What is Aquaculture Healthcare Market Size?

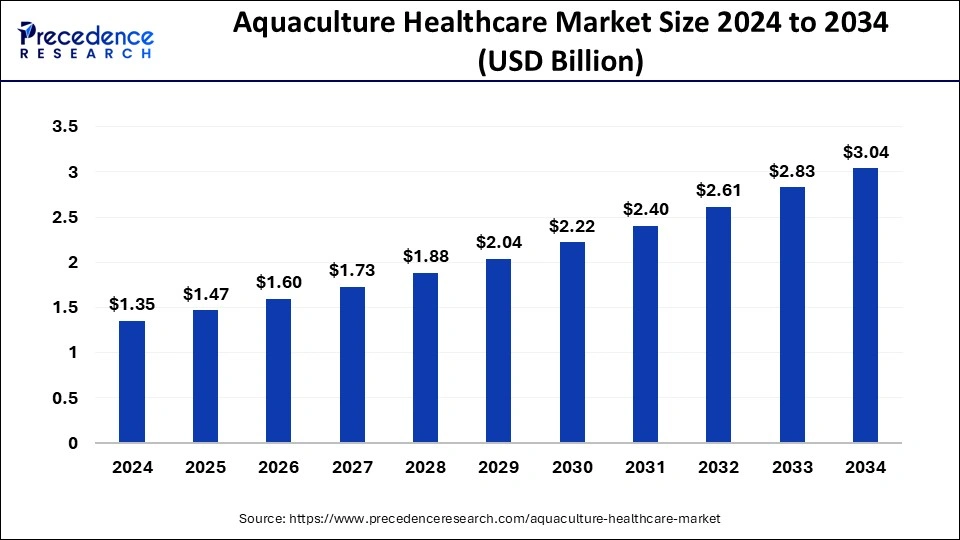

The global aquaculture healthcare market size was calculated at USD 1.35 billion in 2025 and is predicted to increase from USD 1.47 billion in 2026 to approximately USD 3.04 billion by 2035, expanding at a CAGR of 8.46% from 2026 to 2035. The market is growing because more people worldwide are looking for fish protein.

Market Highlights

- Asia-Pacific is likely to witness the fastest growth in the aquaculture healthcare market over the forecast period.

- By product, in 2025, the drugs segment dominated the market.

- By product, the medicated feed additives segment is expected to show significant growth over the forecast period.

- By species, the fish segment held the largest market share in 2025.

- By infection, the bacterial infection segment dominated the market in 2025.

- By route of administration, the topical segment dominated the market in 2025.

- By distribution channel, the retail aqua stores segment dominated the aquaculture healthcare market in 2025.

Role of Artificial Intelligence in the Aquaculture Healthcare market:

Artificial Intelligence (AI) is revolutionizing the aquaculture health market and quite literally changing the way fish health and farms are operated. AI and its various properties, such as machine learning algorithms and predictive analytics, can help with monitoring water quality, detecting early signs of disease, and implementing feeding schedules that help minimize waste, and enhance fish welfare. Also, AI's smart imaging systems can detect abnormal fish behaviors, monitor growth patterns, and identify potential health concerns before they worsen.

The AI-enabled platform replicates the thought process of farm managers by ingesting real-time data from sensors and cameras, allowing an aquaculture farmer to make accurate, timely data-driven decisions. This minimizes the unnecessary use of antibiotics and increased productivity and sustainability. The ability of AI to automate complex tasks and provide continuous monitoring of a fish farming system, is responsible for its rapid uptake, and it is definitely changing fish farming into a more efficient, data-driven, and sustainable business.

Market Overview

The aquaculture healthcare market is witnessing strong growth due to growing worldwide demand for sustainable seafood as well as the incidence of aquatic diseases. Fish farming becomes more intensive, putting an emphasis on products that benefit health management (vaccines, probiotics, diagnostics), and growing importance of technologies to monitor water quality and support fish health diagnostic capacities of aquaculture through clearly defined health management practices is further transforming the market.

Much of this growth is attributed to government policies and mandates to ensure food safety, with government inspections requirements driving the need for aquaculture healthcare technology and practices. Major companies in aquaculture using healthcare are investing in R&D for cleaner, efficient, eco-friendly treatments. Looking forward, aquaculture in the Asia-Pacific region is anticipated continue to play a lead role in the market as many of the largest aquaculture systems globally are based there while new opportunities will open across the market for the continued growth, innovation, expansion of new products and services, and possible strategic partnerships across the aquaculture value chain.

Aquaculture Healthcare Market Growth Factors

- The increasing awareness of the health benefits of fish is driving the growth of the global aquaculture market.

- The market is anticipated to grow further due to the increasing support from governments to promote aquaculture, coupled with the rising global population.

- The main driving force behind the aquaculture healthcare market is the growth of diseases and parasites in aquaculture animals, including fishes and crustaceans.

- The primary opportunity for the aquaculture healthcare market lies in the increased research and development efforts in the aquaculture field, aiming for advancements in healthcare measures.

- As the number of fish farms increases and farms expand, the growing prevalence of diseases is likely to impact the aquaculture healthcare market positively.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 1.35 Billion |

| Market Size in 2026 | USD 1.47 Billion |

| Market Size by 2035 | USD 3.04 Billion |

| Growth Rate from 2026 to 2035 | CAGR of 8.46% |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | By Product, Species, Infection, Route of Administration, and Distribution Channel, and region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

Increasing demand for fish oil as it contains omega-3 fatty acids

Boosting the growth of the aquaculture healthcare market is the growing demand for fish oil, renowned for its omega-3 fatty acids. These essential fatty acids play a crucial role in treating cardiovascular diseases. The University of Maryland Medical Center states that fish oil can lower blood fat levels, diminishing the risk of stroke, heart attack, death, and abnormal heart rhythms in individuals with heart conditions.

- In August 2022, SKAGINN 3X made a significant agreement with BlueWild, Norway, to provide a complete fish processing factory for their innovative new trawler. This trawler is designed for sustainability, quality, and efficiency, marking a significant milestone for the organization.

Rise in prevalence of parasites and diseases in fishes

The increasing occurrence of parasites and diseases among farmed fish is set to drive the growth of the aquaculture healthcare market in the coming years. Like other farm animals, farmed fish are prone to various diseases, often influenced by poor water and nutrition quality, low oxygen levels, and overcrowding in fish farms. This susceptibility of aquatic animals to diseases is anticipated to lead to a higher demand for therapeutic solutions, consequently fostering the growth of the aquaculture healthcare industry.

Restraint

Low acceptance

The low acceptance hinders the growth of the aquaculture healthcare market as it is a new and unconventional fish breeding technique for consumption. This lack of acceptance is linked to a general need for more awareness about aquaculture. The limited knowledge about diseases in aquatic animals is also expected to slow down the expansion of the aquaculture healthcare market. Additionally, the low awareness about the occurrence of diseases and the benefits of aquaculture healthcare significantly impacts industry revenue. This could lead to a slow rate of fish production and an increasing death rate, limiting market progression.

Opportunities

Increase in disposable income

Consumers' increasing disposable income motivates them to invest in highly nutritious food products, including fish. Moreover, the growing focus on health and wellness, along with changes in consumer lifestyles, is expected to contribute to the global growth of the aquaculture healthcare market. Expanding shrimp farming sites in China is also anticipated to boost the market growth.

- In April 2022, Cflow AS participated in Nor-Shipping, an event where maritime and ocean industries converge every two years. This gathering is a central hub for global decision-makers to connect, collaborate, and explore new business opportunities.

Emergence of aquaponics

The increasing international interest in aquaponics is set to create valuable opportunities for market growth. Aquaponics is an innovative technology that cultivates fish and plants in a controlled environment. The waste produced by the fish, when converted into nitrate by nitrifying bacteria, becomes beneficial for plant growth. The growing adoption of aquaponics worldwide, driven by these advantages, is expected to contribute to the future development of the global aquaculture healthcare market. Additionally, introducing innovative launches in aquaponics has the potential to boost market growth further.

- In February 2024, Agriloops, a sustainable aquaculture company based in France, successfully raised €13 million to launch its aquaponics farm through funding, debt, and grants. A crowdfunding campaign on the Sowefund platform facilitated the completion of the funding round. With this financial support, Agriloops can start building its flagship commercial demonstrator.

Segment Insights

Product Insights

The drugs segment dominated the aquaculture healthcare market, holding the most outstanding revenue share in 2025. Aquaculture drugs play a crucial role in taking care of the health of aquatic animals. They contribute to various aspects such as building ponds, managing soil and water, enhancing aquatic productivity, formulating feed, controlling reproduction, promoting growth, and processing the final product to add value.

- In February 2023, fishery scientists and experts from India and the United Kingdom proposed a partnership to establish a One Health Aquaculture concept in India. This approach, rooted in veterinary science, aims to ensure the optimal health of people, aquatic animals, plants, and the environment.

The medicated feed additives segment is expected to show significant growth over the forecast period. Medicated feed is recommended when there's a bacterial disease outbreak in farmed fish. These feeds are ready-made and have antibiotics to control specific bacterial infections by killing or stopping them from reproducing. Free amino acids and nucleotides are commonly added to stimulate feeding behavior. Squid, shrimp, clams, mussels, and polychetes are known to be effective in encouraging feeding. Pigments, specifically carotenoids, are responsible for giving fish their characteristic colors.

Species Insights

The fish segment held the largest market share in 2025. The demand for healthcare solutions in aquaculture has risen because more people want high-quality fishproteins. This trend is expected to drive the growth of this market segment.

Ponds and lakes are still bodies of water, but ponds are more miniature than lakes. In the shallow, sunny areas, there's a lot of life, including different types of fish. Rivers and streams are flowing bodies of freshwater. The water in a river or stream comes primarily from sources like melting glaciers or rainwater. Marine species need to be adapted to living in a place with a lot of salt. Freshwater habitats are ponds, lakes, rivers, and streams, while marine habitats include ocean and salty seas.

- In March 2023, Indian Immunologicals Limited (IIL) from Hyderabad revealed a collaboration with the Central Institute of Freshwater Aquaculture (CIFA) in Bhubaneswar. The partnership aims to commercially develop a vaccine for Hemorrhagic Septicemia, also known as Aeromonas Septicemia, Ulcer Disease, or Red-Sore Disease, in freshwater fish.

Infection Insights

The bacterial infection segment dominated the aquaculture healthcare market in 2025. Many fish can suffer from bacterial infections like Aeromonas septicemia, Edwardsiellosis, Columnaris, and Streptococcosis. Some of these bacteria significantly cause economic losses in aquaculture globally. One common culprit is Aeromonas spp., a type of bacteria that often leads to bacterial hemorrhage in cultured fishes, especially in freshwater and tropical environments.

The viral infection segment is expected to witness notable growth in the forecast period. This is attributed to a chronic viral infection affecting the wild or captive marine and freshwater fish. It's caused by a specific DNA virus belonging to the Iridoviridae family. The infection can show up as benign, cauliflower-like lesions, usually found on the fish fins. This disease impacts various types of fish and is generally found worldwide.

- In September 2023, Kochi's Fish Genetic Resources Centre found three viruses that could threaten the ornamental fish industry. These viruses are Infectious Spleen and Kidney Necrosis Virus (ISKNV), Cyprinid Herpesvirus-2 (CyHV-2), and Carp Edema Virus (CEV).

Route of Administration Insights

The topical route of administration currently leads the charge of the aquaculture health market, as the topical route works well for managing external infections, such as skin infections or ulcers, fin rot, and parasitic infections. Topical administration allows the direct application of antibiotics, antiseptics, and antifungals onto very specific sites on the organism's body, helps reduce systemic side effects associated with drug treatments, and aids in healing the organism more quickly. Topical routes are widely applied to treatment of shrimp and freshwater fish and are typically less expensive, easy to apply, and quick to administer. Lower freight costs on medications that are used for topical routes also help reduce the price per treatment application.

The oral segment is the fastest growing segment of aquaculture health delivery systems because it offers efficiency in mass treatment and ease of adherence to existing feeding rationale, by incorporating the oral delivery method into the feeding protocols. Whether in aquaculture feeding systems, printers, or other options the oral route mixes the medications in feed to ensure that all feed is uniformly dosed with consistently reduced labour costs. As aquaculture producers prioritize health management, and biosecurity becomes a method of increasing productivity, ultimately the oral route of delivery of health care solutions is becoming more convenient and prevalent in more diverse and larger-scale production systems.

Distribution Channel Insights

Retail aqua stores remain the largest distribution channel in the aquaculture healthcare market, especially for developing economies with highly fragmented supply chains. Retail aqua stores give farmers easy access to many products, including antibiotics, feed additives, probiotics, and diagnostic kits. The honesty and familiarity of the knowledge base of trained store staff, and the ability to have a focus on available products, creates trust with small to mid-sized operators along the supply chain, enabling retail stores to be a valuable resource for products and advice specific to a farmer's immediate needs.

Demand in the stores online segment will have the fastest growth, as a growing number of aquaculture operations and businesses embrace digital means of aquaculture management. Online stores offer increased convenience, competitive pricing, and home delivery, while access to a wider range of quality and specific healthcare products is a reality through an online presence. With an increasing number of farmers utilizing internet access as a result of expansion and penetration of the internet, mostly in rural environmental settings, store online channels have begun to gain momentum with more farmers leaving retail stores and moving to these online channels for bulk purchases, expert consultations and comparing products, which will continue to fuel rapid growth in this segment.

Regional Insights

Asia-Pacific Aquaculture Healthcare Market Trends

Countries including China, India, Vietnam, Indonesia, and Thailand have led the region due to favourable weather conditions, coastal and inland waterbody infrastructure, and aquaculture development programs backed by the governments. Moreover, many Asian-Pacific countries have a high density of fish farming practices which results in frequent outbreaks of disease, leading to a rapid adoption of vaccines, water treatments, and disease diagnostics.

Furthermore, local governments are developing and supporting sustainable practices and biosecurity practices while investing in farmer training programs to achieve better outcomes for aquatic animal health. The Asia-Pacific region remains the largest opportunity and fastest developing region for aquaculture healthcare innovations and evidence in market growth due to both increasing export demands and the shift to high-value aquaculture species.

North America Aquaculture Healthcare Market Trends

North America is a significant shareholder and an influential driver of the aquaculture healthcare market, led by increased aquaculture operations, regulatory processes, and consumer demand for sustainable seafood products. The region has significant government support, state-of-the-art facilities, and readiness to embrace preventive healthcare technologies including vaccines, probiotics, and diagnostics, among other products and services.

The U.S. and Canada are investing considerable resources in research and research and are focused on addressing aquatic diseases and biosecurity measures within fish farms. With an emphasis on environmental sustainability and traceable fish products, North American aquaculture producers have shown interest in health management that utilizes modern health management strategies. Proactive outcomes position North America as a mature first market for innovative aquaculture healthcare solutions and sustainable aqua-farming.

Europe

With highly regulated aquaculture systems, a strong emphasis on animal welfare, and increased demand for sustainable and high-quality food sources, Europe has emerged as a leader by dominating the aquaculture consulting market. In Europe, countries such as Norway, Scotland, Spain and Greece have some of the most robust fish farming operations in the world in particular salmon and trout production.

The regulatory frameworks mandate strict controls on the veterinary drugs administered to farmed fish as well as monitoring of disease and fish health monitoring programs, these subsequently stimulate the demand for improvements in farmed fish healthcare. Registered veterinary drugs and vaccines are necessary for industry changing innovations to occur in the areas of fish health diagnostics, treatments, and biosecurity controls.

Both the public and private sector continue to invest for innovation in all three areas. Optimum sustainable practices, coupled with unwavering attention to food safety and traceability, will ultimately enable Europe to continually set global aquaculture healthcare standards while remaining one of the most important growth areas in aquaculture.

Recent Developments

- On March 12, 2025, Indian company Zeolitech launched Ziobind, a natural mineral-based product aimed at improving pond water quality and reducing ammonia stress in aquaculture systems, supporting healthier fish growth and disease prevention. (Source- https://www.whatech.com )

- Earlier, on January 13, 2025, a report highlighted a rising trend in autogenous vaccines tailored for species like salmon and shrimp, enhancing protection against localized pathogens and gaining traction as a sustainable solution in aquaculture healthcare.(Source -https://www.sciencedirect.com)

- On March 3, 2025, researchers at ICAR-CIBA successfully sequenced the goldlined seabream genome, a significant milestone expected to improve genetic breeding and disease resistance in India's aquaculture industry.

(Source- https://timesofindia.indiatimes.com)

Aquaculture Healthcare Market Companies

- Xylem Inc.

- Archer Daniels Midland Company

- Elanco

- Bayer Animal Health

- Merck & Co. Inc.

- Virbac S.A.

- Alltech

- Zoetis (Pfizer, Inc.)

- Benchmark Holdings Plc.

- Pentair plc.

- AKVA Group.

Segments Covered in the Report

By Product

- Vaccines

- Antibiotics

- Antifungals

- Parasiticides

- Anti-Viral Drugs

- Medicated Feed Additives

- Others

By Species

- Fishes

- Freshwater

- Tilapia

- Carp

- Others

- Marine Species

- Seabass Seabream

- Turbot

- Others

- Diadromous Species

- Salmon

- Trout

- Others

- Freshwater

- Crustaceans

- Prawns

- Shrimps

- Others

- Others

By Infection

- Bacterial Infection

- Viral Infection

- Parasitic Infection

- Fungal Infection

By Route of Administration

- Topical

- Oral

- Parenteral

- Immersion

- Spray

By Distribution Channel

- Veterinary Hospitals

- Veterinary Pharmacies

- Online Pharmacies

- Retail /Aqua Stores

By Geography

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting