What is the AI Data Management Market Size?

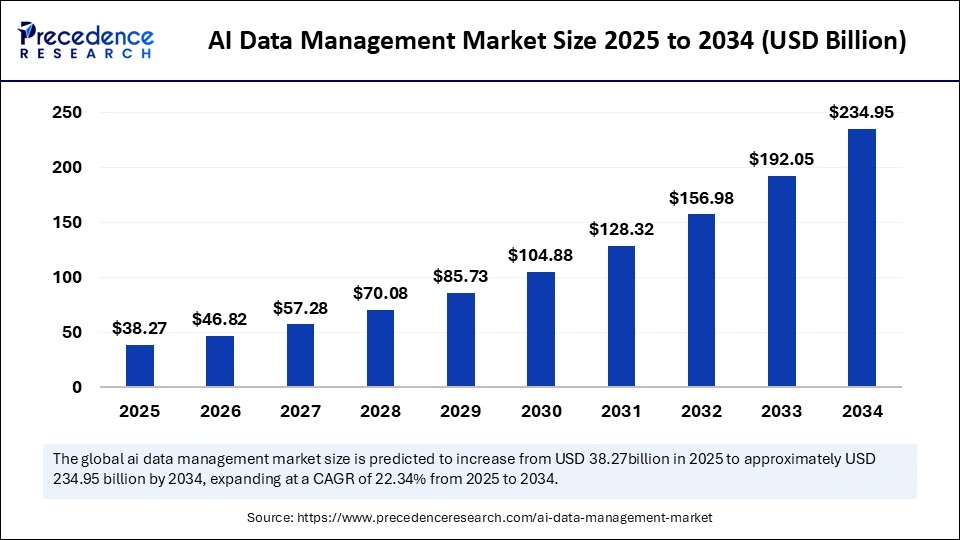

The global AI data management market size is accounted at USD 38.27 billion in 2025 and predicted to increase from USD 46.82 billion in 2026 to approximately USD 234.95 billion by 2034, expanding at a CAGR of 22.34% from 2025 to 2034. The market growth is attributed to the increasing adoption of AI across industries, driving the need for efficient, secure, and scalable data management solutions.

Market Highlights

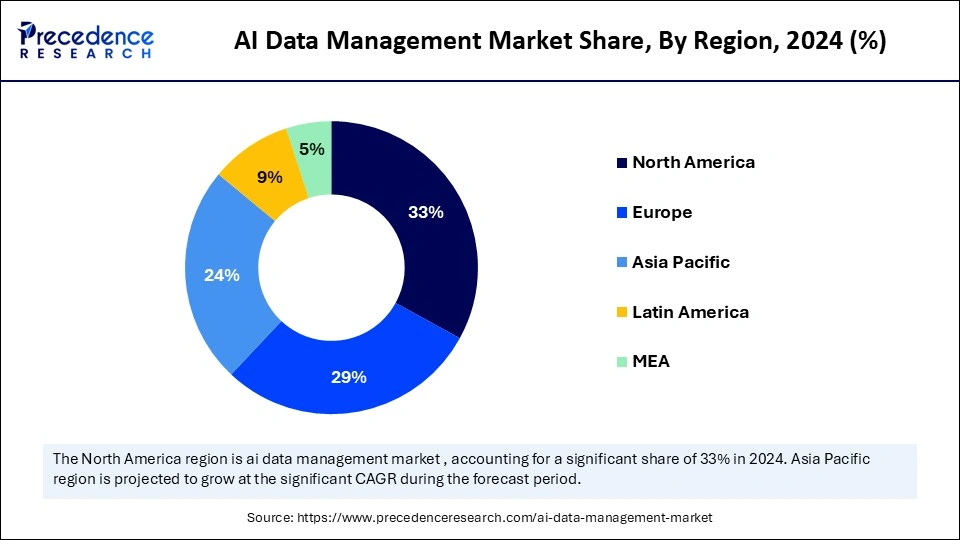

- North America dominated the global AI data management market with the largest market share of 33% in 2024.

- the Asia Pacific is anticipated to grow at the fastest CAGR during the forecast period.

- By capability/solution type, the data lakes & lakehouses segment held biggest market share in 2024.

- By capability/solution type, the feature stores and data lineage/observability segment is expected to grow at the fastest CAGR during the forecast period.

- By deployment model, the cloud-native SaaS segment accounted for a considerable share in 2024.

- By deployment model, the hybrid deployments segment is projected to experience the highest growth CAGR between 2025 and 2034.

- By AI workload stage supported, the training data preparation & storage segment led the market in 2024.

- By AI workload stage supported, the inference data serving & real-time feature serving segment is set to experience the fastest CAGR from 2025 to 2034.

- By industry vertical focus, the financial services segment contributed the highest market share in 2024.

- By industry vertical focus, the healthcare & life science segment is anticipated to grow with the highest CAGR during the studied years.

- By deployment use case, the production ML at scale segment generated the major market share in 2024.

- By deployment use case, the research-to-production pipelines segment is projected to expand rapidly in the coming years.

Market Size and Forecast

- Market Size in 2026: USD 46.82 Billion

- Market Size in 2025: USD 38.27 Billion

- Forecasted Market Size by 2034: USD 234.95 Billion

- CAGR (2025-2034): 22.34%

- Largest Market in 2024: North America

- Fastest Growing Market: Asia Pacific

Market Overview

The Artificial Intelligencedata management market has experienced tremendous growth against the backdrop of the increasing demand for efficient data management in AI applications. According to the 2024 U.S. federal government report, there was a significant increase in the number of AI uses. With more than 1700 AI use cases in 37 agencies, demonstrating the increased dependency on AI technologies to achieve operational efficiencies and execute mission uses. This influx underscores the importance of robust data management systems, which efficiently process large volumes of both structured and unstructured data.

AI data management technologies encompass tools and platforms that facilitate the collection, storage, processing, and governance of data used in AI models. These solutions guarantee the quality of data, regulation, and effective data retrieval. This proves critical in the development and implementation of AI applications. The need to ensure the proper management of AI is also creating pressure on effective data management systems as governments around the globe invest in AI infrastructure. Furthermore, the market is projected to keep growing, as AI technologies will develop, and the use of AI will increase in many spheres.

(Source: https://www.nextgov.com)

AI Data Management MarketGrowth Factors

- Rising Health & Wellness Awareness: Growing consumer focus on physical fitness and holistic health is driving demand for interactive fitness solutions.

- Advancements in Wearable Technology: Innovations in sensors and smart devices are boosting the accuracy and engagement of interactive fitness experiences.

- Expansion of Virtual Fitness Platforms: Rising adoption of online fitness classes and connected apps is propelling user engagement globally.

- Integration of AI and Gamification: AI-powered coaching and gamified workouts are fuelling user motivation and retention in interactive fitness ecosystems.

Market Scope

| Report Coverage | Details |

| Market Size in 2026 | USD 46.82 Billion |

| Market Size in 2025 | USD 38.27 Billion |

| Market Size by 2034 | USD 234.95 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 22.34% |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Capability / Solution Type, Deployment Model, AI Workload Stage Supported, Data Type / Modality Supported, Industry Vertical Focus, Deployment Use Case, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

How Is the Rising Adoption of Cloud Computing Platforms Driving Growth in AI-Driven Data Management Solutions?

Increasing adoption of cloud computing platforms is expected to accelerate the demand for advanced data solutions and boost the AI data management market growth. Using cloud environments, enterprises can store, process, and analyze large volumes of data, both structured and unstructured, effectively. AI inclusion in cloud infrastructure can provide an automated data governance system, predictive analytics, and real-time insights, minimizing operational bottlenecks. Cloud-native AI systems are more economical regarding scale, making it possible to increase storage and processing resources without having to invest heavily in hardware.

Service providers are constantly featuring intelligent tools of data orchestration to enhance the workload distribution and resource usage. A report by IDC indicates that in 2024, spending on shared cloud infrastructure increased by 26.1% over the past year. This investment in cloud infrastructure is a clear indication of the increased dependency on cloud infrastructure to underpin AI-based data management solutions. Furthermore, the growing demand for real-time data analytics is projected to drive the implementation of intelligent data management technologies.(Source: https://my.idc.com)

Restraint

Costs Hamper High Implementation of AI Solutions

High upfront investments in AI-driven data management systems are expected to hamper adoption among small and medium enterprises (SMEs). Companies must incur high costs to acquire AI platforms, update their IT systems, and train staff to work on sophisticated systems. Financial barriers, such as tight budgets, are expected to slow down adoption by industries with tight budgets, like mid-sized manufacturing or retail companies. Furthermore, the shortage of professionals with expertise in AI, machine learning, and data management is projected to restrain the AI data management market.

Opportunity

In What Ways Are Surging Investments in Enterprise Digital Transformation Boosting AI-Driven Data Management System Adoption?

Surging investments in enterprise digital transformation are anticipated to create immense opportunities for the players competing in the market. It is expected that the increased use of AI-based data management systems will follow as investments in enterprise digital transformation surge. Organizations are aiming at automating workflows, decision-making processes, and deriving actionable intelligence out of various sources of data. The Forrester 2024 report notes that 35% of companies use AI-driven data solutions as the heart of their transformation strategy.

Smart systems now combine old systems with new applications, offering visibility of data in one place. According to a 2024 survey by Deloitte, organizations implementing AI-based systems report speeds of up to 30% faster operations, with decisions made especially in the manufacturing, retail, and BFSI industries. Furthermore, the High requirement for data security and compliance is projected to stimulate the adoption of sophisticated AI-based management tools.(Source: https://www.forrester.com)

Segment Insights

Capability / Solution Type Insights

Which AI Workload Stage Dominated the AI Data Management Market in 2024?

The data lakes & lakehouses segment dominated the AI data management market in 2024, due to these architectures offering centralized storage options. That supports large volumes of structured and unstructured data to support the efficient training of AI models and sophisticated analytics. Furthermore, the necessity of effective data governance mechanisms also further encouraged the widespread introduction of data lakehouses in multiple fields.

The feature stores and data lineage/observability segment is expected to grow at the fastest rate in the coming years, as a central storage and management location of features used in machine learning models, ensuring features are consistent across models and teams.

The feature is essential to those organizations that want to automate their machine learning processes and enhance the performance of their models. According to the CoreSite 2025, 98% of IT leaders have adopted or plan to adopt a hybrid IT model, balancing on-premises and cloud infrastructures to meet regulatory and privacy requirements. Moreover, increasing attention to data governance and the necessity of explainable AI are further fuelling the segment demand.(Source: https://www.coresite.com)

Deployment Model Insights

Which Data Types or Modalities Were Most Supported in AI Data Management in 2024?

Cloud-native SaaS segment held the largest revenue share in the AI data management market in 2024. These services are scalable, flexible, and have a low cost, hence organizations manage large volumes of data effectively. Cloud-native architecture can be deployed quickly, easily integrated, and provides real-time analytics, all of which are important to AI-driven applications.

According to McKinsey & Company's 2025 report, 53% of surveyed executives report regularly using generative AI at work, indicating a growing reliance on AI-powered SaaS platforms. Companies have been leading the pack, offering single-pane transaction data engineering, analytics, and AI workflows. Furthermore, the change to cloud native SaaS is prompted by the agility requirement, low infrastructure costs, and the dynamic scaling of the resources according to the demands of AI workloads.(Source: https://www.mckinsey.com)

The hybrid deployments segment is expected to grow at the fastest CAGR in the coming years, owing to its privacy-sensitive and regulated workloads. Hybrid environments consist of on-premises infrastructure and both the private and public clouds that provide organizations. Furthermore, this deployment method ensures adherence to data sovereignty legislation and industry standards, including GDPR and HIPAA, thereby further driving the segment in the coming years.

AI Workload Stage Supported Insights

How Is Training Data Preparation Emerging As the Dominant Workload Stage in the AI Data Management Market?

The training data preparation & storage segment dominated the AI data management market in 2024, as the most prevalent workload of AI data management in 2024. Companies specialize in gathering, cleaning, and storing massive data sets to guarantee the precision and efficiency of the machine learning models. Additionally, the administrative demands for privacy and data security have further increased investment in the secure storage of sensitive datasets.

Inference data serving & real-time feature serving segment is expected to grow at the fastest rate in the coming years, as they are providing model projections at scale and making sure that features are constantly updated in dynamic AI usage.

According to a 2024 Gartner study, the workloads of real-time AI inference increased by 33% annually thanks to the rising use of AI in e-commerce, financial services, and IoT-enabled devices. Furthermore, the emergence of edge AI and online recommendation systems will accelerate the integration of real-time data serving pipelines, refocusing attention on the trend of production-grade AI applications.(Source: https://www.gartner.com)

Data Type / Modality Supported Insights

Why Are Tabular and Time-Series Datasets Holding the Largest Share in the AI Data Management Market?

Tabular & time-series segment held the largest revenue share in the AI data management market in 2024, due to the growing use of classical machine learning (ML) models that depend extensively on structured data representation types. Classical machine learning applications in finance, healthcare, and manufacturing were made without these types of data. That allows forecasting trends, detecting anomalies, and performing predictive analytics.

In June 2024, Databricks announced that its Tabular Data Lake system was handling more than 120 petabytes of enterprise time-series data worldwide. This indicates the increased need for centralized, structured data repositories. Additionally, the implementation of superior data pipelines and real-time data streaming technologies further enhanced the prevalence of tabular and time-series formats in enterprise AI projects.(Source: https://www.databricks.com)

Image/video and multimodal datasets segment is expected to grow at the fastest CAGR in the coming years, owing to the as such models use large multimodal models (LMMs) to process and combine different types of data, such as text, image, video, and audio. Moreover, most AI research projects are currently considering multimodal datasets to enhance the reliability and accuracy of generative AI, thus facilitating the segment growth.

Industry Vertical Focus Insights

Which Industry Vertical Led the AI Data Management Market in 2024?

The financial services segment dominated the AI data management market in 2024, due to its early adoption of feature-comprehensive data governance systems, and the growing need to provide machine learning models with feature-rich datasets. Fraud detection, risk modeling, and hyper-personalized customer experiences were the areas of AI that financial institutions used to become stronger.

In October 2024, the Bank of Montreal hired a Chief Artificial Intelligence and Data Officer, signaling the willingness of the sector to adopt AI in its everyday activities. Additionally, the large European insurers, such as Allianz and AXA, launched AI-based claim validation pilots in 2024, suggesting strong investments in AI-enabled feature stores and data governance systems.(Source: https://www.klover.ai)

The healthcare & life sciences segment is expected to grow at the fastest rate in the coming years, owing to the growing regard for high-value and regulated AI applications. According to a 2024 study by Forrester, almost of healthcare organizations with major roles projected the use of AI to drive change in both clinical and operational areas within the next two years.

Use of AI in drug discovery and clinical trials has gone faster, with models such as Delphi-2M created by the European Molecular Biology Laboratory able to predict susceptibility to more than 1,000 diseases decades before they occur. Furthermore, the application of AI by healthcare providers in the diagnostics of patients further indicates the practical effect of AI-supported data management.(Source: https://www.forrester.com)

Deployment Use Case Insights

How Is Production ML at Scale Shaping the Dominance of Deployment Use Cases in the Market?

The production ML at scale segment dominated the AI data management market in 2024, due to the use case of machine learning (ML) models at scale becoming the most common application in the market for AI data management.

Large enterprises were already producing at least one AI project, a large percentage of which were in the category of scaling ML models to real-time decision-making and automation. Furthermore, the emergence of MLOps practices has focused on the automation of ML workflows, including model development and deployment, in a way that maintains consistency and reliability in production settings.

The research-to-production pipelines segment is expected to grow at the fastest rate in the coming years, owing to the in the healthcare and life sciences sectors are expected to undergo transformational change under the influence of AI, especially in patient-related and operational positions. Additionally, companies such as Verily Life Sciences are reorganizing their approaches based on AI, as they strive to become technology vendors in healthcare through AI models and infrastructures.

Regional Insights

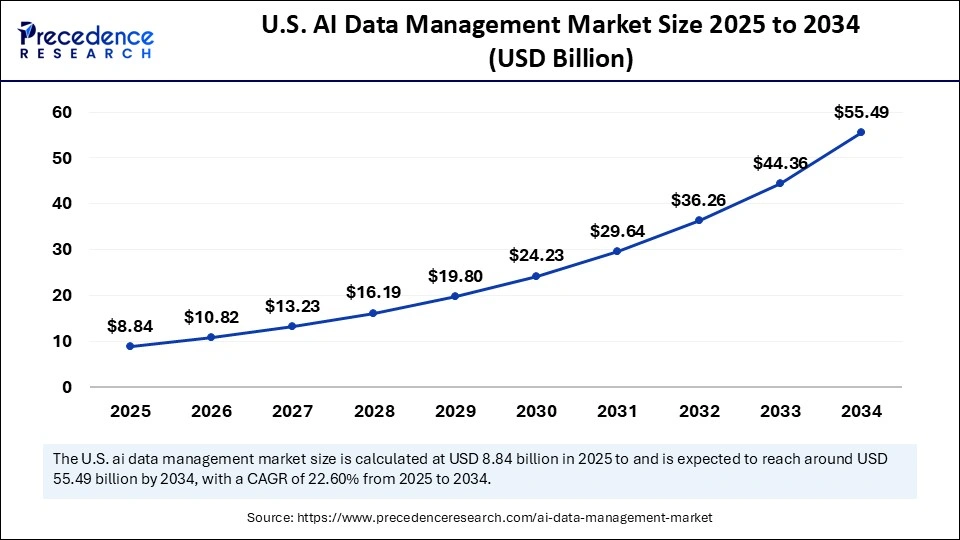

U.S. AI Data Management Market Size and Growth 2025 to 2034

The U.S. AI data management market size was evaluated at USD 7.23 billion in 2024 and is projected to be worth around USD 55.49 billion by 2034, growing at a CAGR of 22.60% from 2025 to 2034.

Why Is North America Leading the Global AI Data Management Market Compared to Other Regions?

North America led the AI data management market, capturing the largest revenue share in 2024, due to the growing integration of AI in finance, healthcare, technology, and manufacturing sectors. Massive investments in AI-enabling cloud architecture, high-performance computing, and sophisticated machine learning systems support such expansion. The density of technology centers, such as Silicon Valley, Boston, and Austin, in the region also helps to promote partnerships between startups and technology giants, boosting the innovation of AI.

The government and other regulatory efforts, such as the U.S. Federal Data Strategy 2024 and the development of privacy legislation at the state level, prompted organizations to implement secure, compliant, and scalable AI data solutions. Major players, including Microsoft, AWS, Databricks, and Snowflake, are growing AI services, data orchestration platforms. Furthermore, this allows companies to handle their production-scale AI workloads effectively, thus facilitating the market in this region.(Source: https://cdp.com)

Asia Pacific is anticipated to grow at the fastest rate in the market during the forecast period, owing to the process of digitalization, governmental programs, and the use of AI in various industries by enterprises. According to ICD, in 2024, the number of APAC AI data management deployments is expected to rise to USD 110 million by 2028, with China, India, Japan, and South Korea in the lead.

The implementation of 5G networks and edge computing systems boosted real-time analytics and increased the speed of implementation of AI models of industrial and consumer applications. Moreover, the research partnerships between universities and corporations in APAC in 2024 were also involved in AI innovation, especially in the fields of genomics, autonomous vehicles, and predictive healthcare.(Source: https://my.idc.com)

AI Data Management Market Companies

- Alation

- Amazon Web Services

- Collibra

- Databricks

- DataRobot

- Feast

- H2O.ai

- Labelbox

- Microsoft

- Monte Carlo / Bigeye

- Scale AI

- Snorkel AI

- Snowflake

- Tecton

Recent Developments

- In June 2025, Uber Technologies, Inc. announced a major expansion of its AI data services through Uber AI Solutions, making its platform available globally to support AI labs and enterprises. The new offerings include customized data solutions for building smarter AI models and agents, global digital task networks, and tools that enable companies to efficiently build and test AI models.

- In May 2025, Informatica announced its comprehensive Agentic AI strategy, reinforcing its position as the industry's first AI-powered cloud data management platform. The strategy builds on innovations, including CLAIRE GPT, CLAIRE Copilot, and GenAI blueprints for cloud ecosystem partners, providing a robust metadata system that enhances AI-driven decision-making.

- In September 2025, Quest Software unveiled a unified data management platform designed to address key barriers preventing enterprise AI initiatives from reaching production. The strategy focuses on three priorities critical for CIOs: trusted and AI-ready data, resilient identities, and modernized platforms capable of supporting AI at scale.

- In March 2025, IBM announced collaborations with NVIDIA to integrate the NVIDIA AI Data Platform reference design, enabling enterprises to better manage data for generative AI workloads and agentic AI applications. IBM plans to introduce content-aware storage in its hybrid cloud offering IBM Fusion, expand WatsonX integrations, and offer new IBM Consulting capabilities to accelerate AI adoption.

(Source: https://investor.uber.com)

(Source: https://www.allvuesystems.com)

(Source: https://us.nttdata.com)

(Source: https://www.thehindu.com)

(Source: https://www.informatica.com)

(Source: https://itbrief.co.nz)

(Source: https://newsroom.ibm.com)

(Source: https://itwire.com)

Segments Covered in the Report

By Capability / Solution Type

- Data Ingestion & ETL/ELT Pipelines

- Data Lakes & Lakehouses (Storage + Query)

- Feature Stores (Online/Offline)

- Data Labeling/Annotation Platforms

- Metadata Management & Data Catalogues

- Data Quality & Profiling Tools

- Data Lineage & Observability

- Synthetic Data Generation

- Data Privacy & Anonymization Tools

- Distributed Data Serving / Data Fabric / Mesh

By Deployment Model

- Cloud-Native SaaS Platforms

- Managed Services (Vendor-Run)

- On-Premises / Enterprise Private Deployments

- Hybrid (Cloud + On-Prem) Deployments

By AI Workload Stage Supported

- Training Data Preparation & Labeling

- Model Feature Engineering & Feature Serving

- Validation/Test Data Management

- Inference/Production Data Serving & Monitoring

- Feedback Loop/Model Retraining Pipelines

By Data Type / Modality Supported

- Tabular / Structured Data

- Time-Series & Telemetry Data

- Text / NLP corpora

- Image/Video/Multimedia

- Genomic & Bioinformatics Data

- Sensor / IoT Streaming Data

By Industry Vertical Focus

- Financial Services & Insurance

- Healthcare & Life Sciences

- Retail & E-Commerce

- Manufacturing / Industrial IoT

- Telecom & Media

- Public Sector & Defense

By Deployment Use Case

- Research & Experimentation (R&D Labs, Academia)

- Production ML At Scale (Customer-Facing Models)

- Compliance & Audit-Centric Deployments

- MLOps / CI-CD Pipelines For Models

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East & Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting