What is the Nutraceutical Contract Manufacturing Services Market Size?

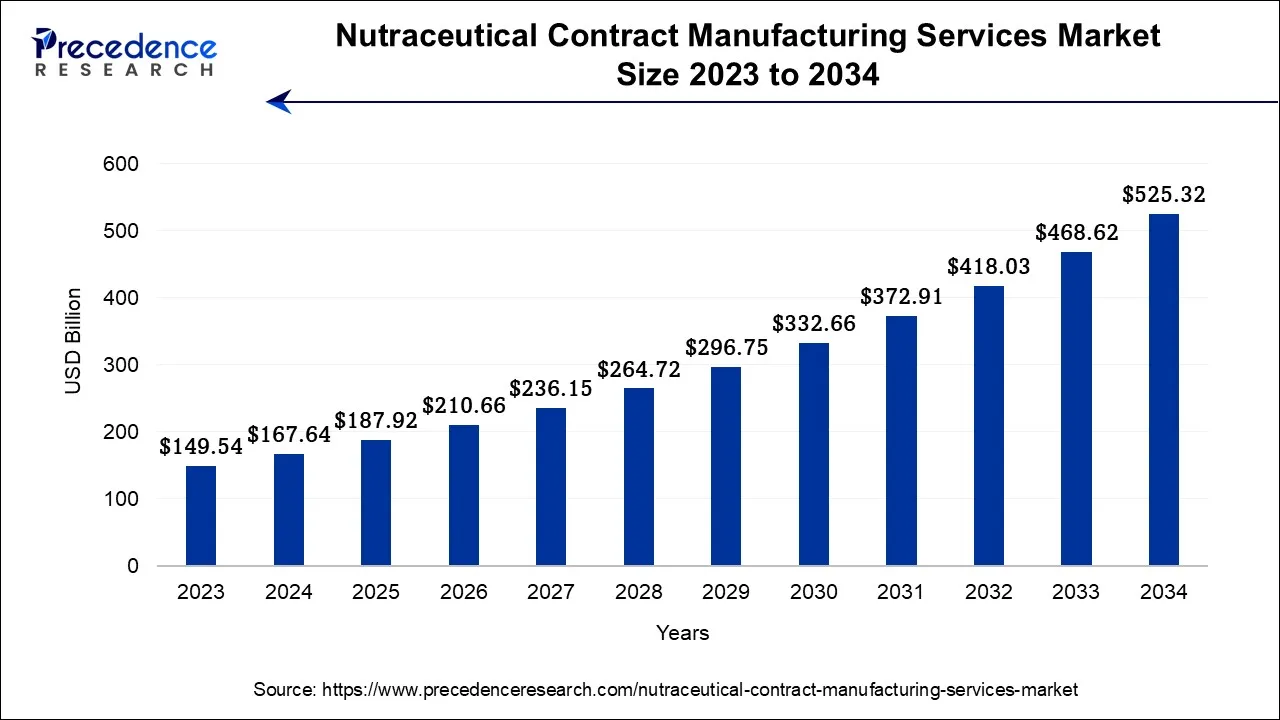

The global nutraceutical contract manufacturing services market size is expected to be valued at USD 187.92 billion in 2025 and is predicted to increase from USD 210.66 billion in 2026 to approximately USD 577.95 billion by 2035, expanding at a CAGR of 11.89% over the forecast period from 2026 to 2035.

Nutraceutical Contract Manufacturing Services Market Key Takeaways

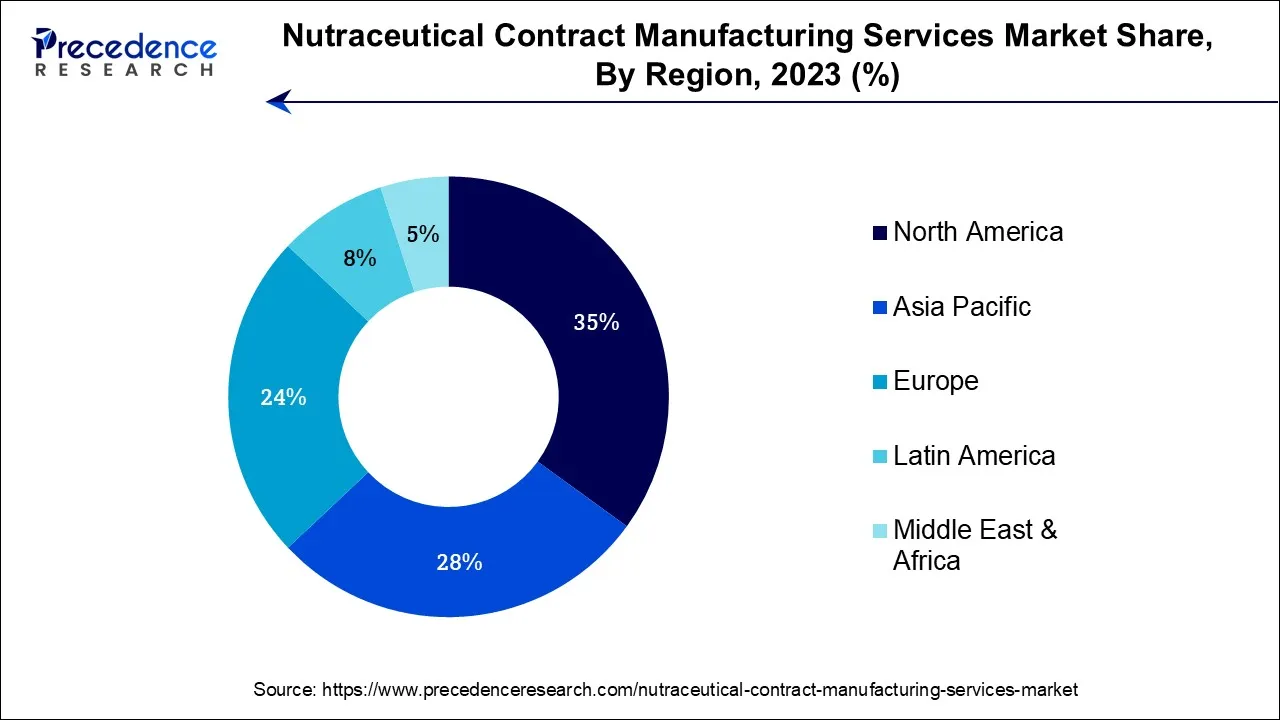

- North America contributed more than 35% of revenue share in 2025.

- Asia-Pacific region is expected to expand at the fastest CAGR between 2026 and 2035.

- By Product, the functional food and beverages segment captured the largest market share of 68.1% in 2025.

- By Product, the dietary supplements segment is anticipated to grow at a remarkable CAGR of 10.8% during the projected period.

- By Type, proteins & amino acid supplements segment has held the highest market share of 39% in 2025.

- By Type, the weight management and meal replacer supplements segment is estimated to grow at the fastest CAGR over the projected period.

Market Overview

The nutraceutical contract manufacturing services market pertains to the segment of the health and wellness industry that provides outsourced manufacturing services for nutraceutical products. Nutraceuticals are functional food, dietary supplements, and herbal products known for their health benefits. This market involves third-party manufacturers producing these items for brand owners and retailers. The nature of this market is characterized by its role in streamlining production, ensuring quality and compliance, and meeting the growing demand for diverse nutraceutical products, reflecting the global focus on preventive health and well-being.

Nutraceutical Contract Manufacturing Services Market Growth Factors

The nutraceutical contract manufacturing services market is a pivotal sector within the health and wellness industry, providing outsourced manufacturing solutions for nutraceutical products. These products encompass functional food, dietary supplements, and herbal remedies that offer various health benefits. This summary explores the market's nature, recent industry trends, key growth drivers, notable challenges, and emerging business opportunities.

The nutraceutical contract manufacturing services market is experiencing robust growth, driven by several key trends and growth drivers. Firstly, there's a growing consumer inclination toward preventive healthcare and natural remedies, spurring demand for a wide range of nutraceutical products. This has fueled the need for specialized contract manufacturers capable of producing high-quality, innovative formulations.

Moreover, regulatory changes and quality standards have prompted many brands to outsource their manufacturing to ensure compliance and product safety. Contract manufacturers offer expertise in navigating the evolving regulatory landscape, enhancing their appeal. Additionally, as the global nutraceutical market diversifies, manufacturers are adapting to cater to niche markets, such as organic, plant-based, or immune-boosting products. This trend has led to increased collaboration with contract manufacturers possessing specific expertise in these segments.

Despite its growth potential, the nutraceutical contract manufacturing services market faces notable challenges. One significant issue is the need to maintain strict quality control, particularly when dealing with natural ingredients. Ensuring consistency and purity in product formulations is paramount to meet customer expectations and regulatory requirements. Another challenge lies in managing the supply chain, as the procurement of high-quality raw materials can be complex and costly. Additionally, the market is highly competitive, with many contract manufacturers vying for clients. This competition places pressure on pricing and forces manufacturers to differentiate themselves through superior quality and service.

The nutraceutical contract manufacturing services market offers numerous opportunities for both manufacturers and brand owners. Firstly, the market's continued growth and diversification present openings for specialized contract manufacturers focused on specific niches or unique formulations. As consumers seek personalized health solutions, custom manufacturing services are in demand.

Furthermore, expanding into emerging markets with growing health-conscious populations provides significant growth potential. Building strategic partnerships with ingredient suppliers and research institutions can foster innovation and enable manufacturers to offer cutting-edge products. Moreover, adopting advanced technologies and automation in manufacturing processes can enhance efficiency and reduce costs, creating a competitive edge. Overall, the nutraceutical contract manufacturing services market is projected for sustained expansion as the global demand for health and wellness products continues to evolve and diversify.

Trends

- Product Innovation: Focus on plant-based, vegan, clean-label, and CBD/hemp-derived products.

- Dosage Form Growth: Gummies and chews are rapidly growing due to palatability, alongside traditional tablets/capsules.

- Digital Integration: Use of AI and data analytics for formulation and supply chain.

- Focus on Specific Health Areas: Immune support and gut health remain strong segments.

Market Scope

| Report Coverage | Details |

| Growth Rate from 2026 to 2035 | CAGR of 11.89% |

| Market Size in 2025 | USD 187.92 Billion |

| Market Size in 2026 | USD 210.66 Billion |

| Market Size by 2035 | USD 577.95 Billion |

| Largest Market | North America |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | By Product |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Driver

Global health challenges and consumer preferences

Global health challenges, such as pandemics and widespread health crises, have surged market demand for nutraceutical contract manufacturing services. These challenges have underscored the importance of health and wellness, driving individuals to seek immune-boosting and preventive solutions. Nutraceuticals, with their focus on well-being, have witnessed increased demand, prompting brands to partner with contract manufacturers to meet this surge in consumer interest. Contract manufacturers play a crucial role in rapidly adapting and scaling production to address these health challenges, making their services invaluable in times of crisis.

Moreover, Consumer preferences play a pivotal role in surging market demand for nutraceutical contract manufacturing services. As consumers increasingly seek natural, plant-based, and clean-label health products, contract manufacturers capable of accommodating these preferences in formulations have a competitive edge. Meeting the demand for specific dietary restrictions, such as gluten-free, organic, or vegan options, drives manufacturers to offer diversified product lines. Consequently, this alignment with consumer preferences fosters trust, boosts brand loyalty, and stimulates greater demand for contract manufacturing services in the nutraceutical industry.

Restraints

Regulatory complexity and quality control

Regulatory complexity poses a significant restraint on the market demand for nutraceutical contract manufacturing services. Diverse and evolving regulations across different regions necessitate meticulous compliance efforts, increasing operational costs and time-to-market. Manufacturers must invest in regulatory expertise and documentation, potentially deterring potential clients with complex compliance requirements. This complexity can lead to delays in product launches and market entry, reducing the attractiveness of contract manufacturing services for nutraceutical brands, thus hindering overall market demand.

Moreover, quality control presents a significant restraint on market demand in the nutraceutical contract manufacturing services industry. Ensuring consistent quality in natural ingredients can be challenging due to variations in sourcing, weather conditions, and agricultural practices. Instances of subpar quality or ingredient discrepancies can lead to product recalls and damage a manufacturer's reputation. This erodes consumer trust and deters brands from seeking contract manufacturing services, thereby limiting market demand as companies prioritize quality assurance in their nutraceutical products.

Opportunities

Custom formulations and clean-label products

Custom formulations significantly drive market demand in the nutraceutical contract manufacturing services industry. Consumers increasingly seek personalized health solutions, leading brands to develop unique nutraceutical products tailored to specific health needs or demographics. Contract manufacturers capable of offering customizable formulations become essential partners in meeting this demand. Such services allow brands to create differentiated products, cater to niche markets, and respond rapidly to emerging health trends. Consequently, the ability to provide custom formulations enhances contract manufacturers' appeal, spurring greater demand in the competitive nutraceutical market.

Moreover, clean-label products are a potent market demand driver in the nutraceutical contract manufacturing services industry. As consumers increasingly prioritize transparency and natural ingredients, contract manufacturers capable of producing clean-label nutraceuticals gain a competitive edge. These products, with minimal additives and preservatives, resonate with health-conscious consumers seeking trustworthy, recognizable ingredients. Clean-label offerings enhance brand reputation, build consumer trust, and stimulate greater demand for contract manufacturing services as brands look to meet the growing consumer preference for clean, wholesome, and transparent nutraceutical products.

Segment Insights

Product Insights

According to the product, the functional food and beverages held a 68.1% revenue share in 2023. Functional food and beverages refer to products that offer health benefits beyond basic nutrition. These items are formulated with bioactive ingredients like vitamins, minerals, probiotics, and antioxidants to address specific health concerns or enhance well-being. In the nutraceutical contract manufacturing services market, there's a noticeable trend toward the development of innovative functional food and beverage products.

Consumers are showing a growing preference for convenient and enjoyable methods of integrating health-promoting ingredients into their diets. This has led to the creation of products like fortified snacks, probiotic-infused beverages, and plant-based protein alternatives. Contract manufacturers are investing in research and development to meet these demands and offer brands a wider array of customized functional food and beverage solutions. This trend aligns with consumers' growing interest in preventive health measures, making functional food and beverages a significant growth area within the nutraceutical industry.

The Dietary supplements segment is anticipated to expand at a significant CAGR of 10.8% during the projected period. Dietary supplements, a prominent category in the nutraceutical contract manufacturing services market, encompass a wide range of products, including vitamins, minerals, herbal extracts, amino acids, and probiotics. These supplements are formulated to provide essential nutrients or address specific health concerns when a balanced diet may fall short. Recent trends in the market highlight consumers' evolving preferences and health-conscious choices.

One significant trend is the demand for clean-label supplements, with transparent ingredient lists and minimal additives. Personalization and a rising interest in plant-based, sustainable dietary supplements are significant trends in the nutraceutical contract manufacturing services industry. Consumers increasingly seek customized supplements that address their unique health requirements and lifestyles. This trend reflects the demand for tailored solutions to individual health concerns.

Additionally, the market observes a growing preference for supplements derived from plant sources, meeting the rising demand for eco-friendly and sustainable products. As consumers become more health-conscious and environmentally aware, contract manufacturers are adapting to meet these evolving preferences by offering personalized and plant-based supplement options.

Dietary Supplements by Type Insights

Based on the Dietary Supplements by Type, proteins & amino acid supplements segment is anticipated to hold the largest market share of 39% in2023. Proteins and amino acid supplements in the nutraceutical contract manufacturing services market refer to dietary supplements designed to provide essential proteins and amino acids to support various aspects of health and well-being. These supplements offer a convenient way for individuals to meet their daily protein needs, aiding muscle recovery, weight management, and overall vitality. Trends in the nutraceutical contract manufacturing services industry for proteins & amino acid supplements include a growing demand for plant-based and clean-label formulations, catering to consumers seeking natural, sustainable, and allergen-free options. Personalization is also on the rise, with manufacturers offering custom blends to meet specific health goals. Furthermore, the integration of advanced technologies in production processes and the development of innovative delivery forms, such as powders, gummies, and beverages, reflect the market's commitment to meeting evolving consumer preferences for convenient and effective protein supplementation.

On the other hand, the Weight Management and Meal Replacer Supplements segment is projected to grow at the fastest rate over the projected period. Weight Management and Meal Replacer Supplements are dietary supplements designed to aid individuals in achieving their weight goals. Weight management supplements typically incorporate components such as green tea extract, garcinia cambogia, or conjugated linoleic acid, which are known to promote metabolism and aid in fat loss. Recent trends in the nutraceutical contract manufacturing services market indicate a growing demand for weight management and meal replacer supplements. Consumers increasingly seek products that promote a healthy lifestyle and aid in weight control. Contract manufacturers are responding by offering custom formulations with natural and clean-label ingredients, addressing consumer preferences for transparency and sustainability. Additionally, there's a trend toward personalized solutions, allowing consumers to tailor supplements to their specific dietary needs. These trends reflect the market's evolving focus on holistic health and wellness, presenting opportunities for contract manufacturers to innovate and meet the demand for these specialized products.

Regional Insights

What is the U.S. Nutraceutical Contract Manufacturing Services Market Size?

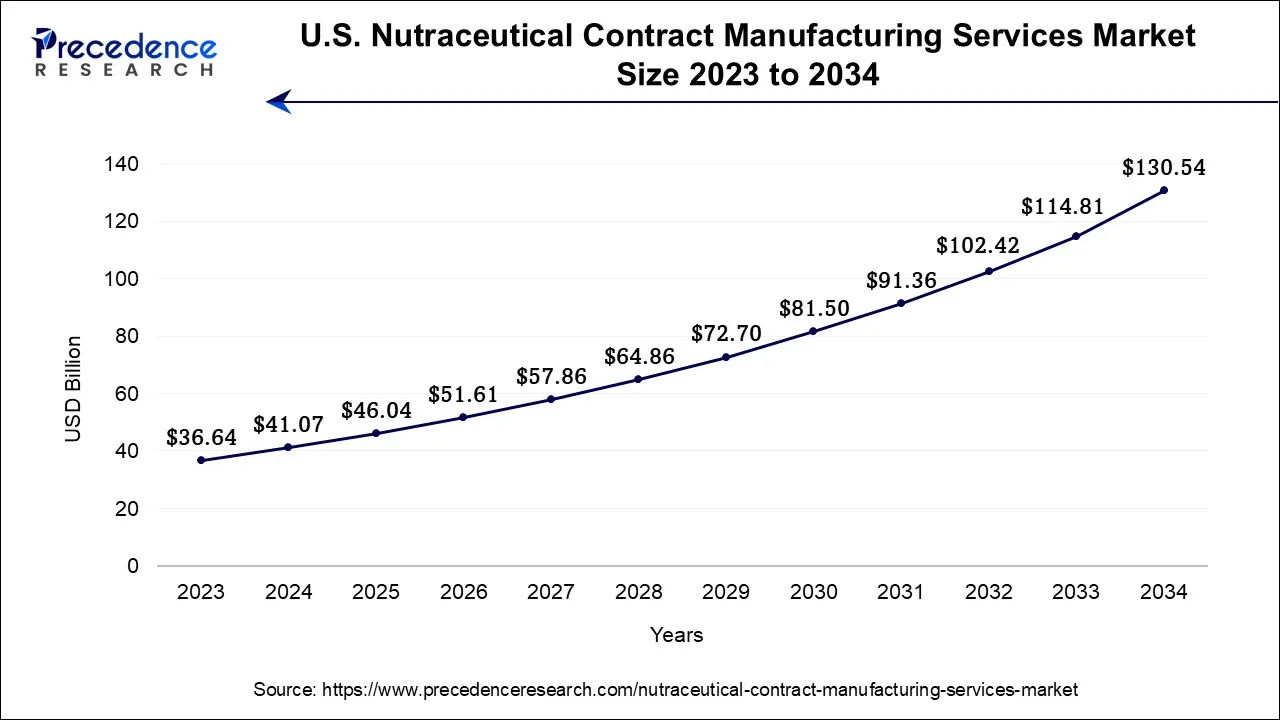

The U.S. nutraceutical contract manufacturing services market size is accounted for USD 46.04 billion in 2025 and is projected to be worth around USD 144.04 billion by 2035, poised to grow at a CAGR of 12.08% from 2026 to 2035.

North America has held the largest revenue share 35% in 2023. North America's nutraceutical contract manufacturing services market encompasses the industry segment offering outsourced manufacturing solutions for dietary supplements, functional foods, and herbal products with health benefits. This region, comprising the United States and Canada, is a hub for innovation and consumer demand for wellness products. Recent trends include a growing preference for clean-label, plant-based, and organic nutraceuticals. Contract manufacturers in North America are increasingly focusing on meeting these demands and adhering to strict quality and regulatory standards. The market is also witnessing a surge in personalized and immunity-boosting products, driven by the COVID-19 pandemic's impact on health consciousness.

US

The US dominates the North American market due to a large dietary supplement consumer base, strong presence of nutraceutical brands, and a well-established CDMO ecosystem. Rising demand for customized formulations, clean-label products, and specialized dosage forms such as gummies and soft gels continues to drive outsourcing to contract manufacturers with advanced R&D and regulatory capabilities.

Asia-Pacific is estimated to observe the fastest expansion The Asia-Pacific nutraceutical contract manufacturing services market refers to the sector in the Asia-Pacific region that offers outsourced manufacturing solutions for nutraceutical products, including dietary supplements, functional foods, and herbal remedies. This market encompasses a diverse range of countries, each with its own regulatory landscape and consumer preferences. Recent trends in this market include a growing demand for clean-label and plant-based products, driven by health-conscious consumers seeking natural and transparent ingredients. Additionally, the region has seen an increase in contract manufacturing partnerships between local brands and global manufacturers to cater to the unique preferences of the Asia-Pacific consumer base. The market also reflects a rising interest in traditional herbal remedies and innovative delivery formats, such as gummies and beverages, to meet evolving consumer demands.

India

India is emerging as a prominent contract manufacturing destination due to its low-cost production, skilled workforce, and strong regulatory alignment with global standards. Indian nutraceutical CMOs are increasingly involved in bulk manufacturing, private labeling, and export-oriented production, particularly for herbal, ayurvedic, and plant-based nutraceutical formulations.

Europe

Europe is characterized by a highly regulated nutraceutical landscape, driving consistent demand for compliant and specialized contract manufacturing services. The region emphasizes quality assurance, traceability, and scientific substantiation, encouraging nutraceutical companies to partner with experienced CMOs for formulation development, testing, and regulatory documentation across diverse product categories.

Germany

Germany serves as a key hub within Europe due to its strong pharmaceutical heritage, advanced manufacturing technologies, and focus on functional nutrition. German contract manufacturers are increasingly preferred for premium nutraceutical products, offering capabilities in capsules, tablets, and functional powders while adhering to strict EU regulatory and quality standards.

Nutraceutical Contract Manufacturing Services Market Companies

- Catalent, Inc.

- Lonza Group AG

- Royal DSM N.V.

- Glanbia plc

- Capsugel (A Lonza Company)

- Patheon, now part of Thermo Fisher Scientific

- Nature's Bounty Co.

- Nutrascience Labs

- Vitakem Nutraceutical Inc.

- Paragon Laboratories

- Abbott Laboratories

- Biovation Labs

- NutraScience Labs

- NutraPak USA

- Robinson Pharma, Inc.

Recent Developments

- In December 2025, ELIS Manufacturing and Packaging Solutions Inc. announced a strategic expansion of its nutraceutical contract manufacturing services in early 2026, specifically focusing on advanced stick pack technology.(Source: https://www.delawareonline.com )

- In August 2025, Sirio Pharma, a global nutraceutical CDMO, initiated an expansion in the Asia-Pacific region to address a 77% revenue increase in these markets (excluding China). A new manufacturing facility in Thailand is a key component of this growth strategy

(Source:https://www.nutritionaloutlook.com/ ) - In June 2025, The Sanner Group initiated manufacturing operations at its inaugural U.S. production site in Greensboro, North Carolina, in mid-2025.

(Source: https://www.contractpharma.com ) - In 2023, NutraLab has expanded with a new enclosed automatic manufacturing and packaging line for powder supplements, enhancing production efficiency and quality control in its powder supplement manufacturing processes.

- In 2022, Catalent is set to acquire Metrics Contract Services, a move aimed at expanding its capabilities in high-potent drug development and increasing oral development and manufacturing capacity. This strategic acquisition will strengthen Catalent's position in the pharmaceutical contract development and manufacturing sector.

Segments Covered in the Report

By Product

- Dietary Supplements

- By Type

- Proteins & Amino Acid Supplements

- Weight Management and Meal Replacer Supplements

- Multivitamin, Multi-Mineral, and Antioxidant Supplements

- Other Supplements

- By Dosage Form

- Tablets

- Capsules

- Liquid Oral

- Powder In Sachet/Jar

- Gummies

- Energy Bars

- Other Suitable Forms

- By Type

- Functional Food and Beverages

By Geography

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting