What is the Orthopedic Bone Defect Repair Materials Market Size?

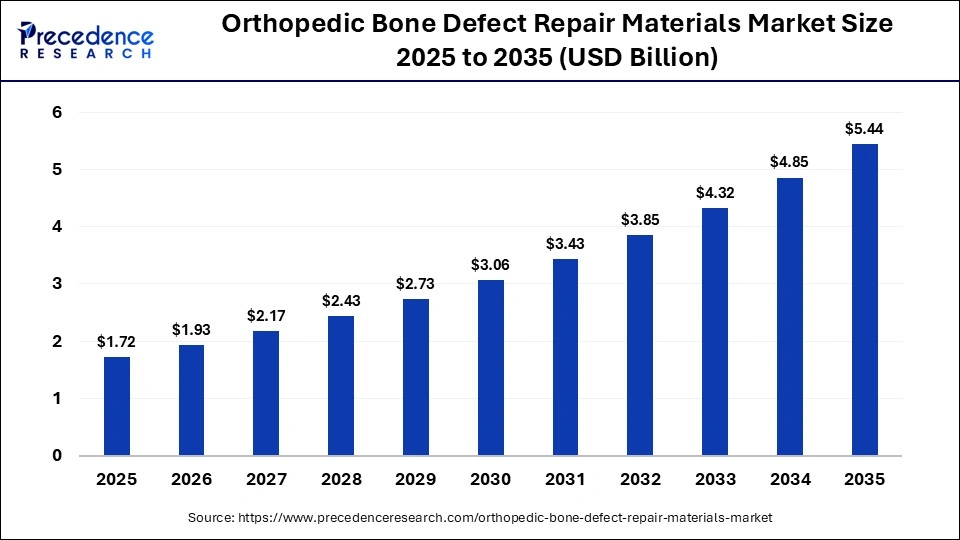

The global orthopedic bone defect repair materials market size was calculated at USD 1.72 billion in 2025 and is predicted to increase from USD 1.93 billion in 2026 to approximately USD 5.44 billion by 2035, expanding at a CAGR of 12.20% from 2026 to 2035. The orthopedic bone defect repair materials market is generally driven by the growing incidence of bone diseases globally, coupled with technological advancements in the orthopedic sector.

Market Highlights

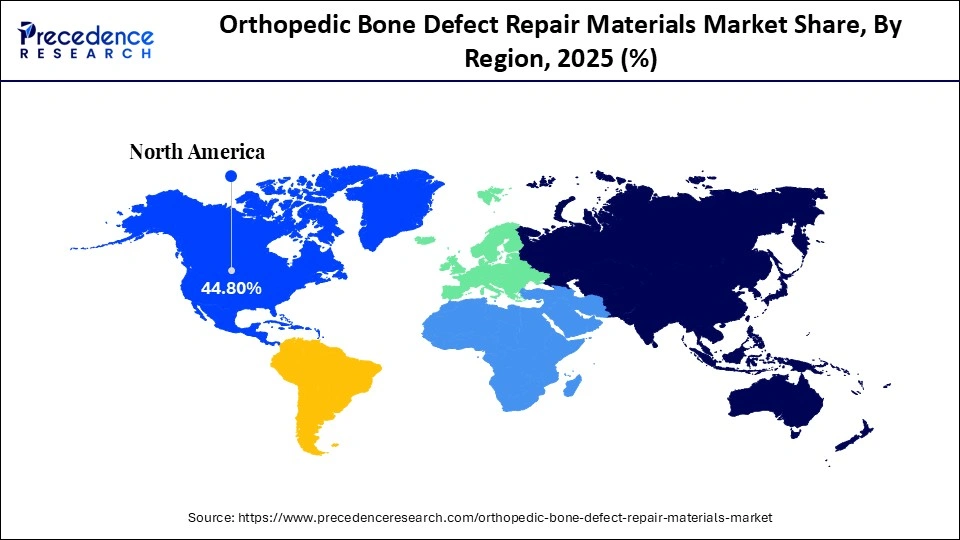

- North America dominated the market, holding the largest market share of 44.8% in 2025.

- Asia Pacific is expected to expand at the fastest CAGR of 12.5% from 2026 to 2035.

- By material type, the artificial bone materials segment held the largest market share, accounting for 52.4% in 2025.

- By material type, the natural bone materials segment is expected to grow at a remarkable CAGR of 11.2% between 2026 and 2035.

- By application, the trauma surgery segment held the largest market share of 48.6% in 2025.

- By application, the spinal surgery/joint surgery segment is expected to grow at a significant CAGR of 11.5% between 2026 and 2035.

- By form/product, the bone graft substitute segment contributed the largest share of 43.8% in the industry.

- By form/product, the bone void fillers segment is poised to grow at a considerable CAGR of 11.4% between 2026 and 2035.

- By end-user, the hospitals segment held the largest share of 42.6% in the market during 2025.

- By end-user, the specialty surgical centers segment is expected to grow at a notable CAGR of 11.2% between 2026 and 2035.

- By distribution channel, the distributors/direct sales segment dominated the industry with a share of 43.7%.

- By distribution channel, the online medical platforms segment is expected to expand with a remarkable CAGR of 11.3% between 2026 and 2035.

What Are Orthopedic Bone Defect Repair Materials?

The orthopedic bone defect repair materials include biomaterials, synthetic grafts, and bone substitutes that are used to repair, regenerate, or replace damaged bone tissue resulting from trauma, disease, or surgery. These materials are derived from natural allografts, artificial bioceramics, and composites. It supports bone healing and structural integrity in spinal and reconstructive procedures. The growth of the orthopedic bone defect repair materials industry is driven by the rising cases of orthopedic issues, aging populations, technological advancements in regenerative materials, and increasing surgical intervention rates.

What Is the Impact of AI on the Orthopedic Bone Defect Repair Materials Market?

The advancements in AI have significantly contributed to the development of the healthcare sector. AI has been constantly integrated into the orthopaedics sector for several applications, including fracture detection, surgical planning, risk assessment, and others. Additionally, the artificial bone manufacturers have started integrating AI in their production centers to enhance the design and create patient-specific scaffolds with tailored porosity. Thus, AI has impacted the orthopedic bone defect repair materials industry in a positive manner.

- In February 2025, Evergen launched an AI-based image processing software. This software is designed to enhance the analysis of CT bone graft scans.

Orthopedic Bone Defect Repair Materials Market Outlook

- Industry Growth Overview: This industry is experiencing immense growth due to the surging investment by governments of several countries in opening orthopedic hospitals, along with constant efforts by market players to develop high-quality bone graft products.

- Global Expansion: North America is leading the market with the presence of numerous prominent market players. Also, other regions, including the Asia Pacific, Latin America, Europe, the Middle East, and Africa, are also gaining immense traction due to the surging cases of bone diseases.

- Major Investors: The major brands that are investing heavily in this industry include Stryker, Biocomposites, Tianjin Sannie Bioengineering Technology, Medtronic, Johnson & Johnson, Olympus Terumo Biomaterials Corp., NovaBone Products, ALLGENS MEDICAL, Jiangsu Yenssen Biotech, and others. Additionally, numerous pharma brands have also made investments in this sector to derive maximum profits.

- Startup Ecosystem: Numerous startup companies are engaged in developing bone defect-repairing materials. The prominent startups dealing in this sector consist of EpiBone, Theradaptive, Ossio, Bonesupport, and some others.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 1.72 Billion |

| Market Size in 2026 | USD 1.93 Billion |

| Market Size by 2035 | USD 5.44 Billion |

| Market Growth Rate from 2026 to 2035 | CAGR of 12.20% |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | Material Type, Application, Form/Product, Distribution Channel, End-User, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Segments Insights

Material Type Insights

Why Did the Artificial Bone Materials Segment Dominate the Orthopedic Bone Defect Repair Materials Market?

The artificial bone materials segment dominated the orthopedic bone defect repair materials market with a share of 52.4% in 2025. The rising use of synthetic materials for manufacturing bone replacement substances has boosted the market expansion. Additionally, the surging research and development activities performed by researchers for developing artificial bone materials are expected to drive the growth of the orthopedic bone defect repair materials industry.

The artificial bone materials segment is also expected to rise at a remarkable CAGR of 11.2% between 2026 and 2035. The surging use of xenografts for the production of dental bones has driven the industrial growth. Moreover, the increasing application of allografts for manufacturing cancellous (spongy) bones is expected to propel the growth of the orthopedic bone defect repair materials industry.

Application Insights

What Made the Trauma Surgery Segment Lead the Orthopedic Bone Defect Repair Materials Market?

The trauma surgery segment led the orthopedic bone defect repair materials market with a share of 48.6% in 2025. The rising cases of road accidents in different regions of the world have increased the demand for trauma surgeries, thereby driving the market expansion. Moreover, the growing use of autografts for providing structural support to patients after encountering trauma surgery is expected to boost the growth of the orthopedic bone defect repair materials sector.

The spinal surgery/joint surgery segment is expected to expand at a significant CAGR of 11.5% between 2026 and 2035. The growing investment by the government for constructing modern hospitals to perform spinal surgeries has boosted the market expansion. Additionally, the rising demand for artificial bones for treating patients undergoing joint surgery is expected to drive the growth of the orthopedic bone defect repair materials market.

Form/Product Insights

Why Did the Bone Graft Substitutes Segment Hold the Largest Share of the Orthopedic Bone Defect Repair Materials Market?

The bone graft substitutes segment held the largest share of the orthopedic bone defect repair materials market with a share of 43.8%. The increasing use of bone graft substitutes for promoting osteoconduction and osteoinduction in human beings has boosted the market expansion. Additionally, the rapid investment by market players for developing a wide range of bone graft substitutes is expected to propel the growth of the orthopedic bone defect repair materials industry.

The bone void fillers segment is expected to expand at a considerable CAGR of 11.4% between 2026 and 2035. The growing usage of bone void fillers to provide structural support and fill gaps that are left during bone surgeries has boosted the market expansion. Moreover, the rising application of bone void fillers in spinal injury patients is expected to foster the growth of the orthopedic bone defect repair materials sector.

End-User Insights

Why Did the Hospitals Segment Lead the Orthopedic Bone Defect Repair Materials Market in 2025?

The hospitals segment led the orthopedic bone defect repair materials market with a share of 42.6%. The growing adoption of advanced technologies, such as AI and IoT, in modern hospitals for operating bone replacement surgeries has driven the market expansion. Also, the rapid investment by the governments of several countries, including the U.S., Japan, India, Qatar, and some others, for opening new orthopedic hospitals is expected to propel the growth of the orthopedic bone defect repair materials market.

The specialty surgical centers segment is expected to rise at a notable CAGR of 11.2% between 2026 and 2035. The increasing tendency of patients to visit specialty surgical centres after encountering road accidents to get immediate medical attention has boosted the market expansion. Additionally, the increasing adoption of bone grafts by these centers to enhance surgical procedures is expected to boost the growth of the orthopedic bone defect repair materials industry.

Distribution Channel Insights

Why Did Distributors/Direct Sales Lead the Global Orthopedic Bone Defect Repair Materials Market in 2025?

The distributors/direct sales segment led the global orthopedic bone defect repair materials market with a share of 43.7% in 2025. The growing investment by distributors to expand their business networks in different regions has boosted the market growth. Also, the surging preference of hospitals to purchase artificial bone replacement products from direct sales platforms is expected to drive the growth of the orthopedic bone defect repair materials sector.

The online medical platforms segment is expected to grow with a remarkable CAGR of 11.3% during the forecast period. The surging adoption of smartphones globally has enabled consumers to buy and purchase products through online platforms, thereby accelerating the industrial expansion. Moreover, the availability of a wide range of bone graft products in online medical platforms is expected to boost the growth of the orthopedic bone defect repair materials market.

Regional Insights

Why Did North America Dominate the Orthopedic Bone Defect Repair Materials Market in 2025?

North America dominated the orthopedic bone defect repair materials market, holding a share of 44.8% in 2025. The increasing cases of scoliosis in several nations, including the U.S., Canada, Mexico, and others, have increased the demand for bone defect materials, thereby driving the market expansion. Additionally, numerous government initiatives aimed at developing the healthcare infrastructure, coupled with the presence of various market players such as Zimmer Biomet, Johnson & Johnson, Medtronic, and some others, are expected to accelerate the growth of the orthopedic bone defect repair materials sector in this region.

- In October 2025, Zimmer Biomet announced that the FDA approved the iG7 hip system. This hip replacement system is designed for the end-users of the U.S. region.

U.S Orthopedic Bone Defect Repair Materials Market Analysis

The U.S. orthopedic bone defect repair materials market is expanding due to sustained government and institutional investment in the development and modernization of specialized orthopedic and trauma care centers across the country. Public funding and reimbursement support for musculoskeletal care are improving patient access to surgical interventions for fractures, spinal disorders, and joint reconstruction, which is increasing demand for bone grafts and bone substitute materials.

At the same time, continuous research and development efforts by bone graft manufacturers are advancing the quality, biocompatibility, and mechanical performance of synthetic and biologically derived bone repair materials. Increasing clinical adoption of minimally invasive orthopedic procedures is further driving demand for injectable and moldable bone substitutes. In parallel, the rising incidence of osteoporosis, sports injuries, and age-related bone degeneration is increasing the volume of complex bone repair surgeries. Together, these infrastructure, innovation, and demographic factors are supporting steady growth of the orthopedic bone defect repair materials industry in the United States.

Why Is Asia Pacific Undergoing the Fastest Growth in the Orthopedic Bone Defect Repair Materials Market?

Asia Pacific is expected to grow at the fastest CAGR of 12.5% during the forecast period. The surging incidences of osteoporosis in various countries, such as China, India, Japan, South Korea, Singapore, Australia, and some others, have driven the market expansion. Moreover, technological advancements in the orthopaedics sector, as well as the presence of numerous bone graft manufacturing brands, including Jiangsu Yenssen Biotech, Shanghai Rebone Biomaterials, Shanghai Bio-lu Biomaterials, Jiuyuan Gene, and some others, are expected to boost the growth of the orthopedic bone defect repair materials market in this region.

China Orthopedic Bone Defect Repair Materials Market Trends

China's orthopedic bone defect repair materials market is expanding due to the rapid growth of private hospitals alongside sustained government initiatives focused on strengthening healthcare infrastructure and expanding access to advanced orthopedic care. Increased public and private investment in trauma centers and specialty orthopedic hospitals is raising surgical volumes for fracture repair, joint reconstruction, and spinal procedures, thereby increasing demand for bone grafts and bone substitute materials.

The fast adoption of AI-enabled surgical robotics and navigation systems is improving procedural precision and outcomes, which is supporting wider use of advanced bone repair materials during complex orthopedic interventions. In parallel, rising incidence of age-related bone disorders, osteoporosis, and road traffic injuries is increasing the clinical need for effective bone regeneration solutions. Domestic manufacturers are also accelerating product development and localization of synthetic and bioactive bone substitutes, improving availability and cost efficiency across the Chinese orthopedic care landscape.

Why Is the European Orthopedic Bone Defect Repair Materials Market Experiencing Notable Growth?

Europe is experiencing notable growth in the orthopedic bone defect repair materials market. The increasing demand for bone void fillers from the orthopedic sector to treat bone patients in several nations, such as Germany, the UK, France, Italy, Sweden, and some others, has boosted the market expansion. Moreover, the rapid adoption of health insurance policies by consumers to attain orthopedic surgeries is expected to drive the growth of the orthopedic bone defect repair materials industry in this region.

- In November 2025, Allianz Partners launched a new health insurance plan in Europe. This insurance policy is designed for the students, digital nomads, and professionals residing in the UK and EU region.

Germany Orthopedic Bone Defect Repair Materials Industry Trends

The rise in the number of orthopedic clinics, along with the rapid investment by market players in opening new artificial bone production centers, has driven the market expansion. Also, the surging focus of the government to provide free medical access to the local citizens is positively contributing to the industry.

Why Is the Middle East and Africa Orthopedic Bone Defect Repair Materials Sector Gaining Momentum?

The Middle East and Africa are gaining significant momentum in the orthopedic bone defect repair materials sector. The growing cases of spinal injuries in several nations, including the UAE, Saudi Arabia, South Africa, Qatar, and others, have increased the demand for composite grafts, thereby boosting the industrial expansion. Moreover, the rapid investment by the government for deploying robots in the healthcare sector is expected to accelerate the growth of the orthopedic bone defect repair materials market in this region.

UAE Orthopedic Bone Defect Repair Materials Market Trends

The surging demand for bone scaffolds from biomedical researchers and surgeons to perform different applications, such as studying bone regeneration and treating complex fractures, has boosted the market growth. Additionally, the increasing deployment of AI-integrated platforms in modern hospitals is positively contributing to the industry.

- In April 2025, Burjeel Holdings partnered with Hippocratic AI. This partnership aims to deploy AI-integrated platforms in the orthopaedics centers across the UAE.

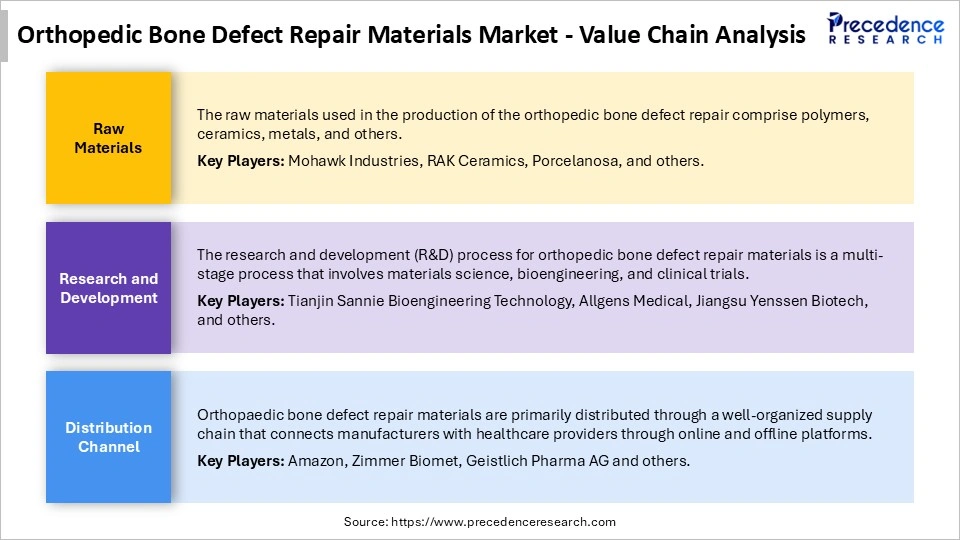

Orthopedic Bone Defect Repair Materials Market Value Chain Analysis

Who are the Major Players in the Global Orthopedic Bone Defect Repair Materials Market?

The major players in the orthopedic bone defect repair materials market include Stryker, Medtronic, Johnson & Johnson (DePuy Synthes), Olympus Terumo Biomaterials Corp, NovaBone Products, Biocomposites, Tianjin Sannie Bioengineering Technology, ALLGENS MEDICAL, Jiangsu Yenssen Biotech, Shanghai Rebone Biomaterials, Shanghai Bio-lu Biomaterials, Jiuyuan Gene, Guona Technology, Zhenghai Bio-Tech, and Zimmer Biomet.

Recent Developments

- In December 2025, Xtant Medical Holdings, Inc., launched nanOss Strata. nanOss Strata is an innovative synthetic bone graft made from hydroxycarbonapatite (HCA) to function similarly to human bones.(Source: https://www.prnewswire.com)

- In September 2025, NovaBone launched a synthetic bioactive pre-contoured wedge. This wedge is designed for correcting deformities in patients suffering from bone diseases.(Source: https://medtechspectrum.com)

- In February 2025, Sree Chitra Tirunal Institute for Medical Sciences and Technology (SCTIMST) launched a new series of bone graft products. These products are manufactured using synthetic medical-grade basanite fortified with phosphate ions.

Segments Covered in the Report

By Material Type

- Artificial Bone Materials (synthetic: ceramics, polymers, composites)

- Natural Bone Materials (allografts, xenografts)

- Autologous Bone Materials

By Application

- Trauma Surgery

- Spinal Surgery

- Joint Surgery

- Other Orthopaedic Procedures

By Form/Product

- Bone Graft Substitutes

- Bone Void Fillers

- Bone Scaffolds

- Composite Grafts

By Distribution Channel

- Direct Sales

- Distributors

- Online Medical Platforms

- OEM Partnerships

By End-User

- Hospitals

- Orthopaedic Clinics

- Specialty Surgical Centers

- Ambulatory Surgical Centres

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting