Automotive Printed Circuit Board Market Size and Forecast 2025 to 2034

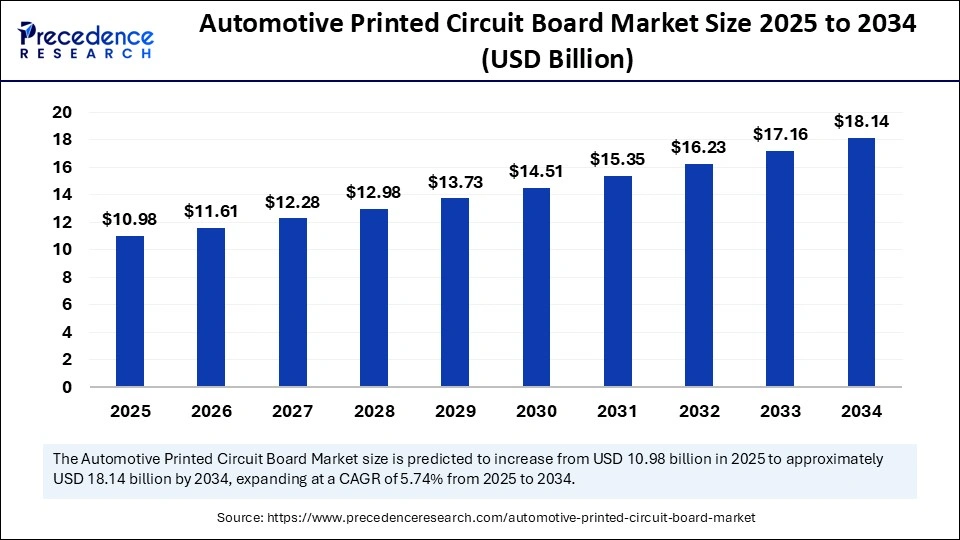

The global automotive printed circuit board market size accounted for USD 10.38 billion in 2024 and is predicted to increase from USD 10.98 billion in 2025 to approximately USD 18.14 billion by 2034, expanding at a CAGR of 5.74% from 2025 to 2034.The increasing production of electric vehicles and the rising demand for automotive electronics contribute to market growth.

Automotive Printed Circuit Board MarketKey Takeaways

- In terms of revenue, the automotive printed circuit board market is valued at $10.98 billion in 2025.

- It is projected to reach $18.14 billion by 2034.

- The market is expected to grow at a CAGR of 5.74% from 2025 to 2034.

- Asia Pacific dominated the automotive printed circuit board market in 2024.

- North America is expected to expand at the fastest CAGR in the upcoming period.

- By type, the double-sided PCBs segment held the largest market share in 2024.

- By type, the multi-layer PCBs segment is expected to grow at a significant CAGR between 2025 and 2034.

- By vehicle type, the passenger cars segment capture the biggest market share in 2024.

- By vehicle type, the commercial vehicles segment is expected to grow at the highest CAGR during the forecast period.

- By level of autonomy, the conventional vehicles segment contributed the highest market share in 2024.

- By level of autonomy, the autonomous vehicles segment is expected to grow at the fastest rate between 2025 and 2034.

- By application, the infotainment components segment led the market in 2024.

- By application, the ADAS and basic safety segment is expected to grow at a remarkable CAGR during the projection period.

How is AI Driving the Revolution in Automotive Components?

Artificial intelligence is dramatically enhancing design optimization, allowing engineers to create more efficient, compact, and higher-performance circuit layouts tailored to intelligent vehicle systems. With AI-assistance CAD, the development cycle becomes faster and more precise, reducing errors and enhancing thermal and power management. Moreover, AI is revolutionizing quality control and predictive maintenance during PCB manufacturing. Machine learning models can detect micro-defects in real-time, ensuring higher production yield and reducing costly recalls. In autonomous and electric vehicles, AI works in tandem with PCBs to manage real-time decision-making, adaptive control, and sensor fusion, making PCBs more functionally dense and mission-critical. By integrating AI deeper into automotive hardware design and testing cycle, the future of PCBs lies not just in conducting current but in empowering cognition, bringing the dream of truly smart mobility closer to reality.

Market Overview

The automotive printed circuit board market is witnessing rapid growth, driven by the global transition toward smarter, safer, and more sustainable vehicles. Printed circuit boards have evolved from their traditional roles to become the central nervous systems of modern cars, powering everything from navigation, entertainment, and connectivity to critical stability controls. As electric and hybrid car production continues to rise, the demand for high-voltage PCBs, lightweight materials, and heart-resistant multilayer designs is surging. These are crucial for managing battery power and motor control and integrating AI-based systems that require real-time data processing and low latency.

Furthermore, the industry is seeing a shift toward rigid-flex and HDI PCBs, which allow greater design flexibility and compromise durability, especially critical in high-vibration and thermal environments. OEMs and tier-1 suppliers are increasingly investing in in-house PCB integration to enhance customization and reduce dependency on third-party suppliers. Stringent safety regulations, high demand for smart mobility, and the ongoing digital transformation of automobiles are likely to boost the growth of the market.

Automotive Printed Circuit Board MarketGrowth Factors

- The rising demand for automotive electronics is expected to boost the growth of the market.

- The rapid shift toward electric vehicles further boosts the demand for automotive PCBs.

- Stringent safety and emission regulations are creating the need for reliable PCBs.

- The rising integration of infotainment systems and ADAS in vehicles leads to higher demand for PCBS.

Market Scope

| Report Coverage | Details |

| Market Size by 2034 | USD 18.14 Billion |

| Market Size in 2025 | USD 10.98 Billion |

| Market Size in 2024 | USD 10.38 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 5.74% |

| Dominating Region | Asia Pacific |

| Fastest Growing Region | North America |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Type Outlook, Vehicle Type Outlook, Level of Autonomy Outlook, Application Outlook, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

Vehicle Electrification Ignites the PCB Revolution

The rising electrification of vehicles is a major factor driving the growth of the automotive printed circuit board market. As governments around the globe enforce stricter emissions regulations and promote EV adoption, automakers are under immense pressure to electrify their fleets. PCBs are the backbone of electric vehicles, powering components such as battery management systems (BMS), electric drive controls, regenerative braking systems, and power converters. The need for high-reliability PCBs that can withstand high voltage and temperature fluctuations is at an all-time high. Moreover, the push toward lightweighting in EVs also promotes the use of compact and efficient rigid-flex PCBs.

Restraints

High Production Costs and Supply Chain Disruptions

The automotive printed circuit board market faces several challenges that slow down its full potential. One of the most pressing challenges is the increasing complexity of automotive electronic systems, which demands highly precise, compact, and thermally stable PCBs. This complexity not only drives up production costs but also necessitates advanced design capabilities, rigorous testing procedures, and strict adherence to automotive safety standards, which create challenges for many small and medium-sized PCB manufacturers.

Moreover, the volatile cost of raw materials, especially copper and substrates, adds to pricing instability, making it difficult for manufacturers to scale cost-effectively. Another major restraint is the stringent regulatory landscape and lengthy qualification processes, especially in safety-critical applications like ADAS (Advanced Driver-Assistance Systems) and powertrain control. OEMs often require years of proven reliability before approving new PCB suppliers, limiting entry for newer or smaller players. Lastly, global supply chain disruptions, exacerbated by geopolitical tensions and ongoing semiconductor shortages, reduce the availability of PCB components and materials.

Opportunity

Shift Toward Smart Cars

With the global boom in connected and autonomous vehicles, there is a massive opportunity to innovate within the PCB space. As consumers shift toward smarter and safer mobility, the need for high-speed data transmission, wireless communication modules, and AI-based decision-making systems in vehicles becomes crucial. This encourages manufacturers to develop next-gen PCBs tailored to sensor fusion, LiDAR integration, and onboard diagnostics. Additionally, as the automotive industry pivots toward software-defined vehicles, there is a rising need for modular, scalable PCB solutions that can support frequent updates and software-driven functionality.

Technology Type Insights

The surface mount technology (SMT) segment registered its dominance with 47.50% over the global automotive printed circuit board market in 2024. SMT is the popular method for assembling printed circuit boards in the automotive industry, owing to its ability to create more reliable circuits. PCB assemblers have significantly transitioned to advanced SMT placement equipment to meet rising precision and speed requirements. The automotive industry is increasingly leveraging SMT's compact design to enhance performance and reduce power consumption, ultimately improving user experience. Moreover, the expansion of 5G and IoT in vehicles is anticipated to strengthen the role of SMT in the automotive sector.

Product Type Insights

The rigid PCB segment accounted for the dominating share of 41.80% in 2024. The segment includes single-sided, double-sided, and multi-layer (>4 layers, >10 layers, >20 layers). Rigid PCBs are non-flexible, solid constructions, mainly based on FR4 material, which provides strength and structural stability to prevent bending or folding. They are widely used in a wide range of automotive systems, which include reverse camera screens, control modules, display monitors, and other applications where the PCB needs to maintain a fixed shape. Automotive rigid PCBs are specifically designed to withstand harsh conditions such as vibrations, temperature fluctuations, and exposure to chemicals.

Type Insights

Why Did the Double-Sided PCBs Segment Dominate the Market?

The double-sided PCBs segment dominated the automotive printed circuit board market with the largest share in 2024. This is mainly due to their perfect balance between cost-efficiency and functionality. These boards feature circuitry on both sides, connected through vias (holes) that allow signals to pass between layers. This design enables denser circuit placement, which is especially beneficial in space-constrained automotive environments.

Most traditional automotive systems, such as LED headlamps, dashboard clusters, rear-view mirror controls, and power windows, rely on double-sided PCBs for their moderate complexity and stable electrical performance. Furthermore, their manufacturing costs are significantly lower than multi-layered alternatives, making them attractive to Original Equipment Manufacturers (OEMs) that seek scalable solutions without compromising performance. Additionally, the growing demand for cost-effective electronic modules in emerging markets, where price sensitivity is high, has solidified the position of double-sided PCBs. These boards are also mechanically robust, making them ideal for vibration-prone environments, a common scenario in road vehicles.

On the other hand, the multi-layer PCBs segment is expected to grow at a significant CAGR in the coming years owing to the exponential rise in vehicle electronics and smart mobility integration. These PCBs are essential for complex circuitry, including ADAS, battery management systems (BMS), infotainment units, and autonomous driving modules. Their multi-tiered architecture allows for signal integrity, noise reduction, and miniaturization, which are critical in processing-heavy applications. As vehicles transition into software-defined machines, the need for high-speed data transmission and power management drives demand for multi-layer PCBs.

Moreover, EVs and hybrid vehicles require intricate circuitry to support high-voltage power management, regenerative braking, and torque vectoring systems, all of which depend on multi-layer boards. This segment is also benefiting from technological breakthroughs in PCB materials, such as ceramic substrates and polyimide layers, which allow higher temperature tolerance and improved flexibility for automotive applications.

Vehicle Type Insights

How Does the Passenger Cars Segment Dominate the Market?

The passenger vehicles segment held the major market share of 54.20% in 2024. The passenger vehicles segment includes Internal Combustion Engine (ICE), Battery Electric Vehicles (BEVs), Plug-in Hybrid Electric Vehicles (PHEVs), and Hybrid Electric Vehicles (HEVs). The growth of the segment is attributed to the increasing demand for electric and hybrid vehicles, as PCBs are the critical components in battery management systems, EV powertrains, lighting systems, power window control, instrument clusters, and various other electronic systems within the passenger vehicle. PCBs are crucial to several safety features, such as Advanced Driver Assistance Systems (ADAS), airbag deployment, anti-lock braking systems (ABS), electronic stability control (ESC), and driver-assistance systems like automatic emergency braking and lane departure warning. Additionally, the safety regulations and increasing consumer preference for safer driving experiences are expected to propel the demand for PCBs in passenger vehicles.

Level of Autonomy Insights

What Made Conventional Vehicles the Dominant Segment in the Market?

The conventional vehicles segment dominated the automotive printed circuit board market in 2024. This is because the global fleet remains largely composed of non-autonomous vehicles, many of which are now being retrofitted with smart modules for better safety and entertainment. These vehicles use PCBs in engine control units (ECUs), anti-lock braking systems (ABS), powertrain management, lighting, and HVAC control features that have become standardized across regions.

Additionally, manufacturers of conventional vehicles have increased their focus on semi-autonomous features like adaptive cruise control and blind-spot monitoring even in conventional vehicle platforms, thereby enhancing PCB usage. Cost-efficiency and easier certification requirements for conventional vehicles ensure that their electronics footprint continues to grow, cementing their dominance in the near term.

Meanwhile, the autonomous vehicles segment is expected to grow at the fastest rate during the projection period. The rising production of autonomous vehicles is creating the demand for multi-dimensional PCBs due to their reliance on advanced perception systems, real-time computing, redundancy, and fault-tolerant design. These vehicles depend on sensor-rich environments involving LiDAR, radar, ultrasonic arrays, GPS, and camera modules, all of which require multi-layer and high-frequency PCBs. The need for zero-latency data transmission, power control, and signal processing lead to a surge in demand for RF PCBs and rigid-flex configurations for space optimization.

Application Insights

Why did the Infotainment Components Segment Dominate the Market in 2024?

Powertrain & engine control segment held a dominant presence in the market in 2024, with 25.60%. The segment includes engine control units (ECUs), transmission control, fuel injection modules, and turbocharger control. Powertrain and engine control systems play a critical role in managing engine timing, fuel injection, emissions control, and overall engine performance. They handle vibration, shock, and environmental factors like temperature and humidity. Powertrain and engine control systems assist in controlling the transmission and other powertrain components.

End user/supply chain tier Insights

The tier 1 suppliers segment contributed the biggest market share of 45.30% in 2024. The tier 1 are the prominent suppliers such as Bosch, Continental, Denso, Meiko Electronics Co., Ltd., Nippon Mektron, Ltd. (Japan), Unimicron Technology Corp. (Taiwan), and others. Tier 1 supplier provides components directly to an Original Equipment Manufacturer (OEM). Several tier 1 suppliers are increasingly investing in innovation, partnerships, and acquisitions to remain competitive and strengthen their market presence.

Regional Insights

What Made Asia-Pacific the Dominant Region in the Automotive Printed Circuit Board Market?

Asia Pacific dominated the market by capturing the largest revenue share in 2024, driven by high vehicle production, fast adoption of EVs, lower manufacturing costs, and aggressive policy backing for smart mobility. This region is the largest consumer and manufacturer of PCBs. Supply chain advantages such as low-cost labor, established PCB foundries in Taiwan, Vietnam, and Thailand, and proximity to rare earth material sources amplify the region's importance in PCB design, fabrication, and assembly.

China is a major player in the market. The country is the world's largest producer of electric vehicles. With companies like BYD, Nio, XPeng, and Geely leading the EV revolution, the country demands sophisticated PCBs for electric drivetrains, battery management systems, and advanced digital cockpits. Government support via subsidies, the NEV mandate, and “Made in China 2025” policies fuels mass production and innovation.

Japan and South Korea contribute significantly through refined automotive engineering and component miniaturization. Japanese giants like Toyota, Honda, and Nissan, and Korean companies like Hyundai and Kia, are embedding hybrid systems, radar, LIDAR, and telematics into their offerings, each application reliant on highly precise and durable PCB assemblies.

India is emerging rapidly due to the PLI scheme (Production-Linked Incentive) for electronics and EVs, government schemes like FAME-II, and a thriving domestic automotive sector that is shifting toward semi-electric fleets. Domestic PCB manufacturing is also gaining traction with facilities springing up in Tamil Nadu, Karnataka, and Maharashtra, supported by policy reforms and public-private collaborations.

North America is expected to grow at the fastest CAGR during the forecast period due to its technological leadership, high adoption of premium vehicles, and early entry into EV and autonomous driving ecosystems. The U.S., being home to Tesla, Rivian, General Motors, and Ford, serves as the epicenter of electric and smart vehicle innovation, driving demand for complex, multi-layer, and rigid-flex PCBs that can handle the load of fast-changing data and energy requirements. There is a high preference for vehicles with advanced digital features, including adaptive cruise control, self-parking, smart infotainment systems, driver assistance technologies, and 5G connectivity. These systems require dense electronic control units (ECUs) supported by high-quality, heat-resistant PCBs with multiple copper layers and high signal integrity.

Furthermore, governmental regulatory pressure is a key market shaper. Standards set by NHTSA (National Highway Traffic Safety Administration) and DoT (Department of Transportation) require automakers to implement fail-safe, dependable electronics. This indirectly boosts demand for high-reliability PCBs that meet ISO and IPC standards. North America's edge also lies in its R&D investments. Companies here partner with universities, tech startups, and global suppliers to co-develop next-gen PCB technologies tailored for Level 3 and Level 4 autonomy, cybersecurity in vehicles, and power electronics in EVs.

Europe is considered to be a significantly growing area. The region stands out as a global innovator in several key areas, including automotive printed circuit boards (PCBs), particularly in quality assurance, design precision, and sustainability practices. This region has a rich history of engineering excellence, encompassing renowned automotive original equipment manufacturers (OEMs) such as Volkswagen, BMW, Mercedes-Benz, Renault, Volvo, and Stellantis, all of which prioritize technological advancement, safety standards, and luxury features in their vehicles. The production of luxury electric vehicles (EVs) and hybrids necessitates PCBs that are not only lightweight and corrosion-resistant but also capable of supporting complex multi-domain architectures.

There is high demand for advanced driver-assistance systems (ADAS), infotainment systems, climate control, and in-car diagnostics, reflecting the sophisticated connectivity requirements of modern vehicles. Crucial to this evolution are the European Union's policy initiatives, including the Green Deal, REACH regulations, and the forthcoming Euro 7 emissions standard. These policies serve as pivotal forces driving the integration of advanced automotive electronics and, consequently, the demand for PCBs.

Germany is leading the charge by making significant strides toward electrification and the development of autonomous driving technologies. The rising adoption of electric vehicles and strict requirements for advanced electronic monitoring and control systems, which are heavily reliant on printed circuit boards, are contributing to market growth. The UK and France are actively investing in cutting-edge technologies such as 5G vehicle-to-everything (V2X) communications, urban smart mobility solutions, and zero-emission logistics. These advancements necessitate the establishment of connected vehicle platforms that depend on high-speed and low-latency PCBs to enable real-time data exchanges and facilitate edge computing capabilities.

Automotive Printed Circuit Board Market Companies

- Chin Poon Industrial

- Meiko Electronics

- Nippon Mektron

- TTM Technologies

- KCE Electronics

- Tripod Technology

- Unimicron Technology

- Kingboard Chem GRP

- Amitron Corp

- CMK Corp.

Recent Developments

- In October 2024, Syrma SGS, a pioneer in Electronic Systems Design and Manufacturing (ESDM), opened a new manufacturing facility in Ranjangaon near Pune. This facility expansion aims to strengthen PCB assembly capabilities to serve the automotive and industrial sectors.(Source: https://telecom.economictimes.indiatimes.com)

- In June 2024, ECM PCB Stator Tech, a Design and software company, and East West Manufacturing, a global engineering and manufacturing services firm, announced a strategic partnership to advance adoption of next-generation products incorporating PCB Stator electric motors.

(Source:https://www.businesswire.com)

Segments covered in the Report

By Product Type (Revenue and Volume)

- Rigid PCB

- Single-sided

- Double-sided

- Multi-layer (>4 layers, >10 layers, >20 layers)

- Flexible PCB

- Single-sided flex

- Double-sided flex

- Multi-layer flex

- Rigid-Flex PCB

- 2-layer

- 4-layer

- 6-layer and above

- High-Density Interconnect (HDI) PCB

- 1st Level HDI

- 2nd Level HDI

- 3+ Level HDI

- Others

- Metal Core PCB (MCPCB)

- High-Frequency PCB (for RF/microwave)

By Application Area / Function

- Powertrain & Engine Control

- Engine Control Units (ECUs)

- Transmission Control

- Fuel Injection Modules

- Turbocharger Control

- ADAS (Advanced Driver Assistance Systems)

- Radar, LiDAR PCBs

- Camera ECU Boards

- Sensor Fusion Modules

- Lane-Keeping & Collision Avoidance Units

- Infotainment & Instrument Cluster

- Navigation Systems

- Digital Cockpits

- Audio/Visual Control Boards

- Display Driver PCBs

- Body Electronics

- Lighting (Interior/Exterior LEDs)

- HVAC System Controls

- Mirror Control Modules

- Door & Seat Controls

- Battery & Power Management (EV Specific)

- Battery Management Systems (BMS)

- DC-DC Converter Boards

- On-Board Chargers (AC & DC)

- Thermal Management Systems

- Electric Drive & Motor Control

- Inverter Control Boards

- Motor Control Units

- Regenerative Braking Controllers

- Safety Systems

- Airbag Control Boards

- Anti-lock Braking Systems (ABS)

- Electronic Stability Control (ESC)

- Others

By Vehicle Type

- Passenger Vehicles

- Internal Combustion Engine (ICE)

- Battery Electric Vehicles (BEVs)

- Plug-in Hybrid Electric Vehicles (PHEVs)

- Hybrid Electric Vehicles (HEVs)

- Commercial Vehicles

- Light Commercial Vehicles (LCVs)

- Heavy Commercial Vehicles (HCVs)

- Electric Commercial Vehicles

- Two-Wheelers

- Motorcycles

- Electric Scooters

- Off-road / Specialty Vehicles

- Agricultural

- Construction

- Military

By Technology Type

- Surface Mount Technology (SMT)

- Through-Hole Technology (THT)

- Substrate-Like PCB (SLP)

- Printed Electronics (Inkjet, Aerosol Jet)

- Embedded Component PCB

- Additive Manufacturing / 3D PCB

By End User / Supply Chain Tier

- OEMs (e.g., Ford, Toyota, VW)

- Tier 1 Suppliers (e.g., Bosch, Continental, Denso)

- Tier 2 & Tier 3 PCB Manufacturers

- Aftermarket Automotive Electronics Vendors

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa

Get a Sample

Get a Sample

Table Of Content

Table Of Content