On The Go Packaging Market Size and Forecast 2025 to 2034

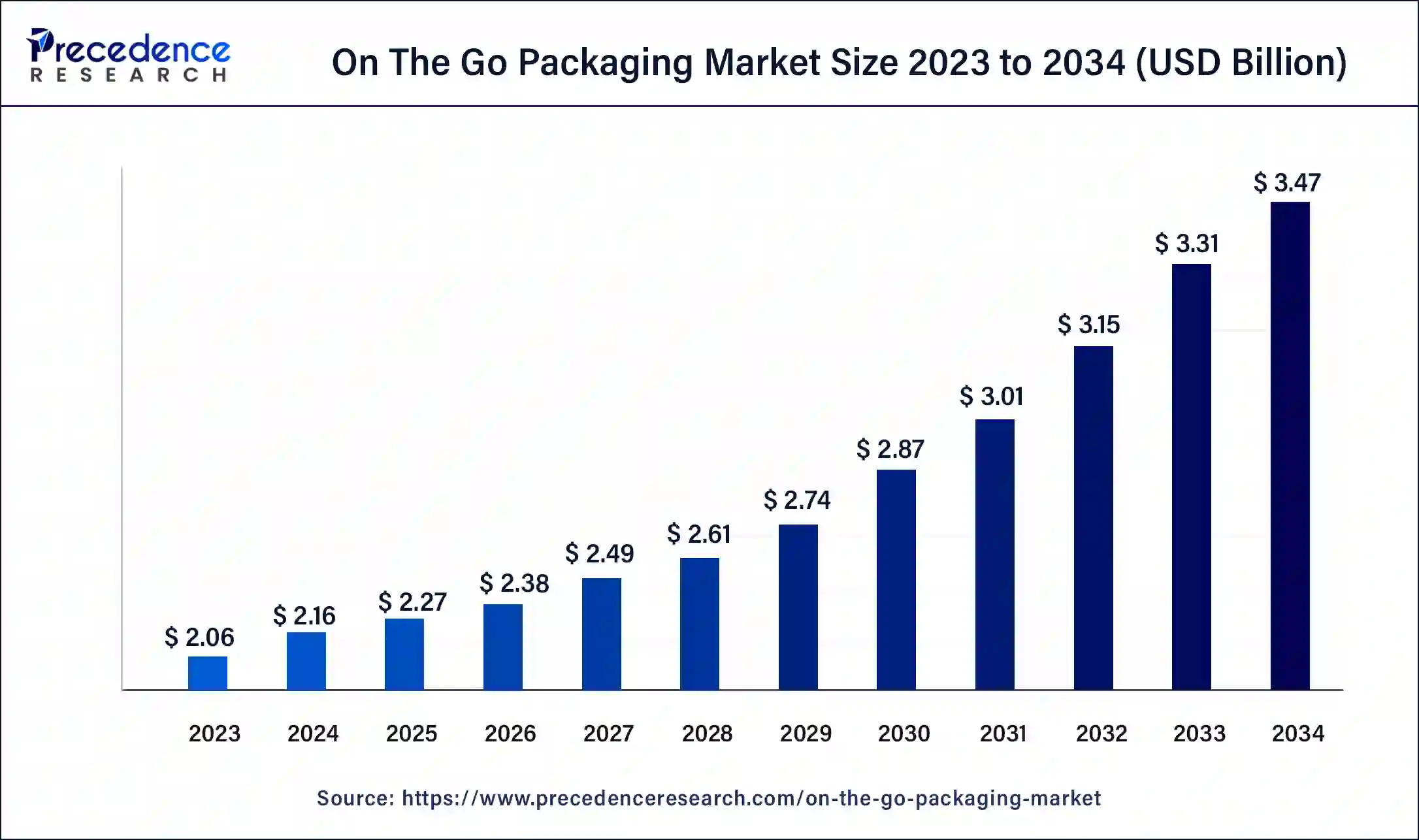

The global on the go packaging market size was estimated at USD 2.16 billion in 2024 and is predicted to increase from USD 2.27 billion in 2025 to approximately USD 3.47 billion by 2034, expanding at a CAGR of 4.85% from 2025 to 2034. Rising rate of urbanization and busy lifestyle demands for instant solutions with sustainable packaging options for diverse industries, majorly for food and beverage industry are the driving factors of the on the go packaging market

On The Go Packaging Market Key Takeaways

- In terms of revenue, the global on the go packaging market was valued at USD 2.16 billion in 2024.

- It is projected to reach USD 3.47 billion by 2034.

- The market is expected to grow at a CAGR of 4.85% from 2025 to 2034.

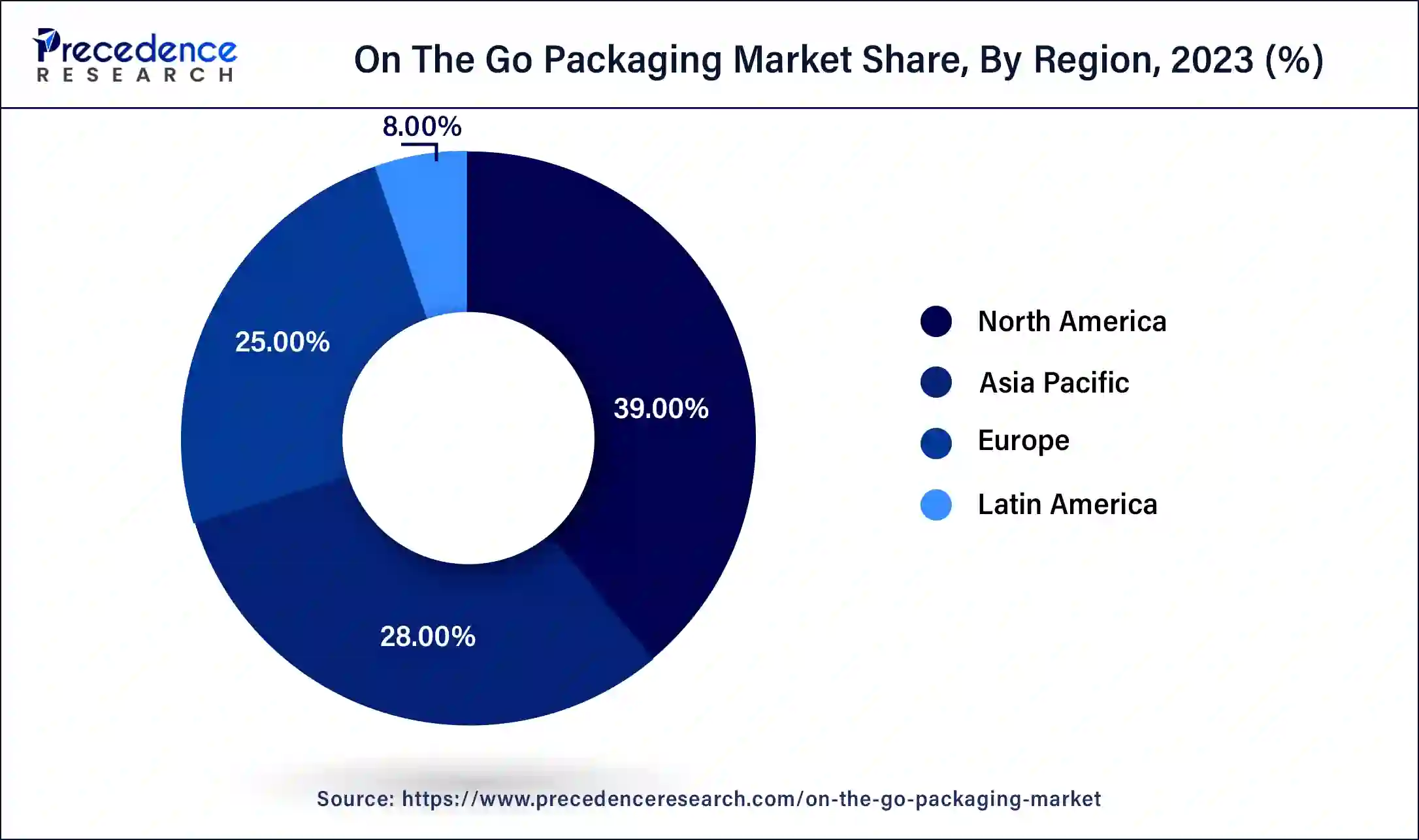

- North America dominated the global market with the largest market share of 39% market.

- Asia Pacific is expected to grow the fastest in the global market over the forecast period.

- By material, the plastic segment dominated the global market in 2024.

- By material, the paperboard/paper segment is anticipated to grow the fastest in the global market over the forecast period.

- By packaging type, the pouches and bags segment dominated the global market in 2024.

- By packaging type, the bottles & jars segment is anticipated to grow the fastest in the global market over the forecast period.

- By end users, the food-service outlets segment dominated the global market in 2024.

- By end user, the online food delivery segment is anticipated to grow at the fastest in the global market over the forecast period.

Impact of Artificial Intelligence on the Packaging Industry

The integration of smart packaging technology presents a significant future opportunity for the on the go packaging market. Smart packaging involves the use of advanced technologies like QR codes, NFC (near-field communication), and RFID (radio frequency identification) to provide consumers with additional information and enhance the user experience. These technologies can offer real-time data on product freshness, nutritional information, and traceability. QR codes can link to digital content, providing recipes or health tips, while NFC-enabled packages can interact with smartphones for promotional offers or loyalty rewards. This added functionality not only enhances consumer engagement but also helps brands differentiate their products in a competitive market. As technology becomes more affordable and widespread, the adoption of smart packaging solutions is expected to grow, offering companies new ways to connect with tech-savvy consumers and improve supply chain efficiencies.

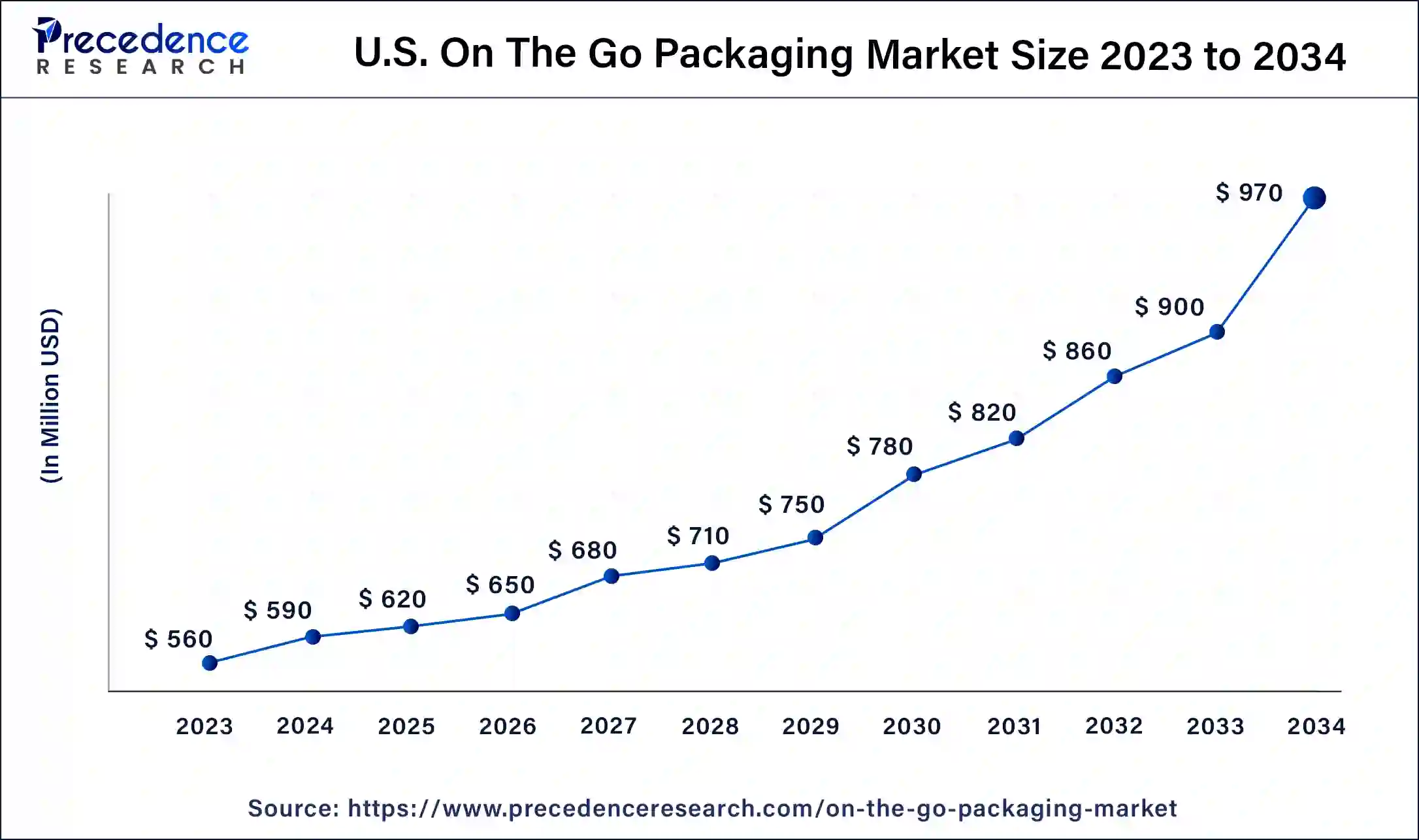

U.S. On The Go Packaging Market Size and Growth 2025 to 2034

The U.S. on the go packaging market size was valued at USD 590 million in 2024 and is expected to be worth around USD 970 million by 2034, at a CAGR of 5.10% from 2025 to 2034.

North America accounted for the largest share of the global on the go packaging market. The U.S. and Canada have highly developed manufacturing and technological infrastructure, allowing for the rapid adoption of innovative packaging solutions. The U.S. is a leader in smart packaging technologies and sustainable materials, driven by significant R&D investments.

- A 2023 survey found that 55 percent of U.S. consumers prefer retailers that remove plastic from their packaging, while 50 percent actively take steps to increase their use of paper packaging.

North America has a large and diverse consumer base with a strong demand for convenience foods and beverages. According to data from the U.S. Bureau of Economic Analysis, consumer spending on food away from home is substantial, reflecting a preference for on-the-go solutions. The region is home to numerous leading packaging companies, including multinational corporations like Amcor and Crown Holdings, which drive market innovation and expansion. The U.S. and Canada have extensive retail networks and a booming e-commerce sector, contributing to high demand for the on the go packaging market.

Asia Pacific is expected to grow the fastest in the global on the go packaging market over the forecast period. Asia is experiencing rapid growth in the market due to several factors. Countries like China and India are undergoing significant urbanization, leading to increasingly busy lifestyles. This shift drives demand for convenient, portable food and beverage packaging solutions. Economic growth in the region is boosting disposable incomes, which enhances consumer spending on convenience products.

According to the Asian Development Bank, rising affluence is expanding the market for premium on-the-go packaging. The expansion of retail networks and e-commerce platforms across Asia, particularly in China, India, and Southeast Asia, increases the need for efficient packaging solutions that cater to a diverse consumer base. There is a growing emphasis on eco-friendly packaging solutions, driven by rising environmental awareness and regulatory pressures.

Market Overview

The on the go packaging market is experiencing robust growth driven by the increasing demand for convenience among consumers with busy lifestyles. The market is characterized by innovations in packaging materials and designs that cater to the needs of portability, sustainability, and ease of use. Key segments include food, beverages, and personal care products, with the rising popularity of single-serve and resealable options.Sustainable packaging solutions, such as biodegradable and recyclable materials, are gaining traction due to growing environmental concerns. Major players are focusing on technological advancements and strategic partnerships to enhance product offerings and expand market reach. Asia Pacific, particularly China and India, is emerging as regions with significant growth in the on the go packaging market due to urbanization and changing consumer behaviors.

On The Go Packaging Market Growth Factors

- Rising urban populations lead to greater demand for convenient, portable packaging solutions.

- Consumers' hectic schedules drive the need for quick, on-the-go food and beverage options.

- Innovations in packaging materials and designs enhance functionality and appeal.

- Growing awareness of sustainability boosts demand for biodegradable and recyclable packaging.

- Higher consumer spending power increases the market for premium and convenient packaging.

- Growth in online food and beverage delivery services necessitates robust on-the-go packaging.

- Demand for healthy, portion-controlled snacks and meals drives the on the go packaging market.

- Rapid urbanization and changing consumer behaviors in regions like Asia Pacific fuel the on the go packaging market expansion.

Market Scope

| Report Coverage | Details |

| Market Size by 2034 | USD 3.47 Billion |

| Market Size in 2023 | USD 2.06 Billion |

| Market Size in 2024 | USD 2.16 Billion |

| Market Growth Rate from 2024 to 2034 | CAGR of 4.82% |

| Largest Market | North America |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Segments Covered | Material, Packaging Type, End-users, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East & Africa |

Market Dynamics

Drivers

Expanding rate of urbanization

Urbanization is a significant driver of the on the go packaging market. As more people move to cities, their lifestyles tend to become busier and more fast-paced, leading to a higher demand for convenient, portable food and beverage options. Urban dwellers often have less time to prepare meals at home and rely more on quick, ready-to-eat products that can be consumed on the move. This shift necessitates packaging solutions that are easy to carry, open, and dispose of, spurring innovations in the market. Additionally, the higher concentration of retail outlets and food service establishments in urban areas supports the widespread availability of on-the-go products. As urban populations continue to grow globally, particularly in emerging economies, the demand for efficient and practical packaging solutions is expected to rise significantly.

Climate concerns

Increasing environmental awareness is driving the on the go packaging market towards more sustainable practices. Consumers are becoming more conscious of the environmental impact of their purchases and are demanding eco-friendly packaging solutions. This shift is pushing manufacturers to develop packaging materials that are biodegradable, recyclable, or made from renewable resources. Innovations such as compostable plastics, plant-based materials, and reusable packaging designs are gaining traction. Companies are also adopting sustainable practices in their production processes to reduce carbon footprints.

- In July 2022, Costa Coffee and Mcdonald's collaborated with Roadchef to co-fund a cup collection and recycling scheme as part of the National Cup Recycling Scheme to increase takeaway cup recycling across the UK. The companies stated consumers could use the new recycling units at 30 Roadchef sites with the cups then backhauled via Costa and processed at facilities including James Cropper's CupCycling facility.

Regulatory pressures and initiatives promoting environmental sustainability further accelerate this trend. By aligning with consumer preferences for green products, businesses can enhance their brand image and meet the growing demand for sustainable on-the-go packaging, thereby driving on the go packaging market growth.

Restraint

A substantial initial investment

A key restraint in the on the go packaging market is the high production costs associated with advanced and sustainable packaging solutions. Innovative materials, such as biodegradable plastics and smart packaging technologies, often require specialized production processes and higher raw material costs compared to conventional packaging. These expenses can significantly impact the overall cost structure for manufacturers, leading to higher prices for end consumers.

Additionally, implementing cutting-edge technologies and maintaining sustainability standards involve considerable investment in research and development, as well as in upgrading production facilities. Smaller companies or startups may find it particularly challenging to absorb these costs, potentially limiting their ability to compete effectively in the market. Furthermore, the need to balance environmental concerns with cost-effectiveness can create financial strain, especially in regions where cost-sensitive consumers dominate. As a result, the high production costs associated with advanced and sustainable packaging solutions represent a significant restraint to the on the go packaging market growth.

Opportunity

Customized packaging solutions

Customized packaging solutions are another promising opportunity in the on the go packaging market. Advances in digital printing and customization technologies allow brands to create unique, tailored packaging for individual consumers or specific market segments. Personalized packaging can include custom graphics, messages, or designs that resonate with consumers on a personal level, enhancing brand loyalty and customer satisfaction. This trend is particularly appealing in the age of social media, where consumers often share their unique experiences online, providing free marketing for brands. Additionally, personalized packaging can cater to specific dietary needs or preferences, offering customized portion sizes, ingredient lists, and nutritional information.

- According to recent data, multilayered packaging investment in chemical waste recycling is rising. Rabobank predicted that advanced recycling plants will double to around 140 plants globally by 2025.

A high level of customization not only meets the diverse needs of modern consumers but also reduces waste by providing more precisely portioned products. As consumer demand for personalized experiences continues to rise, the ability to offer tailored packaging solutions represents a significant growth opportunity for companies in the on the go packaging market.

Material Insights

The plastic segment dominated the global on the go packaging market in 2023 due to its versatility, durability, and cost-effectiveness. Plastics offer a lightweight and robust solution that can be easily molded into various shapes and sizes, making them ideal for a wide range of products, from food and beverages to personal care items. Their barrier properties effectively preserve product freshness and extend shelf life. Additionally, advances in plastic recycling and biodegradable plastics address environmental concerns and maintain plastic dominance. The material's adaptability to innovative features like resealable closures and ergonomic designs further enhances its appeal, solidifying plastic's leading position in the market.

The paperboard/paper segment is anticipated to grow the fastest in the global on the go packaging market over the forecast period. The paperboard segment is fast-growing in the market due to increasing environmental concerns and consumer demand for sustainable packaging solutions. Paperboard is biodegradable, recyclable, and made from renewable resources, making it an eco-friendly alternative to plastics. Advances in coating technologies enhance its durability and barrier properties, making it suitable for a variety of products. Additionally, the paperboard's printability allows for high-quality branding and customization, appealing to both consumers and brands. Regulatory support for sustainable packaging further accelerates the growth of the paperboard segment.

Packaging Type Insights

The pouches and bags segment dominated the global on the go packaging market in 2023. The pouches and bags segment dominates the global market due to its superior convenience, versatility, and cost-effectiveness. Pouches and bags are lightweight and occupy less space compared to rigid packaging, reducing transportation costs and storage space. Their flexible nature allows for a variety of innovative designs, including resealable options that enhance product freshness and consumer convenience. They are suitable for a wide range of products, from snacks and beverages to personal care items.

- According to data, the demand for pouches used in candy and snack food packaging is projected to grow at a rate of 3.8% annually through 2022, reaching USD 3.4 billion.

The bottles & jars segment is anticipated to grow the fastest in the global on the go packaging market over the forecast period. The bottles and jars segment is notably growing in the global market due to their robustness, reusability, and versatility. These packaging options offer excellent product protection and extended shelf life, making them ideal for liquids, condiments, and other perishables. Innovations in lightweight materials and ergonomic designs enhance consumer convenience and appeal. Additionally, the rising trend of premium products often favors glass and high-quality plastic bottles and jars for their aesthetic and functional qualities.

End-user Insights

The food-service outlets segment dominated the global on the go packaging market in 2023. The food service outlets segment dominates the global market due to several key factors. The rising trend of dining out and ordering takeout or delivery, driven by busy lifestyles and convenience-seeking consumers, significantly boosts demand for on-the-go packaging. Fast food chains, cafes, and restaurants require reliable, practical, and cost-effective packaging solutions to serve their customers efficiently.

The online food delivery segment is anticipated to grow at the fastest in the global on the go packaging market over the forecast period. The online food delivery segment is fast growing in the global market due to increasing consumer reliance on digital platforms for convenience and time-saving. The proliferation of smartphones and high-speed internet access has made ordering food online quick and easy. Busy lifestyles and urbanization drive demand for hassle-free meal solutions delivered directly to homes and offices. The COVID-19 pandemic further accelerated this trend as consumers sought safe and contactless dining options. Additionally, innovative delivery apps and partnerships with a wide range of restaurants provide diverse food choices.

Indians are on the road, and out-of-home consumption of food and beverages is on the rise. From chips and carbonated drinks, there is a significant shift towards non-fried options like cookies, crackers, yogurts, granola bars, and biscuits. In fact, biscuits alone constitute a Rs. 50,000 Crore market, with over 66% of the consumption happening outside of the home.

On The Go Packaging Market Companies

- Berry Global Group

- Smurfit Kappa Group

- Sealed Air Corporation

- WestRock Company

- Gerogia-Pacific LLC

- Huhtamaki Oyj

- Tetra-Pak

Recent Developments

- In 2023, a Ukrainian start-up called Releaf Paper created a method for converting cellulose fibers produced from dead leaves into paper packaging products in the field of fiber-based packaging.

- In 2022, Street Food Box organization City to Sea will be in an effort to stop plastic pollution and reduce single-use plastic in the food system through its reusable takeaway box. Street Food Box states the box is made from a patented, indestructible polypropylene that is wipeable, microwaveable, and dishwasher safe, enabling its reuse.

Segments Covered in the Report

By Material

- Paper & Paperboard

- Plastic

- Metal

By Packaging Type

- Bottles & Jars

- Cans

- Trays & Clamshell

- Pouches & Bags

- Boxes & Cartons

- Others

By End-users

- Food Service Outlets

- Institutional Food Services

- Online Food Delivery

By Geography

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East & Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting