What is the Mobile Virtual Network Operator Market Size?

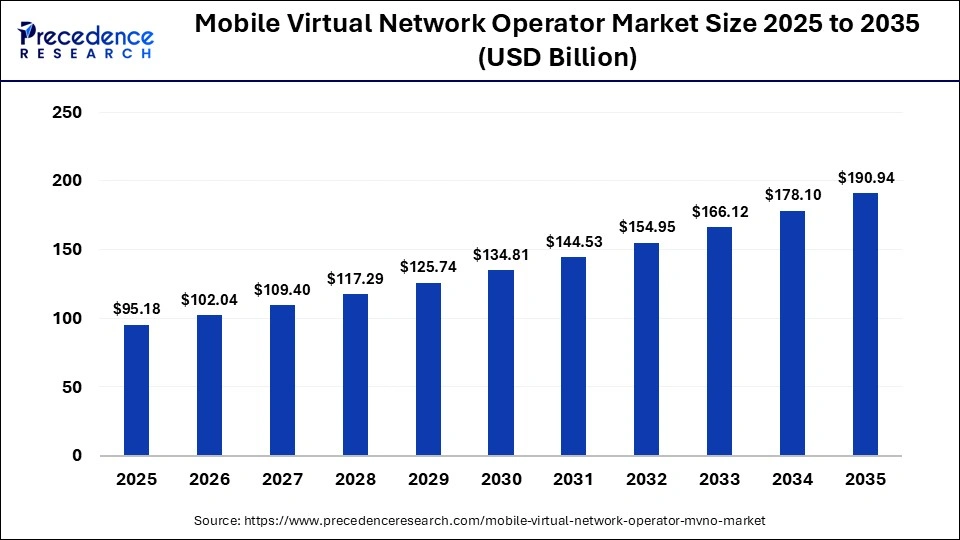

The global mobile virtual network operator market size was calculated at USD 95.18 billion in 2025 and is predicted to increase from USD 102.04 billion in 2026 to approximately USD 190.94 billion by 2035, expanding at a CAGR of 7.21% from 2026 to 2035.The mobile virtual network operator market is majorly driven by the growing need for affordable mobile services and the increasing penetration of mobile devices.

Market Highlights

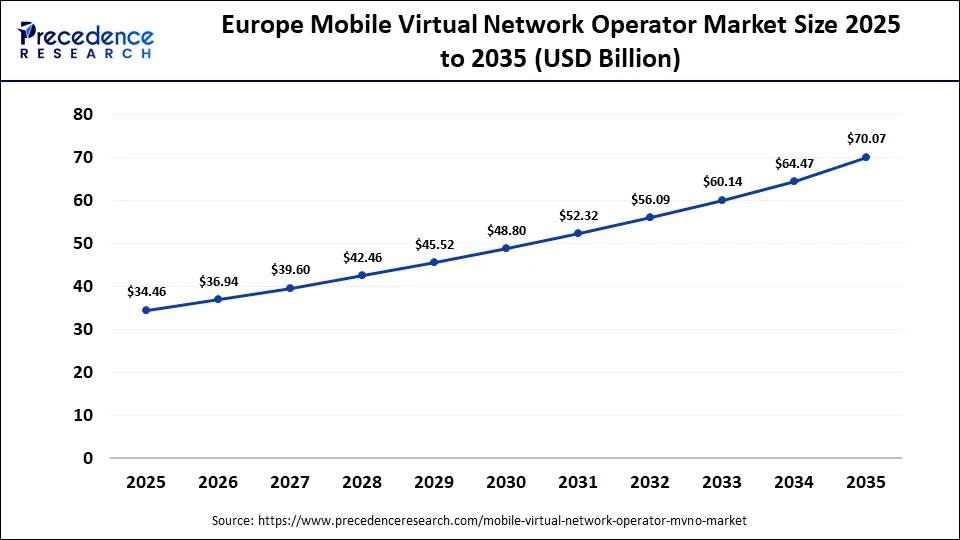

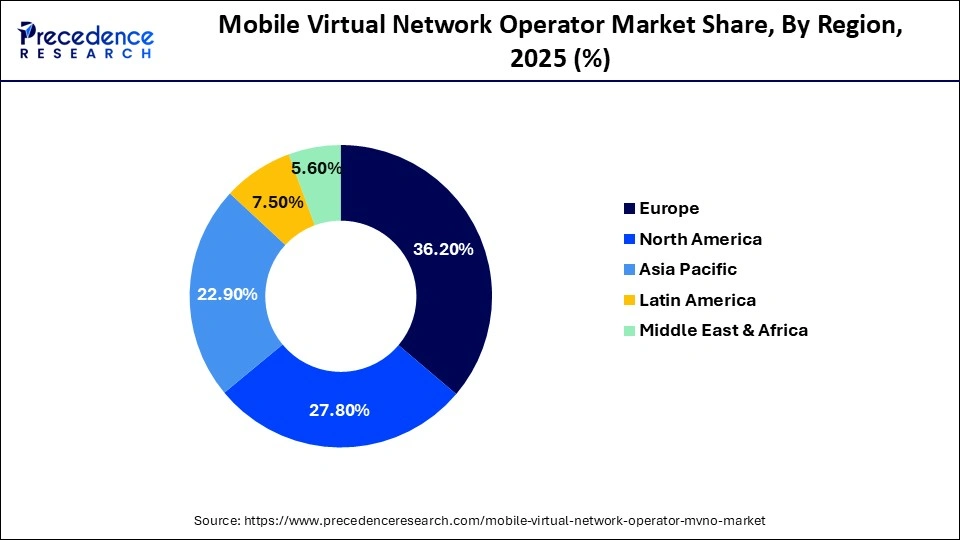

- Europe dominated the market, holding the largest market share of 36.20% in 2025.

- North America is expected to expand at the fastest CAGR of 7.60% in the mobile virtual network operator market between 2026 and 2035.

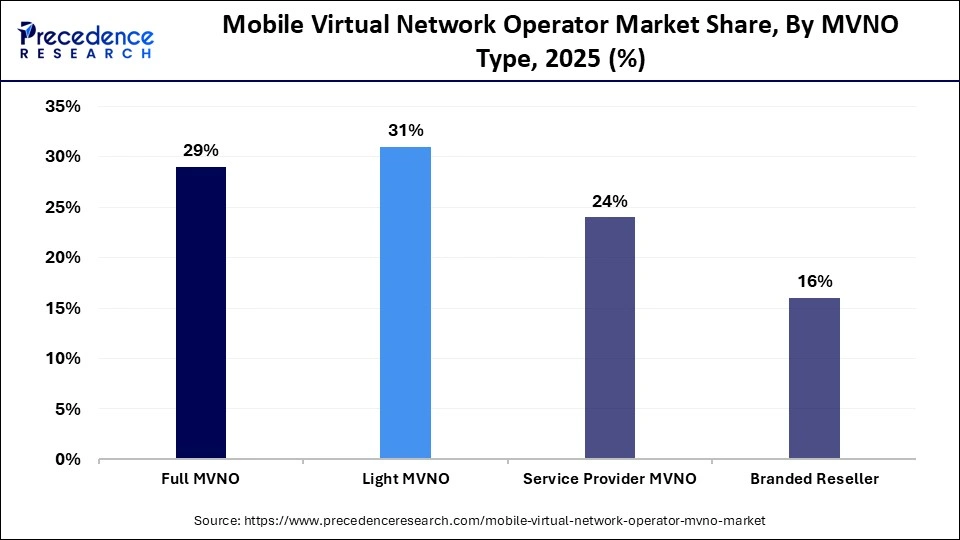

- By MVNO type, the full MVNO segment held the largest market share of 28.60% in 2025.

- By MVNO type, the light MVNO segment is expected to grow at a significant CAGR of 8.20% between 2026 and 2035.

- By pricing/business model, the prepaid segment held the dominant market share of 46.90% in 2025.

- By pricing/business model, the bundled plans segment is expected to expand at a remarkable CAGR of 9.2% between 2026 and 2035.

- By service type, the voice services segment held the largest share in the mobile virtual network operator market during 2025.

- By service type, the data services segment is set to grow at a remarkable CAGR between 2026 and 2035.

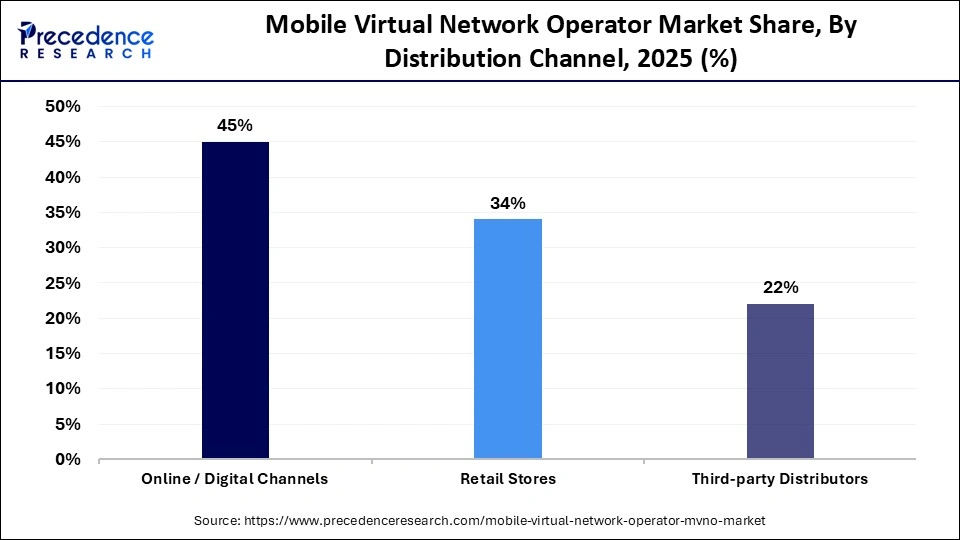

- By distribution channel, the online/digital channels segment held the largest market share of 44.70% in 2025.

- By distribution channel, the retail stores segment is projected to grow at a significant CAGR of 10.30% between 2026 and 2035.

How Are Mobile Virtual Network Operators (MVNOs) Being Redefining Global Connectivity?

As the global telecommunications industry is evolving rapidly, the MVNOs are playing a vital role in reshaping how mobile services are delivered. MVNOs provide a cost-effective and flexible method for expanding customer bases and tapping into niche markets. A mobile virtual network operator (MVNO) is a mobile service provider that does not own its own wireless network infrastructure. MVNOs lease capacity from major Mobile Network Operators (MNOs) and build customer-facing services on top of it.

This enables MVNOs to provide flexible, competitive, and niche mobile services without the significant upfront investment required to build and maintain a strong network infrastructure. Some common MVNO types include Reseller MVNO, Enhanced Service Provider MVNO, Service Provider MVNO, and Full MVNO.

How Are AI-Driven Innovations Reshaping the Mobile Virtual Network Operator Market?

In today's connectivity-driven world, the integration of Artificial Intelligence (AI) presents a transformative opportunity, driving the growth of the mobile virtual network operator market by reducing operational risks, improving personalization, ensuring regulatory compliance, delivering superior customer engagement experiences (including customer support through AI chatbots), and enabling MVNOs to optimize their revenue. The integration of AI is paving the way for more secure and resilient telecom operations. AI enables MVNOs to compete more effectively by efficiently managing resources and delivering personalized digital experiences. AI-powered analytics allows for real-time network optimization, predictive maintenance, fraud detection, and improving overall service quality. Therefore, the integration of Artificial Intelligence (AI) is enhancing the security and efficiency of Mobile Virtual Network Operator (MVNO) operations.

What Are the Emerging Trends in the Mobile Virtual Network Operator Market?

- The increasing consumer demand for high-speed internet access (4G and 5G networks) is anticipated to accelerate the growth of the mobile virtual network operator market during the forecast period.

- The continuously expanding retail and online/digital channels are expected to promote the market's growth during the forecast period.

- The increasing smartphone adoption, along with the increasing focus on targeting the specific demographics (low-budget users, businesses, travelers, and specific communities) with specialized services, is expected to contribute to the overall growth of the market.

- The emergence of the Internet of Things (IoT) is expected to create significant growth opportunities for the mobile virtual network operator market during the forecast period. To deliver superior customer service to their customers, MVNOs require a secure, flexible, and robust IoT platform.

- The rapid economic growth and supportive government digital transformation initiatives are anticipated to fuel the market's expansion in the coming years. Several governments are increasingly implementing attractive policies and regulations to promote access to network infrastructure, which encourages MVNOs to enter the market.

- The evolving lifestyles, like work-from-home trends, telemedicine, virtual learning, and migrating 2G/3G users to faster networks, are likely to create robust demand for data-intensive services.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 95.18Billion |

| Market Size in 2026 | USD 102.04 Billion |

| Market Size by 2035 | USD 190.94Billion |

| Market Growth Rate from 2026 to 2035 | CAGR of 7.21% |

| Dominating Region | Europe |

| Fastest Growing Region | North America |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | MVNO Type, Service Type, Pricing/Business Model, Distribution Channel, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Segmental Insights

MVNO type Insights

What Causes the Full MVNO Segment to Dominate the Mobile Virtual Network Operator Market?

The full MVNO segment held the largest market share of 28.60% in 2025. The implementation of a full MVNO network infrastructure involves significantly less upfront capital investment and handles nearly all aspects of service delivery, which often includes efficiently managing customer relationships, issuing SIMs, and designing unique plans. The full MVNO relies on MNOs for only radio access.

The light MVNO segment is expected to grow at a remarkable CAGR of 8.20% between 2026 and 2035. Light MVNO is a mobile operator that outsources the operational management of its network to the host MNO, strongly focusing on sales, marketing, customer service, and customer engagement. This model allows businesses to launch a mobile service without needing to build telecom infrastructure, often appealing to companies whose core strength lies in marketing. Moreover, the increasing focus on marketing and customer service, with a streamlined approach, makes the Light MVNO model ideal.

Pricing/Business Model Insights

Why Is the Prepaid Segment Dominating the Mobile Virtual Network Operator Market?

The prepaid segment dominates the mobile virtual network operator market, holding a 46.90% share. Prepaid MVNO offers various benefits to the customer, including affordability, flexibility, and simpler activation without long-term contracts. Prepaid MVNOs generally attract budget-conscious users, students, and travelers who prefer pay-as-you-go. MVNOs use prepaid models to serve niche markets with customized and low-risk plans for specific communities, building strong loyalty.

The bundled plans segment is the fastest-growing segment in the mobile virtual network operator market and is projected to grow at a notable CAGR of 9.2% between 2026 and 2035. Growth is driven by MVNOs packaging mobile connectivity with digital services into a single subscription to increase stickiness and average revenue per user. Bundled plans increasingly include OTT content access, cloud storage, and international calling as integrated components rather than optional add-ons. This strategy allows MVNOs to differentiate in highly saturated markets where price-only competition is no longer sustainable. It also supports longer customer lifecycles by embedding non-telecom services into the core mobile plan, making switching less attractive over time.

Service type Insights

Which Sub-segment Is Dominated by the Service Type in the Mobile Virtual Network Operator Market?

The voice services segment is dominating the mobile virtual network operator market by holding a majority share. Voice services are the dominant segment in the mobile virtual network operator market. Voice calls are a core communication function, a basic service that consumers need in the interconnected world. Prepaid voice plans offer budget control and attract price-sensitive customers. In countries such as India and Indonesia, national regulators including the Telecom Regulatory Authority of India require universal voice service availability, which sustains demand for low-cost prepaid voice offerings through MVNO channels. Voice services also remain critical for small enterprises, logistics operators, and field-service workforces that rely on reliable circuit-switched calling in areas where data quality is inconsistent or regulated for priority access.

The data services segment is the fastest-growing in the mobile virtual network operator market. Mobile Virtual Network Operator (MVNO) provides data services by leasing network infrastructure from a major Mobile Network Operator (MNO), allowing them to offer their own branded plans, often catering to niche markets with affordable and specialized data services. MVNOs sign agreements with MNOs to use their towers and spectrum. MVNOs drive innovation with unique data plans, appealing to heavy internet users with unlimited or large data allotments.

Distribution Channel Insights

What Has Led the Online/Digital Channels Segment to Dominate the Mobile Virtual Network Operator Market?

The online/digital channels segment is dominating the mobile virtual network operator market by holding the highest revenue share of 44.70% in 2025 and is set to grow at the highest 10.30% CAGR, owing to the growing demand for flexible, affordable, and app-managed plans. These channels enhance customer convenience through online activation (eSIMs). By leveraging digital channels, MVNOs can reach niche markets with personalized offerings, fostering brand loyalty. Digital-only MVNOs have significantly lower operational expenses, which enables them to attract price-sensitive consumers by offering cheaper rate plans.

The retail stores segment is seeing notable growth in the mobile virtual network operator market between 2026 and 2035. Retail stores have a physical presence in the market as mobile service points for SIM card distribution, customer support, and in-person marketing, which boosts high brand trust and enhances customer engagement. Retailers have direct consumer access, which allows them to offer lower, personalized, and more competitive pricing plans. Direct contact with end consumers in-store provides an opportunity for cross-selling.

Regional Insights

What is the Europe Mobile Virtual Network Operator Market Size and Growth Rate?

The Europe mobile virtual network operator market size has grown strongly in recent years. It will grow from USD 34.46 billion in 2025 to USD 70.07 billion in 2035, expanding at a compound annual growth rate (CAGR) of 7.35% between 2026 and 2035.

Why Did the Europe Mobile Virtual Network Operator Market See Dominant Growth?

Europe dominates the mobile virtual network operator market, holding the largest share of 36.20% in 2025. This leadership position is attributed to the strong presence of mobile virtual network operators (MVNOs), a rapid pace of digital transformation, rising penetration of smartphones, increasing demand for high-speed internet connectivity, increasing popularity of data-intensive applications, and supportive government digital initiatives. The region's growth is also driven by rising consumer demand for cloud-based platforms, AI, and IoT-based applications. Countries such as Germany, the UK, Spain, and France are the major contributors to the market. In addition, the surging demand for value-Added Services (VAS), which includes streaming, cloud, M-commerce, and IoT services, boosts demand for MVNO solutions, which is expected to accelerate the market's growth during the forecast period.

- In May 2025, Revolut unveiled plans to launch MVNO services in the UK and Europe. The fintech company announced that it plans to offer monthly mobile plans with unlimited calls, texts, and data, plus a 20GB roaming allowance across Europe and the US.

- In July 2025, Hungarian telecoms operator 4iG announced its plan to acquire mobile virtual network operator (MVNO) Netfone Telecom, in a move to strengthen its market position and expand its customer reach in Hungary. Under the agreement, 4iG will acquire a 99% stake in Netfone. Netfone operates as an MVNO using the wholesale network of One Hungary, the joint entity of Vodafone and Digi, which is also owned by 4iG. The company currently has 106,000 active connections and employs 72 people.

Germany's Mobile Virtual Network Operator Market Analysis

Germany is experiencing rapid market growth. The country is leading in the region and has a robust presence of industry leaders such as Freenet AG, Aldi Talk (Medion AG), Lycamobile Germany Gmb, Congstar GmbH, and Lebara Mobile Germany Limited. This growth is heavily supported by the increasing penetration of smartphones, growing demand for high-speed 5G internet connectivity, increasing demand for specialized IoT connectivity, increasing shift towards digital-only (eSIM) sales, and favorable government regulations.

- In June 2025, Klarna announced its entry into the network carrier space with the launch of its own MVNO. It's offering users a mobile plan that has no hidden fees and can be easily switched to right from the Klarna app. By launching its own mobile plan, Klarna is technically becoming a Mobile Virtual Network Operator (MVNO) like Google Fi, Mint Mobile, and Metro by T-Mobile.

Why Is North America the Fastest Growing in the Mobile Virtual Network Operator Market?

North America is the fastest-growing region in the mobile virtual network operator market, with the fastest CAGR of 7.60% during the forecast period. MVNOs have gained significant prominence in the region owing to their flexibility, cost-effectiveness, and ability to cater to specific consumer needs. The growth of the region is characterized by the massive 5G expansion, increasing proliferation of smartphones, growing demand for personalized & low-cost mobile services, increasing demand for enterprise IoT/M2M connectivity, and rapid adoption of eSIM technology. The supportive regulatory environment of the region favors fair access to 5G infrastructure and assists in sustaining the competitiveness of MVNOs against well-established MNOs.

U.S. Mobile Virtual Network Operator Market Analysis

The United States leads the market in the North America region in the mobile virtual network operator sector. The United States is the major contributor to the market in the region. The country's growth is supported by the increasing demand for 5G network connectivity, widespread adoption of smartphones, surging adoption of IoT platforms, and increasing focus on targeting niche markets (specific demographics). With the rapid rise of eSIM, 5G, IoT, and private LTE networks, MVNOs are increasingly focusing on expanding beyond consumer mobile into enterprise and industrial solutions, creating new MVNO opportunities in a country's highly competitive market. These collective factors are expected to drive the growth of the mobile virtual network operator market in the country during the forecast period.

- In December 2025, Viper Networks, Inc. and Choice Wireless, LLC signed an agreement under which the two companies plan to jointly market innovative services that bridge the gaps between customer demand and the mobile products and services that are currently available in the market. The services include an on-ramp for new Mobile Virtual Network Operators interested in entering niche geographical and cultural markets; a full suite of enterprise communications products that eliminate the need for complex and redundant Voice-over-IP systems and consolidate corporate communications onto mobile devices natively; and highly secure mobile data services that create virtual private networks throughout the global mobile ecosystem.

Who are the Major Players in the Global Mobile Virtual Network Operator Market?

The major players in the mobile virtual network operator market include Verizon, Klarna, Plintron, Revolut, AT&T, T-Mobile, Tesco Mobile, Boost Mobile, Virgin Mobile, Consumer Cellular, Cricket Wireless LLC., Lyca Mobile, Mint Mobile, LLC, TracFone Wireless, Inc., UVNV, Inc., FRiENDi, Locus Telecommunications, LLC., Red Pocket Mobile

Recent Developments

- In June 2025, Lyca Mobile, one of the world's largest international mobile virtual network operators, announced a major expansion of its Australia operation. The company, which serves over 16 million customers across 20 countries worldwide, will invest heavily in new digital service channels, continued collaboration with retail partnerships, and online services across the country. Lyca provides Australians with some of the best prepaid data plans on the market, with up to 300GB on a single recharge, 5G access, and data rollover up to 500GB.(Source:https://www.iotinsider.com)

- In September 2025, OXIO and Comtrend announced a mobile virtual network operator (MVNO) platform designed for rural service providers, which they plan to provide immediate opportunities for rural service providers to offer bundled broadband plans, expand their reach, and protect their market position without costly infrastructure environments. The OXIO MVNO platform enables Comtrend's network of rural service providers to offer affordable, flexible mobile connectivity to the communities they serve, resell mobile plans, and build solutions tailored to their markets.(Source: https://www.telecompetitor.com)

Segments Covered in the Report

By MVNO Type

- Full MVNO

- Light MVNO

- Service Provider MVNO

- Branded Reseller

By Service Type

- Voice Services

- Data Services

- Messaging Services

- Value-added Services (Roaming, Content, Cloud, IoT)

By Pricing/Business Model

- Prepaid

- Postpaid

- Bundled Plans

- Pay-as-you-go

By Distribution Channel

- Online / Digital Channels

- Retail Stores

- Third-party Distributors

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa

Get a Sample

Get a Sample

Table Of Content

Table Of Content