Medium Insights

How Did the Air-Insulated Segment Rack Up the Major Share of the Market for Medium Voltage AC Power Distribution Units?

Air-insulated systems dominate due to their cost-effectiveness, simplicity in design, and ease of maintenance. Their lower complexity reduces operational costs and ensures a longer lifecycle. These systems are particularly preferred in markets where space is not a major constraint. Their widespread familiarity among engineers makes them a default choice in industrial and utility installations. Additionally, standardized designs simplify compliance with global safety codes. As a result, air-insulated solutions remain the cornerstone of medium voltage PDU deployments.

Gas-insulated PDUs are rapidly expanding in adoption due to their compactness and superior insulation capabilities. They are especially favored in urban and high-density environments where space is limited. These systems also provide higher safety margins and reduce the risk of arc faults. Although they involve higher upfront costs, their efficiency and reliability offset long-term expenses. Environmental regulations are encouraging innovation in eco-friendly insulating gases, making them more sustainable. Hence, gas-insulated PDUs are charting the fastest growth trajectory.

Connectivity/ Intelligence Level Insights

Why Did Conventional PDUs Have Such a Dominant Hold Over the Market for Medium Voltage AC Power Distribution Units?

Conventional PDUs dominate the medium voltage AC power distribution units market as they form the backbone of established power distribution systems. Their proven reliability and lower upfront costs make them a preferred option for utilities and industries alike. Many operators opt for conventional setups due to familiarity, reduced training requirements, and compatibility with legacy infrastructure. These units also minimize cybersecurity concerns compared to connected systems. The simplicity in design reduces downtime and maintenance complexities. Thus, conventional PDUs continue to hold the lion's share of installations worldwide.

IoT-enabled PDUs are experiencing the fastest growth in the medium voltage AC power distribution units market, driven by digitalization and smart grid adoption. These systems allow real-time monitoring, predictive maintenance, and adaptive load management. Utilities and industries are investing in IoT-enabled PDUs to enhance efficiency and resilience against outages. Their integration with AI platforms enables automated fault detection and energy optimization. Although costlier, they deliver strong ROI through reduced downtime and operational savings. Consequently, IoT-enabled PDUs represent the most dynamic growth area within connectivity.

Application Insights

Why Are Utilities Leading the Application Segment in the Medium Voltage AC Power Distribution Units Market?

Utilities dominate the application landscape in the medium voltage AC power distribution units market as they require substantial and consistent investments in medium-voltage PDUs for grid operations. The sector depends on PDUs to manage energy flow across transmission and distribution networks. Utilities prioritize stability, reliability, and cost-efficiency, which align well with established PDU technologies. Ongoing electrification and urbanization continue to expand their deployment needs. Governments also allocate large budgets to utility-scale infrastructure, reinforcing dominance. As a result, utilities remain the primary demand center for medium voltage PDUs.

Renewable energy projects are the fastest-growing application segment, fueled by global decarbonization goals. Solar farms, wind parks, and hydropower facilities require specialized PDUs to manage variable loads. Grid integration of renewables demands advanced distribution units with flexibility and scalability. Investments in clean energy are rising sharply across both developed and emerging markets. The push for carbon neutrality by 2050 further accelerates adoption. Thus, renewable energy applications are surging ahead as the fastest-expanding area.

Service Offering Insights

Why Are Installation & Commissioning Dominating the Market for Medium Voltage AC Power Distribution Units?

Installation and commissioning services are a critical step in the medium voltage AC power distribution units market. Utilities and industries prioritize professional installation to ensure compliance, safety, and performance. These services often include site assessments, load calculations, and system integration. High capital investments in PDUs make reliable installation essential to maximize ROI. The recurring demand for new projects cements this segment's dominance. Consequently, installation and commissioning services anchor the service side of the market.

Predictive maintenance is the fastest-growing service, driven by digitalization and AI-based monitoring tools. It allows operators to identify potential failures before they occur, reducing costly downtime. The integration of sensors and IoT enables continuous health monitoring of PDUs. This approach lowers lifecycle costs and extends equipment longevity. Utilities and industries alike are shifting from reactive to predictive models to improve resilience. Hence, predictive maintenance is emerging as the leading growth engine in services.

Sales Channel Insights

Why Do Direct Original Equipment Manufacturing Sales Lead the Medium Voltage AC Power Distribution Units Market?

Direct OEM sales dominate as customers prefer to purchase from original manufacturers for quality assurance and after-sales support. Large-scale utilities and industries rely on OEMs for customized solutions and warranties. This channel ensures faster access to spare parts and service expertise. A strong brand reputation and established vendor relationships further reinforce its dominance. Direct OEM sales also simplify procurement processes for government and corporate buyers. Therefore, OEMs continue to command the majority of market share.

System integration is the fastest-growing sales channel, fueled by demand for customized, multi-vendor solutions. Integrators combine PDUs with monitoring software, sensors, and smart grid technologies to enhance system performance and efficiency. Their ability to deliver turnkey solutions appeals to utilities modernizing their infrastructure. The rise of renewable energy and microgrids further boosts reliance on integrators. This channel also bridges the gap between legacy systems and new digital platforms. Consequently, system integration is expanding rapidly as the market diversifies.

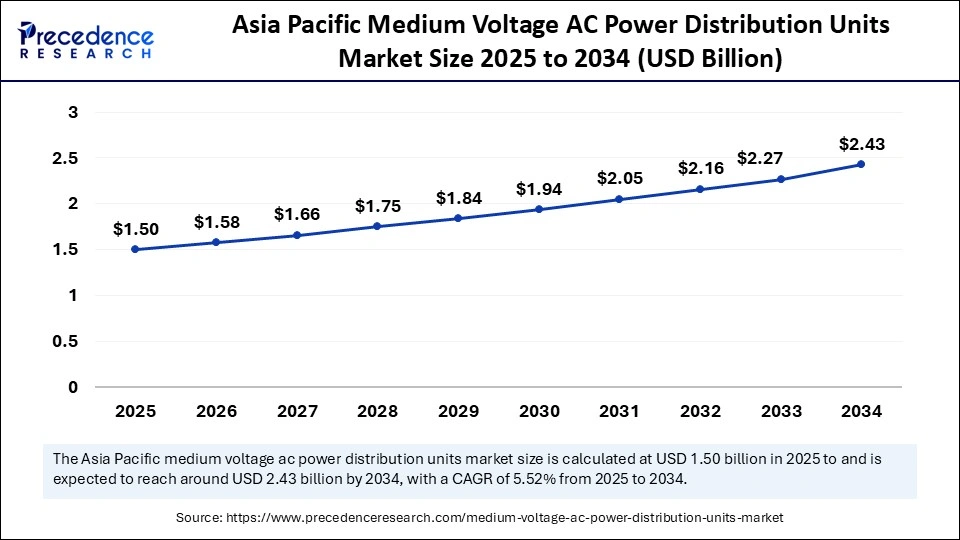

Asia Pacific Medium Voltage AC Power Distribution Units Market Size and Growth 2025 to 2034

The Asia Pacific medium voltage AC power distribution units market size is exhibited at USD 1.50 billion in 2025 and is projected to be worth around USD 2.43 billion by 2034, growing at a CAGR of 5.52% from 2025 to 2034.

Asia Pacific: Powerhouse of Demand

Asia Pacific dominates the medium voltage AC power distribution units market, supported by rapid urbanization, industrial expansion, and robust infrastructure projects. Countries like China, India, and Japan are investing heavily in smart cities, renewable integration, and data center growth, creating strong demand for medium voltage PDUs. Government initiatives supporting energy efficiency further accelerate adoption. The proliferation of 5G networks and hyperscale data centers is another catalyst shaping demand.

The region's dominance is also reinforced by the manufacturing strength of APAC countries, which enables local production of cost-effective PDUs. Strong investment in industrial corridors, logistics hubs, and mega construction projects fuels market expansion. With expanding consumer bases and continuous technological advancements, the Asia Pacific will remain the undisputed leader in the global medium voltage AC power distribution units market demand.

Middle East and Africa: The Fastest Growing Frontier

The Middle East and Africa are emerging as some of the fastest-growing regions in the medium voltage AC power distribution units market, fuelled by massive infrastructure and energy projects. The Gulf nations, particularly Saudi Arabia and the UAE, are channelling investments into smart cities, renewable energy, and large-scale industrial hubs. The need for efficient, reliable power distribution systems is escalating across the oil, gas, and construction sectors.

In Africa, electrification projects, renewable energy adoption, and telecom growth are creating unprecedented demand. Governments are actively modernizing power distribution infrastructure to meet the growing needs of urbanization and industrialization. The region's growth potential lies in bridging infrastructure gaps while leapfrogging into advanced, smart-grid compatible PDU solutions.

Medium Voltage AC Power Distribution Units Market Companies

- ABB

- Siemens

- Schneider Electric

- Eaton

- Hitachi Energy

- Mitsubishi Electric

- Toshiba Energy Systems & Solutions

- GE Grid Solutions

- Hyundai Electric

- CG Power and Industrial Solutions

- Larsen & Toubro

- Powell Industries

- Socomec

- Legrand

- Fuji Electric

- Nari Group Corporation

- Schweitzer Engineering Laboratories (SEL)

- TBEA Co., Ltd.

- Meidensha Corporation

- Doosan Heavy Industries & Construction

Recent Developments

- In September 2025, Adani Power (APL) on Thursday announced that it has secured a Letter of Award (LoA) from MP Power Management Company Limited (MPPMCL) for a total capacity of 1,600 MW. This includes an additional allocation of 800 MW under the "Greenshoe Option," complementing the 800 MW that APL had already won in the same tender process.(Source: https://economictimes.indiatimes.com)

- In July 2025, private equity firm HKW announced the acquisition of the Electric Equipment & Engineering Co. (EEE), an electrical power distribution products manufacturer run by the founding Moroni family. EEE specializes in customized and configured DC power equipment, including switchgear, generator connection boxes, automatic and manual transfer switches, along medium voltage AC power distribution units. (Source: https://peprofessional.com)

Segment Covered in the Report

By Product Type

- Medium Voltage Switchgear

- Medium Voltage Power Distribution Panels

- Medium Voltage Motor Control Centers (MV MCC)

- Medium Voltage Transformers (integrated within PDU assemblies)

- Medium Voltage Circuit Breakers

- Protection & Control Units (relays, ATS, protection panels)

- Busbar & Busduct Systems

- Metering & Instrumentation (CT/PT, energy meters)

- Monitoring & Communication Modules (SCADA, RTU, HMI)

- Power Quality & Compensation Units (harmonic filters, capacitor banks)

- Auxiliary & Safety Systems (earthing, enclosures, cable terminations)

- Smart Digital PDUs

By Voltage Rating

- 1 kV to <7.2 kV

- 7.2 kV to <12 kV

- 12 kV to <24 kV

- 24 kV to 36 kV

By Installation Type

- Indoor MV PDUs

- Outdoor MV PDUs (kiosk/containerised/skid-mounted)

By Insulation / Interruption Medium

- Air-insulated designs

- Gas-insulated designs

- Oil-insulated designs

- Vacuum-interrupting designs

By Connectivity / Intelligence Level

- Conventional (non-communicating) PDUs

- Digital / Smart PDUs (with communication protocols)

- IoT-enabled PDUs (with predictive analytics and remote monitoring)

By Application / End-Use Industry

- Utilities (T&D)

- Power Generation (thermal & nuclear)

- Renewable Energy (wind, solar, hydro)

- Oil & Gas

- Mining & Metals

- Heavy Industrial Manufacturing & Petrochemicals

- Automotive & Transportation Manufacturing

- Data Centers & IT Parks

- Commercial & Institutional Infrastructure (airports, malls, hospitals)

- Railways, Ports & Transport Infrastructure

By Service Offering

- Installation & Commissioning

- Preventive Maintenance

- Predictive Maintenance & Analytics

- Retrofit & Modernization

- Spare Parts & Replacements

By Sales Channel

- Direct OEM Sales

- Distributor / Dealer Sales

- System Integrators / EPC Contractors

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East & Africa

Get a Sample

Get a Sample

Table Of Content

Table Of Content