What is the Metal Closures Market Size?

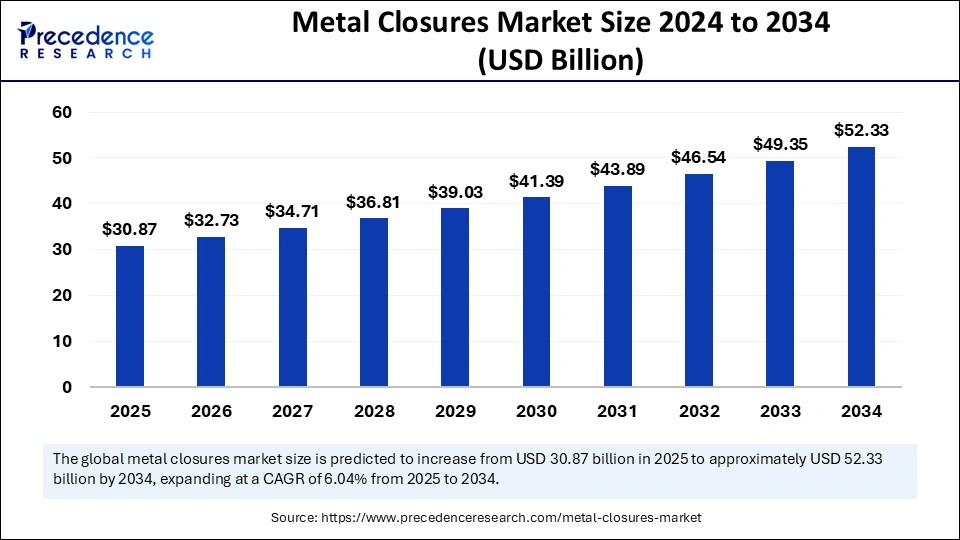

The global metal closures market size is valued at USD 30.87 billion in 2025 and is predicted to increase from USD 32.73 billion in 2026 to approximately USD 52.33 billion by 2034, expanding at a CAGR of 6.04% from 2025 to 2034. The market is witnessing rapid growth due to increasing demand for sustainable packaging options, recyclable materials, and durable closures, especially in the food, beverage, and pharmaceutical industries, driven by innovative designs and manufacturing technologies.

Metal Closures Market Key Takeaways

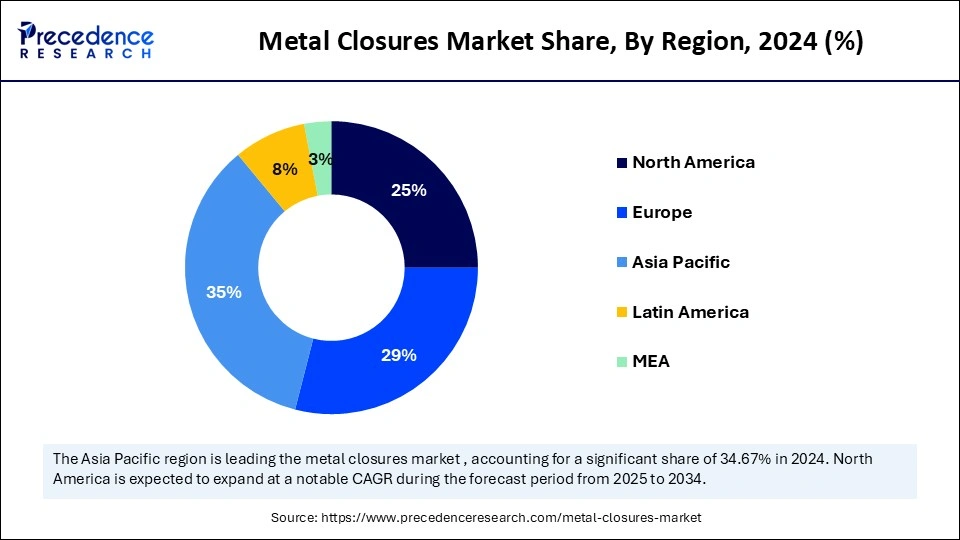

- Asia Pacific led the global metal closures market with the highest share of 35% in 2024.

- North America is observed to host the fastest-growing market over the forecast period of 2025 to 2034.

- By material, the aluminum segment dominated the market with the highest revenue in 2024.

- By material, the steel segment will witness swift expansion over the forecast period of 2025 to 2034.

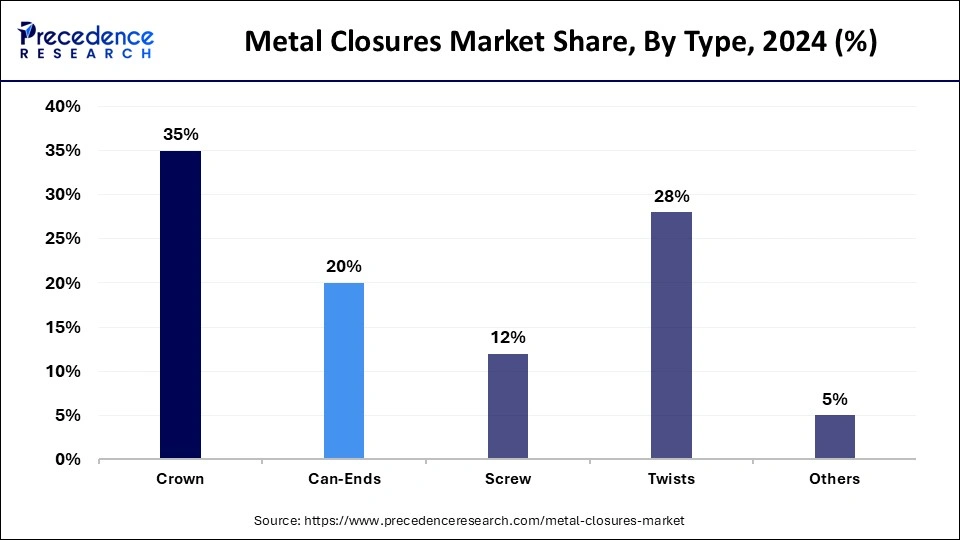

- By type, the crown segment held the major market share of 35% in 2024.

- By type, the twist segment is will grow significantly over the forecast period of 2025 to 2034.

- By end use, the food and beverages segment held the highest market share in 2024.

- By end use, the pharmaceuticals segment will expand significantly over the forecast period of 2025 to 2034.

What are the impacts of AI in the Metal Closures Industry?

Artificial intelligence is transforming the metal closures industry by enhancing efficiency, sustainability, and creativity in manufacturing, design, and supply chain operations. AI enhances manufacturing methods, lowering expenses and boosting output through data analysis. It also facilitates predictive maintenance through the monitoring of machinery condition, reducing downtime and suggesting lightweight designs and recyclable materials. Automation powered by AI enhances processes, spots bottlenecks, and minimizes waste, resulting in better operational efficiency. Sophisticated AI algorithms, especially in computer vision, facilitate real-time quality management and predictive maintenance frameworks, guaranteeing efficient manufacturing processes.

- In June 2024, SwitchOn launched an AI-driven visual inspection system for the metal closures sector, facilitating rapid inspections of closure caps at speeds surpassing 1,000 parts per minute. This technology identifies defects instantly, minimizes material waste, and improves operational efficiency, adhering to strict quality control standards.

What are Metal Closures?

Metal closures are constructed from metal substances such as Aluminum or steel and serve to seal containers and packages, offering secure and tamper-proof sealing for items. They are extensively utilized in sectors such as food and drink, pharmaceuticals, cosmetics, and domestic chemicals. The metal closures market encompasses the worldwide sector engaged in manufacturing, distributing, and utilizing these closures. They maintain product quality, avoid contamination, and prolong shelf life.

The market is expanding because of consumer demand for recyclable and environmentally friendly packaging. Metal closures are a dependable option in many industries due to their exceptional sealing qualities, tamper-evidence capabilities, and longevity. To satisfy a wide range of customer demands, major market participants concentrate on innovation, such as lightweight closures and advanced sealing technologies.

What are the Growth Factors in the Metal Closures Market?

- Growing consumer interest in packaged foods and beverages: Busy schedules and increased disposable incomes have fueled a rise in the consumption of packaged foods and drinks among consumers. Metal caps, found on jars, cans, and bottles, are crucial in the food and beverage sector due to their ability to provide an airtight seal and maintain freshness.

- Sustainability and recyclability: The rising demand for environmentally friendly packaging options and consumer consciousness has resulted in a rise in the use of recyclable metal closures, enhancing sustainability and recyclability.

- Development of the pharmaceutical sector: Metal closures play a vital role in the pharmaceutical sector for guaranteeing product safety and effectiveness, particularly in the packaging of liquid medications, syrups, and vaccines, fueled by the increase in chronic illnesses and the growth of global healthcare infrastructure.

- The expansion of the personal care and cosmetics industry: The cosmetics and personal care sector is adopting metal closures due to their upscale look, robustness, and ability to maintain quality, especially for luxury brands, in order to strengthen brand perception and attract eco-friendly consumers.

- Technological advancement: Advancements in manufacturing techniques and sealing technologies have led to high-performance metal closures that are tamper-evident. These advancements, such as vacuum sealing, embossing, and lightweighting, improve both the functionality and visual attractiveness of metal closures, meeting various consumer tastes.

Metal Closures Market Outlook

- Industry Growth Overview: The metal closures market expects steady expansion from 2025 to 2030, largely thanks to increasing consumer interest in safe, tamper-resistant, and easy-to-tote packaging. Growth will mainly come from food, beverage, and pharma brands as they seek to trade up to high-end, airtight closure solutions across Asia-Pacific, as well as North America.

- Sustainability Trends: Sustainability has begun to shape the metal closures market as brands search for recyclable, lightweight, and low-carbon designs. Producers are increasing research and development on aluminum recycling, BPA-free linings, and energy-efficient manufacturing processes to comply with tightening environmental regulations in Europe and an increasingly eco-friendly global consumer.

- Global Expansion: Key manufacturers are moving to expand into Southeast Asia, Eastern Europe, and LATAM in an effort to exploit rapidly growing fast-moving consumer goods (FMCG) and beverage verticals. Manufacturers are investigating how they can make locally to save costs and take advantage of local regulations, with many manufacturers making capital investments in the form of additional production in Vietnam, Poland, and Mexico.

- Major Investors: Private equity and strategic investors are entering the space because of stable demand, healthy margins, and the movement towards premiumization. The likes of Carlyle and KKR are considering acquisitions in metal packaging and closure systems, looking for companies that offer advanced sealing technologies as well as sustainable materials.

- Startup Ecosystem: The ecosystem of metal closures startups is moving ahead, particularly in recyclable alloys, smart caps, and anti-counterfeiting features. The startups are attracting venture capital by offering track-and-trace closures, ultra-light designs, and digital authentication features for beverage, pharma, and cosmetics brands.

Market Scope

| Report Coverage | Details |

| Market Size by 2034 | USD 52.33 Billion |

| Market Size by 2025 | USD 30.87 Billion |

| Market Size by 2026 | USD 32.73 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 6.04% |

| Dominated Region | Asia Pacific |

| Fastest Growing Market | North America |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Material, Type, End Use, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East & Africa |

Market Dynamics

Drivers

Rising demand for sustainable packaging solutions

The metal closures market is significantly influenced by the rising demand for sustainable packaging solutions. This trend arises from heightened consumer awareness of environmental concerns, leading to a movement toward sustainable alternatives. Metal lids, particularly those crafted from aluminum and steel, are preferred for their recyclability and reduced environmental footprint. With sustainability gaining importance, manufacturers are motivated to innovate and develop products that match ecological objectives, strengthening the preference for recyclable materials in packaging.

- In September 2023, Eviosys launched Horizon, a lightweight metal overcap designed for tins, providing a recyclable substitute for conventional plastic overcaps, enhancing sustainability and minimizing environmental effects by streamlining the recycling process.

Restraint

High production cost

A major restraint in the metal closures market is the high production cost due to increasing raw material prices for metals such as aluminum and steel. In reaction, progress is focusing on reducing weight and optimizing material use, resulting in the creation of lighter closures that utilize fewer resources without compromising performance. Advanced manufacturing techniques also strive to enhance production efficiency and lower expenses. Firms like Eviosys offer ultra-light and endlessly recyclable closures, such as the Horizon, encouraging sustainability by reducing dependence on new resources. Furthermore, fluctuations in raw material prices driven by global supply-demand dynamics and geopolitical issues further complicate matters, affecting production costs and profit margins.

Opportunity

Incorporation of innovative technologies into packaging solutions

A key opportunity in the metal closures market lies in the incorporation of smart technologies like Radio Frequency Identification (RFID) and Near Field Communication (NFC) into packaging. This enhances product security, enables real-time tracking, and boosts consumer engagement. Smart closures provide benefits such as counterfeiting prevention, product condition monitoring, and interactive consumer experiences through connected devices. Notable advancements include closures with digital tracking and authentication features, showcasing the commitment of the industry to smart technologies and establishing metal closures as essential in the intelligent packaging evolution.

- In 2018, Guala Closures launched e-WAK, the inaugural aluminum wine closure featuring NFC technology, enabling wineries to connect with consumers via product authentication and smartphone accessible content. In August 2019, they introduced the inaugural NFC-enabled wine bottles in the U.S., improving consumer engagement and product authenticity.

Material Insights

The aluminum segment dominated the metal closures market with the highest share in 2024, because of its excellent recyclability, light weight, resistance to corrosion, and affordability. Recycling uses 95% less energy than producing from primary materials, making it a sustainable option. This corresponds with the increasing need for eco-friendly packaging options. The adaptability of Aluminum enables tailored designs and functions, addressing market needs and boosting brand distinction. Its fully recyclable nature and tamper-proof seal improve product integrity, preserving consumer confidence and safety. This renders Aluminum a perfect option for various industries.

- In October 2024, Ball Corporation revealed a boost in its Q3 earnings, linked to higher prices for aluminum drink containers and cost-saving measures driven by increased demand for sustainable packaging and the growing use of aluminum closures in convenience foods.

The steel segment will witness swift expansion over the forecast period of 2025 to 2034, because of its strength, affordability, and eco-friendliness. Steel closures are perfect for packaging items such as carbonated drinks and industrial chemicals, and they are very recyclable. Improvements in steel manufacturing technology have led to lighter and more durable closures meeting the needs of both producers and consumers.

Type Insights

The crown segment leads the metal closures metal closures market with the highest share in 2024, for sealing glass bottles used for beverages such as beer and fizzy soft drinks. Crown closures provide tamper resistance along with user-friendly and affordability, creating chances for branding. They are light, cost-effective, and eco-friendly, matching the increasing need for sustainable packaging options. Crown caps, featuring crimped borders, create a tight seal and ensure the beverages stay fresh. Their affordability and suitability for high-speed bottling lines also attract beverage producers. The ability to recycle metal crowns further enhances the increasing need for eco-friendly packaging options.

- In December 2023, Crown Holdings launched lightweight crown caps, whereas in February 2025, Pelliconi unveiled customizable closures for high-end beer labels. Crown Holdings and Pelliconi have both developed new crown closures, emphasizing functionality, sustainability, and brand identity, and thus both firms strive to fulfill market requirements.

The twist segment is will grow significantly over the forecast period of 2025 to 2034, because of its convenient features, affordability, and adaptability. Perfect for sectors such as beverages, pharmaceuticals, and personal care, these closures provide effortless opening and resealing, minimizing material consumption and manufacturing expenses. They further support sustainability objectives by reducing material waste and providing recyclable alternatives. The rising need for smaller bottles and advancements such as flow control and clean dispensing have boosted their usage. Twist closures also incorporate tamper-proof designs, increasing safety and consumer confidence.

End Use Insights

The food and beverages segment held the highest metal closures market share in 2024, especially crowns and screw caps because they are vital for maintaining product texture, color and taste. These closures are commonly utilized in the packaging of alcoholic drinks, along with fizzy beverages, prepared meals, and dairy items. The necessity for closures that indicate tampering and resist contamination, along with their robustness and versatility for different container types, render metal closures an essential option in the industry. The increasing demand for sustainable packaging and their capacity to accommodate various product designs further boosts their attractiveness.

- In March 2024, Kraft Heinz introduced a fully recyclable closure for its ketchup bottles in collaboration with Berry Global. The cap closure substitutes silicone valves for polypropylene, minimizing plastic waste and showcasing the dedication of the industry to sustainability.

The pharmaceuticals segment will expand significantly over the forecast period of 2025 to 2034, because of its critical role in maintaining product integrity, safety, and regulatory compliance. These closures shield pharmaceuticals against environmental influences and contamination because of their strong sealing and tamper-evident features. There is now a greater need for dependable and superior packaging materials due to the growth of fake medications and the expansion of pharmaceutical production in developing nations.

Regional Insights

Asia Pacific Metal Closures Market Size and Growth 2025 to 2034

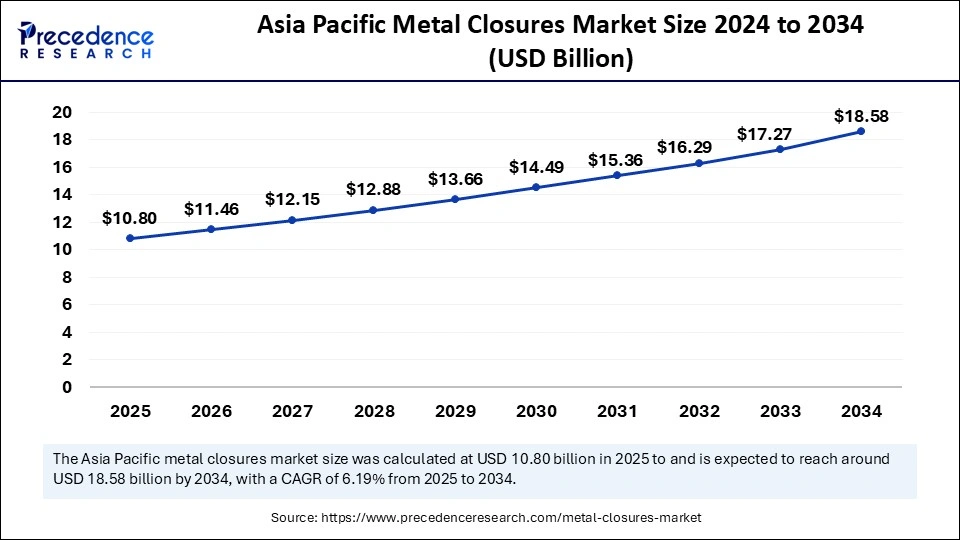

The Asia Pacific metal closures market size is exhibited at USD 10.80 billion in 2025 and is projected to be worth around USD 18.58 billion by 2034, growing at a CAGR of 6.19% from 2025 to 2034.

Asia Pacific: Leading the Market with Diversified Sectoral Growth

Asia Pacific leads the metal closures market with the highest revenue in 2024, because of its vast population, growing disposable incomes, and heightened demand for packaged and high-end products. The food and beverages sector, especially in China and India, is propelling considerable expansion. Additionally, the pharmaceutical industry in the region is witnessing a rise in demand for metal closures driven by increased healthcare awareness and advancements in drug formulation, and the necessity for secure packaging.

The strong manufacturing foundation and progress in Aluminum production of the region, especially in China, facilitate the broad use of metal closures. The recyclability and environmentally friendly attributes of Aluminum support global sustainability objectives, positioning it as a favored material in this industry. The growth of the beauty and household care sectors enhances the use of metal closures, showcasing the global dominance of the region.

- In April 2023, UA Packaging introduced an environmentally friendly Aluminum closure design in Asia Pacific.

India: A Key Driver of the Asia Pacific Market

The expansion of the beverage sector and the growing demand for alcoholic beverages in India have led to a significant number of closures in Asia Pacific. Metal closures guarantee product uniformity and meet regulatory standards. India's industrial foundation, growing consumer market, and strategic efforts such as the National Critical Mineral Mission bolster the sector. The strong manufacturing industry of the nation, especially in steel production, creates a solid basis for the metal closures sector.

Strategic Governmental Support Driving the Chinese Market

The metal closures market of China is led by its strong manufacturing capabilities, vast production capacity, and strategic government programs. The extensive steel sector of the nation, its key role in Asia Pacific, and the Belt and Road Initiative have played a part in its supremacy. The country's swift urban growth and surging middle class have heightened the need for packaged products, enhancing the output of metal closures.

- Government efforts of China, including the proposed issuance of 3 trillion yuan in dedicated treasury bonds for 2025 and its strategies to secure essential minerals like gallium, germanium, and antimony, reinforce its standing.

North America is Witnessing the Fastest Growth Globally

North America in the metal closures market is observed to be the fastest-growing region over the forecast period of 2025 to 2034, driven by its established packaging sector, strict safety regulations, and rising consumer interest in sustainable and tamper-proof packaging options. The food and drink industry, especially in the U.S. and Canada, significantly depends on metal closures to maintain product quality and prolong shelf life.

Increasing health awareness and a desire for premium goods have spurred the uptake of high-quality closures, especially in wine, spirits, and non-alcoholic drinks. Innovations like lightweight and recyclable aluminum closures are meeting sustainability objectives and propelling the growth of the metal closures market.

- The Environmental Protection Agency (EPA) and Canada have initiated efforts to encourage sustainable packaging solutions, with the EPA dedicating USD 150 million and the Innovation Superclusters Initiative of Canada in March 2024, emphasizing advanced manufacturing technologies and environmentally friendly materials.

Increased Adoption of Metal Closures in the U.S.

The U.S. is the fastest expanding market for metal closures, driven by its progressive packaging sector, strong consumer demand for eco-friendly and tamper-proof packaging, and ongoing innovations. The growth is also supported by the food and beverage industry as well as the pharmaceutical sector. The U.S. government has designated USD 75 million to encourage the recycling of resources such as aluminum and steel.

- In October 2024, the Department of Energy announced a partnership with the Aluminum Association and put USD 50 million into energy-efficient methods for aluminum production.

Europe: A Notable Region in the Global Market

Europe is expected to grow considerably in the worldwide metal closures market in the upcoming period because of its developed packaging sector, strict product safety standards, and increasing emphasis on sustainability. The need for metal closures is fueled by sectors such as food and beverages, pharmaceuticals, and cosmetics, where safe, tamper-proof packaging is crucial.

Regulations in the European Union highlight recyclability and environmentally friendly options, leading to metal closures being favored over plastic. The drinks sector similarly requires strong, recyclable closures such as crown caps and aluminum screw caps. Emphasis of Europe on innovation and cooperation among governments and private enterprises guarantees the advancement of sustainable and sophisticated closure solutions.

- In November 2024, the European Commission designated 120 million Euros for the Green Packaging Initiative, intending to encourage sustainable packaging options, minimize waste, and stimulate innovation in packaging designs.

Why did Latin America grow at a Significant Rate in the Metal Closure Market?

Latin America experienced significant growth due to demand created by the growing urban population, which drove the demand for packaged food and beverages. The market broadened as local brands in the region migrated from crowns and corks to safer and stronger metal closures. New government-backed manufacturing projects in the region were announced as various new manufacturers in the region entered low-cost goods production to meet new consumer purchasing.

Brazil Metal Closures Market Trends

Brazil was Latin America's leading country as it had the largest consumer marketplace and substantial demand for packaged food and beverages. Many manufacturers used metal closures for sauces, beverages, and household goods. Manufacturers in Brazil focused on automated production lines and developments in recyclable aluminum production. The size and growing middle class in Brazil created a favorable climate for international brand investment.

What Made the Middle East & Africa Region Experience Considerable Growth in the Metal Closure Market?

The Middle East & Africa region experienced considerable growth due to rapid expansion in packaged food, beverages, and pharmaceuticals. Tourism and population growth increased the consumption of sealed products. Numerous countries put investments into new factories and modern packaging lines. Opportunities expanded in the area of metal closures for edible oil, drinks, and healthcare items. International companies began to enter the region to take advantage of access to growing markets while improving local manufacturing capacity.

The UAE Metal Closures Market Trends

The UAE emerged as the most significant country in the MEA region due to a strong, credible demand for packaged beverages, dairy, and pharmaceutical products. While brand new factories and technology investments allowed local companies to manufacture quality metal closures, the UAE's strong tourism sector increased bottled beverage sales. Moreover, the country imported and exported metal closures throughout the region, strengthening its position.

Metal Closures Market Companies

- Crown Holdings Inc.

- Silgan Holdings Inc.

- Guala Closures Group

- Tecnocap Group

- Sonoco Products Company

- CL Smith Company

- Closure Systems International Inc.

- Amcor Limited

- Berry Global Inc.

- AptarGroup Inc.

- Nippon Closures Co. Ltd.

- Pelliconi & C. SpA

- O. Berk Company

- MJS Packaging

- Finn-Korkki Oy

Leaders' Announcements

- In October 2024, the Director of the European Aluminum Association underscored the importance of metal closures in meeting sustainability objectives of Europe within the Green Packaging Initiative, stressing progress in aluminum recycling technologies for environmentally friendly and economical closures.

- In March 2024, UFlex Limited, an Indian provider of packaging solutions, announced a new manufacturing plant for environmentally friendly metal closures, aligning with the National Critical Mineral Mission of India aimed at sustainable packaging.

- In April 2024, BlueTriton unveiled groundbreaking aluminum bottle packaging, intending to shift towards recyclable or reusable packaging to align with its 2030 Sustainability Goals.

Recent Developments

- In December 2024, the European Commission earmarked 120 million Euros for the Green Packaging Initiative to encourage sustainable packaging solutions, such as metal closures, and lessen environmental consequences.

- In January 2024, Novelis Inc. and Ardagh Metal Packaging USA Corp. teamed up to offer sustainable aluminum beverage packaging sheets, emphasizing environmentally friendly packaging options in alignment with its 2030 Sustainability Goals.

- In September 2024, the India-U.S. TRUST Initiative highlighted the necessity of strong supply chains for essential minerals and advanced materials, thus aiding the metal closures market.

Segments Covered in the Report

By Material

- Aluminum

- Steel

- Tin

By Type

- Crown

- Can-Ends

- Screw

- Twists

- Others

By End Use

- Food and beverages

- Pharmaceuticals

- Consumer Goods

- Personal care and Cosmetics

- Others

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting