What is the MLOps Market Size?

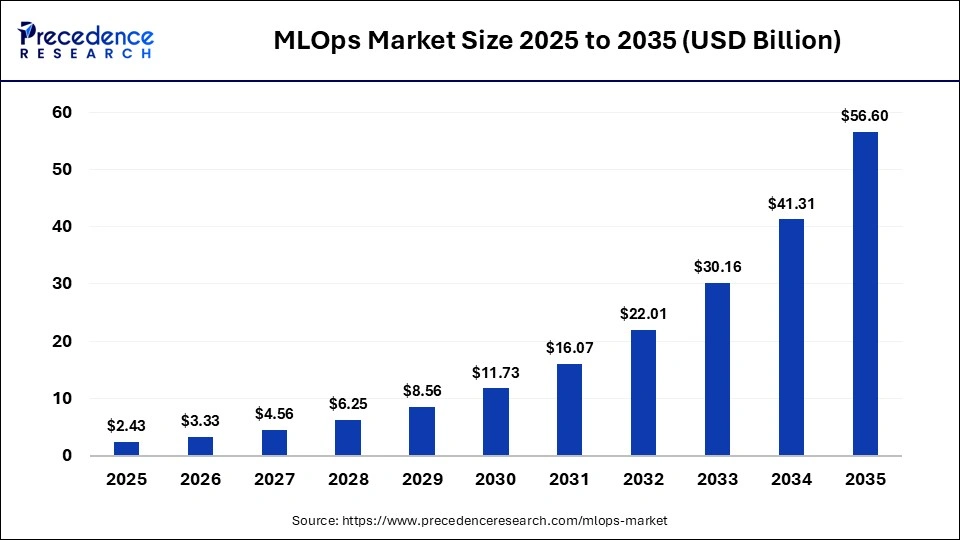

The global MLOps market size was calculated at USD 2.43 billion in 2025 and is predicted to increase from USD 3.33 billion in 2026 to approximately USD 56.60 billion by 2035, expanding at a CAGR of 37.00% from 2026 to 2035. This market is growing due to increasing adoption of machine learning across enterprises, rising demand for automated model deployment, monitoring, and management, and the need to scale AI initiatives efficiently.

Market Highlights

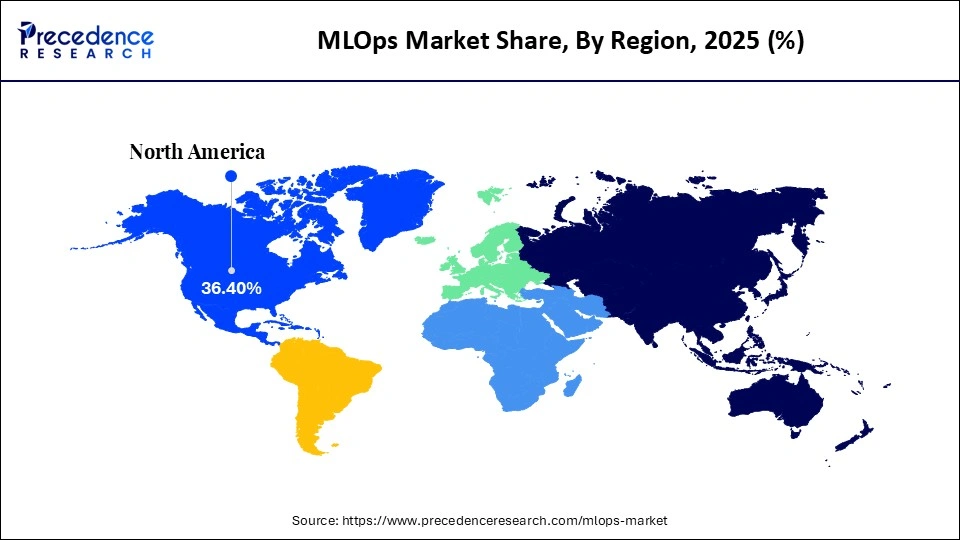

- North America dominated the global MLOps market with a 36.4% share in 2025.

- Asia Pacific is expected to grow at the fastest CAGR between 2026 and 2035.

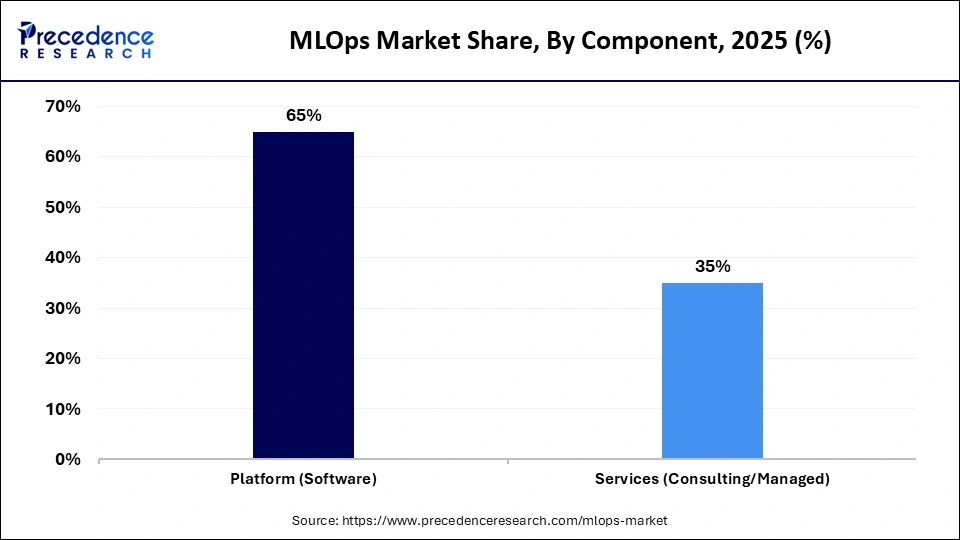

- By component, the platform segment generated the biggest market share of approximately 65% in 2025.

- By component, the services segment is expected to expand at the fastest CAGR between 2026 and 2035.

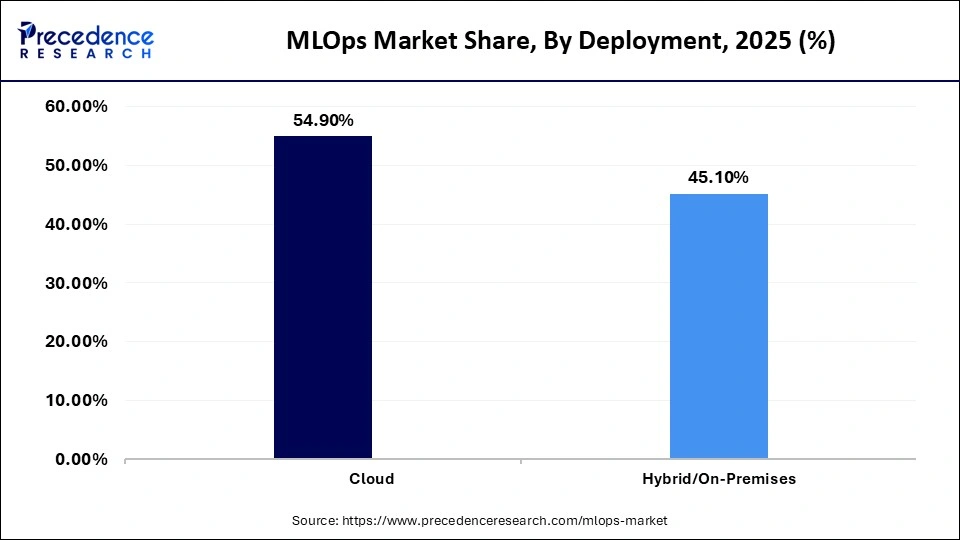

- By deployment, the cloud segment contributed the highest market share of approximately 54.9% in 2025.

- By deployment, the hybrid/on-premises segment is expected to grow at a robust CAGR between 2026 and 2035.

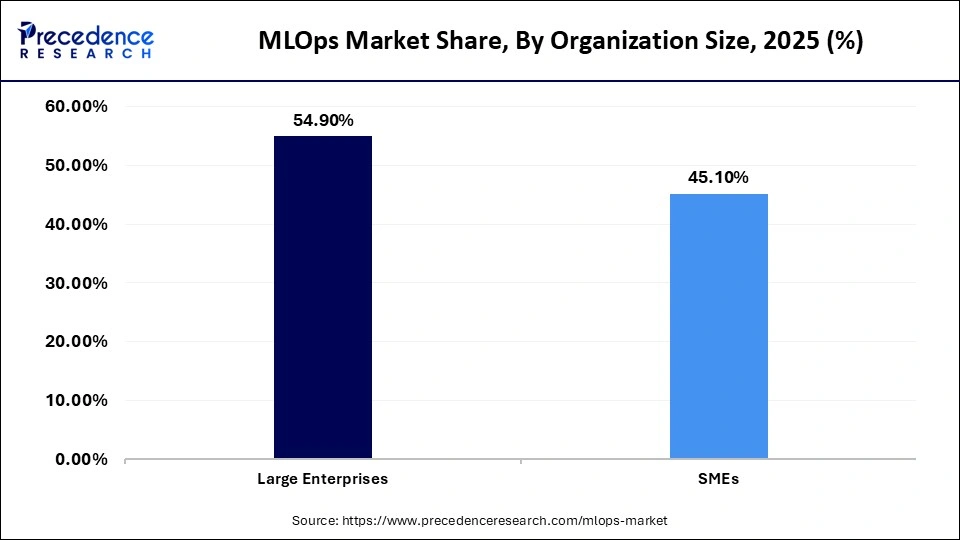

- By organization size, the large enterprises segment held a major market share of approximately 54.9% in 2025.

- By organization size, the SMEs segment is expected to expand at the fastest CAGR from 2026 to 2035.

- By vertical, the BFSI segment generated the biggest market share of approximately 28.4% in 2025.

- By vertical, the healthcare & life sciences segment is expected to expand at the fastest CAGR between 2026 and 2035.

Market Overview

The MLOps market is expanding rapidly as businesses use machine learning more frequently for predictive analytics, process automation, and data-driven decision-making. MLOps platforms enable faster, more dependable, and scalable AI solutions by streamlining the entire AI lifecycle, including model deployment, monitoring, and governance. Investments in advanced MLOp tools are being driven by the increasing need for automation of real-time insights and operational efficiency in the IT, finance, healthcare, and e-commerce sectors.

Market Trends

- Rapid AI Adoption Across Enterprises: As more industries such as IT, finance, healthcare, and retail integrate AI, the need for efficient MLOps tools and platforms becomes crucial.

- Automation of ML Lifecycle: MLOps platforms are designed to automate key steps in the ML lifecycle, including model development, deployment, monitoring, and retraining. As organizations look to reduce manual intervention and accelerate their AI adoption, MLOps tools become essential for automating the end-to-end ML pipeline, improving efficiency, and ensuring models stay current.

- Integration with Cloud & DevOps: With more organizations relying on cloud computing and DevOps pipelines for scalability and flexibility, MLOps tools are increasingly integrated into these systems.

- Focus on Model Governance & Compliance: The growing emphasis on explainability, reproducibility, and regulatory compliance in AI means MLOps platforms must provide tools for model tracking, auditing, and ensuring adherence to ethical standards and regulations.

- Rise of Real-Time Analytics: The increasing demand for real-time analytics in sectors such as finance, e-commerce, and healthcare requires MLOps platforms to support continuous integration and real-time deployment of AI models.

- Collaboration Between Data Scientists & IT Teams: Effective collaboration between data scientists and IT teams is essential for successful AI deployment. MLOps platforms provide the necessary infrastructure for version control, workflow management, and collaborative tools, helping to bridge the gap between development and operational teams.

Future Market Outlook

- Expansion in Emerging Markets: As AI adoption grows rapidly in regions like APAC, Latin America, and the Middle East, the demand for robust MLOps platforms increases.

- Development of Automated AI Tools: There is increasing demand for platforms that offer fully automated AI model training and deployment. As automation becomes more central to the ML lifecycle, MLOps platforms offering these capabilities are poised for growth.

- AI-Driven Edge Computing Solutions: The integration of AI with edge computing is driving demand for real-time MLOps solutions, especially for IoT and edge devices.

- Focus on Explainable AI (XAI): Explainable AI (XAI) is gaining traction as industries and regulators demand transparent and interpretable machine learning models. MLOps platforms that support XAI are increasingly valuable, enabling businesses to meet regulatory requirements and improve trust in AI-driven decisions.

- Integration with Industry-Specific Applications: Industries such as finance, healthcare, retail, and manufacturing present niche growth opportunities for MLOps platforms. These sectors require specialized AI models tailored to their specific needs, such as fraud detection in finance, predictive maintenance in manufacturing, or personalized healthcare recommendations.

- Strategic Partnerships & Acquisitions: Collaborations and technology acquisitions enable companies to expand their market presence and strengthen their MLOps offerings.

How is AI Driving the Growth of the MLOps Market?

As companies adopt AI-driven solutions, MLOps platforms are becoming critical to ensuring the smooth and efficient operation of AI systems across various industries. AI's role in automating key tasks such as model deployment, monitoring, retraining, and training accelerates the time to insights while reducing the risk of human errors. By integrating predictive maintenance, anomaly detection, and workflow optimization, intelligent MLOps platforms enable businesses to proactively address issues, ensure model reliability, and optimize operational performance. This leads to the delivery of dependable, high-performing AI solutions that meet the growing demand for scalable, efficient, and accurate machine learning applications across sectors like healthcare, finance, and retail.

How is MLOps Delivering Strong ROI for Enterprises?

MLOps delivers a strong ROI by significantly reducing the time, cost, and risk associated with deploying and maintaining machine learning models at scale. By automating key processes such as model development, deployment, monitoring, and retraining, MLOps accelerates time to market, enabling businesses to realize business value more quickly while reducing the need for manual intervention. This leads to optimized infrastructure utilization and fosters better collaboration between data science and IT teams, ultimately lowering operating costs. Additionally, ongoing governance and monitoring of models help improve their accuracy and reliability, reducing the likelihood of costly mistakes, legal risks, and performance issues, all of which drive revenue growth and enhance overall cost-effectiveness.

How are government AI strategies accelerating MLOps adoption?

Governments globally are rolling out national AI strategies that emphasize scalable and governed machine learning deployment across public systems. These initiatives require standardized pipelines to manage the model lifecycle, performance, and compliance, which in turn drives the demand for MLOps platforms. To ensure dependability, transparency, and long-term maintainability of AI models, public sector AI projects in areas such as taxation, social welfare, defense, and smart cities are increasingly relying on MLOps solutions to maintain the integrity and effectiveness of their machine learning applications.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 2.43 Billion |

| Market Size in 2026 | USD 3.33 Billion |

| Market Size by 2035 | USD 56.60 Billion |

| Market Growth Rate from 2026 to 2035 | CAGR of 37.00% |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | Component, Deployment, Organization Size, Vertical, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Segment Insights

Component Insights

What made platform (software) the dominant segment in the MLOps market?

The platform (software) segment dominated the market with a 65% share in 2025 because end-to-end machine learning lifecycle management is made possible by it. To automate model development, deployment, monitoring, version control, and governance from a single interface, enterprises are depending more on integrated MLOps platforms. These platforms are a top priority for companies implementing several AI models across business functions because they lower operational complexity, speed up time to market, and guarantee model reliability at scale.

The services (consulting/managed) segment is expected to grow at the fastest CAGR during the forecast period, driven by the difficulty of implementation and the lack of internal MLOps expertise for strategy development, platform integration, customization, and continuous model management. Organizations, particularly those in the early phases of AI adoption, depend more and more on outside vendors. The requirements for security compliance and ongoing ML pipeline optimization further drive the demand for these services.

Deployment Insights

Why did the cloud segment dominate the MLOps market?

The cloud segment dominated the market with a 54.9% market share in 2025 because it is flexible, scalable, and economical. An organization can quickly deploy and scale machine learning models with cloud-based MLOps solutions without having to make significant upfront infrastructure investments. Additionally, cloud deployment is now the preferred choice for businesses pursuing agile and data-driven operations due to its smooth integration with cloud AI services, real-time monitoring capabilities, and support for distributed teams.

The hybrid/on-premises segment is expected to grow at the fastest CAGR during the forecast period, driven by increasing concerns around regulatory compliance, latency-sensitive workloads, and data privacy. Industries such as BFSI (Banking, Financial Services, and Insurance), healthcare, and government agencies are adopting hybrid models to strike a balance between maintaining control over sensitive data and taking advantage of the flexibility of the cloud.

This approach allows organizations to meet strict regulatory requirements and ensure data security without compromising on AI performance and scalability. By leveraging hybrid infrastructures, these industries can achieve both regulatory compliance and high-performance AI capabilities, addressing the growing need for secure, efficient, and flexible computing solutions.

Organization Size Insights

Why did the large enterprise segment dominate the MLOps market?

The large enterprises segment dominated the market with a 54.9% share in 2025. This is because of their early adoption of AI technologies and their capacity to make significant investments in cutting-edge infrastructure. To manage intricate ML ecosystems with numerous models, sizable datasets, and cross-functional teams, these companies use MLOps platforms. The adoption of MLOps among large enterprises is further strengthened by the requirement for governance scalability and operational efficiency across global operations.

The SMEs segment is expected to grow at the fastest CAGR during the forecast period, driven by the increasing availability of low-code, cloud-based MLOps tools that lower entry barriers. These tools enable SMEs to harness the power of machine learning operations (MLOps) without the need for extensive technical resources, allowing them to improve decision-making, automate processes, and compete with larger organizations.

Managed services and affordable subscription models make it easier for SMEs to adopt enterprise-grade MLOps capabilities, providing access to advanced AI tools and infrastructure while reducing the upfront costs and technical complexity typically associated with AI adoption. This shift allows SMEs to become more agile, efficient, and competitive in a data-driven business landscape.

Vertical Insights

What made BFSI the leading segment in the MLOps market?

The BFSI segment led the market with a 28.4% share in 2025, driven by the widespread application of machine learning in algorithmic trading, risk assessment, credit scoring, and fraud detection. MLOps platforms are crucial for operational stability because financial institutions need explainability, ongoing model monitoring, and regulatory compliance. The adoption of MLOps in BFSI is further supported by high transaction volumes and the need for real-time decisions.

The healthcare & life sciences segment is expected to grow at the fastest CAGR during the forecast period, driven by the growing use of AI in clinical analytics, drug discovery, personalized medicine, and diagnostics. In highly regulated healthcare settings, MLOps make it possible to securely deploy, validate, and monitor ML models. MLOps adoption in this vertical is being accelerated by rising investments in AI-driven research and digital health.

Regional Insights

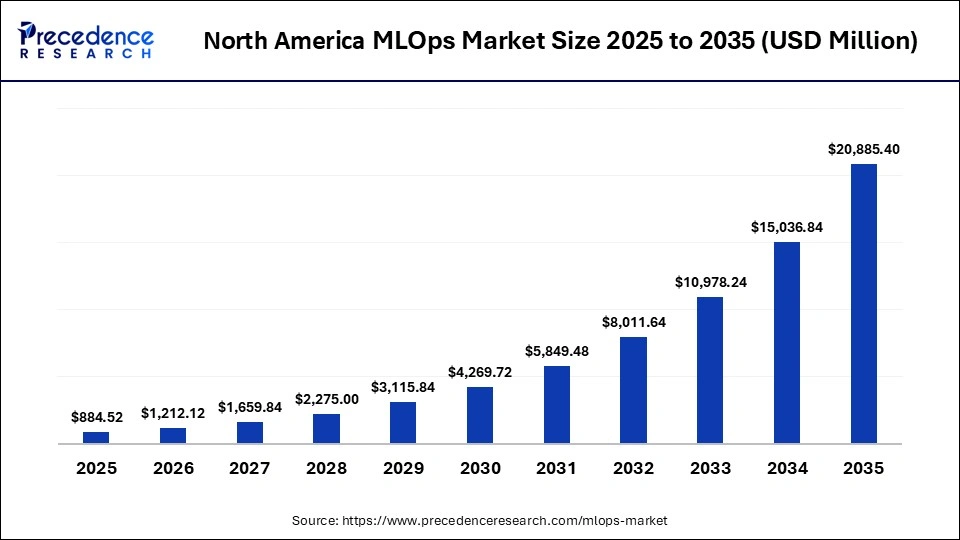

How Big is the North America MLOps Market Size?

The North America MLOps market size is estimated at USD 884.52 million in 2025 and is projected to reach approximately USD 20,885.40 million by 2035, with a 37.19% CAGR from 2026 to 2035.

Why did North America dominate the MLOps market?

North America dominated the market by holding a 36.4% share in 2025. This is because of the early adoption of machine learning, the robust presence of top AI technology providers, and the high enterprise spending on digital transformation. The area benefits from an established cloud ecosystem, a highly qualified labor force, and ongoing advancements in AI infrastructure, especially in the U.S. Additionally, favorable regulatory frameworks, substantial investments in AI innovation, and high demand for automation and scalability have further accelerated the adoption of MLOps solutions, positioning North America as the market leader.

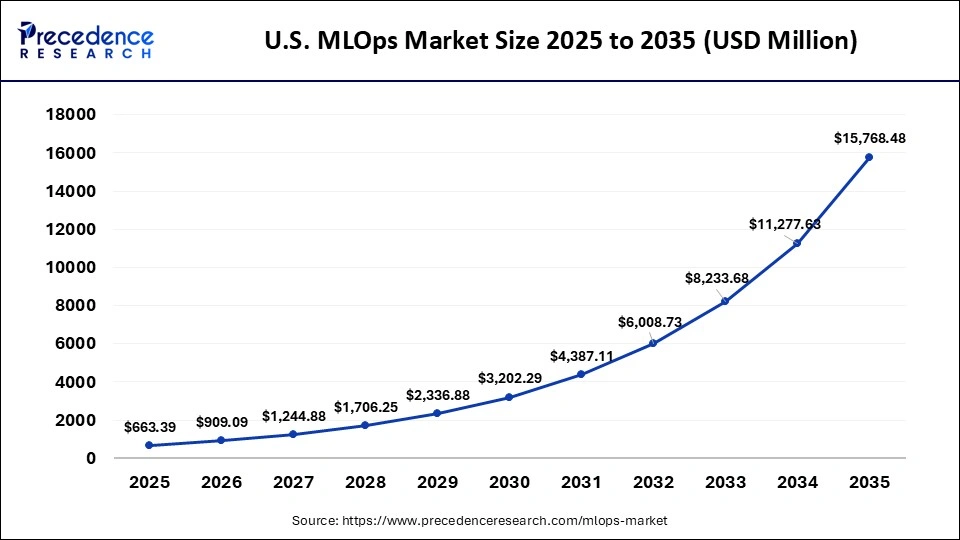

What is the Size of the U.S. MLOps Market?

The U.S. MLOps market size is calculated at USD 663.43 billion in 2025 and is expected to reach nearly USD 15,768.48 million in 2035, accelerating at a strong CAGR of 37.28% between 2026 and 2035.

U.S. MLOps Market Trends

U.S. dominates the North American MLOps market due to early adoption of AI, robust cloud infrastructure, and the existence of top MLOps and AI platforms providers. Market leadership is still being driven by high enterprise spending on scalable machine learning deployment in the technology, healthcare, and BFSI sectors. Moreover, U.S. enterprises are rapidly scaling from single model deployments to complex, multi-model ecosystems, increasing the need for automated monitoring, retraining, and performance management strong emphasis on model reliability, business KPI alghment and production stability is driving adoption of enterprise-grade MLOps platforms across BFSI, healthcare, and technologu sector.

How is the opportunistic Rise of Asia Pacific in the MLOps Market?

Asia Pacific is expected to grow at the fastest CAGR during the forecast period, driven by growing AI investment in nations like India, growing startup ecosystems, and quickening digitalization. AI is also being used by regional businesses and governments to increase automation, customer engagement, and operational efficiency. MLOps growth in the Asia Pacific is further accelerated by growing cloud adoption and affordable AI solutions.

India MLOps Market Trends

India is a major player in the market in Asia Pacific, driven by growing startups, quick digitalization, and rising AI adoption in IT, fintech, and e-commerce. MLOps implementation at scale is being accelerated by a large talent pool in data science and strong cloud adoption. Additionaly India enterprises are increasingly moving from experimental AI projects to production-grade model deployment, creating strong demand for standardized MLOps workflows. The rise of multi-model environments across IT services, fintech, and e-commerce is further driving the need for continuous monitoring, version control, and performance optimization.

Who are the major players in the global MLOps market?

The major players in the MLOps market include Google Cloud (Vertex AI), Microsoft Azure (Azure Machine Learning), Amazon Web Services (AWS) (Amazon SageMaker), Databricks, DataRobot, IBM (watsonx.ai), Dataiku, Snowflake, Alteryx, H2O.ai, Weights & Biases, Comet ML, and Domino Data Lab.

Recent Developments

- In March 2025, JFrog Ltd announced the launch of JFrog ML, a unified MLOps platform designed to integrate machine learning workflows with DevOps and DevSecOps. The solution enables enterprises to securely build, deploy, manage, and monitor ML models at scale while ensuring governance and traceability across the AI lifecycle.(Source: https://investors.jfrog.com)

- In June 2025, Domino Data Lab received the MLOps Platform of the Year award at the 2025 AI Breakthrough Awards, recognizing its leadership in enterprise-grade MLOps solutions. The award highlights Domino's ability to support governed, scalable, and hybrid ML operations across regulated industries.(Source: https://domino.ai)

- In June 2025, Bitdeer AI was honored with the MLOps Innovation Award at the 2025 AI Breakthrough Awards for its advancements in optimizing and automating machine learning operations. The recognition underscores the company's contribution to improving efficiency and reliability in ML deployment workflows.(Source: https://ir.bitdeer.com)

- In May 2025, Domino Data Lab was named a Visionary in the 2025 Gartner Magic Quadrant for Data Science and Machine Learning Platforms. This acknowledgment reflects the company's strong focus on governed AI, hybrid cloud orchestration, and scalable MLOps capabilities for enterprise users.(Source: https://domino.ai)

- In March 2025, JFrog announced a strategic integration with Hugging Face to improve security and transparency in the machine learning supply chain. The collaboration enables developers to identify trusted models and strengthen governance across MLOps pipelines.(Source: https://investors.jfrog.com)

Segments Covered in the Report

By Component

- Platform (Software)

- Services (Consulting/Managed)

By Deployment

- Cloud

- Hybrid/On-Premises.

By Organization Size

- Large Enterprises

- SMEs

By Vertical

- BFSI

- Healthcare & Life Sciences

- IT & Telecom

- Retail & E-commerce

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Tags

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting