What is the Healthcare Contract Research Organization Market Size?

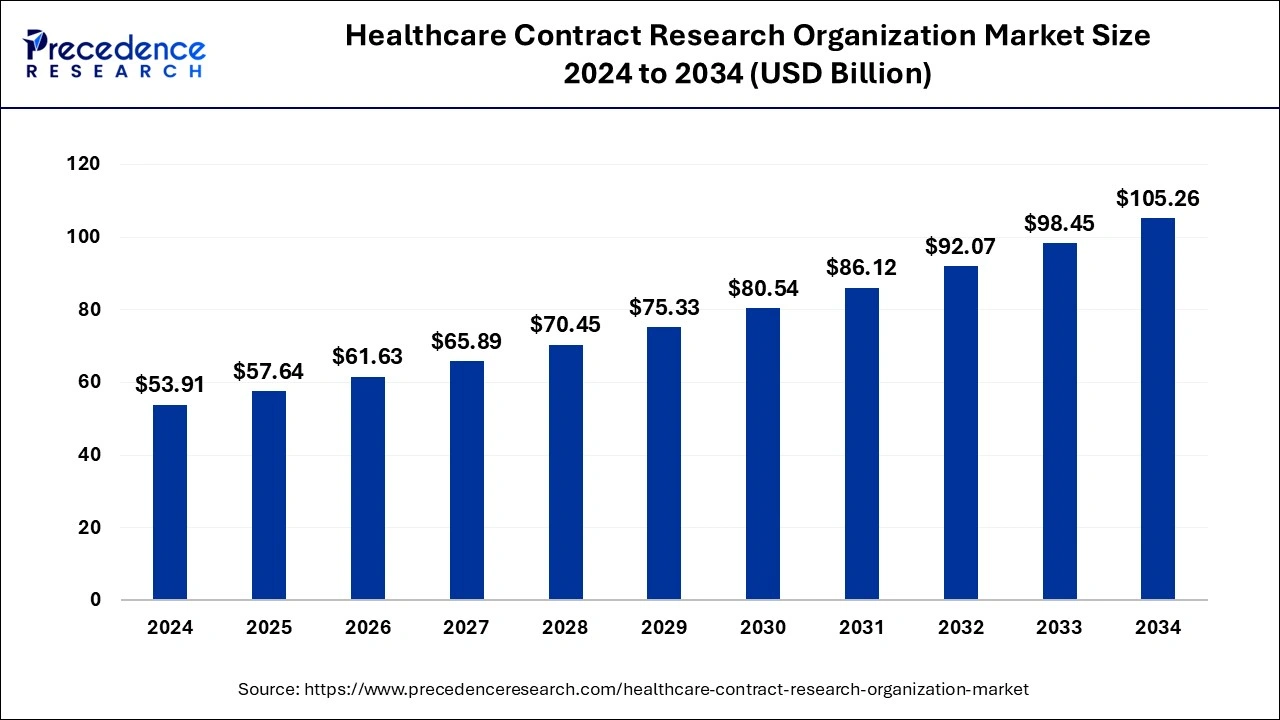

The global healthcare contract research organization market size is calculated at USD 57.64 billion in 2025 and is predicted to increase from USD 61.63 billion in 2026 to approximately USD 111.78 billion by 2035, expanding at a CAGR of 6.85% from 2026 to 2035.

Market Highlights

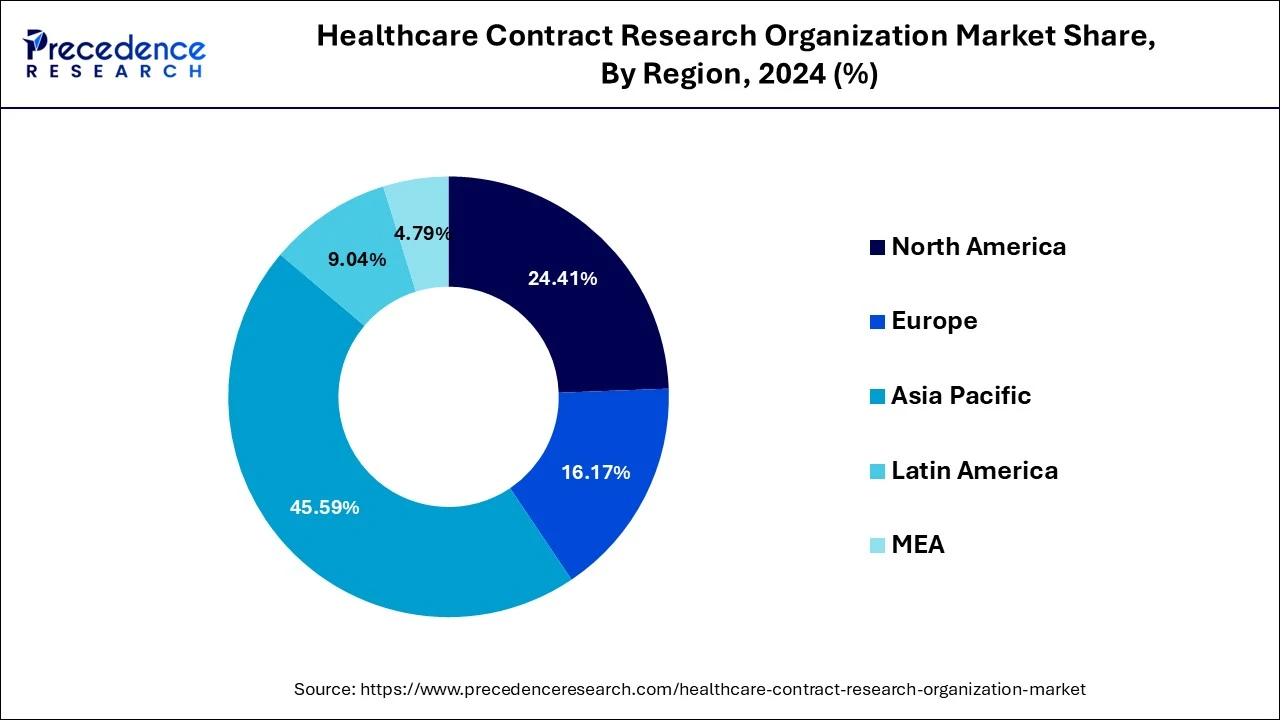

- Asia Pacific dominated the healthcare contract research organization market with the largest market share of 45.59% in 2025.

- North America is expected to grow with the highest CAGR of 5.22% during the forecast period.

- By service, the clinical monitoring segment contributed the highest market share of 21% in 2025.

- By service, the regulatory/medical affairs segment is expected to expand at a notable CAGR of 11.12% during the forecast period.

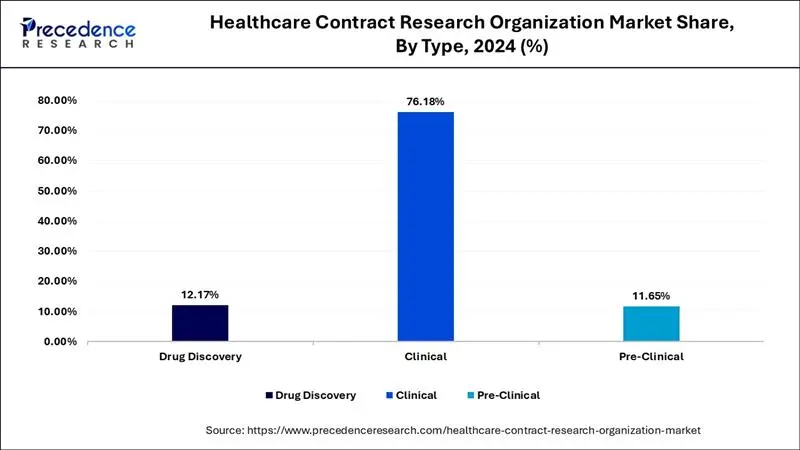

- By type, the clinical segment held the highest share of 76.18 in 2025.

- By type, the preclinical segment is projected to grow at a notable CAGR of 8.51% during the forecast period.

Market Size and Forecast

- Market Size in 2025: USD 57.64 Billion

- Market Size in 2026: USD 61.63 Billion

- Forecasted Market Size by 2035: USD 111.78Billion

- CAGR (2026-2035): 6.85%

- Largest Market in 2025: Asia Pacific

- Fastest Growing Market: North America

Market Overview

The healthcare contract research organization market is an important segment of the life sciences industry. This industry deals in providing services for managing clinical trials in pharmaceutical, biotechnology, and medical device companies. There are several types of services provided by this industry comprising of data management, clinical supply management/project management, medical writing, clinical monitoring, patient & site recruitment, bio-statistics, regulatory & medical affairs, investigator payments, technology, laboratory, quality management and some others. The rise in number of research activities in the biotechnology industry has boosted the market expansion. This industry is expected to rise significantly with the growth of the biopharma sector across the world.

Role of AI in Healthcare Contract Research Organization Market

The advancements in artificial intelligence AI technology is playing a crucial role in shaping the healthcare contract research organization industry. The integration of AI in CRO solutions helps in improving clinical trial design and identifying optimal clinical trial sites. Also, AI can monitor trial data in real-time and automate data cleaning for enhancing clinical trials. Moreover, AI has the capability for generating and managing automated data for the trial lifecycle consisting of patient's medical history.

- In July 2024, Fortrea launched an AI-based CRO platform. This platform is designed for streamlining numerous clinical trials.

Healthcare Contract Research Organization Market Growth Factors

- The increased investment by the biotechnology and the biosimilar companies in the research and development of new drugs and diagnostic instruments.

- Rising preferences for outsourcing activities to the CROs for saving time and costs and expiry of patent in the healthcare sector.

- The high-quality services offered by the healthcare CROs instigate the various government organizations to outsource various projects to the CROs.

- The rapid growth of the biopharmaceutical industry.

- The rise in number of biosimilar companies across the world.

- Increased preference for outsourcing activities in healthcare sector.

- Collaboration among market players for providing advanced services.

Market Outlook

Why is the Contract Research Organization Services Market Growing on a Global Level?

- Industry Growth Overview: The rapid expansion of the CRO Services sector is attributable to the growing difficulties associated with conducting clinical trials and many biopharma corporations utilizing CROs to outsource clinical research services, the increasing development of more complicated biologics, and the desire of biopharma companies for a cost-effective, expert service provider to support each phase of drug development.

- Sustainable Trends: Many CROs are taking measures to mitigate the negative impact on the environment resulting from their activities and the materials used in clinical trials. This includes the adoption of electronic systems for all aspects of clinical trials, developing green laboratory facilities, and ensuring the ethical recruitment of research participants.

- Global Expansion: The global growth of CROs in emerging markets has led to the establishment of regional trial hubs, the utilization of local regulatory expertise, and strategic alliances that aid in speeding up the clinical trial process for patients, lowering the costs associated with clinical trials, and having a more diverse patient population for research purposes.

- Startup Ecosystem: The emergence of AI-driven analytic startups, niche therapeutic CROs, and providers of decentralized trial technology has led to innovative methodologies for conducting research. However, the growth of these entities also presents new funding options for early-stage companies aiming to provide a flexible, tech-enabled alternative to traditional CROs.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 57.64 Billion |

| Market Size in 2026 | USD 61.63 Billion |

| Market Size in 2035 | USD 111.78 Billion |

| Growth Rate from 2026 to 2035 | CAGR of 6.85% |

| Largest Market | Asia Pacific |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | Service, Type, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

The rising demand for the drug discovery services is significantly boosting the growth of the global healthcare contract research organization market. The rising burden of chronic diseases is fostering the investments by the pharmaceutical manufacturers in the drug discovery to develop new and effective drugs. The rising investments in the development of small molecule drugs have significantly driven the demand for the drug discovery services of healthcare CROs across the globe. The small molecule drugs are the most effective drugs that can effectively treat various diseases by directly affecting the infected cells. Moreover, the growing penetration of CROs across the globe owing to the lucrative growth opportunities being offered by the market due to the growing geriatric population and growing burden of non-communicable diseases is significantly propelling the market growth.

Restraint

Regulatory Complexities along with Data Privacy Concerns Hinders the Industrial Expansion

The healthcare contract research organization market faces several problems in their daily operations. Firstly, there are numerous regulations by several governments that forbids the adoption of healthcare CRO services which in turn acts a restrain in the industry. Secondly, the data breaching issues in the CRO platforms can result in duplication of data which may create a havoc among the end-users, thereby hindering the market expansion.

Opportunity

Advancements in Biologics and cell and gene therapies to Shape the Future

The developments in gene therapies and biologics has increased the demand for healthcare CRO services. CRO solutions can help in clinical trial management by ensuring that trials are conducted according to protocol and compliances. Moreover, these services find applications in logistics management by facilitating multi-country transport of genetic products. Thus, rising advancements in Biologics and cell and gene therapies is expected to create ample growth opportunities for the companies in the upcoming days.

Segments Insights

Service Insights

The clinical monitoring segment dominated the global healthcare contract research organization market with the highest market share of 21% in 2025. This can be attributed to the technical expertise and specialized services offered by the CROs that helps to save time and cost of the client and also provides efficient results. The adoption of real time data acquisition equipment and smart analytics amongst the healthcare CROs has enhanced the clinical monitoring services, which is further expected to drive the market growth. These technologies help to detect any errors early and avoid the delay or termination of the projects.

The regulatory/medical affairs segment is expected to expand at a notable CAGR of 11.12% during the forecast period. There are strict regulations and rules imposed by the government that needs to be followed strictly. The regulatory affairs associated with various tasks such as clinical trials, product registration, research & development, and approvals are hectic and hence most of the companies outsource these tasks to the specialist CROs.

Type Insights

Clinical segment dominated the global healthcare contract research organization market, accounting for around 76.18% of the market share in 2025. The rising demand for the personalized medicines and growing number of biologic drugs coupled with the rising demand for the advanced technologies in the healthcare CROs. The Phase III of the clinical trials are the most expensive phase that generates the maximum revenue. The rise in number of clinical trials associated with discovery of novel medications for cancer treatment has driven the market growth.

The pre-clinical segment is projected to grow at a notable CAGR of 8.51% during the forecast period. The failure of 50% of the toxicology tests in the pre-clinical trials is expected to foster the number of pre-clinical trials. In preclinical trials, CRO services are used for several applications such as generating data, modifying drug formulations, scaling operations, ensuring regulatory compliance and some others. The growing demand for CROs to perform in vivo tests has boosted the industrial expansion.

Regional Insights

What is the Asia Pacific Healthcare Contract Research Organization Market Size?

The Asia Pacific healthcare contract research organization market size is evaluated at USD 26.28 billion in 2025 and is predicted to be worth around USD 51.03 billion by 2035, rising at a CAGR of 6.86% from 2026 to 2035.

Asia Pacific dominated the healthcare contract research organization market with the largest market share of 45.59% in 2025. This is attributable to the rising prevalence of chronic diseases, easy recruitment and retention of patients, and strict adherence to the regulatory standards. Moreover, the presence of several top contract research organizations such as ACM Global Laboratories, George Clinical, Syngene International Limited, TFS HealthScience (TFS) and some others in the region that offers high quality services at a low cost has fueled the growth of the Asia Pacific healthcare contract research organization market. The availability of cheap labor and experienced research professionals at affordable costs is further fueling the market growth.

The main factors expected to drive the healthcare contract research organization market of India include the internationalization of clinical trials, the integration of innovative technologies in clinical research, increasing diversity and frequency of diseases, and a growing focus on research and development that promotes outsourcing. The Indian government is actively working to enhance R&D initiatives, expected to promote market growth. Clinical trials in India are approximately 50% cheaper than in the United States and Europe. Consequently, the county is expected to lead the market due to its affordability and large number of untreated patients.

- In March 2024, TFS HealthScience (TFS) announced to expand its CRO services in Australia. This service is designed for the end-users of Asia-Pacific region.

North America is expected to grow with the highest CAGR of 5.22% during the forecast period. The presence of several top biopharmaceutical and biosimilar companies along with the presence of several CROs has collectively contributed towards the market growth. According to the Pharmaceutical Research and Manufacturers Association (PhRMA), US conducts more than half of the research & development activities in the pharmaceutical field and also holds intellectual rights of a significant amounts of new medicines. Thus, the rapidly growing investments in the research and development by the top pharmaceutical companies coupled with launch of new medicines in the region are expected to significantly drive the growth of the North America contract research organization market in the forthcoming years.

The growth of the United States healthcare contract research organization market is propelled by technological progress as swift technological innovations are transforming the clinical trial procedure. Advancements in data analysis offer more profound understanding of trial information, facilitating better decision-making, while artificial intelligence enhances efficiency through process automation. CROs are forming a growing number of strategic partnerships with pharmaceutical firms, promoting improved cooperation and synergy in laboratory research activities. These partnerships utilize the capabilities and assets of both organizations, promoting the implementation of optimal practices and fueling innovation throughout the clinical research field. The existence of many biotechnology companies in the nation is aiding collaborative research initiatives in the United States healthcare contract research organization sector.

Europe is expected to grow significantly in the healthcare contract research organization market during the forecast period. The increasing diseases in Europe are increasing the demand for new treatment options. This, in turn, is increasing the clinical trials, which increases the demand as well as the use of healthcare contract research organizations. These organizations are providing advanced technologies as well as a suitable environment to conduct the clinical trials. At the same time, the presence of skilled personnel is also improving the workflow. Moreover, with the help of expertise, various methodologies as well as decisions can be made effectively. Additionally, these developments are also being supported by the regulatory bodies as well as the government. Thus, this promotes the market growth.

Europe: Clinical Excellence Through Innovation:

The regulatory harmonization of Europe, advanced healthcare systems, and widespread acceptance of decentralized clinical trials have contributed to Europe's growth. In addition, the increase in oncology and rare disease investments has contributed to the rising demand for clinical research organizations (CROs) in Western and Nordic Europe.

Poland has been growing rapidly because of low costs associated with trials, high-quality investigators, and highly efficient patient recruitment.

Latin America: The Low-Cost Trial Expansion Hub:

Latin America has become a major player for late-phase clinical trials due to its diverse patient populations, shorter approval timeframes, and improved clinical infrastructure, which provide sponsors with operational benefits when conducting trials.

Brazil leads in growth because of its extensive patient base, expanding investment by biopharma companies, and a supportive regulatory environment.

MEA: A Developing Destination for Clinical Research:

MEA is quickly becoming a destination for clinical trials and has begun to evolve as a research destination with the support of government investment in healthcare, a growing prevalence of chronic diseases, and increasing interest in conducting international multi-centre trials. The modernization of infrastructure and increased CRO adoption are driving this growth.

Saudi Arabia is undergoing rapid transformation and improvement through Vision 2030 health initiatives, increased funding for clinical trials, and continued regulatory modernization.

Value Chain Analysis of the Contract Research Organization (CRO's) Market

- Preclinical & Early-Stage Research: This segment deals with all aspects of preclinical development, including target identification, lead optimization, bioanalytics, and toxicology.

Key Players: Charles River Laboratories, WuXi AppTec, Eurofins Scientific. - Clinical Trial Management & Execution: Clinical Operations account for the greatest revenue generating component within the value chain, which includes the processes associated with clinical trial design, patient recruitment, clinical site monitoring, and data management.

Key Players: IQVIA, ICON plc, and Labcorp Drug Development. - Regulatory, Medical Writing, & Post-Marketing: CROs provide support for faster approval by creating harmonized global regulatory strategies, conducting safety monitoring, and post-marketing surveillance so that the sponsor can continue to maintain regulatory compliance and maximize the value of the product in the marketplace.

Key Players: Parexel, Syneos Health, and Medpace.

Healthcare Contract Research Organization Market Companies

- QVIA

- LabCorp

- Charles River Laboratories

- WuXiAppTec

- Syneos Health

- Parexel International

- PPD

- ICON Plc

- Medpace Holdings

- SGS

- PSI CRO AG

- Axcent Advanced Analytics

- BIO Agile Therapeutics

- Firma Clinical Research

- Acculab Life Sciences

Recent Developments

- In June 2025, to develop a new Cancer Research and Innovation Centre in India, a memorandum of understanding (MoU) was signed between the Tata Memorial Centre (TMC) and Wipro GE HealthCare Technologies. Thus, with the help of advanced technologies, academic collaboration, and clinical research, cancer care will be enhanced, which will be the goal of this center. In this collaboration, TMC will serve as the clinical oncology partner, while the technology partner will be Wipro GE HealthCare. Furthermore, to develop a five-year roadmap for collaborative work and to define important project areas, a joint working group will be established. (Source: https://analyticsindiamag.com)

- In April 2025, oncology models, along with research services, to meet the demand of life science R&D companies, were launched by Powered Research, which is a leading preclinical CRO specializing in non-GLP models. Furthermore, its newest advancements as well as capabilities will be revealed at the American Association for Cancer Research (AACR) Annual Meeting 2025, creating a groundbreaking achievement. (Source: https://finance.yahoo.com)

- In May 2025, IQVIA, a premier worldwide supplier of clinical research services, commercial insights, and healthcare intelligence for the life sciences and healthcare sectors, announced a strategic partnership with the contract research organization division of Sarah Cannon Research Institute, SCRI Development Innovations, focused on revolutionizing oncology trials for biopharma partners globally.

- In January 2025, Expecto Health Science, a top-tier full-service Contract Research Organization in Asia Pacific concentrating on emerging markets, revealed the signing of an important Memorandum of Understanding (MOUs) with Mayapada Hospital Jakarta Selatan, a primary hospital unit of Mayapada Healthcare.

- In September 2024, Lindus Health launched All-in-One Ophthalmology CRO. This CRO solution is designed for ophthalmology clinical trials.

- In June 2024, IQVIA launched One Home for Sites. One Home for Sites is a CRO platform designed for conducting clinical trials.

- In June 2024, Labcorp launched Labcorp Global Trial Connect. Labcorp Global Trial Connect is designed for improving clinical trial efficiency.

Industry Leaders' Announcements

- In September 2024, Dr. Alexander Dobranowski, CEO of HEALWELL, made an announcement stating that the BioPharma industry is the major contributor of the CRO services and he also announced to leverage AI in their CRO platform for leveraging healthcare operations.

Segments Covered in the Report

By Service

- Data Management

- Clinical Supply Management/Project Management

- Medical Writing

- Clinical Monitoring

- Patient & Site Recruitment

- Bio-Statistics

- Regulatory & Medical Affairs

- Investigator Payments

- Technology

- Laboratory

- Quality Management

- Others

By Type

- Pre-Clinical

- Clinical

- Phase I Trial Services

- Phase II Trial Services

- Phase III Trial Services

- Phase IV Trial Services

- Drug Discovery

- Target Validation

- Lead Identification

- Lead Optimization

By Application

- Oncology

- Cardiovascular

- Autoimmune/Inflammation

- Central nervous system (CNS)

- Dermatology

- Infectious diseases

- Diabetes

- Pain

- Others

By End-use

- Pharmaceutical & Biopharmaceutical Companies

- Medical Device Companies

- Others

By Region

- North America

- Latin America

- Europe

- Asia-pacific

- Middle and East Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting