What is High Voltage Cables and Accessories Market Size?

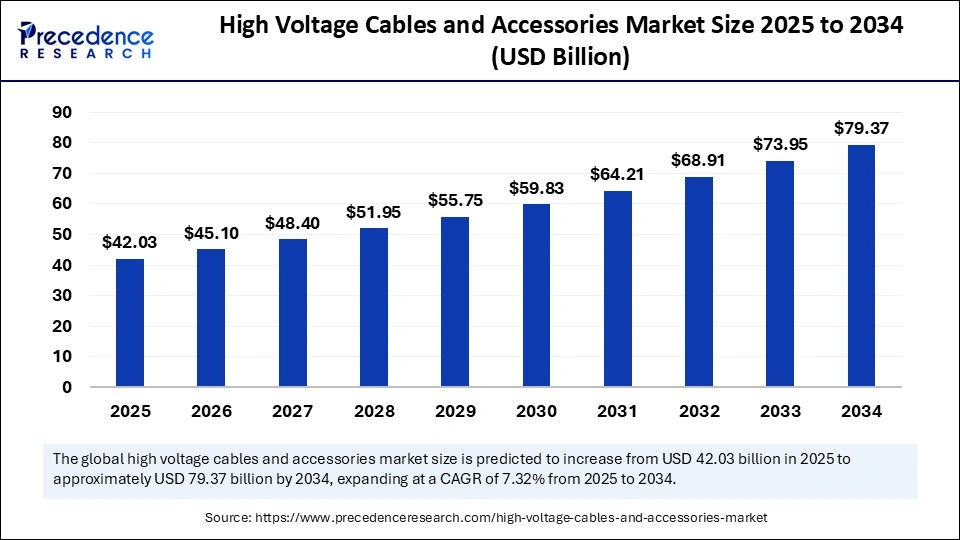

The global high voltage cables and accessories market size accounted for USD 42.03 billion in 2025 and is predicted to increase from USD 45.10 billion in 2026 to approximately USD 79.37 billion by 2034, expanding at a CAGR of 7.32% from 2025 to 2034. The market is expanding at a significant rate owing to the increasing demand for rising global energy demand, expanding renewable energy infrastructure, grid modernization projects, and increasing urbanization and industrialization. Therefore, the market contributes to improved cable performance by transmitting electricity at high voltages and protecting high-voltage cables.

Market Highlights

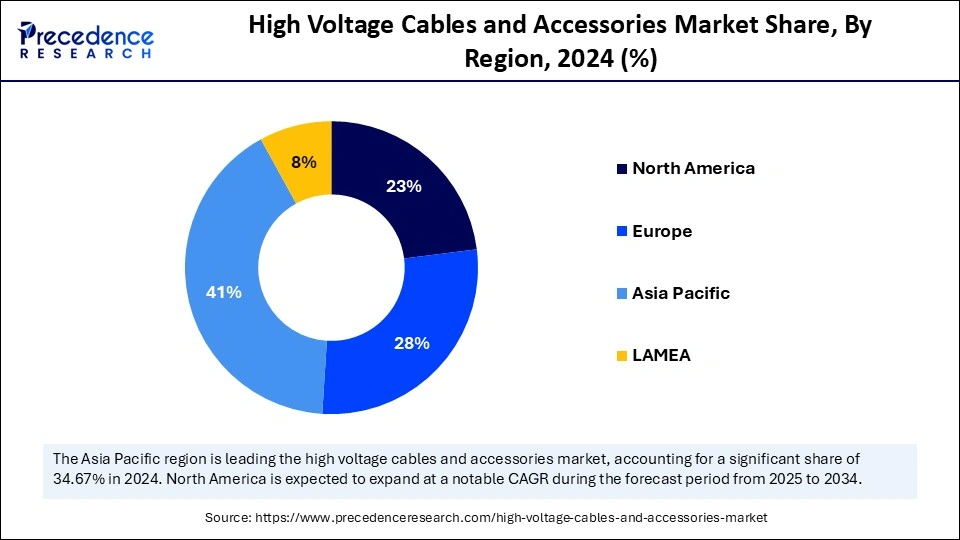

- Asia Pacific dominated the high voltage cables and accessories market in 2024.

- North America is anticipated to grow at the fastest rate in the market during the forecast period.

- Europe emerged as a notable region in the global market.

- By conductor type, the copper segment held a dominant presence in the market in 2024.

- By conductor type, the aluminum segment is projected to expand rapidly in the coming years.

- By voltage, the 72.5 kV segment dominated the market with the largest share in 2024.

- By voltage, the 400 kV and above segment is expected to witness the fastest growth during the predicted timeframe.

- By product type, the cables segment held a significant share of the market in 2024.

- By product type, the accessories segment is observed to grow rapidly during the forecast period.

- By installation, the underground segment captured the biggest market share in 2024.

- By installation, the overhead segment is seen to grow at the fastest rate in the upcoming years.

- By end user, the industrial segment dominated the market with the highest share in 2024.

- By end user, the renewable segment is expected to witness the fastest rate of growth during the predicted timeframe.

What are the High Voltage Cables and Accessories Transforming?

The global high voltage cables and accessories market deals with the demand for cables designed to transmit electricity at high voltages, along with related accessories essential for connecting, terminating, and protecting high voltage cables, including joints, terminations, bushings, and other related parts. The market is experiencing significant growth, driven by increasing global electricity consumption and the need for efficient power transmission.

Artificial Intelligence in High-Voltage Cables

Artificial intelligence (AI) is transforming the high voltage cables and accessories market by enabling predictive maintenance, optimizing power grid management, and enhancing the design and manufacturing of cables and accessories. This allows for proactive maintenance, minimizing downtime, reducing costs, and improving the reliability of power systems. Especially, AI algorithms can analyze tremendous amounts of data to identify the best materials and designs for specific applications, leading to more efficient and reliable products. Thus, AI is altering the market.

High Voltage Cables and Accessories Market Growth Factors

- Increasing energy demand: Rapid population growth, urbanization, and industrialization are driving increased electricity consumption, necessitating expansion and improvement of power grids for the high voltage cables and accessories market.

- Renewable energy solutions: The increasing adoption of sustainable energy solutions is propelling the need for the market. Thus, increasing the penetration of renewable energy sources like solar and wind power requires robust transmission infrastructure, including high-voltage cables.

- Modernization of the grid: Advancements of existing grids with smart grid technologies and improving efficiency through automation and innovative monitoring systems are uplifting demand for high-voltage cables and accessories.

- Infrastructure development: Governments and utility companies are investing heavily in upgrading and expanding electricity grids. New infrastructure projects, including power plants, substations, and transmission lines, are creating demand for high-voltage cables and accessories.

- Technological advancements: The development of new cable materials, insulation technologies, and manufacturing processes of accessories is improving the efficiency, durability, and reliability of high-voltage systems.

High Voltage Cables and Accessories Market Outlook:

- Global Expansion: A rise in investments in power grids, the transition to HVDC transmission, and the rising need for underground and submarine cables to connect renewable sources are assisting the comprehensive growth.

- Major Investors: Prysmian Group, Nexans, Sumitomo Electric, NKT A/S, and LS Cable & System, and other firms are bolstering their investment to encourage and profit from global energy infrastructure progression, mainly in renewable energy projects and grid modernization.

- Startup Ecosystem: In July 2024, TS Conductor, a U.S.-headquartered startup, raised $60 million to enhance its manufacturing capacity for advanced power cables.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 42.03 Billion |

| Market Size in 2026 | USD 45.10 Billion |

| Market Size by 2034 | USD 79.37 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 7.32% |

| Dominating Region | Asia Pacific |

| Fastest Growing Region | North America |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Conductor Type, Voltage, Product Type, Installation, End User, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

Increasing demand for electricity

The primary driver in the high voltage cables and accessories market is the increasing demand for electricity. As populations grow and economies develop, the need for electricity increases, driving demand for high-voltage cables to efficiently transmit power over long distances. This is further fueled by the adoption of renewable energy sources like wind and solar, which require new high-voltage cables for grid connections. Many European countries are investing in offshore wind farms and upgrading their transmission infrastructure to meet the increasing demand for renewable energy and reduce reliance on fossil fuels.

Restraint

Higher cost

The primary restraint in the high voltage cables and accessories market is the higher costs associated with materials, manufacturing, and installation. The prices of key raw materials like copper, aluminum, and steel fluctuate significantly, impacting production costs and potentially squeezing profit margins for cable producers. Underground and submarine cable installations involve specialized equipment, skilled labor, and challenging conditions, leading to high installation costs. This can hinder market growth by making it difficult for many companies to enter, limiting competition, and increasing costs for consumers.

Opportunity

Adoption of renewable energy sources and the modernization of power grids

The key future opportunity in the high voltage cables and accessories market is the adoption of renewable energy sources and the modernization of power grids, particularly smart grids and underground distribution systems. The increasing adoption of renewable energy sources like solar and wind power necessitates the development of new high-voltage cables and accessories to connect these sources to the grid. Many countries are investing in smart grids to improve grid efficiency, reliability, and resilience, which requires new high-voltage cables and accessories to handle the advanced technologies.

- In March 2024, Raychem RPG announced that the Central Power Research Institute has approved its locally manufactured 245 KV extra high voltage cable accessories. This further reduces reliance of India on European imports and strengthens domestic power transmission capabilities under the Make in India.

Segment Insights

Conductor Type Insights

The copper segment held a dominant presence in the market in 2024 because of its superior electrical conductivity, which enables efficient and low-resistance transmission of electricity. Along with this ductility, thermal resistance, and relatively lower cost of copper compared to alternatives like silver and aluminum, make it a preferred material for various applications such as power transmission, telecommunications, and building wiring.

According to HV Energy Cables DNO, Tratos High Voltage and Extra High Voltage cables are distinguished by ongoing investment of Tratos in the latest technology, materials, and human resources needed to meet the highest safety and performance requirements demanded of these cables installed in Electrical Transmission Systems across the world.

The aluminum segment is projected to expand rapidly in the high voltage cables and accessories market, due to various factors, including its lightweight, corrosion-resistant, and cost-effectiveness, which make it the material of interest for large-scale infrastructure projects and long-distance power transmission. Higher conductivity-to-weight ratio of aluminium also contributes to its popularity in overhead power connections.

Voltage Insights

The 72.5 kV segment dominated the market with the largest share in 2024, due to its widespread adoption in different applications such as grid expansion, renewable energy projects, and industrial facilities. This segment is frequently used in medium voltage distribution and sub-transmission systems by making it a critical component for connecting power sources to consumers.

ABB launched the 72.5 kV CO2 circuit breaker is the first in a new series of eco-efficient live tank breakers, which substitutes SF6 gas with more environmentally friendly alternatives.

The 400kV and above segment is expected to witness the fastest rate of growth during the predicted timeframe, owing to increasing demand for efficient and reliable power transmission, particularly over long distances. High-voltage cables are crucial for efficiently transmitting electricity over long distances with minimal energy loss. The higher the voltage, the lower the current required to transmit the same amount of power, reducing losses due to resistance in the cables. This is further driven by increasing demand for renewable energy, modernization of power grids, and growing urbanization.

Product Type Insights

The cables segment held a significant share in the market in 2024, because of their crucial role in ensuring reliable power transmission over long distances and maintaining cable continuity. Especially, Cross-linked Polyethylene cables (XLPE) are popular due to their high insulation properties and flexibility, making them suitable for various applications, which include offshore power generation and renewable energy projects. The increasing use of these cables in these areas drives market growth.

- In March 2024, Taihan Cable and Solution, a South Korean cable manufacturer, secured a USD 82 million contract to replace aging power grids with ultra-high voltage power grids in the U.S. This project demonstrates the growing demand for technologically advanced high-voltage cables.

The accessories segment is observed to grow rapidly during the forecast period, owing to increased investments in grid modernization, as countries invest in upgrading existing power grids and integrating renewable energy sources such as solar and wind, the demand for reliable and efficient cable accessories increases significantly. These accessories ensure secure connections and protect the cables from damage, making them vital for the reliable operation of modernized and renewable energy systems.

Installation Insights

The underground segment captured the biggest high voltage cables and accessories market share in 2024, due to its better performance, reliability, minimizing visual disruption to the landscape, and providing aesthetic advantages over overhead installations. Underground cable accessories face lower exposure to environmental factors and weather-related disruptions, making them highly preferred for critical power infrastructure. As urban areas become more congested, underground cables become a more viable solution for adapting power distribution, making with suitable for industries like power utilities, mining, and data centers, where reliability and longevity are crucial.

- In April 2023, after Transco Abu Dhabi, the ERJ Joint has been installed in DEWA Dubai to replace a few old, faulty joints. The existing circuits are put on outage, and the Brugg team is engaged to dismantle the old joints and install the ERJ by providing reliability to networks and saving up to 60% from both cost and time compared to classical repair methods.

The overhead segment is seen to grow at the fastest rate in the upcoming years, due to factors such as ease of installation, overhead lines can be strategically positioned to minimize energy loss over long distances, and economic advantages. This growth is driven by increased demand for electricity, expanding renewable energy generation, and the modernization of power grids, which often necessitate new or upgraded overhead installations. These are often favored in areas where underground installation is difficult, such as areas with dense urban infrastructure and historical districts, by lowering transmission Losses.

End User Insights

The industrial segment dominated the market with the highest share in 2024, due to its high electricity consumption and the demand for reliable power transmission across long distances, which includes offshore operations. Oil and gas exploration, production, and refining processes require significant amounts of electricity for various operations. Also, these facilities are often located in remote areas, necessitating the transmission of electricity over long distances.

The renewable segment is expected to witness the fastest rate of growth during the predicted timeframe, due to the global shift towards renewable energy sources like solar and wind power. This shift necessitates the construction of new grid infrastructure and the modernization of existing grids to efficiently transmit power from renewable energy sources, driving demand for high-voltage cables and accessories. Governments are implementing policies and providing incentives to promote renewable energy adoption, further driving the demand for related infrastructure.

Component Insights

The cables segment held a dominant presence in the high-voltage cables and accessories market in 2024. The growth of the segment is attributed to the rising global electricity demand, the rising expansion of renewable energy sources like wind and solar, and increasing investments of government in infrastructure development. As the global population continues to grow and economies develop rapidly has led to an increasing demand for electricity, further necessitating more efficient and reliable transmission infrastructure that heavily relies on high-voltage cables. Additionally, several countries are increasingly investing in modernizing their power grids to improve efficiency, resilience, and reliability. This includes adopting smart grid technologies and replacing aging infrastructure, which necessitates high-voltage cables for handling increased loads.

Voltage class Insights

The high voltage (HV) (>33 kV to ≤132 kV) segment contributed the highest revenue share in 2024. The growth of the segment is driven by the rising global electricity demand and the rising need to upgrade aging grid infrastructure. The surging integration of renewable energy sources such as solar and wind power has led to the development of new transmission and distribution networks, driving the demand for high voltage (HV) (>33 kV to ≤132 kV) cables and accessories during the forecast period.

Installation type Insights

The underground installation segment held the majority of the market share in 2024. The segment's growth is mainly driven by the rapid pace of urbanization, increasing infrastructure modernization projects across developed economies, and growing demand for underground power distribution in densely populated areas. Underground high voltage (HV) cables and accessories are widely used for power transmission and require installation methods such as trenching, direct burial, and duct laying, often with specialized cables. The underground installation of cables and accessories often faces lower exposure to environmental factors and weather-related disruptions, as well as offers lower maintenance requirements as compared to overhead lines.

End-use application Insights

The utility sector segment held the largest share in 2024, owing to the rapid infrastructure development, rising energy demand, rising expansion of renewable energy projects, and a surge in government investments in electricity networks. Utilities are the major end-users of high-voltage cables and accessories. The utility sector is increasingly utilizing high-voltage cables and accessories to transmit large volumes of electricity over long distances, from generation sources to consumption centers. High voltage (HV) cables and their accessories in the utility sector assist in the efficient transmission of electricity and allow the connection of power generation sources to distribution networks.

Component material Insights

The aluminum conductor cables segment registered its dominance in the high voltage cables and accessories market in 2024. The market is witnessing increasing use of aluminum conductors owing to their lightweight, durability, and cost-effectiveness, which makes them well-suited for long-distance and high-volume power transmission critical for energy infrastructure. The rapid technological advancement in cable insulation and transmission technologies results in reducing power losses and enhancing efficiency, accelerating the segment's growth during the forecast period.

Regional Insights

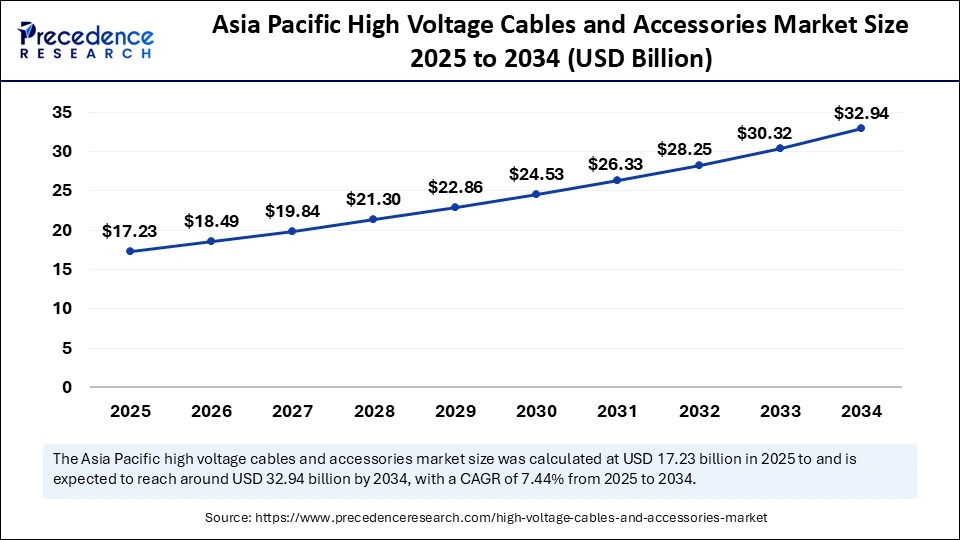

Asia Pacific High Voltage Cables and Accessories Market Size and Growth 2025 to 2034

Asia Pacific high voltage cables and accessories market size is exhibited at USD 17.23 billion in 2025 and is projected to be worth around USD 32.94 billion by 2034, growing at a CAGR of 7.44% from 2025 to 2034.

How did the Asia Pacific Capture the Largest Share of the Market in 2024?

The Asia Pacific region dominated the high voltage cables and accessories market in 2024, due to governments in the Asia Pacific region are increasingly prioritizing renewable energy sources like solar and wind power. This requires specialized cables and accessories to transmit energy from these sources, together with rapid economic growth and increasing urbanization of the region, necessitating robust infrastructure, including power transmission networks, fueling demand for high-voltage cables and accessories. International collaborations, such as those between cable manufacturers and renewable energy project developers, are also contributing to the growth of the high-voltage cable market in the Asia Pacific region.

- In January 2025, OKI Electric Cable announced the development of a coaxial cable with a FAKRA connector, designed for machine vision systems in robotics and industrial factory automation equipment.

Expanding Industrial Sector of China Drives the Market

China plays a crucial role in the high voltage cables and accessories market. Because of industrial sector of China is a major consumer of high-voltage cables and accessories, supporting factories, manufacturing facilities, and associated infrastructure. The integration of solar, wind, and hydro power plants into the grid requires extensive cabling infrastructure. Ongoing upgrades to power transmission and distribution grids are crucial for meeting growing energy demands and require high-voltage cables and accessories.

India: A Key Force in the High Voltage Cables Industry

India is the key player in the high voltage cables and accessories market, due to the growing urban population and rural electrification initiatives of India, such as Saubhagya and Deendayal Upadhyaya Gram Jyoti Yojana, and Power for All, for smart city development contribute significantly to the demand for high-voltage cables and accessories. Moreover, commitment of India to renewable energy sources such as solar and wind power needs substantial infrastructure investments for the market.

Government Policies and Investments of North America Propel the Market

North America is anticipated to grow at the fastest rate in the market during the forecast period, due to the push of the region for renewable energy sources, particularly wind and solar, which require high-voltage cables and accessories for efficient power transmission from these distributed sources to the grid. Additionally, government policies and investments support smart grid development. These advancements are directly linked to regional targets for reducing carbon emissions and improving grid reliability. These advancements are directly linked to regional targets for reducing carbon emissions and improving grid reliability.

- In July 2024, In July 2024, Prysmian completed the acquisition of Encore Wire Corporation, a U.S.-based cable producer, for USD 290.00 per share. This move aims to enhance the presence of Prysmian in the North American market and drive electrification and digital transformation.

The U.S. Market Trends

The U.S. is the fastest-growing country in North America for the high-voltage cables and accessories market due to the U.S. government and utilities investing heavily in upgrading and modernizing existing electrical grids, which demand the replacement of old equipment and the installation of new, high-voltage cable systems. The increasing exchange of power between the U.S. and Canada necessitates the development of strong transmission networks, which in turn fuels the demand for high-voltage cables and accessories.

Europe: A Notable Region in the Global Market

Europe emerged as a notable region in the high voltage cables and accessories market due to its strong focus on renewable energy transition, grid infrastructure modernization, and cross-border interconnection projects. This is driven by initiatives such as the European Green Deal and REPowerPlan. Countries like Germany, Sweden, Poland, and Spain are also investing in grid improvements to meet growing electricity demand and support renewable energy integration.

- In October 2024, Europe races toward a clean energy future. The EU Grid Action Plan, targeting almost 600 billion Euros in investments in the next six years, is an important step.

Commencement of Robust Projects: Germany Market Trend

Germany, with a lucrative growth in the market, is further encouraging the development of extensive projects, such as the Super Link project in Munich is testing the high-voltage superconductor cable prototype, with a probable to escalate to 15km and become the world's longest superconducting cable. Also, the SuedOstLink encompasses the installation of a 580km, ±525 kV underground HVDC cable system, with the initial portion using P-Laser technology.

Promoting Submarine and International Cables is Propelling Latin America

In February 2025, the Meta Project announced with 50,000 km submarine cable system focused on connecting Brazil with five continents, enhancing international connectivity and necessitating high-voltage cable infrastructure. On the other hand, in June 2025, Google signed a deal for a 14,800 km trans-Pacific cable connecting to Valparaiso, Chile, further raising the demand for advanced subsea cable systems and related accessories.

Enhancements in Transmission Auctions: Brazilian Market Trend

A key growth of the Brazilian market has been leveraged by the Brazilian electricity regulator ANEEL, which is accelerating multiple large-scale transmission auctions, appealing billions in investments for new high voltage lines and substations. These projects develop opportunities for suppliers of high-voltage equipment, particularly transformers, switchgear, and cables.

High Voltage Cables and Accessories Market: Value Chain Analysis

- Resource Extraction : This primarily covers sourcing both metals for conductors and shields, and diverse polymers and other materials for insulation and sheathing.

Key Players: Sumitomo Electric Industries, Ltd., NKT A/S, LS Cable & System Ltd., etc. - Grid Maintenance and Monitoring: This is mainly dependent on a combination of visual inspections, advanced diagnostic testing, and continuous real-time monitoring.

Key Players: Qualitrol, OMICRON, Doble Engineering Pvt. Ltd., etc. - Regulatory Compliance and Energy Trading: Companies are emphasizing safety, reliability, and standardized performance, with governing bodies and international standards to provide safe and effective energy trading and transmission.

Key Players: Sumitomo Electric Industries, KEI Industries Ltd., Polycab, etc.

Key Players in High Voltage Cables and Accessories Market and Their Offerings

- Prysmian Group: A global leader in energy and telecom cable systems, Prysmian provides a vast portfolio of HV and extra-high-voltage (EHV) submarine and terrestrial cables. They are heavily involved in offshore wind farm connections and interconnectors, known for their innovative P-Laser technology and HVDC cable systems.

- Sumitomo Electric Industries: This Japanese giant is a pioneer in advanced HV cable technologies, including XLPE insulated cables. They specialize in long-distance power transmission and supply critical components for smart grids and renewable energy projects worldwide.

- Nexans: A key player in electrification, Nexans offers a comprehensive range of HV and EHV solutions. They are a leader in submarine cabling and focus on sustainable, high-performance systems for energy transition, including specialized solutions for harsh environments.

- LS Cable & System: This Korean company is a major producer of power and communication cables, supplying high-capacity HV cable systems globally. They are heavily involved in infrastructure projects and developing advanced materials for next-generation power networks.

- NKT A/S: NKT excels in the design and manufacture of high-voltage cables for both land and sea applications. They are significant contributors to Europe's energy transition, focusing on sustainability and innovative cable solutions for offshore wind parks and grid integration.

Leaders' Announcements

- In May 2023, Sumitomo Electric Industries announced its decision to build a strategically important high voltage cable manufacturing plant in the Scottish Highlands, bringing more than 200 million in investment and creating 150 highly skilled green jobs. This investment will help offshore wind projects and support UK developers to enhance their contribution to UK growth.

- In April 2023, Sumitomo announced plans to establish a new power cable facility in the Scottish Highlands, aiming to contribute to local supply chains and technological advancement within the renewable energy industry of the UK.

Recent Developments

- In June 2023, NKT is finalizing the contract for offshore export power cables for the first major offshore wind farms in Poland awarded by Baltic Power Sp. z o.o. For NKT, the order is expected to have a value of more than EUR 120m and will comprise the design and production of approx. 130 km of 230 kV high-voltage power cables for the Baltic Power Offshore Wind Park.

- In May 2023, Prysmian Group was awarded a contract worth above 800 million Euros for a new power interconnection between France and Spain. The project falls within the European Commission's Projects of Common Interest, as it increases power supply reliability, enables the further integration of renewable energy into electricity grids.

Segments Covered in the Report

By Voltage Class

- Medium Voltage (MV) (1 kV to ≤33 kV)

- High Voltage (HV) (>33 kV to ≤132 kV)

- Extra High Voltage (EHV) (>132 kV to ≤220 kV)

By Component

- Cables

- Accessory

By Installation Type

- Underground Installation

- Overhead Installation

- Submarine/Underwater Installation

By End-Use Application

- Utility Sector

- Renewable Energy

- Industrial Sector

- Infrastructure & Construction

- Defense & Strategic Sectors

- Other End-Use Applications

By Component Material

- Copper Conductor Cables

- Aluminum Conductor Cables

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting