What is On-Board Charger Market Size?

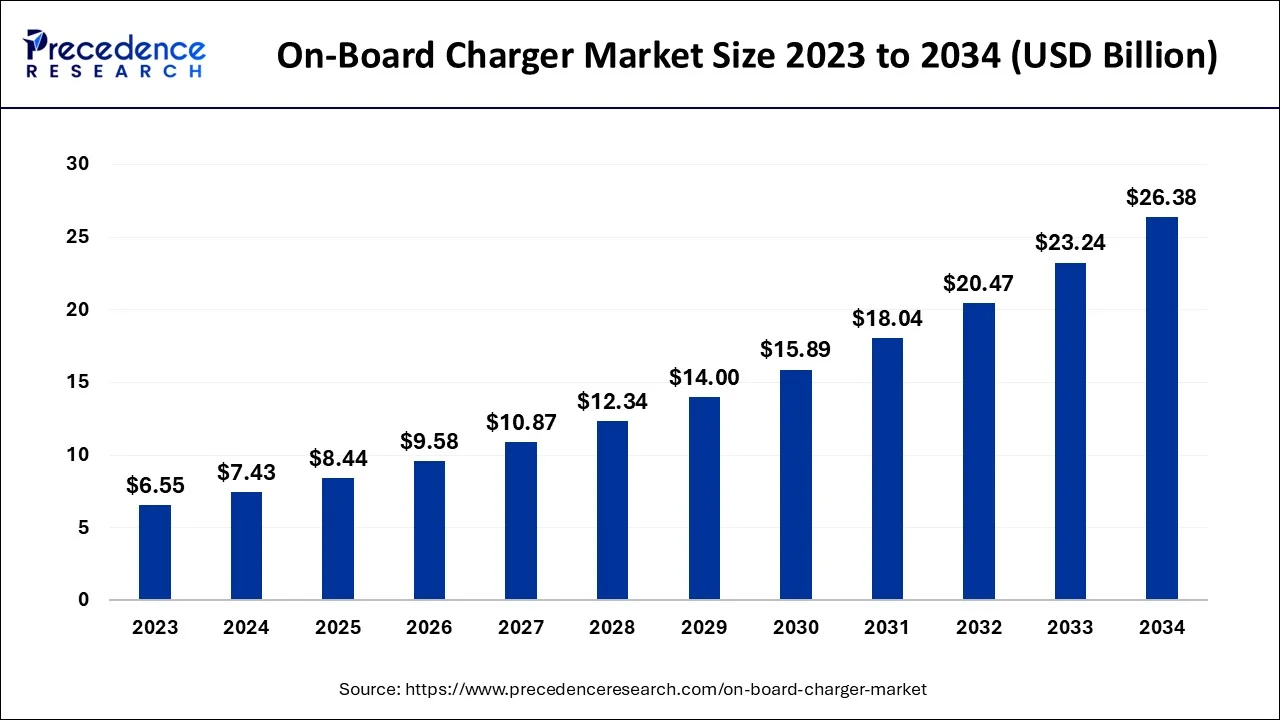

The global on-board charger market size is calculated at USD 8.44 billion in 2025 and is predicted to increase from USD 9.58 billion in 2026 to approximately USD 29.57 billion by 2035, expanding at a CAGR of 12.24% from 2026 to 2035.

Market Highlights

- By power output, the 11 kW to 22 kW segment accounted market share of around 43% in 2025

- By vehicle type, the passenger cars segment garnered 37% market share in 2023 and bus segment is projected to grow at a remarkable CAGR from 2026 to 2035.

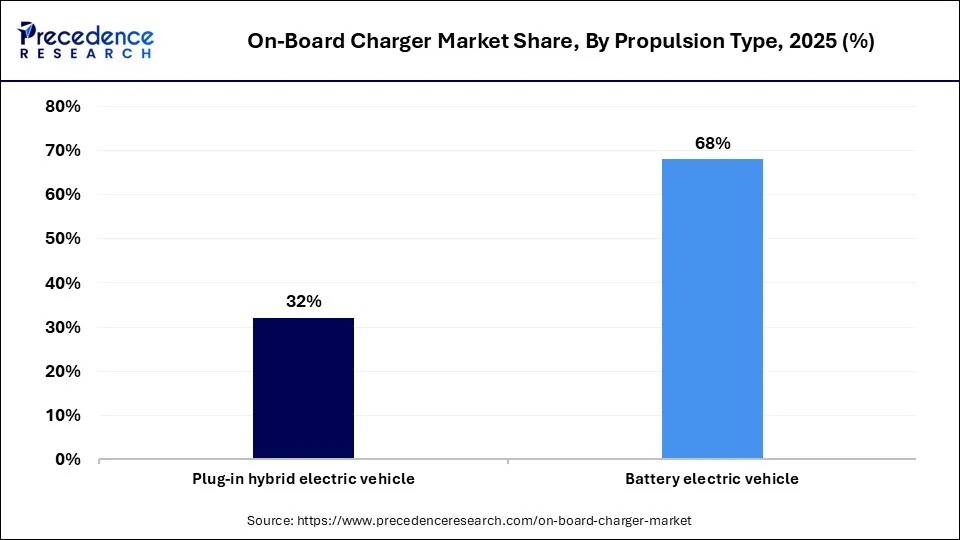

- By propulsion type, the BEV segment hit 68% market share in 2025 and PHEV segment will register notable growth from 2025 to 2034.

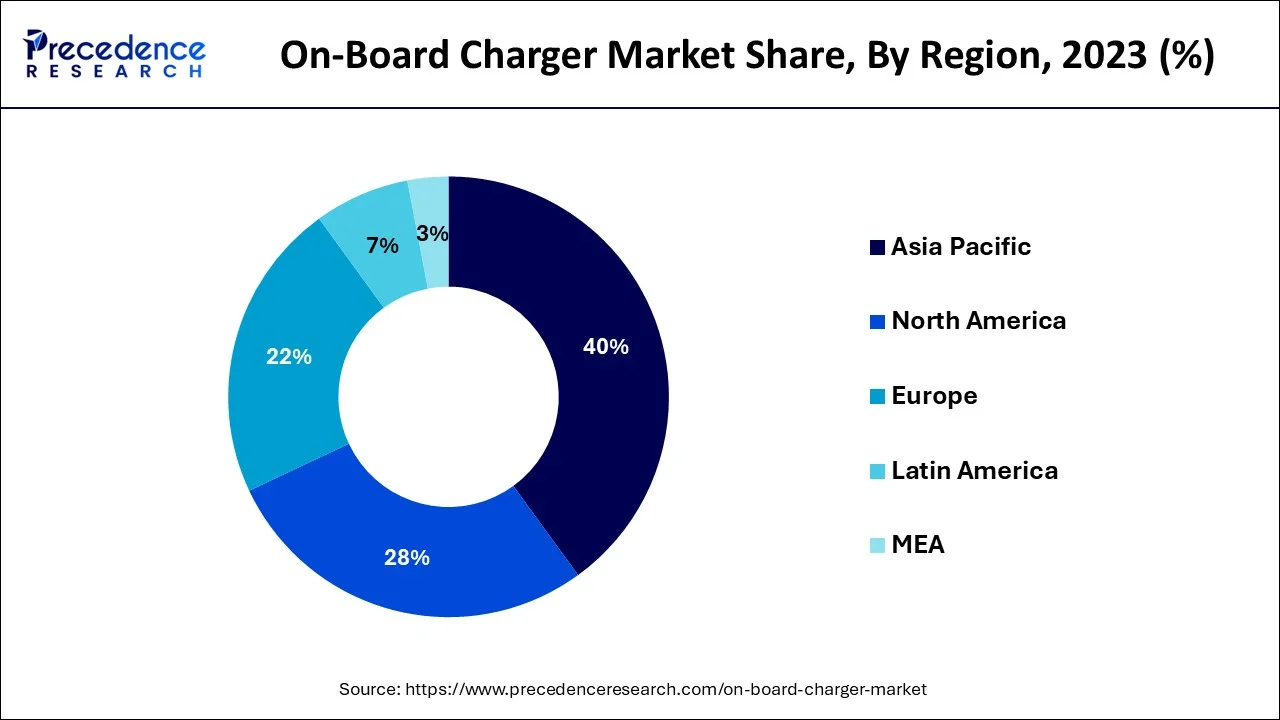

- In 2023, the Asia Pacific region representing in excess of 40% of overall income

- Europe is projected to witness significant growth from 2026 to 2035

- European plug-in passenger car sales registered at 8% in 2023 in contrast to 4% in 2025.

Rising Demand for On-Board Charges in Electric Vehicles

The costly cost of charging an electric vehicle at public charging stations is driving the current interest for on-board chargers. Business electric costs apply to public chargers close to streets, shopping centers, and organizations, which are more than private rates. This requires the utilization of on-board chargers for electric vehicles. In an electric vehicle, an on-board charger is utilized to charge the foothold battery by changing over the AC input from the lattice to the DC input important to charge the batteries. One of the essential reasons driving business sector extension is the expansion in the quantity of AC private and public charging stations all through the world. The AC level 1 on-board charger might be associated into standard electrical plugs and is utilized in a wide range of electric vehicles.

An on-board charger makes it simpler to charge the batteries of electric or cross breed vehicles. Roughly 80% of the time, drivers charge their vehicles at home. High voltage chargers have recently seen an extensive expansion popular because of their higher charging speed. For instance, Tesla has laid out 31,000+ supercharger networks around the United States; this charger considers 200 miles of driving in only 15 minutes of charging. Different players are supposed to stick to this same pattern later on years by delivering various compact superchargers.

Impact of Artificial Intelligence on the On-Board Charger Market

Artificial Intelligence (AI) is transforming the on-board charger market by shifting intelligence from cloud-based systems to embedded controllers and firmware within charging hardware. AI-enabled chargers perform device-aware power delivery, predictive battery management, and real-time thermal monitoring, which improves charging efficiency, extends battery life, and reduces fault risks. These capabilities are especially valuable for electric vehicles (EVs) and high-power consumer electronics, where safety and performance are critical. As a result, manufacturers are increasingly integrating AI to differentiate products and meet stricter safety standards.

AI is also enabling smarter energy management and system-level optimization in both residential and EV charging applications. Intelligent charging algorithms can shift charging loads from peak to off-peak periods, lowering electricity costs and easing grid strain. When combined with advanced power electronics such as gallium nitride (GaN), AI helps deliver higher charging power in smaller form factors while maintaining thermal stability. This convergence of AI and power technology is accelerating innovation and driving growth in the on-board charger market.

On-Board Charger Market Growth factors

Electric vehicle deals moved by 176% in the primary portion of 2025 contrasted with a similar period in 2022. It represented 26% of new vehicle deals in the car area. China arose as the world's driving EV community, representing 11% of the market. One more impact of the EV market blast is that lithium costs have ascended by around 17%. Thus, these factors lead to higher purchaser spending. Buyers overall spent around $12 billion USD on EV merchandise in 2021. Moreover, as per a Power Technology research, EV deals in the principal half of 2022 were 2.7 million units, with 5 million units anticipated before the years over. Accordingly, these factors add to advertise extension. The limitation on involving non-renewable energy source as a vehicle fuel upheld by different nations is probably going to expand deals of electric vehicles, which will drive the extension of the on-board charger industry.

The worldwide arrangement of electric charging stations is driving development in the locally available charger industry. Locally available chargers are utilized in electric vehicles that permit AC level 1 and level 2 charging. An on-board charger controls the progression of force from the network to the battery. This suggests that the On-board charger should satisfy the rules of the matrix in the spots where it will be used. The rising establishment of AC charging stations in arising countries is pushing the on-board charger business forward. As far as vehicle type, the on-board charger market is separated into battery electric vehicles and module crossover electric vehicles. The foundation for charging electric vehicles is basic for the inescapable utilization of electric vehicles. A few government projects have been sent off across the world to supply electric vehicle charging stations.

The Automotive Research Association of India, for instance, planned to introduce more than 200 EV charging stations around the country. Moreover, Tata Power, an Indian electric utility firm that is essential for the Tata Group (India), upholds the Indian Government's National Electric Mobility Mission by laying out the primary arrangement of electric vehicle charging stations in Mumbai (India) for India's blossoming EV environment.

Major Market Trends

- Increased Power Levels: Many automakers are shifting from low-power (240V & 7-10kW) to high-power (480V & 11-22kW) charging systems to reduce the time needed to charge an electric vehicle and support larger battery packs. These upgraded systems provide greater convenience for customers, enable higher charging levels, and align with automakers' move toward long-range electric vehicle designs.

- Increased Two-Way Power Flow: The rising demand for Vehicle-to-Home and Vehicle-to-Grid capabilities underscores the need for OBCs with bi-directional power flow. Bi-directional OBCs allow EV owners to use backup power when needed and help stabilize the electrical grid more effectively.

- Integrating Power Electronics: OEMs are combining on-board chargers, inverters, and DC-DC converters into integrated modules. This results in reduced component count, reduced weight for the overall system, improved thermal management, and improved efficiency in the overall architecture of EV Powertrains.

Market Outlook

- Industry Growth Offerings- The market is growing due to increasing electric vehicle adoption, demand for efficient and fast charging solutions, and advancements in compact, high-voltage AC/DC chargers. Integration with smart grids and innovative power electronics further drives industry expansion.

- Global Expansion- The global market is expanding as EV adoption rises across North America, Europe, and Asia Pacific. Increasing investments in charging infrastructure, government incentives, and technological advancements in high-voltage and smart chargers are driving international market growth.

- Startup ecosystem- The on-board charger startup ecosystem is growing with ventures developing compact, high-efficiency AC/DC chargers, smart charging solutions, and integration with renewable energy and vehicle-to-grid systems. Innovation, funding support, and partnerships with automakers are accelerating new market entrants.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 8.44 Billion |

| Market Size in 2026 | USD 9.58 Billion |

| Market Size by 2035 | USD 29.57 Billion |

| Growth Rate from 2026 to 2035 | CAGR of 13.24% |

| Asia Pacific Market Share in 2024 | 40% |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | Vehicle Type, Power Type, Propulsion Type, Sales Channel, Geography |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Segment Insights

Vehicle Type Insights

Thepassenger cars segment is supposed to rule the market. In view of vehicle type, this market might be isolated into traveler cars and business vehicles. In 2025, the passenger cars area will rule the overall market. Quick urbanization, which increments interest for monetary transportation mediums like as electric cars, is a key driver influencing market extension. When contrasted with IC vehicles, electric vehicles are more practical and have a lower natural effect. Thus, state run administrations of significant economies, for example, the China, India and USA support the utilization of such vehicles. Such government backing, joined with expanded public interest in EV innovation, is projected to fuel EV interest before very long.

The passenger cars portion is supposed to overwhelm the market. Since the EV Ob-Board charger business is inseparably connected to the EV business, development in the last option will ultimately prompt expanded interest for chargers. Despite the fact that there are restricted conceivable outcomes in the business market from the EV environment, what's to come looks encouraging as key makers offer new items. Business EV reception is more troublesome than passenger cars reception since such vehicles utilize greater power and require more upkeep. We guess that interest for business EV on-board chargers will ascend as the quantity of business EV models available grows all through the conjecture period.

Power Type Insights

The market is separated into two segments in view of force yield: 20kilowatt and >20. Vehicle on-board chargers convert power from substituting current to coordinate current and afterward put it into the vehicle's battery. Since power from the framework is consistently AC, AC is the most continuous charging choice for electric vehicles. A Level-1 AC charger takes around eight to nine hours to re-energize an EV's battery totally. Level-2 and Level-3 charges are speedier for EVs since they utilize bigger power limit chargers.

The quantity of kW power given by chargers is determined. Every KiloWatt Hour got by the battery equivalents to around 6.5 km of driving reach. With the approach of associated and independent EV's, vehicle configuration will develop more muddled, requiring the utilization of an OBC with a bigger power limit with regards to charging. Thus, OBC with under 20kilowatt power yield are presently more functional. Besides, as client interest for fast charging develops, OBC with more than 20 kilowatt power limit will exhibit a higher Compound annual growth rate during the projection time frame.

Technology Insights

Auto producers are logically gathering and putting resources into the plan and improvement of electric vehicles, which is likewise a pattern in the portability and cargo transportation enterprises. Thus, the electric vehicle on-board charger industry will extend in lockstep with the EV market. Right now, most of EVs available remember for board unidirectional battery charging strategies. A few vehicles use off-board chargers to charge their batteries. The ongoing spike in EV ventures by the transportation business mirrors a change in good examples. For instance, the production of remote, bi-directional, and quick chargers the vehicle to grid thought alludes to the straightforward methodology of connecting an EV's battery accusing arrangement of the power matrix. V2G is recognized by the way that it requires just battery chargers with bidirectional power stream capacities and association with Smart Grids.

Moreover, a few EV and EV charging producers have started to examine two-way charging innovations. For instance, Hyundai Mobis declared in August 2017 the presentation of a two-way ready charger for impending Ev and Plug - in half breed electric with phenomenal wellbeing effectiveness. Thus, the progression of battery charging innovation will produce beneficial possibilities for development plans throughout the projected time period.

Propulsion Type Insights

Remote charging for cell phones is as of now accessible, and it is likewise pertinent to electric vehicles. The vehicle's battery might be remotely re-energized by leaving the auto on the area and putting a charger on the ground. It works similarly as remote telephone chargers, however for a bigger scope. Notwithstanding, in light of the fact that the amount of energy returned in these remote frameworks is undeniably more than that of a remote cell charger, it should serious areas of strength for be protected.

One of the essential concerns for shoppers buying an EV is range uneasiness, the fear of running out of battery power and not having the option to find a charging station close by. Power banks for cars are being created by charging gear creators, like how power banks for cell phones might be gained through a versatile application.

Regional Insights

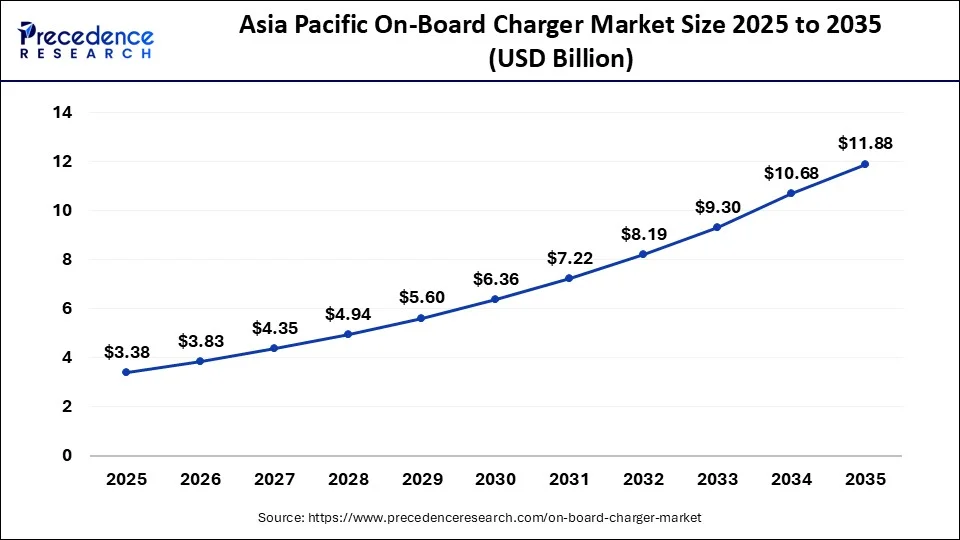

The Asia Pacific on-board charger market size is evaluated at USD 3.38 billion in 2025 and is predicted to be worth around USD 11.88 billion by 2035, rising at a CAGR of 13.39% from 2026 to 2035.

How Urbanization and EV Adoption Are Driving Asia Pacific's Charger Market

In 2023, the Asia Pacific region accounted largest market share. Government drives to advance electric vehicle deals in countries, for example, China and India are improving provincial market development. For instance, the Chinese government's deals amounts for 2020, 2021, and 2022 are one of the essential drivers helping EV on-board charger deals in the country. Tesla Model 3, GAC Aion S and BYD Qin Pro EV are among the EVs in China that utilization on-board chargers.

In 2023, the Asia Pacific on-board charger market was assessed to be worth USD 2.62 billion. The developing metropolitan populace in India and China dirties the climate by producing ozone depleting substances from vehicles and production lines. Thus, legislatures are answering by supporting clean fuel-controlled vehicles, especially EVs, through an assortment of good government estimates remunerating the EV business. Besides, quick urbanization and savvy urban areas are anticipated to support EV extension, impelling the improvement of the electric vehicle on-board charger market around here.

China's On-Board Charger Market Accelerates with Rising EV Adoption

The China market is expanding due to rapid adoption of electric vehicles, government incentives for EV manufacturing, and growing investment in charging infrastructure. Rising consumer preference for home charging and efficient, high-speed on-board solutions further drives demand. Additionally, increasing production of AC and high-voltage chargers, combined with China's focus on reducing charging costs and supporting sustainable mobility, fuels market growth during the forecast period.

Europe is anticipated to increment altogether all through the projection period. Europe's players are continuously attempting to expand their EV offers, which is expanding interest for on-board chargers. BMW plans to charge its SUVs, vehicles, and Mini vehicles in Europe by 2034, as per its vision. All the while, a flood in motivations for the acquisition of electric vehicles is one of the essential drivers driving business sector development in the locale.

Why the UK On-Board Charger Market is Gaining Momentum

The UK market is growing due to rising adoption of electric and hybrid vehicles, government policies promoting EV infrastructure, and increasing consumer demand for convenient home and workplace charging solutions. Expansion of high-speed charging networks, investments in AC and DC chargers, and the push for sustainable transportation further drive market growth, while automakers and technology providers develop advanced, efficient on-board charging systems to meet evolving EV requirements.

The North American market is expanding due to the region's growing EV fleet, rising need for energy-efficient charging solutions, and increasing integration of smart grid technologies. Corporate fleets and commercial EV adoption are further driving demand, while innovations in modular, high-voltage on-board chargers enhance convenience, reduce dependency on public stations, and support faster, safer charging across residential and commercial sectors.

U.S. On-Board Charger Market: Innovation and Adoption Fuel Growth

The U.S. market is rising due to increasing emphasis on reducing charging costs and enhancing energy efficiency in EVs. Growing urban EV adoption, expansion of smart home charging solutions, and integration of advanced power electronics in vehicles are driving demand. Automakers' focus on compact, reliable, and multi-standard on-board chargers, along with corporate fleet electrification, is further boosting market growth across the country.

Latin America is witnessing substantial growth in the market throughout the forecasted years. This rapid expansion is driven by the region's growing government support for clean mobility and increasing EV adoption. Key urban centers are seeing significant investments in both public and private charging infrastructure. Technological advancements, including fast-charging solutions and smart grid integration, are also underway, improving efficiency and user experience.

Key market players are also seen actively forming strategic partnerships in order to accelerate infrastructure deployment and broaden market scope. In addition to that, rising environmental awareness among consumers is further fueling demand for sustainable transportation solutions.

Brazil On-Board Charger Market Trends

The country's growth is driven by supportive government policies that are promoting sustainable mobility and the increasing rates of EV adoption due to cost incentives and expanding charging infrastructure investments. The country is also witnessing increasing collaborations between automakers and energy providers, which ensure technological advancements and wider accessibility.

The Middle East and Africa are witnessing slow but steady market growth. This is due to the gradual adoption of EVs in the region, especially in countries like Saudi Arabia and the United Arab Emirates. In addition to that, several governments in the region are making active investments in the construction of EV charging infrastructure, fueling the expansion of the on-board charger market.

The region is also witnessing a surge in the adoption of modular OBC designs, offering greater flexibility and scalability for manufacturers. This allows manufacturers to easily adapt their OBCs to different EV models and charging standards, thus streamlining the supply chain, fostering innovation, and reducing production costs.

Saudi Arabia On-Board Charger Market Trends

The country's growth is driven by rapid EV adoption, supportive government policies, and regional infrastructure investments. Early market entry also offers a decisive competitive advantage amid factors such as accelerating demand, declining technology costs, and evolving regulatory frameworks.

Value Chain Analysis

- Raw Material Sourcing

Metals and alloys provide structural support and electrical conductivity for on-board chargers.

Advanced polymers are used for insulation and protective enclosures to ensure safety and durability.

Specialty electronic components handle power conversion, control, and efficient energy management.

Key players: Delta Electronics, Bosch, Continental AG, TE Connectivity, Schneider Electric, and Siemens. - Component Manufacturing

Manufacturing EV on-board chargers (OBCs) involves producing specialized electronic components that convert AC power from the grid to DC power for the vehicle battery.Key components include advanced power electronics such as integrated circuits, transistors, capacitors, and magnetic elements.

These parts ensure efficient, safe, and reliable charging for electric vehicles.

Key Players: Delta Electronics, Continental AG, Bosch, TE Connectivity, Schneider Electric, Infineon Technologies. - Vehicle Assembly and Integration

Vehicle assembly and integration of on-board chargers (OBCs) in electric vehicles (EVs) involves converting AC power from the grid into DC power for the battery.The process emphasizes efficient integration, reliability, and advanced features such as bidirectional charging.

Modern OBC designs focus on optimizing performance, reducing energy loss, and supporting smart charging functionalities.

Key Players: Tesla, Continental AG, Bosch, Delta Electronics, Schneider Electric, Siemens.

Top Vendors and their Offerings

- Lear Corporation: Lear provides advanced on-board charging solutions for electric and hybrid vehicles, focusing on efficient power conversion, thermal management, and integration with battery systems to support faster, safer, and reliable EV charging.

- Anghua: Anghua specializes in EV on-board chargers offering high-efficiency AC/DC conversion, compact designs, and smart charging capabilities, catering to passenger vehicles, commercial EVs, and fleet electrification projects.

- Delphi Technologies: Delphi delivers innovative on-board charging systems with optimized power electronics, enhanced thermal management, and flexible integration for various EV platforms, enabling faster and efficient battery charging.

- Infineon Technologies: Infineon develops semiconductor-based OBC components, including power modules, MOSFETs, and controllers, enabling high-efficiency AC/DC conversion and reliable energy management in electric and hybrid vehicles.

- Wanma: Wanma provides on-board chargers with advanced AC/DC conversion, compact and lightweight designs, and integration with smart grid systems, supporting residential and commercial EV charging applications.

On-Board Charger Market Companies

- Tonhe Technology

- Anghua

- Wanma

- Kongsberg

- Lear

- Delphi

- Infineon

Key market developments

- BrusaElektronik delivered an improvement to their original remote charging in Jan 2019, permitting electrical vehicle drivers to re-energize the footing batteries of vehicles going in limit from 3.6 to 11 kilowatts

- Bel Power Solutions delivered the BCL 25-700-7, a bidirectional on-board battery-powered battery that can interface up to four charging units in equal and has an effectiveness of more than 95%, in Jan 2021. As indicated by Bel Power, this charger might be associated with a charging station or straightforwardly to the framework to charge EV batteries.

- STMicroelectronics will work with Renault Group, a French worldwide vehicle maker, in June 2021. The objective of this organization is to configuration, create, produce, and give STMicroelectronics items and related bundling answers for the Renault Group for the power gadgets frameworks of battery-controlled and half and half vehicles. Besides, these advances would considerably affect the driving reach and charging of electric vehicles by diminishing power misfortunes and helping productivity, bringing about less expensive battery costs, more kilometers per charge, more limited charging time, and lower client costs.

Recent Developments

- In September 2025, Sterling Gtake E-Mobility Ltd (SGEM) partnered with China-based Landworld Technology to locally manufacture on-board chargers, DC/DC converters, and power distribution units. SGEM, a subsidiary of Sterling Tools, expects the collaboration to generate approximately ₹450 crore in revenue by FY30.

(Source:economictimes.indiatimes.com) - In August 2025, BRUSA HyPower announced the series launch of its automotive-certified OBC7 and BSC7 product families. Designed for modern electric vehicles, including passenger cars, commercial vehicles, and off-highway applications, the products emphasize high performance, durability, and sustainability. The OBC7 on-board charger supports fast AC charging up to 19.2 kW (single-phase) and 22 kW (three-phase) and is compatible with both 400 V and 800 V battery systems.

(Source:chargedevs.com)

Segments Covered in the Report

By Vehicle Type

- Boats

- Vans

- Passenger Cars

- Buses

- Medium and Heavy Duty Vehicles

- Others

By Power Type

- 11 kW to 22 kW

- Less than 11 kW

- More than 22 kW

By Propulsion Type

- Plug-in Hybrid Electric Vehicle

- Battery Electric Vehicle

By Sales Channel

- Original Equipment Manufacturer (OEM)

- Aftermarket

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

Get a Sample

Get a Sample

Table Of Content

Table Of Content