List of Contents

What is the Military Sensors Market Size?

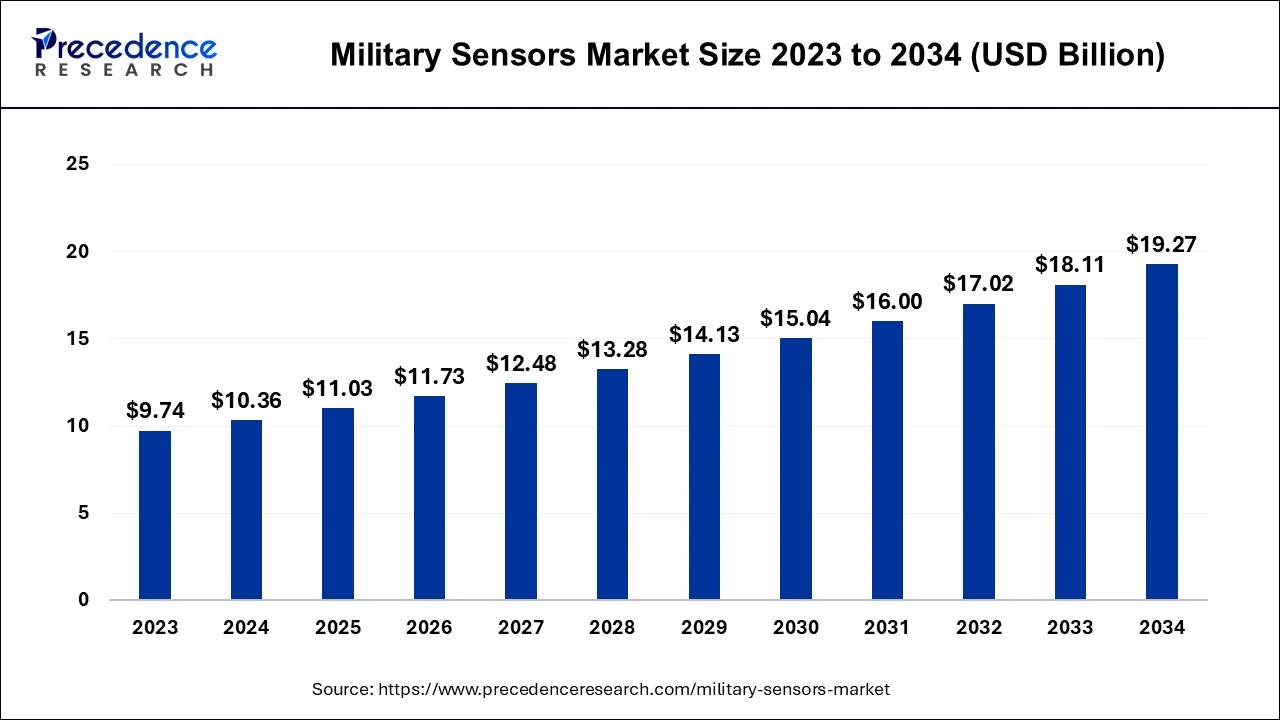

The global military sensors market size is calculated at USD 11.03 billion in 2025 and is predicted to increase from USD 11.73 billion in 2026 to approximately USD 19.27 billion by 2034, expanding at a CAGR of 6.40% from 2025 to 2034.

Military Sensors Market Key Takeaways

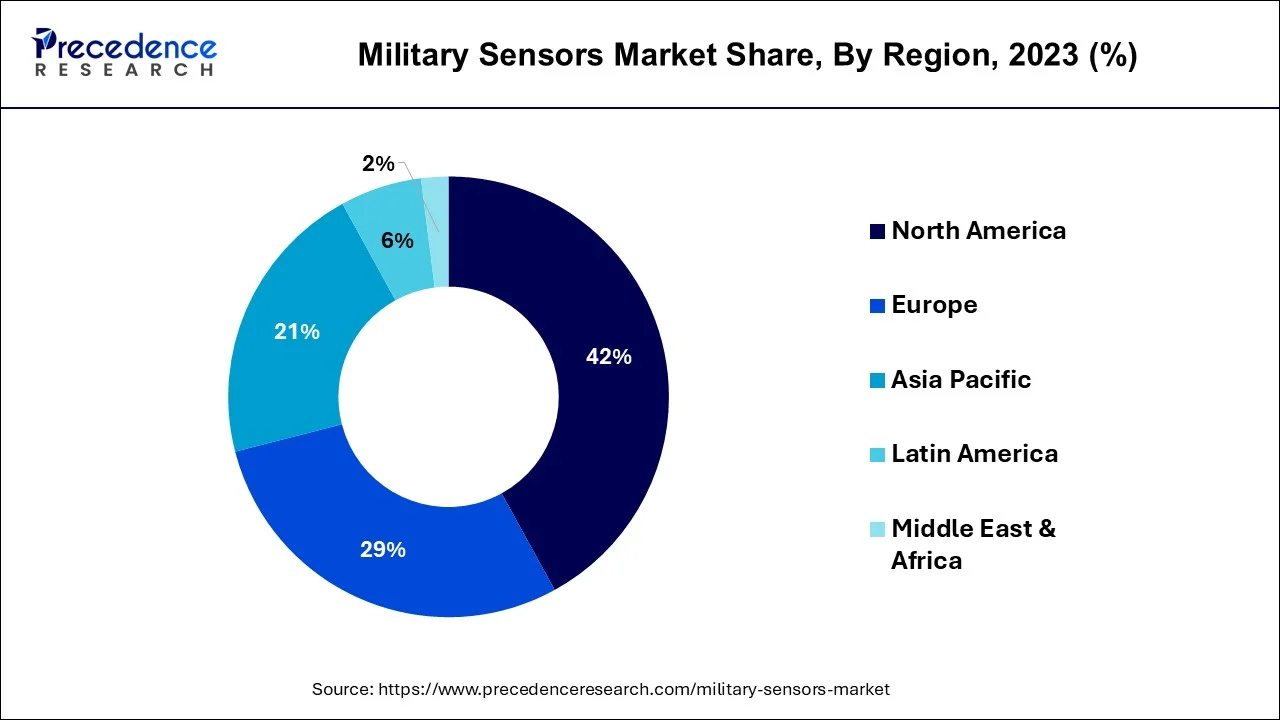

- North America contributed more than 42% of the revenue share in 2024.

- Asia Pacific is estimated to expand the fastest CAGR between 2025 and 2034.

- By Platform, the land segment held the largest market share of 40% in 2024.

- By Platform, the airborne segment is anticipated to grow at a remarkable CAGR of 8.2% between 2025 and 2034.

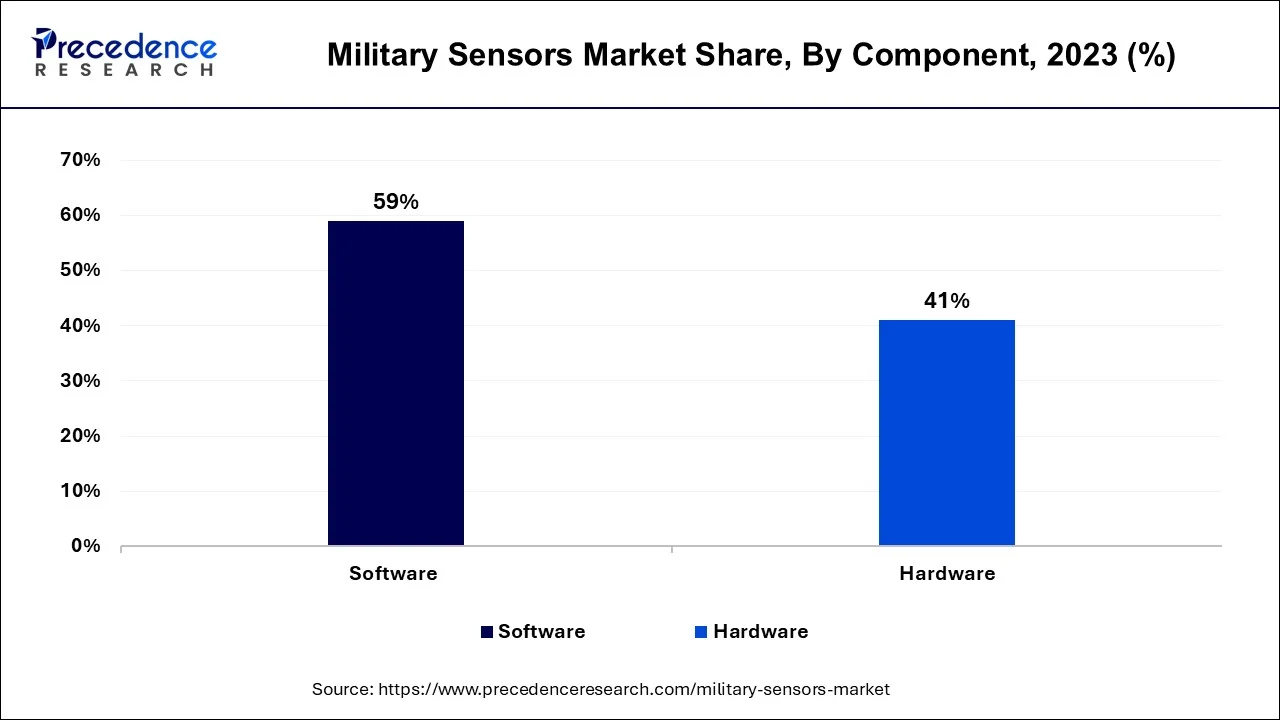

- By Component, the software segment generated over 59% of revenue share in 2024.

- By Component, the hardware segment is expected to expand at the fastest CAGR over the projected period.

- By Application, the communication and navigation segment had the largest market share of 42% in 2024.

- By Application, the combat operations segment is expected to expand at the fastest CAGR over the projected period.

Market Overview

The militarysensors marketencompasses a wide array of technological devices designed to enhance the capabilities of military forces. These sensors are instrumental in gathering critical data, monitoring the battlefield, and providing intelligence for informed decision-making. The market includes various sensor types, such as radar, sonar, infrared, acoustic, andchemical sensors.

These technologies aid in detecting and tracking threats, protecting military assets, and improving situational awareness. With increasing defense budgets and the need for modernization, the military sensors market is projected for substantial growth, driven by advancements in sensor technologies and evolving defense requirements.

Military Sensors Market Outlook

- Industry Growth Overview: The military sensors market is poised for significant growth between 2025 and 2034, driven by escalating geopolitical tensions, defense modernization programs, and rising demand for enhanced battlespace awareness. High-growth segments include AI-enabled multi-sensor fusion, unmanned vehicle systems (UAVs and UUVs), and advanced platforms like quantum sensing for GPS-independent navigation.

- Technological Modernization and System Integration: This prioritizes the development of multifunctional sensor suites and open-architecture designs to enable real-time data fusion and network-centric warfare capabilities, thereby enhancing mission adaptability and operational effectiveness across platforms.

- Major Investors: The market is led by large, established defense contractors such as Raytheon (RTX), Lockheed Martin, Thales Group, and BAE Systems. Investment focuses on strategic acquisitions to enhance technological capabilities and secure major government contracts. Significant R&D efforts are aimed at integrating advanced technologies like AI, quantum sensing, and photonics.

- Startup Ecosystem: While the market remains highly consolidated, a growing startup ecosystem is developing in niche, high-tech sectors. These startups, particularly in quantum and specialized EO/IR sensing, often spin out of universities and obtain early funding through government programs like Small Business Innovation Research.

Military Sensors Market Growth Factors

- The continuous development of sensor technologies, including advanced radar, infrared, and acoustic sensors, enhances military capabilities for threat detection, tracking, and surveillance.

- The rise in defense spending by various nations, driven by security concerns and modernization needs, provides substantial funding for military sensor procurement and development.

- Encompassing traditional and non-traditional challenges such as cyberattacks, terrorism, and asymmetric warfare, drives the need for cutting-edge military sensor systems. These systems play a pivotal role in ensuring national security by detecting and countering threats effectively.

- The rise in geopolitical tensions and territorial disputes in various regions fuel a higher demand for military sensors. These advanced sensors are instrumental in enhancing defense capabilities, safeguarding national interests, and maintaining strategic stability.

Market Scope

| Report Coverage | Details |

| Market Size by 2034 | USD 19.27 Billion |

| Market Size in 2026 | USD 11.73 Billion |

| Market Size in 2025 | USD 11.03 Billion |

| Growth Rate from 2025 to 2034 | CAGR of 6.40% |

| Largest Market | North America |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Platform, Component, Application, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

Increased defense spending and technological advancements

Increased defense spending and technological advancements are significant drivers that surge the market demand for military sensors. Firstly, increased defense budgets worldwide have a profound impact on the demand for military sensor systems. Nations are allocating substantial funds to bolster their defense capabilities due to growing security concerns and evolving threats. This heightened investment translates into higher procurement of advanced military sensor technologies. The need to modernize and equip armed forces with state-of-the-art sensor systems to maintain national security and strategic superiority is a driving factor.

Moreover, rapid technological advancements play a pivotal role in fueling market demand. Sensor technologies are continuously evolving, leading to the development of more sophisticated and efficient military sensor systems. Innovations in radar, infrared, acoustic, and other sensor types enhance military capabilities for threat detection, surveillance, and reconnaissance. These advancements provide defense forces with a competitive edge, as they can detect and respond to threats more effectively. The demand for cutting-edge sensor systems grows as military organizations seek to stay ahead of adversaries and address emerging security challenges.

Restraint

Budget constraints and export control regulations

The budget constraints can limit the ability of defense departments to invest in the acquisition and development of advanced sensor technologies. With finite financial resources, defense agencies may prioritize other critical areas of military expenditure, such as personnel, maintenance, and existing equipment, at the expense of investing in new sensors. This budgetary restraint can lead to delays in upgrading sensor capabilities and may limit the acquisition of the latest sensor technologies.

Moreover, export control regulations can pose significant challenges for international sales and collaboration. Many countries have strict export controls in place to protect sensitive defense technologies. These regulations restrict the transfer of military sensor technology to foreign nations, particularly those in regions of geopolitical concern. This can hinder the international expansion of military sensor manufacturers and limit their access to a broader customer base, thus constraining market demand. As a result, companies must navigate complex regulatory processes to gain approval for international sales, which can be time-consuming and expensive. These challenges can deter potential customers and hinder market growth, particularly in the global defense sector.

Opportunity

Integration with unmanned systems, artificial intelligence and machine learning

Integrating military sensors with unmanned systems, artificial intelligence (AI), and machine learning has become a game-changer in the defense sector, significantly surging the demand for these sensors. Unmanned systems such as drones and autonomous vehicles rely heavily on sensors to gather critical data and enable autonomous decision-making.

Military sensors equip these platforms with advanced situational awareness, enhancing their surveillance, reconnaissance, and target-tracking capabilities. This integration is particularly valuable in intelligence, surveillance, and reconnaissance (ISR) missions, where unmanned systems equipped with sensors can operate in hostile or hard-to-reach environments without exposing human personnel to potential risks.

Furthermore, AI and machine learning algorithms are revolutionizing data analysis and interpretation, making military sensors more intelligent and responsive. These technologies can rapidly process vast datasets, identify patterns, and predict potential threats or anomalies. They enable real-time data fusion from multiple sensor sources, enhancing the accuracy of threat detection and reducing false alarms.

As a result, defense forces are increasingly adopting AI and machine learning-integrated sensor systems to make data-driven decisions, streamline operations, and respond effectively to evolving security challenges. This surge in demand for military sensors is driven by the compelling advantages of improved accuracy, faster decision-making, and enhanced overall situational awareness achieved through this integration.

Platform Insights

According to the platform, the land segment has held 40% revenue share in 2024. Land-based military sensors are integral components of modern warfare, providing crucial intelligence, surveillance, and reconnaissance (ISR) capabilities. These sensors are deployed on various platforms, including ground vehicles, fixed installations, and soldier-wearable systems. A trend in this segment is the increasing focus on miniaturization and the integration of sensors into soldier equipment, enhancing individual situational awareness on the battlefield. Furthermore, data fusion and artificial intelligence play a growing role in processing the information gathered by land-based sensors, enabling more effective threat detection and decision-making.

The airborne segment is anticipated to expand at a significantly CAGR of 8.2% during the projected period. Airborne military sensors are pivotal for aerial reconnaissance, target identification, and threat detection. Drones and manned aircraft are equipped with advanced sensors, including radar, electro-optical, and infrared systems. A significant trend in this category is the integration of these sensors into unmanned and autonomous systems, improving the efficiency of reconnaissance and data collection. Additionally, advancements in synthetic aperture radar (SAR) and electronic warfare sensors are enhancing the capabilities of airborne platforms, providing more comprehensive intelligence for military operations.

Component Insights

Based on the component, the software segment is anticipated to hold the largest market share of 59% in 2024. In the military sensors market, software plays a critical role in processing, analyzing, and interpreting the vast amount of data collected by various sensor systems. Advanced software solutions enable real-time threat assessment, data fusion from multiple sensors, and enhanced situational awareness. The trend in military sensor software involves the integration of artificial intelligence and machine learning algorithms for more accurate target recognition and reduced false alarms. Cybersecurity is another key focus, as the protection of sensor data and system integrity is of paramount importance, especially in an era of increasing cyber threats.

On the other hand, the hardware segment is projected to grow at the fastest rate over the projected period. Hardware in the military sensors market refers to the physical components of sensor systems, including the sensors themselves, signal processors, and data transmission equipment. In the military sensors market, hardware trends are primarily focused on two key aspects. The first trend emphasizes miniaturization and lightweight design, allowing sensors to be deployed on smaller, more agile platforms such as drones and unmanned vehicles. This miniaturization enables increased mobility and versatility in military operations.

Emerging hardware trends also include the development of multi-sensor platforms that offer versatility and multi-functionality in a single package, reducing the need for multiple standalone sensor systems. Moreover, it enhances the durability and resilience of hardware components to ensure they can withstand the demanding conditions of military use, including extreme environmental factors. This focus ensures that sensors can perform reliably in challenging terrains and adverse weather conditions, contributing to their effectiveness and longevity in the field.

Application Insights

In 2024, the communication and navigation segment had the highest market share of 42% on the basis of the application. Military sensors play a vital role in communication and navigation applications. They facilitate secure and efficient data transfer and positioning for troops and military vehicles. Advanced GPS systems, satellite communication sensors, and secure data links are employed for real-time information sharing, enhancing situational awareness.

In recent trends, there is a growing emphasis on anti-jamming and anti-spoofing technologies to protect communication and navigation systems from hostile interference. The integration of sensors with artificial intelligence (AI) also allows for autonomous navigation and communication capabilities, reducing the reliance on external networks and ensuring operational continuity in challenging environments.

The combat operations segment is anticipated to expand fastest over the projected period. In combat operations, military sensors are integral for threat detection, target acquisition, and battlefield surveillance. These sensors encompass a wide range, including radar systems, infrared sensors, and acoustic devices. Recent trends point towards the development of multi-sensor fusion technologies to provide a comprehensive picture of the battlefield.

Moreover, there is a focus on miniaturization to enable sensors to be deployed on unmanned platforms, increasing reconnaissance capabilities while reducing risks to human soldiers. Enhanced sensor data processing through AI and machine learning is another notable trend, allowing for faster and more accurate threat identification and response in combat scenarios.

Regional Insight

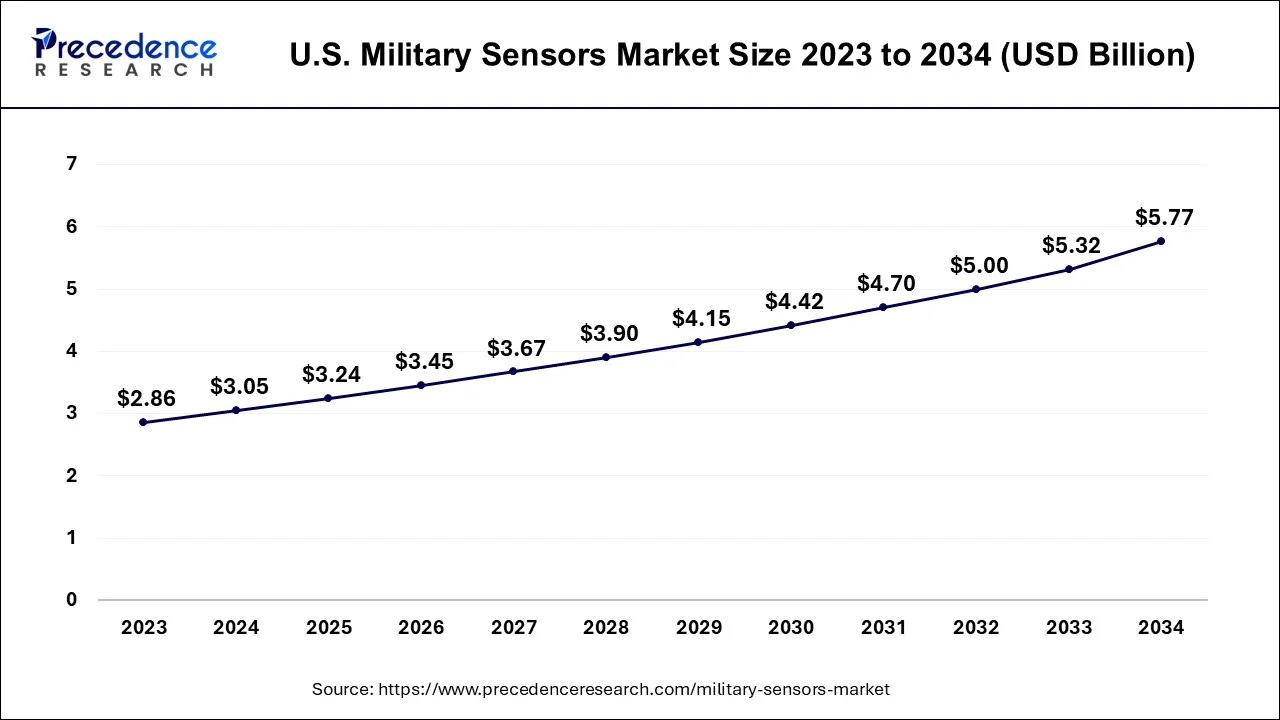

U.S. Military Sensors Market Size and Growth 2025 to 2034

The U.S. military sensors market size is estimated at USD 3.24 billion in 2025 and is expected to be worth around USD 5.77 billion by 2034, growing at a CAGR of 6.58% from 2025 to 2034.

North America has held the largest revenue share 42% in 2024. North America has been a frontrunner in the adoption of advanced military sensors, driven by the continuous modernization efforts of the U.S. Department of Defense. The region has witnessed a growing focus on integrating artificial intelligence and machine learning into military sensor systems, enhancing real-time data processing and threat detection. The U.S. Department of Defense's investments in cutting-edge sensor technologies, including radar, EO/IR, and CBRN sensors, reflect the region's commitment to maintaining military superiority. Furthermore, partnerships with private defense companies for research and development initiatives are fostering innovation.

U.S. Military Sensors Market Trends

The U.S. leads the global military sensors market in North America because of large defense budgets and ongoing military upgrades. The Department of Defense invests heavily in advanced sensor tech for electronic warfare, soldier monitoring, and surveillance. Major U.S. defense companies like Lockheed Martin and RTX Corporation drive innovation and integrate these systems into platforms such as F-35 jets and UAVs.

What Makes Asia Pacific the Fastest-Growing Region in the Market?

Asia Pacific is estimated to observe the fastest expansion. Asia Pacific is witnessing a significant increase in military expenditures, driven by the growing emphasis on indigenous sensor development to enhance defense capabilities. Geopolitical tensions and territorial disputes have amplified the demand for military sensors, particularly in the context of maritime and border security. Countries such as China, India, and Japan are actively investing in sensor technologies across land, air, and naval applications to fortify their security postures. Consequently, the market has emerged as a burgeoning hub for sensor development and production, presenting substantial growth prospects for both domestic and international sensor manufacturers.

India Military Sensors Market Trends

India is rapidly emerging as a significant force, driven by its Make in India initiative and a push for indigenous development to reduce reliance on foreign technology. Geopolitical tensions have prompted increased defense budgets and investment in sensor technology for modern military platforms. India's efforts are evident in systems such as the indigenous Akash-Teer air defense system, reflecting strong collaboration between the DRDO and private-sector players

What Potentiates the Growth of the military Sensors Market in Europe?

Europe is seeing a steady progression in its military sensor market. Several European nations are investing in advanced sensor technologies, including radar systems and unmanned aerial vehicles (UAVs). Additionally, collaboration on multinational defense projects, such as the Euro drone initiative, is driving innovation in sensor development, further propelling the European military sensor market. The European military sensor market is also addressing emerging threats in the cyber domain, investing in technologies that can counter cyberattacks on defense systems and networks. This holistic approach ensures the region's readiness for modern warfare challenges.

Germany Military Sensors Market Trends

Germany is a major hub for military sensor technology in Europe, featuring a strong defense industry and a focus on high-tech solutions. The country hosts leading defense contractors and heavily invests in R&D for advanced sensor integration. The market is fueled by the need to modernize armed forces with cutting-edge capabilities, especially in technologies like conformal photonic apertures embedded in composite skins for low-observable platforms.

A Look at Latin America's Military Sensors Market

The military sensors market in Latin America is expanding steadily, driven by increasing efforts to modernize defense systems and the need to upgrade existing military platforms. However, it remains a smaller and more fragmented market compared to North America or Europe, with defense budgets often limiting spending. Countries focus on acquiring advanced surveillance, navigation, and targeting technologies, but reliance on imports and varying levels of technological development across the region pose challenges.

Brazil Military Sensors Market Trends

Brazil leads the Latin American military sensors market, backed by its strong domestic defense electronics and avionics manufacturing capabilities. The market is driven by ongoing military modernization programs, focusing on upgrading command, control, communication, computers, intelligence, surveillance, and reconnaissance (C4ISR) capabilities. There's also an effort to integrate AI-enhanced sensors and produce avionics modules locally to support both military needs and industrial growth.

What Factors Drive the Growth of the Military Sensors Market in the Middle East and Africa?

The MEA military sensors market is growing due to significant defense spending in the region, especially in Gulf Cooperation Council (GCC) countries. Major factors include increasing security threats, ongoing military upgrades, and high demand for advanced surveillance, intelligence, and reconnaissance technology. While GCC nations are acquiring advanced radar and counter-drone systems, African countries are focusing on improving patrol capabilities with low-cost day-night cameras.

Saudi Arabia Military Sensors Market Trends

Saudi Arabia's military sensors market is a key part of its plan to diversify the economy and boost national security. The country is strongly investing in local manufacturing of defense electronics and avionics to cut down on imports. This includes integrating AI-powered systems and sensor fusion tech to improve situational awareness, with high demand for advanced radar, surveillance, navigation, and electronic warfare systems.

Value Chain Analysis

- Component Manufacturing and Raw Material Supply

This focuses on producing fundamental components, such as specialized semiconductors, microelectronics, and advanced materials.

Key Players: Intel, Qualcomm, Analog Devices, and TE Connectivity. - R&D, Design, and Integration

This involves designing and developing sensor systems and integrating advanced technologies such as AI and machine learning.

Key Players: RTX Corporation, Lockheed Martin, and Thales Group. - System Assembly and Platform Integration

Sensors are integrated into military platforms like aircraft, vehicles, and satellites.

Key Players: Lockheed Martin and BAE Systems. - Distribution and Government Procurement

This involves governments and defense agencies procuring the sensor-integrated systems through a highly regulated process.

Key Players: U.S. DoD, European defense ministries, and major contractors. - End-User Deployment and Application

Sensor systems are deployed in military operations for various applications like ISR, EW, and target recognition.

Key Players: Military forces and defense agencies. - Maintenance, Upgrades, and Support

This involves providing regular maintenance, software upgrades, and support to ensure the long-term operational efficiency of military sensors.

Key Players: Lockheed Martin, Honeywell International, Hindustan Aeronautics Limited.

Top Companies for the Military Sensors Market and Their Offerings

- Lockheed Martin: Offers advanced EO/IR targeting systems (F-35 EOTS), long-range ground radars (TPY-4), and space-based infrared sensors for missile warning.

- Raytheon Technologies (RTX):Specializes in high-power radar systems (AN/SPY-6 naval radar), advanced IR sensors (FLIR B-Kit), and integrated missile defense sensors.

- Northrop Grumman: Provides integrated EO/IR systems, airborne early warning radar (AN/APY-9), and electronic warfare sensors for enhanced situational awareness.

- BAE Systems: Focuses on electronic warfare (Common Missile Warning Systems), thermal imaging sensors, and Identification Friend or Foe (IFF) technologies.

- Thales Group: Offers a wide array of radar and sonar systems, advanced optronics for targeting and surveillance, and EW suites for aerial and naval platforms.

Other Key Players

- General Dynamics Corporation

- Safran S.A.

- L3Harris Technologies, Inc.

- Leonardo S.p.A.

- Rheinmetall AG

- FLIR Systems, Inc.

- Textron Inc.

- Honeywell International Inc.

- Elbit Systems Ltd.

- Terma A/S

Recent Developments

- In July 2025, with the help of a local tech firm in France, the army is looking for the integration of shock microsensors for personal protective equipment in bulletproof vests. It will be a 7-year contract worth 3 million euros, which will provide a self-monitoring mechanism for the ballistic plates inserted in the vest. The vest will consist of multi-layered composite plates and hard ceramic, as the intrinsically fragile ceramic could crack in the event of an accidental fall, compromising the protection level. The microprocessor will detect and record the record, and it will help the soldier to assess the protection integrity.

- In Dec 2024, the Pentagon's Defense Advanced Research Projects Agency is going to launch a program which will develop more sophisticated quantum sensors which will be developed for integration and application of various US military platforms based on requirements. As per Pentagon officials they are continuously exploring the capabilities of alternative positioning, navigation, and timing, and intelligence surveillance and reconnaissance.

- In July 2025, U.S. Air Force airborne weapons experts have requested Lockheed Martin Corp. to build another batch of AGM-158C Long-Range Anti-Ship Missiles (LRASM) to be deployed against targets like aircraft carriers, troop transport ships, and guided-missile cruisers. A new order worth $45.9 million is given by U.S. Airforce in the late June to the Lockheed Martin Corp. Missiles and Fire Control segment in Orlando, Fla., for LRASMs lots 7 and 8.

- In The new stealth technology integration into wind turbines can turn them in a stealth equipment for the military. wind turbines, many time create lots of clutter in the radar signals. which can be reduced with the help of new stealth technology. Which is similar to the aircraft stealth technology developed with the help of nanotechnology, artificial intelligence and mesh sensor network. This wind turbine technology will avoid it from radar sensors and even turn them into military assets with the help of radar signals absorbing materials. The wind turbines will have a very low radar signature, which will be a great help to declutter radar signals and get better clarity.

- In December 2022,the Air Force Research Laboratory partnered with Nano Bio-materials Consortium and Case western Reserve University to build wearable sensors that measure biomarkers in Airmen.

Segments Covered in the Report

By Platform

- Land

- Naval

- Airborne

By Component

- Software

- Hardware

By Application

- Combat Operations

- Target Recognition

- Electronic Warfare

- Communication and Navigation

- Command and Control

- Surveillance and Monitoring

- Intelligence and Reconnaissance

By Geography

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client