What is the Naloxone Spray Market Size?

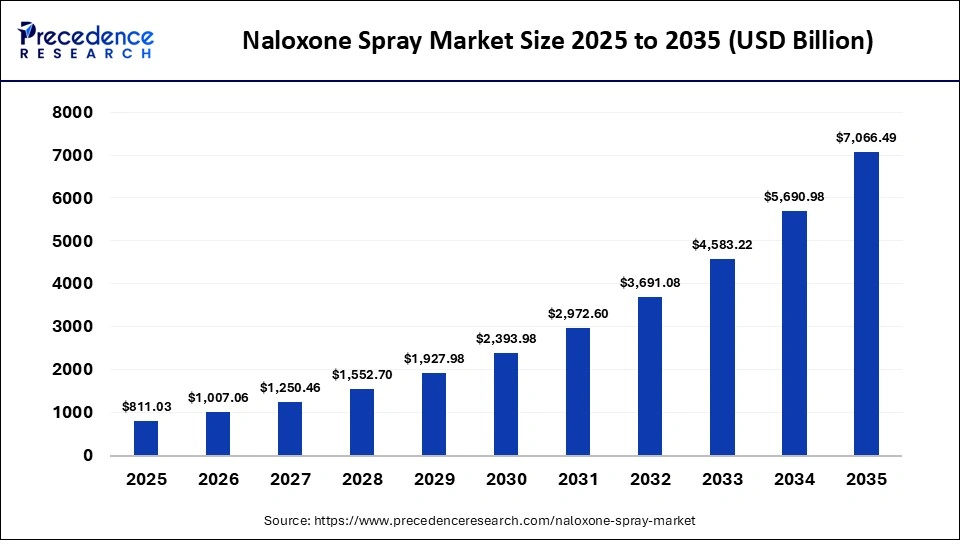

The global naloxone spray market size was estimated at USD 811.03 billion in 2025 and is predicted to increase from USD 1,007.06 billion in 2026 to approximately USD 7,066.49 billion by 2035, expanding at A CAGR of 24.17% from 2026 to 2035. This market is growing due to rising opioid overdose cases and increasing government initiatives to improve access to emergency treatments.

Key Takeaways

- North America dominated the market with the largest share in 2025.

- Asia Pacific is expected to grow at the fastest CAGR between 2026 and 2035.

- By category, the branded segment held the biggest market share in 2025.

- By category, the generic segment is expected to expand at the fastest CAGR between 2026 and 2035.

- By type, the over-the-counter segment contributed the highest market share in 2025.

- By type, the prescription segment is expected to grow at a strong CAGR between 2026 and 2035.

- By dosage, the 4mg/actuation segment held a major market share in 2025.

- By dosage, the 2mg/actuation segment is expected to expand at the fastest CAGR from 2026 to 2035.

- By age group, the adults segment held the biggest market share in 2025.

- By age group, the pediatric group segment is expected to expand at the fastest CAGR between 2026 and 2035.

- By distribution channel, the hospital pharmacies segment held a major market share in 2025.

- By distribution channel, the retail pharmacies segment is expected to expand at the fastest CAGR from 2026 to 2035.

What Drives the Growth of the Naloxone Spray Market?

The naloxone spray market is witnessing strong growth due to the rising number of opioid overdose cases that occur globally and the increased awareness of the need for emergency overdose treatment. Through public health initiatives and over-the-counter approvals, governments and healthcare institutions are increasing naloxone accessibility. Products like Hikms Pharmaceuticals ReVive and Emergent BioSolutions Narcan, for example, have greatly increased community-level accessibility. Expanded distribution through pharmacies, community programs, and harm-reduction initiatives, along with support from public health policies and funding, further fuel market growth.

How is Artificial Intelligence Supporting the Growth of the Naloxone Spray Market?

Artificial intelligence is supporting the growth of the market by optimizing drug distribution and pinpointing high-risk overdose areas through predictive analytics. AI-driven healthcare data systems help organizations and governments plan for emergencies and increase the effectiveness of their supply chains. Digital health platforms powered by AI also assist in awareness campaigns, training, and real-time overdose monitoring, strengthening overall market expansion. Additionally, AI improves supply chain efficiency by forecasting demand and optimizing inventory management, ensuring timely availability.

Key Trends in the Market

- Increasing Over-the-Counter Availability:Regulatory approvals for OTC naloxone sprays are expanding public access and reducing barriers to emergency treatment.

- Rising Government Harm-Reduction Initiatives:Governments are actively promoting overdose prevention programs and distributing products such as Narcan through public health channels.

Growing Public Awareness Campaigns:Educational initiatives are encouraging individuals to recognize overdose symptoms and respond quickly. - Technological Advancements in Nasal Spray Devices:Improved, easy-to-use delivery systems are increasing adoption among non-medical users.

- Expansion of Community-Based Distribution:Pharmacies, schools, and community centers are increasingly stocking naloxone sprays.

- Increased Funding for Opioid Crisis Management:Government grants and private investments are supporting broader access and research.

- Strategic Collaborations and Partnerships:Pharmaceutical companies are partnering with healthcare organizations to strengthen distribution networks.

- Data-Driven Public Health Strategies:AI and analytics tools are being used to identify overdose hotspots and optimize product allocation.

Future Market Outlook

- Penetration into Emerging Markets:Growing awareness in developing countries presents new opportunities for regulatory approvals and product launches.

- Development of Cost-Effective Generic Alternatives:Affordable versions can improve accessibility among underserved populations.

- Integration with Digital Health Solutions:Linking naloxone distribution with mobile health platforms can enhance emergency response systems.

- Public–Private Partnerships Expansion:Collaborations with government agencies can scale harm-reduction initiatives.

- Innovation in Long-Lasting Formulations: Research into improved formulations can increase product effectiveness and differentiation.

- Workplace and Institutional Adoption:Encouraging the stocking of naloxone in offices, factories, and public institutions offers growth potential.

- Training and Certification Program:Expanding overdose response training can indirectly boost product demand.

- Global Policy Support and Advocacy:Favorable policy reforms supporting OTC sales can sustain long-term market growth.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 811.03 Billion |

| Market Size in 2026 | USD 1,007.06 Billion |

| Market Size by 2035 | USD 7,066.49 Billion |

| Market Growth Rate from 2026 to 2035 | CAGR of 24.17% |

| Dominating Region | North America |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | Category, Type, Dosage, Age group, Distribution Channel, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Segment Insights

Category Insights

What Made Branded the Dominant Segment in the Naloxone Spray Market?

The branded segment dominated the market with the largest share in 2025 because of its well-established clinical credibility, high level of brand recognition, and extensive use in government-funded overdose prevention initiatives. Branded products are frequently preferred by emergency responders and healthcare professionals due to their consistent supply availability and proven safety profiles. The segment's dominant position is further reinforced by organized procurement agreements with public health organizations and hospitals.

The generic segment is expected to grow at the fastest CAGR in the coming years as a result of growing demand for affordable treatment alternatives. The use of less expensive alternatives is being encouraged by the growing emphasis on increasing naloxone access in underprivileged and rural areas. Additionally, policy support for reasonably priced overdose reversal medications is speeding up the market penetration of generics.

Type Insights

Why Did the Over-the-Counter Segment Dominate the Naloxone Spray Market?

The over-the-counter segment dominated the market in 2025 due to regulatory approvals allowing non-prescription access, significantly expanding product availability. OTC availability improved community-level distribution, enabling families, caregivers, first responders, and bystanders to carry naloxone without medical consultation. Public health initiatives promoting widespread access and overdose awareness further accelerated adoption. Additionally, the convenience of purchasing naloxone directly from pharmacies strengthened consumer uptake and market growth.

The prescription segment is expected to grow at the fastest CAGR in the coming years because of continued use in clinical and supervised treatment settings, where monitoring and controlled distribution are required. Naloxone's integration into comprehensive opioid treatment programs is further driving prescription demand. Additionally, physicians are increasingly prescribing naloxone alongside opioids as a precaution, and expanded insurance coverage for prescriptions is expected to support segmental growth.

Dosage Insights

Why Did the 4Mg/Actuation Segment Dominate the Naloxone Spray Market?

The 4Mg/actuation segment dominated the market while capturing the largest share in 2025. This is mainly due to its demonstrated capacity to quickly reverse opioid overdoses. Because of its high effectiveness and single-dose dependability, it is frequently advised for use in emergencies. This dosage strength is also recommended by standardized emergency response guidelines. Its dominant position is further supported by first responders' high familiarity with it. Furthermore, adoption rates have increased due to widespread regulatory approvals in important markets.

The 2Mg/activation segment is expected to grow at the fastest CAGR in the coming years, as more people want options for controlled and adjustable dosage. To reduce the negative effects of withdrawal, medical professionals are seeking lower-dose alternatives. Another factor influencing the segment's growth is the expansion of preventive distribution initiatives. Ongoing research into optimal dosing protocols is also contributing to segmental growth.

Age Group Insights

What Made Adults the Leading Segment in the Naloxone Spray Market?

The adults segment led the market with a major share in 2025. This is because adults are the most affected by opioid overdoses. Adults are the primary target of the majority of harm-reduction and public health initiatives. Community response programs, workplace safety measures, and increased awareness among caregivers and family members further drive demand. Additionally, adult-focused rehabilitation and treatment facilities contribute significantly to the widespread use of naloxone sprays in this age group.

The pediatric segment is expected to grow at the fastest CAGR in the coming years due to increasing awareness of the risks of opioid exposure among teens. The demand for naloxone sprays in this age group is being driven by school-based awareness campaigns, preventive education initiatives, and a stronger focus on protecting vulnerable youth populations. Additionally, more medical professionals are recommending precautionary measures in adolescent households, and supportive policy measures targeting youth protection are expected to further drive market expansion.

Distribution Channel Insights

Why Did the Hospital Pharmacies Segment Dominate the Naloxone Spray Market?

The hospital pharmacies segment dominated the market with the largest share in 2025. This is because hospitals are key points for emergency opioid overdose treatment and controlled distribution. Hospital pharmacies ensure immediate availability for patients, first responders, and clinical programs, supporting both inpatient and outpatient needs. Additionally, hospitals often integrate naloxone into comprehensive opioid management and harm-reduction initiatives, while professional oversight ensures safe administration, further reinforcing the segment's market leadership.

The retail pharmacies segment is expected to grow at the fastest CAGR in the coming years due to increasing over-the-counter availability, which makes naloxone easily accessible to the general public. Expanded public health initiatives and community awareness programs are encouraging consumers, caregivers, and first responders to purchase naloxone directly from pharmacies. Additionally, the convenience of retail purchase, coupled with widespread pharmacy networks, supports broader distribution and rapid adoption, driving segment growth.

Regional Insights

What Made North America the Dominant Region in the Naloxone Spray Market?

North America dominated the naloxone spray market by holding the major share in 2025. The region's dominance in the market is attributed to the high rate of opioid use disorder and effective government intervention programs. Product accessibility in the region has been improving in the region due to extensive public awareness campaigns and favorable regulatory policies. Another factor facilitating the broad adoption of naloxone sprays is a well-established healthcare system. Regional demand was further reinforced by substantial funding allotted to harm-reduction programs. Market leadership was strengthened by ongoing cooperation between government organizations and healthcare providers.

U.S. Naloxone Spray Market Trends

The market in the U.S. is expanding, driven by robust government intervention programs and the high frequency of opioid overdoses and increasing public health initiatives aimed at overdose prevention. Regulatory approvals for over-the-counter naloxone, along with widespread availability through pharmacies and community programs, have improved access. Additionally, growing awareness among caregivers, first responders, and healthcare providers, combined with insurance coverage and integration into opioid treatment programs, is further driving market expansion.

How is the Opportunistic Rise of Asia Pacific in the Naloxone Spray Market?

Asia Pacific is expected to grow at the fastest CAGR in the coming years because of improving healthcare infrastructure and rising awareness of opioid misuse. Governments in the region are increasingly implementing overdose prevention initiatives, while expanding pharmaceutical distribution networks enhances market reach. Growth is further supported by increased healthcare spending, supportive legislation, and collaborations with global health organizations, which improve access to emergency treatments and drive regional market expansion.

India Naloxone Spray Market Trends

India's naloxone spray market is growing due to rising awareness of opioid misuse and improvements in emergency care services. Government initiatives targeting substance abuse treatment, expanding hospital infrastructure, and increased training programs for healthcare professionals are further supporting market development.

Naloxone Spray Market Value Chain Analysis

- R&D: This stage focuses on developing advanced nasal delivery technologies to ensure rapid drug absorption and easy administration during opioid overdose emergencies.

- Key players: Emergent BioSolutions and Hikma Pharmaceuticals.

- Distribution to Hospitals & Pharmacies:Naloxone nasal sprays are distributed through hospitals, retail pharmacies, community clinics, and government-backed public health programs to ensure wide accessibility.

- Key players:Teva Pharmaceutical Industries and Pfizer Inc.

- Patient Support and Services: Companies actively conduct overdose awareness campaigns, training initiatives, and community outreach programs to promote emergency preparedness.

- Key players: Harm Reduction Coalition and the Centers for Disease Control and Prevention.

Naloxone Spray Market Companies

- Emergent BioSolutions

- Teva Pharmaceuticals

- Hikma Pharmaceuticals

- Amneal Pharmaceuticals

- Harm Reduction Therapeutics

- Amphastar Pharmaceuticals

- Indivior PLC

- Sandoz

- Viatris Inc.

- Pfizer Inc.

- Padagis

- Nasus Pharma

- Apotex Inc.

- Fresenius Kabi

Recent Developments

- In February 2026, Emergent BioSolutions announced that it received the U.S. FDA approval for new multipack configurations of over-the-counter Narcan Nasal Spray. The company launched 6-count and 24-count packs to facilitate high-volume distribution for first responders and community health organizations. (Source: https://www.morningstar.com)

- In July 2025, Emergent BioSolutions announced the expansion of its NARCANDirect platform to include the 8 mg Kloxxado nasal spray. The company launched this initiative to provide community customers with a broader range of naloxone options following their acquisition of exclusive commercial rights for the product. This development streamlines the procurement process for high-potency overdose reversal tools. (Source: https://investors.emergentbiosolutions.com)

- In May 2024, Amneal Pharmaceuticals announced it had begun supplying its over-the-counter Naloxone Hydrochloride Nasal Spray to U.S. retail pharmacies and the State of California. The company launched this distribution to increase nationwide access and fulfill its commitment to the State of California's CalRx Naloxone Access Initiative. (Source: https://investors.amneal.com)

- In March 2023, the U.S. Food and Drug Administration approved Narcan (naloxone hydrochloride) 4 mg nasal spray for over-the-counter use, making it the first naloxone product available without a prescription. Naloxone rapidly reverses opioid overdoses and is the standard emergency treatment for opioid overdose.(Source: https://www.fda.gov)

Segments Covered in the Report

By Category

- Branded

- Generic

By Type

- Prescription

- Over-the-Counter (OTC)

By Dosage

- 2Mg/Actuation

- 4Mg/Actuation

- Others

By Age group

- Pediatric

- Adults

- Geriatric

By Distribution Channel

- Hospital Pharmacies

- Retail Pharmacies

- Online Pharmacies

By Region

- North America

- Asia Pacific

- Europe

- Latin America

- Middle East & Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Tags

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting