Non-Dispersive Infrared Market Size and Forecast 2025 to 2034

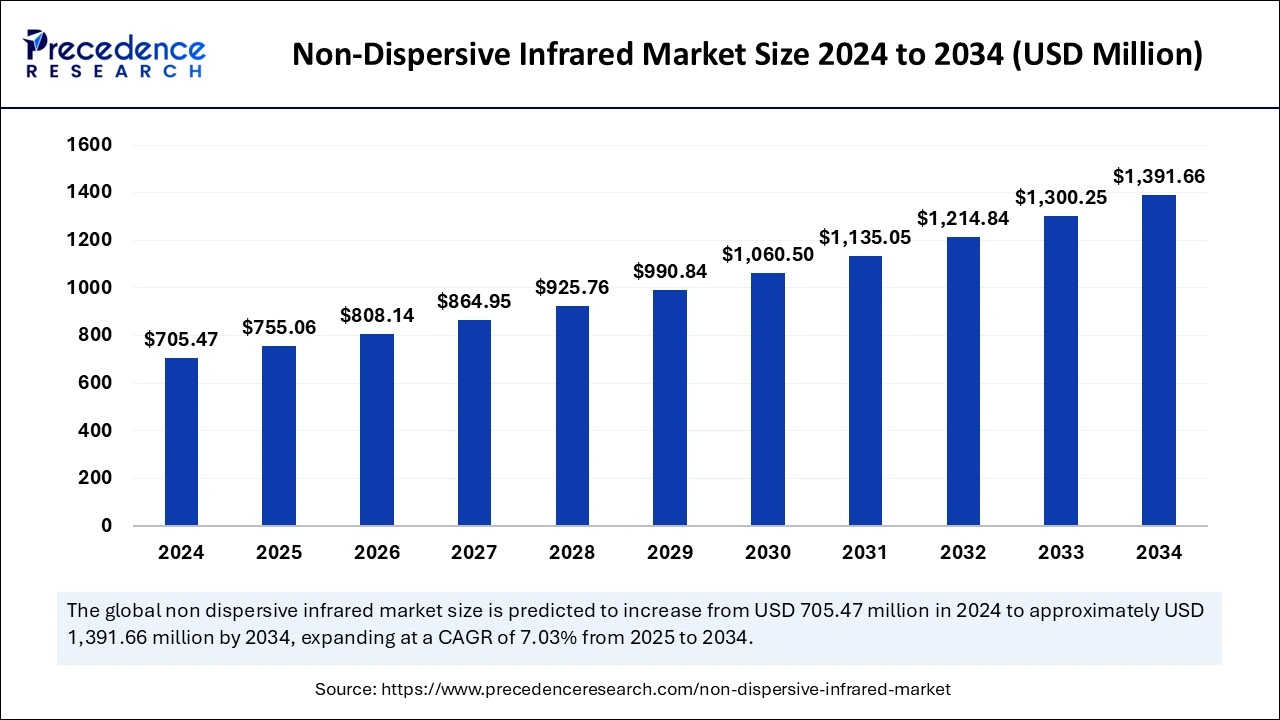

The global non-dispersive infrared market size is estimated at USD 755.06 million in 2025 and is predicted to increase from USD 808.14 million in 2026 to approximately USD 1391.66 million by 2034, expanding at a CAGR of 7.03% from 2025 to 2034.

Non-Dispersive Infrared Market Key Takeaways

- Asia Pacific accounted for the largest non-dispersive infrared market share in 2024.

- North America is anticipated to witness the fastest growth during the forecasted years.

- By gas type, the carbon dioxide segment has generated a significant market share in 2024.

- By gas type, the methane segment is projected to witness the fastest growth during the forecast period.

- By technology type, the multi-wavelength NDIR segment has generated a market share in 2024.

- By end-use, the environmental monitoring segment noted the largest market share in 2024.

- By end-use, the industrial safety segment is estimated to witness the fastest growth in the forecast period.

Market Overview

Non-dispersive infrared serves as a gas-detection system that analyzes gases through infrared absorption of light waves. IR light from an NDIR sensor goes through a sample chamber containing measured gases at specific wavelengths before detection. A detector measures the incoming light, which remains after the gas absorbs specific wavelengths of infrared light. The non-dispersive infrared market takes a leading position by offering advanced precision solutions that drive industrial efficiency in various sectors. The absorption properties of infrared radiation by gases enable NDIR technology to function as a dependable tool for specific element detection and concentration measurement.

The non-dispersive infrared market expands because worldwide authorities adopt environmental standards, including safety protocols coupled with emission and air quality control requirements. NDIR sensor manufacturers, together with software developer's service providers and distributors, support an ecosystem that serves automotive and aerospace industries and building management systems along with their end-users. Rising awareness about indoor air quality (IAQ) serves as a major market driver that increases demand for NDIR sensors for both residential and commercial buildings. NDIR technology provides an effective means to monitor and control indoor air pollutants, contributing to a healthier and safer indoor environment.

Artificial Intelligence (AI) Integration in the Non-Dispersive Infrared Market

The integration of Artificial Intelligence techniques with machine learning methods in the non-dispersive infrared market results in fundamental transformations of analytic procedures. The combined power of AI functions with machine learning features generates predictive maintenance abilities and anomaly detection tools for industry processes, which optimize operations while preventing critical application breakdowns and elevating safety measures. By merging NDIR technology with AI/ML capabilities, the system develops into an advanced industrial tool for organizations that need predictive maintenance solutions and data-based decision support.

The non-dispersive infrared market products are equipped with capabilities that enable remote monitoring, data sharing, and centralized control. The integration of NDIR sensors with the Internet of Things (IoT) infrastructure improves the overall efficiency, responsiveness, and seamless incorporation of NDIR technology into the interconnected fabric of the modern industrial ecosystem.

Market Outlook

- Industry Growth Overview: The non-dispersive infrared market is expected to grow steadily from 2025 to 2034, fueled by increasing demand for accurate gas sensing technology in environmental monitoring, industrial safety, and automotive emission control applications. Advances in sensor technology, energy efficiency, and IoT system integration further boost adoption across automotive, chemical, and environmental sectors worldwide.

- Global Expansion: The market is expanding worldwide, fueled by increasing demand for precise gas monitoring in industrial, automotive, and environmental applications. Adoption of smart buildings, HVAC systems, and IoT-enabled air quality solutions, combined with technological advances in multi-gas detection and miniaturization, is boosting deployment across North America, Europe, and Asia-Pacific.

- Major Investors: Major investors in the market include corporate giants such as Amphenol Advanced Sensors, Honeywell International Inc., Siemens AG, and Teledyne Technologies Inc., which are funding extensive R&D in infrared gas sensing, mini‑module integration, and IoT‑enabled air‑quality platforms. Additionally, venture capital and strategic investments are increasingly flowing into sensor startups, driving miniaturization and multi‑gas NDIR innovation, creating opportunities for rapid market expansion.

- Startup Ecosystem:The startup ecosystem for the non-dispersive infrared market is expanding, with innovators such as Sensirion, Figaro Engineering, and Cubic Sensor and Instrument focusing on miniaturized, IoT-enabled, multi-gas NDIR sensing solutions.

Non-Dispersive Infrared Market Growth Factors

- Growing need for environmental surveillance: The need for environmental surveillance continues to escalate, which drives the market demand for NDIR sensors because these instruments enable precise gas identification. The accuracy of these sensors' gas identification capability becomes essential for environmental regulation compliance across various sectors.

- Technological progress: The market growth of NDIR sensors depends on technological improvements in sensor features, such as increased sensitivity and diminished power requirements combined with smaller designs.

- Rising awareness of carbon emissions: The market demand for NDIR sensors rises because these CO2 concentration tracking devices help industries in transportation, manufacturing, and energy to reduce their carbon emissions while increasing environmental sustainability.

- Healthcare adoption: Medicine takes advantage of NDIR sensors for healthcare tools because they deliver accurate gas measurement results in devices like respiratory monitors for oxygen and carbon dioxide evaluation.

- Regulatory standards and compliance: The rise of stringent safety standards alongside environmental regulations obligates industries to adopt NDIR sensors for emission detection applications besides regulatory compliance.

Market Scope

| Report Coverage | Details |

| Market Size by 2034 | USD 1391.66 million |

| Market Size in 2026 | USD 808.14 million |

| Market Size in 2025 | USD 755.06 million |

| Market Growth Rate from 2025 to 2034 | CAGR of 7.03% |

| Dominating Region | Asia Pacific |

| Fastest Growing Region | North America |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Gas, Technology, End-Use, and Regions |

| Regions Covered | North America,Europe,Asia Pacific,Latin America,Middle East and Africa |

Market Dynamics

Drivers

Rising usage in healthcare and medical diagnostics

The use of non-dispersive infrared market services continues to grow for detecting diseases in their early stages through disease monitoring, respiratory conditions detection, and metabolic disorder diagnosis. The installation of NDIR sensors within health applications fuels medical diagnostic improvements that allow doctors to complete accurate non-invasive disease identification and patient observation techniques.

The analysis of exhaled breath gases depends on NDIR gas sensors optimized for this particular purpose. Healthcare experts can maximize their professional capabilities by using this integration to achieve better disease diagnosis and condition management abilities. Breath analysis through NDIR sensors operates as a vital screening method for medical diagnosis along with patient monitoring, which delivers superior diagnostic results.

Growing focus on food safety and quality control

Food safety and quality control have gained importance throughout the modern food industry because consumers are concerned about diseases caused by food and their well-being. The food industry widely implements advanced technologies, including non-dispersive infrared market technologies. These sensors specialize in detecting many harmful substances as well as toxic elements and infectious pathogens that threaten food security.

Quality control within the food processing industry benefits from NDIR sensor implementation because the technology ensures products satisfy demanding regulatory requirements. The integration of NDIR sensors functions as an essential tool to prevent foodborne diseases while maintaining products that satisfy health standards, quality inspections, and regulatory requirements. The evolving food safety sector will see more innovations because of NDIR technology advancements.

Restraint

High Development and Manufacturing Costs

The development and manufacturing expenses for NDIR sensors must be considered a significant hurdle that affects cost-sensitive applications. Research and development of sensors requiring high performance and reliability with miniaturization requires major investments. The high manufacturing expenses create a barrier for the non-dispersive infrared market that restricts smaller companies from entering the NDIR sensor market, making these sensors less available to some business sectors.

The production of advanced NDIR sensors with high-performance miniaturization and reliability status remains expensive, which makes them impractical for broad implementation, especially in price-conscious deployment fields. The substantial financial demands associated with NDIR sensor research and development create entry difficulties for smaller businesses that restrict affordability in specific sectors, thus affecting general sensor integration.

Opportunity

Emphasis on sustainability and environmental concern The increasing awareness about environmental issues worldwide makes the non-dispersive infrared market more focused on green practices and sustainability methods. The production industry embraces environmentally friendly technological solutions to reduce sensor-generated environmental hazards. NDIR sensor production receives energy-efficient manufacturing improvement, which leads to reduced environmental impact for these devices during their entire lifecycle.

Manufacturers enhance both emission reduction and environmental protection by maximizing production energy efficiency. NDIR technology development enhances sustainability practices, which help achieve worldwide environmental targets, simultaneously improving sensor performance throughout various applications from air quality measurement to industrial emission monitoring processes.

Segment Insight

Gas Type Insights

The carbon dioxide segment has generated a significant non-dispersive infrared market share in 2024. The widespread use of carbon dioxide (CO2) gas types requires the implementation of NDIR technology. The NDIR sensing technology and its variant for measuring CO2 shows widespread use across residential, commercial, and industrial sectors for environmental monitoring, indoor air quality control, and emissions measurement. NDIR technology for CO2 detection will experience sustained demand growth as industries, together with consumers, put greater emphasis on environmental sustainability, health, and safety standards. The NDIR technology enables effective indoor CO2 level monitoring and control to create both a comfortable and healthy environmental setting.

- In January 2024, Senseair introduced its new Sunrise CO2 sensor through its Asahi Kasei Group subsidiary to optimize energy efficiency and improve indoor air quality, thus producing healthier environments.

The methane segment is projected to witness the fastest growth during the forecast period. NDIR stands for a technique that measures methane gas concentrations. Methane exists as a colorless and odorless gas, which makes it dangerous for fires, and it functions as a strong greenhouse gas. A gas concentration reading method for methane uses infrared light under the NDIR (Non-dispersive infrared) approach. NDIR sensors exist within oil and gas industrial settings where methane byproducts emerge and serve applications that need to identify possible methane fire hazards. Non-dispersive infrared (NDIR) stands as an optimal solution to detect methane leaks since sensors operate independently from oxygen presence and are poison-resistant to outside elements.

Technology Type Insights

The multi-wavelength NDIR segment has generated a significant non-dispersive infrared market share in 2024. NDIR sensors acquired the ability to monitor multiple gases with enhanced selectivity through the advancement into multi-wavelength and hyperspectral devices. NDIR sensors bring efficient multiple gas detection capability for specific industrial applications that need exact gas identification. NDIR multi-wavelength employs infrared light for sample gas concentration measurement. NDIR represents an accepted analytical method that detects gases by measuring carbon dioxide, methane, and volatile organic compounds.

End-Use Insights

The environmental monitoring segment noted the largest non-dispersive infrared market share in 2024. The market demands NDIR sensors to enhance pollution monitoring and greenhouse gas detection alongside industrial emissions control because of increased concerns about air quality and CO2 emissions and industrial process control needs. NDIR technology operates as a crucial instrument to tackle environmental problems because global communities are dedicated to maintaining environmental protection standards as well as conservation practices. The manufacturing sector for NDIR sensors now aims to adopt sustainable and eco-friendly solutions. The absolute sustainability goals for the sensor extend to both biodegradable materials and energy-efficient manufacturing alongside compulsory limits on waste generation during the equipment's operating lifespan.

The industrial safety segment is estimated to witness the fastest growth in the forecast period. The industrial safety sector is witnessing substantial growth fueled by several essential factors that highlight the vital importance of NDIR technology in maintaining workplace safety. NDIR gas sensors operate as part of industrial safety systems to detect dangerous gases. NDIR sensors emerged as preferred options for industrial gas detection systems because they deliver accurate results and reliable performance after more industries began utilizing sophisticated detection systems under tightened safety regulations. The sensors serve as essential tracks for hazardous gases, including methane (CH4) and carbon monoxide (CO), to provide instant alerts that help prevent and minimize potential risks.

Regional Insights

What Made Asia Pacific the Dominant Region in the Non-Dispersive Infrared Market?

Asia Pacific accounted for the largest non-dispersive infrared market share in 2024. This is due to vibrant economic development, industrialization, and an increasing emphasis on environmental sustainability. In nations like China and India, where industrial operations are blooming, there is an increased need for NDIR sensors to manage and regulate emissions. Cities in the area are also adopting smart city programs that incorporate NDIR sensors into their infrastructure to enable real-time environmental monitoring and improved public safety.

China's influence in the market is significantly shaped by its robust regulatory structure and dedication to environmental oversight and management. The nation has become a major contributor because of its widespread adoption of cutting-edge technologies, such as NDIR sensors, to meet its striving ecological objectives.

What Makes North America the Fastest-Growing Region in the Market?

North America is anticipated to witness the fastest growth in the non-dispersive infrared market during the forecasted years. The region owns a strong industrial base and emphasizes environmental regulations and technologies, establishing it as the leading player in the market.

North America leads the market because of its extensive use across multiple sectors, including HVAC systems, oil and gas surveillance, automotive, and air quality control. The increased awareness amongst North American end-users regarding modern gas detection technologies and analytical systems plays a major role in expanding market coverage. Regulatory health and safety protocols enforce accurate toxic gas monitoring in industrial spaces.

The U.S. is the major contributor to the North America non-dispersive infrared market due to its strong industrial base, strict environmental regulations, and high adoption of gas sensing technologies across sectors such as automotive, manufacturing, and oil & gas. The country's emphasis on air-quality monitoring and emissions control drives significant demand for NDIR sensors. Additionally, ongoing technological advancements and the presence of leading sensor manufacturers further strengthen the U.S. market leadership.

How Big is the Success of Europe in the Non-Dispersive Infrared Market?

Europe has achieved significant success in the market because of strict environmental regulations, broad industrial adoption of advanced sensor technologies, and the integration of NDIR systems in HVAC, automotive, and environmental monitoring applications. The UK leads the European market due to strict environmental and workplace safety regulations, advanced industrial infrastructure, and early adoption of smart building and HVAC technologies. Strong research initiatives, local sensor manufacturers, and the integration of IoT-enabled gas monitoring systems further reinforce its leadership in the region.

How Crucial is the Role of Latin America in the Non-Dispersive Infrared Market?

Latin America plays a crucial role in the market due to growing industrialization, increasing environmental monitoring initiatives, and rising demand for gas detection in oil & gas, chemical, and manufacturing sectors. Government regulations and infrastructure development further drive the adoption of NDIR technologies across the region. Brazil leads the market in Latin America due to its extensive industrial base, growing oil and gas sector, and strict environmental and workplace safety regulations. Increasing investments in smart manufacturing, air-quality monitoring, and industrial automation further strengthen Brazil's position as the regional hub for NDIR sensor adoption.

How Big is the Opportunity for the Growth of the Non-Dispersive Infrared Market in the Middle East and Africa?

The Middle East and Africa (MEA) region presents significant opportunities in the market due to rising industrialization, expanding oil and gas exploration, and growing environmental monitoring initiatives. Adoption of smart building systems, HVAC automation, and emissions control technologies further drives demand for accurate and reliable NDIR gas sensors. The UAE leads the market thanks to extensive industrial and oilfield activities, strong government backing for environmental monitoring, smart city projects, and early adoption of advanced gas detection and HVAC systems, establishing the country as a regional technology leader.

Value Chain Analysis

Feedstock Procurement:

Raw materials for NDIR sensors, including infrared optical components, semiconductors, and detector materials, are sourced from suppliers specializing in high-purity metals, ceramics, and optics.

- Key Players: Schott AG, Thorlabs.

Chemical Synthesis and Processing:

Infrared detector wafers and optical filters are manufactured and processed into precise sensor elements through cleanroom fabrication and thin-film coating.

- Key Players:Hamamatsu Photonics, Sensirion AG, Honeywell International Inc.

Compound Formulation and Module Assembly:

Detector elements are combined with optical filters, signal-processing electronics, and housing to produce NDIR sensor modules for industrial and environmental applications.

- Key Players:Siemens AG, Amphenol Advanced Sensors, Dynament Ltd.

Waste Management and Recycling:

Manufacturing waste, including defective sensors and unused materials, is collected, recycled, or disposed of in accordance with environmental regulations.

- Key Players: Veolia Environmental Services, Sims Lifecycle Services, Waste Management, Inc.

Regulatory Compliance and Safety Monitoring:

NDIR sensor production and deployment follow international safety, emissions, and environmental standards to ensure quality and operational safety.

- Key Players:International Electrotechnical Commission (IEC), European Chemicals Agency (ECHA), Environmental Protection Agency (EPA).

Top Companies in the Non-Dispersive Infrared Market

- ABB Group: ABB offers advanced NDIR-based gas analyzers and emission monitoring systems for industrial applications, including process control, environmental compliance, and energy management solutions.

- Dynamite Ltd.:Dynamite Ltd. provides NDIR gas detection modules and sensors for HVAC, industrial safety, and environmental monitoring, focusing on compact, high-accuracy solutions.

- ELT Sensor Corporation: ELT Sensor Corporation develops NDIR gas sensors for COâ‚‚, methane, and multi-gas detection, targeting indoor air quality, automotive, and industrial process applications.

- Figaro Engineering Inc.:Figaro Engineering offers NDIR gas sensors for COâ‚‚, CHâ‚„, and volatile organic compounds, emphasizing low-power, high-sensitivity solutions suitable for HVAC, smart building, and safety applications.

- Gas Sensing Solutions:Gas Sensing Solutions provides miniature NDIR gas sensors for COâ‚‚, methane, and multi-gas detection, focusing on IoT-enabled, low-power, and portable monitoring devices.

Other Major Players

- Emerson Electric Co.

- Honeywell International Inc.

- HORIBA, Ltd.

- SenseAir AB

- Siemens AG

- SICK A

Recent Developments

- In December 2024, Sensidyne launched the SensAlert IR federal fixed-point infrared gas detector. The SensAlert IR demonstrates excellence in testing harsh conditions using its dual-wavelength non-dispersive infrared system to provide precise gas detection under any demanding situation.

- In April 2024, Beckman Coulter Life Sciences presented the QbD1200+ total organic carbon (TOC) analyzer. The analyzer utilizes a digital non-dispersive infrared sensor (NDIR) that includes automatic drift adjustment to maintain long-term measurement stability.

- In May 2024, Servomex announced the SERVOTOUGH SpectraExact 2500F photometric analyzer specifically for performing accurate liquid water measurements in corrosive, hazardous, and flammable environments. By using non-dispersive infrared technology in single-beam dual-wavelength mode, the SpectraExact 2500F achieves stable performance and increased sensitivity levels.

- In May 2023, Yokogawa Electric Corporation introduced the newest members of its OpreX Analyzers lineup: the advanced Non-Dispersive Infrared method (NDIR) gas analyzers. This selection features the IR800G Rack Type Infrared Gas Analyzer, the IR810G wall and panel mount infrared gas analyzer, and the IR810S Explosion-proof version of the infrared gas analyzer (wall mount).

Segment Covered in the Report

By Gas Type

- Carbon Dioxide (CO2)

- Methane (CH4)

- Carbon Monoxide (CO)

- Hydrocarbons

- Refrigerant Gases

- Others

By Technology Type

- Single-Wavelength NDIR

- Dual-Wavelength NDIR

- Multi-Wavelength NDIR

By End-Use

- Environmental Monitoring

- Industrial Safety

- Food and Beverage Processing

- Medical Diagnostics

- Automotive Emissions Monitoring

- Others

By Geography

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting