Native Grass Seeds Market Size and Forecast 2025 to 2034

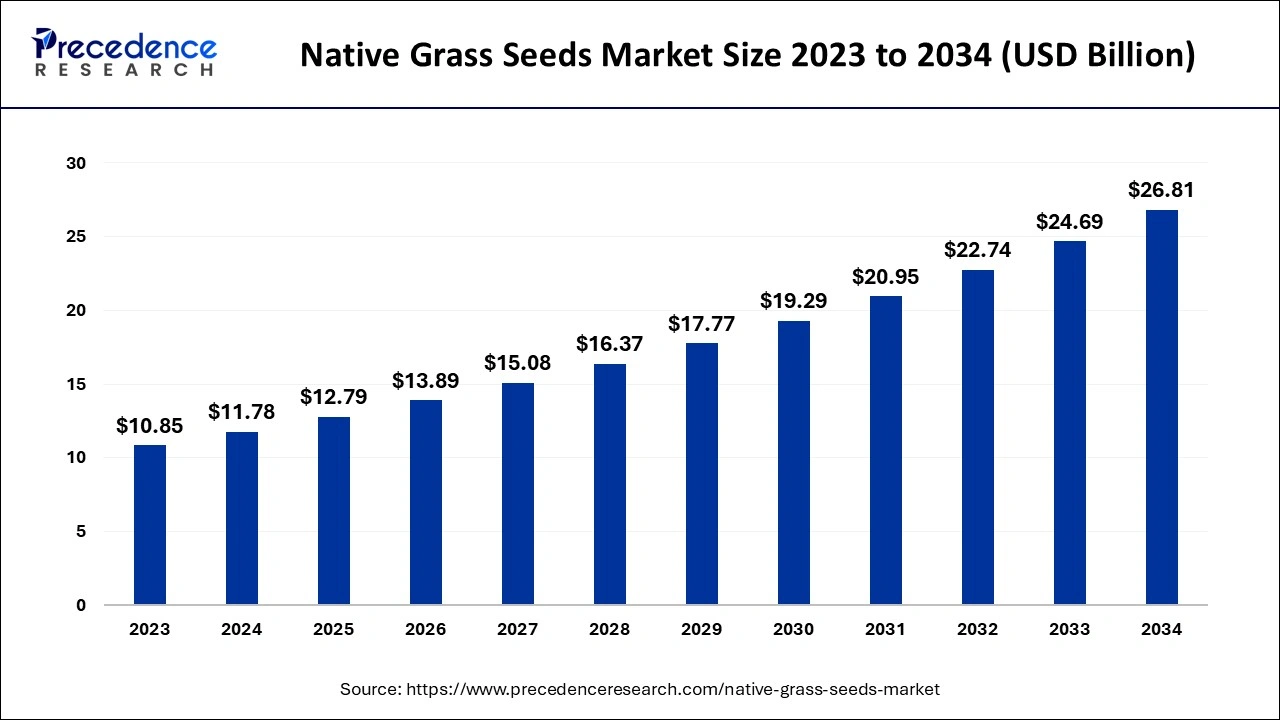

The global native grass seeds market size was estimated at USD 11.78 billion in 2024 and is anticipated to reach around USD 26.81 billion by 2034, growing at a CAGR of 8.57% over the forecast period 2025 to 2034. The native grass seeds market growth is attributed to the rising demand for sustainable land management practices that prioritize biodiversity and environmental restoration.

Native Grass Seeds Market Key Takeaways

- The global native grass seeds market was valued at USD 11.78 billion in 2024.

- It is projected to reach USD 26.81 billion by 2034.

- The native grass seeds market is expected to grow at a CAGR of 8.57% from 2025 to 2034.

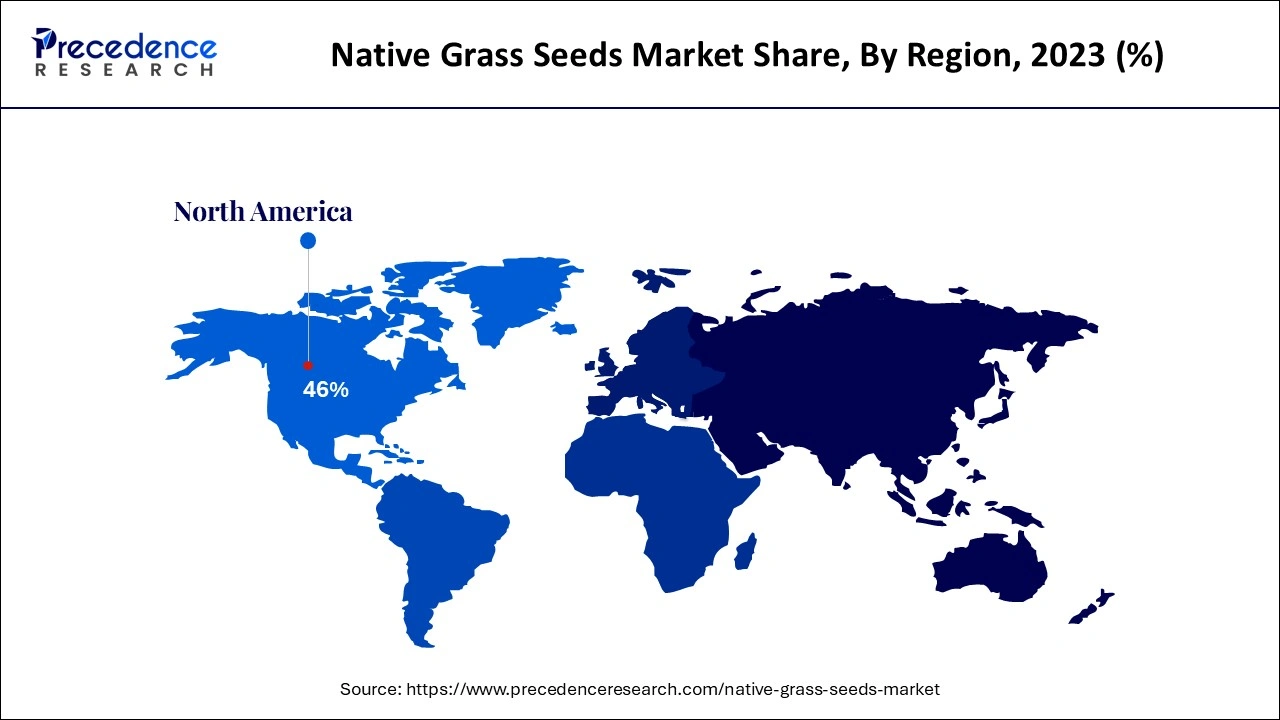

- North America dominated the native grass seeds market with the largest market share of 46% in 2024.

- Asia Pacific is anticipated to grow at the fastest rate in the market during the forecast period.

- By product type, the warm season segment held a dominant presence in the market in 2024.

- By product type, the mixture segment is expected to grow at the fastest rate in the market during the forecast period of 2025 to 2034.

- By application, the land conservation & rehabilitation segment accounted for a considerable share of the market in 2024.

- By application, the landscaping segment is anticipated to grow at the highest CAGR in the market during the studied years.

- By distribution channel, in 2024, the offline stores segment led the global market.

- By distribution channel, the online stores segment is projected to expand rapidly in the market in the coming years.

Impact of Artificial Intelligence on the Native Grass Seeds Market

Artificial intelligence (AI) is increasing efficiency from the selection of a seed to distribution. Sophisticated calculative tools are used to estimate the best time for planting and enhancing the chances of growth. Smart farming is harnessed by drones and sensors for efficient measurements of soil capability of holding water. This capability of supporting plant nutrient solutions allows farmers to make informed decisions regarding irrigation and the use of fertilizer in the native grass seeds market. Furthermore, in applying the results, AI assists in identifying traits that make seeds superior in resisting such conditions as arid climates.

U.S. Native Grass Seeds Market Size and Growth 2025 to 2034

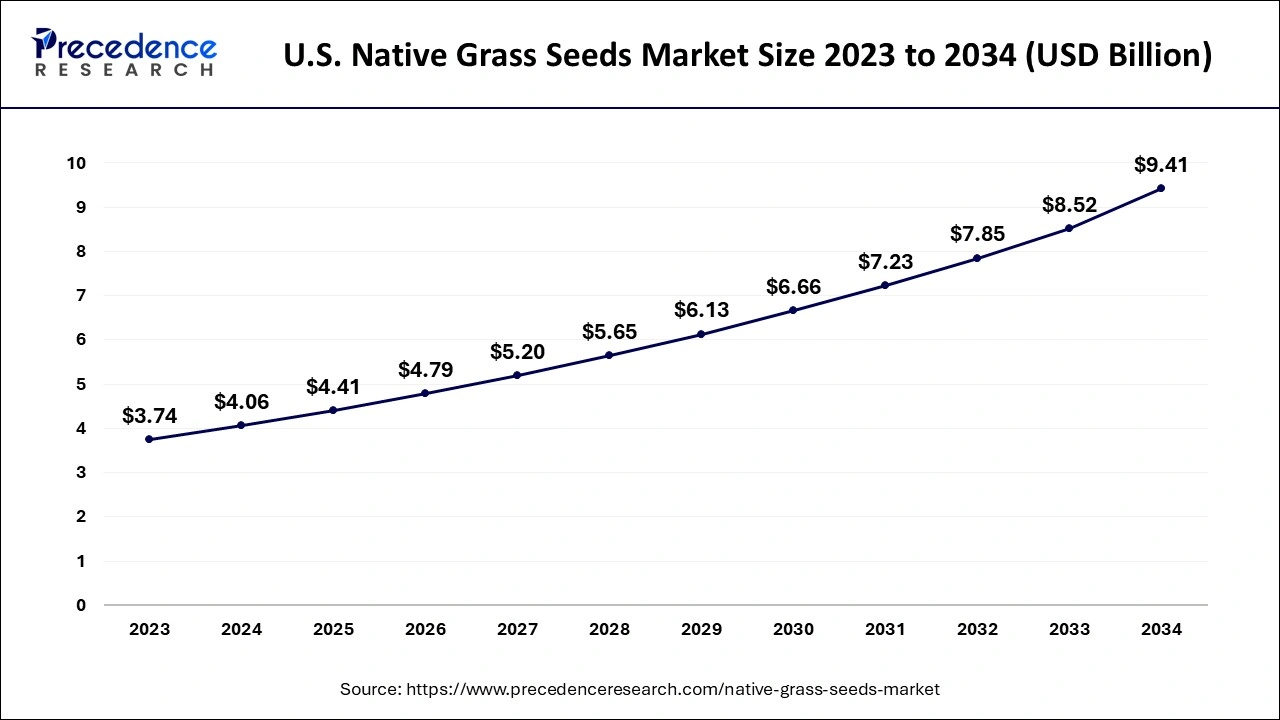

The U.S. native grass seeds market size was evaluated at USD 4.06 billion in 2024 and is projected to be worth around USD 9.41 billion by 2034, growing at a CAGR of 8.77% from 2025 to 2034.

North America held the largest share of the market in 2024 due to the emphasis on environmental protection together with sustainable farming methods. Many activities have been undertaken by the United States and Canada in an effort to bring back degraded ecosystems and support biological diversity, thus enhancing the need for native grass seeds. The U.S. Department of Agriculture (USDA) encourages farmers and landowners to use native grasses to re-establish disturbed land and prevent erosion. Furthermore, people have shifted towards native plants in the ecology, either in agriculture or landscaping businesses, and food production.

- The global demand for native seed was approximated to be clocking USD 240 million in 2023, with North America alone holding at least half the global market as estimated by the National Native Seed Conference.

- USDA recently revealed that 2 million acres of grassland were restored through this program in 2023, which is essential to market development.

Asia Pacific is anticipated to grow at the fastest rate in the native grass seeds market during the forecast period, owing to population growth, especially the fast rate of urbanization, and the rising concern of the people for the environment. Australia, India, and China use sustainable land management practices to prevent further soil degradation, loss of biodiversity, and the effects of climate change. New government policies and the launch of new NGO programs regarding native vegetation for the regeneration of land for use and landscaping in cities are expected to drive the growth of the overall biological market.

- The National Land Care program in Australia is intended to maintain the ecological integrity of Australian land; USD 1,100,000,000 is planned to be spent on environmental remediation in Australia from the 2023 to 2026 fiscal years.

- The India National Biodiversity Action Plan, last revised in 2018, heavily focuses on the conservation of native plant species.

Market Overview

The growing consciousness of the people about the preservation of the bio-diversity of native grass seeds is boosting the native grass seeds market. Native grass seeds help in ecosystem stability by providing protection against water runoff, enhancing wildlife habitats, and improving the ground soil texture. Native to the central city, the NPS notes that the grasslands hold significant importance for climate change mitigation owing to their ability to sequester carbon.

- The market size of native seeds for global consumption was about USD 240 million in 2023 due to the increasing demand for sustainable land management.

The growing concern with ecological restorative projects, which in turn has grown due to the increasing global adoption of native plants. Additionally, this rising awareness of the native grass ecosystem further supports the significance of native grasses in promoting the biological and agricultural uniqueness of the land.

Native Grass Seeds Market Growth Factors

- Rising demand for sustainable agricultural practices leads to increased adoption of native grass seeds among farmers.

- Increasing awareness of soil health emphasizes the role of native grasses in improving soil quality and preventing erosion.

- Growth in landscaping and urban green space initiatives promotes the use of native grass seeds for aesthetic and ecological benefits.

- Expansion of government policies and incentives supporting conservation efforts boosts the market for native grass seeds.

- Growing interest in ecological restoration projects encourages the use of native grass species for habitat rehabilitation.

- Surging interest in local and organic gardening stimulates demand for native seeds among environmentally conscious consumers.

- Increased research and development efforts focused on enhancing the performance of native grass varieties to drive market innovation.

Market Scope

| Report Coverage | Details |

| Market Size by 2034 | USD 26.81 Billion |

| Market Size in 2025 | USD 12.79 Billion |

| Market Size in 2024 | USD 11.78 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 8.57% |

| Largest Market | North America |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Product Type, Application, Distribution Channel, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East & Africa |

Market Dynamics

Driver

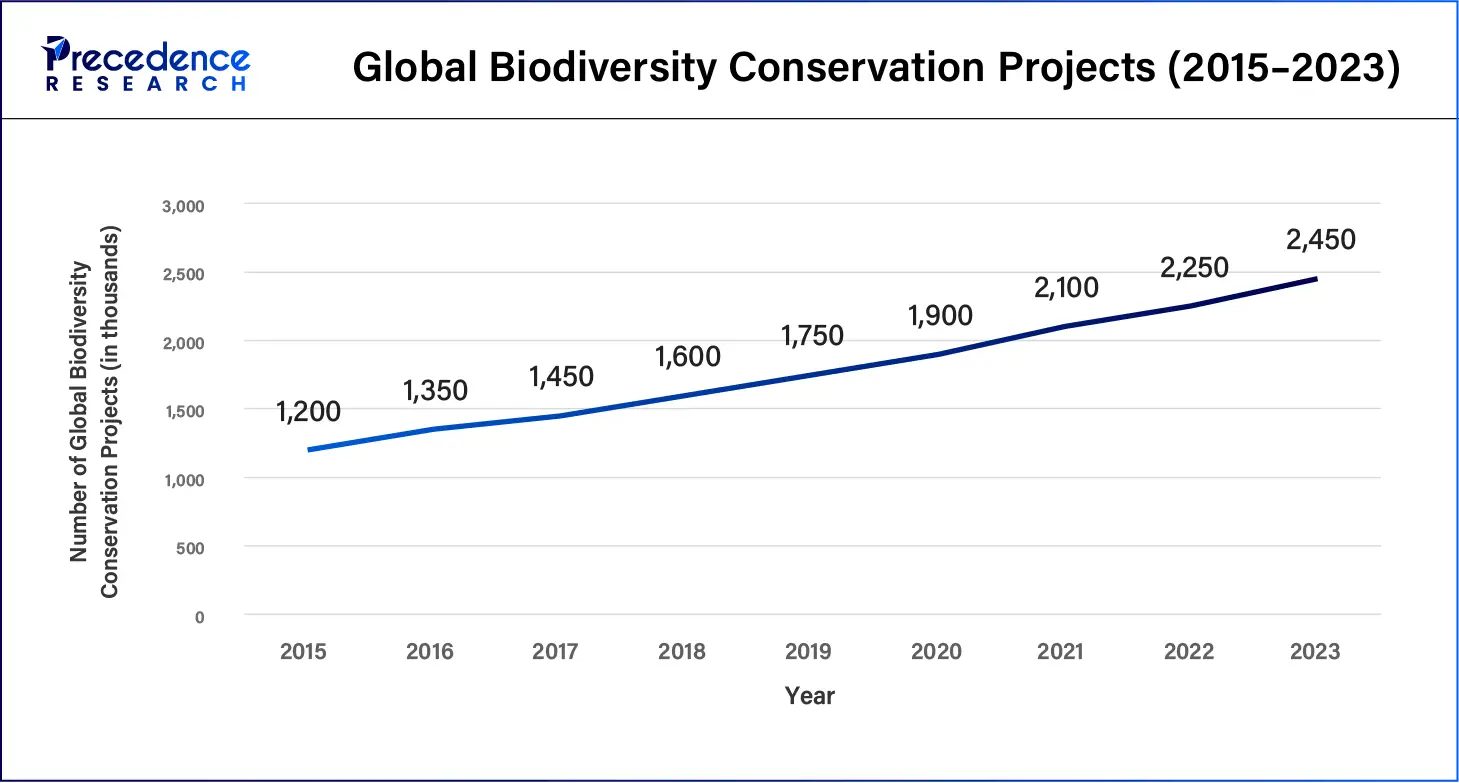

Growing awareness of biodiversity conservation

Growing awareness of the importance of biodiversity conservation is projected to spur the demand for the native grass seeds market. Wildlife-saving activities are over-focusing on the preservation of natural systems, whereby native grasses are essential in checking soil erosion, feeding wildlife, and improving a healthy ecosystem. The soil management policies in most parts of the world are today promoting the planting of autochthonous species in the afforestation and regeneration programs.

The Farm Service Agency (FSA) of the U.S. Department of Agriculture (USDA) began programs such as the Conservation Reserve Program (CRP). This is aimed at paying farmers to use native grasses for land conservation with benefits on the reserves or the quality of the arable land and water bodies. These favorable conditions, along with the growing emphasis on conserving biological diversity and the support of the authorities, are crucial for the native grass seeds market development.

- The European Union's Biodiversity Strategy for 2030 states massive afforestation and the restoration of at least 25,000 km of rivers with significant roles of native species.

- Funding towards the conservation of global biodiversity has steadily risen, with the World Bank Group indicating that its investment in the ecosystem had risen by 21% in 2022.

| Year | Global Biodiversity Conservation Projects (in thousands) | Native Grass Seed Demand (in metric tons) | Major Conservation Programs |

| 2015 | 1,200 | 15,000 | U.S. Conservation Reserve Program (CRP), EU Natura 2000 |

| 2016 | 1,350 | 16,500 | UNEP Ecosystem Restoration Initiatives, African Forest Landscape Restoration |

| 2017 | 1,450 | 17,200 | UN Decade on Ecosystem Restoration Launched |

| 2018 | 1,600 | 18,500 | EU Biodiversity Strategy 2020, Bonn Challenge |

| 209 | 1,750 | 20,000 | Global Environment Facility (GEF) Biodiversity Projects, CRP Expansion |

| 2020 | 1,900 | 21,500 | European Green Deal, UNEP Land Restoration Programs |

| 2021 | 2,100 | 23,000 | EU Biodiversity Strategy for 2030, U.S National Pollinator Protection Strategy |

| 2022 | 2,250 | 24,800 | World Bank Group Ecosystem Investments, African Union Reforestation Efforts |

| 2023 | 2450 | 26,000 | Global Environmental Facility Biodiversity Fund, UN Decade on Ecosystem Restoration |

Restraint

Competition from synthetic and conventional grass solutions

Competition from synthetic and conventional grass solutions is anticipated to restraint the native grass seeds market. Natural grass has been replaced by artificial turf and easily accessible seeds to grow an expensive blend of grass. These product features make them appealing to consumers, as they are easy and quick to maintain. Such preference for synthetic or non-native grass products is likely to restraint the usage of seed from native grass, particularly in the urban markets where aesthetic value is an overriding factor as compared to ecological.

- According to data from the European Commission's Joint Research Centre, synthetic turf sales have increased by nearly 10% per year in Europe in the past five years.

Opportunity

Increasing government and NGO support for habitat restoration

Increasing government and NGO support for habitat restoration projects is anticipated to create immense opportunities for the native grass seeds market. The U.S. Department of Agriculture's Conservation Reserve Program encourages the growing utilization of native grasses to regain soil fertility and prevent soil erosion. In Europe, the Committee of EU Ministers has budgeted billions of Euros under the Green Deal to restore ecosystems and support native plants. Such an increasing trend points to an increased commitment by governments and NGOs to support ecological health.

- The U.S. National Oceanic and Atmospheric Administration (NOAA) states that the rehabilitation of habitats enhances water quality and supports the fish stocks in order to generate the enhanced status of sustainable ecosystems.

- The Society for Ecological Restoration notes a global trend of growing funding for restoration, including a figure of around USD 240 billion per annum.

Product Insights

The warm season segment held a dominant presence in the native grass seeds market in 2024 due to their ability to grow in warmer climates and the low maintenance aspect of production. These turf grasses, Bermuda and Zoysia, are common in the southern parts of the world and are common in lawns, sporting fields, and golf courses. Due to the growth of the xeriscape craze, where landscapes are constructed to require little water, there has been a high demand for grown warm-season grasses. Furthermore, the drought-tolerant characteristics of dahlias have gained increasing admiration, especially in regions that experience dry weather or high temperatures.

- Lawn experts from the Turfgrass Water Conservation Alliance claim that warm-season turf has a poorer water retention ability than that of the cool season turf and, thus, consumes about 30% less water.

The mixture segment is expected to grow at the fastest rate in the native grass seeds market during the forecast period of 2024 to 2034, owing to the need for flexible and durable turf systems. These mixtures contain warm-season and cool-season grasses, which make the lawn suitable for different climate changes and long seasons. Amending mixtures improves turf performance by increasing disease tolerance and soil conditioning factors. This makes them very attractive to horticulturists and lawn managers in both the residential and commercial sectors.

According to the National Turfgrass Federation, blended seed products have become more conspicuous during the past five years, being used in the present high average grass growth rate and appearance all year round. Additionally, the development toward sustainability in landscapes is that mixtures are used to build habitats for biodiversities and are less likely to require chemical fertilizers.

Application Insights

The land conservation & rehabilitation segment accounted for a considerable share of the native grass seeds market in 2024 due to the increasing efforts to restore degraded landscapes and promote biodiversity. Soil erosion, loss of habitats, and the quality of water have become a concern that led to the formation of restoration projects by governments and organizations. The native grass seeds are very important for these undertakings, as they support the growth of local wildlife while helping the sand to coagulate so that it holds water better. Moreover, there are constant environmental recovery activities and increasing concerns regarding proper and sustainable land management.

- The U.S. EPA has stated that attempts to restore the native vegetation of an area cut down the erosion of the soil by up to 75% and even enhance the overall usefulness of the environment a lot.

The landscaping segment is anticipated to grow at the highest CAGR in the native grass seeds market during the studied years, owing to the increasing concern with sustainable and environmentally sound landscaping products. People are looking for appropriate grass to improve the view of their homes or solve the problems of landscape designers. They often turn to native grass seeds as these types of seeds need less care and water than non-native seeds. This new trend in drought landscaping, commonly known as xeriscaping, has increased the number of demands for native grass seeds in landscaping. Awareness towards environmental conservation has grown rapidly, and this is with a shift towards sustainable landscaping practices.

- A survey conducted by the American Society of Landscape Architects (ASLA) reveals that over 50% of these architects have observed a growing interest by clients in the use of native plants for sustainable purposes.

Distribution Channel Insights

The offline stores segment led the global native grass seeds market. Supermarkets, garden centers, agricultural supplies, and home improvement retailers allow customers to touch and see the seed quality. People tend to shop offline when it comes to procuring gardening equipment and supplies since certain personnel advise them on which type of grass to use. Furthermore, the local agricultural extensions and other conservation agencies extend support from the online stores to promote native grasses and encourage the sale of the same from the offline stores.

- According to IBISWorld, the research attests that in 2023, the retail sales in garden centers grew by 4.5% as people continued to buy gardening and landscaping materials.

The online stores segment is projected to expand rapidly in the native grass seeds market in the coming years, owing to the rise in home and convenience in accessing e-commerce sites. Consumers using e-commerce platforms directly information search for native grass seed varieties available on the market. This makes comparisons about price and review without being physically restricted by a certain region. While staying at home due to COVID-19, many consumers learned about the advantages of ordering gardening supplies through the Internet. This segment is also expected to grow further as focused e-commerce sites are developed suggesting native grass seeds with relevant advice and recommendations.

Native Grass Seeds Market Companies

- American Meadows

- Bamert Seed Company

- Everwilde Farms, Inc.

- Hedgerow Farms

- Millborn Seeds Inc.

- Missouri Seeds Southern

- Outsidepride.com, Inc.

- Prairie Seed Farms

- Roundstone Native Seeds LLC

- Star Seed Inc.

- Wildflower Farm

Recent Developments

- In February 2024, the Bureau of Land Management (BLM) announced an investment of nearly USD 18 million to enhance the supply of native seeds in the U.S. This initiative is part of President Biden's broader agenda to combat climate change and strengthen landscape resilience. The funds support the National Seed Strategy Keystone Initiative, aimed at restoring native vegetation and improving the infrastructure for seed collection and production, which includes partnerships with local farmers and Tribal greenhouse facilities.

- In August 2024, the Oklahoma-based company Native Seed Company unveiled a new line of native grass seeds tailored for restoration projects in the Southern Great Plains. These seeds are designed to improve soil health and provide habitat for local wildlife. The new product line includes species such as Little Bluestem and Big Bluestem, which are known for their drought resistance and ability to thrive in local conditions.

Segments Covered in the Report

By Product Type

- Warm Season

- Cool Season

- Mixture

By Application

- Land Conservation & Rehabilitation

- Landscaping

- Animal Grazing & Hay

- Biofuel

- Fertilizers

By Distribution Channel

- Offline Stores

- Online Stores

By Geography

- North America

- Asia Pacific

- Europe

- Latin America

- Middle East & Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting