Nefopam Hydrochloride Injection Market Size and Forecast 2025 to 2034

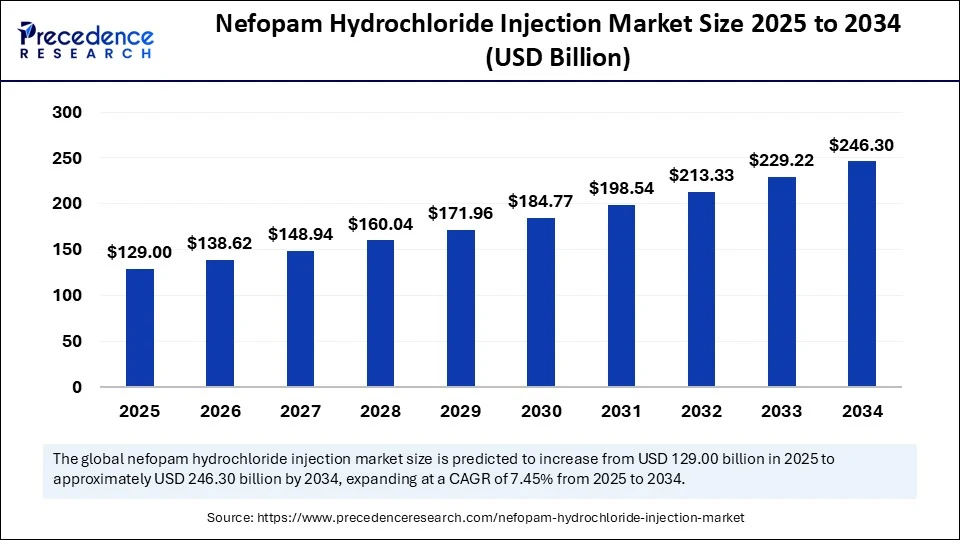

The global nefopam hydrochloride injection market size accounted for USD 120.06 billion in 2024 and is predicted to increase from USD 129 billion in 2025 to approximately USD 246.30 billion by 2034, expanding at a CAGR of 7.45% from 2025 to 2034. The increased demand for non-opioid analgesics is driving the adoption of nefopam hydrochloride injections, leading to an expansion of the market acceptability and availability. Additionally, the ongoing advancements in drug delivery systems are further contributing to the increasing adoption of nefopam hydrochloride injections globally, particularly in Europe, the Asia Pacific, and Latin America.

Nefopam Hydrochloride Injection Market Key Takeaways

- In terms of revenue, the global nefopam hydrochloride injection market was valued at USD 120.06 billion in 2024.

- It is projected to reach USD 246.30 billion by 2034.

- The market is expected to grow at a CAGR of 7.45% from 2025 to 2034.

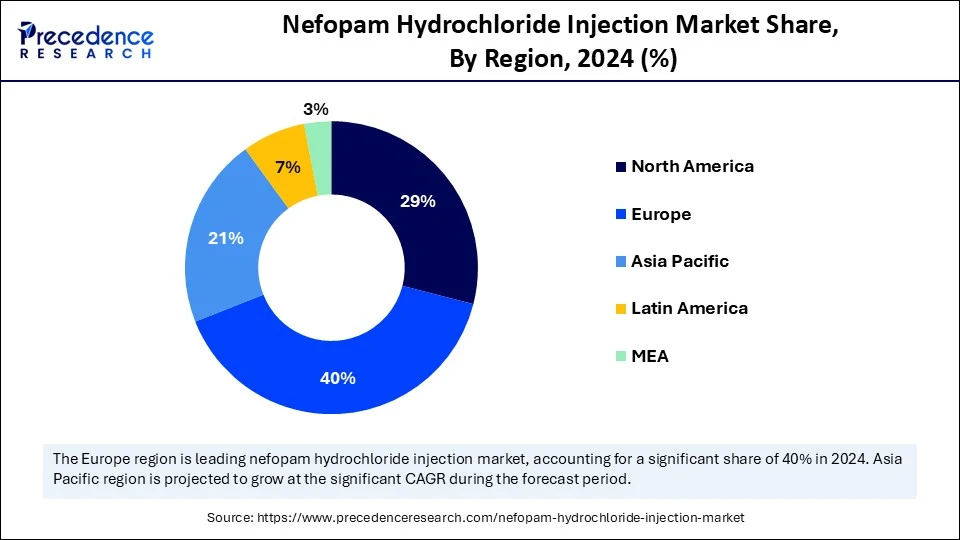

- Europe dominated the global nefopam hydrochloride injection market with the largest share of 40% in 2024.

- Asia Pacific is expected to grow at a significant CAGR from 2025 to 2034.

- By dosage form/presentation, the injection / parenteral (ampoules 20 mg/2 mL; vials) segment contributed the biggest market share of 85% in 2024.

- By dosage form/presentation, the oral solid (tablets/capsules) segment is expected to grow at a notable rate CAGR between 2025 and 2034.

- By injectable presentation/format, the single-dose glass ampoules (2 mL ampoules typical) segment captured the highest market share of 70% in 2024.

- By injectable presentation/format, the multi-dose vials segment will grow at a CAGR between 2025 and 2034.

- By route of administration/use case, the intravenous (IV bolus / slow IV injection) segment contributed the largest market share of 65% in 2024.

- By route of administration/use case, the intramuscular (IM) segment will grow at a CAGR between 2025 and 2034.

- By end-user/buyer, the hospitals & surgical centers (primary purchasers) segment generated the major market share of 80% in 2024.

- By end-user/buyer, the ambulatory surgery centers segment will grow at a CAGR between 2025 and 2034.

AI in Nefopam Hydrochloride Injection Development

AI is playing a game-changing role in accelerating drug development procedures. Major pharmaceutical companies are focusing on the integration of AI in their research & development, clinical trials, and drug development settings, including the development of nefopam hydrochloride injections, to enhance the effectiveness and safety profile of this formulation. AI has become an essential tool for potential drug candidate identification to optimization of drug formulation, and prediction of their effect and safety. The spectacular performance of AI in various drug development stages is advancing nefopam hydrochloride injections with high efficiency and reducing potential side effects.

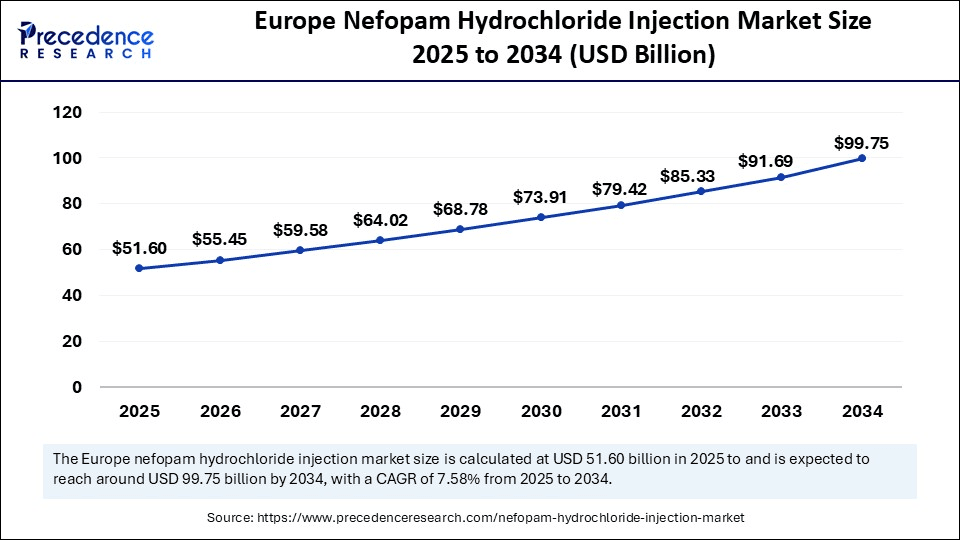

Europe Nefopam Hydrochloride Injection Market Size and Growth 2025 to 2034

The Europe nefopam hydrochloride injection market size is evaluated at USD 51.60 billion in 2025 and is projected to be worth around USD 99.75 billion by 2034, growing at a CAGR of 7.58% from 2025 to 2034.

Europe Nefopam Hydrochloride Injection Market

Europe dominates the global market due to the region's well-established R&D sector and robust healthcare infrastructure. Europe is the largest consumer of nefopam hydrochloride injections. The increased adoption of these injections in clinical use, including European hospitals and clinics, is for pain management. The strong regulatory acceptance of nefopam for postoperative pain relief by the European Medicines Agency (EMA) is contributing to rising clinical adoption. Additionally, the increasing awareness about nefopam for traditional pain relief alternatives among healthcare professionals is facilitating its adoption.

European Countries and their Market Trends

Germany is a major player in the regional market, contributing to growth due to the country's robust healthcare infrastructure, high R&D investments, and robust industrial base. The strong presence of major pharmaceutical companies and a robust manufacturing base leverage this growth.

The UK and France are the significant players, facilitating market growth due to increased demand for non-opioid pain management solutions and strong experience of pharmaceutical companies. The growing awareness of Nefopam and its efficacy and safety profiles is shifting focus toward its wider adoption in hospitals and clinical settings.

Asia Pacific Nefopam Hydrochloride Injection Market

Asia Pacific is the fastest-growing region in the global market, growth driven by the region's robust manufacturing scale, expanded registration of nefopam hydrochloride injection, and rapid export growth. The expanding pharmaceutical companies and healthcare expenditure are driving demand for non-opioid analgesics. The increasing elderly population and surgical procedures are driving the need for more effective and safe pain relievers in Asia. The growing regional focus on technological advancements, digital transformation, and government support and polices for local pharmaceutical companies, and the adoption of new drug formulations contribute to this growth.

China and India: Emerging Market for Nefopam Hydrochloride Injection

Countries like China and India are leading the regional market, due to their expanded urbanization, industrialization, and growing middle-class population. The expanded healthcare infrastructure is contributing to increasing accessibility and availability of nefopam hydrochloride injections. Countries' strong focus on the adoption of modern technologies and innovative drugs is fostering the market growth. Additionally, a strong presence of key manufacturers and a robust distribution channel is expanding the reach of nefopam hydrochloride injections in these emerging countries.

- For instance, in India, IndiaMART enables precise accessibility of nefopam through several suppliers, including JM Lifesciences, Vilarsh Healthcare, Livealth Biopharma, and Medihome Pharma. This supplier provides injection in various forms and locations.

Market Overview

Nefopam is a centrally acting, non-opioid analgesic (chemically a benzoxazocine) used for moderate acute pain, including postoperative pain; it is available as injectable formulations (ampoules/vials) and oral forms. The nefopam hydrochloride injection market covers clinical injectable products, manufacturers (finished product and API suppliers), contract manufacturing for injection fill/finish, primary packaging (ampoules/vials), distribution to hospitals/pharmacies, and related services (regulatory, pharmacovigilance, specialty distribution).

Nefopam is widely used in several European and some Asian countries; it is not FDA-approved for use in the United States. However, the non-opioid nature of nefopam is gaining popularity in North America, making it a sustained potential for its acceptance and adoption. Additionally, the growing research on the use of Nefopam as a therapeutic solution for neuropathic pain, driven by its dual analgesic mechanism, including neurotransmitter reuptake inhibition and NMDA receptor modulation, is expected to boost the adoption of Nefopam hydrochloride injections in the upcoming period.

What are the Key Trends of the Nefopam Hydrochloride Injection Market?

- Rising Geriatric Population: The growing geriatric population is driving demand for nefopam hydrochloride injections, as the elderly are more susceptible to acute and chronic pain.

- Increased Demand for Non-opioid Analgesics: The demand for non-opioid analgesics has increased due to opioid addiction and side effects, driving the need for alternative pain management options.

- Rising Awareness: The growing awareness of nefopam among healthcare professionals and patients has boosted its adoption in treatment for neuropathic pain and as an alternative to opioids for post-operative pain relief.

- Expanding Healthcare Expenditure: The growing healthcare expenditure and spending on effective pain management strategies are contributing to increasing adoption of nefopam hydrochloride injections.

- Technological Advancements in Drug Delivery Systems: Ongoing innovations in delivery methods and formulations are enabling highly efficient and safe developments of nefopam hydrochloride injections.

Market Scope

| Report Coverage | Details |

| Market Size by 2034 | USD 246.30 Billion |

| Market Size in 2025 | USD 129 Billion |

| Market Size in 2024 | USD 120.06 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 7.45% |

| Dominating Region | Europe |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Dosage Form / Presentation, Injectable Presentation / Format, Route of Administration / Use Case, End-User / Buyer, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

Increase Incidence of Chronic Pain Conditions

The rising prevalence of acute and chronic pain conditions is the major driver offer increasing demand for nefopam hydrochloride injections first up, and the growing prevalence of conditions like neuropathic pain and musculoskeletal disorders is a driving demand for effective pain management solutions, including nefopam hydrochloride injection. The non opioid nature of nefopam hydrochloride injection makes it a significant alternative for pain management options. The use of nefopam as a multimodal approach for postoperative analgesia aims to reduce chronic postsurgical pain. The growing number of surgeries driving the need for effective pain relief options drives demand for nefopam hydrochloride injections.

- In February 2023, the NCT05071352 identifier clinical trial investigated nefopam for the management of pain in mechanically ventilated ICU patients. They got approval from the Research and Ethics Committee for Experimental and Clinical studies to enhance the effectiveness of nefopams to reduce opioid use and side effects in these patients. (Source: https://www.clinicaltrials.gov)

Restraint

Regulatory Restrictions

The strict drug safety regulations, like the FDA and EMA, are enforcing strict guidelines fr manufacturing, distribution, and marketing of nefopam hydrochloride injections. High-quality control standards, regional nuances, and a delayed regulatory approval process are limiting the entry of nefopam hydrochloride injections in the market. Strict regulatory restrictions are leading to increasing development costs, prolonging market entry time, and fueling the need for significant investments in concluding infrastructure.

For instance, in April 2025, the Indian Central Drugs Standard Control Organization (CDSCO) issued a notice to disallow the manufacture, sale, and distribution of fixed-dose combination (FDCs) of drugs to state and union territories (UT), including drugs such as nefopam, and has required state/UT Drugs Controllers to ensure compliance. (Source: https://drugscontrol.org)

Opportunity

Development of Combination Therapies

Researchers are focusing on the development of combination therapies of nefopam with other analgesics and adjunct medication for improving pain management are spectacular opportunity for nefopam hydrochloride injection acceptability. The combination therapies of injection with other pain management medications are expected to enhance pain management and patient outcomes. The growing unmet medical needs are addressing the requirement for combination therapy developments, which can offer targeted treatments. The growing patient compliance and adherence are driving innovations in the development of combination therapies.

Dosage Form/Presentation Insights

Which Dosage Form/Presentation Segment Dominated the Nefopam Hydrochloride Injection Market in 2024?

In 2024, the injection / parenteral (ampoules 20 mg/2 mL; vials) segment dominated the market, due to its effective role in quick pain relief. The injection / parenteral injection dose allows precise control over dosage, leading foe effective pain relief. The increased demand for targeted API management outcome options, reducing potential side effects, and the need for specialized administration techniques drive the preference for injection / parenteral (ampoules 20 mg/2 mL; vials). Adoption of injection / parenteral (ampoules 20 mg/2 mL; vials) nefopam hydrochloride injections in high-acuity care settings such as hospitals and emergency rooms.

The oral solid (tablets/capsules) segment is expected to grow fastest over the forecast period, due to increasing administration of nefopam hydrochloride through tablets and capsules. Oral solids (tablets/capsules) are widely used in chronic pain management conditions, making them easy for administration. The increasing demand for patient-centric healthcare and ongoing advancements in formulation technologies are contributing to the segment's growth. The increasing prevalence of chronic disease and surgical procedures among aging populations is driving demand for oral solid (tablets/capsules) dosage of Nefopam.

Injectable Presentation/Format Insights

What Made Single-dose Glass Ampoules (2 mL Ampoules Typical Segment Dominate the Nefopam Hydrochloride Injection Market?

The single-dose glass ampoules (2 mL ampoules typical) segment dominated the market in 2024, due to their high convenience and safety standards. The single-dose dose-glass ampoules reduce medical personnel workload and contamination risk. The sterility of single-dose glass ampoules is maintained by product filling and transportation stages. The suitable nature of single-dose glass ampoules for sterile injection solutions, including nefopam hydrochloride injections, facilitates their adoption. The 2 mL ampoules are typically ideal for packaging vaccines, biologics, anesthetics, and other injectable drugs.

The multi-dose vials segment is the second-largest segment, leading the market, due to its cost-effectiveness and convenience. The multi-dose vials are more cost-effective compared to single-dose vials. The less need for multi-dose vials for long storage and handling makes them more convenient than single-dose vials. Additionally, multi-dose vials are flexible, can be used in hospitals, clinics, and other clinical settings. The multi-dose vials with self-sealing rubber stoppers are gaining spectacular traction in the market.

Route of Administration/Use Case Insights

Which Route of Administration/Use Case Segment Lead the Nefopam Hydrochloride Injection Market in 2024?

In 2024, the intravenous (IV bolus / slow IV injection) segment led the market, due to its ability to provide rapid pain relief. The intravenous (IV bolus / slow IV injection) is crucial in patients who need quick pain management and emergency conditions, and helps to reduce injection site pain and other side effects. The intravenous (IV bolus / slow IV injection) nature of rapid-onset actions makes them suitable for emergencies and acute care settings. The intravenous (IV bolus / slow IV injection) is flexible, utilized in different clinical settings like hospitals, clinics, and emergency departments.

The intramuscular (IM) segment is the second-largest segment, leading the market, driven by its wide use in the management of chronic pain conditions. The intramuscular (IM) administration of nefopam hydrochloride injection is ideal for pain management in conditions like neuropathic pain, cancer pain, and musculoskeletal pain. The adoption of intramuscular (IM) administration is high in outpatient settings. The intramuscular (IM) injections provide sustainable pain relief, making them ideal for chronic pain condition management.

End-User/Buyer Insights

How Hospitals & Surgical Centers Segment Dominates the Nefopam Hydrochloride Injection Market?

The hospitals & surgical centers segment dominated the market in 2024, due to high volume adoption in these clinical settings. The hospitals & surgical centers offer advanced medical infrastructure, emphasize their focus on cutting-edge medical technology, and have strong supply chain networks. The demand for nefopam hydrochloride injection has increased for post-surgical pain management. The increased number of surgical activities in hospitals & surgical centers drives the need for efficient pain relief options, driving the adoption of nefopam hydrochloride injections.

The ambulatory surgery centers segment is the fastest-growing segment in the market, growth driven by the high need for comprehensive pain relief options in ambulatory surgery centers. These centers perform same-day surgeries, driving the requirements of effective post-surgical pain management solutions, which drives the adoption of nefopam hydrochloride injections. The ambulatory surgery centers conduct a high volume of surgeries due to their cost-effective alternative to hospital-based surgeries, making them a large buyer for sophisticated pain management solutions. The advanced medical technologies equipped with ambulatory surgery centers drive the adoption of nefopam hydrochloride injections.

Nefopam Hydrochloride Injection Market – Value Chain Analysis

- R&D

The R&D activities of nefopam hydrochloride injection include identification of drugs & screening, drug validation, mechanical and pharmacological action studies, preclinical studies, process development & optimization, method development, analysis and validation, and clinical trials.

Key Players: Global Calcium, Maxoma Pharmaceuticals, and Taj Pharma India.

- Distribution to Hospitals, Pharmacies

Nefopam hydrochloride injection is distributed to hospitals & pharmacies through bulk storage by wholesalers and distributors. The drug is highly prescribed by senior hospital physicians for chronic pain, with a dosage form of oral 20 mg/6h with 120 mg maximum daily dose.

Key Players: Taj Pharma India, JM Lifesciences Pvt. Ltd., Ambica Pharma, and Mehadia Tradelinks

- Clinical Trials and Regulatory Approvals

Clinical trial of nefopam hydrochloride injection highlights opioid conuptions. The stringent regulatory standards, including USFDA, WHO-GMP, and UKMHRA, facilitate adherence of nefopam manufacturing to meet standards with increased demand for non-opioid analgesics for modern severe pain.

Key Players: Tianjin Kingyork Pharmaceuticals, Shanghai Hyundai Hassen, and Sinopharm Ronshyn Pharmaceuticals.

Nefopam Hydrochloride Injection Market Comapnies

- Biocodex (Acupan)

- Polpharma

- PMC Isochem

- Arene Lifesciences

- CF Pharma

- Emcure Pharmaceuticals

- Micro Labs Limited

- Maiden Group

- PRG Pharma

- Sai Life Sciences

- Amkamed Pharmaceuticals

- WellsPharmtech Co., Ltd.

- Shandong SanYoung Industry Co., Ltd.

- Xiamen Equation Chemical Co., Ltd.

- Polpharma (if separate legal entities/brands in different markets)

- Global Calcium (API / intermediates supplier)

- Sun Pharmaceutical (regional/formulation capability — generics/finished dose capability)

- Teva Pharmaceutical Industries (regional generics suppliers)

- Sandoz / Novartis (regional generic / hospital supply capability)

- Contract injectables CDMOs (representative: PCI Pharma Services, Catalent)

Recent Developments

- In July 2025, a research paper was published in the Journal of Drug Delivery and Therapeutics highlighting the formulation and characterization of Nefopam Hydrochloride-loaded niosomes to improve analgesic delivery. Research explored the noisome preparation with Span 60 via the Ether injection method, showing potential outcomes in drug entrapment and sustained release. The research focused on novel approaches in nefopam delivery, potentially enhancing its effect and patient compliance. (Source: https://jddtonline.info)

- In May 2025, Ethypharm Iberia signed an agreement with Medochemie for commercializing the license of Neforpam HCL 20mg/2ml injectable solutions in Spain. This product reflects the company's commitment to expanding its portfolio of essential medicines in pain and addressing a real need for additional therapeutic options in the Spanish market.

Segment Covered in the Report

By Dosage Form / Presentation

- Injection / parenteral (ampoules 20 mg/2 mL; vials)

- Oral solid (tablets/capsules)

- Oral liquid (syrup)

By Injectable Presentation / Format

- Single-dose glass ampoules (2 mL ampoules typical)

- Multi-dose vials (if marketed in region)

- Prefilled syringes / ready-to-use formats (emerging/rare)

By Route of Administration / Use Case

- Intravenous (IV bolus / slow IV injection)

- Intramuscular (IM)

- Perioperative/postoperative analgesia protocols

By End-User / Buyer

- Hospitals & surgical centers (primary purchasers)

- Ambulance/emergency services (limited)

- Retail pharmacies (where outpatient prescription is allowed)

- Government / public health procurement (some markets)

By Region

- Europe

- Asia-Pacific

- North America

- Latin America

- Middle East & Africa (MEA)

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting