What is Patient Lifting Equipment Market Size?

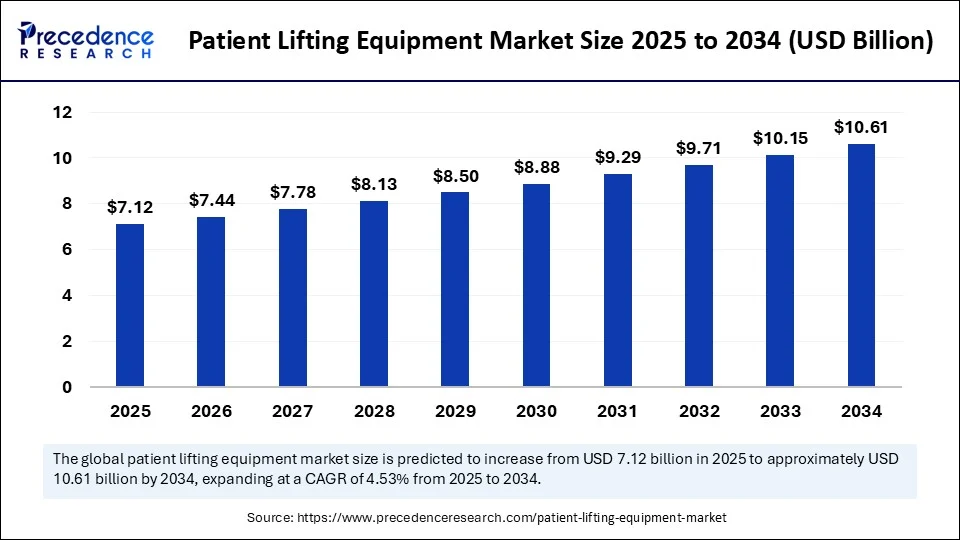

The global patient lifting equipment market size accounted for USD 7.12 billion in 2025 and is predicted to increase from USD 7.44 billion in 2026 to approximately USD 10.61 billion by 2034, expanding at a CAGR of 4.53% from 2025 to 2034. The patient lifting equipment market is growing due to rising elderly and disabled populations, increasing demand for home healthcare, and a strong focus on reducing caregiver injuries.

Market Highlights

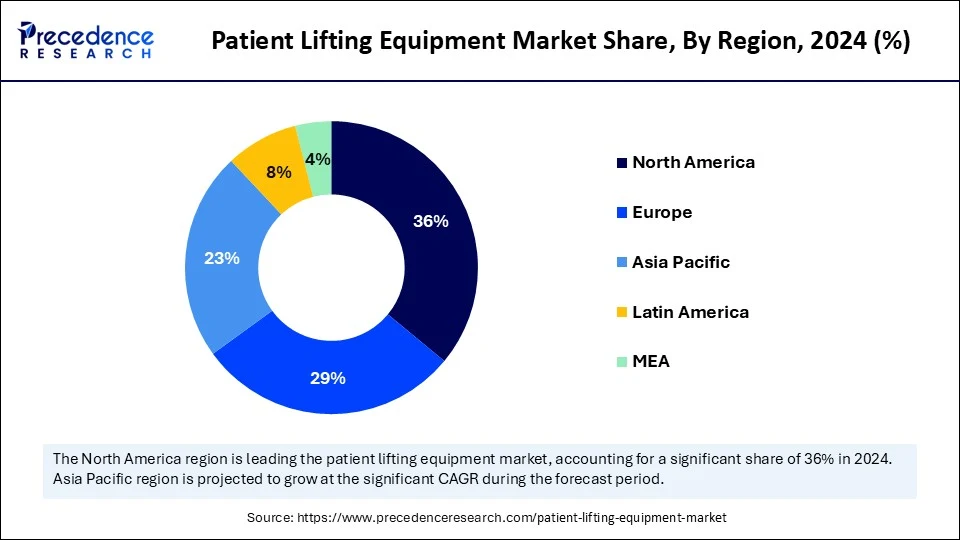

- North America led the global patient lifting equipment market with the highest share of 36% in 2024.

- Asia Pacific is expected to expand the fastest CAGR between 2025 and 2034.

- By product, the powered sit-to-stand lifts segment held the largest market share in 2024.

- By product, the floor-based lifts segment is anticipated to grow at a significant CAGR between 2025 and 2034.

- By end user, the hospitals segment captured the biggest market share in 2024.

- By end user, the homecare segment is expected to expand at the fastest CAGR over the projected period.

Market Overview

The global market for patient lifting equipment consists of a variety of solutions to safely and effectively transfer patients with limited mobility from point to point. These products (e.g., mobile lifts, ceiling lifts, sit-to-stand lifts, and slings) help to maintain the comfort of the patient while supporting the safety of the caregiver. Patient lifting equipment is being used in hospital settings, rehabilitation centers, and elderly agencies and is notably increasing in the home care environment.

The patient lift equipment market has transitioned from a niche market in the healthcare system to an essential component of the health continuum due to the increasing demand for mobility aids in acute or long-term care. Manufacturers are focusing on improving designs to enhance functionality, ease of use, and interoperability with digital health. The demand for patient lifting equipment is driving as a result of advances in design, growing attention to patient safety, and the continued modernization of non-invasive and efficient patient handling.

How is Artificial Intelligence Transforming the Patient Lifting Equipment Market?

Artificial intelligence is rapidly being incorporated into patient lifting equipment, improving safety, efficiency, and real-time monitoring during transfers. AI-powered sensors detect potential hazards, such as unstable surfaces or obstacles, and alert caregivers. This, in turn, reduces the risk of accidents and optimizes patient care. They also monitor patient movement and detect signs of falls, enabling caregivers to intervene promptly. AI also enables the development of smart lifting equipment that encompasses motion detection, weight sensing, and wireless monitoring capabilities. The combination of artificial intelligence, IoT, and predictive analytics not only improves the safety of the patient with respect to mobility but also reduces the risk of physical burden on caregivers.

What are the Top 5 Trends Transforming the Patient Lifting Equipment Market?

- Smart Lift Systems: Digital integration, including sensor-based control and remote monitoring, is improving the functionality, safety, and tracking of patient lifting equipment within hospitals and home care.

- Growth of Homecare Equipment: The high demand for compact and user-friendly lifting devices dedicated to home care, driven by the increasing elderly population and chronic conditions, is now transforming both developed and developing countries.

- Ergonomic Innovations: Manufacturers are creating ergonomically friendly designs to alleviate caregiver injuries, make them easier to use, and enhance patient comfort and dignity while being moved.

- Sustainable Materials: Sustainability goals within healthcare are leading manufacturers to use more sustainable and durable materials in their products, in addition to reducing costs for hospitals and caregivers.

- Growth of Rental Models: Rental is gaining popularity as an option with healthcare facilities that desire flexibility, cost-effectiveness, or access to the best and latest equipment and technology without the substantial upfront cost.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 7.12 Billion |

| Market Size in 2026 | USD 7.44 Billion |

| Market Size by 2034 | USD 10.61 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 4.53% |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Product, End User, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

Rising Injuries Among Healthcare Workers to Boost the Demand for Patient Lifting Equipment

The growing incidence of musculoskeletal injuries in the healthcare workforce due to manual patient handling is expected to drive the growth of the patient lifting equipment market. According to CDC and the National Institute for Occupational Safety and Health (NIOSH), patient handling is the leading cause of work-related musculoskeletal disorders (WMSDs) in healthcare, with NIOSH reaffirming, as recently as 2024, that manual lifting still puts nursing staff, aides, and other healthcare workers at high risk, especially when transferring immobilized patients or patients who are overweight.

For context, the U.S. Occupational Safety and Health Administration (OSHA) recently reported in their 2024 update that the rate of injury among healthcare workers is nearly three times higher than that of other professions. In October 2024, OSHA and NIOSH jointly updated their Safe Patient Handling and Mobility (SPHM) guidelines with great emphasis on the recommended use of mechanical lifting devices in hospital environments and implemented that all nursing homes use mechanical lifting devices in the event that staff loading was cited in order to protect cohort groups residing in nursing homes. These regulatory changes mean that there will be an increase in hospitals, rehabilitation centers, and long-term care facilities capital expenditures in mechanized patient lifting equipment (e.g., ceiling lifts and mobile hoists, sit-to-stand, etc.) in order to follow safety standards, reduce caregiver injuries, and improve patient care outcomes.

Restraint

High Equipment Costs Restrict Market Access

One of the major barriers to the growth of the patient lifting equipment market is the high initial and ongoing costs of lifting equipment. Equipment like ceiling lifts and powered mobile hoists require an upfront investment, which many smaller healthcare facilities, long-term care homes, and homecare organizations cannot afford. Adding to this, these costs also entail ongoing expenditures to train staff and service and replace the equipment itself as needed.

The NHS Supply Chain in the UK recently reported that budget constraints are a significant barrier to purchasing patient lifting technologies. Manual lifting is still prevalent in low- and middle-income countries, limiting the growth of the market. Affordability is still an obstacle to widespread adoption among healthcare systems without wider reimbursement models or government incentives.

Opportunity

Increasing Elderly Population

The major opportunity for the growth of the patient lifting equipment market lies in the growing elderly population worldwide, which is driving the demand for patient-handling equipment to assist with mobility. According to the World Health Organization, the number of people aged 60 and older worldwide is projected to increase from 1.1 in 2023 to 1.4 billion by 2030. This growth brings an increased prevalence of age-related problems that can cause mobility issues, equating to more demand for lifting equipment in hospitals, long-term care facilities, and home care settings.

Governments are also taking steps to promote patient safety and protect caregivers. For instance, the U.S. Occupational Safety and Health Administration (OSHA) and the American Nurses Association endorse Safe Patient Handling and Mobility (SPHM) programs that focus on mechanical lifting devices to prevent injuries. Additionally, the NHS Manual Handling Operations Regulations in the UK encourage the use of lifting aids to lessen or eliminate the physical stress on caregivers. With institutional support reinforced by policy efforts to promote the safe movement of patients or residents, there is a significant opportunity for innovation and expansion in this space.

Segment Insights

Product Insights

Why Did the Powered Sit-To-Stand Lifts Segment Dominate the Patient Lifting Equipment Market?

The powered sit-to-stand lifts segment dominated the market with the largest revenue share in 2024, as these lifts are the most frequently utilized product in clinical and homecare settings. They provide semi-mobile patients with the means of transitioning from sitting to standing with little physical exertion while increasing safety for patients and caregivers. The relatively simple ease of transferring weight for elderly or post-operative individuals has made a powered sit-to-stand lift a preferred choice for long-term care or rehabilitation facilities. Furthermore, these lifts increase patients' mobility while decreasing the risk of them falling, making them appealing to patients as well as healthcare providers.

The floor-based lifts segment is expected to grow at the fastest rate during the forecast period due to their versatile nature and affordability. Unlike ceiling lifts, floor-based lifts do not require installation, so they are mostly mobile units that can be easily transported to another room or area to assist in patient transfers without modifying existing infrastructure. Floor lifts are suitable for smaller healthcare/clinical facilities, as structural constraints prohibit permanent lifts from being installed. Ultimately, the rising development of newer floor lifts that are more compact and lighter, enabling ease of maneuvering and portability for homecare use, is expected to drive the growth of the segment.

End User Insights

Which End User Segment Dominate the Market in 2024?

The hospitals segment dominated the patient lifting equipment market with a major revenue share in 2024. This is mainly due to the heightened focus on patient safety and injury prevention with caregivers. Hospitals have strict regulations and safety standards, which require the immediate move toward upgrading manual methods of patient transfer to advanced lifting technologies. The increase in surgery, rehabilitation, and chronic disease management boosted the need for lifting equipment in hospitals. Advancements in healthcare infrastructures and increases in patient volumes in these settings are likely to ensure the long-term growth of the segment.

The homecare segment is expected to grow at the fastest CAGR in the upcoming period due to the continual increase in home care facilities. The growing aging population is creating the need for home care solutions with affordable, accompanied, safe patient handling solutions. Families and caregivers are heavily investing in sit-to-stand and portable floor lifts that are user-friendly and easy to navigate to manage mobility impaired family members and friends without professional assistance.

Regional Insights

U.S. Patient Lifting Equipment Market Size and Growth 2025 to 2034

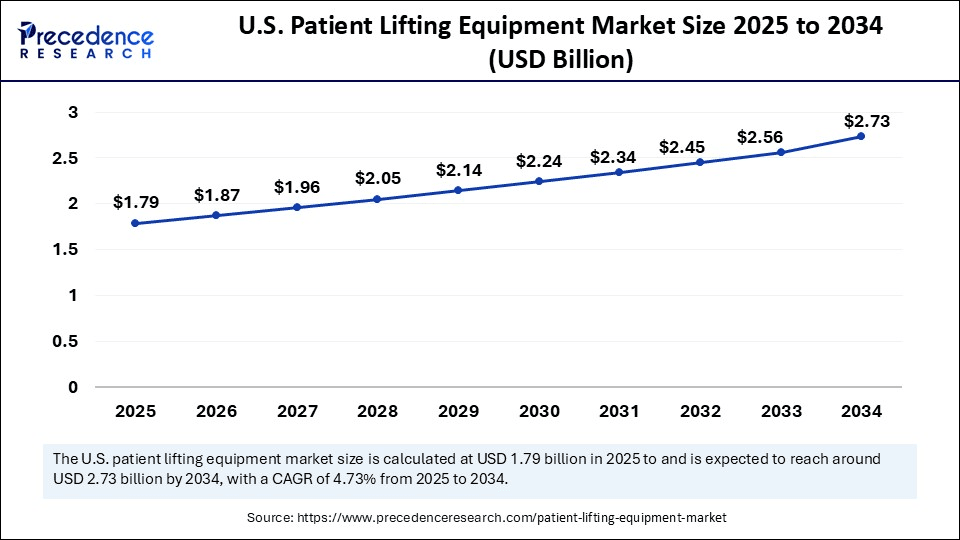

The U.S. patient lifting equipment market size is exhibited at USD 1.79 billion in 2025 and is projected to be worth around USD 2.73 billion by 2034, growing at a CAGR of 4.73% from 2025 to 2034.

What Made North America the Dominant Region in the Patient Lifting Equipment Market?

North America registered dominance in the market by holding the largest share in 2024. This is mainly due to its well-developed healthcare systems, growing aging population, and stringent regulations aimed at decreasing injuries among caregivers. Both the U.S. and Canada have initiated comprehensive legislation mandating mechanical lifting devices used in hospitals and healthcare facilities, decreasing the use of manual handling. Government initiatives resulted in improved safety that included ceiling lifts, floor lifts and sit-to-stand lifts when transferring patients. Continuous product innovation, including smart lifting solutions, advanced sensors, and tracking systems, continuous funding support, and awareness of occupational hazards related to patient care bolster the growth of the market in the region.

The U.S. continues to be a leader in the region with its established policies via federal agency guidelines and other agencies like OSHA, which promotes the use of lifting devices in the healthcare industry. Healthcare facilities and homecare service providers in the U.S. are quickly transitioning to smart lifting equipment to ease staff's burden and reduce musculoskeletal injuries.

- In May 2023, SSM Health, a U.S.-based healthcare system, launched the SSM Health Illinois program named LIFTsmart: Living Injury Free Together. The program aims to assist in reducing patient falls, bedsores, length of patient stay, and staff injuries associated with patient handling.

Why is Europe Considered the Second-Largest Market?

Europe is the second-largest market because of its strong focus on healthcare workers' safety and comprehensive elderly care. Countries across the region have developed strict occupational safety standards to limit musculoskeletal injuries for all caregivers. This has increased the use of powered and mechanical lifting equipment in hospitals and care homes. The growing elderly population across Europe countries is encouraging healthcare providers to modernize their infrastructure with ergonomically, automated patient transfer systems. The European Union's financial support for new technology adoption, including advanced healthcare equipment, supports regional market growth

Germany is a major player in the European patient lifting equipment market, owing to its quality health care infrastructure and mandatory regulations to use assistive lifting devices in hospital and eldercare environments. The country also benefits from regional government support to boost domestic production of medical devices. The UK is a significant player due to the rising focus on improving public health. Government-funded programs have increased the installation of modern patient lifting systems, contributing to market expansion.

What Makes Asia Pacific the Fastest-Growing Region in the Patient Lifting Equipment Market?

Asia Pacific is expected to grow at the fastest CAGR during the projected timeframe, driven by a growing aging population and rising healthcare expenditure. Countries like China, India, and Japan are investing heavily in improving eldercare services, rehabilitation centers, and modernizing hospitals. Governments of some Asian countries are incentivizing the adoption of assistive technologies to improve patient mobility and lessen the burden on caregivers. Furthermore, there is a strong focus on ergonomic care solutions, coupled with an increase in preference for home-based treatment, boosting the demand for cost-effective lifting equipment. As the prevalence of chronic disease and disabilities continues to rise, hospitals and home care facilities must implement automated lifting solutions to enhance patient safety and better utilize caregivers' time.

China is ahead of the race due to rising government initiatives to improve elderly care and drive healthcare innovation. Japan is another front-runner, particularly due to its highest proportion of the aging population. Japanese healthcare systems continue to invest in robotic and sensor-enabled patient transfer mechanisms to enhance patient outcomes.

What Potentiates the Growth of the Market in Latin America?

The patient lifting equipment market in Latin America is expected to grow at a notable rate in the coming years, driven by an aging population, efforts to reduce caregiver injuries, and a growing focus on patient safety. Increasing life expectancy in the region is contributing to a rise in age-related mobility issues, creating a growing demand for assistive lifting devices. Brazil is leading the market. In August 2025, the Brazilian government invested US$480 million in medical equipment used in surgical procedures and basic healthcare. Brazil's health regulatory agency, ANVISA, announced its 2024-2025 regulatory framework to improve medical device standards and to implement unique device identification (UDI) requirements.

What Opportunities Exist in the Middle East and Africa?

The Middle East and Africa (MEA) region presents significant opportunities for expanding the patient lifting equipment market, driven by an aging population, enhancements in healthcare infrastructure, and investments in digital health, AI, and medical devices. New product launches are focused on robotic, automated, and smart-technology-integrated lifting devices. Saudi Arabia dominates the market due to a rapidly aging population and a rising prevalence of chronic diseases, both of which are boosting demand for lifting and mobility‑assist devices.

In October 2025, the Ministry of Health allowed government entities to access its health and administrative facilities for the year 2025. This initiative aims to provide hospitals and government organizations with equipment, medical devices, various supplies, and furniture. In July 2025, Saudi Arabia's Ministry of Industry and Mineral Resources announced the launch of the Non-Profit Association of Medical Device Manufacturers, which supports the development and growth of the medical device industry.

Patient Lifting Equipment Market Companies

- Baxter International Inc.

- Gainsborough Specialist Bathrooms

- Getinge AB

- Guldmann Inc.

- Invacare Corporation

- Joerns Healthcare LLC

- Savaria Corporation

- Stryker Corporation

- Sunrise Medical LLC

- Winncare Group

- Others

Recent Developments

- In June 2025, Medical device manufacturer Winncare has released a new ‘all-in-one' ceiling lift system, which can be used as a fixed or portable hoist, and can lift either 150kg, 200kg or 275kg. From private homes to care facilities with complex architectural constraints, the Luna X5 ceiling lift system offers a lifting height of 2500mm.Source: https://thiis.co.uk)

- In April 2025, Arjo strengthens the leading position in patient handling by introducing the new top-of-the-line mobile patient floor lift features several innovative technical solutions designed to help reduce caregiver injuries and optimize efficiencies in care situations. (Source:https://www.arjo.com)

- In May 2024, Küschall, renowned for its pioneering designs and use of state-of-the-art materials, launched the new Champion SL manual wheelchair. The all-new chair has a range of innovative features that will improve the experience for wheelchair users.(Source: https://www.invacare.eu.com)

Segments Covered in the Report

By Product

- Stand Up & Raising Lifts/Aids

- Overhead/Ceiling Lifts

- Floor-Based Lifts

- Gantry Lifts

- Powered Sit-to-stand Lifts

- Bath Patient Lifters

- Others

By End User

- Homecare

- Hospitals

- Elderly Care Homes

- Others

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting