What is the Multiexperience Development Platforms Market Size?

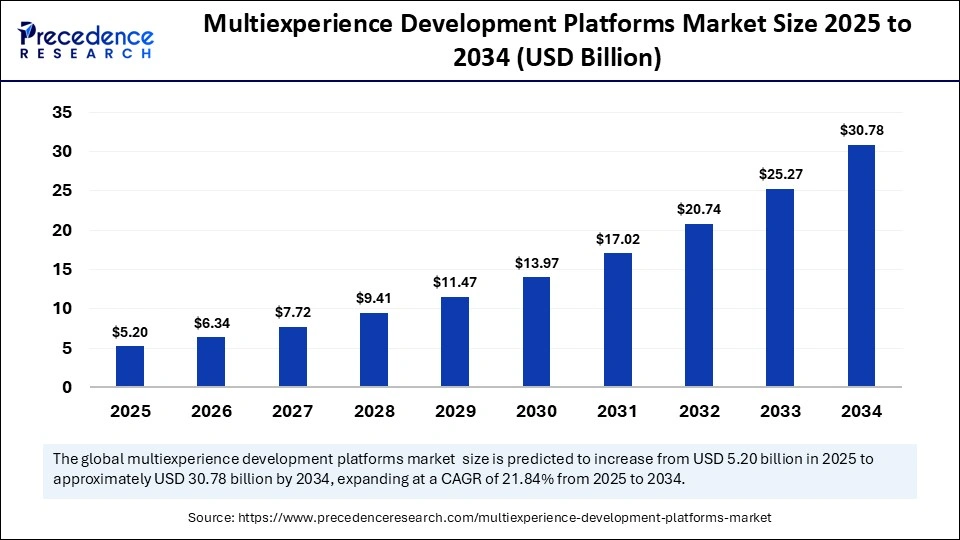

The global multiexperience development platforms market size is calculated at USD 5.20 billion in 2025 and is predicted to increase from USD 6.34 billion in 2026 to approximately USD 30.78 billion by 2034, expanding at a CAGR of 21.84% from 2025 to 2034. The market is experiencing significant growth driven by increasing demand for seamless omnichannel experiences across devices, including wearables, smartphones, and voice assistants. Furthermore, the integration of advanced technologies such as AI, AR/VR, and IoT, along with the growing need for scalable, efficient application development platforms, is a key driver of market growth.

Market Highlights

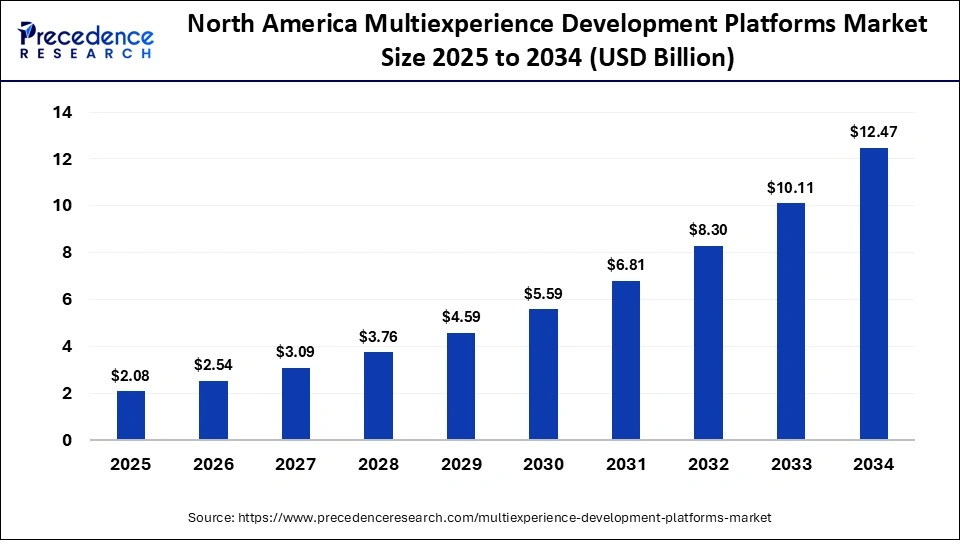

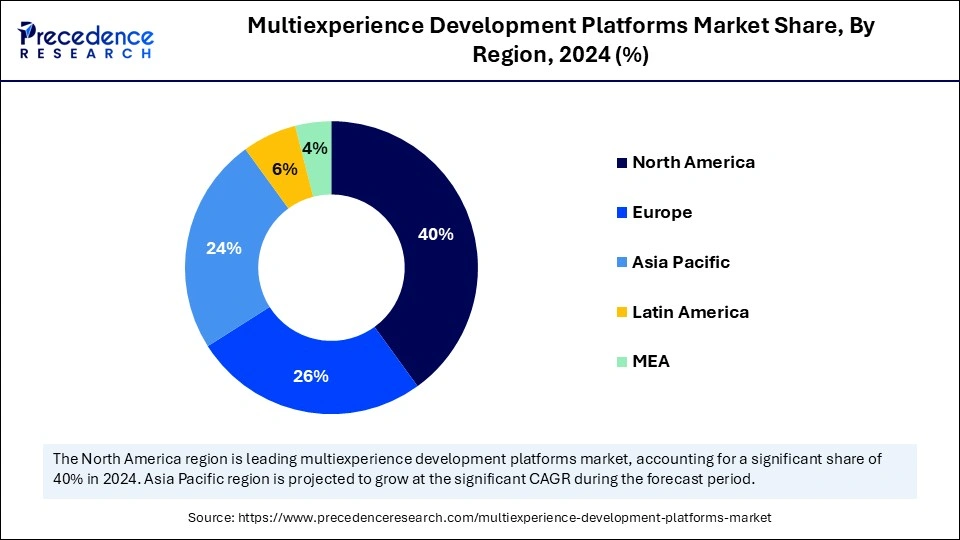

- North America held the largest market share of 40% in 2024.

- The Asia Pacific is expected to experience the fastest growth from 2025 to 2034.

- By component, the development tools segment held the largest market share of 40% in 2024.

- By component, the analytics & AI/ML engines segment is expected to grow at the fastest CAGR between 2025 and 2034.

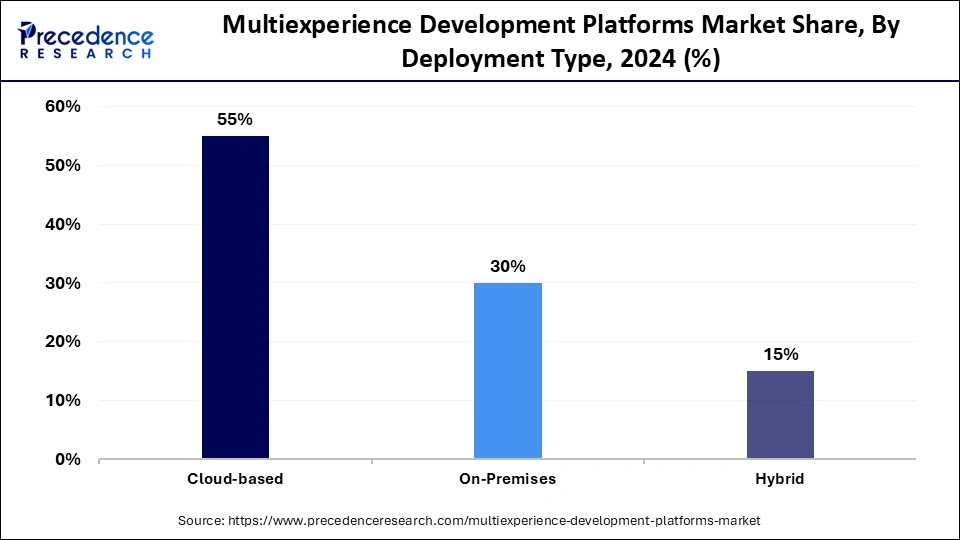

- By deployment type, the cloud-based segment held the largest market share of 55% in 2024.

- By deployment type, the hybrid segment is growing at the fastest rate from 2025 to 2034.

- By application type, the web applications segment held the largest market share of 35% in 2024.

- By application type, the AR/VR & XR applications segment is expected to expand at the fastest CAGR between 2025 and 2034.

- By end-user/industry vertical, the IT & telecom segment held the largest market share of 25% in 2024.

- By end-user/industry vertical, the healthcare & life sciences segment is poised to grow at the fastest CAGR from 2025 to 2034.

What are the Major Factors Driving the Growth of the Multiexperience Development Platforms Market?

The growth of the market for multiexperience development platforms is driven by the increasing demand for seamless and consistent omnichannel experiences across devices such as smartphones, wearables, tablets, and voice assistants. The rapid adoption of advanced technologies, including AI, AR/VR, and the IoT, is enabling more interactive and personalized user experiences. Organizations are also seeking scalable, efficient, and agile application development platforms to accelerate digital transformation and improve customer engagement.

The multiexperience development platforms market encompasses software solutions that enable organizations to design, develop, and deploy applications delivering consistent and seamless user experiences across multiple digital touchpoints. These platforms support various modalities, including web, mobile, voice, chat, augmented reality (AR), virtual reality (VR), and wearables.

By providing a unified development environment, MXDPs facilitate the creation of applications that function across diverse devices and interaction channels, addressing the growing demand for omnichannel user experiences. The market's expansion is also driven by factors such as the proliferation of digital devices, the increasing need for personalized user interactions, and the acceleration of digital transformation initiatives across industries.

Key Technological Shifts in the Multiexperience Development Platforms Market Driven By AI

AI is playing a transformative role in the multiexperience development platforms market by enabling personalized user experiences, automating tasks, and providing advanced capabilities such as natural language processing (NLP) and predictive analytics. Its integration enhances customer satisfaction through real-time, personalized interactions while streamlining development by analyzing user behavior and interaction patterns. Tools like Autodev assist with processes ranging from planning to code generation, allowing edits across multiple files and automating tasks such as pull requests. By combining AI with low-code and no-code platforms, these solutions make it easier for individuals without prior coding experience to build robust applications efficiently.

Multiexperience Development Platforms Market Outlook

The multiexperience development platforms market is expected to grow significantly between 2025 and 2034, driven by the increasing need for enterprises to provide personalized and seamless experiences across multiple endpoints. The shift toward no-code and low-code development platforms allows business professionals and developers to quickly build applications tailored to evolving business needs.

A major trend is a focus on resource optimization and operational efficiency beyond just tool development. Platform providers are incorporating features that help enterprises streamline processes, minimize waste, and reduce energy consumption. As a result, many companies are adopting MXDP solutions as part of broader digital transformation initiatives to achieve sustainability goals and enhance ESG performance.

Key investors in the market include venture capital firms, large technology enterprises, and corporate venture arms. Leading tech companies such as Salesforce, Microsoft, and SAP are heavily investing in their platforms through strategic developments and acquisitions to drive growth and strengthen their global presence.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 5.20 Billion |

| Market Size in 2026 | USD 6.34 Billion |

| Market Size by 2034 | USD 30.78 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 21.84% |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2025 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Component, Deployment Type, Application Type, End-User / Industry Vertical, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Multiexperience Development Platforms Market Segment Insights

Component Insights

The development tools segment led the market, holding the largest share of 40% in 2024. The segment's dominance is attributed to the fact that these tools offer comprehensive, integrated solutions that support every stage of building and managing applications across multiple channels. Development tools also provide a unified and integrated approach with cost savings, leading to more efficient resource use.

The analytics & AI/ML engines segment is expected to expand at the fastest CAGR during the projection period. The growth of this segment is driven by the ability of these engines to help businesses develop more intelligent, efficient, and highly personalized applications. By leveraging analytics, companies are able to anticipate future trends rather than merely reacting to current data, while AI/ML capabilities enable tailored product recommendations based on individual user preferences.

Deployment Type Insights

The cloud-based segment led the multiexperience development platforms market by capturing the largest share of 55% in 2024. This is mainly because of its advantages like high scalability, flexibility, and affordability. It allows businesses to quickly deploy various applications without requiring large upfront costs or investments in hardware. Additionally, the cloud solutions' hosted nature lets enterprises access development platforms online, removing the need for in-house IT teams.

The hybrid segment is expected to grow at the fastest CAGR during the forecast period. The segment's growth is due to its ability to provide a balance of cost-effective solutions, flexibility, and performance by leveraging the advantages of cloud-based solutions alongside on-premises options as needed. This approach is highly valued by companies that want to modernize their IT systems while maintaining full control over data security within their own premises.

Application Type Insights

The web applications segment led the market with a 35% share in 2024. Its dominance comes from a well-established web infrastructure, scalability, and cost-efficiency. Web applications run directly in browsers, allowing users to access them via any internet service without needing installation, which makes them very convenient. Additionally, updates to web browsers can be easily rolled out to consumers, simplifying maintenance and ensuring access to the latest versions without manual updates.

The AR/VR & XR applications segment is projected to grow at the fastest CAGR in the upcoming period. The segment's growth is driven by benefits such as increased hardware accessibility, improved immersive use cases across various industries, and enabling technologies like 5G and AI. XR also provides hands-on practice with risk-free simulated environments.

End User/Industry Vertical Insights

The IT & telecom segment led the market while holding a 25% share in 2024. The segment's dominance is driven by the growing demand for rapid development of high-speed, low-latency applications across multiple devices, alongside the expansion of technologies such as edge computing and 5G. IT and telecom companies are increasingly adopting applications and services that are accessible across a wide range of devices and capable of managing complex digital ecosystems, enabling a seamless user experience across multiple touchpoints.

The healthcare & life sciences segment is expected to expand at the highest CAGR during the foreseeable period. Growth in this segment is fueled by the industry's focus on improving patient experiences across various digital touchpoints, as well as the broader digital transformation of healthcare aimed at enhancing outcomes and operational efficiency.

Multiexperience Development Platforms MarketRegional Insights

The North America multiexperience development platforms market size is estimated at USD 2.08 billion in 2025 and is projected to reach approximately USD 12.47 billion by 2034, with a 21.98% CAGR from 2025 to 2034.

What Factors are Responsible for the Dominance of North America in the Multiexperience Development Platforms Market?

North America dominated the multiexperience development platforms market, capturing the largest share of 40% in 2024. The region's leadership is driven by extensive digital transformation initiatives, significant investments from both private and government sectors, robust technology infrastructure, and growing demand for omnichannel experiences across key industries such as healthcare, finance, and retail. Growth is further supported by collaborations between large corporations and startups, as well as frequent new product launches. Additionally, the rising integration of AI with low-code and no-code platforms in major sectors has fueled demand, contributing significantly to the region's market expansion.

For instance, In June 2024, Mendix, a Siemens business, announced the general availability of Mendix 10.12 in the U.S., featuring next-generation AI-assisted development, enhanced developer experience in Studio Pro, and strengthened governance, security, and control. The update enables organizations to build smarter applications faster, offering improvements across intelligent digital experiences, accelerated AI-powered development, and enhanced control and visibility. Mendix 10.12 underscores the company's commitment to continuous innovation, making AI accessible while streamlining workflows and improving the overall development experience.

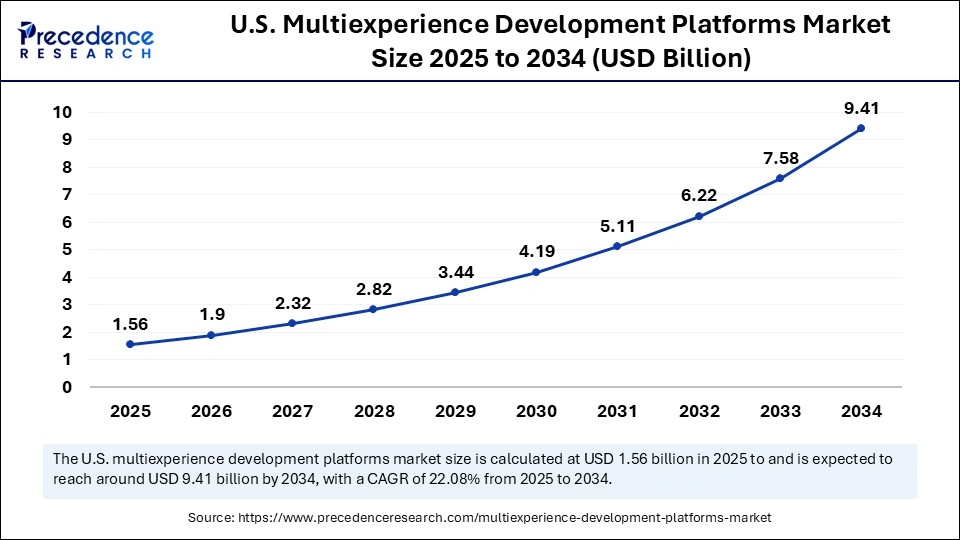

The U.S. multiexperience development platforms market size is expected to be worth USD 9.41 billion by 2034, increasing from USD 1.56 billion by 2025, growing at a CAGR of 22.08% from 2025 to 2034.

U.S. Multiexperience Development Platforms Market Trends

The market in United States is expanding due to the growing demand for omnichannel experiences across major industries. Companies in the United States are leveraging global platforms offered by tech giants like Microsoft, Salesforce, and OutSystems, driven by the rising adoption of low-code and no-code tools, seamless integrations, and the competitive landscape in the country. Moreover, the presence of major investors, start-ups based in the country and expansion of end users in the nation create potential for the market to expand. Additionally, substantial government support in technological developments create strong base for the market players to grow.

Asia Pacific is expected to experience the fastest growth in the market during the foreseeable period of 2025-2034. The region's growth is driven by digital transformation initiatives in emerging countries, strong government support for digitizing key sectors, and widespread adoption of mobile internet technologies, which are boosting demand for these platforms. APAC is also at the forefront of adopting emerging technologies like 5G, AR/VR, and AI/ML, enhancing platform capabilities and improving user experiences. Recent research shows that to overcome outdated frameworks and low developer productivity, nearly 68% of companies in the region are adopting modern development tools such as low-code platforms, IDEs, and DevOps practices.

- For instance, around 25% of APAC enterprises are prioritizing the integration of generative AI into developer tools to enable smarter application development, with notable adoption in India (24%), Japan (26%), and Southeast Asia (23%).

China Multiexperience Development Platforms Market Trends

The market in China is rapidly growing due to the country's extensive digital infrastructure and large tech-savvy consumer base. Domestic tech leaders like Baidu, Alibaba Cloud, and Tencent are adopting model context protocols to develop AI agents that assist with real-world tasks such as payments, map navigation, and responding to consumer queries beyond simple text or scripted replies.

Europe is expected to witness notable growth in the coming period, driven by high digital adoption across key sectors and a growing focus on delivering consistent, seamless user experiences across multiple channels such as mobile, web, and AR/VR. Industries like retail, financial services, and manufacturing are major adopters of multiexperience development platforms, further supporting market growth in the region.

France Market Analysis

France has emerged as the fastest-growing market for Multiexperience Development Platforms (MXDP) in Europe, supported by accelerating digital transformation across enterprises, strong government backing for software innovation, and the rapid rise of AI-driven, low-code, and omnichannel customer engagement strategies. French organizations are increasingly prioritizing seamless user experiences across mobile, web, voice, augmented reality (AR), and wearable devices, driving the adoption of MXDP solutions that enable unified, low-code development for multiple interfaces.

The French government's digital modernization agenda, including initiatives under France Num and France 2030, has significantly boosted the country's technology ecosystem, encouraging local enterprises and startups to adopt advanced digital platforms. Sectors such as banking, retail, insurance, and public services are leading adopters of MXDPs, using them to streamline customer journeys, automate workflows, and deploy applications faster across devices. Moreover, the growth of cloud infrastructure, strengthened by major data center investments and sovereign cloud initiatives, has provided a scalable foundation for MXDP deployment in compliance with European data protection standards.

Multiexperience Development Platforms MarketValue Chain

This stage focuses on continuous innovation to build and maintain the platform’s core technology. Key activities include developing essential components, ensuring scalability, and integrating advanced features.

This stage involves constructing and maintaining the platform while offering a unified environment for designing, developing, and deploying applications across multiple touchpoints.

This stage focuses on creating awareness and generating demand for multiexperience development platforms and their benefits. It includes marketing strategies, lead generation, and ecosystem development to drive adoption.

Multiexperience Development Platforms Market Companies

- Headquarters: Redmond, Washington, United States

- Year Founded: 1975

- Ownership Type: Publicly Traded (NASDAQ: MSFT)

History and Background

Microsoft Corporation was founded in 1975 by Bill Gates and Paul Allen as a computer software company developing and licensing programming languages and operating systems. Over the past several decades, Microsoft has become one of the world’s largest and most diversified technology enterprises, with leadership spanning software, cloud computing, artificial intelligence, and enterprise solutions.

In the context of the Multiexperience Development Platforms (MXDP) Market, Microsoft plays a pivotal role through its Power Platform, Azure, and Dynamics 365 ecosystems. These platforms enable developers and enterprises to build unified digital experiences across web, mobile, chat, AR/VR, and voice interfaces using low-code and AI-enhanced tools. Microsoft’s extensive integration of AI, cloud computing, and developer tools supports seamless, multichannel application development for organizations worldwide.

Key Milestones / Timeline

- 1975: Founded by Bill Gates and Paul Allen

- 1986: Public listing on NASDAQ (MSFT)

- 2016: Launched Microsoft Power Platform as part of its low-code/no-code initiative

- 2019: Introduced Azure Mixed Reality and AI tools for immersive app experiences

- 2023: Integrated generative AI (Copilot) across Microsoft 365 and Power Apps

- 2025: Expanded Power Platform capabilities to support advanced multiexperience development through AI-driven design and mixed reality

Business Overview

Microsoft’s MXDP initiatives center around enabling cross-platform development that unifies user experiences across web, mobile, voice, and AR/VR environments. The Power Platform, powered by Azure AI and Microsoft Cloud, provides a comprehensive environment for developers and business users to design, build, deploy, and manage multiexperience applications.

Business Segments / Divisions

- Productivity and Business Processes

- Intelligent Cloud (Azure)

- More Personal Computing

- Power Platform and Dynamics 365

Geographic Presence

Microsoft operates in more than 190 countries, with major data centers and R&D hubs in the United States, Europe, and Asia-Pacific.

Key Offerings

- Microsoft Power Platform (Power Apps, Power Automate, Power Virtual Agents)

- Azure AI and Mixed Reality services

- Dynamics 365 for customer engagement and business process management

- Copilot AI-assisted app development tools

Financial Overview

Microsoft reports annual revenues exceeding $240 billion USD, with its cloud and productivity segments driving strong growth. The Power Platform has become a critical growth engine within the enterprise application and low-code market, contributing to Microsoft’s position as a top MXDP provider.

Key Developments and Strategic Initiatives

- April 2023: Introduced Power Platform Copilot to integrate generative AI into multiexperience app development

- October 2023: Enhanced Azure Mixed Reality tools for AR/VR collaboration applications

- March 2024: Unified Power Apps and Dynamics 365 experiences for cross-device integration

- January 2025: Launched a developer-focused mixed reality design studio for immersive MXDP applications

Partnerships & Collaborations

- Partnerships with global enterprises for MXDP deployment

- Collaborations with Accenture, Deloitte, and Infosys for low-code enterprise app development

- Alliances with hardware manufacturers to expand AR/VR multiexperience environments

Product Launches / Innovations

- Microsoft Power Platform Copilot (2023)

- Azure Mixed Reality Developer Tools (2024)

- Power Pages with multichannel adaptive UI framework (2025)

Technological Capabilities / R&D Focus

- Core technologies: Low-code/no-code development, AI, cloud infrastructure, mixed reality, and automation

- Research Infrastructure: Microsoft Research Labs in Redmond, Cambridge, and Beijing

- Innovation focus: Unified digital experiences, AI-driven app development, and extended reality integration

Competitive Positioning

- Strengths: End-to-end MXDP ecosystem, deep AI integration, enterprise-grade scalability

- Differentiators: Unified data, AI, and development tools under one cloud framework

SWOT Analysis

- Strengths: Large enterprise customer base, AI-driven development, and robust cloud ecosystem

- Weaknesses: Complex integration for legacy enterprise systems

- Opportunities: Expansion in immersive and AI-powered multiexperience applications

- Threats: Competition from Salesforce, Oracle, and emerging low-code MXDP vendors

Recent News and Updates

- February 2024: Microsoft announced an AI-powered multiexperience builder toolkit for Power Platform

- July 2024: Integrated 3D and AR asset creation tools into Power Apps Studio

- January 2025: Released Power Platform updates enabling seamless deployment across voice, chat, and immersive devices

- Headquarters: San Francisco, California, United States

- Year Founded: 1999

- Ownership Type: Publicly Traded (NYSE: CRM)

History and Background

Salesforce was founded in 1999 by Marc Benioff, Parker Harris, Dave Moellenhoff, and Frank Dominguez as one of the first companies to deliver business software over the internet. Salesforce pioneered the Software-as-a-Service (SaaS) model and became a global leader in cloud-based customer relationship management (CRM).

In the Multiexperience Development Platforms (MXDP) Market, Salesforce provides a unified ecosystem through Salesforce Lightning Platform, Heroku, and MuleSoft, empowering developers and enterprises to build, integrate, and manage applications across web, mobile, chat, voice, and immersive digital environments. Salesforce’s integration of Einstein AI and Slack GPT further enhances its multiexperience capabilities by combining conversational AI, automation, and data-drivenpersonalization.

Key Milestones / Timeline

- 1999: Founded in San Francisco as a cloud-based CRM provider

- 2004: Public listing on NYSE (CRM)

- 2013: Launched Salesforce1 platform for mobile-first app development

- 2018: Acquired MuleSoft for API-driven app connectivity

- 2021: Acquired Slack Technologies to expand into conversational and collaborative MXDP capabilities

- 2024: Launched Einstein Copilot and Flow GPT for AI-driven multiexperience development

Business Overview

Salesforce operates as a global leader in enterprise software and digital experience platforms. Its Lightning Platform allows developers to build and deploy applications seamlessly across multiple digital touchpoints, including mobile, web, and chat interfaces. The integration of Slack GPT and Einstein AI enablesintelligent, conversational, and adaptive multiexperience applications for businesses.

Business Segments / Divisions

- Sales Cloud

- Service Cloud

- Marketing Cloud

- Slack and Collaboration

- MuleSoft Integration Platform

- Lightning Platform and AppExchange

Geographic Presence

Salesforce operates in more than 100 countries, with major offices in the United States, the United Kingdom, Germany, Japan, and India.

Key Offerings

Salesforce Lightning Platform for low-code application development

Einstein AI and Copilot for adaptive and generative app creation

MuleSoft for multichannel integration and data orchestration

Slack GPT for conversational multiexperience applications

Financial Overview

Salesforce reports annual revenues of approximately $35 billion USD, maintaining strong growth driven by cloud adoption and AI integration. The Lightning Platform, combined with Slack and MuleSoft, contributes significantly to Salesforce’s presence in the MXDP market.

Key Developments and Strategic Initiatives

- March 2023: Launched Einstein GPT for generative AI-powered app creation

- August 2023: Introduced Slack GPT for conversational multiexperience environments

- February 2024: Integrated Lightning Platform with Flow GPT for automated app workflows

- June 2025: Expanded Salesforce Platform to include mixed reality and spatial application design

Partnerships & Collaborations

- Partnerships with AWS, Google Cloud, and IBM for cloud-native MXDP scalability

- Collaborations with Deloitte Digital, Accenture, and Capgemini for enterprise implementation

- Alliances with hardware and XR developers for immersive experience integration

Product Launches / Innovations

- Einstein GPT for CRM and MXDP (2023)

- Slack GPT conversational experience framework (2023)

- Flow GPT multichannel automation tools (2024)

- Lightning Platform Extended Reality Developer Suite (2025)

Technological Capabilities / R&D Focus

- Core technologies: AI, low-code development, API integration, multiexperience orchestration, and generative automation

- Research Infrastructure: Salesforce Innovation Centers in San Francisco, Tokyo, and London

- Innovation focus: Generative AI for application development, conversational UX, and spatial computing

Competitive Positioning

- Strengths: Deep CRM integration, strong AI and automation capabilities, and cloud-first architecture

- Differentiators: Unified data-driven and conversational multiexperience ecosystem

SWOT Analysis

- Strengths: Strong ecosystem integration, large enterprise client base, AI leadership

- Weaknesses: High platform complexity for small enterprises

- Opportunities: Growth in generative AI and immersive MXDP environments

- Threats: Competition from Microsoft, ServiceNow, and niche low-code MXDP providers

Recent News and Updates

- April 2024: Salesforce unveiled Flow GPT for intelligent process and app automation

- September 2024: Announced integration of Slack GPT with Lightning Platform for multichannel experiences

- January 2025: Released Einstein Copilot updates enabling voice, chat, and AR-based multiexperience development

Other Companies in the Market

- Appian Corporation: Appian is a global leader in low-code automation and workflow orchestration platforms, empowering enterprises to rapidly build business applications. Its unified platform integrates process automation, AI, and data fabric, enabling organizations to automate complex operations with minimal coding. Appian's strong presence in finance, government, and healthcare makes it a key innovator in enterprise-grade low-code solutions.

- Cigniti Technologies: Cigniti provides digital assurance and low-code testing services, helping enterprises accelerate app development and deployment. The company's focus on quality engineering and automation frameworks supports clients using platforms like Mendix, Appian, and OutSystems, ensuring reliability and faster time-to-market for low-code applications.

- Convertigo: Convertigo offers an open-source low-code and no-code development platform that enables web, mobile, and progressive web app (PWA) creation. It provides integrated backend connectors, microservices, and automation features, supporting digital transformation for SMEs and enterprises through flexibility and scalability.

- Decimal Technologies: Decimal Technologies delivers low-code and digital lending solutions tailored for banking and financial services. Its Vigyaa platform enables financial institutions to automate onboarding, credit assessment, and customer workflows without extensive coding, enhancing operational agility and compliance.

- Easy Software AG: Easy Software specializes in process digitization and document management, providing low-code tools for workflow automation and content management systems. Its cloud-based architecture simplifies business process optimization across enterprise ecosystems.

- GeneXus: GeneXus provides a low-code development environment that uses AI to automatically generate applications and databases. Its multi-platform support enables the creation of web, mobile, and cloud apps with minimal manual intervention. GeneXus is widely used in banking, government, and retail sectors for digital modernization.

- HCL Technologies: HCL integrates low-code application development into its HCL Volt MX platform, designed for multi-experience application delivery. Volt MX supports no-code visual design, enterprise backend integration, and AI-enhanced automation, making it a preferred choice for large-scale enterprises.

- IBM Corporation: IBM offers Watsonx Orchestrate and IBM Cloud Pak for Business Automation, incorporating low-code tools for process automation, app development, and AI integration. IBM's hybrid cloud strategy and enterprise security capabilities strengthen its role in scalable low-code digital transformation.

- i-exceed Technologies: i-exceed provides the Appzillon Digital Experience Platform (DXP), a leading low-code platform for banking and financial services. It enables omnichannel app development and integration with legacy systems, supporting both customer-facing and internal digital solutions.

- Mendix (a Siemens business): Mendix is one of the most advanced low-code platforms globally, enabling cloud-native, AI-assisted application development. It supports multi-experience and microservice-based apps for manufacturing, banking, and logistics. Mendix's integration with Siemens' industrial ecosystem gives it a strong foothold in Industry 4.0 and enterprise automation.

- Neptune Software: Neptune Software offers Neptune DXP, a low-code platform built specifically for SAP and enterprise systems integration. It simplifies digital transformation by extending SAP applications with modern UX, mobility, and workflow automation without disrupting backend logic.

- Neutrinos: Neutrinos provides a cloud-native low-code platform that focuses on AI, process automation, and multi-channel engagement. Its solutions accelerate digital application development for insurance, banking, and government clients.

- Oracle Corporation: Oracle's Application Express (APEX) is a highly scalable enterprise low-code platform that enables secure web app development directly within the Oracle Database ecosystem. Oracle's cloud-first strategy ensures easy deployment, data integration, and performance optimization for mission-critical applications.

- OutSystems: OutSystems is a global leader in enterprise low-code development, offering high-performance, AI-powered tools for complex, scalable application delivery. Its OutSystems Developer Cloud (ODC) combines visual programming, full-stack capabilities, and DevOps integration for rapid innovation.

- Pegasystems Inc.: Pegasystems delivers Pega Platform, a leading low-code workflow automation and customer engagement solution. Pega combines case management, AI-driven decisioning, and business rules automation to streamline operations in sectors like healthcare, finance, and telecom.

- Progress Software: Progress Software's Telerik and Kinvey platforms enable low-code and no-code app creation with strong support for data connectivity, UI development, and cloud deployment. The company focuses on enabling digital agility for enterprises through rapid, scalable app development.

- Resco: Resco provides Resco MxDP (Multi-experience Development Platform) for building offline-capable business apps. It's particularly popular among field service, mobility, and CRM extension users, offering low-code customization for Salesforce and Dynamics 365.

- SAP SE: SAP's Business Technology Platform (BTP) and SAP Build tools deliver low-code and no-code development capabilities integrated with its ERP ecosystem. These tools empower business users to create applications, automate workflows, and analyze data with minimal IT intervention.

- Salesforce, Inc.: Salesforce offers Lightning Platform and Flow Builder, enabling low-code application development, automation, and AI-driven analytics. These tools support the Salesforce ecosystem by helping organizations build custom CRM extensions and business workflows seamlessly.

- ServiceNow: ServiceNow's Now Platform App Engine provides low-code application development and process automation capabilities that integrate with ITSM, HR, and customer workflows. Its intuitive design tools enable business users to create enterprise-grade digital solutions rapidly.

- TDox: TDox offers a no-code platform for mobile workflow automation, enabling the creation of field service and logistics applications. It focuses on digitizing paper-based operations with cloud-based, low-maintenance tools for SMEs.

- Temenos: Temenos provides Temenos Infinity, a low-code digital banking platform that enables rapid deployment of customer-facing applications. Its configurable workflow and API-first architecture support digital transformation across banking and fintech ecosystems.

Recent Developments

- In May 2025, Zoho Corporation, a leading tech company, added more advanced AI and work orchestration features to its CX platform, which is powered by Zia, Zoho's in-house AI engine. These AI capabilities help remove technological barriers to CRM adoption across groups that are actively working to serve consumers.(Source: https://www.businesswire.com)

- In August 2024, Appian launched the latest version of its Appian Platform 24.3, which introduces new AI use case support for enterprises. It encompasses capabilities from process automation to application development.(Source: https://www.enterprisetimes.co.uk)

Exclusive Analysis on the Multiexperience Development Platforms Market

The global multiexperience development platforms market is poised for exponential growth over the forecast period, driven by the confluence of digital transformation imperatives and the accelerated adoption of low-code/no-code development frameworks across enterprise ecosystems. Organizations are increasingly prioritizing seamless omnichannel engagements, necessitating platforms capable of orchestrating consistent experiences across mobile, web, wearable, AR/VR, and voice-driven interfaces. The proliferation of AI, ML, and advanced analytics further augments the market potential by enabling predictive, context-aware, and hyper-personalized application experiences.

From a strategic vantage point, the market exhibits significant white-space opportunities in sectors such as healthcare, finance, and retail, where operational complexity and digital touchpoint proliferation demand agile, scalable solutions. Emerging regions in Asia Pacific and Latin America represent untapped growth corridors, bolstered by robust governmental support for digitalization, expanding internet penetration, and heightened enterprise investment in innovative IT infrastructure. Additionally, the convergence of multiexperience platforms with generative AI, blockchain, and IoT paradigms opens avenues for hybrid application ecosystems, facilitating operational efficiency, enhanced customer engagement, and measurable ROI.

In sum, the market presents a compelling value proposition for enterprises and investors alike, with opportunities anchored in accelerating digital adoption, next-generation AI integration, and the imperative for rapid, cross-channel application deployment.

Multiexperience Development Platforms MarketSegments Covered in the Report

By Component

- Development Tools

- Low-code/No-code development tools

- Visual development environments

- Application Programming Interfaces (APIs) & Integration Tools

- Pre-built connectors & APIs

- Custom integration modules

- Analytics & AI/ML Engines

- User behavior analytics

- Predictive AI modules

- Testing & Monitoring Tools

- Application performance monitoring

- Automated testing tools

- Other Tools & Utilities

- Collaboration & project management tools

- Debugging & deployment utilities

By Deployment Type

- Cloud-based

- Public cloud

- Private cloud

- Hybrid cloud

- On-Premises

- Enterprise-managed servers

- Data-center hosted solutions

- Hybrid

By Application Type

- Web Applications

- Enterprise portals

- E-commerce platforms

- Mobile Applications

- Consumer apps

- Business productivity apps

- AR/VR & XR Applications

- Immersive training & simulations

- Virtual showrooms & product demos

- IoT Applications

- Connected devices & smart home apps

- Industrial IoT dashboards

- Other Applications

- Chatbots & conversational interfaces

- Voice-enabled applications

By End User / Industry Vertical

- IT & Telecom

- Banking, Financial Services & Insurance (BFSI)

- Retail & E-commerce

- Healthcare & Life Sciences

- Manufacturing & Automotive

- Government & Public Sector

- Media & Entertainment

- Others

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East & Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting