What is the Military Displays Market Size?

The global military displays market size is calculated at USD 1.40 billion in 2025 and is predicted to increase from USD 1.48 billion in 2026 to approximately USD 2.42 billion by 2035, expanding at a CAGR of 5.63% from 2026 to 2035.

Military Displays Market Key Takeaways

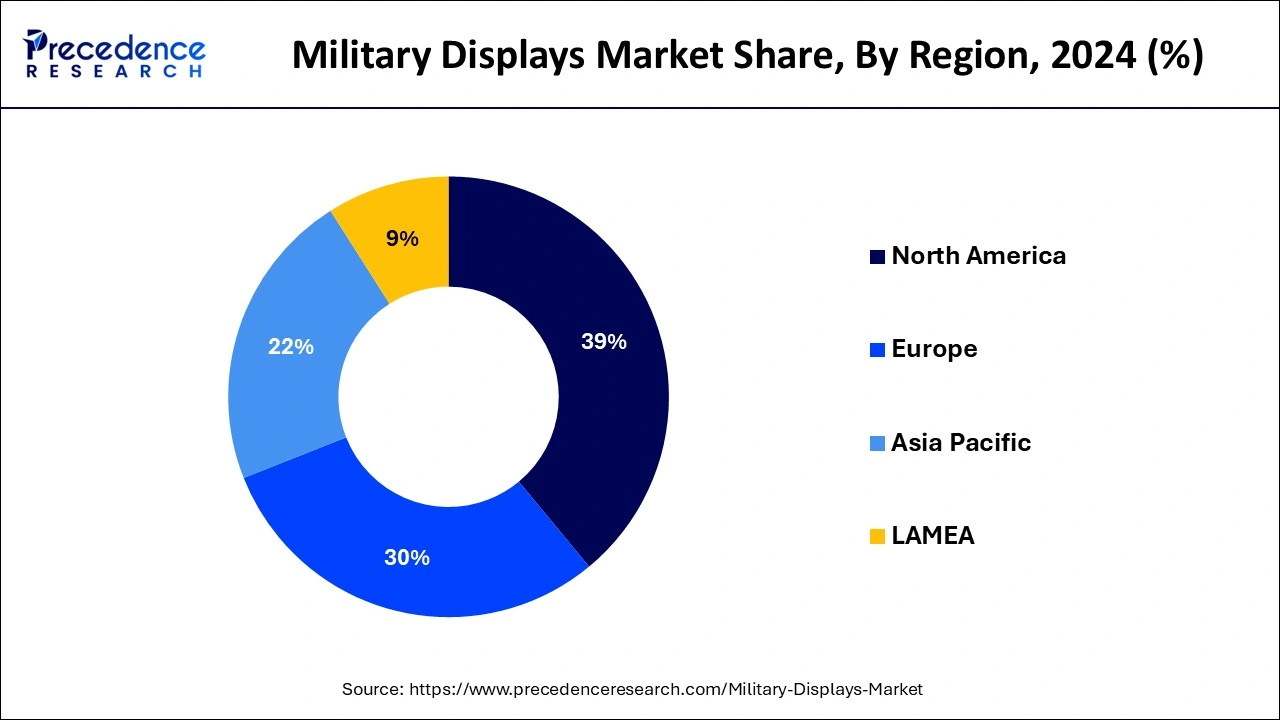

- North America dominated the military displays market with the largest market share of 39% in 2025.

- Asia Pacific is expected to grow at the fastest rate over the studied period.

- By product, the computer displays segment has held a major market share of 36% in 2025.

- By product, the handheld segment is anticipated to grow at the fastest rate in the market over the forecast period.

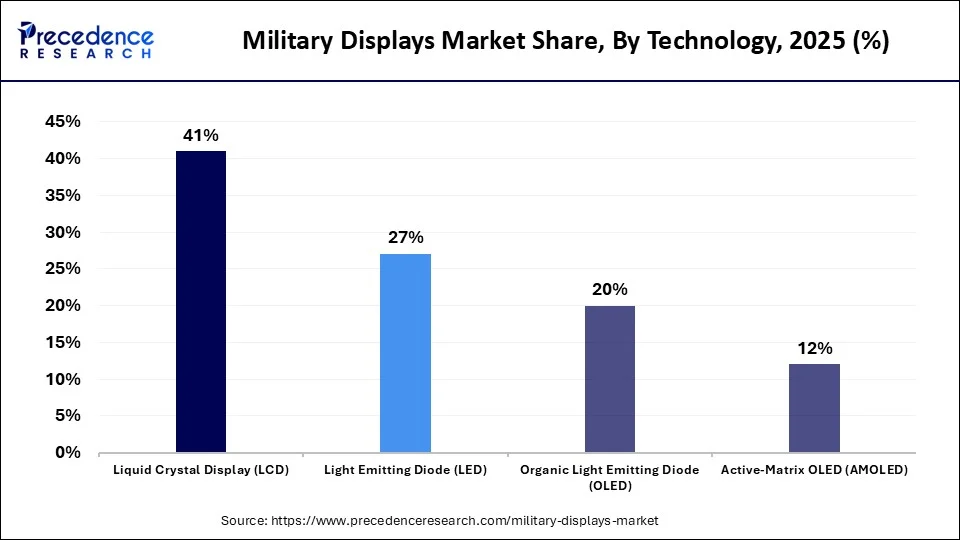

- By technology, the liquid crystal display (LCD) segment contributed the highest market share of 41% in 2025.

- By technology, the OLED segment is expected to grow at the fastest CAGR of 6.1% over the forecast period.

- By end use, in 2025, the land segment held the largest market share.

- By end use, the airborne segment is estimated to grow rapidly over the projected period.

- Role of Artificial Intelligence (AI) in Modern Military Applications

Market Overview

Military displays are created for harsh climatic conditions and mission-oriented applications. These displays are designed to withstand vibration, shock, dirt, dust, and extreme temperatures. Special features are also included such as night vision compatibility, high brightness, and anti-reflective coatings. Military vehicles like aircraft, tanks, and armed personnel carriers use these displays to offer crucial information to vehicle crews. Military displays are referred to as command-and-control displays.

Artificial intelligence is rapidly revolutionizing the military displays market

Artificial intelligence (AI) is emerging as an important area of development. The army is using AI to improve logistics, battlefield awareness, and combat effectiveness. Furthermore, AI-driven unmanned ground vehicles (UGVs) can transport supplies and perform reconnaissance with no or minimal human help: AI systems can manage and monitor soldiers' physiological data to improve combat performance.

- In June 2024, the U.S. Air Force and U.S. Space Force launched an artificial intelligence (AI) tool, with encouragement to service members to initially experiment with using the AI tool for routine tasks such as producing reports, assisting with IT issues, and computer coding.

Military Expenditure by Country 2025

| Country | Expenditure (USD billion) |

| United States | 939 |

| China | 373 |

| Russia | 225 |

| India | 132 |

| South Korea | 65.1 |

Military Displays Market Growth Factors

- Increasing integration of displays with other military systems is expected to boost military displays market growth soon.

- Increasing demand for displays in new military platforms can propel market growth shortly.

- A growing need for displays for training and simulation purposes will likely contribute to the market expansion further.

Market Outlook

- Market Growth Overview: The military display market is expected to grow significantly between 2025 and 2034, driven by the rising worldwide investment in the upgrading of military, innovation in technological advancement, and the rising need for real-time, intuitive data visualization for soldiers and command centers.

- Sustainability Trends: Sustainability trends involve the energy efficiency and low power consumption, using environmentally conscious material, and sustainable design and life-cycle management.

- Major Investors: Major investors in the market include Lockheed Martin, BAE Systems, Raytheon Technologies, Thales Group, L3Harris, Elbit Systems, and Crystal Group.

Market Scope

| Report Coverage | Details |

| Market Size by 2025 | USD 1.40 Billion |

| Market Size in 2026 | USD 1.48 Billion |

| Market Size in 2035 | USD 2.42 Billion |

| Market Growth Rate from 2026 to 2035 | CAGR of 5.63% |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | Product, Technology, End Use, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

Surge in defense budgets

In the era of ongoing security threats, governments across the globe are focusing more on their defence sector. The heavy investment of funds in the advancement of military programs has a positive influence on the demand for an innovative military display market. In addition, the surge in defense budgets enables the military to invest in advanced display technologies.

- In October 2024, Innovative Solutions & Support, Inc. announced it acquired the license for various generations of military Display Generators and Flight Control Computers from Honeywell. The deal includes an exclusive license to manufacture, upgrade, and repair the product line. The agreement also grants IS&S exclusive intellectual property.

Restraint

Tedious procurement processes

Lengthy and tedious procurement processes can lengthen the installation of innovative display technologies, hampering the military displays market growth. Military displays have to undergo strict testing to fulfill the requirement for safety standards. Moreover, hurdles in allocating enough funds to military budgets can constrain market growth.

Opportunity

Increasing focus on cybersecurity

Military displays are becoming more integrated with essential systems, hence the concerns regarding cyberattacks are increasing. Military displays market players are emphasizing strong cybersecurity measures to protect these displays to ensure system and data integrity. Furthermore, innovative military displays provide new design possibilities for combining displays into many military platforms, enhancing the space utilization within cockpits.

- In October 2024, Innovative Solutions & Support, Inc. announced it acquired the license for various generations of military Display Generators and Flight Control Computers from Honeywell. The deal includes an exclusive license to manufacture, upgrade, and repair the product line. The agreement also grants IS&S exclusive intellectual property rights.

Segment Insights

Product Insights

The computer displays segment dominated the military displays market in 2025. The dominance of the segment can be attributed to the increasing requirement for convenient visual technologies by armed forces for real-time data delivery in crucial environments. Additionally, the integration of computer displays with sonar equipment, radar systems, and other communication networks facilitates improved situational awareness for further operations.

The handheld segment is anticipated to grow at the fastest rate in the military displays market over the forecast period. The growth of the segment can be linked to the growing use of handheld devices in military applications as they are lightweight, portable, and give good battery backup. Moreover, the developers have to consider many factors before the direct implementation of these devices in military applications including efficiency, performance, and safety.

- In August 2024, ZOTAC has just launched its much-anticipated gaming handheld, the new ZOTAC GAMING ZONE, with pre-orders in select regions and e-tailer platforms at USD 799. ZOTAC GAMING is using AMD's in-house driver-level fluid motion frames (FMR), and FidelityFX Super Resolution to further enhance performance.

Technology Insights

The liquid crystal display (LCD) segment led the global military displays market in 2025. The dominance of the segment can be credited to the surge in the use of LCD technology while manufacturing military displays because it provides convenience of space and cost. This display consumes less power as compared to other displays and is also flexible in nature. LCD displays offer excellent brightness, resolution, and contrast to make clear picture quality.

The OLED segment is expected to grow at the fastest rate in the military displays market over the forecast period. The growth of the segment can be driven by the growing investment by military forces in innovative display technologies to improve situational awareness. This technology offers enhanced contrast ratios, superior color accuracy, and decreased power consumption as compared to conventional displays. Also, the launch of bendable and flexible OLED displays has facilitated smooth integration into various applications.

- In July 2024, Ayaneo announced the development of the Pocket EVO. The pre-launch of the Android handheld is now live, and it will officially debut at an upcoming launch event. The company is boasting that the Pocket EVO will be the first Android handheld to feature a 7-inch 120Hz OLED display.

End-Use Insights

In 2025, the land segment held the largest military displays market share. The dominance of the segment is owing to innovations in technology and transforming the landscape of contemporary warfare. Armed military forces depend on these displays for situational awareness, simulated drills, and tactical strategizing. Furthermore, armed forces are focusing on enhancing operational processes.

The airborne segment is estimated to grow rapidly in the military displays market over the projected period. The growth of the segment can be linked to the growing use of these displays in airborne systems due to their cost-effectiveness, versatility, and easy deployment. In addition, they are also used for reconnaissance, surveillance, and strike missions.

Regional Insights

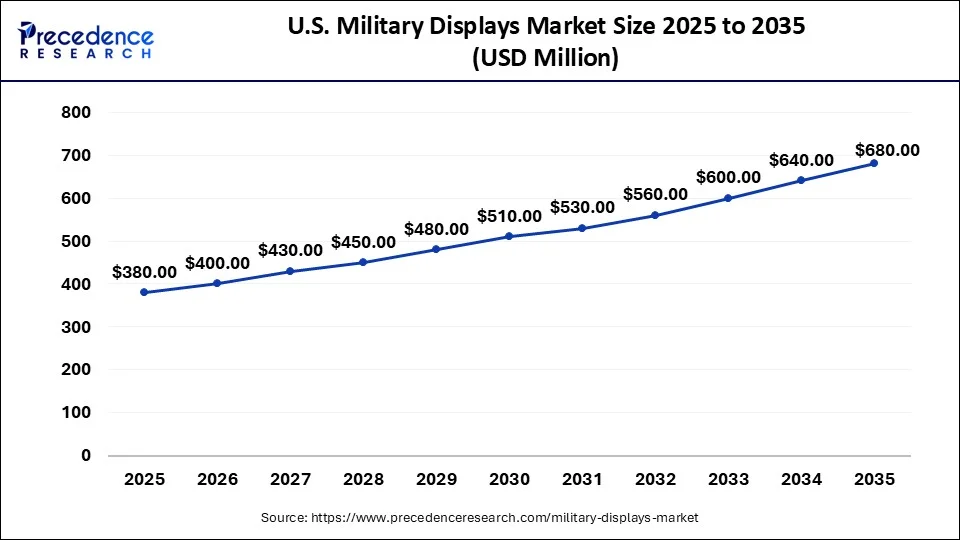

What is the U.S. Military Displays Market Size?

The U.S. military displays market size was exhibited at USD 380 million in 2025 and is projected to be worth around USD 680 million by 2035, growing at a CAGR of 5.98% from 2026 to 2035.

North America dominated the global military displays market in 2025. The dominance of the region can be attributed to the increasing demand for high-performance and integrated systems that improve both combat readiness and operational efficiency. However, in North America, the U.S. led the market, owing to the incorporation of innovative technologies like mixed reality to develop interactive displays.

U.S. Military Displays Market Trends

The U.S. is increasingly focused on achieving comprehensive multi-domain situational awareness through ruggedized technology capable of withstanding extreme operational conditions. The evolution of advanced microdisplay and digital HUD technology for helmet-mounted and soldier-worn applications has significantly improved pilot efficiency and dismounted soldier effectiveness.

Asia Pacific is expected to grow at the fastest rate in the market over the studied period. The growth of the region can be linked to the increasing demand for displays that offer real-time data, high resolution, and flexibility while swiftly integrating with different defense systems. Furthermore, in Asia Pacific, China led the market owing to the strong presence of key market players who manufacture high-brightness displays for remote operations.

China Military Displays Market Trends

China's growing government initiatives, rising focus on high-resolution, bright, sunlight-readable, waterproof, night-vision-capable, and strong demand for smart displays over conventional ones, and adoption of technological integration fuel the market growth. Integration of AI, sensor fusion, and real-time data processing into military display systems enhances battlefield awareness and operational effectiveness, reflecting the broader trend toward digitalized, networked military electronics.

How Did Europe Experience A Notable Growth in the Military Displays Market?

Europe's leveraging policies and funding, like the European Defence Fund and EDIRPA, to foster collaborative defense R&D and streamline procurement. These initiatives are designed to enhance industrial readiness, boost ammunition production (ASAP), and decrease dependency on external suppliers.

Germany Military Displays Market Trends

Germany's innovation focuses on ruggedized OLED, MicroLED, and AR/VR integration to provide high-clarity, low-power visualization for network-centric warfare and AI-driven data processing. These advancements ensure that military systems deliver the modularity and real-time situational awareness required for superior performance in harsh, multi-domain environments.

Value Chain Analysis of the Military Displays Market

- Raw Material Sourcing & Component Manufacturing:This initial stage involves the production of fundamental display components such as glass substrates, liquid crystals, organic light-emitting diodes, semiconductors for microdisplays, and specialized filters for sunlight readability.

Key Players: Samsung Display, LG Display, AU Optronics, Corning Incorporated, Merck Group, and Kopin Corporation. - Module & Sub-System Manufacturing:At this stage, raw components are assembled into functional, ruggedized display modules, such as LCD panels, touchscreen modules, and heads-up display (HUD) units.

Key Players: Barco NV, Kyocera Display, Winmate Inc., AU Optronics, and BOE Technology. - System Integration & Prime Contracting (Ruggedization):This is a critical, high-value-adding stage where specialized displays are integrated into larger, complex defense platforms like aircraft cockpits, naval command centers, and armored vehicle control systems.

Key Players: BAE Systems PLC, Lockheed Martin Corporation, Raytheon Technologies (RTX), Thales Group, and Elbit Systems Ltd.

Military Displays Market Companies

- Aselsan: Aselsan develops and manufactures high-tech electro-optical systems, including helmet-integrated command systems (AVCI) and thermal imaging displays for land, naval, and airborne platforms.

- BAE Systems:BAE Systems supplies advanced display technologies, including Helmet Mounted Displays (HMDs) and cockpit displays for combat aircraft such as the F-35 and Eurofighter Typhoon.

- CMC Electronics: CMC Electronics specializes in designing and manufacturing advanced, certified, and cost-effective multi-function displays (MFDs), control display units (CDUs), and Head-Up Displays (HUDs) for military trainers and fighters.

- Crystal Group:Crystal Group specializes in designing and manufacturing rugged, commercial-off-the-shelf (COTS) displays and embedded hardware designed to function in harsh environments.

- Curtiss-Wright:Curtiss-Wright provides advanced, ruggedized display systems and mission-critical technologies designed to deliver real-time data visualization in demanding military operations.

Other Major Key Players

- Elbit Systems

- General Digital

- General Dynamics

- Hatteland Technology

- L3Harris

- Leonardo

- Milcots

- Saab

- Thales

Latest Announcement by Market Players

- In September 2024, Crystal Group announced a partnership with BAE Systems to develop an advanced cross-domain solution (CDS) device for tactical military operations. “Pairing Crystal Group's scalable, custom engineering with BAE Systems' storied technical prowess, it allows us to better serve our customers by meeting any requirement,” said Mike Ivester, program manager at Crystal Group.

- In June 2024, Thales, the leading global technology and security provider, announced Passwordless 360°, a new concept for passwordless authentication that offers Thales customers the broadest coverage of passwordless functions across multiple types of users and assurance levels. “Overall, Thales offers a comprehensive solution that enables organizations to improve their identity management practices, adapt to evolving technologies, and effectively secure their systems and data,” said Alejandro Leal, Research Analyst at KuppingerCole.

Recent Developments

- In April 2024, EIZO Rugged Solutions introduced a 24-inch 4K rugged LCD monitor, the Talon RGD2443W, from the Orlando, Florida facility. The monitor serves military applications including naval displays, ground control, and airborne operations. Meeting military size, weight, power consumption, and cost requirements, the monitor measures 599 by 369 by 70 millimeters and weighs under 10 pounds.

- In September 2023, MilDef launched a Panel PC featuring a detachable computer module designed for military operations. The integrated system combines a ruggedized display with a removable computer unit, enabling users to extract the module for post-mission data analysis while maintaining the independent functionality of both components.

- In December 2023, FOSSIBOT DT1 Lite launched a new 2K display rugged Android tablet for under USD 140. The IP68/IP69K/MIL-STD-810H-rated tablet runs Android 13 and has a 10,000mAh+ batter with a handy power bank function.

- In November 2023, LG Business Solutions USA announced the immediate availability of a new 55-inch surgical monitor (model 55MH5K) that offers 4K resolution, wide viewing angles, robust resilience to damage, convenient failover technology, and the ability to display multiple images at once in a 2x2 onscreen grid.

Segments Covered in the Report

By Product

- Handheld

- Smartphones and Tablets

- Tactical Radios

- Global Positioning System (GPS)

- Wearables

- Head-Mounted

- Smartwatches

- Multifunction Displays (MFDS)

- Vehicle Mounted

- Airborne

- Land

- Naval

- Simulators

- Computer Displays

By Technology

- Light Emitting Diode (LED)

- Liquid Crystal Display (LCD)

- Active-Matrix Organic Light Emitting Diode (AMOLED)

- Organic Light Emitting Diode (OLED)

By End-Use

- Naval

- Airborne

- Land

By Geography

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa (MEA)

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Tags

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting