What is the Paper Diagnostics Market Size?

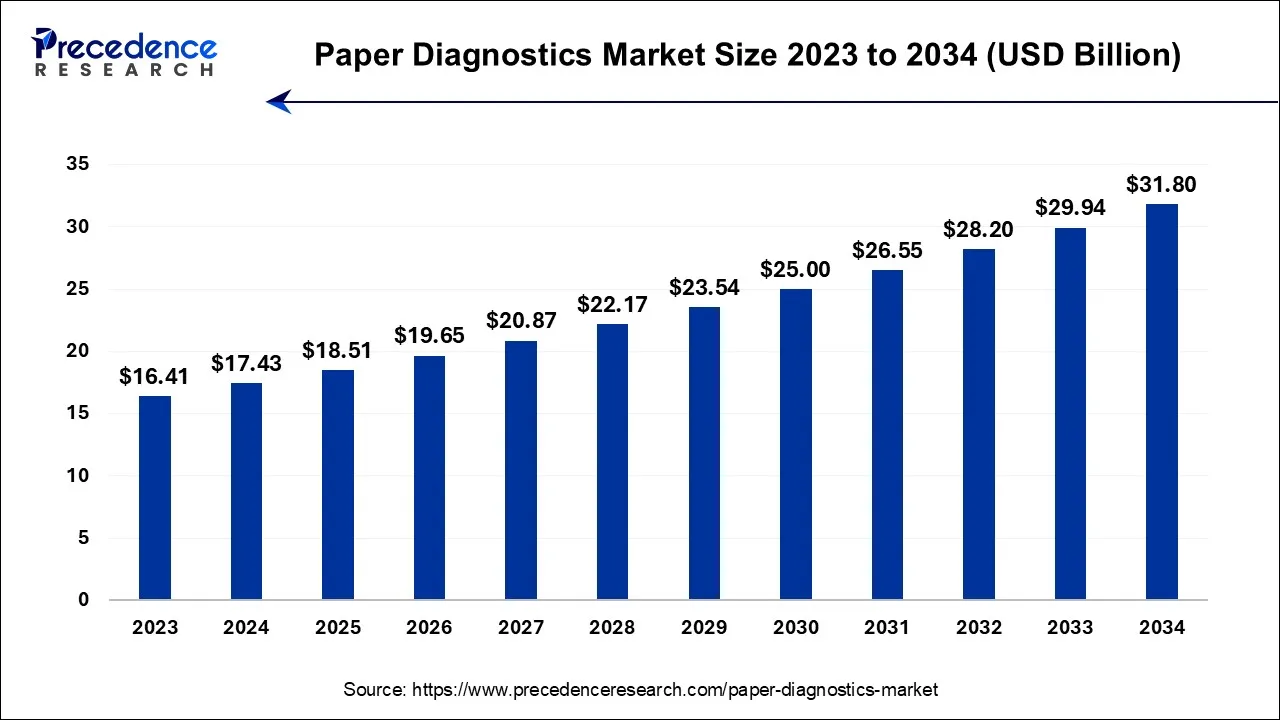

The global paper diagnosticsmarket size is calculated at USD 18.51 billion in 2025 and is predicted to increase from USD 19.65 billion in 2026 to approximately USD 31.80 billion by 2034, expanding at a CAGR of 6.20% from 2025 to 2034.

Paper Diagnostics Market Key Takeaways

- The global paper diagnostics market was valued at USD 17.43 billion in 2024.

- It is projected to reach USD 31.80 billion by 2034.

- The paper diagnostics market is expected to grow at a CAGR of 6.20% from 2025 to 2034.

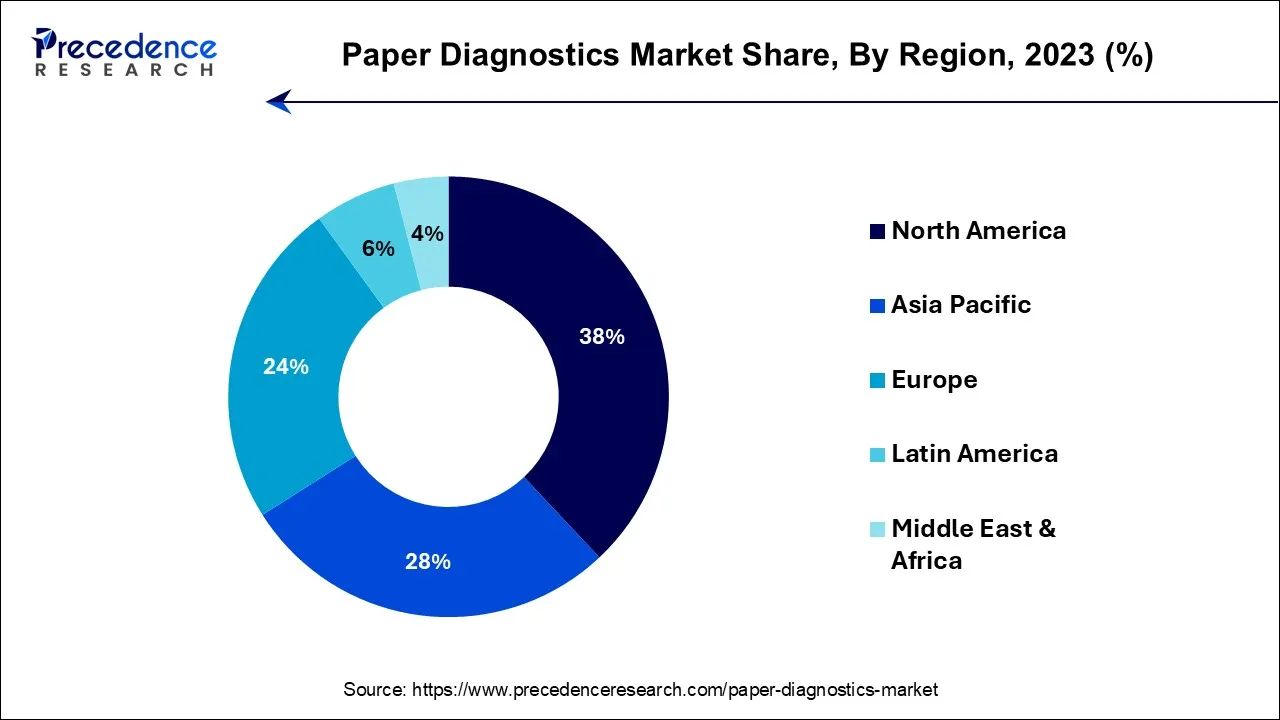

- North America contributed highest market share of 38% in 2024.

- Asia Pacific is estimated to expand the fastest CAGR between 2025 and 2034.

- By kit type, the lateral flow assays segment has held the largest market share of 46% in 2024.

- By kit type, the paper based microfluidics segment is anticipated to grow at a remarkable CAGR of 8.1% between 2025 and 2034.

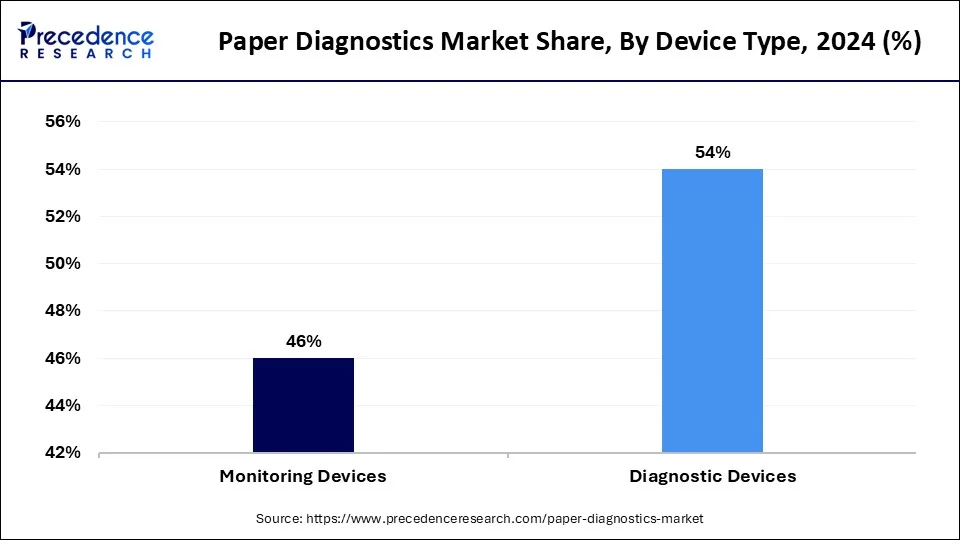

- By device type, the diagnostic devices segment has held the largest market share of 54% in 2024.

- By device type, the monitoring devices segment is anticipated to grow at a remarkable CAGR of 6.9% between 2025 and 2034.

- By application, the clinical diagnostics segment has held the largest market share of 45% in 2024.

- By end-use, the hospitals & clinics segment has held the largest market share of 49% in 2024.

- By end-use, the assisted living healthcare facilities segment is anticipated to grow at a remarkable CAGR of 8.1% between 2025 and 2034.

Strategic Overview of the Global Paper Diagnostics Industry

Paper diagnostics refer to a class of diagnostic tools and devices that utilize paper as a key component in the detection and analysis of biological samples. The tests are designed to be simple, cost-effective, and often portable, making them particularly suitable for point-of-care testing in resource-limited or remote settings. The use of paper as a substrate allows for the capillary flow of fluids, enabling various analytical processes without the need for complex equipment.

The technology relies on the principles of microfluidics, where small volumes of fluids are manipulated within paper channels to perform analytical tasks. Various formats, such as lateral flow assays, are commonly used in paper diagnostics. Its formats may be employed for applications like pregnancy tests, infectious disease detection, glucose monitoring, and others. According to the World Health Organization (WHO), paper-based lateral flow tests accounted for 45% of all point-of-care diagnostic tests globally in 2022, driven by their utility in infectious disease management and other critical applications.

The paper diagnostics market encompasses the development, manufacturing, and distribution of diagnostic tools that utilize paper as a substrate for various analytical purposes. Key features of paper diagnostics include their portability, ease of use, and low cost. These tests designed for detecting a range of analytes such as biomarkers, pathogens, or other indicators of health or disease. The Global Health Expenditure Database (World Bank) reports that in 2023, 68% of low- and middle-income countries integrated paper diagnostics into their national healthcare strategies to improve diagnostic access in rural areas. The market for paper diagnostics has grown in response to the increasing demand for rapid and accessible diagnostic solutions, particularly in areas with limited access to sophisticated laboratory infrastructure. Additionally, the U.S. Food and Drug Administration (FDA) has approved over 50 new paper-based diagnostic devices in 2023 alone, further validating the rising importance of this technology in healthcare.

How AI is Changing the Paper Diagnostics Market?

Artificial Intelligence: The Next Growth Catalyst in Paper Diagnostics

AI is significantly impacting the Paper Diagnostics market by introducing digital capabilities to enhance the speed, accuracy, and accessibility of traditional paper-based tests. By using smartphone cameras and machine learning algorithms, AI can analyze the colorimetric or other visual results of paper tests, interpreting and quantifying them with a precision that surpasses manual human evaluation. This integration transforms simple, low-cost paper tests into powerful, intelligent diagnostic tools, enabling rapid and reliable point-of-care testing in remote or low-resource settings where access to lab equipment is limited.

Market Outlook

- Market Growth Overview: The Paper Diagnostics market is expected to grow significantly between 2025 and 2034, driven by the rising demand for rapid diagnostics outside of traditional lab settings, innovation in smartphones, and AI-driven analytics is boosting accuracy and reliability. They are cost-effective and accessible and home healthcare expansion.

- Sustainability Trends: Sustainability trends involve increasingly prioritizing sustainability by utilizing biodegradable paper substrates to reduce biomedical waste compared to traditional plastic-heavy devices. Manufacturers are adopting life cycle assessments and eco-design principles to minimize environmental impact from production to disposal.

- Major Investors: Major investors in the market include Abbott Laboratories (acquired Alere), Siemens Healthineers, Bio-Rad Laboratories, Roche Diagnostics, Arkray, Inc., and Acon Laboratories.

- Startup Economy: The startup economy in the advanced biomaterials and microfluidics, targeted diagnostics and niche applications, and software-as-a-service and AI integration.

Paper Diagnostics Market Growth Factors

- The demand for point-of-care testing is on the rise, driven by the need for rapid and accessible diagnostic solutions. Paper diagnostics offer quick results without the need for sophisticated laboratory infrastructure, making them well-suited for decentralized testing in various settings.

- The low cost of paper diagnostics makes them attractive for both healthcare providers and patients. The affordability and accessibility of these tests contribute to their widespread adoption, particularly in regions with limited healthcare resources.

- Events such as pandemics can accelerate the adoption of point-of-care diagnostics, including paper-based solutions. The need for rapid, on-site testing becomes particularly apparent during health crises, contributing to market growth.

- As researchers explore new applications for paper diagnostics beyond traditional uses, such as in environmental monitoring or veterinary diagnostics, the market's potential for growth broadens.

- Ongoing research and development efforts lead to technological innovations in the design and functionality of paper diagnostic devices. Advances in materials, manufacturing processes, and detection methods enhance the performance and reliability of these tests, attracting interest from healthcare professionals and researchers.

- Support from government initiatives, grants, and funding for research and development in the field of diagnostics can significantly boost the paper diagnostics market. Public-private partnerships and investments in healthcare infrastructure contribute to market growth.

- The simplicity and portability of paper diagnostics make them suitable for a wide range of applications, including in remote or underserved areas. The ease of use and minimal training required for these tests contribute to their adoption.

- The application of paper-based sensors for environmental monitoring, such as detecting pollutants or contaminants, has expanded the scope of paper diagnostics. This diversification of applications contributes to market growth.

- Awareness campaigns and educational programs targeting healthcare professionals, end-users, and the general public contribute to the adoption of paper diagnostics. As awareness grows, there is an increased acceptance of these technologies in various healthcare settings.

- Paper diagnostics are particularly beneficial in remote or underserved areas where access to traditional healthcare infrastructure is limited. The portability and ease of use of these tests make them suitable for outreach programs and mobile clinics.

Market Scope

| Report Coverage | Details |

| Growth Rate from 2025 to 2034 | CAGR of 6.20% |

| Market Size in 2026 | USD 19.65 Billion |

| Market Size in 2025 | USD 18.51 Billion |

| Market Size by 2034 | USD 31.80 Billion |

| Largest Market | North America |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | By Kit Type, By Device Type, By End-use, and By Application |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Driver

Growing demand for rapid and decentralized diagnostic solutions

The growing demand for rapid and decentralized diagnostic solutions has become a pivotal driver for the expansion of the paper diagnostics market. In an era where timely and accessible healthcare is paramount, paper diagnostics offer a compelling solution by providing quick and reliable results at the point of care. The simplicity and cost-effectiveness of paper-based tests make them particularly well-suited for deployment in diverse settings, ranging from remote areas with limited access to sophisticated laboratory infrastructure to emergency situations where immediate diagnostics are imperative.

As the global healthcare landscape increasingly emphasizes the importance of early detection and rapid intervention, paper diagnostics fulfill a crucial role in meeting these demands. The ease of use and portability of paper-based tests facilitate their integration into decentralized healthcare environments, including clinics, community health centers, and even home-based testing scenarios.

Furthermore, the ongoing technological advancements in microfluidics and sensor technologies enhance the sensitivity and specificity of paper diagnostics, further fueling their adoption. This trend is amplified by the rising awareness among healthcare professionals and the general public about the benefits of point-of-care testing. In essence, the paper diagnostics market is thriving on the imperative need for swift, cost-effective, and decentralized diagnostic solutions to address the dynamic healthcare challenges of our time.

Growth of Rapid and Decentralized Diagnostic Solutions (2018-2023)

| Year | Percentage of Decentralized Healthcare Facilities Using Paper Diagnostics | Number of Approved Paper Diagnostic Products (Worldwide) | Sources |

| 2018 | 15% | 25 | WHO, FDA,World Bank |

| 2019 | 18% | 30 | WHO, FDA,World Bank |

| 2020 | 22% | 35 | WHO, FDA,World Bank |

| 2021 | 27% | 42 | WHO, FDA,World Bank |

| 2022 | 33% | 48 | WHO, FDA,World Bank |

| 2023 | 38% | 55 | WHO, FDA,World Bank |

Restraint

Sensitivity and Specificity Concerns

Sensitivity and specificity concerns pose potential restraints on the demand for the paper diagnostics market. While paper-based diagnostic tests offer advantages such as affordability, simplicity, and portability, questions surrounding their sensitivity and specificity may impede widespread adoption. The accuracy of diagnostic results is paramount in healthcare decision-making, and if paper diagnostics exhibit limitations in detecting or ruling out certain conditions, it could diminish confidence among healthcare professionals and end-users.

Challenges in achieving high sensitivity and specificity levels can be attributed to the inherent characteristics of paper-based tests, which may not always match the performance of more advanced laboratory methods. In situations where precise and reliable diagnostic outcomes are critical, healthcare providers may be hesitant to fully embrace paper diagnostics. Regulatory authorities also scrutinize the accuracy of diagnostic tools, and if sensitivity and specificity are not consistently demonstrated, obtaining approvals and market acceptance may become challenging.

Addressing these concerns requires ongoing research and development efforts to enhance the performance of paper diagnostics, ensuring that they meet the rigorous standards expected in clinical settings. Establishing a balance between simplicity and accuracy remains a key challenge, and resolving sensitivity and specificity concerns will be pivotal in unlocking the full potential of paper diagnostics across various healthcare applications.

Opportunity

Rapid testing in emergencies

The demand for rapid and decentralized diagnostic solutions, particularly during emergency situations, presents significant opportunities for the paper diagnostics market. The unique attributes of paper-based tests, such as their portability, simplicity, and quick turnaround time, position them as invaluable tools in emergency response scenarios. According to the World Health Organization (WHO), point-of-care testing, including paper diagnostics, reduced the time to diagnosis by an average of 50% in emergency response settings during recent outbreaks, such as Ebola and COVID-19. During disease outbreaks, natural disasters, or public health crises, the ability to conduct immediate on-site testing becomes paramount for timely decision-making and effective containment strategies.

Paper diagnostics offer a rapid and accessible means of diagnosing infectious diseases, enabling healthcare professionals to swiftly identify and manage cases in emergency settings. Their ease of use allows for deployment in diverse environments, including makeshift healthcare facilities, mobile clinics, and remote areas with limited access to traditional laboratory infrastructure. In 2021, Médecins Sans Frontières (MSF) reported that portable diagnostics, including paper-based tests, were used in over 60% of its emergency health missions, helping to detect and manage disease outbreaks in remote and conflict-affected areas. Furthermore, the simplicity of these tests facilitates training for non-specialized personnel, a crucial factor in emergency situations where the availability of skilled healthcare professionals may be constrained.

Governments, public health organizations, and humanitarian agencies recognize the pivotal role that paper diagnostics play in emergency response efforts. In 2021, UNICEF collaborated with diagnostic manufacturers to distribute over 20 million rapid diagnostic kits to countries facing health crises, highlighting the growing reliance on such technologies. Collaborations and strategic partnerships between these entities and paper diagnostics manufacturers further enhance the development and distribution of tailored diagnostic solutions, solidifying the market's position as an indispensable component in global health preparedness and crisis management. As the world faces increasing uncertainties, the paper diagnostics market stands poised to provide swift and reliable diagnostic support in times of emergencies.

Segment Insights

Kit Type Insights

Kit Type

According to the kit type, the lateral flow assays segment has held the highest market share of 46% in 2024. Lateral Flow Assays (LFAs) are widely used, with the World Health Organization (WHO) estimating that over 2 billion lateral flow tests are performed globally each year, including applications in pregnancy tests and infectious disease detection. These assays typically use a strip of paper as the medium for detecting the presence or concentration of a target analyte. The test sample flows laterally through the paper, interacting with specific reagents to produce a visible result, often in the form of a color change. LFAs are commonly used in pregnancy tests, infectious disease detection, and various rapid tests due to their simplicity and quick results.

The paper-based microfluidics segment is anticipated to expand at a CAGR of 8.1% over the projected period. In 2022, a study published by the U.S. National Institutes of Health (NIH) noted that paper-based microfluidics had the potential to reduce diagnostic costs by 40% compared to traditional lab-based methods, making it highly attractive for resource-limited settings. Paper-based microfluidics involves the integration of microfluidic principles into paper diagnostics. These platforms use paper as a substrate for creating intricate fluidic channels on a microscale. This allows for more sophisticated and multiplexed diagnostic capabilities. Paper-based microfluidic devices are designed to control the flow of small volumes of liquids, enabling precise and controlled reactions for detecting multiple analytes simultaneously. This technology is advancing the capabilities of paper diagnostics, especially in scenarios where more complex testing is required.

Device Type Insights

The diagnostic devices segment had the highest market share of 54% in 2024. According to the Centers for Disease Control and Prevention (CDC), approximately 70% of all clinical decisions are based on diagnostic test results, underscoring the critical importance of rapid testing. Diagnostic devices in the paper diagnostics market are designed primarily for the detection of specific analytes or the diagnosis of medical conditions. These devices enable rapid and accessible testing for various diseases, infections, or biomarkers. They encompass a wide range of tests, including infectious disease detection, pregnancy tests, glucose monitoring, and other point-of-care diagnostics. They play a crucial role in providing quick and reliable results for immediate decision-making in clinical settings or at the point of care.

The monitoring devices segment is anticipated to expand at a CAGR of 6.9% over the projected period. A report by the World Health Organization (WHO) indicates that the prevalence of diabetes has been steadily increasing, with an estimated 422 million people globally affected by the condition, thereby driving the demand for effective monitoring devices. Monitoring devices in the paper diagnostics market are geared toward continuous or periodic assessment of specific parameters over time. These devices enable ongoing tracking and surveillance of health indicators for managing chronic conditions or monitoring specific health parameters. They are used in scenarios where regular and repeated testing is necessary, such as in the management of chronic diseases like diabetes. They facilitate patient self-monitoring or allow healthcare providers to track changes in health status over time.

Application Insights

The clinical diagnostics segment had the highest market share of 45% in 2024 and is expected to expand at the fastest CAGR of 8.5% over the projected period. According to a report by the World Health Organization (WHO), timely diagnosis and treatment reduce disease morbidity and mortality, particularly for infectious diseases, which is driving the demand for rapid diagnostics. Clinical diagnostics in the paper diagnostics market pertain to applications within the field of human healthcare. These diagnostics are designed for the detection of specific diseases, infections, or health conditions, providing rapid and accessible results for healthcare professionals. They cover a broad spectrum of tests, including infectious disease detection (such as HIV, malaria, and COVID-19), pregnancy testing, monitoring of chronic conditions (like diabetes), and various point-of-care tests. The portability and simplicity of paper-based diagnostics make them particularly suitable for clinical settings and decentralized healthcare environments.

End-Use Insights

The hospitals and clinics segment had the highest market share of 49% in 2024. According to the American Hospital Association (AHA), approximately 6,090 hospitals in the U.S. are leveraging advanced diagnostic technologies, including paper diagnostics, to improve patient outcomes and operational efficiency. Hospitals and clinics represent traditional healthcare settings where a wide range of diagnostic tests and medical services are provided. In this segment, paper diagnostics may be integrated into existing healthcare workflows to enhance the efficiency of point-of-care testing. Paper diagnostics in hospitals and clinics cover a broad spectrum of applications, including infectious disease testing, rapid diagnostics in emergency departments, and routine screenings. They contribute to streamlined and decentralized testing within these healthcare institutions.

The assisted living healthcare facilities segment is anticipated to expand at a CAGR of 8.1% over the projected period. A study by the Centers for Disease Control and Prevention (CDC) indicates that about 800,000 individuals reside in assisted living facilities, highlighting the need for efficient health monitoring solutions. Assisted living healthcare facilities encompass settings where individuals receive support for daily living activities but may not require full-time medical care. Paper-based diagnostics in these facilities provide a means for convenient and efficient testing, contributing to resident care and health management. They may use paper diagnostics for routine monitoring of health parameters, managing chronic conditions, and conducting basic diagnostic tests without the need for extensive laboratory resources.

Regional Analysis

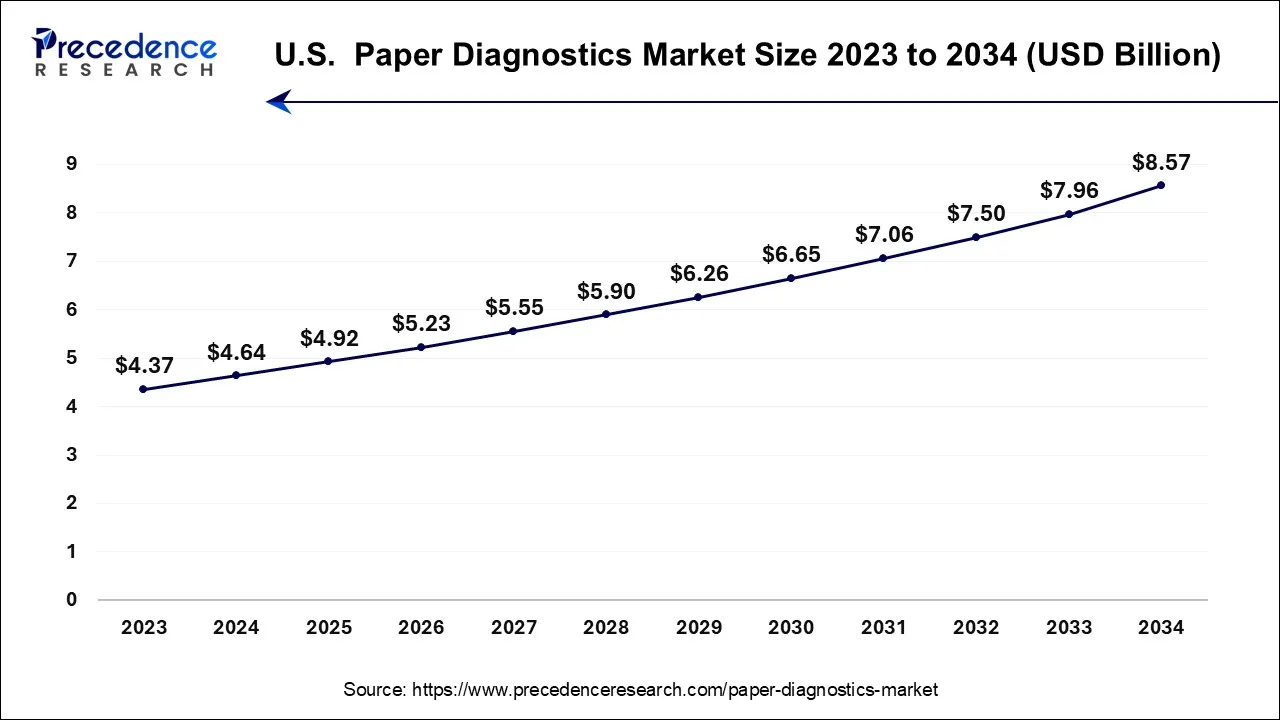

The U.S. paper diagnostics market size is valued at USD 4.92 billion in 2025 and is projected to be worth around USD 8.57 billion by 2034, poised to grow at a CAGR of 6.33% from 2025 to 2034.

North America has held the largest market share of 38% in 2024

The North America paper diagnostics market has seen growth driven by factors such as the increasing demand for rapid andpoint-of-care diagnostic solutions, advancements in microfluidics and sensor technologies, and the emphasis on accessible and cost-effective healthcare. The region is home to several key players in the diagnostics industry, contributing to innovation and the development of new paper-based diagnostic technologies. The demand for point-of-care testing solutions, which includes paper diagnostics, has been on the rise in North America. This is driven by the need for quick and decentralized diagnostic results, especially in settings such as clinics, emergency departments, and home healthcare.

| Key Metric | 2023 Data | Source |

| Demand for Point-of-Care Testing Solutions | 15% year-on-year growth | Control and Prevention (CDC) |

| Paper Diagnostics Adoption Rate in Healthcare Facilities | 48% of clinics & hospital | World Health Organization (WHO) |

| Advancements in Microfluidics Technology | 12 new patents filed by top companies | United States Patent and Trademark Office (USPTO) |

| Spending on Diagnostic Solutions | $1.3 billion in North America | U.S. Department of Health and Human Services (HHS) |

U.S. Paper Diagnostics Trends

The U.S. paper diagnostics market is driven by the integration of artificial intelligence and smartphone technology to enhance result accuracy and user convenience. The market's growth is also fueled by the cost-effectiveness and accessibility of these tests, making them ideal for managing chronic and infectious diseases. While operating within a stringent regulatory environment, technological advancements in areas like microfluidics continue to broaden the application and reliability of paper diagnostics.

Asia-Pacific is estimated to observe the fastest expansion

Asia-Pacific for paper diagnostics market, driven by factors such as the increasing prevalence of infectious diseases, a large and diverse population, rising healthcare awareness, and the need for affordable and accessible diagnostic solutions. The high prevalence of infectious diseases in some parts of the Asia-Pacific region has fueled the demand for rapid and cost-effective diagnostic solutions. Paper diagnostics, with their ability to provide quick results, are well-suited for addressing these healthcare challenges.

China Paper Diagnostics Market Trends

China's rising demand for investment in expanding healthcare infrastructure, particularly in rural areas, to improve access to diagnosis. Government support for domestic innovation, integration of AI and microfluidics, and expanding end-use markets.

Europe is a significant market for paper diagnostics

Europe is a significant market for paper diagnostics, characterized by a developed healthcare infrastructure, a strong emphasis on research and innovation, and a growing awareness of the need for accessible and rapid diagnostic solutions. The region includes diverse countries with varying healthcare systems and regulatory environments.

Germany Paper Diagnostics Trends

Germany's Paper Diagnostics market has an integration of high-tech solutions like AI and microfluidics with traditional paper tests to enhance accuracy and convenience. The market benefits from a strong domestic medical technology sector and strict European regulatory standards that foster trust in high-quality diagnostics.

Value Chain Analysis

Paper Diagnostics Market Value Chain Analysis

- Raw Material Sourcing & Preparation

This foundational stage involves procuring and preparing specialized materials, primarily high-quality chromatography or filter paper, which serves as the diagnostic platform. - Manufacturing & Functionalization

In this critical stage, the paper substrate is processed: reagents are precisely deposited, often using advanced printing technologies, and then dried and stabilized onto the paper to ensure a consistent and sensitive diagnostic reaction.

Key Players (Manufacturing & R&D focus): Abbott Laboratories, Roche Holding AG, Danaher Corporation (through subsidiaries like Cepheid and Pall), Siemens Healthineers, Bio-Rad Laboratories, Inc. - Assembly & Packaging

The functionalized paper strips are then assembled into final product formats, such as test kits, cartridges, or dipsticks, often integrated with plastic housing for ease of use.

Key Players: Abbott Laboratories, Roche Holding AG, Danaher Corporation, Siemens Healthineers, QuidelOrtho Corporation. - Distribution & Sales

Products are distributed through a complex network to reach diverse end-users, including hospitals, clinics, pharmacies, laboratories, and direct-to-consumer channels.

Paper Diagnostics Market Companies

- Abbott (Alere Inc.) is a dominant force in the paper diagnostics market, primarily through its acquisition of Alere, a leader in point-of-care diagnostics. Their contribution includes a vast portfolio of rapid diagnostic tests, such as pregnancy and infectious disease kits, which are widely used due to their accessibility and reliability.

- Bio-Rad Laboratories, Inc. contributes to the market through its strong focus on research and clinical diagnostics, including products used in infectious disease testing and blood banking.

Diagnostics for All, Inc. (DFA) is a non-profit organization that has significantly contributed to the market by developing innovative, low-cost paper diagnostic tests for use in developing countries. - Arkray, Inc. is a key player in the diabetes care segment of the paper diagnostics market, offering a variety of blood glucose monitoring systems that utilize test strips.

- Acon Laboratories, Inc. specializes in developing and manufacturing rapid diagnostic tests for a range of conditions, including infectious diseases, substance abuse, and diabetes monitoring. They are known for producing cost-effective and high-volume products such as the "Mission" brand of diagnostic tests and readers.

- Ffei Life Science (Biognostix) has historically been involved in developing advanced diagnostic solutions. Their contributions focus on creating precise diagnostic technologies which can be adapted for paper-based applications, aiding in the advancement of diagnostic capabilities.

- Kenosha Tapes contributes to the paper diagnostics value chain as a supplier of specialized adhesive tapes crucial for assembling rapid test kits and ensuring product integrity.

- GVS S.p.A. plays a vital role in the paper diagnostics market by providing advanced filtration solutions and membrane technologies. Their high-quality membranes are critical components in lateral flow assays, ensuring consistent flow rates and reliable test results.

- Micro Essential Laboratory Inc. is involved in the market through its expertise in pH testing and water quality testing products, which use paper-based indicator strips. They provide simple, reliable, and inexpensive tools for environmental and industrial monitoring applications.

- Navigene likely contributes to the R&D and potentially the manufacturing of paper-based tests, focusing on genetic and molecular diagnostics applied to paper platforms. Their work would focus on developing novel tests for infectious diseases or genetic markers.

- Siemens Healthcare GmbH is a major global player in the broader diagnostics market with a focus on high-performance laboratory and point-of-care testing solutions.

Recent Development

- In March 2024, MediCheck Labs launched a new line of biodegradable paper diagnostic tests designed for environmental sustainability without compromising performance. These tests detect a range of conditions, from glucose levels to infections, and offer results in under 30 minutes. The company highlights that their EcoCheck tests are user-friendly and also align with growing demands for eco-conscious products in healthcare. Furthermore, the integrating eco-friendly materials, MediCheck aims to reduce the ecological footprint of medical diagnostics.

- In February 2024, BioPaper Solutions unveiled its groundbreaking diagnostic platform that combines paper diagnostics with AI-powered data analysis. This hybrid approach allows for rapid, on-site testing for a variety of conditions, including metabolic disorders and allergies. The company claims that their product, BioCheck, enhances the accuracy of results by utilizing AI algorithms to interpret data collected from the tests. This innovation is anticipated to bridge the gap between laboratory tests and point-of-care diagnostics, potentially transforming patient care in clinical settings.

- In January 2024, GenoMe Inc. announced the launch of its innovative paper-based diagnostic tests aimed at revolutionizing infectious disease detection. The new product, named GenoTest, utilizes advanced biosensing technology embedded in paper strips that provide results for common viral infections, including influenza and COVID-19, within 15 minutes. The simplicity and low cost of GenoTest are expected to enhance accessibility, particularly in remote areas. Additionally, the tests are designed for easy disposal, reducing environmental impact compared to traditional diagnostic methods.

Segments Covered in the Report

By Kit Type

- Lateral Flow Assays

- Paper Based Microfluidics

- Dipsticks

By Device Type

- Diagnostic Devices

- Monitoring Devices

By End-use

- Assisted Living Healthcare Facilities

- Hospital and Clinics

- Home Healthcare

- Others

By Application

- Food Quality Testing

- Environmental Monitoring

- Clinical Diagnostics

By Geography

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting