Nitric Acid MarketSize and Forecast 2025 to 2034

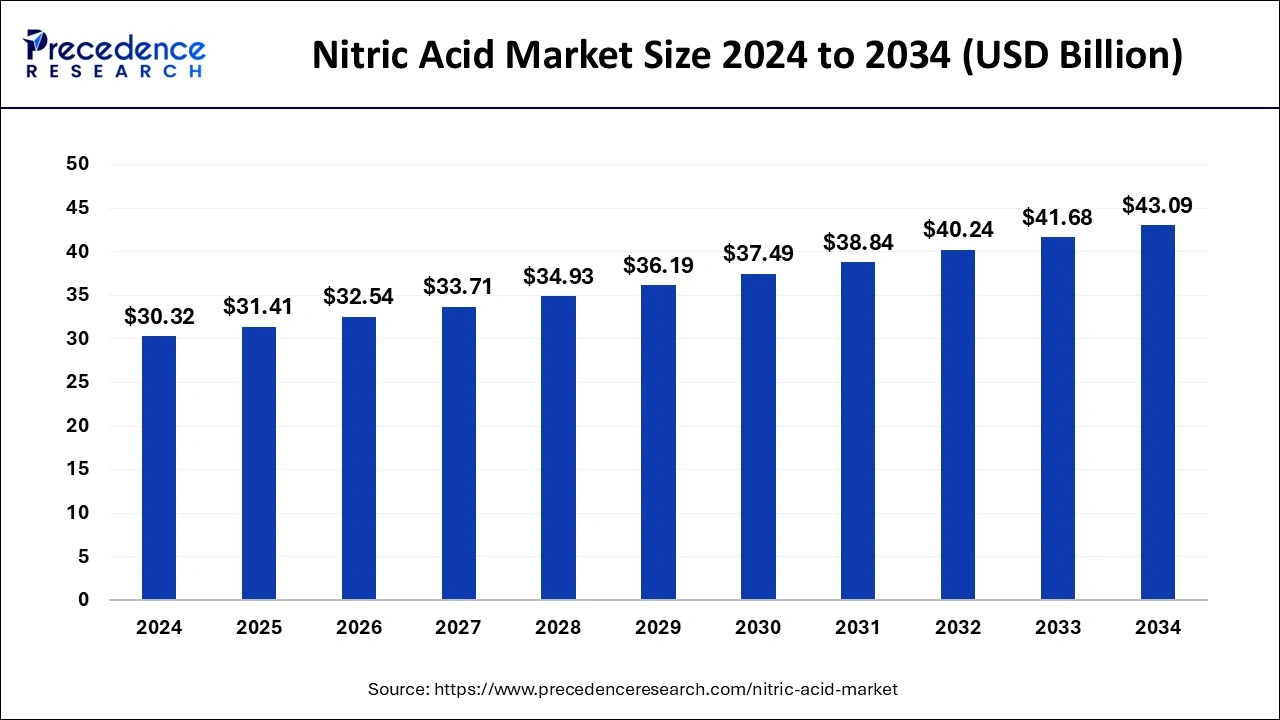

The global nitric acid market size accounted for USD 30.32 billion in 2024 and is expected to exceed around USD 43.09 billion by 2034, growing at a CAGR of 3.58% from 2025 to 2034.

Nitric Acid Market Key Takeaways

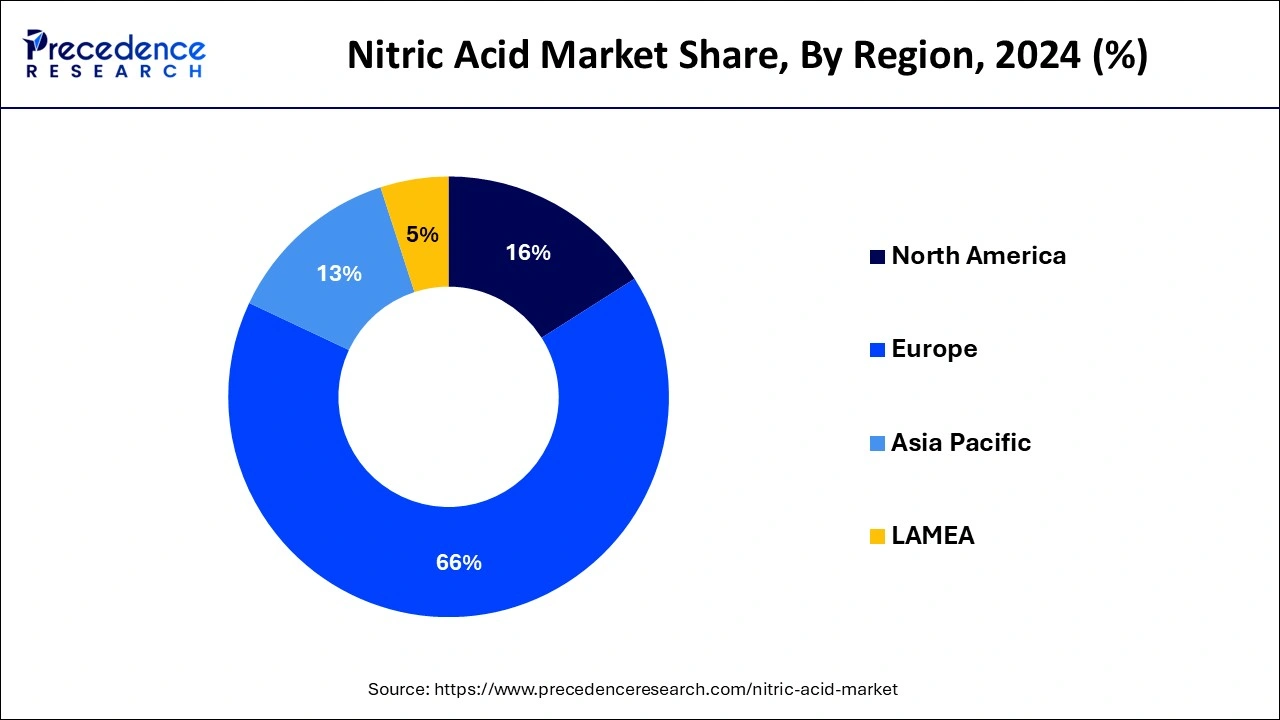

- Europe dominated the nitric acid market with a share of 65.84% in 2024.

- By applications, the fertilizer segment has captured a revenue share of over 81% in 2024.

- The nitrobenzene segment accounted for 4.5% of revenue share in 2024.

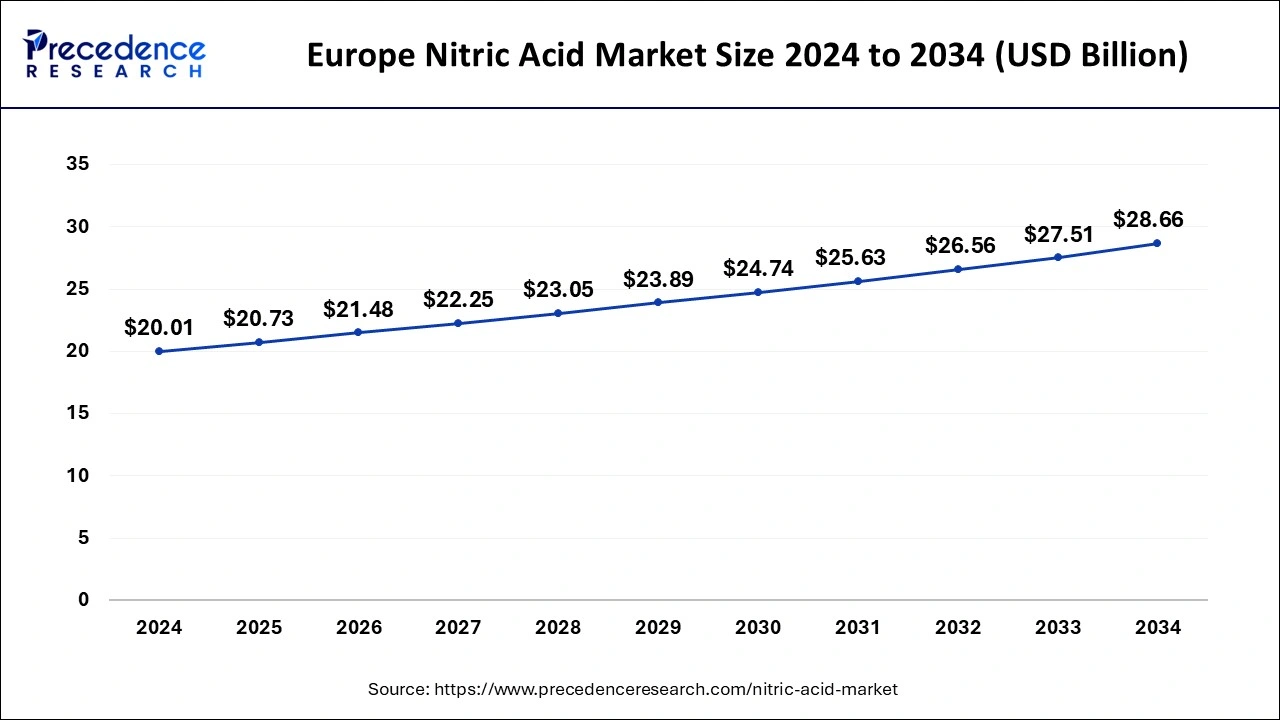

Europe Nitric Acid Market Size and Growth 2025 to 2034

The Europe nitric acid market size was exhibited at USD 20.01 billion in 2024 and is projected to be worth around USD 28.66 billion by 2034, growing at a CAGR of 3.66% from 2025 to 2034.

Europe held the largest share of the nitric acid market in 2024. The overall presence of major key players and the wide scope of application in several European countries create a strong base for the market to grow in the region. Large-scale infrastructure projects in multiple European countries require significant amounts of explosives for construction activities. This, in turn, fuels the demand for nitric acid. Nitric acid is used to manufacture adipic acid, a precursor for nylon production. The growing automotive and aerospace industries in the region require high-performance materials like nylon for various applications, boosting the demand for nitric acid.

Asia-Pacific is expected to continue to be among the most alluring markets. Nitric acid is in high demand in the agriculture sector in nations like India, China, and Japan due to the financial development and growing populations in these nations. China, which dominates the Asia Pacific region due to its fast population growth, expanding infrastructure projects, and rising middle-class income, is also consuming a lot of HNO3. Due to the rising production of cotton, wheat, and potatoes in nations like India, and China, fertilizer is one of nitric acid's most often utilized applications in the Asia Pacific region. The requirement for nitric acid in the area will rise throughout the course of the projected period as a result of these causes. Due to the presence of developing nations like China and India, whose sizable populations, improved infrastructure, and rising standard of living have all contributed to an increase in the region's demand for nitric acid, the Asia Pacific region currently holds the largest market share in terms of value and volume.

Due to the region's strong demand, the North American region is the largest market, followed by the Asia-Pacific region. Some of the reasons for this include the region's quick technological progress and rise in disposable income. The key drivers of market growth are the rising demand for lighter and more fuel-efficient automobiles and the expansion of new building and renovation projects. This is fueling this sector together with the expanding fashion industry in the area. The industries' fast expansion, such as construction, automotive, agricultural, and furniture, the nitric acid market is projected to continue to see strong growth. Nitric acid of the highest caliber is required by these sectors to manufacture fertilizers and nylon. Additionally, there has been an increase in demand for ammonium nitrate from the mining sector to make explosives, which is propelling the growth of the entire market.

Market Overview

With the formula HNO3, nitric acid is a nitrogen oxoacid. Nitric acid is created when the nitrogen atom forms equivalent bonds with two more oxygen atoms and a hydroxy group, forming nitric acid. This substance is a nitrate's conjugate acid. Also, a powerful oxidizing agent is a nitric acid. It is described as an indistinct liquid used in the production of organic and inorganic nitrates and nitro compounds for dye intermediates, fertilizers, explosives, and a variety of other organic chemicals.

Nitric acid is a poisonous liquid that emits suffocating red or yellow fumes in the damp air. It quickly becomes an effective conductor of electricity by ionizing in the solution. The existence of international firms, who are always coming out with new products to get a greater piece of the nitric acid market, makes the global nitric acid market very competitive. Growing consumer demand for lightweight automobiles has forced manufacturers to concentrate on research and development in the automotive industry. As a result, nitric acid has a significant potential for intake.

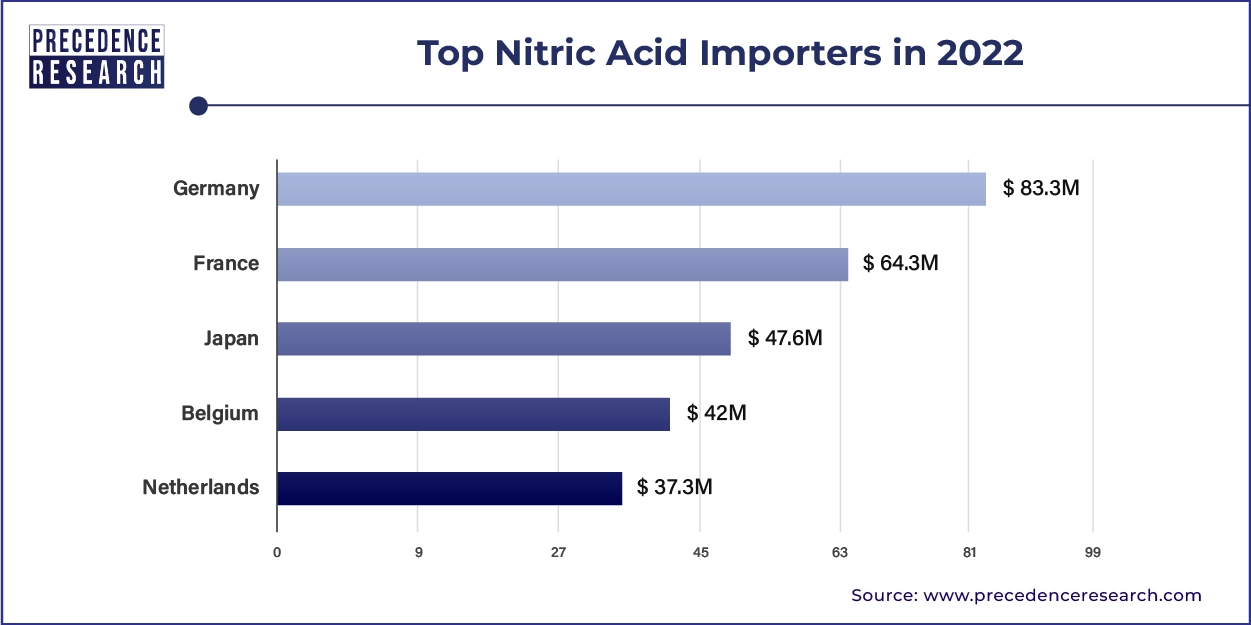

Nitric Acid Importers in 2022

In 2022, the global trade landscape for nitric acid saw significant movements, with Germany leading the pack as the top importer. Germany imported nitric acid worth $83.3 million, followed closely by France at $64.3 million. Japan secured the third position with imports totaling $47.6 million. Belgium and the Netherlands also made substantial contributions to the import market, with $42 million and $37.3 million respectively. These countries have robust industrial sectors that utilize nitric acid for various applications, including fertilizers, explosives, and chemical manufacturing, which drives their high import volumes.

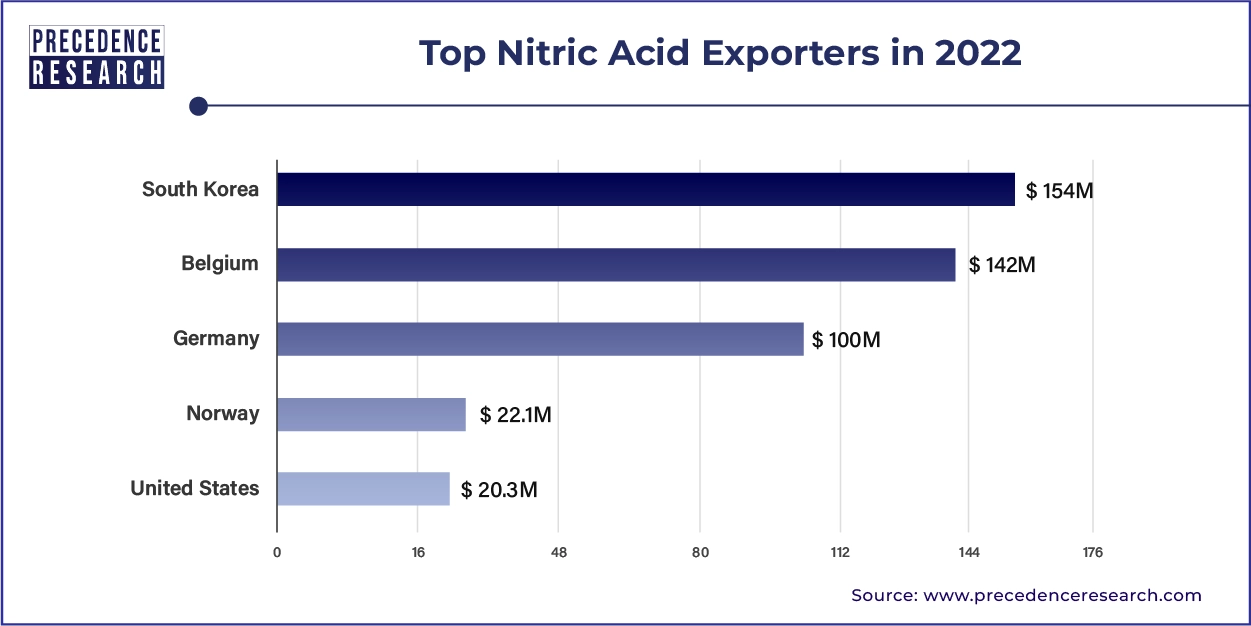

Top Nitric Acid Exporters in 2022

On the export front, South Korea emerged as the leading exporter of nitric acid in 2022, with exports valued at $154 million. Belgium was a close second, exporting $142 million worth of nitric acid. Germany, not only a top importer but also a significant exporter, recorded exports worth $100 million. Norway and the United States rounded out the top five exporters, with $22.1 million and $20.3 million respectively. These figures highlight the dynamic nature of the nitric acid market, where countries with advanced chemical manufacturing capabilities dominate the export landscape, catering to the global demand for this essential industrial chemical.

Nitric Acid Market Growth Factors

The rising need for nylon in the manufacture of automobiles is the driving force behind the nitric acid market. Cyclohexanol, cyclohexanone, and nitric acid are all oxidized to create adipic acid. Adipic acid is used to create nylon, a material widely utilized in the car industry. In the production of automobiles, nylon materials are employed as a replacement for heavy metal parts. Because nylon is regarded as a lightweight material, vehicles made of nylon are lighter and require less gasoline, which reduces carbon emissions. As a result, nitric acid demand has increased. The growth in the demand for polyurethane foam is another factor supporting the nitric acid market.

- The rising research and development operations

- Increasing demand from the end-use market

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 31.41 Billion |

| Market Size in 2024 | USD 30.32 Billion |

| Market Size by 2034 | USD 43.09 Billion |

| Growth Rate from 2025 to 2034 | CAGR of 3.58% |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Application, End-Use, Concentration, and Distribution Channel |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

- Rising demand for fertilizers - The increasing demand for the product in end-use industries is responsible for the expansion of the nitric acid market. Nitric acid's demand in the market is projected to increase due to its expanding application in the production of many agrochemicals, including ammonium nitrate, urea ammonium nitrate, and calcium ammonium nitrate. During the anticipated period, a significant factor driving the nitric acid market is anticipated to be the rising demand for fertilizers caused by the increased need for high crop yields to reflect the growing need for crops.

- Increased construction activity - Growing construction activity stimulates the market because Toluene di-isocyanate (TDI) and HNO3 are utilized as intermediates in the production of polyurethane foams, floor and wood coatings, and insulation products. A further element driving the growth of the HNO3 market is the improvement in consumer lifestyles, rising renovation activity, and new government infrastructure projects.

- Increased need for lightweight vehicles - Manufacturers are beginning to concentrate on innovation and development within the automotive sector as a result of the rising consumer demand for lightweight vehicles. Because of this, there are now many opportunities for increased nitric acid consumption, which has helped the market grow. The manufacture of adipic acid, which is used to make nylon, requires nitric acid as a necessary ingredient. In order to lighten automobiles and increase their fuel efficiency, nitric acid manufacturers are switching from metal-based composites to those based on polymers, such as nylon. The production of lighter cars has also become more and more important due to the growing population and increased customer demand for private automobiles. This has stiffly set back efforts to make lighter automobiles. This is a result of government regulations intended to reduce carbon dioxide emissions, which have prompted chemical companies to employ their more sophisticated understanding in the creation of vehicle solutions that are both economical and fuel-efficient. This market gains from the growing trend for lighter cars, which is what is behind this development.

Key Market Challenges

- Standards, norms, and laws - The government's implementation of strict limitations on a variety of industrial uses related to the creation of fertilizers and the use of nitric acid in agrochemicals would further slow the market's rate of expansion. The market scenario will get worse if there are no rules for uniformity. Nitric acid is emitted as a result of the manufacturing of chemicals, driving automobiles, and dumping of contaminated effluent from agricultural fields. The respiratory system may have trouble breathing in environmental pollutants. Government regulations designed to reduce environmental harm and reduce industrial waste production are preventing the market from growing. Growing concerns about the amount of carbon dioxide that vehicles release is putting more pressure on the market.

Key Market Opportunities

- Increasing mining activities - As a result of the increase of mining operations globally, the global market for nitric acid is continually providing more appealing chances for nitric acid manufacturers. Nitric acids are therefore often employed in the mining industry as explosives and blasting agents. Additionally, the variety of business prospects accessible to industry players on the worldwide market is growing as nitric acid is being used as an oxidizer in rocket propellants.

Application Insights

On the basis of application, the fertilizers segment is expected to have the largest market share in the coming years period. This is because more products are being used in the large-scale production of different fertilizers, including ammonium nitrate and nitro phosphates. The increased food demand and agricultural activities are a result of the rising consumer household incomes. The increased use of fertilizers to increase agricultural output and meet the rising demand for organic and high-quality foods would significantly contribute to the market's expansion. Nitric acid's rising demand from the agricultural sector has benefited the market. The industry is anticipated to benefit greatly from increased production of agrochemicals such as pesticides, insecticides, and fertilizers.

Due to increased penetration in the textiles, automotive, and tire industries, the demand for nitric acid in the adipic acid application segment is expected to rise profitably. The product is indicating a significant presence in the manufacture of lighter cars and vehicle parts. Expanding the market's application potential for nylon and resin production will also be beneficial.

End-Use Insights

On the basis of end-use, the agrochemicals segment is expected to have the largest market share in 2023. The need for ammonium nitrate, which is made from nitric acid, has increased due to the rising demand for fertilizers in developing nations like India, China, and Brazil. Additionally, the market share will expand in the anticipated time due to an increase in demand brought on by greater consumer knowledge of fertilizers.

Nitric Acid Market Companies

- BASF SE

- Apache Nitrogen Products Inc.

- CF Industry Holdings, Inc

- Dupont

- Nutrien Ltd.

- Omnia Holding Limited

- Rashtriya Chemical & Fertilizers Ltd.

- Thyssenkrupp AG

- Yara International ASA

Recent Developments

- In April 2021 –A nitric acid production plant with a 400-kiloton annual production capacity will be built at Yeosu Industrial Complex, south of Seoul, South Korea, by Hanwha Corporation for KRW 190 billion (about USD 170 million). As a consequence, by 2024, the company's capacity to create nitric acid yearly is anticipated to increase by half, from 120 kilotons at now to 520 kilotons.

Segments Covered in the Report

By Application

- Fertilizers

- Adipic Acid

- Toluene Diisocyanate

- Nitrobenzene

- Others

By End-Use

- Explosives

- Agrochemicals

- Electronics

- Automotive

- Others

By Concentration

- Dilute Nitric Acid (68%)

- Concentrated Nitric Acid (69% 71%)

By Distribution Channel

- Direct/Institutional Sales

- Retail Sales

- Others

By Geography

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa (MEA)

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting