Oxycodone Hydrochloride Market Size and Forecast 2025 to 2034

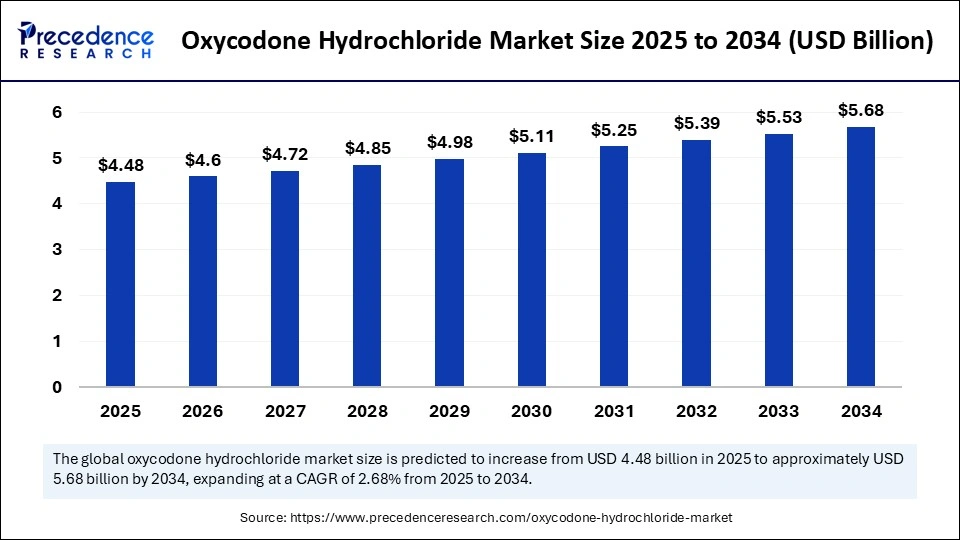

The global oxycodone hydrochloride market size accounted for USD 4.36 billion in 2024 and is predicted to increase from USD 4.48 billion in 2025 to approximately USD 5.68 billion by 2034, expanding at a CAGR of 2.68% from 2025 to 2034.The rising demand for several pain relief solutions is driving the growth of the oxycodone hydrochloride market. Advancements in pharmaceutical formulations are advancing oxycodone hydrochloride drugs, contributing to the market expansion.

Oxycodone Hydrochloride MarketKey Takeaways

- The global oxycodone hydrochloride market was valued at USD 4.36 billion in 2024.

- It is projected to reach USD 5.68 billion by 2034.

- The market is expected to grow at a CAGR of 2.68% from 2025 to 2034.

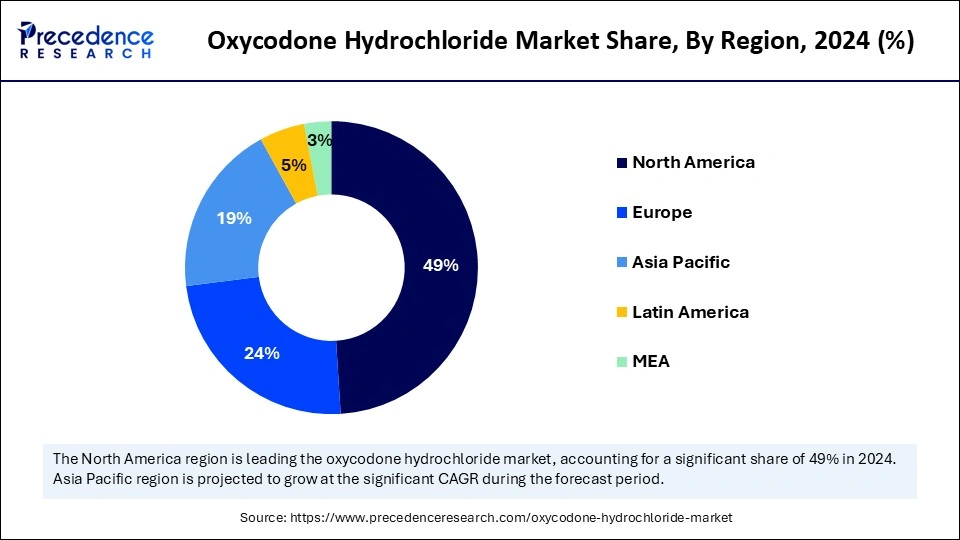

- North America dominated the global market with the largest revenue share of 49% in 2024.

- Asia Pacific is expected to grow at a significant CAGR from 2025 to 2034.

- By type, the controlled-release segment held the major market share in 2024.

- By type, the immediate-release segment will grow at a CAGR between 2025 and 2034.

- By route of administration, the oral route segment contributed the largest market revenue in 2024.

- By route of administration, the parenteral route segment will expand at a significant CAGR between 2025 and 2034.

- By distribution channel, the hospital pharmacies segment led the market in 2024.

- By distribution channel, the retail pharmacies segment is expected to grow at a significant CAGR over the projected period.

Impact of Artificial Intelligence (AI) on the Oxycodone Hydrochloride Market?

Artificial intelligence is emerging as a major force, driving the growth of the oxycodone hydrochloride market. AI finds applications in oxycodone hydrochloride formulation and production. AI is a significant tool designed for new formulation optimization, which can enable easy combinations of oxycodone hydrochloride drugs with other ingredients. Predictive modeling of AI helps to predict pharmacokinetic properties to enhance the adsorption and bioavailability of drugs. Additionally, AI can facilitate significant approaches in personalized medicine and treatment solutions, including oxycodone hydrochloride content pain relief and management drugs. AI has potential benefits in not only the accurate and efficient formulation and production of oxycodone hydrochloride but also plays a vital role in supply chain optimization to ensure significant availability and easy access to medicines. The growing development of abuse-deterrent formulations of oxycodone and generic formulations is bringing significant opportunities for AI.

U.S. Oxycodone Hydrochloride Market Size and Growth 2025 to 2034

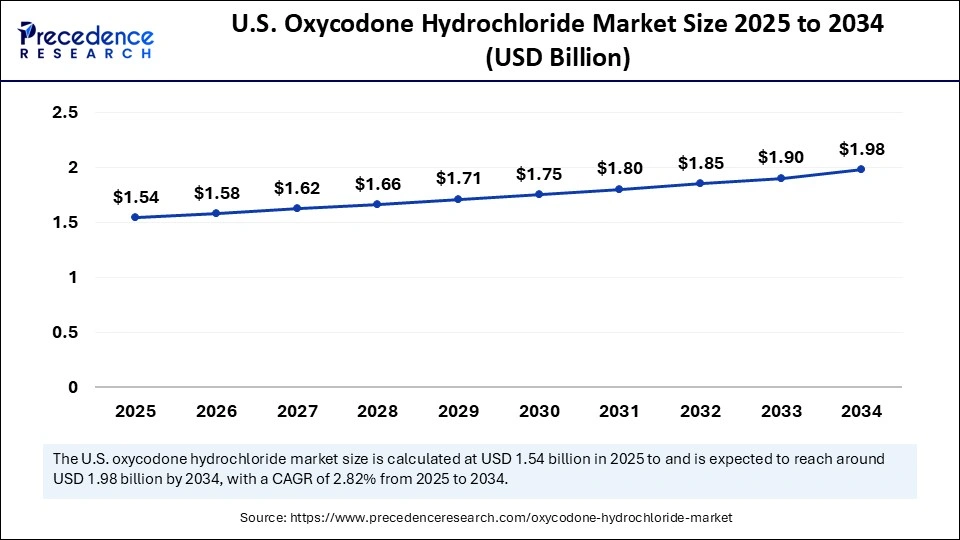

The U.S. oxycodone hydrochloride market size was exhibited at USD 1.50 billion in 2024 and is projected to be worth around USD 1.98 billion by 2034, growing at a CAGR of 2.82% from 2025 to 2034.

What Made North America the Dominant Region in the Market?

North America dominated the global oxycodone hydrochloride market with the largest share in 2024. This is mainly due to the high prevalence of chronic pain conditions, including cancer, osteoarthritis, and rheumatoid arthritis. North America is witnessing significant growth in the aging population, driving the incidence of severe pain and surgical procedure requirements, contributing to increased demand for pain relief and management solutions, including oxycodone hydrochloride drugs.

The U.S. is a major player in the regional market, driven by the increased incidence of chronic pain conditions, an aging population, well-established healthcare expenditure, and growing healthcare spending on healthcare. The U.S. has the largest number of cases of cancer pain, musculoskeletal disorders, and post-operative pain. Additionally, stringent regulations and growing focus on the safety of drugs are fostering innovative approaches in the development of abuse-deterrent formulations, generic versions, and combination therapies are contributing to the market competition.

Asia Pacific Oxycodone Hydrochloride Market Trends

Asia Pacific is the fastest-growing region in the market, driven by various factors like rising chronic pain conditions, an aging population, and growing healthcare expenditure. Governments around the region are investing heavily in boosting healthcare expenditure. Additionally, the government's focus on investing in pharmaceutical companies and establishing local start-up manufacturers is contributing to the development of novel and effective drugs, like a generic version of oxycodone hydrochloride and abuse-deterrent formulations.

Japan is a significant player in the regional market, with major consumption of oxycodone hydrochloride drugs, driven by a growing aging population and growing surgical procedures. Well-established regulatory forces and significant approaches to pain management and opioid use are fuelling the market.

India is expected to foster market growth over the forecast period due to the potential market for pain relief drugs and major exports of generic pharmaceuticals. India is a robust manufacturer and exporter of generic drugs, including oxycodone hydrochloride content drugs. India supplies 20% of the world's generic medicines. Taj Pharma is one of the major manufacturers of Oxycodone generic drugs in India. Additionally, the growing expiry of drug patents is driving focus on novel innovations and developments, creating significant opportunities for market growth.

Europe Oxycodone Hydrochloride Market Trends

Europe is considered to be a significantly growing area. The rising incidence of chronic pain conditions and widespread use of oxycodone hydrochloride in managing post-operative and severe pain are driving the growth of the market in the region. Europe has a well-established R&D and pharmaceutical sector, which contributes to the innovation and development of medications. Strict regulations and government investments in pharmaceutical companies have increased European companies' initiatives in the development of long-lasting opioid and abuse-deterrent formulations. The high availability of illicit drugs is a key factor driving the European drug market.

Countries like the UK, Germany, France, Italy, and Russia are leading the regional market. The UK is a major player in the regional market, driven by a well-established pharmaceutical sector and the Research & development industry. The presence of major pharmaceutical companies, including Johnson & Johnson, Purdue Pharma, Mallinckrodt, and Teva Pharmaceutical Industries Ltd. Shaping the regional market.

Market Overview

The oxycodone hydrochloride market reflects increased demand for pain management solutions, driven by increased chronic pain prevalence, an aging population, and rising surgical procedure numbers. The aging population is more susceptible to chronic pain contributes to increased demand for sophisticated pain management solutions. The treatments of chronic ailments and the need for post-surgery pain relief are major factors driving demand for these medicines. Oxycodone hydrochloride has 602 patent family members in forty-nine countries and twelve drug master file entries for oxycodone. Physicians mostly prescribe long-acting opioid medications for chronic pain, especially cancer and arthritis.

The market has witnessed a significant hamper in the past few years due to increased negative perspectives toward drugs for their abuse and addiction risk. However, strict regulations for drug safety have empowered pharmaceutical companies to develop abuse-deterrent formulations, generic versions, and combination therapies. The innovation and developments of oxycodone hydrochloride drugs with reduced abuse and enhanced efficiency are fostering its adoption again. Major regulations are helping the market to expand, highlighted by the National Institutes of Health (NIH) on the potential for opioid-induced hyperalgesia (OIH), suggesting careful monitoring and dose adjustments if OIH is suspected.

- In October 2024, the FDA approved Protega Pharmaceuticals' RoxyBond as an alternative treatment for managing severe pain. The approval granted use of an immediate-release (IR) schedule II tablet at a dose of 10 mg.

(Source:https://www.ajmc.com)

What are the Key Trends of the Global Oxycodone Hydrochloride Market?

- Prevalence of Chronic Pain: The incidence of chronic pain conditions like back pain, cancer, and arthritis has increased, driving demand for oxycodone hydrochloride.

- Growing number of Surgeries: Growing surgeries are causing demand for pain relief and management solutions, like oxycodone hydrochloride.

- Advancements in Drug Formulations: The growing focus on manufacturers to advance drug formulations and extended-release versions, with high safety concerns, is contributing to the market growth.

- Growing Healthcare Expenditure: The increasing healthcare expenditure enables access to advanced pain management solutions, including oxycodone hydrochloride drugs.

- Collaborative Strategies: Pharmaceutical companies, government, and healthcare providers are collaborating to advance innovations and the availability of oxycodone hydrochloride drugs.

Market Scope

| Report Coverage | Details |

| Market Size by 2034 | USD 5.68 Billion |

| Market Size in 2025 | USD 4.48 Billion |

| Market Size in 2024 | USD 4.36 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 2.68% |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Type, Route of Administration, Distribution Channel, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

Rising Prevalence of Chronic Pain

The prevalence of chronic pain has increased, including back pain, cancer, rheumatoid arthritis, osteoarthritis, fibromyalgia, and osteoporosis, driving the need for efficient pain management solutions like oxycodone hydrochloride. The cancer cases have increased, and so has increased pain associated with it, driving demand for efficient oxycodone and other opioid analgesics. The growing aging population and surgical procedure numbers are also contributing to the rising prevalence of severe pain. The physicians have increased the prescription of oxycodone hydrochloride for pain relief and management. Growing focus on the development of abuse-deterrent formulations is contributing to addressing safety concerns, making the drug more acceptable in the global market.

Restraint

Potential Abuse and Addiction

The oxycodone hydrochloride has the potential for abuse and addiction. The drug can lead to overdose and even death. Oxycodone hydrochloride also causes several side effects, like constipation, sedation, euphoria, constricted pupils, and breathing problems. The negative public perception and stigma reading use of opioid use hinder the adoption of oxycodone hydrochloride drugs. Strict drug safety regulations and monitoring programs like the FDA and WHO focus on mitigating the abuse and addiction risks of the drugs.

The FDA's Anesthetic and Analgesic Drug Products and Drug Safety and Risk Management advisory committees noted the U.S. population and their understanding of misuse and abuse, like pain-adjusted outcome measures for opioid use disorder (OUD), at a joint meeting that opens in a new tab or window. The initiatives have helped to boost new opioid formulations and address the public health implications of increasing opioid availability.

(Source: https://www.medpagetoday.com)

Opportunity

Combination Therapies

Ongoing focus on pharmaceutical companies for the development of combination therapies like oxycodone hydrochloride Naloxone, Oxycodone hydrochloride + Acetaminophen to reduce potential abuse, maintain efficacy, provide additive pain relief, and reduce opioid dosage are holding potential opportunities for the oxycodone hydrochloride drugs. A combination of oxycodone hydrochloride with other medications and analgesics helps to improve pain relief and reduce side effects. The focus of oxycodone hydrochloride drug combinations with abuse-deterrent agents is to help mitigate the risk of abuse. Additionally, the rise in combination therapies enables the use of drugs for specific needs, making them more reliable and effective.

Type Insights

Why did the Controlled-release Segment Dominate the Oxycodone Hydrochloride Market?

The controlled-release segment dominated the market with the largest share in 2024, driven by the high adoption of tamper-resistant features of oxycodone hydrochloride drugs, like OxyContin. The oxycodone hydrochloride helps extend pain relief and drives adoption for chronic pain management. Controlled release ensures the long-acting effects of the drugs, reduces the need for frequent dosing, and improves patient outcomes. The use of controlled-release oxycodone hydrochloride is high for the sudden intensification of pain, like back pain.

The immediate-release segment is expected to grow at the fastest rate in the upcoming period due to its major use for acute or chronic pain management. The immediate-release oxycodone hydrochloride is often prescribed drug for the first choice of treatment. The segment growth is attributed to the high given of short-acting oxycodone drugs for cancer patients. Ongoing focus on the development of abuse-deterrent formulations (ADFs) is expected to enhance segment growth.

Route of Administration Insights

What Made Oral the Dominant Segment in the Oxycodone Hydrochloride Market?

The oral segment dominated the market in 2024 due to its convenient nature and bioavailability. Oral administration is suitable for both acute and chronic pain relief and management. Oral administration is an easier way for drug administration, contributing to higher patient compliance than parenteral administration. The high preference and wider availability of orally administered oxycodone hydrochloride drugs foster the segment.

The parenteral segment is expected to grow at the fastest rate over the forecast period due to the high demand for intravenous and subcutaneous routes for severe pain conditions like cancer. The patient who is unable to tolerate oral opioids or requires fast pain relief needs to be administered drugs through parenteral routes. The parenteral administration offers a rapid onset of action, making it suitable for the aging population and chronic and post-operation pain, where pain relief is required immediately.

Distribution Channel Insights

How does Hospital Pharmacies Segmented Dominate the Oxycodone Hydrochloride Market in 2024?

The hospital pharmacies segment held the largest revenue share of the market in 2024 due to increased hospitalizations, availability of professional experts, and access to advanced medications. Hospitals are crucial parameters in the chronic pain condition. High number of surgeries and hospitalizations, direct purchase of medication from hospital pharmacies. Additionally, the controlled environment of hospital pharmacies ensures the stringent monitoring and supervision required for oxycodone, making them a preferred choice for patients.

The retail pharmacies segment is expected to grow at a significant rate in the coming years. The segment growth is driven by retail pharmacies offering outpatient access to oxycodone hydrochloride. Patients with back pain are the major customers for retail pharmacies. Additionally, patients with ongoing prescriptions prefer purchasing medications through retail pharmacies for more convenient and cost-effective options, which contributes to segment growth.

Oxycodone Hydrochloride MarketCompanies

- Mallinckrodt Pharmaceuticals

- Teva Pharmaceutical Industries Ltd.

- Sun Pharmaceutical Industries Ltd.

- Lupin Ltd

- Amneal Pharmaceuticals LLC

- Alvogen

- Rhodes Pharmaceuticals L.P.

- Protega Pharmaceuticals LLC

- Noramco

- Johnson & Johnson

- Pfizer Inc.

Recent Developments

- In April 2025, Elite Pharmaceuticals, Inc., a specialty pharmaceutical company developing niche generic products, launched Elite's generic version of Percocet (oxycodone hydrochloride and acetaminophen tablets, USP CII) 5mg/325mg, 7.5mg/325mg, and 10mg/325mg tablets. The tablets are designed for the relief of moderate to moderately severe pain.

(Source:https://finance.yahoo.com)

- In January 2025, Purdue Pharma and the Sackler family agreed to invest USD 7.4 bn (£6bn) to settle claims regarding its powerful prescription painkiller, oral formulation, OxyContin. The deal showcased a rise of over USD 1 bn on a previous settlement that was rejected in 2024 by the US Supreme Court.

(Source:https://www.bbc.com)

Segment Covered in the Report

By Type

- Controlled-Release

- Immediate-Release

By Route of Administration

- Oral

- Parenteral

By Distribution Channel

- Hospital Pharmacies

- Retail Pharmacies

- Online Pharmacies

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting