PEEK Interbody Devices Market Size and Forecast 2025 to 2034

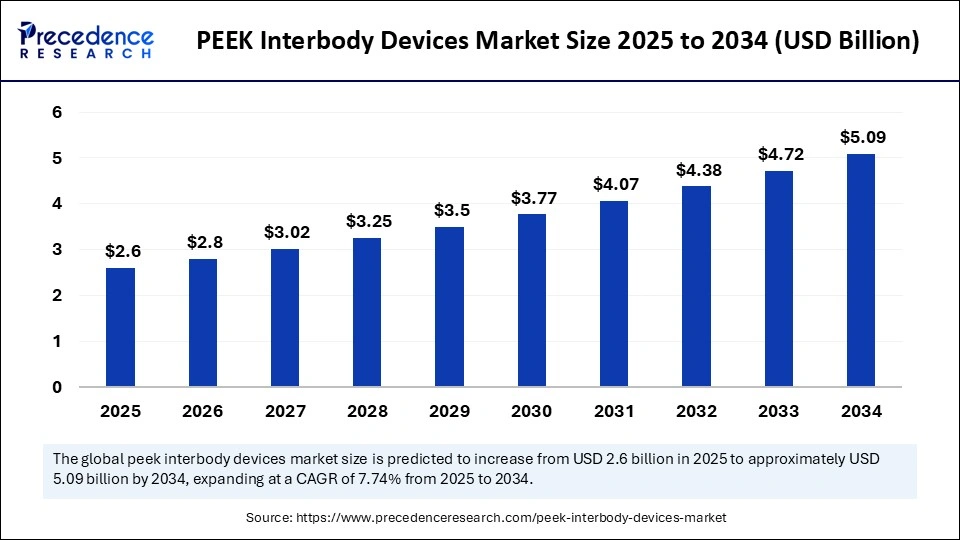

The global PEEK interbody devices market size accounted for USD 2.41 billion in 2024 and is predicted to increase from USD 2.6 billion in 2025 to approximately USD 5.09 billion by 2034, expanding at a CAGR of 7.74% from 2025 to 2034.The PEEK interbody devices market is driven by increasing spinal disorders, an aging population, and the development of minimally invasive surgical technology.

PEEK Interbody Devices MarketKey Takeaways

- The global PEEK interbody devices market was valued at USD 2.41 billion in 2024.

- It is projected to reach USD 5.09 billion by 2034.

- The market is expected to grow at a CAGR of 7.74% from 2025 to 2034.

- North America dominated the PEEK interbody devices market in 2024.

- Asia Pacific is expected to witness the fastest growth during the forecast years.

- By product type, the interbody fusion devices segment held the largest market share in 2024.

- By product type, the posterolateral fusion devices segment is anticipated to show considerable growth in the market over the forecast period.

- By end-user, the hospitals segment held the biggest market share in 2024.

- By end user, the ambulatory surgical centers segment is expected to grow at the fastest CAGR in the upcoming period.

How is AI Integration Transforming the PEEK Interbody Devices Market?

Artificial intelligence is revolutionizing the PEEK interbody devices market by enhancing product development, clinical outcomes, and surgical techniques, leading to higher fusion rates and reduced risks. AI-driven systems aid in post-surgery monitoring. AI-enriched navigation and robotic-assisted surgical systems reduce human error and assist low-impact approaches. Connecting to a smart health platform, AI monitors post-surgery patient outcomes, providing real-time feedback and data-driven intelligence on implant performance and patient recovery.

Market Overview

PEEK (Polyetheretherketone) interbody devices, or spinal cages, are surgical implants designed to be utilized in spinal fusion surgeries to replace damaged intervertebral discs and maintain spinal alignment and stability. They offer better biomechanical performance than traditional metal implants, improving load sharing and reducing stress shielding, which enhances spinal fusion success. These devices are used in various spinal surgeries and come in different shapes and sizes.

The rising number of spinal disorders, like degenerative disc disease, herniated discs, and spinal stenosis, especially in the aging population, is increasing the demand for spinal fusion surgical procedures. The development of new surgical procedures, particularly minimally invasive spine surgery, is increasing the utilization of PEEK implants because of their lightweight nature and suitability for this kind of surgery. The rising healthcare spending, growing awareness of superior spinal care, and escalating demand for durable and biocompatible implant material are also contributing to market growth.

Whar are the Major Factors Boosting the Growth of the PEEK Interbody Devices Market?

- Rising Cases of Spinal Issues: The growing cases of spinal complications, such as degenerative disc disease, spinal stenosis, and herniated discs, are increasing the need for effective spinal implants, leading to the application of PEEK interbody devices because they provide adequate biomechanical support and compatibility with spinal anatomy.

- Aging Population: The growing aging population worldwide is increasing the need for spinal healthcare due to the rising risks of spinal degeneration, trauma, and chronic back pain, which are age-related.

- Rising demand for Minimally Invasive Spine Surgery: The demand for less invasive spine surgeries is rising due to the reduced recovery time, fewer complications, and shorter hospital stays associated with them.

- PEEK Technological Advancements: PEEK-based biomaterials are continuously evolving, with innovations enhancing implant functionality and clinical outcomes. Surface texturing, bioactive coatings, and additive manufacturing are improving bone-implant integration and fusion rates, representing a recent advancement.

Market Scope

| Report Coverage | Details |

| Market Size by 2034 | USD 5.09 Billion |

| Market Size in 2025 | USD 2.6 Billion |

| Market Size in 2024 | USD 2.41 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 7.74% |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Product Type, End User, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

Increasing Incidence of Spinal Disorders

Conditions like degenerative disc disease, herniated discs, spinal stenosis, and spondylolisthesis are increasingly prevalent, especially among the aging population. These conditions often lead to chronic pain, reduced mobility, and a lower quality of life. PEEK interbody devices are crucial in treating these spinal disorders. The global health systems are improving diagnostic capabilities and specialized care to enhance the effectiveness of the treatment of spinal disorders. As spinal fusion surgeries become more common and successful, surgeons are increasingly favoring PEEK cages over traditional metal implants, driving the demand for safe, durable, and effective surgical options, making PEEK devices the cutting edge of spinal care technology.

Increasing Preference for Minimally Invasive Surgery

The increasing demand for minimally invasive spine surgeries (MISS) is driving the growth of the PEEK interbody devices market. A suite of benefits, such as less tissue destruction, shorter hospitalization, quicker recovery, and decreased post-operative complications, is making minimally invasive procedures the preferred choice over the traditional open surgeries by both patients and healthcare providers. PEEK implants are lightweight, strong, biocompatible, easy to handle, and can be implanted through small incisions. Hospitals and surgical facilities are also recognizing the financial advantages of MISS, such as reduced healthcare costs and improved patient flow. The characteristics of PEEK implants align well with the demands of MISS, promising rapid market growth and advancements in spinal surgery solutions.

Restraint

High Cost of PEEK Devices and Limited Healthcare Access in Low-Income Regions

PEEK is a high-end, high-performance polymer that exhibits better biomechanical strength, chemical resistance, and radiolucency as compared to conventional materials, such as titanium and stainless steel. The complex manufacturing and quality control increase the final costs of PEEK devices, resulting in lower availability in cost-conscious markets. Many patients in low- and medium-income countries lack comprehensive health coverage, making it difficult to afford the out-of-pocket expenses for premium implants.

Opportunity

Rising Demand for Customized Implants and 3D Printing Advancements

The rising demand for customized implants creates immense opportunities in the PEEK interbody devices market. The rise of 3D printing has enabled the development of patient-specific implants, improving surgical precision and enhancing biomechanical stability, which leads to better clinical outcomes. Custom design of spinal implants can improve surgical outcomes relative to patients' spinal anatomy and operative position. Also, the probability of fusion may increase with PEEK designs tailored for each patient, through advanced designs utilizing patient-specific PEEK. There is a significant opportunity to improve operational and clinical outcomes with patient-specific PEEK interbody devices made through 3D printing.

Product Type Insights

Why did the Interbody Fusion Devices Segment Dominate the PEEK Interbody Devices Market?

The interbody fusion devices segment dominated the market with the largest revenue share in 2024. This is mainly due to the increased need for spinal fusion surgeries. PEEK is a high-performance thermoplastic with excellent biomechanical properties, chemical resistant and biocompatible. These properties render it an ideal material to be used in interbody fusion devices, as it offers better load sharing. PEEK interbody fusion devices are radiolucent, enabling more accurate post-operative imaging and monitoring of bone fusion. Their compatibility with minimally invasive surgical procedures is a significant advantage in current spine care, emphasizing rapid recovery and minimal surgical trauma. These devices effectively replace injured or degenerated discs, restore disc height, and, like other anterior disc replacements, promote bony fusion of the vertebral bodies, thus enhancing long-term outcomes and spinal stability.

The posterolateral fusion devices segment is expected to grow at the highest CAGR over the forecast period. Posterolateral fusion involves placing bone grafts between the vertebrae's transverse processes to stimulate fusion in the lumbar spine, avoiding the intervertebral disc space. This method is gaining traction for its adaptability in treating various spinal conditions, especially in patients with complex spinal anatomy. The segment's growth is fueled by the aging population and rising spinal degenerative disease rates. Advances in surgical techniques and fixation systems, alongside the growing preference for fusion surgeries over conservative treatments, are expected to boost the growth of the segment.

End-user Insights

What Made Hospitals the Dominant Segment in 2024?

The hospitals segment dominated the market with the most revenue share in 2024. This is mainly due to the increased volume of surgeries performed in these settings. Hospitals increasingly adopt advanced technologies like PEEK implants, especially in complex spinal fusions such as anterior cervical, posterior lumbar, and transforaminal lumbar fusions. Additionally, hospitals in developed economies benefit from well-established healthcare systems and a growing number of spinal-related hospitalizations.

Hospitals will remain key adopters of PEEK interbody devices due to ongoing advancements in surgical techniques and implant technologies, offering patients improved clinical outcomes and quicker recovery. This segment's consistent growth is bolstered by the continuous development of healthcare infrastructures and the increased emphasis on spinal care within hospitals.

The ambulatory surgical centers segment is expected to grow at the fastest rate in the coming years. This is mainly due to the increasing demand for outpatient surgeries. Ambulatory Surgery Centers (ASCs) offer personalized surgical plans, attracting more patients and boosting the neef for PEEK interbody devices. ASCs prefer PEEK due to its biocompatibility, radiolucency, and customization capabilities. Less invasive procedures lead to reduced tissue damage, less post-operative pain, and shorter hospital stays, aligning well with the outpatient focus of ASCs. The shift towards outpatient care and cost control makes the ASC segment a significant growth opportunity for PEEK interbody devices.

Region Insights

What Factors Contributed to North America's Dominance in the Market?

North America dominated the PEEK interbody devices market by holding the largest revenue share in 2024. This is mainly due to the high incidence of spine-related disorders, such as degenerative disc disease, herniated discs, spinal stenosis, and other degenerative disorders. An aging population across the region further increased the number of spinal fusion surgeries, which created the need for high-quality implants, including PEEK interbody devices.

The U.S. Is a major player in the market. This is mainly due to its large geriatric population and well-established healthcare system. There is a high demand for minimally invasive spine surgeries. In addition, the availability of reimbursement policies and insurance coverage for spinal surgeries supports market growth. The presence of a large number of medical device manufacturing companies further contributes to regional market growth.

- In March 2023, Curiteva Inc. received FDA 510(k) clearance of its 3D-printed Inspire Porous PEEK Cervical Interbody System, highlighting the interest of the region in novel spinal solutions.

(Source: https://curiteva.com)

Why is Asia Pacific Experiencing the Fastest Growth in the PEEK Interbody Devices Market?

Asia Pacific is expected to grow at the fastest CAGR during the forecast period. Rapid healthcare infrastructural development in emerging economies like China, India, Japan, and South Korea is a key driver of market expansion. Increasing investment in the development of modern surgical facilities and spine care centers is increasing access to spinal surgeries, boosting the demand for advanced implants like PEEK interbody devices. Rising cases of degenerative disc diseases and spine conditions from trauma are also increasing the number of spinal fusion surgeries. In addition, domestic medical device manufacturers are boosting their production capabilities to meet the increasing demand. Increased insurance coverage has made modern spinal surgeries affordable, contributing to the market growth.

What Opportunities Exist in the European PEEK Interbody Devices Market?

Europe is considered to be a significantly growing area. There is increasing demand for minimally invasive spine surgery (MISS), driven by its ability to improve recovery times, reduce complications, and maximize patient outcomes. The rise in degenerative disc disease, spinal stenosis, and herniated discs is leading to more spinal fusion surgeries, often utilizing PEEK interbody devices to restore stability and promote fusion. Reimbursement policies increase the likelihood of healthcare providers using new biomaterials like PEEK in spinal implants, leading to better clinical outcomes. Ongoing collaborations between medical device manufacturers and research organizations in Europe continuously drive innovation and product development.

Recent Developments

- In April 2025, Curiteva reported treating more than 5,000 levels with its new Inspire Cervical 3D-Printed Trabecular PEEK implants. Inspire platform employs a fully interconnected porous PEEK structure that is meant to provide better osseointegration and radiographic evaluation, which is a major step forward in the biomaterials used in spinal implants.

(Source:https://www.surgicalroboticstechnology.com)

- In March 2025, Globus Medical, Inc., one of the largest musculoskeletal technology companies in the world, has announced two commercial launches: COHERE ALIF Spacer: The first Porous PEEK interbody spacer system to be used in anterior lumbar interbody fusion (ALIF) surgery and Modulus ALIF Blades: An expansion of the already market-leading Modulus ALIF interbody spacer system.

(Source: https://www.marketwatch.com)

- In February 2025, Medtronic plc, a multinational technology powerhouse in spine solutions, declared it had acquired the nano-surface technology of Nanovis to boost the work of its PEEK interbody fusion gadgets. The addition of this nanotechnology shall be to promote osseointegration and fixation of the spinal implants, which ultimately shall give it an edge in the growing field of spinal surgery.

(Source: https://nanovistechnology.com)

PEEK Interbody Devices Market Companies

- Medtronic (Ireland)

- Stryker (U.S.)

- NuVasive, Inc. (U.S.)

- Zimmer Biomet (U.S.)

- Globus Medical (U.S.)

- DePuy Synthes (U.S.)

- Alphatec Spine (U.S.)

- B. Braun SE (Germany)

- Orthofix Medical Inc. (U.S.)

- LDR Holding Corporation (U.S.)

- SpineArt (Switzerland)

- Mazor Robotics (Israel)

- Invibio (UK)

- Raymedica (U.S.)

- K2M (U.S.)

- Finceramica (Italy)

- Biomet (U.S.)

- Exactech (U.S.)

- Japan Medical Materials (Japan)

- Curiteva (U.S.)

Segments Covered in the Report

By Product Type

- Posterolateral Fusion Devices

- Interbody Fusion Devices

- Anterior Lumbar Interbody Fusion Devices (ALIF)

- Extreme Lateral Interbody Fusion Devices (XLIF)

- Posterior Lumbar Interbody Fusion Devices (PLIF)

- Transforaminal Lumbar Interbody Fusion Devices (TLIF)

- Other Devices

By End User

- Hospitals

- Ambulatory Surgical Centers (ASCs)

- Specialty Clinics

By Region

- North America

- Asia-Pacific

- Europe

- Latin America

- Middle East & Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting