Electronic Grade Nitric Acid Market Size and Forecast 2025 to 2034

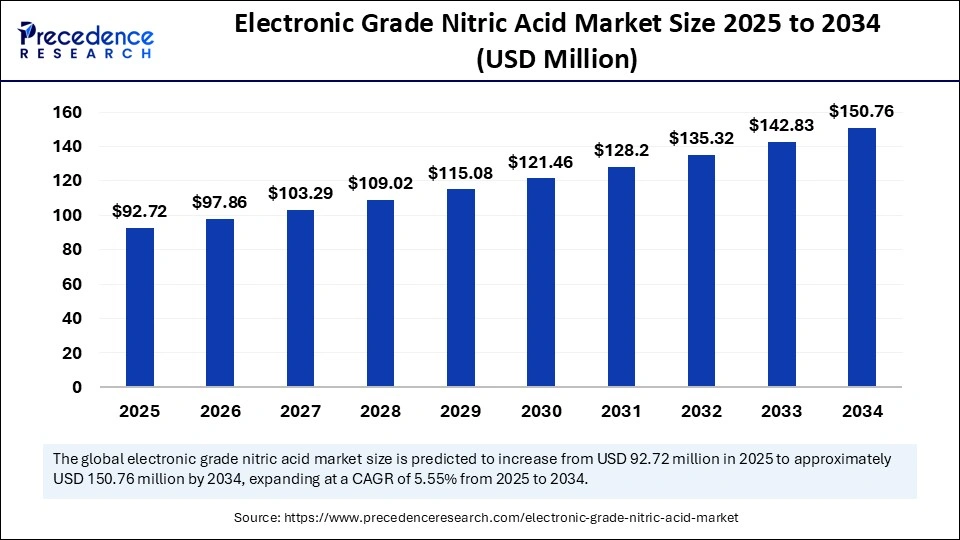

The global electronic grade nitric acid market size accounted for USD 87.84 million in 2024 and is predicted to increase from USD 92.72 million in 2025 to approximately USD 150.76 million by 2034, expanding at a CAGR of 5.55% from 2025 to 2034. The rising production of semiconductors and electronic devices and ongoing technological advances are likely to boost the growth of the market.

Electronic Grade Nitric Acid MarketKey Takeaways

- In terms of revenue, the electronic grade nitric acid market is valued at $92.72 million in 2025.

- It is projected to reach $150.76 million by 2034.

- The market is expected to grow at a CAGR of 5.55% from 2025 to 2034.

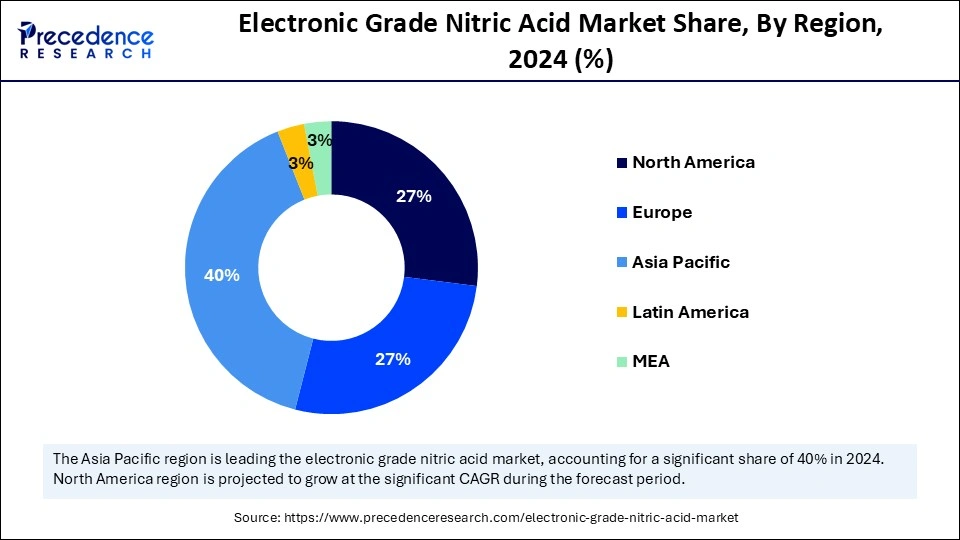

- Asia Pacific dominated the electronic grade nitric acid market with the largest share of 40% in 2024.

- North America is expected to expand at the fastest CAGR in the market between 2025 and 2034.

- By product type, the EL grade segment held the biggest market share of 51% in 2024.

- By product type, the VL grade segment is expected to grow at the highest CAGR of 5.94% between 2025 and 2034.

- By application, the semiconductor segment captured the major market share of 57% in 2024.

- By application, the solar energy segment is expected to grow at a significant CAGR of 5.95% during the forecast period.

How Artificial Intelligence is Reshaping the Electronic Grade Nitric Acid Industry

Artificial Intelligenceis driving a transformative shift in the market for electronic grade nitric acid, redefining how this ultra-pure chemical is produced, tested, and deployed. AI-powered predictive analytics are helping manufacturers optimize acid purification processes, reducing impurities to parts per billion with unprecedented consistency. Machine learning algorithms are streamlining quality control, enabling real-time monitoring of production conditions, and proactively identifying potential contaminations or inefficiencies. In semiconductor fabs, AI aids in determining the ideal usage patterns of nitric acid, minimizing waste, and enhancing yield. This intelligent integration of AI not only boosts productivity but also aligns with growing sustainability goals in the chemical and electronics industries.

Asia Pacific Electronic Grade Nitric Acid Market Size and Growth 2025 to 2034

Asia Pacific electronic grade nitric acid market size was exhibited at USD 35.14 million in 2024 and is projected to be worth around USD 61.06 million by 2034, growing at a CAGR of 5.68% from 2025 to 2034.

Why did Asia Pacific Dominate the Electronic Grade Nitric Acid Market in 2024?

Asia Pacific dominated the market by holding the largest revenue share of 40% in 2024. This is mainly due to the rising production of electronic devices. The region is home to the world's most advanced and large-scale electronics and semiconductor manufacturing hubs. Countries like China, South Korea, Taiwan, and Japan are the backbone of global chip production, hosting leading foundries such as TSMC, Samsung, and SMIC, which demand extremely high-purity chemicals like EL and VL-grade nitric acid for wafer cleaning and etching.

China is aggressively investing in semiconductor self-sufficiency under its "Made in China 2025" initiative, while South Korea has committed billions to semiconductor expansion plans. Taiwan continues to dominate logic chip manufacturing, contributing significantly to demand. Furthermore, the region benefits from a robust ecosystem of chemical suppliers, competitive labor, and efficient logistics that support just-in-time delivery of hazardous ultra-pure substances. Asia Pacific also leads in solar energy manufacturing, which drives the demand for nitric acid in photovoltaic applications. The region's unmatched scale, government support, and technological edge ensure its continued leadership in the global market.

What Factors are Contributing to North America's Rapid Growth?

North America is expected to grow at the fastest CAGR in the coming years. This is mainly due to regional players' strategic move to secure supply chains and reduce reliance on Asian manufacturing. With the passing of the CHIPS and Science Act, the U.S. government is investing billions of dollars into domestic semiconductor production, prompting the construction of advanced fabs by giants like Intel, TSMC (Arizona), and Samsung (Texas). This rapid expansion requires a localized and reliable supply of electronic-grade chemicals, including nitric acid. As these new fabs come online, demand for ultra-high purity chemicals is expected to skyrocket, especially for EL and VL grades used in advanced node production and packaging.

In addition, North America is experiencing a clean energy renaissance, with strong federal incentives for solar energy adoption. This is stimulating the demand for nitric acid for PV cell manufacturing, especially as the U.S. aims to boost domestic solar production to meet climate targets. Despite historical dependency on imports for ultra-pure chemicals, North American chemical companies are now investing in regional production capabilities, making it the fastest-growing region with immense long-term potential.

What Makes Europe a Notable Player in The Market?

Europe is considered to be a significantly growing area due to its advanced R&D capabilities, strong environmental regulations, and a growing emphasis on technological sovereignty. Key countries such as Germany, France, and the Netherlands are home to major semiconductor equipment manufacturers (e.g., ASML) and electronics firms that demand high-spec chemicals. The European Union is also backing its semiconductor industry through the EU Chips Act, with billions allocated to scale up fabrication and reduce dependency on global supply chains.

While Europe's semiconductor production is smaller in scale than the Asia Pacific, its focus on quality, sustainability, and precision gives it a strong foothold in the specialty chemicals industry. Europe is also leading in green chemistry and environmentally responsible production, which aligns with the increasing demand for sustainable manufacturing of electronic-grade nitric acid. Additionally, the region's burgeoning solar sector, especially in Germany and Spain, continues to drive steady demand. Although not the largest consumer, Europe plays a strategic role in innovation and high-end application development, making it a valuable and growing market within the global landscape.

Market Overview

The electronic grade nitric acid market is a critical segment of the semiconductor and electronics industry, where ultra-high-purity chemicals are essential for manufacturing precision components. As technology advances, the demand for higher-purity materials like electronic grade nitric acid continues to rise, especially in chip fabrication, display technologies, and photovoltaic cells. The market is experiencing robust growth, driven by the rising demand for high-performance semiconductors, smartphones, and solar cells.

The rise of electric vehicles and 5G infrastructure is also creating the need for ultra-pure chemicals. The rising demand for electronic components further contributes to market growth. Key players are focusing on vertical integration, capacity expansion, and technological innovations in purification to stay competitive. As the digital world deepens its roots, electronic grade nitric acid remains a cornerstone chemical, with AI-driven enhancements pushing its role into the future.

What are the Market Trends in the Electronic Grade Nitric Acid Market?

- Shift toward ultra-high purity standards: With chip nodes shrinking to sub-5nm levels, there is zero tolerance for contamination. This trend is pushing manufacturers toward ultra-high purity nitric acid and investing in advanced purification systems to meet stringent quality requirements.

- AI-enabled process optimization: AI and automation are increasingly being used to monitor and control nitric acid production and application processes. These technologies enhance consistency, reduce waste, and enable predictive maintenance, cutting downtime in fabs and improving operational efficiency.

- Sustainability and green chemistry: Environmental regulations and ESG goals are driving interest in greener production methods. Manufacturers are exploring ways to minimize energy consumption and recycle waste nitric acid, aligning with global sustainability targets.

- Geopolitical influence and supply chain localization: Trade tensions and global chip shortages are prompting nations to localize their semiconductor supply chains. This shift is creating regional demand spikes for electronic-grade chemicals, including nitric acid, as governments support domestic chip production with subsidies and policy incentives.

- Strategic collaboration and capacity expansion: Major chemical players are forming strategic partnerships with semiconductor companies and expanding production capacity near key fabrication hubs. This ensures a secure supply and aligns with just-in-time delivery needs in critical manufacturing processes.

Market Scope

| Report Coverage | Details |

| Market Size by 2034 | USD 150.76 Million |

| Market Size in 2025 | USD 92.72 Million |

| Market Size in 2024 | USD 87.84 Million |

| Market Growth Rate from 2025 to 2034 | CAGR of 5.55% |

| Dominating Region | Asia Pacific |

| Fastest Growing Region | North America |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Product Type, Application, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

Surge in Semiconductor Demand

The rising demand for advanced electronics, particularly semiconductors, serves as the major catalyst for growth of the electronic grade nitric acid market. This burgeoning demand is further supported by the rapid expansion of various technologies, including 5G networks, electric vehicles, artificial intelligence hardware, and renewable energy solutions like photovoltaics. Each of these sectors necessitates the use of high-quality electronic-grade nitric acid to ensure efficiency and product reliability in their manufacturing processes.

The trend toward more compact and powerful devices has led manufacturers to seek higher-purity chemicals essential for critical processes such as etching, cleaning, and wafer fabrication. The global boom in semiconductor manufacturing, driven by AI chips, 5G, and internet of things (IoT), is significantly increasing the need for ultra-pure chemicals like electronic grade nitric acid. Foundries are scaling up, especially in Asia-Pacific and the U.S., resulting in higher consumption of this critical etchant and cleaning agent.

Restraint

High Costs and Complex Production

The electronic grade nitric acid market is beset by significant challenges that impact its production. Complexities involved in producing ultra-high purity nitric acid are particularly notable. Rigorous purification processes, precise handling requirements, and the need for completely contamination-free logistics increase complexities. Each of these factors contributes to a substantial hike in manufacturing costs. Moreover, not all geographical regions possess the necessary technological advancements or infrastructural capabilities to consistently meet these stringent manufacturing standards. This creates a dependency on a select few specialized suppliers, which can destabilize availability and pricing.

In addition to production issues, the market contends with various external factors, including stringent regulatory compliance requirements and the inherent risks associated with transporting hazardous materials. Another layer of complexity is added by the volatility of raw material prices, which can fluctuate significantly based on global supply chains and demand. These combined challenges not only create barriers for new entrants aspiring to join the market but also hinder scalability for smaller companies already in the field, limiting their growth potential and competitiveness.

Opportunity

Focus on Sustainability and Technological Advancements

The rising focus on sustainable manufacturing practices creates the need for eco-friendly production methods. Stringent environmental regulations and regulatory pressures are urging manufacturers to adopt cleaner production technologies along with closed-loop systems that minimize chemical processing. As a result, manufacturers are adopting advanced technologies that help maintain sustainability in production. AI innovation presents a substantial growth opportunity for the electronic grade nitric acid market. AI not only enhances efficiency but also leads to a reduction in operational costs.

Companies that proactively invest in green chemistry solutions and the development of smart factories are likely to attract eco-conscious clients while complying with increasingly stringent global regulations. Furthermore, the expanding markets for advanced display technologies and microelectronics in developing economies present significant and untapped potential for suppliers of ultra-pure nitric acid. This evolution in the market landscape underscores the synergy between sustainable practices and technological advancement, highlighting the critical role of eco-friendly initiatives in shaping future industry dynamics.

Product Type Insights

Why did the EL Grade Segment Dominate the Market in 2024?

The EL grade segment dominated the electronic grade nitric acid market with the largest share of 51% in 2024. This is mainly due to its expectational purity and compatibility with sensitive semiconductor processes. EL (electronic level) grade nitric acid typically meets or exceeds purity, making it ideal for cleaning silicon wafers, removing organic residues, and preventing contamination during fabrication. Major semiconductor manufacturers rely on this grade to ensure high chip yields and minimal defects. As chip architecture becomes more complex and precise, the use of EL-grade nitric acid has become a non-negotiable standard in advanced fabs, bolstering the growth of the segment.

On the other hand, the VL (Very Large-Scale Integration) grade segment is expected to grow at the highest CAGR of 5.94% in the upcoming period, driven by the increasing miniaturization of electronic components and the push toward ultra-high-performance integrated circuits. VL-grade nitric acid is used in cutting-edge microfabrication and emerging technologies like AI chips and quantum computing hardware, where ultra-clean environments are crucial. The segment growth is further attributed to the rising investments in nanotechnology and next-gen chip design, particularly in regions building new fabs to keep up with global tech demand. Innovations in purification and cost-efficient production methods are also making VL grade more accessible.

Application Insights

What Made Semiconductor the Dominant Segment in the Electronic Grade Nitric Acid Market in 2024?

The semiconductor segment dominated the market with the biggest share of 57% in 2024. This is mainly due to the critical role of electronic-grade nitric acid in the production of semiconductors. Electronic-grade nitric acid is essential in wafer surface preparation, etching, and cleaning. As device nodes shrink to the sub-5nm range, the need for ultra-pure chemicals becomes increasingly critical. Nitric acid is used in combination with other reagents in RCA cleaning processes to remove microscopic contaminants from silicon wafers. The massive global investments in semiconductor fabrication facilities, particularly under government-backed initiatives in the U.S., EU, and Asia-Pacific, boost the demand for electronic-grade nitric acid.

The solar energy segment is expected to grow at a significant CAGR of 5.95% during the forecast period, driven by the global shift toward renewable energy and carbon neutrality goals. In photovoltaic (PV) cell manufacturing, nitric acid is used for surface cleaning and texturizing silicon wafers to enhance light absorption. As solar panel efficiency becomes more important, manufacturers are turning to higher-purity materials to boost performance and longevity. Emerging markets like India, Southeast Asia, and Africa are expanding their solar infrastructure rapidly, contributing to rising demand. Additionally, government subsidies and green energy incentives are fueling solar adoption globally, making this segment a key growth frontier.

Electronic Grade Nitric Acid Market Companies

- Mitsubishi Chemical Corporation

- Everest Kanto Cylinder

- BASF SE

- Columbus Chemicals

- UBE Corporation

- T. N. C. Industrial

- KMG Electronic Chemicals

- EuroChem

- Asia Union Electronic Chemicals

- Juhua Group

- Everest Kanto Cylinder

- KMG Electronic Chemicals

- Suzhou Crystal Clear Chemical Co., Ltd.

- thyssenkrupp Uhde

Recent Development

- In December 2024, Grupa Azoty Pulawy commissioned the fifth line of its nitric acid installation. The fifth line is part of a major modernization and construction project for nitric acid production and related facilities, improving the efficiency of nitric acid production.

(Source: https://www.worldfertilizer.com)

Segments Covered in the Report

By Product Type

- EL Grade

- VL Grade

- UL Grade

- SL Grade

By Application

- Semiconductor

- Solar Energy

- LCD Panel

- Others

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East & Africa

Get a Sample

Get a Sample

Table Of Content

Table Of Content