What is the Palm Vein Biometric Market Size?

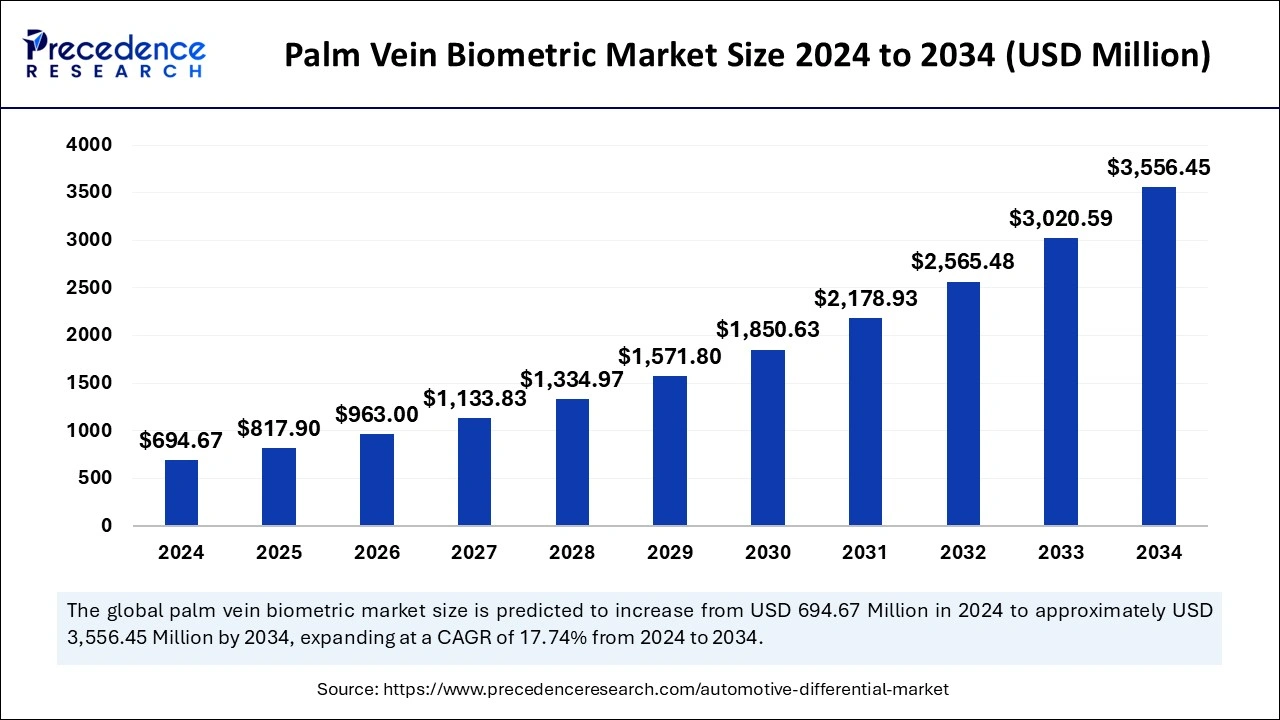

The global palm vein biometric market size is accounted at USD 817.90 billion in 2025 and predicted to increase from USD 963.00 billion in 2026 to approximately USD 3,556.45 billion by 2034, growing at a CAGR of 17.74% from 2025 to 2034. Rising demand for reliable and secure authentication methods across different industries is the key factor driving the palm vein biometric market. Also, increasing instances of security breaches coupled with the escalating business competition across market players can fuel market growth further.

Palm Vein Biometric Market Key Takeaways

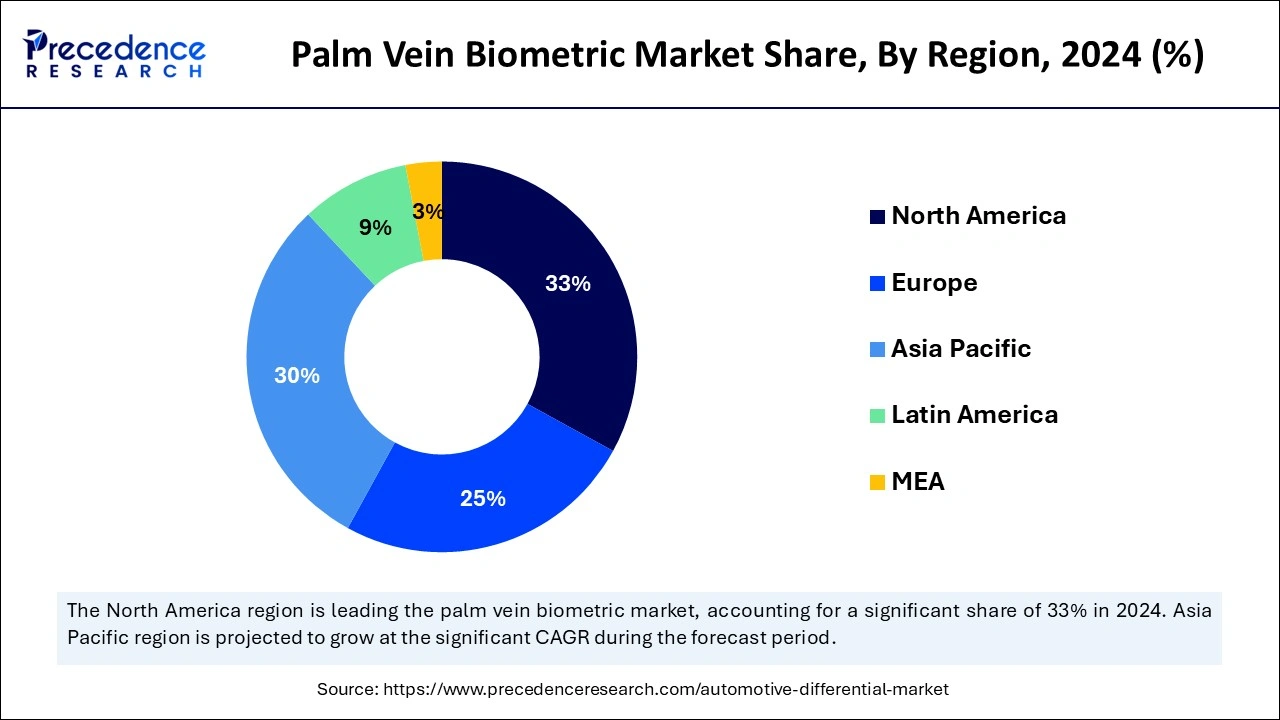

- North America led the palm vein biometric market with the largest market share of 33% in 2024.

- Asia Pacific is expected to grow at the fastest growth over the forecast period.

- By technology, the contact-based segment dominated the market in 2024.

- By technology, the contactless segment is expected to grow at the fastest rate over the forecast period.

- By component, the hardware segment dominated the market in 2024.

- By application, the healthcare segment contributed the maximum market share in 2024.

- By end use, the commercial segment has held a major market share in 2024.

- By end use, the residential segment is anticipated to grow at the fastest rate over the projected period.

What is the Impact of AI on the Palm Vein Biometric Market?

The integration of Artificial Intelligence with palm vein biometric systems for access control and identification of systems is expected to boost the palm vein biometric market, as many institutions and businesses are seeking more reliable and secure biometric solutions. Furthermore, this integration of two cutting-edge technologies can significantly improve their accuracy and efficiency by enhancing the pattern recognition capabilities of the whole system.

What is Palm Vein Biometric?

Palm vein biometrics is a touchless innovative authentication technology that depends on the vascular patterns of the palm as private identification data. It captures an image of the vein pattern under the skin of a person by using IR light and then compares and verifies it with the already existing patterns in the database for authentication. The palm vein biometric market has several benefits, such as higher accuracy, optimum security, and improved reliability.

What are the Growth Factors in the Palm Vein Biometric Market?

- The increasing use of palm vein biometrics in the BFSI sector is expected to boost palm vein biometric market growth shortly.

- The extensive adoption of this technology in the healthcare industry for precise and automatic patient identification can propel market expansion soon.

- Growing national security concerns will likely contribute to the market growth over the forecast period.

Palm Vein Biometric Market Outlook

- Industry Growth Overview: The palm vein biometric market is expected to grow quickly from 2025 to 2030 as organizations transition to high-accuracy and contactless authentication. Adoption is increasing in banking, border control, and healthcare sectors, fueled by security concerns and hygienically driven verification. Asia-Pacific and North America are still the top regions for deploying palm vein biometrics.

- Global Expansion: Palm vein biometric vendors are expanding into Southeast Asia, the Middle East, and Eastern Europe in response to digital identity needs. In addition, they are collaborating with governments and fintech companies to support national identity programs and secure payment strategies for banks, which will ultimately facilitate the international expansion of palm vein biometrics.

- Significant Investors: Strong margins, the cybersecurity imperative, and long-term growth of digital identity continue to attract private equity and strategic investors. Investment interest remains steady in those organizations servicing AI-enabled biometric, secure hardware modules (e.g., chips), and mass-rollout enterprise deployment of biometric identity technology across BFSI and public sector services.

- Startup Ecosystem: Startups are focused on AI-based anti-spoofing biometric measures, cloud biometric platforms, and smaller palm-vein scanners. New companies out of Japan, India, and the U.S. are getting VC funding for building smaller, quicker, and more secure modules, which will be suitable for mobile devices, kiosks, and remote authentication.

Market Scope

| Report Coverage | Details |

| Market Size by 2026 | USD 963.00 Million |

| Market Size in 2025 | USD 817.90 Million |

| Market Size in 2034 | USD 3,556.45 Million |

| Market Growth Rate from 2025 to 2034 | CAGR of 17.74% |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Technology, Component, Application, End Use, and Regions. |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

Increasing demand for advanced security solutions

Organizations are rapidly seeking advanced methods to improve their security infrastructure from potential cyber threats. This technology gives a significant solution by using g unique vein patterns within the palm, which is quite challenging for traditional biometric systems like facial recognition and fingerprints. In addition, this technology also enhances the overall user convenience and mitigates risks related to unauthorized access.

- In September 2024, Tencent Cloud launched a palm verification system that utilizes infrared cameras to capture and analyze unique palm vein patterns and prints. It can be integrated into various applications, such as contactless payments and access management. Tencent has shared that the biometric system has been deployed in several locations in China since last year.

Restraint

Limited awareness among end users

The lack of awareness regarding the innovative technology among the palm vein biometric market end users is the major factor hampering its growth. Also, the high implementation and maintenance costs of this technology pose a significant challenge to its market expansion. However, the large reliance of palm vein biometrics on specific environmental conditions, including temperature and lighting, can affect its accuracy and reliability negatively.

Opportunity

Rising awareness of biometric solutions

There is an increasing awareness of this solution among many demographics, such as governments, businesses, and consumers. Because stakeholders become more aware of the advantages of the palm vein biometric market technology. Furthermore, governments across the globe are realising the need for secure identification systems.

- In September 2024, Anviz, a brand of Xthings, announced the upcoming release of its latest access control solution, the M7 Palm, equipped with cutting-edge Palm Vein Recognition technology. This innovative device is designed to provide superior accuracy, security, and convenience to high-security and privacy-sensitive environments in various industries.

Technology Insights

The contact-based segment dominated the palm vein biometric market in 2024. The dominance of the segment can be attributed to the increasing need for advanced accuracy in identification, which makes it important for environments where security is essential. However, obstacles like data privacy concerns and requirements for strong regulatory frameworks can hamper market growth.

The contactless segment is expected to grow at the fastest rate over the forecast period. The growth of the segment can be credited to the rapid processing times and convenience provided by this technology, which makes it crucial for high-traffic areas, including public transportation and airports. The segment's significance is highlighted by its adaptability specific to diverse needs.

- In June 2024, Germany-based biometric security company IDloop introduced the CFS flats, an optical contactless fingerprint scanner that incorporates 3D imaging. This product is designed to operate without physical contact in high-traffic environments, such as airports. Jörg Reinhold.

Component Insights

The hardware segment dominated the palm vein biometrics palm vein biometric market in 2024 and is expected to grow at the fastest rate over the forecast period. The dominance and growth of the segment can be credited to the rising development of advanced hardware materials to grow the overall efficiency of the biometric system. The hardware segment includes scanners, cameras, and readers. These hardware components enhance the efficiency of the system.

Application Insights

The healthcare segment dominated the palm vein biometric market in 2024 and is expected to grow at the fastest rate over the forecast period. The dominance and growth of the segment can be linked to the increasing use of this technology to improve patient identification and ensure proper access to datasets. In addition, it also helps track and monitor individual patient history based on the data provided to the system.

End Use Insights

The commercial segment dominated the palm vein biometric market in 2024. The dominance of the segment can be driven by the increasing adoption of advanced security solutions from businesses to safeguard confidential data and prevent unauthorized access. However, increasing business competition among end-use industries has raised the demand for the protection of confidential information of an organization.

- In September 2024, Spain-based biometrics startup B-FY launched in the U.S. market and introduced its cloud-based identity verification and authentication software. B-FY's technology verifies user face biometrics against data stored on their own mobile device, side-stepping the risk of mass biometric data theft. The process also includes device verification through a QR code scan.

The residential segment is anticipated to grow at the fastest rate over the projected period. The growth of the segment is owing to the increasing use of smart home technologies consisting of biometric systems for improved security and convenience. Also, various government initiatives are enabling the higher adoption of this technology for residential use.

Regional Insights

U.S. Palm Vein Biometric Market Size and Growth 2025 to 2034

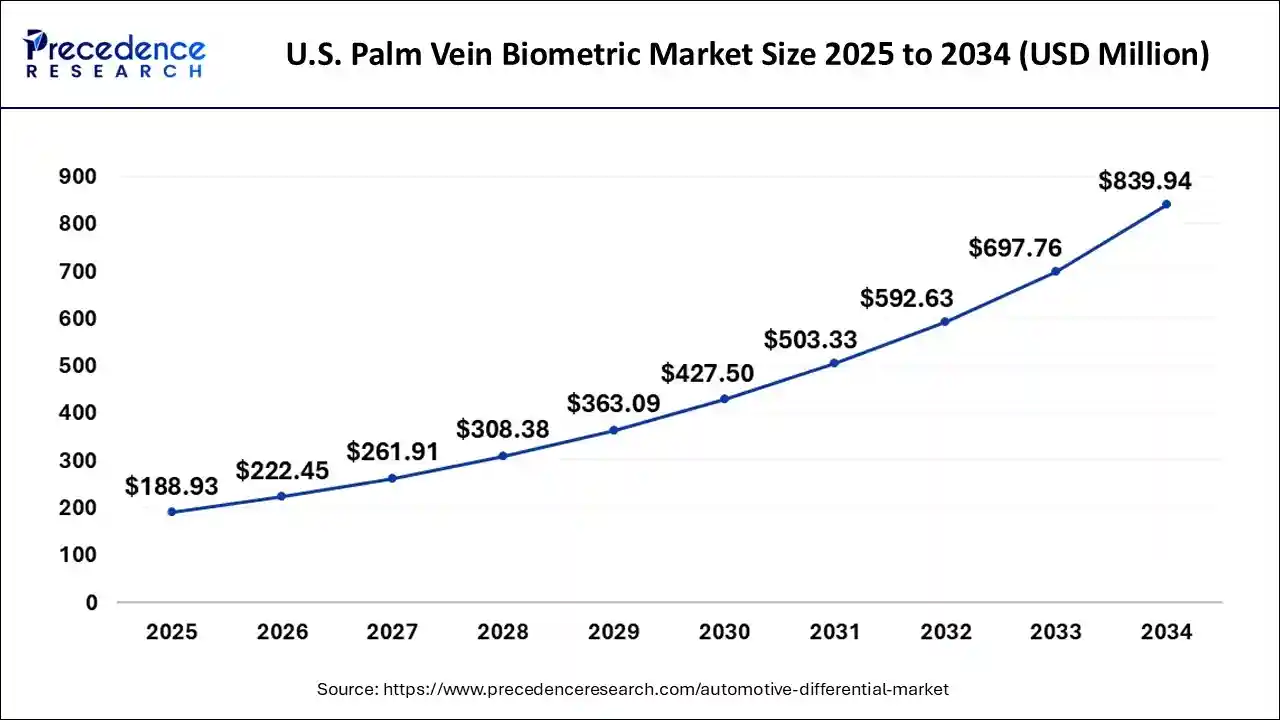

The U.S. palm vein biometric market size is exhibited at USD 188.93 million in 2025 and is projected to be worth around USD 839.94 million by 2034, growing at a CAGR of 18.00% from 2025 to 2034.

North America dominated the palm vein biometric market in 2024. The dominance of the region can be attributed to the increasing urbanization along with the innovations in technology, which creates market opportunities for emerging market players. However, high disposable income in developed countries like the U.S. and Canada will impact positive market expansion in the region.

Asia Pacific is expected to show the fastest growth over the studied period. The growth of the region can be credited to the rising awareness of the palm vein biometric market technologies, a growing number of production companies, and the rising population base in emerging nations such as China and India. Furthermore, the increasing adoption of biometrics in commercial and homeland security is expected to fuel market growth in the region shortly.

- In May 2024, Norway-based card manufacturer IDEX Biometrics announced that it opened an additional market in South Asia by partnering with a challenger bank. By entering a strategic collaboration with the challenger bank, IDEX Biometrics advances the opening of an additional market in the region.

Why did Europe Grow at a Moderate Pace in the Palm Vein Biometrics Market?

Europe's growth trajectory continued at a moderate pace thanks to strict security regulations and data protection. Several countries in Europe have adopted palm vein systems in hospitals, banks, airports, and public offices. Demand was increasing for secure and touchless verification, which contributed to the growth of this market. As governments rolled out digital identity systems, technology companies and systems integrators invested in new biometrics.

Germany Palm Vein Biometric Market Trends

Germany was the leading country in the region due to strong security legislation and an advanced healthcare system. Palm vein systems were widely adopted in hospitals and research centers to verify patients. Banks and airports also adopted palm vein systems to create a safer environment and reduce fraud. The German government supported digital identity programs and secure authentication.

Why did Latin America grow at a Robust rate in the Palm Vein Biometrics Market?

Latin America experienced robust growth, as banks, border operations, and government offices began adopting palm vein biometrics to mitigate fraud. Countries concentrated their efforts on the enhancement of safety, digital identity, and secure payments. Additionally, the region experienced a number of challenges involving security, which drove demand for reliable biometric systems. More of the burgeoning fintech environment, in addition to airport modernization, created healthy momentum.

Brazil Palm Vein Biometric Market Trends

Brazil emerged as the leading country in Latin America, given the high demand for secure banking, secure payment systems, and agency verification. A number of banks have fashioned and adopted palm vein tools to combat fraud. As a result, airports and governmental agencies upgraded their verification systems to create safer verification processes. Brazil also finalized multiple investments in government-induced digital programs, adding fuel to market growth. These actions created growth opportunities dedicated to financial technology, secure identification systems, verification for transport, and healthcare authentication.

Why did the Middle East & Africa grow at a Moderate Pace in the Palm Vein Biometrics Market?

The expansion of the Middle East and Africa region was attributed to government investment in modern security systems, airport upgrades, and projects involving smart cities. The adoption of palm vein biometric security measures enhanced safety within banking institutions, hospitals, and government office buildings. Countries desired highly accurate touchless authentication systems for providing important public services or traveling. Digital transformation initiatives and increasing adoption of fintech applications offered considerable opportunities for related service growth.

The UAE Palm Vein Biometric Market Trends

The UAE was the regional leader because of significant investment in airport security, banking systems, and smart government services. The UAE also adopted palm vein authentication devices across many public and private sectors in the UAE facilities. Hospitals and businesses adopted this for fast verification. Increased UAE digital transformation and smart city growth offered strong opportunities for advanced security tools and the development of better systems for travel and health care verification.

Palm Vein Biometric Market Companies

- HID Global

- IDEMIA

- INFINIDAT

- Oak Ridge National Laboratory

- SRI International

- MorphoTrust USA

- Analogic

- ZKTECO

- BioSec Group

- Versasec

- Fujitsu

- Crossmatch

- SecuGen

- NEC Corporation

Latest Announcement by Industry Leaders

- In July 2024, Fujitsu announced a strategic partnership with Cohere Inc., a security and data privacy-focused enterprise AI company headquartered in Toronto and San Francisco. The strategic partnership will focus on developing and providing a large language model (LLM) that enables enterprises to leverage industry-leading Japanese language capabilities.

- In January 2023, NEC Corporation announced that a decision to transition its structure from a Company with an Audit and Supervisory Board to a Company with a Nominating Committee, etc., was made at the meeting of the Board of Directors held on January 30, 2023. NEC is promoting initiatives that combine strategy and culture in order to achieve the Mid-term Management Plan 2025.

Recent Developments

- In July 2024, Nigeria-based Quantum Space Dynamics introduced VerifyNG, an identity verification app using face biometrics to meet the demands of government agencies, financial institutions, healthcare providers, and businesses requiring security software in Nigeria.

- In November 2022, BioIntelliSense, Inc., a company that provides continuous health monitoring and clinical intelligence, announced a collaboration with the Translational Research Institute for Space Health (TRISH) to advance the understanding of human health in space.

- In November 2022, Keyo, a palm vein biometrics developer based in New York, is introducing an identity management network to provide physical and logical access control with a focus on privacy.

- In June 2024, Mastercard announced the expansion of its global Biometric Checkout Program in Latin America (LAC). With partners Ingenico, Fulcrum Biometrics, Fujitsu Frontech, and Scanntech, Mastercard has launched an innovative in-store biometric payment experience at Tienda Inglesa's Red Expres in Uruguay.

Segments covered in the report

By Technology

- Contact-Based

- Contactless

- Hybrid

By Component

- Hardware

- Software

- Services

By Application

- Healthcare

- Banking

- Security Systems

- Automated Attendance

By End Use

- Commercial

- Government

- Residential

By Geography

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting