Network Management System Market Size and Forecast 2025 to 2034

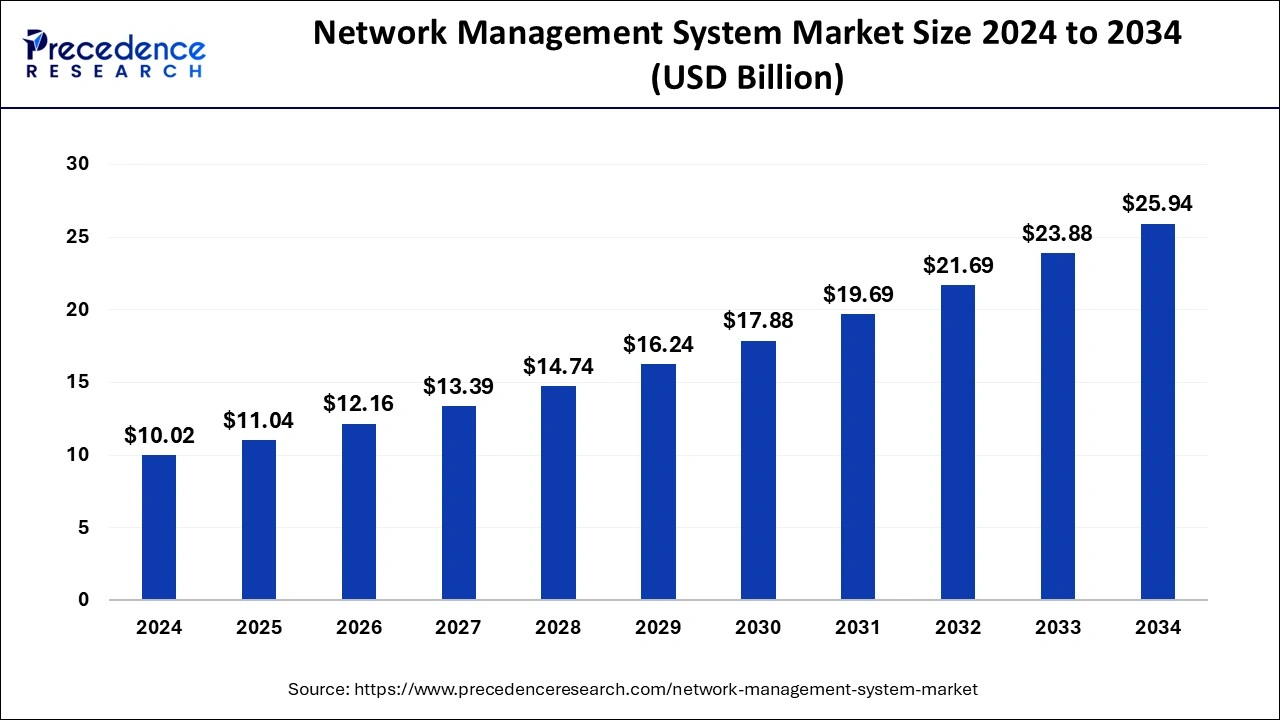

The global network management system market size accounted for USD 10.02 billion in 2024 and is predicted to increase from USD 11.04 billion in 2025 to approximately USD 25.94 billion by 2034, expanding at a CAGR of 9.98% from 2025 to 2034. Owing to prominent offerings such as cloud integration, storage management, and integrated communications management, the rapidly expanding system infrastructuresoftware industry is also contributing to the growth of the network management system market.

Network Management System Market Key Takeaways

- The global network management system market was valued at USD 10.02 billion in 2024.

- It is projected to reach USD 25.94 billion by 2034.

- The market is expected to grow at a CAGR of 9.98% from 2025 to 2034.

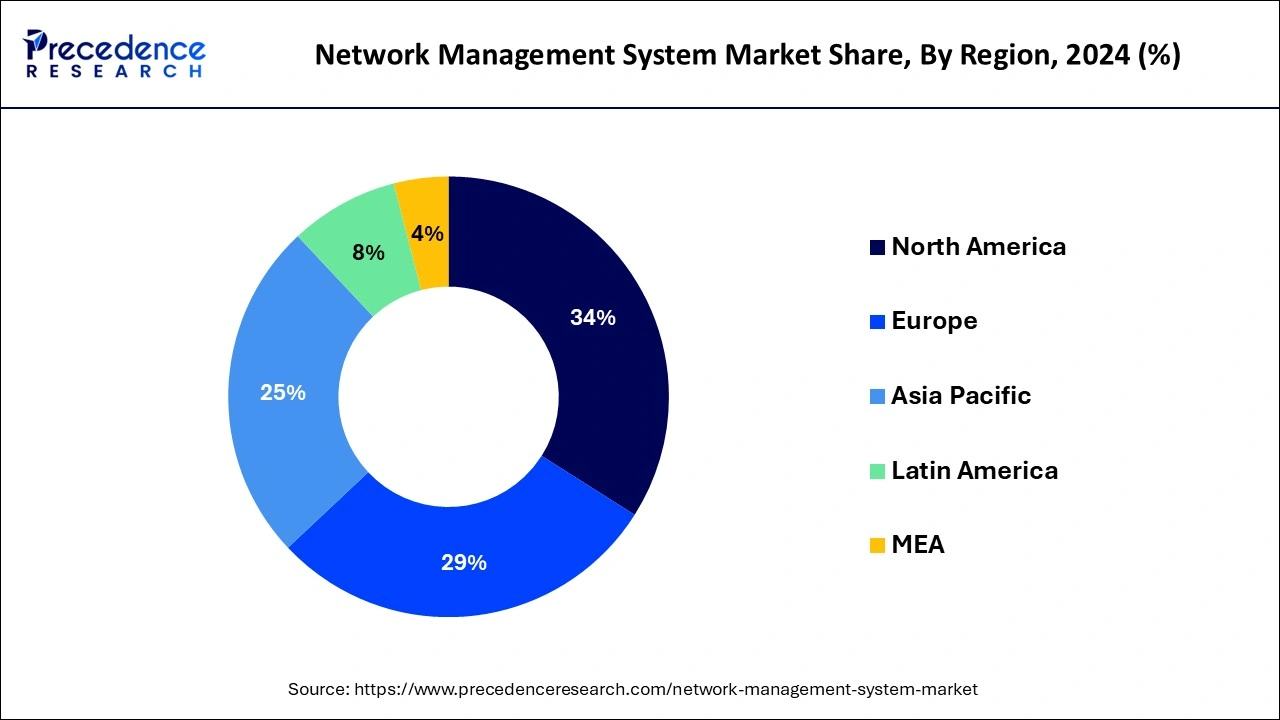

- The North America network management system market size accounted for USD 3.41 billion in 2024 and is expected to attain around USD 8.82 billion by 2034.

- North America led the market with the largest revenue share of 34% in 2024.

- Asia Pacific is expected to grow the fastest during the forecast period.

- By component, the solutions segment has held the major revenue share of 69% in 2024.

- By component, the services segment is expected to grow the fastest during the forecast period.

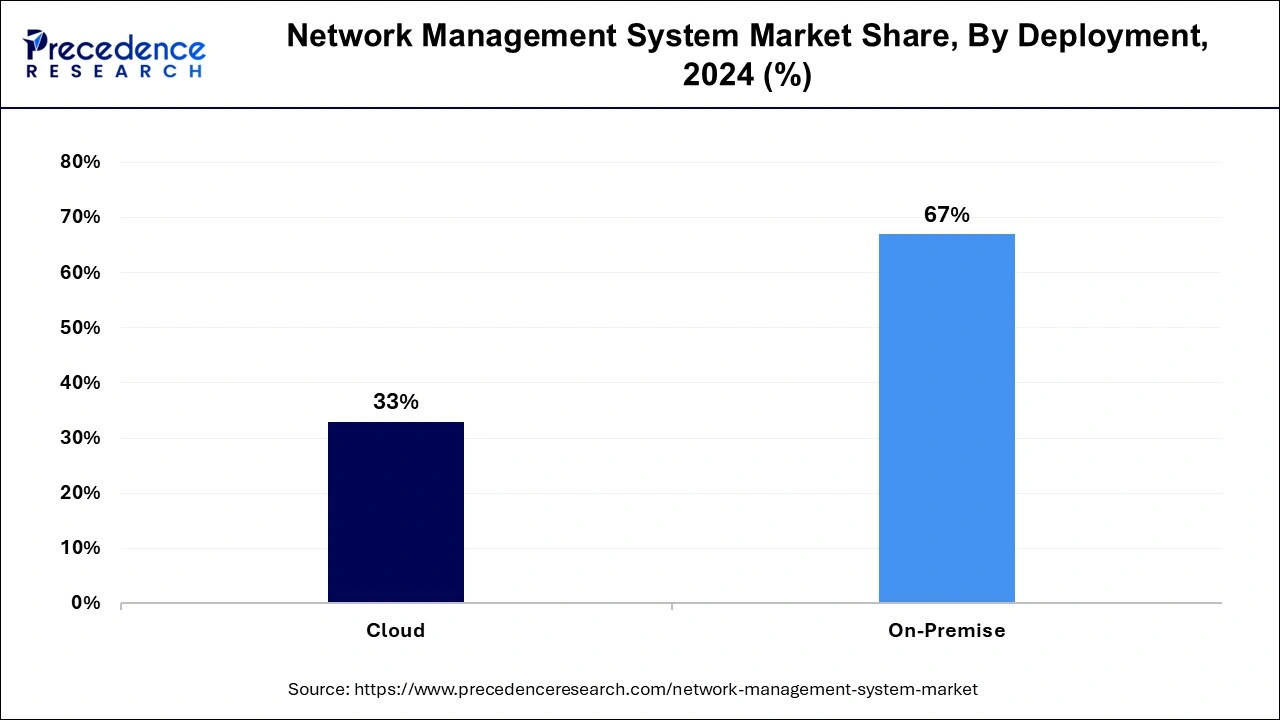

- By deployment, the on-premise segment has contributed more than 67% of revenue share in 2024.

- By deployment, the cloud-based segment is expected to grow the fastest during the forecast period.

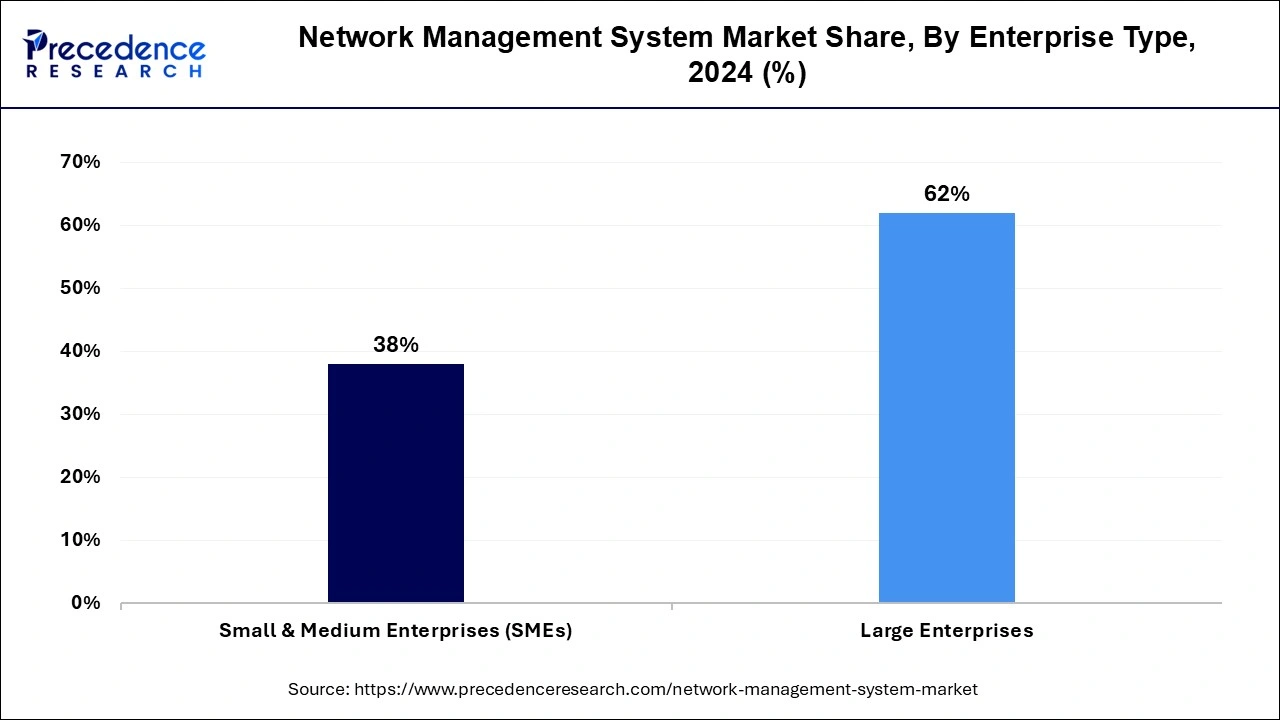

- By enterprise, the large enterprise segment has generated the biggest revenue share of 62% in 2024.

- By enterprise, the small and medium segment is expected to grow the fastest during the forecast period.

- By industry vertical, the IT & telecom segment accounted for the major revenue share 28% in 2024.

- By industry vertical, the healthcare segment is expected to grow the fastest during the forecast period.

U.S.Network Management System Market Size and Growth 2025 to 2034

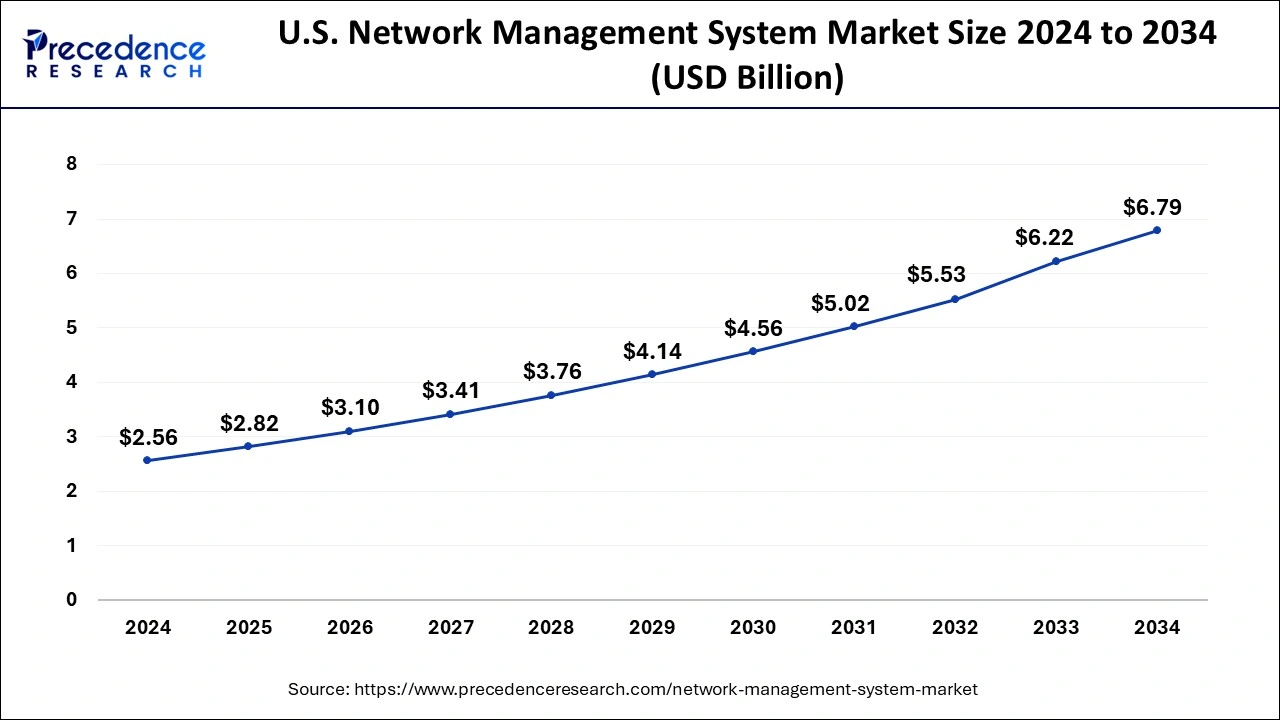

The U.S. network management system market size was exhibited at USD 2.56 billion in 2024 and is projected to be worth around USD 6.79 billion by 2034, growing at a CAGR of 10.25% from 2025 to 2034.

North America held the largest share of the global network management system market in 2024. In 2023, the U.S. held the highest share, followed by Canada. Considering the presence of nations with high gross domestic product (GDP), favorable financial policies, and early adoption of the latest network technologies, the North American market is projected to grow remarkably. North America boasts a highly advanced and well-developed telecommunications infrastructure, including extensive networks of fiber-optic cables, high-speed internet connectivity, and widespread adoption of broadband services. This infrastructure supports the deployment and operation of sophisticated NMS solutions for managing complex network environments.

Asia Pacific is expected to be the fastest-growing region during the forecast period. D-Link Corporation, an Asia-based company, offers a high-end D-View 8 Network Management System. This network management system's key features include versatile network management software, real-time network analytics, role-based administration, an intuitive dashboard, centralized reporting, a flow analyzer (D-View 8 Enterprise Edition), inventory management, batch configuration, firmware management, and service monitoring. Thus, the presence of such well-established network management system companies is encouraging market growth in the Asia Pacific (APAC) region.

Market Overview

Network management refers to a process of administering and managing computer networks within an organization or enterprise. Some of the prominent functions offered by network management systems include fault management, performance management, account management, and security management. The main responsibility of network management systems is to ensure that the computer network functions smoothly, and users have quick, efficient, and easy access to network resources. Network management systems leverage numerous component solutions for optimizing the network's structure. The increasing adoption of network management systems (NMS) to optimize the existing network is driving the market's growth drastically.

Network Management System Market Growth Factors

- Network management systems offer various benefits, such as downtime detection, network visibility, fault detection, and performance optimization, among others.

- Continuous 5G rollouts, increasing investments in IT network infrastructure, and the growing use of networks for the company's external and internal operations are driving the network management system market's growth in recent times.

- As network management systems are cost-effective, they automate the process and decrease overhead IT costs. Since processes get automated with network management systems, IT staff can focus on other crucial tasks, which can significantly enhance the company's work productivity.

- The latest network management systems also tend to decrease downtime and increase flexibility. Thus, owing to all the advantages mentioned, the demand for network management systems is expected to rise drastically.

Market Scope

| Report Coverage | Details |

| Growth Rate from 2025 to 2034 | CAGR of 9.98% |

| Market Size in 2025 | USD 11.04 Billion |

| Market Size in 2024 | USD 10.02 Billion |

| Market Size by 2034 | USD 25.94 Billion |

| Largest Market | North America |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Component, Deployment, Enterprise, and Industry Vertical |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Driver

Software-defined networking (SDN) technology

With significant offerings such as virtual network automation and hybrid networks, the expanding network automation market is anticipated to support the growth of the network management system market across the world. The emergence of software-defined networking (SDN) across various enterprises is acting as a driving factor. Software-defined networking (SDN) technology is a kind of new approach to network management that enables programmatically efficient network configuration. Dynamic programmatically efficient network configuration is necessary for enhancing network monitoring and performance. SDN enables an easy flow of data across distributed locations and also quickly supports moving workloads around a network.

Restraint

Lack of tech infrastructure

The lack of needed tech infrastructure and the initial expenditure involved with network management systems are some of the factors that may hinder the network management system market growth to some extent. Additionally, the high utility of configuration management is creating immense scope for various players operating in the global network management system market.

Opportunity

Collaboration between key players

Important businesses may want to think about joint ventures, partnerships, and cooperation to improve the development of network management services and solutions. Furthermore, the ever-evolving field of network management technology has the potential to render current technologies quickly outdated. The main companies in the industry are anticipated to compete more fiercely as a result.

Component Insights

The solutions segment held the largest share in network management system market in 2023. The solutions segment is further divided into performance management, configuration management, fault management, security management, and account management. Customizable network management solutions that can be personalized as per the client's requirements are expected to contribute to the solutions segment growth. The growth of the solutions segment is also attributable to the increasing concerns over data security and cyber-attacks.

The services segment is predicted to grow at the fastest CAGR during the forecast period. The services segment is further bifurcated into consulting, integration & implementation, and training, support & maintenance. The deployment of network management systems (NMSs) is a complex process that usually requires professional guidance. Network management services look after the integration, deployment, upgradation, and maintenance of the software. These services tend to decrease the company's burden of software deployment.

Deployment Insights

The on-premise segment had the highest network management system market share in 2023. On-premise network management solutions can be deployed as per the company's requirements. This provides better control and customization of the software. Most importantly, opting for an on-premise network management software cuts access to the network for any third parties, thus enhancing the overall security of the network.

The cloud segment is estimated to grow with the highest compounded annual growth rate (CAGR) during the forecast period till 2033. Adopting cloud-based network management solutions removes the hassle involved in the deployment, maintenance, and upgradation of network management. The cloud-based network management system can be accessed and controlled from many locations.

Enterprise Insights

The large enterprise segment dominated the network management system market in 2023. Large enterprises have several aspects that need network management. These aspects include a large number of employees and a large number of network devices. Apart from this, large enterprises have their offices in multiple locations, which needs to be communicated for proper functioning. The incorporation of network management systems helps improve efficiency, reduce revenue loss, reduce human errors, increase productivity, and improve the overall performance of organizations.

The small and medium enterprises segment is anticipated to grow at the fastest rate during the forecast period. There were approximately 23.1 SMEs in the European Union as of 2022. Thus, such a high count of small and medium-sized enterprises is anticipated to create great scope for various wireless network management services. Small and medium enterprises do not have high-tech networks as large enterprises have. Due to this, the risk of data theft and other security issues arise. Better network management solutions can help in reducing these threats. The networks can also have an impact on the growth and development of small and medium enterprises.

Industry Vertical Insights

The IT & telecom segment dominated the network management system market in 2023. IT and telecommunication organizations have large amounts of data, and their entire work is based on commuter networks and other sorts of networks. A huge amount of data is generated every day, which needs to be managed and stored properly. Such data is also vulnerable to data theft, which can be misused. It is humanly impossible to keep track of such a huge amount of data, and therefore, network management systems are needed for proper data management. It improves workflow, reduces human errors, and needs less time, which leads to improved accuracy. Such networks also provide strong security and data processing abilities, which increases safety and efficiency.

The healthcare segment is predicted to grow at the fastest rate during the forecast period. In healthcare, a lot of data is generated, which largely includes patient data followed by staff data and other hospital & clinics related data. Such data is highly sensitive and needs strong protection against data thefts due to ethical and national security reasons. Network management systems can easily do this. Apart from this, having these systems reduces the burden on healthcare professionals, who then can fully focus on treating patients. It improves patient outcomes, patient & staff satisfaction, and the overall functioning of the healthcare industry.

Recent Developments

- In February 2023, D-Link launched two versions of its new D-View 8 Network Management System, the Enterprise Edition (DV-800E) and the Standard Edition (DV-800S). These powerful software solutions are dedicated to comprehensive network management and provide high-precision network monitoring and traffic management. D-View 8 also offers cost-efficient and simple management to enhance network security and optimize performance. D-View 8 offers proactive network monitoring to prevent outages by using immediate diagnostics to resolve respective network issues.

- In March 2023, Steven Zhao, Vice President of Huawei's Data Communication Product Line, announced the launch of a Digital Managed Network Solution. This offering is dedicated to carriers' business-to-business (B2B) services. Huawei's Data Communication's Digital Managed Network Solution supports carriers seize digital transformation opportunities. This solution offers digitally managed network capabilities that help carriers transform from ISPs to MSPs.

Network Management System Market Companies

- SolarWinds Worldwide, LLC.

- NetScout Systems, Inc.

- Broadcom, Inc.

- Cisco Systems, Inc.

- BMC Software, Inc.

- Oracle Corporation

- International Business Machines Corporation

- Nokia Corporation

- Paessler AG

- Viavi Solutions Inc.

- Colasoft, Inc.

- Huawei Technologies Co., Ltd.

- Dell Technologies, Inc.

- Riverbed Technology, Inc.

- Hewlett Packard Enterprise Company

Segments Covered in the Report

By Component

- Solution

- Configuration Management

- Performance Management

- Security Management

- Fault Management

- Accounting Management

- Services

- Consulting

- Integration & Implementation

- Training, Support & Maintenance

By Deployment

- On-Premise

- Cloud

By Enterprise

- Small & Medium Enterprises

- Large Enterprises

By Industry Vertical

- IT & Telecom

- BFSI

- Government

- Manufacturing

- Healthcare

- Transportation & Logistics

- Retail

- Media & Communication

- Others

By Geography

- North America

- Asia Pacific

- Europe

- Latin America

- Middle East & Africa

Get a Sample

Get a Sample

Table Of Content

Table Of Content