Next Generation Memory Market Size and Forecast 2025 to 2034

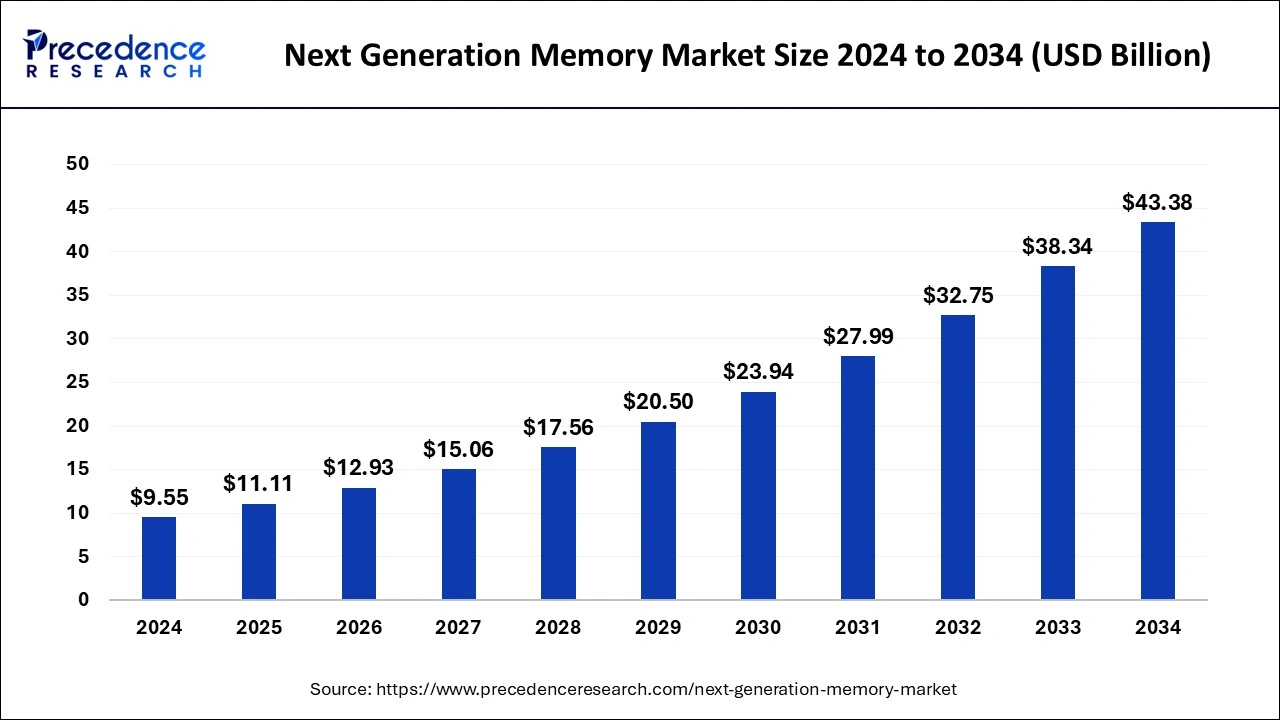

The global next generation memory market size was estimated at USD 9.55 billion in 2024 and is predicted to increase from USD 11.11 billion in 2025 to approximately USD 43.38 billion by 2034, expanding at a CAGR of 16.34% from 2025 to 2034.

Next Generation Memory MarketKey Takeaways

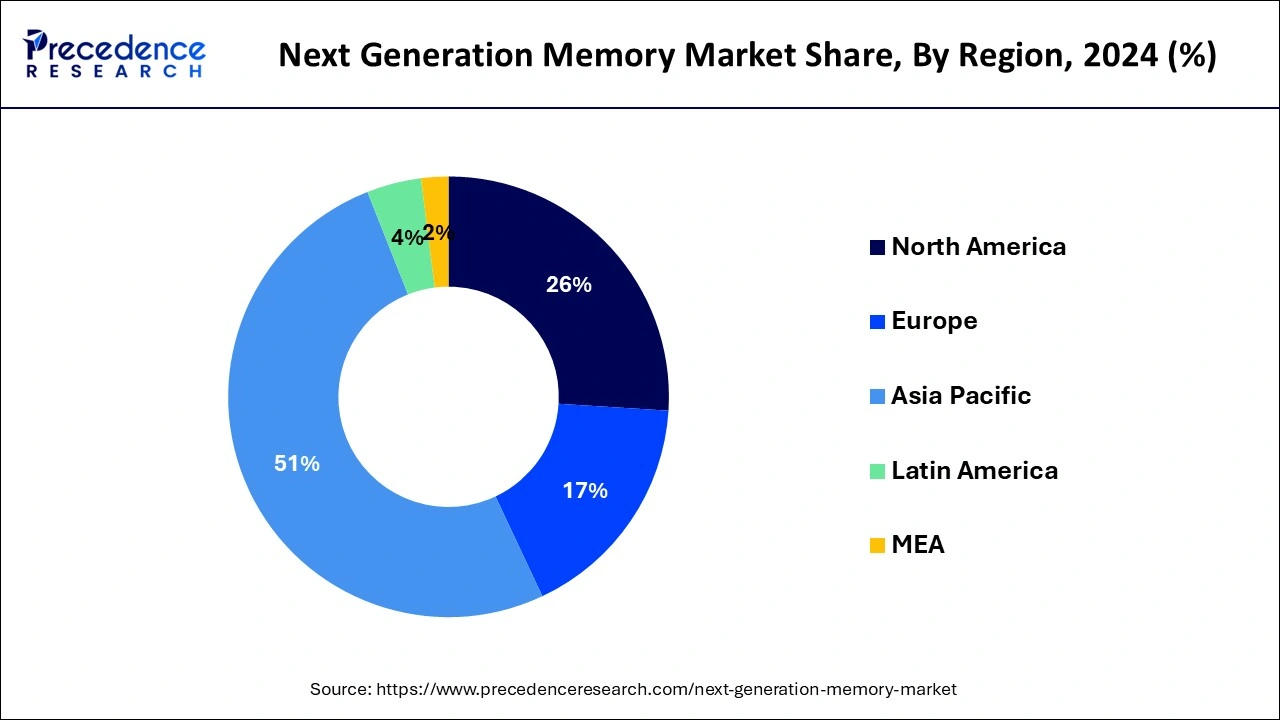

- Asia-Pacific held the largest share of 51% in 2024.

- North America is expected to grow at a CAGR of 25.1% during the forecast period.

- By technology, the non-volatile memory segment held the largest share of 76% in 2024.

- By wafer size, the 300mm segment held the largest share of 61% of the market in 2024.

- By wafer size, the 200mm segment is expected to grow at a significant rate during the forecast period.

- By application, the BFSI segment held the largest share of the market by contributing 32% in 2024.

Asia PacificNext Generation Memory Market Size and Growth 2025 to 2034

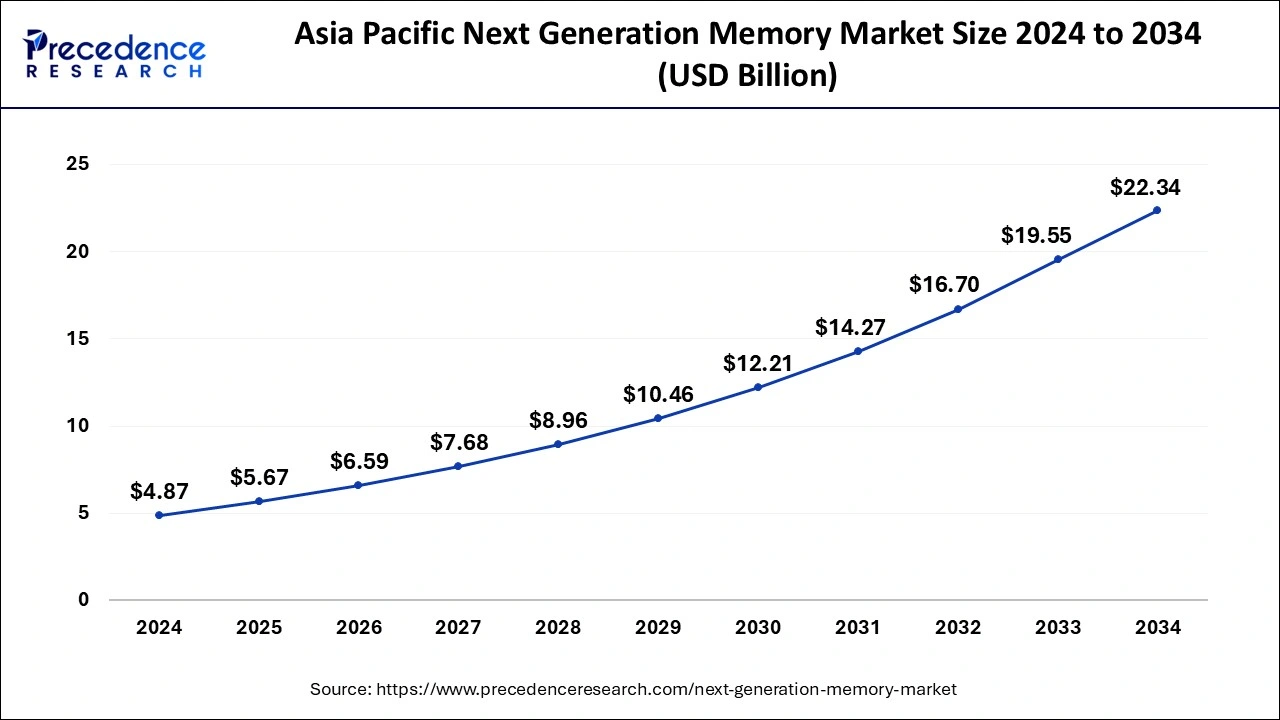

The Asia Pacific next generation memory market size was estimated at USD 4.87 billion in 2024 and is anticipated to reach around USD 22.34 billion by 2034, growing at a CAGR of 16.45% from 2025 to 2034.

Asia-Pacific held the dominating share of 51% in the next generation memory market. The adoption of next-generation memory technology in the region is experiencing significant growth due to factors aligned with its dynamic business landscape. The rapid expansion of mobile technology and the Internet of Things (IoT) across Asia-Pacific has heightened the demand for energy-efficient memory solutions capable of retaining data during power-off situations. This aligns with the region's tech-savvy consumer base and the widespread use of smart devices.

Additionally, Asia-Pacific's robust manufacturing ecosystem positions it as a key location for semiconductor production, facilitating the swift integration of advanced memory technologies into various devices. Along with that, the burgeoning data center industry in the region, driven by the surge in cloud computing and digital services, requires memory solutions that provide speed and energy efficiency.

North America is observed to grow at a CAGR of 25.1% in the next generation memory market during the forecast period. North America is witnessing a swift adoption of next generation memory technologies, fueled by various factors. The continuous demand for enhanced data processing speed, particularly in finance, healthcare, and cloud computing, is compelling companies to adopt advanced solutions to stay competitive and meet evolving customer expectations. North America, with its flourishing technology and semiconductor industry, serves as a hub for innovation and research in memory technologies, with leading companies and research institutions driving development and implementation. Moreover, the growing focus on data security and compliance regulations highlights the significance of non-volatile memory in securing sensitive information.

Market Overview

The next generation memory market offers a significant advancement beyond software-hardware products, representing an ideal alternative to existing mass production memories like SRAM and Flash. The technology comes with distinctive features and is poised to replace current mass production memories in the near future. The escalating demand for enterprise storage applications worldwide is a key driver propelling the growth of the next-generation memory market. The surge in requirements for high bandwidth, low power consumption, and highly scalable memory devices for technologies such as artificial intelligence (AI), Internet of Things (IoT), and big data, coupled with the emerging need for enterprise storage, is accelerating market expansion. The adoption of next-generation infotainment systems and advanced driver assistance systems (ADAS), along with the imperative for memory solutions catering to diverse applications, further contributes to market dynamics.

However, challenges such as higher design costs due to a lack of standardization, issues with storage in niche applications, and the high cost of emerging memory technologies are expected to impede market growth. The lack of stability under extreme environmental conditions poses a challenge to the next-generation memory market in the forecast period.

Next Generation Memory Market Data and Statistics

- In October 2023, Samsung introduced its advanced memory solutions during Memory Tech Day, with the goal of playing a significant role in providing cutting-edge artificial intelligence models for hyperscale applications. The company revealed a range of innovative memory solutions, including the latest Shinebolt HBM3e memory, LPDDR5X CAMM2 solutions based on LPDDR package modules, and the detachable AutoSSD designed for convenient use through storage virtualization. This groundbreaking chip has the potential to revolutionize the future market for PC and laptop DRAM.

- In August 2023, SK Hynix Inc. entered the semiconductor technology race by introducing its latest next-generation high-bandwidth memory (HBM). SK Hynix successfully developed the 5th generation DRAM product, named HBM3E, specifically tailored for high-performance artificial intelligence (AI) applications. HBM, a valuable and high-performance chip, enhances data processing speed by vertically linking multiple DRAMs, surpassing the capabilities of traditional DRAMs.

Next Generation Memory MarketGrowth Factors

Next generation memory represents an advanced category of computer memory technology currently in the developmental stages. These innovations aim to overcome the limitations of traditional memory types like DRAM and NAND Flash. These technologies often provide higher data density, allowing organizations to store more information in a smaller physical space. Embracing these advanced solutions can give businesses a competitive advantage, facilitating faster and more efficient data processing, which is essential in today's data-centric business environment.

Emerging technologies such as AI, machine learning, and edge computing heavily rely on memory technologies that offer rapid access to extensive datasets. These advancements are critical for the development and deployment of cutting-edge applications and services. A notable advantage of next generation memory technologies is their non-volatile nature, meaning they retain data even when power is removed. This characteristic contributes to faster boot times and plays a crucial role in enhancing data integrity, a significant concern for businesses depending on uninterrupted access to critical information.

Market Scope

| Report Coverage | Details |

| Growth Rate from 2025 to 2034 | CAGR of 16.34% |

| Market Size in 2025 | USD 11.11 Billion |

| Market Size by 2034 | USD 43.38 Billion |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | By Technology, By Wafer Size, and By Application |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Driver

Rising demand for high-performance data processing

The increasing demand for high-performance data processing is a result of the rising complexity of data-intensive applications and the necessity for more efficient memory solutions capable of meeting escalating processing requirements. Next generation memory technologies, including MRAM, PCM, and others, are well-suited to address these demands, and their integration into various sectors has led to noteworthy developments. An evident outcome of this heightened demand is the acceleration of innovation within the next generation memory market. These solutions play a crucial role in the success of in-memory computing by providing the high-speed data access required for this approach. In summary, the surging demand for high-performance data processing has acted as a catalyst for transformative changes within the market.

- In October 2023, Micron Technology, Inc. partnered with Qualcomm Technologies, Inc., a company specializing in wireless telecommunication products. In this collaboration, Micron Technology utilized Qualcomm Technologies' Snapdragon 8 Gen 3 mobile platform to launch the 5X (LPDDR5X) memory, featuring low power consumption and a double data rate. Operating at a speed grade of 9.6 gigabits per second (Gbps), the new product provides the rapid performance essential for running generative artificial intelligence (AI).

Additionally, the increasing complexities of modern workloads are driving the demand for accelerated data processing, leading to vast quantities of data and, consequently, a need for advanced memory technologies. These technologies must be adept at seamlessly adapting to the ever-changing requirements of computing systems. The industry's focus has shifted towards the next generation of non-volatile and low-power memory solutions. These innovations play a crucial role in ensuring both energy efficiency and data retention, two critical factors significantly impacting the performance and longevity of mobile and IoT devices.

Restraint

The high manufacturing costs associated with next-generation memories

The manufacturing costs of high-density DRAM and SRAM are relatively high, and the current production costs of high-bit-density next generation memories are also elevated. Next-generation memory technologies often entail more intricate manufacturing processes compared to traditional memory technologies. These processes may necessitate specialized equipment, materials, and expertise, thereby contributing to higher costs.

In the initial stages of development and production, next-generation memory technologies may encounter lower production yields, attributed to issues like defects, process variations, or materials challenges. Lower yields result in a higher cost per functional chip. Some next generation memory technologies may depend on advanced and expensive materials, further impacting overall manufacturing costs. Additionally, the more complex manufacturing processes for next-generation memory technologies may lead to longer manufacturing cycles and slower throughput, thereby increasing manufacturing costs.

Opportunity

Rising acceptance of advanced memory technologies in embedded systems and IoT devices

The increasing adoption of next generation memory technologies, such as MRAM and ReRAM, provides a significant opportunity for market players. These advanced memories offer fast read and write speeds, low power consumption, and non-volatility, making them well-suited for integration into embedded systems and IoT devices. The benefits include instant-on capabilities, improved energy efficiency, and enhanced data retention in smart devices. Thus, the rising acceptance of advanced memory technologies is observed to offer multiple growth opportunities for the next generation memory market.

The high endurance of MRAM and ReRAM allows them to withstand a large number of read and write cycles without degradation, a crucial feature for applications where data is frequently updated. This ensures the long-term reliability and longevity of IoT and embedded devices. Moreover, the compact size of MRAM and ReRAM memory cells facilitates high-density memory storage in a small footprint, making them suitable for space-constrained embedded systems. Their fast write speeds make them ideal for applications like data logging and edge analytics, where real-time data processing and storage are crucial.

Technology Insights

The non-volatile segment dominated the next generation memory market with 76% market share in 2024. Non-volatile memory, which includes Hybrid Memory Cube (HMC) and High-bandwidth Memory (HBM), offers several advantages crucial for contemporary businesses. Notably, its ability to retain data even when power is removed ensures faster boot times and improved data integrity—essential for applications prioritizing data consistency, such as financial transactions and critical data storage.

Additionally, non-volatile technology plays a central role in enhancing energy efficiency, extending battery life in mobile devices, and reducing operational costs in data centers. The energy-saving attributes of non-volatile technology make it an attractive choice, aligning with the growing emphasis on sustainability and cost-effectiveness in business strategies. Moreover, the higher endurance of these technologies, enduring more read and write cycles before degradation, ensures long-term reliability and cost savings, particularly in environments with heavy data usage.

The volatile segment includes Magneto-Resistive Random-Access Memory (MRAM), Static Random Access Memory (SRAM), Ferroelectric RAM (FRAM), Nano RAM, Resistive Random-Access Memory (ReRAM), and Others (Phase change RAM & STT-RAM). Volatile technologies boast exceptional speed, providing faster read and write operations than traditional memory. This heightened performance significantly enhances overall system responsiveness and productivity, crucial factors in data-driven industries. Volatile technologies also contribute to reduced energy consumption, making them an environmentally friendly choice that can lead to cost savings in energy-intensive data center operations. Additionally, these solutions offer impressive endurance, with the ability to endure a high number of read and write cycles before showing signs of wear and tear.

Wafer Size Insights

The 300 mm segment held a dominant share of the global next generation memory market while carrying 61% market share in 2024. The preference for adopting 300 mm wafer size is strategically advantageous in this market, offering increased production efficiency and economies of scale. The use of larger wafers, such as 300 mm, results in higher throughput and lower production costs per unit. This scalability proves especially beneficial in high-volume production scenarios, like data centers and consumer electronics, where optimizing costs and improving yields are crucial. Furthermore, the trend in favor of larger wafer sizes aligns with industry requirements for intricate designs and manufacturing processes of cutting-edge memory components.

The 200 mm segment is expected to witness a substantial CAGR throughout the forecast period. The utilization of 200 mm wafer size in the semiconductor industry brings notable business advantages, primarily in terms of cost-effectiveness. The manufacturing of smaller wafers tends to be more economical, appealing to businesses looking to optimize production processes and reduce expenses while maintaining the quality and performance of next-generation memory components. The attractiveness of 200 mm wafers is particularly notable for niche markets and specialized applications, where smaller production volumes suffice. The flexibility offered by these wafers allows companies to meet unique customer demands without the necessity for high-volume production facilities. Therefore, the adoption of 200 mm wafers continues to be driven by the pursuit of cost-efficiency and adaptability in the dynamic landscape of next-generation memory technology.

Application Insights

The BFSI segment dominated the next generation memory market while carrying a 32% market share in 2024. Integration of next-generation memory technologies in the BFSI sector yields substantial benefits. These solutions contribute to enhanced speed and efficiency, crucial for improving real-time transaction processing and data analytics capabilities. For financial institutions, this translates into faster and more accurate decision-making, a critical factor in markets where microseconds can make a significant impact.

Additionally, the non-volatile nature of specific next-gen memory types ensures data integrity, playing a crucial role in maintaining trust and regulatory compliance. Given the increasing volume of financial data and the imperative for robust security measures, next-generation memory serves as a catalyst for enhancing operational efficiency and data security in the BFSI sector.

Next Generation Memory Market Companies

- Micron Technology, Inc. (United States)

- Samsung Electronics Co., Ltd. (South Korea)

- SK Hynix Inc. (South Korea)

- Intel Corporation (United States)

- Western Digital Corporation (United States)

- Toshiba Memory Corporation (Japan)

- Fujitsu Ltd. (Japan)

- Adesto Technologies Corporation (United States)

- Crossbar Inc. (United States)

- Everspin Technologies Inc. (United States)

- Viking Technology (United States)

- Avalanche Technology Inc. (United States)

- Spin Memory Inc. (United States)

- Nantero Inc. (United States)

- Cypress Semiconductor Corporation (United States

Recent Developments

- In April 2023, SK Hynix Inc. of South Korea achieved a significant industry milestone by developing a 12-layer HBM31 product with a memory capacity of 24 gigabytes (GB), marking the largest capacity in the industry. This achievement represented a 50% increase in memory capacity compared to the previous product, following the company's mass production of the world's first HBM3 in June 2022.

- In May 2022, Everspin Technologies Inc. based in the United States introduced the STT-MRAM EMxxLX xSPI Family, featuring densities ranging from 8 Mbit up to 64 Mbit.

- In March 2022, Fujitsu Semiconductor Memory Solution Limited in Japan launched a 12Mbit ReRAM (Resistive Random Access Memory) known as MB85AS12MT, representing the highest density in Fujitsu's ReRAM product family. The MB85AS12MT is a non-volatile memory with a 12Mbit memory density and operates within a wide power supply voltage range from 1.6V to 3.6V.

Segments Covered in the Report

By Technology

- Non-volatile Memory

- Volatile Memory

By Wafer Size

- 200 mm

- 300 mm

By Application

- Consumer Electronics

- Enterprise Storage

- Automotive & Transportation

- Military & Aerospace

- Industrial

- Telecommunications

- Energy & Power

- Healthcare

- Agricultural

- Retail

- Others

By Geography

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting