Phentermine Hydrochloride Market Size and Forecast 2025 to 2034

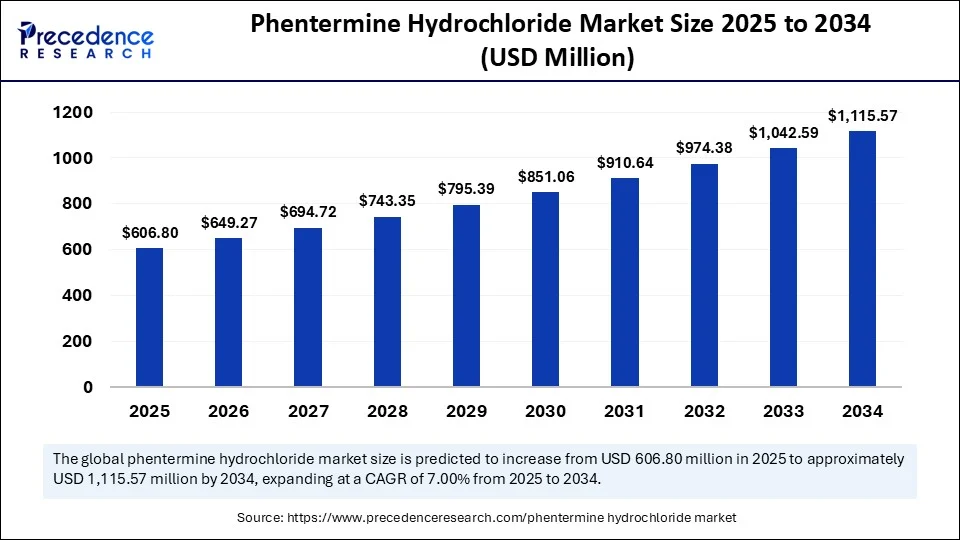

The global phentermine hydrochloride market size was calculated at USD 567.10 million in 2024 and is predicted to increase from USD 606.80 million in 2025 to approximately USD 1,115.57 million by 2034, expanding at a CAGR of 7.00% from 2025 to 2034. The growth of the market is attributed to the rising rates of obesity and the increasing awareness of health risks associated with it.

Phentermine Hydrochloride Market Key Takeaways

- In terms of revenue, the global labeling services market was valued at USD 567.10 million in 2024.

- It is projected to reach USD 1,115.57 million by 2034.

- The market is expected to grow at a CAGR of 7.00% from 2025 to 2034.

- North America dominated the phentermine hydrochloride market, holding the largest market share in 2024.

- Asia Pacific is expected to expand at the fastest CAGR in the market between 2025 and 2034.

- By dosage form, the tablets segment led the market while holding the largest share in 2024.

- By dosage form, the orally disintegrating tablets (ODT) segment is expected to grow at a significant CAGR between 2025 and 2034.

- By drug type, the generic drugs segment led the market in 2024.

- By drug type, the branded drugs segment is expected to grow at a remarkable CAGR between 2025 and 2034.

- By strength, the 37.5 mg segment led the market while holding the largest market share in 2024.

- By strength, the 15 mg segment is expected to grow at the fastest CAGR between 2025 and 2034.

- By route of administration, the oral segment dominated the market in 2024.

- By route of administration, the sublingual segment is likely to grow at the fastest rate in the coming years.

- By distribution channel, the retail pharmacies segment led the market while holding the largest market share in 2024.

- By distribution channel, the online pharmacies segment is expected to grow at a remarkable CAGR between 2025 and 2034.

- By application, the obesity (BMI ≥30) segment led the market while holding the largest share in 2024.

- By application, the overweight with comorbidities segment is expected to grow at a significant CAGR between 2025 and 2034.

- By end user, the specialty weight loss clinics segment led the market while holding the largest market share in 2024.

- By end user, the homecare/telehealth users segment is expected to grow at the fastest CAGR between 2025 and 2034.

How is AI Reshaping the Phentermine Hydrochloride Market?

Artificial Intelligence (AI) plays a vital role in transforming the phentermine hydrochloride market by enhancing drug discovery and development processes. AI-powered health platforms are enabling personalized treatment plans by analyzing patient data, lifestyle patterns, and medical histories to optimize dosage and duration. Telehealth services integrated with AI tools now help doctors quickly identify eligible patients for phentermine therapy, improving both safety and effectiveness. Predictive analytics help forecast treatment outcomes, side effect risks, and adherence trends, enhancing decision-making for both clinicians and patients. It is also streamlining supply chain logistics, ensuring timely drug availability. As digital health continues to evolve, AI is expected to further enhance accessibility, precision, and regulatory compliance.

Market Overview

The phentermine hydrochloride market refers to the global market for phentermine HCl, a prescription appetite suppressant used as a short-term treatment for obesity. It works by stimulating the central nervous system (similar to an amphetamine), reducing hunger. Phentermine is usually prescribed in conjunction with diet, exercise, and behavior modification. It is primarily regulated due to its classification as a Schedule IV controlled substance in many countries, and its use is limited to short-term durations under medical supervision. The market spans generic manufacturers, branded drug producers, weight management clinics, and online telehealth platforms and is influenced by obesity prevalence, regulatory changes, and shifts toward tele-prescription services.

The worldwide phentermine hydrochloride market is witnessing rapid growth, driven by the increasing obesity rates and heightened awareness of weight-related health risks. As lifestyle diseases like type 2 diabetes and hypertension rise, physicians are turning to pharmacological options for faster weight control. Phentermine remains one of the most prescribed anti-obesity drugs, valued for its effectiveness in appetite suppression. Growing acceptance of medication for weight loss in developing nations also drive the market. However, due to its classification as a controlled substance in many regions, regulatory scrutiny remains high. Despite this, the market continues to evolve with the introduction of combination therapies and improved delivery formats.

Key Market Trends

- Combination therapy growth: Phentermine is often combined with topiramate or other agents to enhance weight-loss outcomes, increasing its scope of applications.

- Telemedicine & online prescription: Expanding telehealth services are making it easier for patients to consult with a doctor and access prescriptions, including phentermine.

- R&D in novel formulations: Innovation in extended-release and combination capsules helps improve compliance and minimize side effects.

Market Scope

| Report Coverage | Details |

| Market Size by 2034 | USD 1,115.57 Million |

| Market Size in 2025 | USD 606.80 Million |

| Market Size in 2024 | USD 567.10 Million |

| Market Growth Rate from 2025 to 2034 | CAGR of 7.00% |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Dosage Form, Strength, Route of Administration, Distribution Channel, Application, End User, Sales Type, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

Global Obesity Epidemic

As obesity becomes a global health crisis, the demand for rapid and effective pharmacological interventions is rising rapidly. According to the WHO, by 2025, over 167 million people, including adults and children, will become less healthy because of overweight or obese. This highlights the need for drugs that offer rapid results. Phentermine hydrochloride, known for its short-term appetite-suppressing effects, effectively addresses this need. Phentermine hydrochloride is a prescription medication used to aid in weight loss, primarily as an appetite suppressant. It plays a key role in short-term obesity management and is often prescribed alongside lifestyle modification.

Governments and healthcare organizations are investing in public health programs that include pharmaceutical treatments alongside diet and exercise. Additionally, increased consumer awareness of the health risks linked to obesity, such as cardiovascular disease and diabetes, is driving more patients toward medical solutions. All these factors accelerate the uptake of phentermine hydrochloride.

Restraint

Regulatory Hurdles and Potential Side Effects

Despite its effectiveness, phentermine faces strict regulatory hurdles due to its stimulant-like properties and potential for dependency. In many countries, it is classified as a schedule IV-controlled substance, restricting its availability and marketing. Physicians are cautious when prescribing phentermine, especially for patients with cardiovascular risks. Moreover, concerns about side effects like increased blood pressure, insomnia, and nervousness can deter long-term use. Insurance coverage is also inconsistent, limiting affordability for some patients. Unless balanced by clinical education and improved formulations, these challenges could restrict broader adoption in several markets.

Opportunity

Potential in Emerging Markets and Digital Health Integration

Rising middle-class populations and improved healthcare access in emerging markets present a major growth opportunity for the phentermine hydrochloride market. As obesity becomes a major concern in several regions, the need for affordable and effective weight-loss medications is increasing. In parallel, digital health platforms are expanding access to prescriptions, especially in remote or underserved regions. Online pharmacies and teleconsultations help remove stigma and barriers to treatment. There is also an opportunity for manufacturers to develop low-dose, extended-release, or combo formulations tailored for new demographics. These innovations could help penetrate untapped markets and broaden phentermine's appeal.

Dosage Form Insights

Why Did the Tablets Segment Dominate the Phentermine Hydrochloride Market in 2024?

The tablets segment remains the dominant dosage form due to their convenience, stability, and patient familiarity. They are easy to manufacture, store, and distribute, making them highly cost-effective for pharmaceutical companies. Tablets also allow for precise dosing and consistent drug delivery, which is essential for long-term therapies like weight management. Their acceptability among all age groups and ease of administration drive their widespread adoption. With strong brand recognition and a broad range of strengths available, tablets continue to be the go-to format for prescribers and consumers alike. This traditional form maintains a strong foothold across both generic and branded categories.

On the other hand, the orally disintegrating tablets (ODTs) segment is expected to grow at the fastest rate in the upcoming years as they ensure patient compliance and convenience. These tablets dissolve quickly on the tongue without water, making them ideal for patients with swallowing difficulties or those with active lifestyles. The rapid onset of action and improved bioavailability further enhance their appeal in weight loss treatments. Pharmaceutical innovation has led to more palatable flavors and increased stability of ODTs. As telemedicine and home-based care grow, demand for easy-to-use dosage forms like ODTs is accelerating. This segment represents the future of user-friendly and accessible obesity medication.

Drug Type Insights

What Made Generic Drugs the Dominant Segment in the Market in 2024?

The generic drugs segment dominated the phentermine hydrochloride market in 2024 due to their affordability, widespread availability, and therapeutic equivalence to branded products. As patents expire, more generic versions of weight loss medications enter the market, increasing competition and accessibility. This is especially critical in markets with cost-sensitive populations. Generics ensure that effective treatments reach a larger patient base, improving public health outcomes. Physicians frequently prescribe generics as a first-line approach to minimize cost burdens. Their dominance is likely to continue as healthcare systems strive for cost-effective solutions.

Meanwhile, the branded drugs segment is likely to witness the fastest growth in the market, driven by innovation, aggressive marketing, and perceived efficacy. New formulations and delivery methods often launch under premium branding, attracting early adopters. Patients seeking newer, cutting-edge options are often willing to pay a premium for perceived superiority. Pharmaceutical companies also invest heavily in awareness campaigns that boost brand loyalty. As digital marketing and influencer endorsements gain traction, branded medications are finding favor with younger and affluent consumers. Their growth reflects both innovation and a shift in consumer behavior toward recognizable, high-trust products.

Strength Insights

How Does the 37.5 mg Segment Dominate the Market in 2024?

The 37.5 mg segment dominated the phentermine hydrochloride market with a major share in 2024, as it is the most prescribed dose for adult patients seeking weight loss therapy. It strikes a balance between efficacy and safety, offering noticeable results with manageable side effects. This strength is often the starting point in therapeutic regimens and is favored in both branded and generic formulations. Clinicians prefer it due to its proven effectiveness in appetite suppression and energy balance. The 37.5 mg dose is also well-supported by clinical data and longstanding usage patterns. As a result, it remains the backbone of many anti-obesity protocols.

Meanwhile, 15 mg is the fastest-growing segment as physicians embrace a more personalized and cautious approach to weight loss therapy. The lower strength of this dose is ideal for patients with mild obesity or those prone to side effects from higher doses. It allows titration for long-term weight management and reduces the risk of tolerance buildup. Additionally, the 15 mg option is frequently used in combination therapies or stepped regimens. It is gaining favor among older patients and those with comorbidities requiring conservative dosing. As treatment personalization grows, so does the relevance of this gentler yet effective strength.

Route of Administration Insights

What Made Oral the Dominant Segment in the Phentermine Hydrochloride Market in 2024?

Oral administration continues to lead the market thanks to its simplicity, non-invasiveness, and high patient compliance. It enables self-administration, eliminating the need for healthcare provider supervision. Pills, capsules, and oral solutions are convenient and widely accepted by both prescribers and patients. This route also offers diverse options for formulation and dosing flexibility. For chronic conditions like obesity, oral delivery ensures adherence and long-term treatment feasibility. Its dominance is reinforced by strong infrastructure and extensive pharmaceutical familiarity.

On the other hand, the sublingual segment is expected to grow at the fastest CAGR in the coming years due to its rapid absorption and bypassing of the digestive system. Medications taken sublingually enter the bloodstream directly, offering faster therapeutic effects. This method is especially appealing to patients seeking quicker results or those with gastrointestinal sensitivities. It also improves bioavailability, making lower doses more effective. With increasing innovation in film and spray technologies, sublingual delivery is becoming more practical and appealing. Its rise signals a shift toward smarter, faster-acting drug delivery systems in weight management.

Distribution Channel Insights

How Does the Retail Pharmacies Segment Dominate the Market in 2024?

Retail pharmacies remain the primary distribution channel thanks to their accessibility, established network, and wide geographic coverage. Patients benefit from face-to-face pharmacist consultations, which aid adherence and proper usage. These outlets often handle both branded and generic drugs efficiently, offering flexible purchasing options. Insurance coverage and established supply chains further support their dominance. Retail pharmacies also cater to patients who prefer traditional buying methods over digital platforms. High prescription volumes and in-store promotional efforts reinforce their continued dominance.

On the other hand, the online pharmacies segment is expected to expand at the fastest rate over the forecast period, driven by convenience, privacy, and the growing adoption of telehealth. Patients can order medication discreetly, compare prices, and access virtual consultations all from the comfort of their own homes. This is especially appealing for weight loss treatments, where concerns about stigma or confidentiality may exist. Improved cold-chain logistics and fast shipping are making online purchases more reliable. Regulatory clarity and digital prescriptions are enhancing consumer confidence in this channel. As e-commerce continues to reshape healthcare access, online pharmacies are becoming an essential player in the obesity drug market.

Application Insights

Why Did the Obesity (BMI ≥30) Segment Dominate the Phentermine Hydrochloride Market?

The obesity (BMI ≥30) segment dominated the market with the largest share in 2024. Patients with a body mass index (BMI) of 30 or higher are at high risk of serious health complications like diabetes, hypertension, and heart disease. Physicians aggressively target this group with pharmacological interventions as part of structured weight-loss programs. Clinical trials and drug approvals have traditionally focused on this segment, ensuring the development of robust treatment protocols. The demand for effective medication is highest here, given the urgent need for intervention. As obesity continues to rise globally, this segment maintains its leading position.

Meanwhile, the overweight with comorbidities (BMI ≥27 with conditions like hypertension, diabetes) segment is likely to grow at the fastest rate in the upcoming period due to the rising awareness among people about the health risks and diseases linked with obesity. Early intervention is increasingly being encouraged to prevent full-blown obesity and related complications. This proactive approach is changing the prescription landscape, where previously only obese individuals received medication. Health insurance providers and public health campaigns are now supporting this group. The rising demand for personalized, low-dose therapies for weight management, driven by increasing health consciousness, supports the growth of this segment.

End User Insights

What Made Specialty Weight Loss Clinics the Dominant Segment in the Market?

The specialty weight loss clinics segment dominated the phentermine hydrochloride market while holding the largest share in 2024 due to their structured, medically supervised programs. These centers offer personalized treatments, often combining medication, counseling, and nutrition plans. Patients are more likely to adhere to therapy when under the expert supervision of a healthcare professional. Clinics also facilitate dosage adjustments and monitoring of side effects, enhancing safety and outcomes. Their credibility and one-stop solution model make them the preferred choice for many struggling with obesity. As demand for professional weight loss solutions increases, these clinics remain the primary setting for therapeutic intervention.

On the other hand, the homecare/telehealth users segment is expected to grow at the highest CAGR during the projected period due to the increased adoption of digital health platforms and remote consultations. Patients now have access to prescriptions, remote monitoring, and lifestyle coaching without needing to visit a clinic. This is particularly attractive for those in remote areas or those seeking privacy in their treatment journey. Wearables and mobile health apps support this ecosystem, enabling real-time tracking and feedback. Convenience, flexibility, and cost-effectiveness are driving this segment's explosive growth. It signifies the broader shift toward decentralization of healthcare delivery.

Regional Insights

What Made North America the Dominant Area in the Phentermine Hydrochloride Market?

North America, particularly the U.S., dominated the phentermine hydrochloride market by capturing the largest share in 2024 due to the high obesity rates and widespread acceptance of prescription-based weight loss treatments. The U.S. FDA fast-track approvals and long-standing use of phentermine. The expansion of weight management clinics, telemedicine startups, and online pharmacy platforms further increases access to phentermine. Insurance coverage for weight-loss programs and rising demand for combination therapies are also fueling growth. The presence of major pharmaceutical players and structured regulations ensures a robust and competitive market. As lifestyle diseases remain prevalent, North America is expected to retain its position in the market.

What Factors Contribute to Asia Pacific's Growth in the Market?

Asia Pacific is expected to experience the fastest growth in the market, driven by urbanization, sedentary lifestyles, and changing dietary habits. Countries like India, China, and Indonesia are experiencing a surge in demand for anti-obesity medications, including phentermine. There is increasing awareness about the timely management of overweight, boosting the uptake of phentermine. The region's large population base, expanding middle class, and rising healthcare expenditure are expected to boost market growth. Moreover, governments in the region are making efforts to boost local manufacturing capabilities, enabling more affordable generic production. As obesity-related health conditions rise, Asia Pacific is expected to become one of the most dynamic markets for phentermine hydrochloride.

Phentermine Hydrochloride Market Companies

- KVK Tech, Inc.

- Teva Pharmaceutical Industries Ltd.

- Lannett Company, Inc.

- Vintage Pharmaceuticals, LLC (Acella Pharmaceuticals)

- CorePharma LLC

- Actavis Pharma, Inc. (Now Teva)

- Aytu BioPharma, Inc.

- Sandoz (a Novartis division)

- Micro Labs Ltd.

- Tris Pharma, Inc.

- Genpharm Inc.

- Sun Pharmaceutical Industries Ltd.

- Aurobindo Pharma Ltd

- Hikma Pharmaceuticals PLC

- Cipla Ltd.

- Hetero Drugs Ltd.

- Mylan N.V. (Now part of Viatris Inc.)

- Lupin Pharmaceuticals

- Glenmark Pharmaceuticals

- Torrent Pharmaceuticals Ltd.

Recent Development

- In June 2025, Zydus Cadila has received final approval from the U.S. Food and Drug Administration (FDA) to market Phentermine Hydrochloride Orally Disintegrating Tablets for the treatment of obesity in the U.S. This approval allows the company to launch the product in various strengths, expanding its presence in the U.S. The FDA's authorization marks a significant milestone for Zydus Cadila, enabling it to offer a convenient, fast-acting dosage form to patients seeking effective obesity treatment.

(Source: https://economictimes.indiatimes.com)

Segments covered in the Report

By Dosage Form

- Tablets

- Capsules

- Orally Disintegrating Tablets (ODT)

- Extended-Release Formulations

By Strength

- 8 mg

- 15 mg

- 18.75 mg

- 30 mg

- 37.5 mg

By Route of Administration

- Oral

- Sublingual

By Distribution Channel

- Hospital Pharmacies

- Retail Pharmacies

- Online Pharmacies

- Weight Loss Clinics

By Application

- Obesity (BMI ≥30)

- Overweight with Comorbidities (BMI ≥27 with conditions like hypertension, diabetes)

By End User

- Hospitals

- Ambulatory Surgical Centers

- Specialty Weight Loss Clinics

- Homecare/Telehealth Users

By Sales Type

- Branded Drugs

- Generic Drugs

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting