What is the Mobile Wallet Market Size?

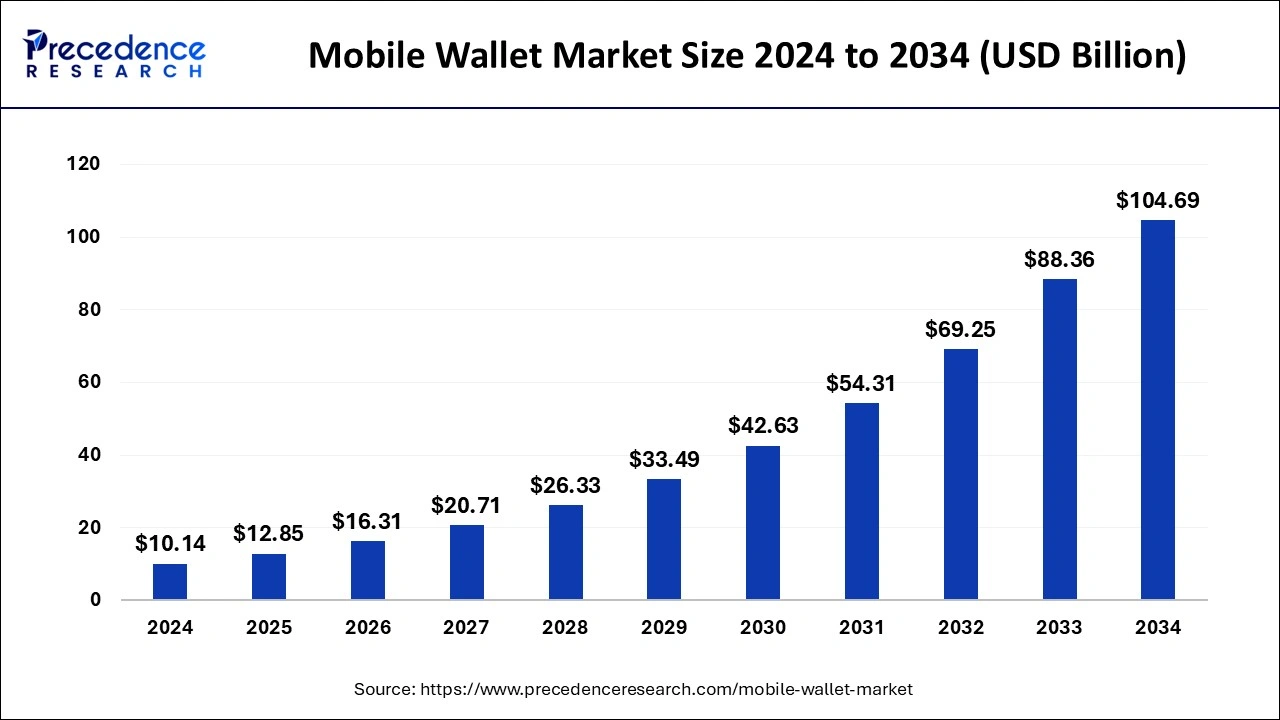

The global mobile wallet market size is valued at USD 12.85 billion in 2025 and is predicted to increase from USD 16.31 billion in 2026 to approximately USD 104.69 billion by 2034, expanding at a CAGR of 26.30% from 2025 to 2034.

Mobile Wallet MarketKey Takeaways

- In terms of revenue, the global mobile wallet market was valued at USD 10.14 billion in 2024.

- It is projected to reach USD 104.69 billion by 2034.

- The market is expected to grow at a CAGR of 26.30% from 2025 to 2034.

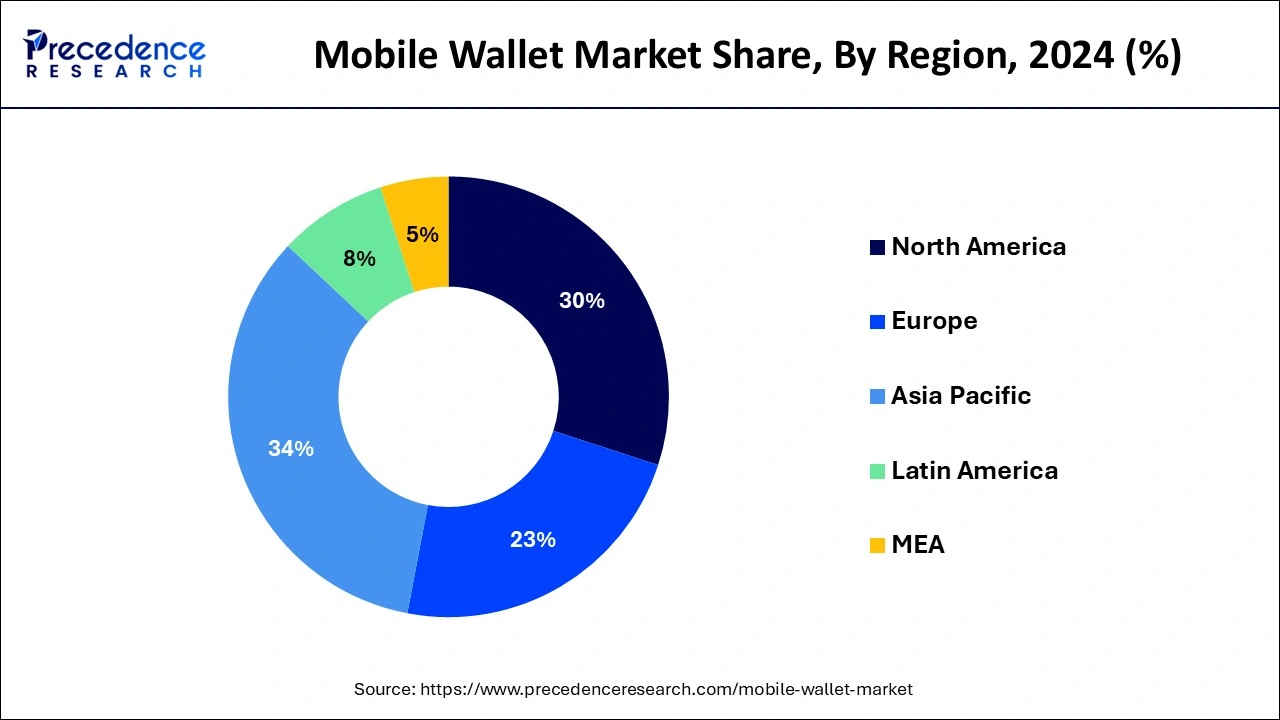

- Asia Pacific held the dominating share of the market in 2024 while contributing 34% of the market share.

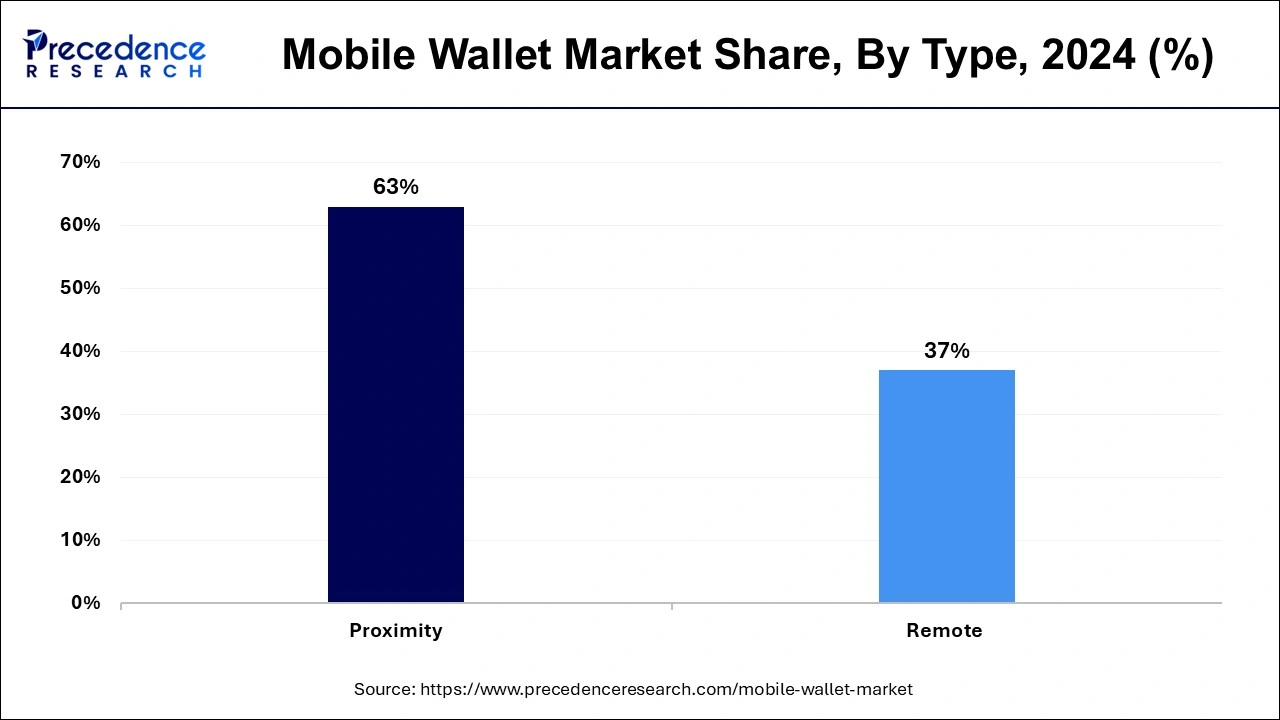

- By type, the proximity segment held the largest share of the market while contributing a market share of 63% in 2024; the segment is expected to sustain its position throughout the forecast period.

- By type, the remote segment is expected to grow significantly at a CAGR of 28.7% during the forecast period.

- By application, the retail and e-commerce segment held the largest share of 34% in 2024.

- By application, the banking segment is expected to grow at a significant rate at a CAGR of 29.8% during the forecast period.

- By technology, the QR code segment held the largest portion of the mobile wallet market in 2024.

- By technology, the near field communication (NFC) segment is expected to grow significantly during the forecast period.

Growing Adoption of Mobile Wallet in the Digital Payment Landscape

The mobile wallet market refers to the ecosystem of digital platforms and applications that enable users to store, manage, and transact money electronically using their smartphones or other mobile devices. Mobile wallets offer a convenient and secure alternative to traditional payment methods such as cash, checks, or physical credit/debit cards.

Anyone can use them at any merchant where digital payment is widely accepted. The need for a faster and more convenient way of money transfers is compelling people to use mobile wallets, which are gradually becoming more common and preferred by customers. Mobile wallets often integrate with other apps, including ride-sharing, online shopping, and food delivery services, enabling users to make payments conveniently within those apps.

Mobile wallets enable users to make in-store payments quickly and easily. They facilitate convenience and security to the users as well as offer rewards. Digital wallets such as Apple Wallet, Google Wallet, and Samsung also allow users to store and use loyalty cards, membership cards, coupons, boarding passes, event tickets, and other items on their smartphones.

Mobile Wallet Market Data and Statistics

- In October 2023, Samsung announced an investment in Skipify to expand its digital wallet.

- In December 2023, Samsung Electronics and Mastercard announced their partnership on the launch of a Mastercard program, Wallet Express. The service provides banks and card issuers with a swift and cost-effective means of expanding their digital wallet offerings. By incorporating Wallet Express, issuers can provide their customers with Samsung Wallet.

- In April 2023, Decentralized Finance (DeFi) exchange Uniswap launched a mobile wallet application to promote wider DeFi wallet adoption and support on-the-go trading. The Uniswap mobile wallet enables users to buy crypto, offering what the protocol says is a competitive 2.55% fiat on-ramp fee.

Market Outlook

- Industry Growth Offerings- The mobile wallet industry offers secure, convenient, and fast digital payment solutions for in-store, online, and peer-to-peer transactions. Key features include contactless payments, integration with banking and e-commerce apps, loyalty programs, and enhanced data security for users.

- Global Expansion- The global mobile wallet market is expanding through rising smartphone adoption, increasing e-commerce, and supportive digital payment regulations. Companies are entering new regions, forming partnerships, and localizing solutions to drive international usage and strengthen their worldwide presence.

- Startup Ecosystem- The mobile wallet startup ecosystem is growing rapidly, driven by fintech innovation, demand for seamless digital payments, and integration with e-commerce and lifestyle apps. Startups focus on AI, blockchain, and contactless technologies to enhance security, convenience, and user engagement.

Market Scope

| Report Coverage | Details |

| Growth Rate from 2025 to 2034 | CAGR of 26.30% |

| Market Size in 2025 | USD 12.85 Billion |

| Market Size in 2026 | USD 16.31 Billion |

| Market Size by 2034 | USD 104.69 Billion |

| Largest Market | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | By Type, By Application, and By Technology |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Driver

Increasing adoption of contactless payments

The rapidly rising adoption of contactless payments across the globe is expected to boost the market's revenue during the forecast period. In recent years, mobile wallets have grown rapidly due to customers' preference for quick, safe, and touchless transactions in physical and virtual establishments. The robust growth of the mobile wallet market is encouraged and promoted by the tech-savvy society, where consumers inclination to integrate digital payment methods into their daily lives. Therefore, the increasing usage of contactless payment is anticipated to fuel the market expansion in the coming years.

- In August 2023, The Bank of Montreal (BMO) announced the launch of a mobile wallet for virtual cards alongside Mastercard and Extend for its users across the USA and Canada. This move will give Canadian organizations' clients access to even greater payment management functionality with the launch of Extend for the BMO app.

Restraint

Lack of awareness

The lack of awareness is anticipated to hamper the market's growth. The need for more understanding of mobile wallets in middle and lower-income countries prevents users from adopting mobile wallets. The low trust in mobile wallets is also a major factor. Several consumers are reluctant to adopt mobile wallets in their daily lives as contactless payment due to the fear of fraud, such as leaked data, hacking, and other security issues, which is likely to limit the expansion of the global mobile wallet market.

Opportunity

Increasing use of smartphones and rising internet penetration

The rising use of smartphones, coupled with growing internet penetration across the globe, is projected to offer immense growth opportunities to the market during the forecast period. The use of mobile wallets increased as the market witnessed the rising use of smartphones, resulting in the rapid adoption of digital payments. The increasing use of smartphones indicates the growing acceptance of mobile wallets. Smartphone and internet users can make the most use of the mobile wallet functionalities. Moreover, mobile payment systems are expanding beyond the usage of smartphones and tablets with the various uses of wearable technology, including smartwatches.

- According to secondary sources, there are more than 5.3 billion active Internet users around the globe, accounting for 65.4 percent of the global population in 2023. 58.33 percent of total traffic came from mobile devices globally. China is leading with the highest number of internet users, with 1.05 billion, followed by India, with 729 million, and the United States, with 311 million.

Type Insights

The proximity segment held the largest share of 63% in the mobile wallet market in 2024, and it is expected to sustain its position throughout the forecast period. A proximity wallet is used for authorization and transactions involving entities that are generally physically close to each other. The proximity interaction is between the mobile wallet and the control or acceptance entity. In today's market, there are various proximity-based payments available, including NFC, MST, UHF, and others. These are the leading technologies boosting the segment's growth. With the use of proximity technology, a user can easily pay for goods and services with their smartphones or any smart device at a physical point-of-sale terminal.

The remote segment is expected to grow significantly at a CAGR of 28.7% during the forecast period. Remote wallets are also known as digital wallets, cloud wallets, or e-wallets. The entities involved in the authorization and transaction process are not physically close to each other. Remote wallets are usually connected with loyalty programs or value-added services.

Application Insights

The retail and e-commerce segment held the largest share of 34% in the mobile wallet market in 2024. Mobile wallets are designed to simplify the process of purchase for customers; It saves time at checkout in retail shops, eliminates the hassle of carrying cash, and helps shoppers plan their expenses accurately. In addition, it encourages purchasing through using a loyalty program. The benefits of accepting mobile wallet payments are becoming popular in retail and e-commerce. Retailers integrating cashless or contactless payment technology are intended to gain consumer data opportunities and loyalty.

The banking segment is observed to grow at a CAGR of 29.8% during the forecast period. Banks are established financial institutions with a long history of trust and reliability. Consumers are more inclined to use mobile wallets provided by banks because they perceive them as secure and trustworthy. Banks already have a large customer base, providing them with a significant advantage in promoting and distributing mobile wallet services. They can leverage their existing relationships with customers to encourage adoption of mobile wallet solutions.

Technology Insights

The QR Code segment dominated the mobile wallet market in 2024; the segment is observed to grow in the coming years. QR codes are one of the most popular contactless payment methods in which a mobile app scans a specific image. QR codes are encrypted, which ensures that the transaction is safe and facilitates a faster and more reliable method of payment. Customers generally use their device's camera and the wallet's scanning function to make purchases for in-store payments. This technology uses the merchant and payment processor information included in the bar-coded image.

The NFC segment is expected to grow at a rapid CAGR rate during the forecast period. NFC is the technology that enables contactless payment. NFC solutions allow users to integrate existing payment cards through mobile phones, and the activation of payment services ensures convenience and security. This technology permits two devices, such as your phone and a payment terminal, to communicate with each other while nearby (about an inch and a half, or 4 centimeters). This technology is considered more secure than a physical credit card.

Regional Insights

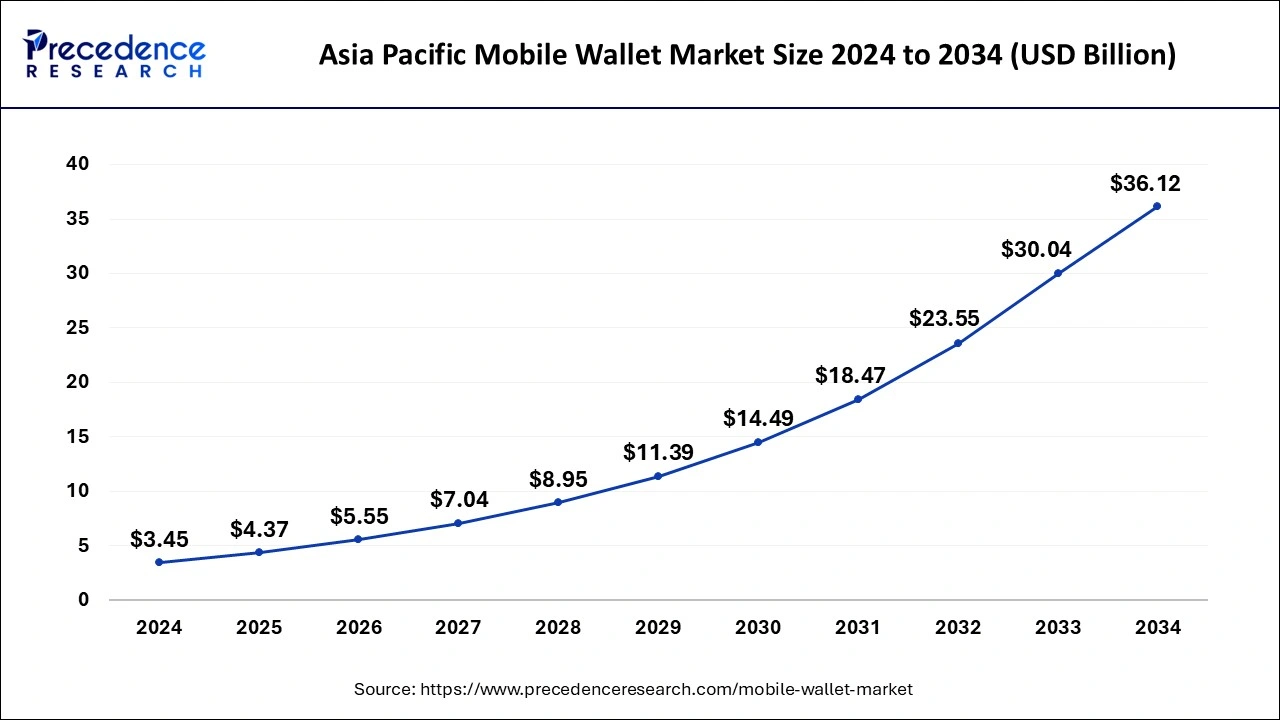

Asia PacificMobile Wallet Market Size and Growth 2025 to 2034

The Asia Pacific mobile wallet market size is valued at USD 4.37 billion in 2025 and is anticipated to reach around USD 36.12 billion by 2034, poised to grow at a CAGR of 26.47% from 2025 to 2034.

Asia Pacific emerges as the Powerhouse of Mobile Wallet Adoption

Asia Pacific dominated the mobile wallet market in 2024 while contributing 34% of the market share. The dominance of the region is attributed to the rapid pace of urbanization, advancement in technology, well-established financial infrastructure, a supportive regulatory framework of the government, the emerging trend of digitalization, and the rising use of contactless payment solutions which facilitates the high adoption of mobile wallet services in the region. In recent years, the mode of payment has shifted from cash to debit cards to online transactions, and this transition has led to the advent of contactless payment options, including mobile wallets.

The robust growth of the retail and e-commerce sector across developing countries such as India, Japan, and China is boosting the market's revenue. Consumers in the region are adopting mobile payments increasingly rapidly due to the increasing number of smartphone and internet users. The supportive government initiatives have boosted the digital payments industry to promote a cashless economy and introduced several policies and regulations, such as Digital India and Make in India, resulting in the rising acceptance of mobile wallets.

Prominent companies in the region are aggressively working to increase user engagement and retention by offering loyalty programs, discounts, and exclusive offers within their mobile wallet platform. Companies are also embracing IoT while leveraging the potential of advanced technologies such as blockchain and AI to ensure the security of transactions. Thus, such factors are expected to propel the mobile wallet market's growth in the region during the forecast period.

The growth of the e-commerce sector is the main driving factor contributing to the widespread adoption of mobile wallet systems in North America. Digital wallet has been developed in mobile phones with integration of the Near Field Communication. Furthermore, mobile payment is a best alternative for other payment processes. The rising integration of the 5G technology in the high-speed network of region has changed the customer focus towards online buying and payments.

5G Boom and Digital Baking Push North America to the Forefront

North America will have the highest 5G penetration around 90% in 2027, reported by Ericson Mobility Report. Consumers in North America can easily find suitable 5G service providing. Additionally, the rising volume of banks that foster online transactions has benefited to the market's expansion. Furthermore, key market industries like Paypal are experiencing increased revenue growth.

U.S. Mobile Wallet Market Trends

The U.S. mobile wallet market sector is experiencing significant growth driven by the rising use of digital payment solutions. The Federal Reserve indicated that in 2021, 80% of adults in the U.S. utilized at least one form of digital payment, underscoring a major transition from cash to electronic transactions. The increasing demand for convenience and quick transactions has led to a rise in e-wallet services, enabling users to make immediate payments through smartphones and other gadgets.

These payment methods have gained significant popularity in recent years, and experts anticipate that the transaction value of proximity mobile payments will keep growing at double-digit rates for at least the next four years. By 2028, the worth of products bought through proximity mobile payments is expected to keep rising and surpass $1 trillion by 2027. By 2028, this number is anticipated to exceed $1.2 trillion.

- Apple Pay has seen significant expansion since it was first introduced. By 2024, it is estimated to have around 60.2 million users just in the United States, with forecasts suggesting that more than 75 million customers will use Apple Pay by 2030.

- By 2025, digital wallets have become more than just a payment method, they are the favored choice for millions of people around the globe. Currently, over 5.2 billion individuals utilize digital wallets, representing more than 60% of worldwide e-commerce activities.

China's Mobile Waller Boom: What's Fueling the Digital Payment Revolution?

China's market is expanding rapidly due to widespread smartphone penetration, a strong digital infrastructure, and the dominance of platforms like Alipay and WeChat Pay. Consumers increasingly prefer cashless transactions for convenience, speed, and security. Government support for digital payments, growing e-commerce activity, and the integration of wallets with daily services such as transport, shopping, and utilities further accelerate adoption and drive market growth.

Europe's Cashless Surge: The Forces Accelerating Mobile Wallet Adoption

Europe's mobile wallet market is growing due to rising adoption of contactless payments, expanding digital banking services, and strong regulatory support through frameworks like PSD2, which encourages secure, open banking. Increasing smartphone penetration, booming e-commerce, and consumer preference for fast, secure, and convenient transactions are further fueling demand. Additionally, financial institutions and tech companies are rapidly integrating mobile wallets with loyalty programs, transit systems, and retail ecosystems, strengthening market expansion.

UK's Digital Payment Takeoff: Why Mobile Wallets Are Growing Faster Than Ever

The UK mobile wallet market is growing due to high smartphone penetration, widespread acceptance of contactless payments, and strong digital banking adoption driven by fintech innovation. Consumers increasingly prefer quick, secure transactions through platforms like Apple Pay, Google Wallet, and PayPal. Supportive regulations, the rise of cashless retail environments, and integration of mobile wallets with transport, e-commerce, and loyalty services further accelerate market expansion across the country.

Top Vendors and their Offerings

- Visa- Visa provides secure mobile wallet solutions enabling fast, tokenized digital payments, seamless in-app transactions, and contactless purchases. Its integration with global banks and merchants supports widespread acceptance and enhances user convenience across diverse payment ecosystems.

- Alipay- Alipay offers a comprehensive mobile wallet ecosystem featuring digital payments, money transfers, bill payments, QR-based transactions, and financial services. It also provides lifestyle features like booking, shopping, and rewards, making it widely adopted across China and global markets.

- Apple Inc. (Apple Pay)- Apple Pay enables secure, encrypted mobile payments using Face ID/Touch ID authentication. It supports contactless purchases, in-app transactions, transit payments, and digital card storage, offering users a seamless, privacy-focused payment experience across Apple devices.

- Tencent (WeChat Pay)- WeChat Pay delivers integrated mobile payments within the WeChat ecosystem, supporting peer-to-peer transfers, in-store QR payments, online shopping, and utility transactions. It powers a highly convenient, all-in-one digital lifestyle and financial service experience.

- PayPal- PayPal's mobile wallet supports secure online payments, peer-to-peer transfers, in-store QR payments, and global transactions. It offers buyer protection, seamless integration with e-commerce platforms, and digital budgeting tools, enabling a trusted and flexible payment experience.

Mobile Wallet Market Companies

- Mastercard

- Google Wallet

- Visa Inc.

- Tencent

- Samsung

- PayPal Holdings Inc.

- PayPal

- Google Inc.

- Bharti Airtel Limited

- ApplePay

- WeChat Pay

- Apple Inc

- American Express Company

- American Express

- Amazon Web Services, Inc.

- AliPay

Recent Developments

- In June 2023, Google proudly announced the expansion of Google Wallet in 5 new countries: Albania, Argentina, Bosnia and Herzegovina, North Macedonia, and Montenegro. In November 2022, the app was expanded to 12 countries throughout Asia, Europe, and North America.

- In August 2022, Thunes, a global cross-border payments company, partnered with Alipay+, operated by Ant Group. Under this partnership, Thunes' customers and merchants in Europe will be able to accept Asia's most popular mobile wallets, such as China's Alipay, Malaysia's Touch' n Go and Boost, Philippines' GCash, South Korea's KakaoPay, Thailand's Rabbit LINE Pay and TrueMoney.

- In June 2022, MoneyGram International, Inc. announced a partnership to launch MoneyGram's leading international money transfer capabilities on Mobily Pay. This partnership empowers millions of consumers in Saudi Arabia to use the Mobily Pay mobile wallet to send money worldwide in near real-time.

Segments Covered in the Report

By Type

- Remote

- Proximity

By Application

- Retail & E-commerce

- Mobile Commerce

- Restaurant

- Banking

- Transportation

By Technology

- Near Field Communication (NFC)

- QR Code

- Mobile apps

- Others

By Geography

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting