On-Board Diagnostics (OBD) Aftermarket Size and Forecst 2025 to 2034

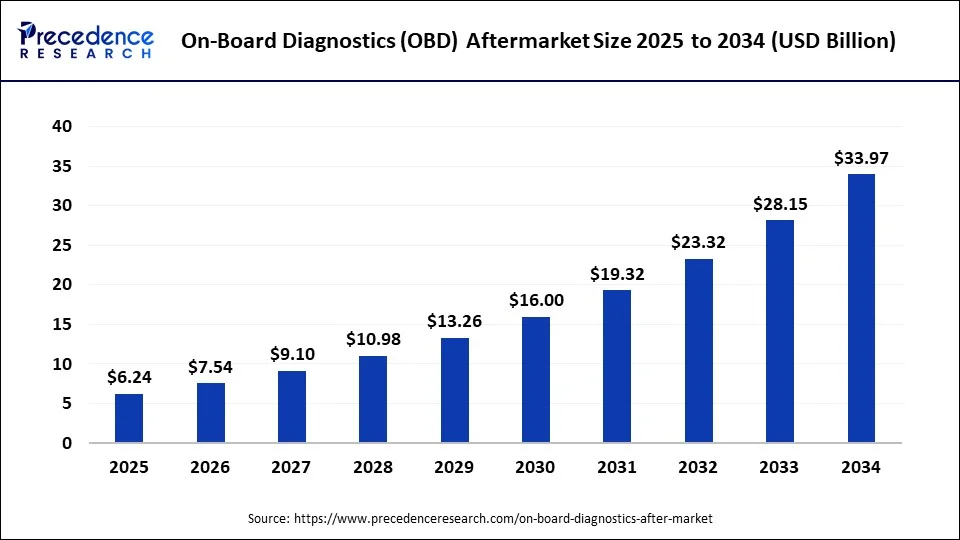

The global on-board diagnostics (OBD) aftermarket was valued at USD 5.17 billion in 2024 and is anticipated to reach around USD 33.97 billion by 2034, expanding at a CAGR of 20.71% over the forecast period from 2025 to 2034.

On-Board Diagnostics (OBD) Aftermarket Key Takeaways

- In terms of revenue, the market is valued at $6.24 billion in 2025.

- It is projected to reach $33.97 billion by 2034.

- The market is expected to grow at a CAGR of 20.71% from 2025 to 2034.

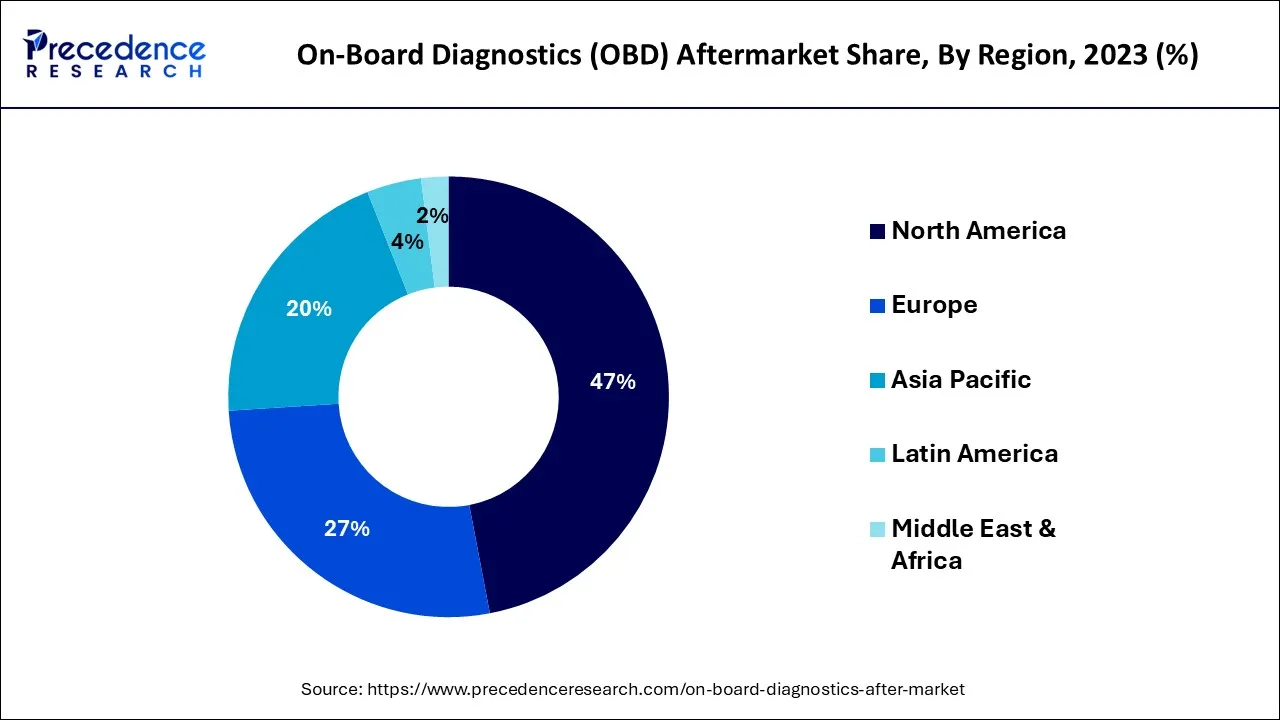

- North America contributed more than 47% of revenue share in 2024.

- By Vehicle Type, the passenger vehicle segment led the global market with the largest market share in 2024.

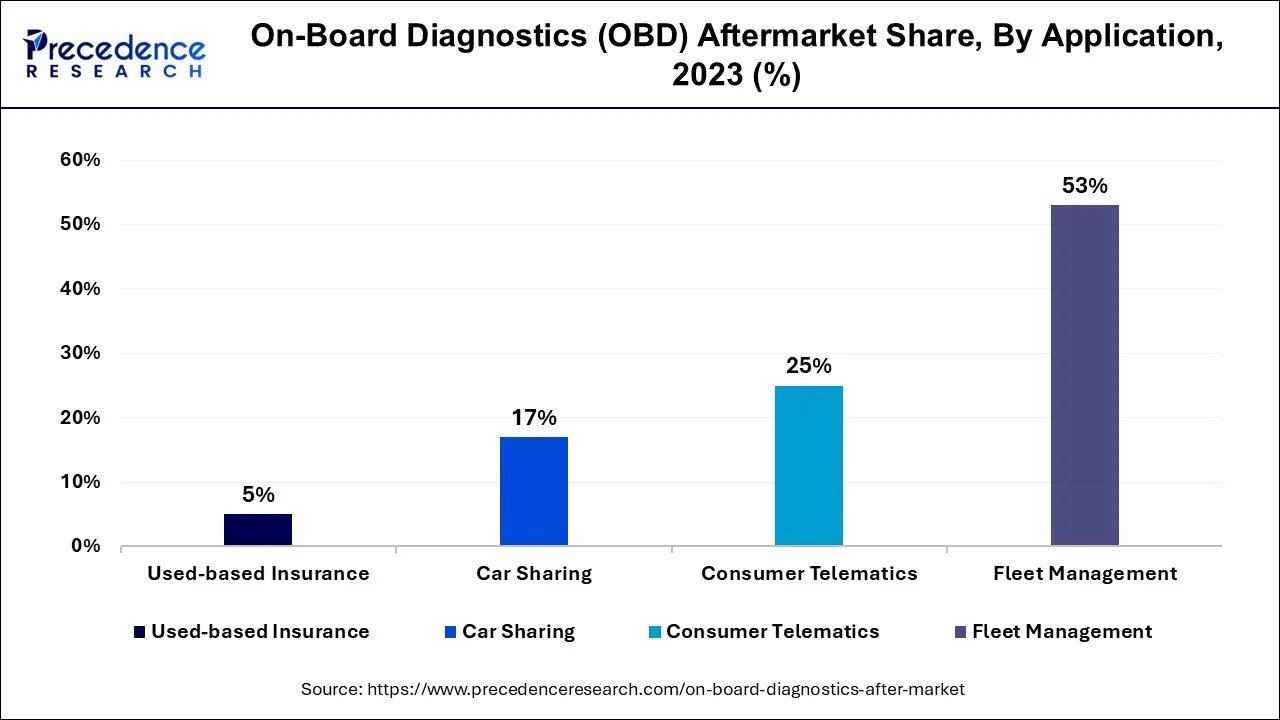

- By Application, the fleet management segment contributed more than 53% of revenue share in 2024.

- By Component, the hardware segment accounted the maximum market share in 2024.

U.S. On-Board Diagnostics (OBD) Aftermarket Size and Growth 2025 to 2034

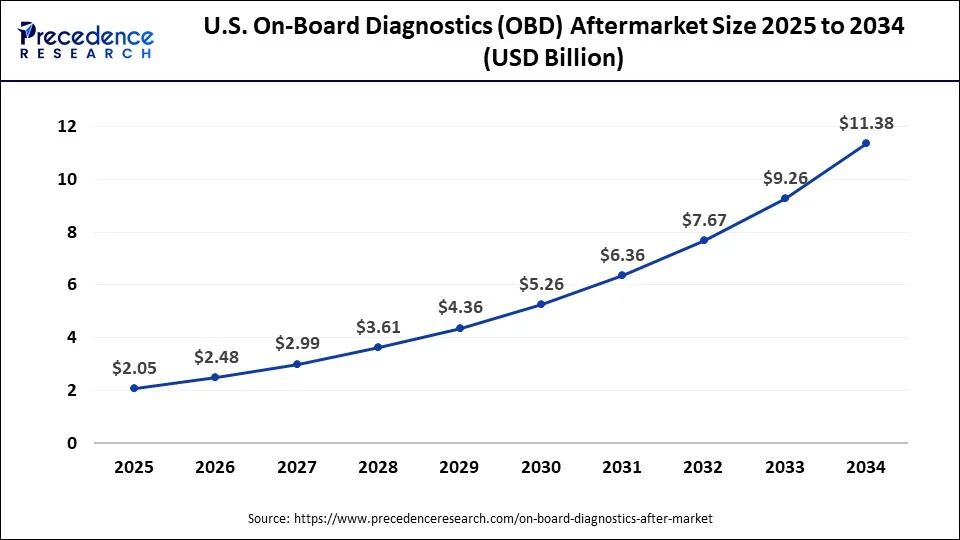

The U.S. on-board diagnostics (OBD) aftermarket size was accounted for USD 1.70 billion in 2024 and is projected to be worth around USD 11.38 billion by 2034, poised to grow at a CAGR of 20.93% from 2025 to 2034.

North America has experienced significant growth in aftermarket OBD solutions. This surge can be attributed to various factors, including the rising awareness of vehicle diagnostics, the increasing adoption of connected cars, and the growing demand for customization and performance enhancement.

Both individual vehicle owners and businesses in North America have demonstrated a strong interest in utilizing OBD aftermarket products. These products are sought after as they allow monitoring of vehicle health, improvement of fuel efficiency, and an overall enhanced driving experience. Additionally, the stringent emissions regulations and emphasis on road safety in this region have further driven the necessity for OBD solutions.

The North America OBD aftermarket, amidst the ever-evolving automotive landscape driven by technological advancements and sustainability concerns, stands steadfast as a frontrunner. It provides an extensive array of cutting-edge products and services meticulously designed to cater to the unique requirements and preferences of its astute clientele.

The Asia-Pacific On-board Diagnostics (OBD) Aftermarket thrives and expands rapidly within the automotive industry.

This region has experienced a surge in demand for OBD aftermarket solutions because of its booming automotive market, urbanization growth, and increasing awareness of vehicle diagnostics and maintenance. Consumers in Asia-Pacific are actively searching for ways to optimize their vehicles' performance, improve fuel efficiency, and monitor their overall health.

OBD aftermarket products provide effective solutions to fulfill these needs. Additionally, the region's strong emphasis on environmental sustainability and strict emissions regulations have fueled the adoption of OBD solutions even further, particularly for emissions monitoring and compliance.

The Asia-Pacific OBD Aftermarket market benefits from the increasing presence of connected vehicles and the growing popularity of ride-sharing and delivery services. These developments necessitate efficient fleet management solutions. With a continued embrace of automotive technological advancements, the Asia-Pacific OBD aftermarket is positioned for sustained growth and innovation as it caters to a diverse and rapidly expanding customer base.

Why is Europe Considered a Notable Region in the On-Board Diagnostics (OBD) Aftermarket in 2024?

Europe plays a crucial role in the On-Board Diagnostics (OBD) aftermarket, driven by stringent emission regulations, a growing adoption of telematics and connected vehicles, and an increasing demand for efficient fleet management solutions. The Euro emission standards, which are updated periodically, require specific diagnostic capabilities to ensure that vehicles comply with emission limits. Additionally, the region's focus on environmental sustainability and the push for improved vehicle safety and performance further fuels the market for advanced diagnostic tools and systems. Key players in the European automotive diagnostics market, such as Robert Bosch GmbH and Continental AG, are at the forefront of driving innovation and technological advancements.

Market Overview

The aftermarket industry for on-board diagnostics (OBD) has experienced significant growth. It revolves around the creation and distribution of solutions that aim to improve and expand the functionality of OBD systems found in modern vehicles. Initially, these systems were implemented by regulatory requirements to control emissions and ensure safety. However, they have now evolved into sophisticated onboard computer systems within contemporary automobiles. Their main responsibility involves continuously monitoring and reporting essential data regarding a vehicle's performance. This includes analyzing factors such as engine health, fuel efficiency, emissions levels, and various other parameters to ensure optimal functioning.

The OBD aftermarket covers a diverse range of products and services designed to enhance the capabilities of the standard OBD system. This industry comprises diagnostic tools, software applications, and hardware devices that allow vehicle owners, mechanics, and fleet managers to access real-time data and conduct advanced diagnostics. These aftermarket solutions often provide additional insights beyond what the basic OBD system offers, including detailed fault codes, live data streaming, and performance tuning options.

On-Board Diagnostics (OBD) Aftermarket Growth Factors

The progression of vehicle technology has led to the inclusion of advanced onboard diagnostic (OBD) systems in modern cars. These systems possess the ability to continuously monitor various parameters, continually expanding their functionality. As a result, there is an increasing demand for aftermarket solutions that effectively unleash the complete potential of these OBD systems. Such solutions empower users with deeper insights into important aspects like performance and vehicle health. In light of the ongoing integration of electronics and connectivity features in vehicles, it is expected that the aftermarket OBD industry will further evolve to address the growing need for diagnostics and customization.

Furthermore, the growing fascination with customizing and personalizing vehicles serves as a major catalyst for the OBD Aftermarket's expansion. Enthusiasts and car owners alike are actively seeking methods to augment their vehicle's performance, fuel efficiency, and overall driving encounter. Aftermarket OBD solutions offer an avenue to achieve these aspirations by allowing users to optimize engine settings, monitor real-time data, and even undertake advanced modifications while ensuring compliance with regulatory standards.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 6.24 Billion |

| Market Size in 2024 | USD 5.17 Billion |

| Market Size by 2034 | USD 33.97 Billion |

| Growth Rate from 2025 to 2034 | CAGR of 20.71% |

| Largest Market | North America |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Components, Application, Platform, End-User, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

Vehicle customization

Vehicle customization serves as a major driving force behind the growth of the on-board diagnostics (OBD) aftermarket. Car enthusiasts and owners, driven by a desire to personalize their vehicles and optimize performance, fuel this trend. Whether it involves boosting engine power, fine tuning fuel efficiency, or enhancing handling capabilities, aftermarket OBD systems empower users to delve into their vehicle's electronic systems and make precise adjustments.

OBD aftermarket products go beyond performance upgrades. They provide users with enhanced diagnostic and troubleshooting capabilities, which is particularly valuable for those involved in intricate customizations. This enables quick identification and resolution of any issues that may arise during the modification process, ensuring both reliability and compliance with emissions and safety regulations. Furthermore, OBD aftermarket solutions address the increasing enthusiasm for eco-friendly driving by enabling users to enhance fuel performance and track emissions instantaneously. Not only is this cost-effective, but it also promotes a cleaner and more eco-conscious driving experience.

Therefore, vehicle customization plays a vital role in driving the OBD Aftermarket. It attracts passionate car enthusiasts and owners who are eager to enhance their vehicle's performance, efficiency, and unique character. As technology advances and customization options increase, the OBD aftermarket is set to fulfill the desires of those seeking to personalize their vehicles.

Restraint

Vehicle warranty concerns

Vehicle warranty concerns present a significant hindrance to the growth of the on-board diagnostics (OBD) aftermarket market. Many vehicle manufacturers explicitly state in their warranty policies that using or modifying aftermarket OBD devices may void warranty coverage. This poses a substantial deterrent to cautious vehicle owners who prioritize preserving their warranty benefits.

Despite the alluring advantages of aftermarket OBD solutions, such as performance enhancements, real-time data monitoring, and customization options, consumers often hesitate due to fears of warranty disputes and potential financial burdens resulting from unexpected repairs. To overcome this obstacle, there is an urgent need for enhanced clarity and standardized warranty policies that grant consumers the confidence to embrace aftermarket OBD products without fearing any negative repercussions.

Collaborative efforts between automakers and aftermarket OBD manufacturers aim to establish guidelines that facilitate warranty-friendly modifications. These guidelines have the potential to address concerns and promote wider acceptance within the market.

Opportunity

Connected car ecosystem

As vehicles continue to be integrated into the Internet of Things (IoT), aftermarket OBD solutions have greater potential to thrive. These solutions utilize modern vehicles' extensive connectivity, offering a wide range of advanced features. By enabling real-time data transmission, remote diagnostics, and over-the-air updates, OBD aftermarket products significantly enhance the driving experience.

Connected cars enable the seamless transmission of crucial data from OBD devices to users' smartphones, tablets, or cloud-based platforms. This allows vehicle owners to conveniently monitor their vehicles' health and performance from anywhere. Real-time access empowers them with valuable insights into engine diagnostics, fuel efficiency, maintenance requirements, and more. This not only enhances convenience but also enables proactive maintenance and early issue detection, ultimately leading to time and cost savings.

Furthermore, the potential for aftermarket OBD solutions to provide remote over-the-air updates is advantageous as it improves their adaptability and longevity. This allows manufacturers to continuously enhance their products by delivering firmware and software updates directly to users' devices. These updates effectively address issues, enhance features, and ensure compatibility with the ever-evolving automotive landscape.

Therefore, the Connected Car Ecosystem aligns with the growing trend of vehicle connectivity and provides a fertile ground for the expansion of the OBD aftermarket. By tapping into a vast network of connected vehicles, aftermarket OBD solutions offer innovative features, remote monitoring, and proactive maintenance. This positions them as indispensable tools in the era of smart and connected automobiles. As vehicles continue to evolve in their connectivity and capabilities, the OBD aftermarket plays a pivotal role in enhancing the driving experience and vehicle management.

Vehicle Type Insights

According to the vehicle type, the passenger vehicle sector has held the major revenue share in 2024. The passenger vehicle segment includes a wide range of products and services designed to improve the performance, safety, and functionality of cars. Consumers in this segment seek OBD aftermarket solutions for various purposes. These include enhancing engine performance and fuel efficiency, monitoring vehicle health, and personalizing their driving experience. OBD solutions provide real-time data access for owners to diagnose issues and make informed decisions regarding maintenance and modifications.

Additionally, the passenger vehicle segment has experienced significant growth due to the rising popularity of connected cars. The demand for user-friendly OBD solutions that seamlessly connect with smartphones and other devices has also contributed to this growth. As vehicles continue to advance technologically and become more interconnected, the OBD Aftermarket expects sustained growth in the passenger vehicle segment. This thriving market offers a wide range of innovative products and services that cater to the evolving needs and preferences of modern vehicle owners.

Application Insights

Based on the application, fleet management segment is anticipated to hold the largest market share the market in2024. The fleet management segment is a crucial component of the on-board diagnostics (OBD) aftermarket. It plays a vital role in enhancing the efficiency, safety, and cost-effectiveness of commercial vehicle operations. Fleet managers heavily depend on OBD aftermarket solutions to effectively monitor and control their vehicle fleets. Fleet managers can make well informed decisions by utilizing real-time data on various aspects, including vehicle performance, driver behavior, fuel consumption, and maintenance requirements. These data-driven decisions enable optimization of route planning, reduction in fuel usage, enhancement of driver safety, and extension of the vehicles' lifespan. Moreover, reliance on these OBD aftermarket solutions ensures compliance with environmental regulations and safety standards which mitigates the risk of fines and penalties.

The fleet management segment in the OBD Aftermarket is expected to continue expanding as the demand for efficient and sustainable transportation grows. It offers innovative solutions to support the evolving needs of businesses operating vehicle fleets.

Component Insights

Based on the component, the hardware sector is anticipated to hold the largest market share the market in 2024. The hardware segment of the on-board diagnostics (OBD) aftermarket includes a wide range of devices aimed at enhancing vehicle diagnostics, performance tuning, and data monitoring. These physical solutions consist of OBD scan tools, diagnostic adapters, performance chips, and various sensors that connect to a vehicle's OBD port.

Mechanics, automotive technicians, and car enthusiasts rely on these essential OBD hardware devices to access real-time data from a vehicle's onboard computer system for analysis. They enable comprehensive diagnostics and prompt issue identification with accurate resolutions. Moreover, these hardware components are instrumental in optimizing engine parameters for improved horse power, torque, and fuel efficiency. The hardware segment of the OBD Aftermarket is constantly innovating as vehicles become more complex and connected. This innovation aims to offer advanced and user-friendly solutions that cater to the evolving demands of the automotive industry.

On-Board Diagnostics (OBD) Aftermarket Companies

- Magneti Marelli S.p.A.

- Intel Corporation

- Innova Electronics Corporation

- Hella GmbH & Co. KGaA

- Geotab Inc.

- Electronic System LTD

- ERM

- Continental AG

- CalAmp Corporation

- Danlaw Inc.

- Bosch Diagnostic (Robert Bosch GmbH)

- Azuga Inc.

- AVL DiTEST GmbH

- Autel Intelligent Technology Corp., Ltd.

Recent Developments

- In May 2024, MAHLE launched its E-HEALTH Charge battery diagnostic solution in Europe. This system provides quick and reliable reports on the health and performance of electric vehicle high-voltage batteries, with a maximum runtime of 15 minutes. It combines the E-CHARGE 20 charger and the E-HEALTH app for charging and diagnostics, compatible with any vehicle make or model by functioning purely as a DC charger, thus requiring no prior knowledge from the service team.

- In July 2023, Innova Electronics introduced its Smart Diagnostic System (SDS) Tablets and RepairSolutionsPRO™ app, designed for professional automotive repair. Developed with input from ASE-certified technicians and customers, these tools enhance the diagnostic process, save time, and improve communication within automotive shops.

- In January 2024, Forward Thinking Systems (FTS) integrated OBD-II diagnostics and telematics data into its FleetCam Pro dash camera through an over-the-air firmware update. This upgrade enables the FleetCam Pro to connect directly to a vehicle's Engine Control Unit (ECU) via the OBD-II port, capturing essential data such as engine RPM, vehicle speed, fuel level, odometer mileage, and diagnostic trouble codes (DTC), thus eliminating the need for separate GPS trackers and video dashcams.

- Innova Electronics Corporation, an esteemed provider of diagnostic reporting and testing equipment for the automotive aftermarket, has recently unveiled its newest software and firmware update for its OBD2 scanner tools and dongles in the present generation.

- Bartec USA recently unveiled a new software update for its TPMS tool, boasting more extensive coverage of Rite-Sensor and a greater range of model year tools. This update also showcased Bartec's enhanced OBD II capabilities.

Segments Covered in the Report

By Components

- Empennage

- Wings

- Fuselage

- Nacelle & Pylon

- Nose

- Others

By Application

- Fleet Management

- Consumer Telematics

- Car Sharing

- Used-based Insurance

By Platform

- Fixed-Wing Aircraft

- Military

- Commercial

- General Aviation Aircraft

- Business Jet

- Rotary-Wing Aircraft

- Military Helicopters

- Commercial Helicopters

- UAVs

By End-User

- OEM

- Aftermarket

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

Get a Sample

Get a Sample

Table Of Content

Table Of Content