What is Molecular Cytogenetics Market Size?

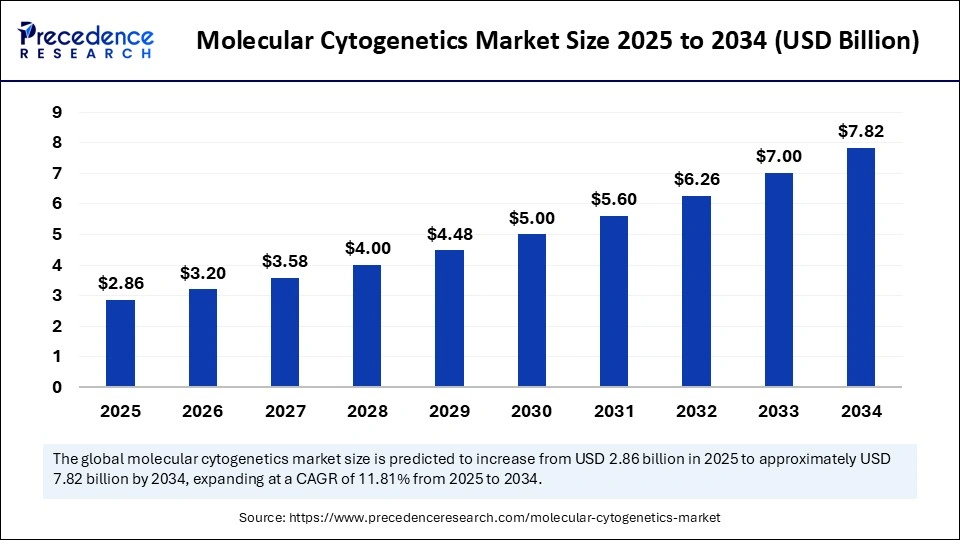

The global molecular cytogenetics market size is calculated at USD 2.86 billion in 2025 and is predicted to increase from USD 3.20 billion in 2026 to approximately USD 7.82 billion by 2034, expanding at a CAGR of 11.81% from 2025 to 2034. The growth of the molecular cytogenetics market is driven by the growing adoption of advanced genomic technologies for the precise detection of genetic abnormalities in cancer and congenital disorders.

Market Highlights

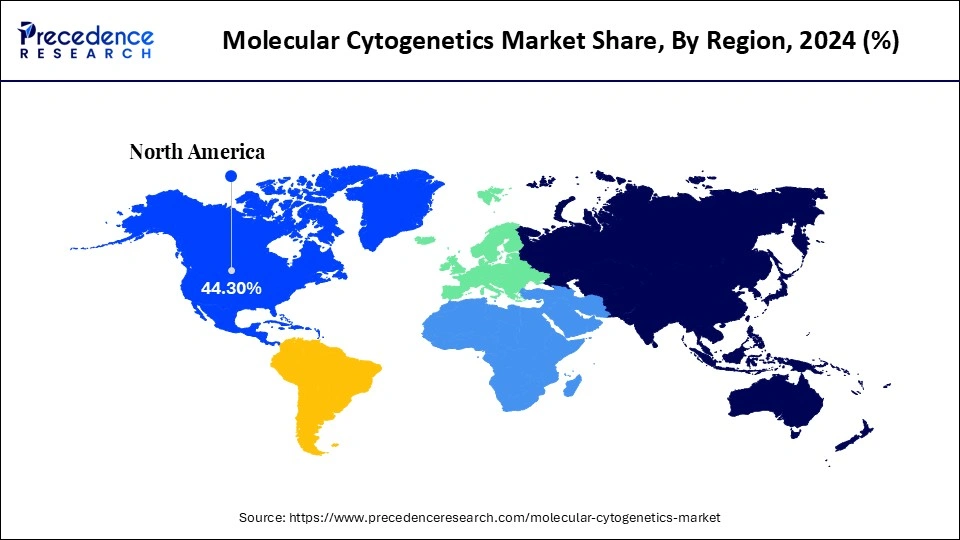

- By region, North America dominated the global market with the largest market share of 44.3% in 2024.

- By region, Asia Pacific is expected to expand at a 7.8% CAGR throughout the forecast period.

- By technique, the fluorescence in situ hybridization (FISH) segment led the market while holding a 43.4% share in 2024.

- By technique, the comparative genomic hybridization (CGH) segment is expected to grow at a 6.7%CAGR over the forecast period.

- By product, the instruments segment captured a 61.4% revenue share in 2024.

- By product, the reagents & kits segment is expected to expand at a 7.0% CAGR in the upcoming period.

- By application, the oncology segment led the market while holding a 39.2% share in 2024.

- By application, the prenatal diagnostics segment is expected to grow at a 6.8% CAGR in the coming years.

- By end-user, the hospitals & diagnostic laboratories segment captured a 46.5% revenue share in 2024.

- By end-user, the academic & research institutes segment is expected to expand at a 7.1% CAGR over the projection period.

- By technology, the manual systems segment led the market while holding a 68.4% share in 2024.

- By technology, the automated systems segment is expected to grow at a 7.2% CAGR during the forecast period.

Market Size and Forecast

- Market Size in 2025: USD 2.86 Billion

- Market Size in 2026: USD 3.20 Billion

- Forecasted Market Size by 2034: USD 7.82 Billion

- CAGR (2025-2034): 11.81%

- Largest Market in 2024: North America

- Fastest Growing Market: Asia Pacific

What is Molecular Cytogenetics?

The molecular cytogenetics market focuses on the study and analysis of chromosomes and genetic material at the molecular level to identify genetic disorders, chromosomal abnormalities, and cancer-related mutations. Core techniques such as fluorescence in situ hybridization (FISH), comparative genomic hybridization (CGH), spectral karyotyping, and array-based technologies enable precise visualization of both structural and numerical chromosomal changes. These advanced technologies are widely used in oncology, prenatal and postnatal diagnostics, and genetic research.

The rising prevalence of genetic disorders and various forms of cancer is significantly driving the demand for accurate diagnostic tools. Growing awareness of early genetic screening, along with advancements in high-resolution imaging and automation, has improved the accuracy and efficiency of chromosomal analysis. Additionally, strong investments by governments and private stakeholders in genomics and molecular biology are accelerating innovation across the field.

Molecular Cytogenetics Market Outlook

- Industry Growth Overview: The molecular cytogenetics market is witnessing steady growth, driven by the rising incidence of genetic disorders and cancers, along with the ongoing integration of advanced genomic technologies and high-throughput cytogenetic testing platforms in both diagnostic and research settings.

- Global Expansion:Growth in emerging regions is unlocking significant market potential by addressing large, underserved populations amid rising healthcare awareness and improving diagnostic infrastructure. Countries across Asia Pacific, Latin America, and the Middle East are investing in genomics, oncology care, and prenatal screening, leading to increased demand for advanced cytogenetic tools such as FISH and CGH. The proliferation of research institutions, public–private partnerships, and government-led health initiatives is further supporting clinical adoption and R&D efforts in these regions.

- Major Investors: Key investors include multinational healthcare corporations, government research bodies, and venture capital firms supporting genomic innovation. Industry leaders such as Thermo Fisher Scientific, Agilent Technologies, Abbott Laboratories, and Roche Diagnostics are actively advancing molecular diagnostics and cytogenetic technologies.

- Market Drivers:The growing prevalence of genetic abnormalities, hematologic malignancies, and solid tumors is driving demand for early detection and continuous monitoring. This is propelling the integration of cytogenetic techniques into both clinical diagnostics and research applications.

- Opportunities: Innovations such as high-resolution imaging, digital FISH, next-generation sequencing (NGS), and automated cytogenetic systems are enhancing diagnostic speed, precision, and scalability. These advances are expanding the scope of molecular cytogenetics across oncology, prenatal diagnostics, and personalized genetic testing.

Key Technological Shifts in the Molecular Cytogenetics Market Driven by AI

Artificial intelligence (AI) is revolutionizing the molecular cytogenetics market by making diagnostic analysis more precise, efficient, and rapid. Complex procedures such as karyotyping and fluorescence in situ hybridization (FISH) are increasingly being automated through advanced algorithms and deep neural networks (DNNs), significantly reducing manual workload and the potential for human error. AI-powered tools can accurately detect chromosomal abnormalities and enhance image-based genetic testing through predictive analytics. Moreover, AI facilitates the advancement of personalized medicine by analyzing genetic data in correlation with patient outcomes, enabling the development of more targeted and effective treatment plans.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 2.86 Billion |

| Market Size in 2026 | USD 3.20 Billion |

| Market Size by 2034 | USD 7.82 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 11.81% |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Technique, Product, Application, Technology, End User and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Segment Insights

Technique Insights

Why Did the FISH Segment Lead the Molecular Cytogenetics Market in 2024?

The fluorescence in situ hybridization (FISH) segment led the market while holding a 43.4% share in 2024 due to the high levels of accuracy, flexibility, and broad clinical use. FISH is a cytogenetic method of molecular technique, which involves the application of fluorescent probes to detect and localize a particular sequence of DNA on a given chromosome to detect chromosomal abnormalities, a fused gene, a deleted gene, and an amplified gene with very high accuracy.

It has wide application in oncology, prenatal diagnostics, and also in genetic studies to discover complex genetic diseases and cancers. This has resulted in its high turnaround time and the capability to analyze non-dividing cells, which have made it a choice in both research and clinical laboratories. The increased efficiency and diagnostic confidence have also been clinical benefits of technological advances, e.g., automated FISH imaging systems and AI-assisted analysis.

The comparative genomic hybridization (CGH) segment is expected to grow at a significant CAGR of 6.7% in the coming years. This is mainly due to its ability to examine chromosomal abnormalities like copy number variation (CNVs), deletions, duplications, and amplifications in a wide range of situations where conventional chromosomal karyotyping methods would have failed. It is also being used in clinical diagnostics, oncology, and genetic research to reveal submicroscopic alterations in the chromosomes that are associated with the occurrence of disease. This has been changed through the introduction of array-based CGH (aCGH), which has enabled it to conduct the DNA analysis on non-dividing cells, making it more accurate, scalable, and flexible in samples. Continuous technological developments of microarray devices and data analysis systems have increased the precision of diagnoses and workflow.

Product Insights

What Made Instruments the Dominant Segment in the Market in 2024?

The instruments segment dominated the molecular cytogenetics market with a 61.4% share in 2024, owing to the growing use of advanced imaging systems, automated analyzers, and digital platforms in clinical and research labs. Instruments used- Fluorescence microscopes, hybridization systems, and image analysis systems will be needed in conducting high-precision cytogenetic methods like fluorescence in situ hybridization, comparative genomic hybridization, and karyotyping. The precision, velocity, and sensitivity of these tools have been enhanced by the ongoing advancements in technology that enable reliable detection of chromosome abnormalities and mutations. Their introduction has also been enhanced by the increased demand to automate and develop systems that facilitate high throughput, which would reduce the human touch and improve efficiency in the workflow. In addition, cytogenetic testing is being applied in oncology, prenatal diagnostics, and personalized medicine, which is further augmenting the application of equipment.

The reagents & kits segment is expected to grow at a 7.0% CAGR over the projection period, owing to the increased demand for effective, convenient, and quality consumables in the processes of cytogenetic testing. These reagents and kits play a critical role in hybridization, staining, sample preparation, and probe labeling techniques of molecular cytogenetic methods (FISH and CGH). The development of diagnostic laboratories and research centers, and an increase in the volume of genetic testing, led to the growth of the consumption of these products. Manufacturers are working on developing specialized reagent kits that are more sensitive and reduce turnaround time, and enhance reproducibility. Also, the automation and standardization trend is driving the need for compatible reagents that are favorable to high-throughput systems.

Application Insights

How Does the Oncology Segment Lead the Molecular Cytogenetics Market in 2024?

The oncology segment led the market while holding a 39.2% share in 2024, as cytogenetic techniques are extensively used in the detection and management of cancer. Molecular cytogenetics is also very important in determining the presence of chromosomal changes, including fusions of genes, gross rearrangements, and changes in the copy numbers, which are normally found in every type of cancer. The growing cancer rate in the world, with the rise of awareness about the importance of early cancer diagnosis and precision medicine, has contributed to the ever-growing need for cytogenetic analysis in cancer. Such techniques have been made more accessible to clinical applications due to technological developments, such as automated FISH systems, array-based CGH, and AI-assisted imaging, which have enhanced the accuracy, efficiency, and throughput.

The prenatal diagnostics segment is expected to grow at a CAGR of 6.8% over the forecast period. Molecular cytogenetics has extensive use in prenatal diagnosis to identify chromosomal abnormalities, e.g., trisomies, deletions, duplications, and translocations, which could point to congenital diseases. Such methods, including FISH and array-based CGH, are used to diagnose early and accurately using amniotic fluid, chorionic villus sampling, or maternal blood, making sure that expecting parents will be able to take timely medical actions and make informed decisions. Market adoption is increasing due to increased awareness of prenatal screening, adoption of non-invasive testing technologies, and improved high-resolution cytogenetic technologies. Moreover, the government programs encouraging maternal health and prenatal care, or the increased investment in the diagnostic laboratory sector, also contribute to the development of the prenatal diagnostics market.

End-User Insights

Why Did Hospitals & Diagnostic Laboratories Segment Hold the Largest Market Share in 2024?

The hospitals & diagnostic laboratories segment held around 46.5% share of the molecular cytogenetics in 2024. Hospitals and diagnostic laboratories are the main units to conduct cancer diagnostics, prenatal and postnatal testing, and genetic disorder analysis, in which the rapid and accurate chromosomal assessment is essential. The growing rate of cancers and genetic abnormalities has necessitated the need to conduct molecular cytogenetic tests in these centers. Such methods have become more practical in the hospital and laboratory setting due to the improvement of their workflow, accuracy, and throughput by technological progress, such as automation, high-resolution imaging, and AI-assisted analysis. Moreover, the extension of diagnostic services and the modernization of laboratory infrastructure in emerging economies also solidifies the position of hospitals and diagnostic laboratories to guarantee their leading position in the market.

The academic & research institutes segment is expected to grow at a 7.1% CAGR in the upcoming period. Molecular cytogenetic techniques are becoming important in research organizations and universities to study genetic disorders, cancer genomics, and chromosomal biology. The next-generation tools, like array-based CGH, automated FISH, and AI-assisted analysis, allow the researcher to investigate complex chromosomal rearrangements, copy number variation, and fusions with genes, which would inform the researcher of the disease-causing processes and possible therapeutic targets. Increased interest in genomics studies, governmental support, and joint projects with biotech/pharmaceutical firms are driving faster usage of the cytogenetic technologies in academic institutions. Besides, the growth of training programs and research grants is also assisting the institutes to obtain state-of-the-art equipment and reagents.

Technology Insights

Why Did the Manual Systems Segment Lead the Molecular Cytogenetics Market in 2024?

The manual systems segment led the market with a 68.4% share in 2024. Techniques such as traditional karyotyping and fluorescence in situ hybridization (FISH) remain widely used due to their reliability, versatility, and well-established protocols in both clinical and research laboratories. These systems allow trained cytogeneticists to visually analyze chromosomal abnormalities, structural rearrangements, and copy number variations with high diagnostic accuracy. Despite the emergence of automated technologies, manual systems continue to be preferred in many settings due to lower initial equipment costs and familiarity among laboratory personnel. They are particularly suitable for small laboratories, hospitals, and academic institutions, where testing volumes are limited and expert interpretation remains critical.

The automated systems segment is expected to grow at the fastest CAGR of 7.2% in the coming years. In molecular cytogenetics, automation is being driven by the integration of advanced imaging, artificial intelligence (AI), and software-based analysis, enabling processes such as karyotyping and FISH to be conducted with greater efficiency. These systems offer higher accuracy, reduced error rates, and greater throughput, making them ideal for high-volume laboratories and large-scale research programs. Ongoing advancements in AI, machine learning, and digital imaging are further enhancing the ability of automated platforms to detect chromosomal abnormalities, gene fusions, and copy number variations more effectively than manual methods. The growing need for high-throughput testing, reproducibility, and faster turnaround times is accelerating adoption, particularly in oncology diagnostics and genomics research.

Region Insights

U.S. Molecular Cytogenetics Market Size and Growth 2025 to 2034

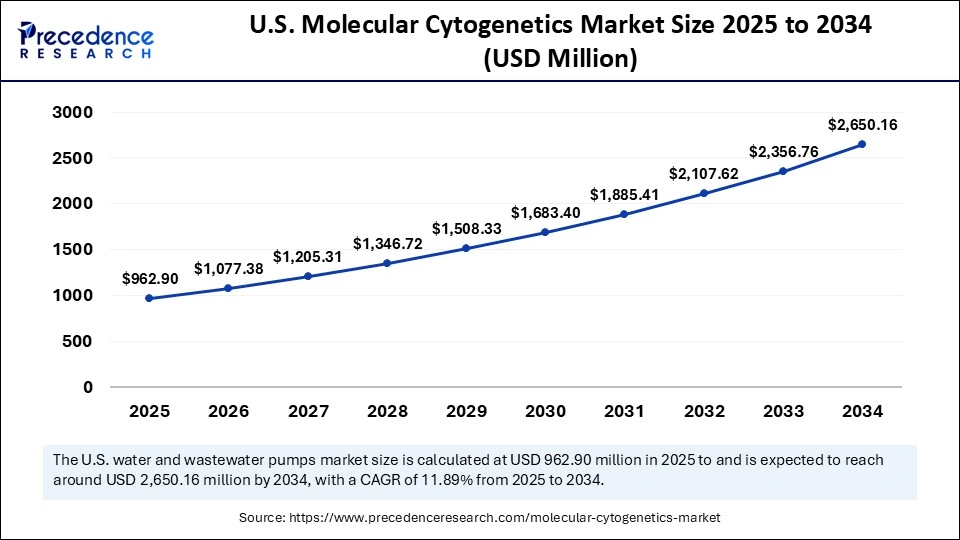

The U.S. molecular cytogenetics market size is exhibited at USD 962.90 million in 2025 and is projected to be worth around USD 2,650.16 million by 2034, growing at a CAGR of 11.89% from 2025 to 2034.

Why Did North America Lead the Global Molecular Cytogenetics Market in 2024?

North America led the global molecular cytogenetics market with the highest market share of 44.3% in 2024, driven by its advanced healthcare infrastructure, well-equipped laboratories, and strong investments in genomic research. The region benefits from widespread application of molecular cytogenetic techniques in oncology, prenatal diagnostics, and genetic disorder analysis. Growing awareness of genetic testing and the importance of early diagnosis among patients has fueled demand for high-precision diagnostic tools. Automated platforms and high-resolution imaging systems are being increasingly adopted across hospitals, diagnostic labs, and research institutions to enhance testing accuracy and efficiency. Additionally, innovation and adoption of molecular cytogenetic technologies are supported by government initiatives, private funding, and strategic collaborations with biotechnology and pharmaceutical companies.

U.S. Molecular Cytogenetics Market Trends

The U.S. plays a pivotal role in the market due to its significant investments in genomic research, advanced healthcare infrastructure, and growing demand for genetic testing. Government funding for large-scale genomic initiatives, channeled through federal agencies such as the National Institutes of Health (NIH) and the National Human Genome Research Institute (NHGRI), has accelerated the clinical and research applications of molecular cytogenetic techniques. These efforts have expanded the adoption of cytogenetic tools across hospitals and laboratories, particularly in the areas of personalized medicine, oncology diagnostics, and rare disease detection. Rapid analysis of chromosomal abnormalities is being increasingly facilitated by automated platforms, digital imaging, and bioinformatics software.

Notably, the 2025 U.S. federal budget allocated USD 663.7 million to the NHGRI, marking a continued commitment to advancing genomics and cytogenetics research to improve disease detection and therapeutic outcomes.

Why is Asia Pacific Considered the Fastest-Growing Area in the Molecular Cytogenetics Market?

Asia Pacific is projected to expand at the highest CAGR of 7.8% over the forecast period, driven by rising demand for accurate and reliable cytogenetic tools in clinical diagnostics, oncology, and prenatal screening. The adoption of molecular cytogenetic techniques is accelerating, supported by government initiatives in genomics, personalized medicine, and precision healthcare across the region. Growing academic-industry collaborations are enhancing diagnostic capabilities, while increased investment in healthcare infrastructure is improving laboratory efficiency. Additionally, rising awareness of genetic disorders and the importance of early diagnosis is fueling the adoption of cytogenetic testing across hospitals and research institutions.

China Molecular Cytogenetics Market Trends

China represents a major growth opportunity in the molecular cytogenetics market, supported by substantial government funding for genomics and precision medicine initiatives. Rising healthcare expenditure and growing awareness of genetic disorders are encouraging hospitals and research laboratories to adopt cytogenetic technologies for oncology, prenatal screening, and rare disease diagnostics. Government-backed large-scale genomic programs are accelerating the integration of molecular cytogenetics into routine clinical practice. Investments in automated platforms, high-resolution imaging, and AI-driven solutions are improving both diagnostic accuracy and operational efficiency. Furthermore, collaboration among academic institutions, biotech firms, and healthcare professionals is fostering innovation and knowledge exchange in cytogenetic research.

Why is the European Molecular Cytogenetics Market Experiencing Notable Growth?

The European market is experiencing notable growth driven by increasing demand for genetic testing, expanding clinical research, and heightened focus on rare and inherited diseases. Countries such as Germany, the UK, and France are leading adopters, particularly in cancer diagnosis, prenatal screening, and personalized medicine initiatives. The integration of molecular cytogenetic tools into routine diagnostics and research within public healthcare systems is increasingly encouraged, enhancing diagnostic accuracy. Supportive government programs, investments in genomics research, and favorable reimbursement policies are further propelling market expansion. Additionally, the rise in advanced diagnostic facilities and collaborations between academic and clinical institutions is strengthening the region's diagnostic capabilities.

Germany Molecular Cytogenetics Market Trends

Germany is emerging as a major player in the market due to its advanced healthcare system and high adoption rate of genetic testing in clinical practice. The country's focus on precision diagnostics has accelerated the use of advanced cytogenetic techniques, especially in oncology, prenatal diagnosis, and reproductive health. Both governmental and non-governmental entities are actively involved in genomic research, with numerous collaborations between hospitals, universities, and biotech companies fostering innovation and knowledge sharing.

Molecular Cytogenetics Market – Value Chain Analysis

- R&D: Molecular cytogenetics research and development aims at developing improved diagnostic assays, probes, and image platforms used to identify chromosomal abnormalities and genetic diseases. This phase is a motivation for innovation and improvement of test accuracy and efficiency.

Key Players: Thermo Fisher Scientific, Agilent Technologies, and Roche Diagnostics

- Clinical Trials and Regulatory Approvals: The safety, efficacy, and compliance of molecular cytogenetic products are verified through clinical trials and regulatory approvals before being introduced to the market. This validates the performance of the products and builds a trusting relationship between the clinicians and the researchers.

Key Players: Abbott Laboratories, Qiagen, and PerkinElmer

- Formulation and Final Dosage Preparation: Reagents, probe kits, and consumables have been designed for use in laboratory and clinical cytogenetics. Advancement of an effective formulation provides reliable and credible results in testing.

Key Players: Cytocell Ltd., F. Hoffmann-La Roche, and Becton Dickinson

Top Companies in the Molecular Cytogenetics Market

|

Tier |

Companies |

Rationale / Roles |

Estimated Cumulative Share |

|

Tier I – Major Players |

Thermo Fisher Scientific; Illumina; Danaher; Roche Diagnostics; Abbott Laboratories; Agilent Technologies; Bio-Rad Laboratories; Revvity |

These companies lead due to their broad product portfolios, advanced cytogenetic technologies, strong global presence, and significant R&D investments. They dominate clinical and research markets with high-volume, high-precision cytogenetic instruments and assays. |

~45–50% |

|

Tier II – Established Players |

MetaSystems; SciGene; Biomodal; Biocare Medical; BioDot; OncoDNA |

These firms have specialized product offerings, focus on imaging, microarrays, or personalized medicine solutions. They maintain strong regional presence and partnerships but are somewhat smaller or niche-focused compared to Tier I. |

~30% |

|

Tier III – Emerging / Niche Players |

Biocept; Freenome; Personal Genome Diagnostics; Myriad Genetics; Invitae; others |

Newer or niche market entrants focused on specialized areas such as early detection, liquid biopsy, or specific cytogenetic applications. Their market penetration and volumes are smaller but growing steadily. |

~20–25% |

Recent Developments

- In April 2024, Bionano Genomics, Inc. (BNGO) has partnered with China-based Diagens, an AI-driven assisted reproductive technology company, to commercialize the first cytogenetic workflow combining OGM and AI chromosome karyotype analysis. This solution aims to detect pathogenic structural variants linked to recurrent pregnancy loss and other genome abnormalities affecting pregnancy and newborn development.

- In January 2023, Redcliffe Labs expanded operations in the large cities of Punjab: Bhatinda, Ludhiana, and Jalandhar. The new state-of-the-art laboratories are equipped with sophisticated diagnostic equipment, such as molecular cytogenetics analysis.

Exclusive Analysis on the Molecular Cytogenetics Market

The molecular cytogenetics market is undergoing a paradigmatic evolution, anchored by the confluence of high-resolution genomic technologies and a global surge in demand for precision diagnostics. With a rapidly expanding clinical application base, particularly in oncology, reproductive genetics, and rare disease diagnostics, the market is poised for robust, non-linear growth. Emerging economies, increasingly equipped with genomic infrastructure and regulatory support, are unlocking previously untapped revenue pools, especially in Asia Pacific and Latin America.

Moreover, the integration of automated imaging systems, AI-enhanced karyotyping, and digital FISH platforms is reducing diagnostic latency and enhancing throughput, thereby expanding the market's viability across both high- and mid-volume laboratories. As public and private stakeholders ramp up genomics-driven health initiatives and multi-omics research, the market's addressable base is anticipated to broaden significantly. These converging forces present compelling investment opportunities in workflow automation, cloud-based genomic analytics, and custom probe development, underlining a bullish trajectory for molecular cytogenetics over the coming decade.

Segments Covered in the Report

By Technique

- Fluorescence In Situ Hybridization (FISH)

- Comparative Genomic Hybridization (CGH)

- Karyotyping

- Array CGH

- PCR-Based Cytogenetics

By Product

- Instruments

- Reagents & Kits

- Software & Services

By Application

- Oncology

- Prenatal Diagnostics

- Postnatal Diagnostics

- Genetic Disorder Screening

- Research Applications

By End-User

- Hospitals & Diagnostic Laboratories

- Academic & Research Institutes

- Biotechnology & Pharmaceutical Companies

- Contract Research Organizations

By Technology

- Automated Systems

- Manual Systems

By Region

- North America (US, Canada)

- Europe (EU, UK, Rest)

- Asia-Pacific (China, Japan, South Korea, Australia)

- Latin America

- Middle East & Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting