What is the Open Banking Market Size?

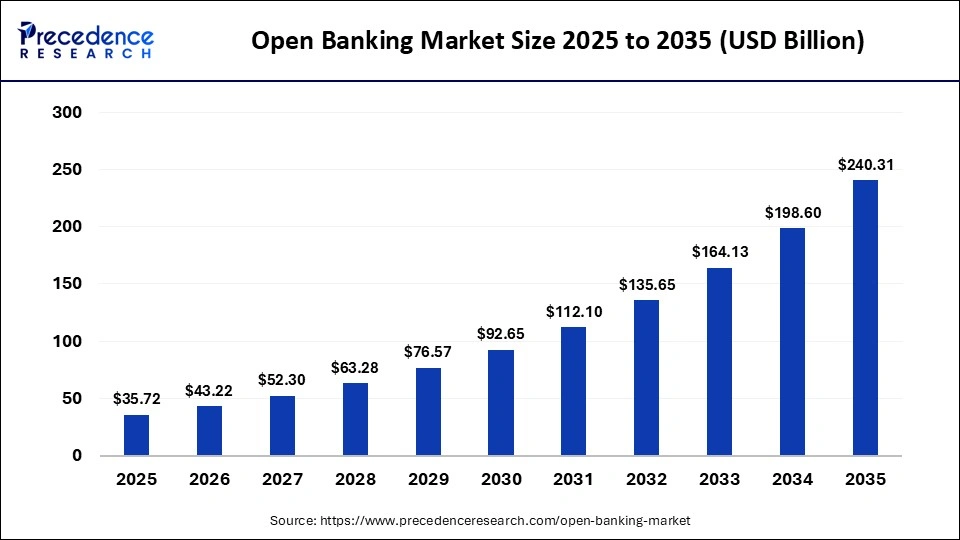

The global open banking market size accounted for USD 35.72 billion in 2025 and is predicted to increase from USD 43.22 billion in 2026 to approximately USD 240.31 billion by 2035, expanding at a CAGR of 21.00% from 2026 to 2035. This market is growing due to increasing demand for secure data sharing, digital financial services, and personalized banking experiences powered by APIs and fintech innovation.

Market Highlights

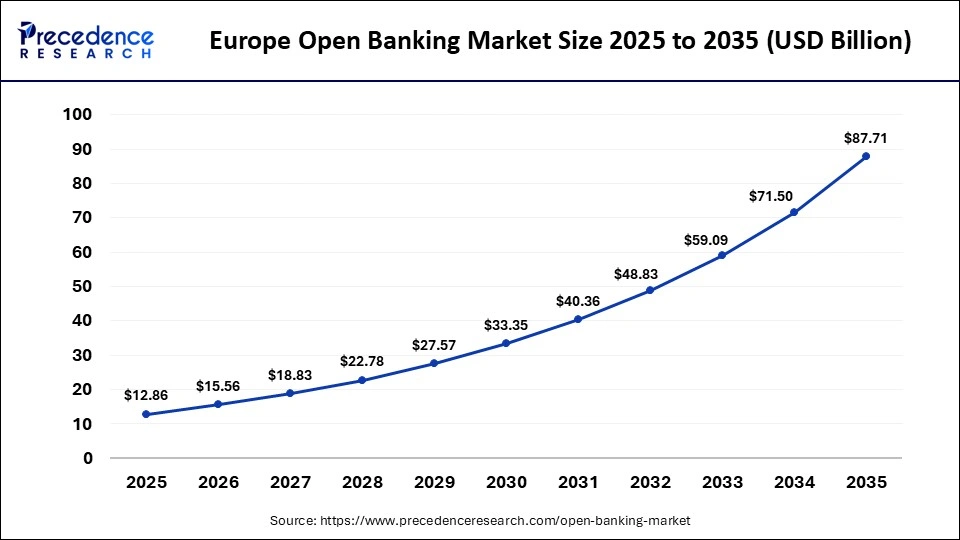

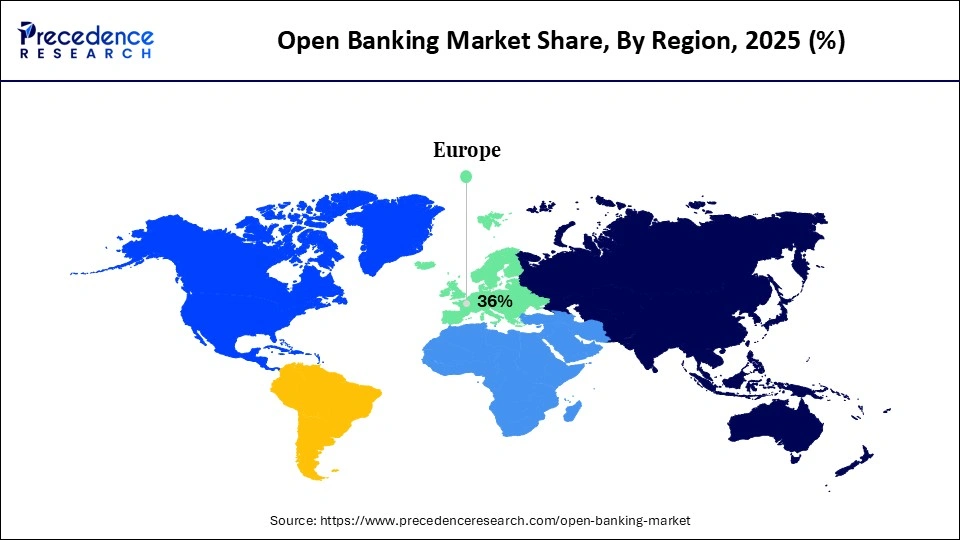

- Europe dominated the global open banking market with a major revenue share of approximately 36% in 2025.

- Asia Pacific is expected to grow at the fastest CAGR between 2026 and 2035.

- By service type/financial service, the banking & capital segment generated the biggest market share of approximately 46% in 2025.

- By service type, the payments segment is expected to expand at the fastest CAGR between 2026 and 2035.

- By component/service offering, the transactional/account & payment APIs segment contributed the highest market share of approximately 50% in 2025.

- By component/service offering, the communicative/informative services segment is expected to grow at a strong CAGR between 2026 and 2035.

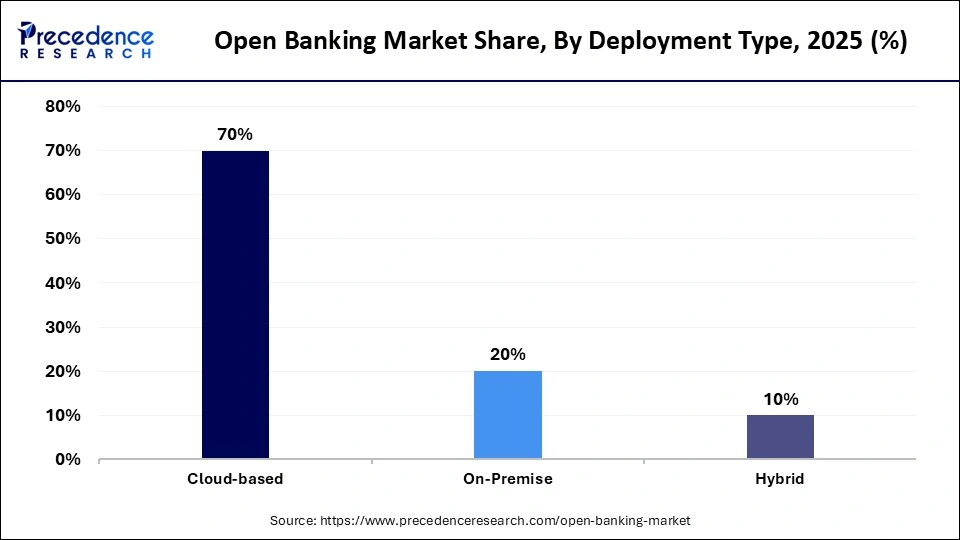

- By deployment type, the cloud-based segment dominated the market with a 70% share in 2025 and is expected to maintain its leadership position in the coming years.

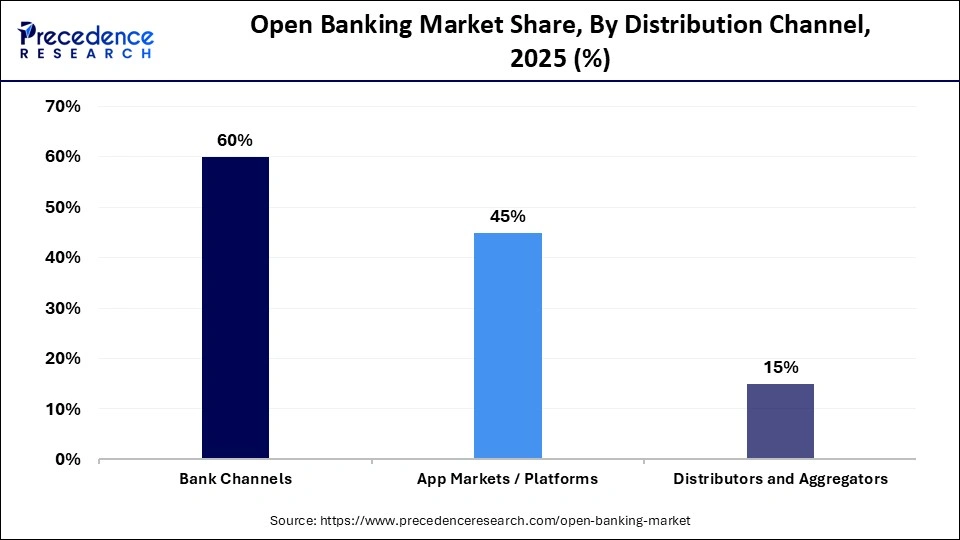

- By distribution channel, the bank channels segment generated the biggest market share of approximately 60% in 2025.

- By distribution channel, the apps/platforms segment is expected to expand at the fastest CAGR between 2026 and 2035.

- By end user, the banks & traditional financial institutions segment contributed the highest market share of approximately 40% in 2025.

- By end user, the fintech & third-party developers segment is expected to grow at a robust CAGR between 2026 and 2035.

Market Overview

The open banking market is expanding as banks leverage APIs to securely provide third parties with access to customer data, enabling personalized digital services such as financial management tools and instant payments. The growth of the market is driven by increasing fintech partnerships, supportive regulatory frameworks, and rising consumer demand for seamless digital banking experiences worldwide. Additionally, advancements in APIs, cloud computing, and data analytics enable secure data sharing, while businesses benefit from improved customer insights, new revenue streams, and enhanced user experiences.

How is AI Driving Innovation in the Open Banking Market?

Artificial intelligence is boosting the open banking market by enabling real-time data analysis, personalized financial insights, smarter credit scoring, and advanced fraud detection. By enhancing security efficiency and customer experience through integration with open APIs, it speeds up market expansion. AI also improves user engagement by enabling automated customer service via chatbots and virtual assistants. By using data-driven decision-making and predictive analytics, it also assists financial institutions in finding new revenue streams.

Key Trends

- Rising API Adoption: Banks are increasingly implementing open APIs to enable seamless integration with fintech platforms and third-party service providers.

- Growing Fintech Collaborations: Strategic partnerships between traditional banks and fintech firms are accelerating innovation and expanding digital service portfolios.

- Expansion of Embedded Finance: Open banking is driving embedded financial services within e-commerce, retail, and non-banking digital platforms.

- Increase in Digital Payment Solutions: Account-to-account (A2A) payments and real-time payment systems are gaining traction.

- Regulatory Support and Compliance Frameworks: Government initiatives promoting secure data sharing are strengthening market growth.

- AI and Data Analytics Integration: Financial institutions are leveraging AI for fraud detection, credit assessment, and personalized banking.

- Focus on Enhanced Cybersecurity: Advanced encryption and authentication systems are being adopted to ensure secure data exchange.

- Rising Consumer Demand for Financial Transparency: Customers prefer platforms offering better financial visibility, budgeting tools, and control over data.

Future Market Outlook

- SME Digital Lending Expansion: Open data access enables faster and more accurate credit assessment for small businesses.

- Personalized Wealth Management Services: Data-driven advisory platforms can offer tailored investment solutions.

- Growth in Emerging Markets: Increasing smartphone penetration and digital banking adoption create untapped opportunities.

- Development of Cross-Border Payment Solutions: Open banking can simplify and reduce the cost of international transactions.

- Expansion of Banking-as-a-Service (BaaS): Financial institutions can monetize APIs by offering infrastructure to fintech startups.

- Integration with Insurtech and Regtech: Collaboration with insurance and regulatory technology firms can create new value streams.

- Advanced Financial Data Monetization: Secure and consent-based data sharing opens new revenue models.

- Innovative Customer Experience Platforms: AI-powered budgeting apps, financial dashboards, and smart assistants present strong growth potential.

How is Open Banking Building a More Resilient and Future Ready Financial Ecosystem?

Open banking enhances financial system resilience through encouraging competition, innovation, and safe data exchange between institutions. It encourages a variety of service models and lessens reliance on a single banking channel by decentralizing access to financial data via APIs. Ecosystems are made secure and organized by regulatory frameworks like PSD2 and comparable international projects. Adaptability to market disruptions is strengthened by the combination of real-time payments, AI-driven analytics, and fintech collaboration. The infrastructure required for scalable and robust financial innovation is provided by open banking as digital financial services expand.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 35.72 Billion |

| Market Size in 2026 | USD 43.22 Billion |

| Market Size by 2035 | USD 240.31 Billion |

| Market Growth Rate from 2026 to 2035 | CAGR of 21.00% |

| Dominating Region | Europe |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | Service Type/Financial Service, Component/Service Offering, Deployment Type, Distribution Channel, End-User, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Segment Insights

Service Type/Financial Service Insights

What made banking & capital the dominant segment in the open banking market?

The banking & capital segment dominated the market with a 46% share in 2025 because core banking services, such as account information services, payments, lending, and cash management, are the primary use cases enabled by open APIs. Financial institutions and fintechs heavily adopt open banking to improve customer onboarding, real-time payments, credit assessment, and personalized financial products, which directly impact revenue generation. Additionally, strong regulatory mandates initially focused on retail banking data sharing, further accelerating adoption within the banking and capital markets segment.

The payments segment is expected to grow at the fastest CAGR in the coming years because API-enabled account-to-account (A2A) payments offer faster, lower-cost alternatives to traditional card networks. Open banking supports real-time payments, instant fund transfers, and seamless checkout experiences, which are increasingly demanded by consumers and merchants. Additionally, reduced transaction fees, improved security through strong customer authentication, and the rise of e-commerce and digital wallets are accelerating adoption across both retail and business payment use cases.

Component/Service Offering Insights

What made transactional/account & payment APIs the leading segment in the open banking market?

The transactional/account & payment APIs segment led the market with a major share of 50% in 2025 since they serve as the foundation of open banking. These APIs make it possible to initiate payments, share secure data, and access accounts in real time. These APIs are given top priority by financial institutions to guarantee both customer transparency and regulatory compliance. The dominance of these APIs is further reinforced by their direct involvement in services that generate revenue.

The communicative/informative services segment is expected to grow at the fastest CAGR in the coming years because of an increase in the need for individualized insights and financial data analytics. AI-driven recommendations improve credit scores, and budgeting tools are made possible by these services. Adoption is fueled by growing consumer preference for financial transparency and intelligent financial management tools.

Deployment Type Insights

Why is the cloud-based segment dominating the open banking market?

The cloud-based segment dominated the market while holding a 70% share in 2025 and is expected to maintain its leadership position in the coming years. This is because of its capacity for faster API deployment cost effectiveness and scalability. Cloud infrastructure supports high transaction volumes, regulatory compliance, and secure data exchange, while enabling real-time analytics and seamless fintech integration. Ongoing innovations in cybersecurity and hybrid cloud models are expected to sustain the segment's dominant position in the market.

Distribution Channel Insights

Why did the bank channels segment dominate the open banking market?

The bank channels segment dominated the market with a 60% share in 2025 because banks serve as the primary custodians of customer financial data and are central to account information and payment services. Leveraging their existing customer base, trust, and regulatory compliance frameworks, banks can offer secure API access to third-party providers, enabling personalized financial services and seamless transactions. Additionally, banks' established infrastructure and partnerships with fintechs make them the most effective and widely adopted distribution channel for open banking solutions.

The apps/platforms segment is expected to grow at the fastest CAGR in the coming years because third-party apps and digital platforms provide consumers with convenient, integrated financial services across multiple banks. Platforms offering budgeting tools, payments, investment tracking, and multi-bank connectivity enhance user experience and drive engagement. Growth is further fueled by super apps, embedded finance models, and the expanding fintech ecosystem, which leverage open banking APIs to deliver seamless, personalized services outside traditional banking channels.

End User Insights

Why did the banks & traditional financial institutions segment dominate the open banking market?

The banks & traditional financial institutions segment dominated the market with a 40% share in 2025. This is because they control a large volume of customer account data and core banking systems. As the primary focus of regulatory mandates, banks are central to open banking implementation. Their leadership is further strengthened by investments in API management and ongoing digital transformation initiatives.

The fintech & third-party developers segment is expected to grow at the fastest CAGR in the upcoming period because they leverage APIs to create innovative financial products, such as digital wallets, lending platforms, and personal finance apps. Their agility allows rapid deployment of personalized services and seamless integration across multiple banks, meeting rising consumer demand for convenience and real-time financial management. Additionally, supportive regulatory frameworks and partnerships with traditional banks enable fintechs and developers to scale quickly, driving segment growth.

Regional Insights

What is the Europe Open Banking Market Size and Growth Rate?

The Europe open banking market size has grown strongly in recent years. It will grow from USD 12.86 billion in 2025 to USD 87.71 billion in 2035, expanding at a compound annual growth rate (CAGR) of 21.17% between 2026 and 2035.

What made Europe the dominant region in the open banking market?

Europe dominated the open banking market by holding a 36% share in 2025. This is due to the early adoption of open API standards and robust regulatory frameworks such as PSD2. Government regulations pushed banks to exchange consumer data securely, spurring innovation. There is a high adoption of digital banking services. Additionally, strong digital banking infrastructure, high smartphone penetration, and consumer demand for personalized financial services have reinforced Europe's leadership in open banking.

Germany Market Analysis

Germany is a leading contributor to the European open banking market due to its highly digitalized banking industry and strict compliance with PSD2 regulations. Strong API standardization, the presence of major banks and fintech hubs in Frankfurt and Berlin, and growing consumer preference for digital payments and account aggregation are driving adoption. Additionally, collaborations between fintechs and traditional banks are fostering innovation in digital payment and lending solutions.

How is the opportunistic rise of Asia Pacific in the market?

Asia Pacific is expected to grow at the fastest CAGR in the coming years because of government-supported digitalization initiatives, rapid fintech expansion, and increasing adoption of digital payments. The introduction of open banking regulations in countries like Australia, Singapore, and India, combined with rising smartphone penetration and a large unbanked population, is creating significant growth opportunities in the region.

India Market Analysis

India is experiencing rapid growth in open banking driven by initiatives like India Stack, UPI, and the Account Aggregator framework, which enable scalable real-time payments and secure data sharing. Key growth factors include the rise of fintech startups, increasing smartphone penetration, and widespread adoption of digital payments. Expansion of financial inclusion programs and embedded finance models is expected to further accelerate India's open banking market.

Who are the Major Players in the Global Open Banking Market?

The major players in the open banking market include Plaid Inc., Tink (Visa), Yodlee/Envestnet, TrueLayer, Token.io, Salt Edge, Bud Financial, Figo, Mambu, MX Technologies, GoCardless Ltd., Stripe, Inc., Jack Henry & Associates, Inc., OpenWrks, and BBVA Open Platform.

Recent Developments

- In February 2026, Amazon announced the launch of Pay by Bank in the UK through a partnership with TrueLayer. This service allows UK customers to pay for purchases directly from their bank accounts using biometric authentication or a PIN. It is designed for faster checkout and quicker refunds.(Source: https://www.openbankingexpo.com)

- In February 2026, Wrisk announced the acquisition of Atto to create an integrated platform for embedded finance and protection. The platform aims to offer hyper-personalised insurance products using open banking data by combining Wrisk's insurance infrastructure with Atto's real-time financial intelligence. The integration of credit and risk insights is intended to simplify underwriting and provide more accurate, automated coverage for global automotive and consumer brands(Source: https://www.prnewswire.com)

Segments Covered in the Report

By Service Type/Financial Service

- Banking & Capital Markets

- Payments

- Digital Currencies

- Value-Added Services/Others

By Component/Service Offering

- Transactional/Account & Payment APIs

- Communicative/Informative Services

- Others

By Deployment Type

- Cloud-based

- On-Premise

- Hybrid

By Distribution Channel

- Bank Channels

- Apps/Platforms

- Distributors & Aggregators

By End-User

- Banks & Traditional Financial Institutions

- Fintech & Third-Party Developers

- SMEs & Enterprises

- Consumers/Individuals

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Tags

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting