Penicillin G Acylase Market Size and Forecast 2025 to 2034

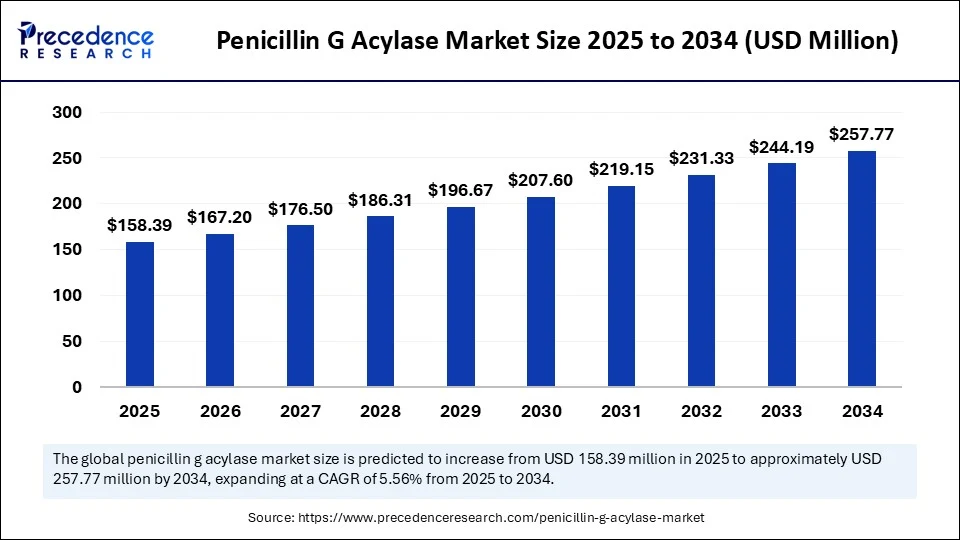

The global penicillin G acylase market size accounted for USD 150.05 million in 2024 and is predicted to increase from USD 158.39 million in 2025 to approximately USD 257.77 million by 2034, expanding at a CAGR of 5.56% from 2025 to 2034. The growing demand for semi-synthetic antibiotics, rapid advancements in enzyme immobilization technologies, growing demand for enzyme-based manufacturing processes, and increasing popularity of sustainable production methods are expected to drive the growth of the global market for penicillin G acylase over the forecast period. Several key players in the market are widely adopting effective strategies to expand their market share and gain a competitive edge. Additionally, the market is expanding in emerging regions, particularly North America, fuelled by increasing healthcare expenditure and a surge in research activities.

Penicillin G Acylase Market Key Takeaways

- In terms of revenue, the global penicillin G acylase market was valued at USD 150.05 million in 2024.

- It is projected to reach USD 257.77 million by 2034.

- The market is expected to grow at a CAGR of 5.56 % from 2025 to 2034.

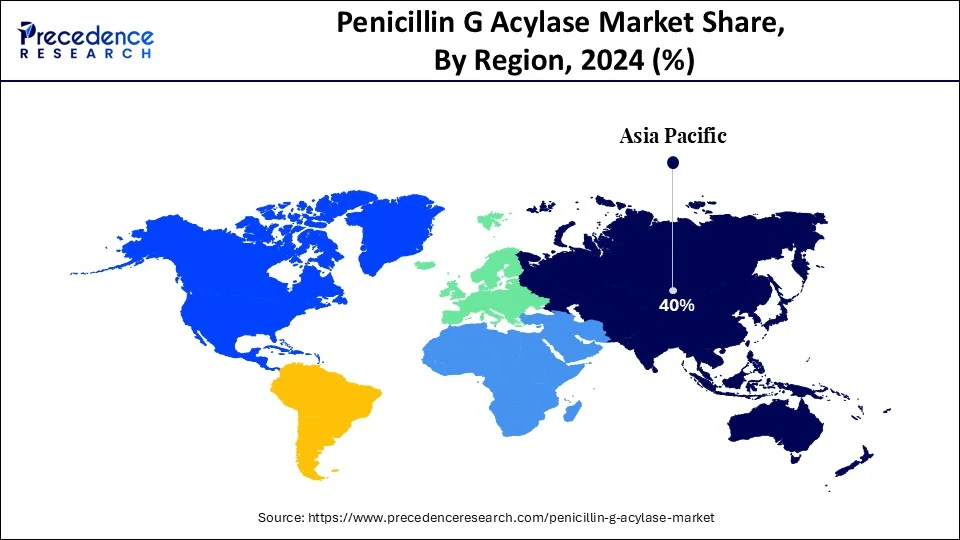

- Asia Pacific dominated the global penicillin G acylase market with the largest share of 40% in 2024.

- North America is expected to grow at a significant CAGR from 2025 to 2034.

- By type, the immobilized enzyme segment captured the biggest market share of 60% in 2024.

- By type, the free enzyme segment is experiencing the fastest growth during the forecast period.

- By application, the β-lactam antibiotic production segment contributed the largest market share of 70% in 2024.

- By application, the industrial biocatalysis segment is anticipated to grow at a significant CAGR from 2025 to 2034.

- By end-use industry, the pharmaceutical industry segment held the highest market share of 65% in 2024.

- By end-use industry, the biotechnology companies' segment is expanding at a significant CAGR from 2025 to 2034.

- By form, the powder segment generated the major market share of 55% in 2024.

- By form, the liquid segment is experiencing rapid growth during the forecast period.

- By production method, the microbial fermentation segment accounted for the highest market share of 60% in 2024.

- By production method, the recombinant technology segment is expected to witness remarkable growth during the forecast period.

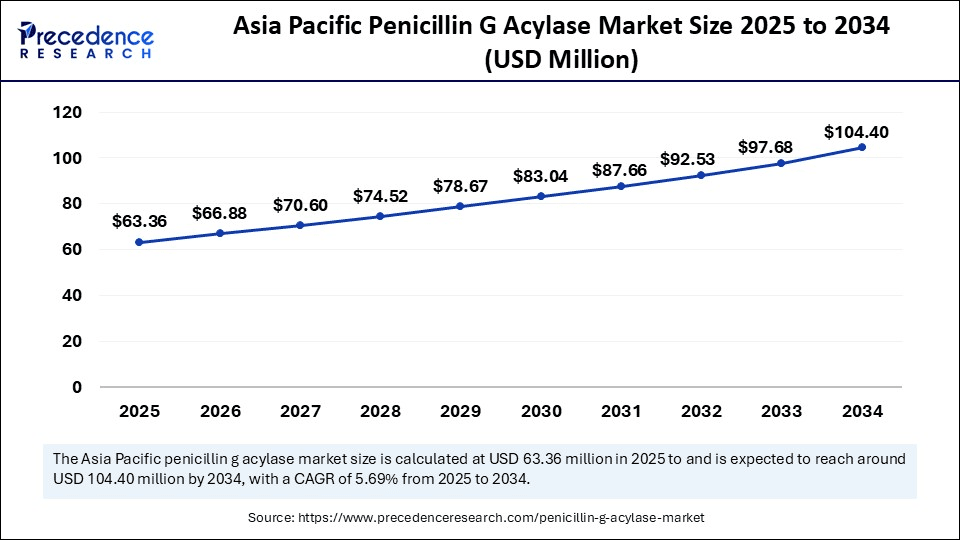

Asia Pacific Penicillin G Acylase Market Size and Growth 2025 to 2034

The Asia Pacific penicillin G acylase market size is exhibited at USD 63.36 million in 2025 and is projected to be worth around USD 104.40 million by 2034, growing at a CAGR of 5.69% from 2025 to 2034.

How Did Asia Pacific Lead the Penicillin G Acylase Market in 2024?

Asia Pacific held the dominant share of the penicillin G acylase market in 2024. The region benefits from a well-developed healthcare infrastructure, increasing shift toward sustainable production, growing demand for antibiotics, rising improvement in enzyme technology, and stringent regulations regarding antibiotic quality. The market is experiencing increasing demand for semisynthetic penicillin, such as ampicillin and amoxicillin, owing to the increasing prevalence of bacterial infections. The rising investment in R&D activities in the pharmaceutical sector and rising healthcare expenditures, bolstering the market's growth in the region. Several enzyme producers are increasingly focusing on collaborating with API manufacturers, CDMOs, and academic institutions to develop tailored biocatalysis solutions, driving innovation and fuelling market expansion in the coming years.

What Made North America the Fastest-Growing Region in the Penicillin G Acylase Market in 2024?

North America is expected to grow at the fastest rate in the market during the forecast period because of the region's well-established healthcare infrastructure, with its advanced medical facilities and supportive regulatory framework, and increasing demand for penicillin-based drugs. The increasing prevalence of infectious diseases has led to an increasing demand for effective antibiotics, driving the growth of the penicillin G acylase market in the region. Several prominent companies are increasingly focusing on strategic alliances or partnerships to gain a competitive edge and widen their market reach. The key market players are increasingly investing in advanced technologies to improve enzyme engineering and improve efficiency. Moreover, the ongoing research and development in PGA production technologies is expected to boost its cost-effectiveness and efficiency, leading to wider applications in the biopharmaceutical and pharmaceutical industries in the region.

The U.S. Penicillin G acylase market Trends

The U.S. continues to be a major contributor to the global penicillin G acylase market, supported by its advanced healthcare infrastructure, increasing presence of key market players, high per capita expenditure on bacterial infections, and ongoing research activities. The U.S. has a rising prevalence of infectious diseases, as well as leads in developing and adopting effective antibiotics. Penicillin G acylase (PGA) plays a vital role in producing semi-synthetic antibiotics like ampicillin and amoxicillin, which are highly effective against infectious diseases.

Market Overview

Penicillin G Acylase (PGA) is an enzyme widely used in the pharmaceutical industry to catalyze the hydrolysis of penicillin G to produce 6-aminopenicillanic acid (6-APA), a critical intermediate for manufacturing semi-synthetic β-lactam antibiotics such as amoxicillin and ampicillin. Beyond pharmaceutical applications, the penicillin G acylase market services the production of cephalosporins and fine chemicals. Its industrial demand is driven by the rising global consumption of β-lactam antibiotics, enzyme-based green synthesis trends, and increasing biocatalyst applications in pharmaceutical production.

What Are the Key Trends in the Penicillin G Acylase Market?

- The rising advancements in enzyme technology are estimated to promote the growth of the penicillin G acylase market during the forecast period. The innovations in enzyme immobilization techniques improve penicillin G acylase (PGA)'s stability and efficiency.

- The expanding healthcare infrastructure, particularly in emerging countries, and supportive government initiatives to improve healthcare accessibility are expected to propel the growth of the market during the forecast period.

- The increasing investment to develop new and improved PGA-based production processes is anticipated to accelerate the market's growth during the forecast period.

- The shift toward sustainable production methods is expected to propel the market's growth. PGA-based processes are more environmentally friendly than various chemical synthesis methods, meet the sustainability goals, and encourage pharmaceutical companies to adopt enzyme-based technologies.

- The surge in healthcare expenditure and ongoing research and development focused on improving PGA's efficiency, stability, and production methods are expected to contribute to the overall growth of the penicillin G acylase space.

- The global rise in incidence of infectious diseases necessitates the increasing use of antibiotics, bolstering the growth of the penicillin G acylase market during the forecast period.

Market Scope

| Report Coverage | Details |

| Market Size by 2034 | USD 257.77 Million |

| Market Size in 2025 | USD 158.39 Million |

| Market Size in 2024 | USD 150.05 Million |

| Market Growth Rate from 2025 to 2034 | CAGR of 5.56% |

| Dominating Region | Asia Pacific |

| Fastest Growing Region | North America |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Type, Application, End-Use Industry, Form, Production Method, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

Growing Demand for Semi-synthetic Antibiotics

The rising demand for semi-synthetic antibiotics is expected to boost the growth of the penicillin G acylase market during the forecast period. The surging need for antibiotics, fuelled by the rising incidence of bacterial infections and antimicrobial resistance, results in increased demand for PGA. Penicillin G acylase plays a crucial role in producing semisynthetic penicillins such as ampicillin and amoxicillin. Moreover, surging awareness regarding antibiotic resistance has led to an increasing development of high-purity antibiotics with potentially reduced side effects, encouraging pharmaceutical companies to increasingly adopt PGA-based methods for selective hydrolysis in drug manufacturing. The increase in antimicrobial resistance propels the research into new and improved antibiotics, where PGA assists in developing novel semi-synthetic compounds.

- In August 2025, Altegra, a resident of the Dubna Special Economic Zone (SEZ), completed construction of a workshop for solid dosage forms of beta-lactam antibiotics. The pharmaceutical company has already launched production of its first experimental batches. After receiving a license in the fall, Altegra plans to start mass production. Investments in the workshop amounted to about 200 million rubles. The new site will expand the company's product range to 40 items and increase annual production to 70 million capsules and around 150 million tablets.(Source: https://gxpnews.net)

Restraint

High Costs of Production

The high cost associated with enzyme production is anticipated to hamper the market's growth. The high investment required for producing penicillin G acylase, especially significant in large quantities for industrial applications. This can limit its adoption due to budget constraints and make it less competitive with other enzyme production processes. In addition, the availability of Alternative Antibiotics and the potential side effects of Penicillin G, such as nausea, diarrhea, vomiting, and allergic reactions in some individuals, may lead to caution among healthcare providers and patients. Such factors may hinder the growth of the global penicillin G acylase market during the forecast period.

Opportunity

Rapid Expansion of the Pharmaceutical and Biotechnological Industry

The rapid expansion of the pharmaceutical and biotechnological industries is projected to offer lucrative growth opportunities to the penicillin G acylase market during the forecast period. The pharmaceutical and biotechnological industries rely on penicillin G acylase (PGA) for the production of antibiotics, owing to its various benefits in terms of cost-effectiveness, sustainability, and environmental friendliness. The surge in research and development activities in the pharmaceutical and biotechnological industries, along with the rising healthcare expenditures, is spurring the demand for PGA as a crucial component for developing new and improved antibiotics. In addition, stringent regulations regarding antibiotic traceability, quality, and rising environmental concerns are compelling the biotechnological and pharmaceutical companies to shift towards enzymatic production pathways such as penicillin G acylase (PGA).

Type Insights

What Made the Immobilized Enzyme Segment Lead the Penicillin G Acylase Market in 2024?

The immobilized enzyme segment was dominant, with the biggest share of the global penicillin G acylase market in 2024, as it is extensively used in the production of semi-synthetic penicillins for the hydrolysis of Penicillin G into 6-aminopenicillanic acid (6-APA). Immobilization offers various benefits, such as improving PGA's stability, reusability, and efficiency. Immobilized Penicillin G acylase (PGA) is more resistant to changes in pH, temperature, and other various factors, leading to more reliable performance and an extended lifespan. Immobilized PGA offers the crucial function of preventing substrate contamination by the enzyme itself or other compounds, which results in producing high-purity products. On the other hand, the free enzyme segment is also experiencing the fastest growth. Free Penicillin G acylase (PGA) is extensively used; its immobilization onto solid supports provides numerous advantages which including easier separation from the reaction mixture and improved stability. However, free PGA is generally more susceptible to several environmental conditions, leading to the development of immobilized PGA.

Application Insights

What Made the β-Lactam Antibiotic Production Segment Lead the Penicillin G Acylase Market in 2024?

The β-lactam antibiotic production segment dominated the market in 2024, as it is a crucial biocatalyst in the production of β-lactam antibiotics, which are widely adopted in the synthesis of semi-synthetic penicillin and cephalosporin. β-Lactam antibiotics are a popular class of antibacterial drugs. These antibiotics are extensively used as clinical anti-infection drugs, owing to their broad antibacterial spectrum, strong bacteriostatic efficacy, lower toxicity, and others. On the other hand, the industrial biocatalysis segment is witnessing the fastest growth. PGA is one of the vital industrial biocatalysts widely used in the production of 6-aminopenicillanic acid (6-APA). Its ability to hydrolyze penicillin G and catalyze synthetic reactions makes it immensely popular in pharmaceutical manufacturing. Thus, bolstering the segment's expansion in the coming years.

End-Use Industry Insights

What Causes the Pharmaceutical Industry Segment to Dominate the Penicillin G Acylase Market?

The pharmaceutical industry segment held a dominant presence in the market in 2024, with the growth of the segment driven by the growing adoption of enzyme-based manufacturing processes in the pharmaceutical industry. Penicillin G acylase (PGA) is a vital enzyme in the pharmaceutical industry, especially for the production of semi-synthetic β-lactam antibiotics and in the resolution of racemic mixtures. In addition, the ongoing research is increasingly focusing on optimizing PGA production, enhancing its catalytic properties, and exploring new applications through advanced techniques like immobilization. On the other hand, the biotechnology companies' segment is expected to grow at a notable rate. Penicillin G acylase (PGA) is one of the most crucial enzymes in the biotechnology industry for the production of semi-synthetic beta-lactam antibiotics. Several biotechnology companies are actively involved in the Penicillin G acylase (PGA) market, including Fermenta Biotech, Biosynth, Creative Enzymes, Amicogen, Crawford Wisdom International, and MuseChem Chemicals. The rapid expansion of the biotechnology industry continues to drive the rapid advancements in PGA production, leading to more cost-effective, sustainable, and efficient methods for antibiotic synthesis.

Form Insights

How Did the Powder Segment Dominate the Penicillin G Acylase Market in 2024?

The powder segment dominated the market in 2024. Penicillin G acylase is an enzyme used in the production of semi-synthetic beta-lactam antibiotics, and is widely available in powder form. The powder form is often described as a grey-white or white powder. On the other hand, the liquid segment is expected to register the fastest growth. Penicillin G acylase (PGA) is an enzyme, produced in a liquid form, that is widely utilised in the industrial production of semi-synthetic cephalosporins and penicillins. This enzyme can be found in numerous liquid forms, which often include aqueous solutions and immobilized forms within whole cells.

Production Method Insights

How Microbial Fermentation Segment Dominate the Penicillin G Acylase Market in 2024?

The microbial fermentation segment held the largest share in the penicillin G acylase market in 2024 because it is one of the most primary and crucial production methods for Penicillin G acylase (PGA), an enzyme widely adopted in the synthesis of various β-lactam antibiotics. Microbial fermentation is a scalable and cost-effective method, making it suitable for industrial-scale manufacturing. PGA produced through fermentation is vital for treating bacterial infections. The optimization of fermentation processes enhances PGA yield and reduces production costs, which affects the availability and affordability of antibiotics. On the other hand, the recombinant technology segment is expected to grow significantly in the coming years. Recombinant technology is a crucial production method in the Penicillin G acylase (PGA), offering large-scale production of this enzyme, essential for synthesizing semi-synthetic antibiotics. Recombinant technology allows for the optimization of PGA production through strain selection and genetic engineering. Several advantages are offered by the recombinant PGA production, such as higher yields, cost reduction, and improved processes.

Penicillin G Acylase Market Companies

- Novozymes A/S

- DSM N.V.

- Amano Enzyme Inc

- Takeda Pharmaceutical Company Limited

- Meiji Seika Pharma Co., Ltd.

- Codexis, Inc.

- Chr. Hansen Holding A/S

- Gist-Brocades (now part of DSM)

- Henan Lingrui Biochemical Co., Ltd.

- Advanced Enzymes Technologies Ltd.

- Jiangsu Meilin Pharmaceutical Co., Ltd.

- Beijing Anno Pharmaceutical Co., Ltd.

- BioCatalytics Inc.

- Shanghai Enzyme Co., Ltd.

- Kyowa Hakko Bio Co., Ltd.

- Shandong Longda Biochemical Co., Ltd.

- Xiamen Innovax Biotech Co., Ltd.

- Biocon Limited

- AB Enzymes GmbH

- Enzymicals AG

Industry Leader Announcements

- In June 2025, the Pharmaceutical major Wockhardt Ltd. announced plans to enter the USD 7 billion US and European markets with its new antibiotic Zaynich, aimed at treating gram-negative infections. The company also plans to seek European and emerging market approvals in the second half of FY2025, with an Indian launch depending on clearance from the Drug Controller General of India (DCGI).(Source: https://economictimes.indiatimes.com)

Recent Developments

- In August 2025, ECHO India, a non-profit trust working for health system strengthening through capacity building, launched an Antimicrobial Stewardship Programme in Punjab and Andhra Pradesh to address the growing threat of antimicrobial resistance (AMR) in India. The three-year pilot will be implemented in Punjab and Andhra Pradesh, engaging 400 healthcare professionals from tertiary care centres to strengthen capacity in rational antibiotic use and infection prevention. The programme was inaugurated at the National Health Systems Resource Centre (NHSRC).(Source: https://www.businesswireindia.com)

- In May 2025,Vietnam's pharma major Imexpharm plans to build a USD 58 mln plant in southern Vietnam. The USD 57.75 million project, covering over 97,600 square meters in the Quang Khanh Industrial Cluster, aims to diversify Imexpharm's product portfolio to meet domestic demand and expand export markets.

(Source: https://theinvestor.vn)

Segments Covered in the Report

By Type

- Free Enzyme

- Immobilized Enzyme

- Others: Enzyme blends, recombinant PGA

By Application

- β-Lactam Antibiotic Production

- Amoxicillin

- Ampicillin

- Cephalosporin Derivatives

- Industrial Biocatalysis

- Research & Development

- Others: Specialty chemicals, biosensor applications

By End-Use Industry

- Pharmaceutical Industry

- Biotechnology Companies

- Contract Manufacturing Organizations (CMOs)

- Research Institutes & Academic Labs

- Others: Specialty chemical manufacturers

By Form

- Powder

- Liquid

- Others: Lyophilized formulations

By Production Method

- Microbial Fermentation

- Recombinant Technology

- Others: Enzyme immobilization techniques

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting