What is the Peptide-based Cancer Therapeutics Market Size?

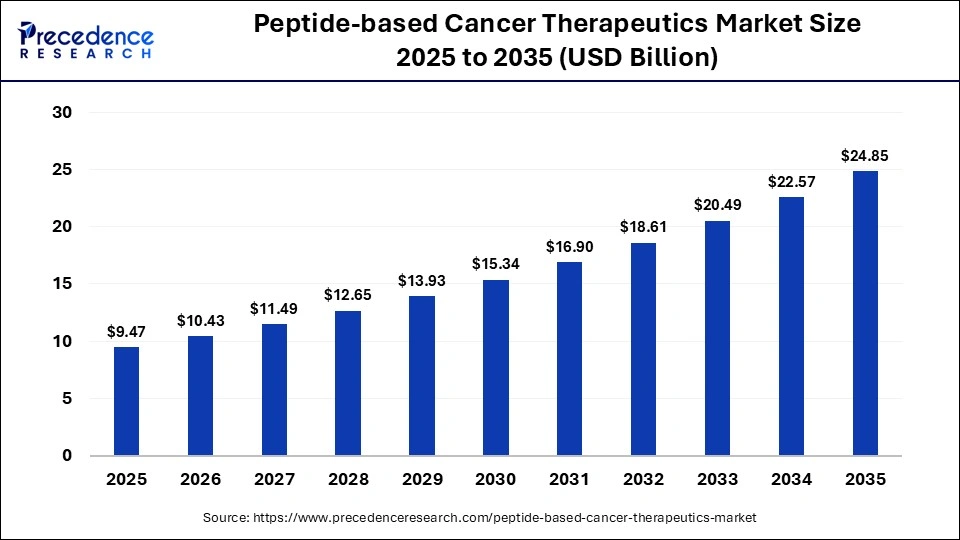

The global peptide-based cancer therapeutics market size was calculated at USD 9.47 billion in 2025 and is predicted to increase from USD 10.43 billion in 2026 to approximately USD 24.85 billion by 2035, expanding at a CAGR of 10.13% from 2026 to 2035.The market is witnessing substantial growth driven by the increasing prevalence of cancer, and the high specificity and efficacy of peptide drugs often result in fewer side effects than traditional chemotherapy.

Market Highlights

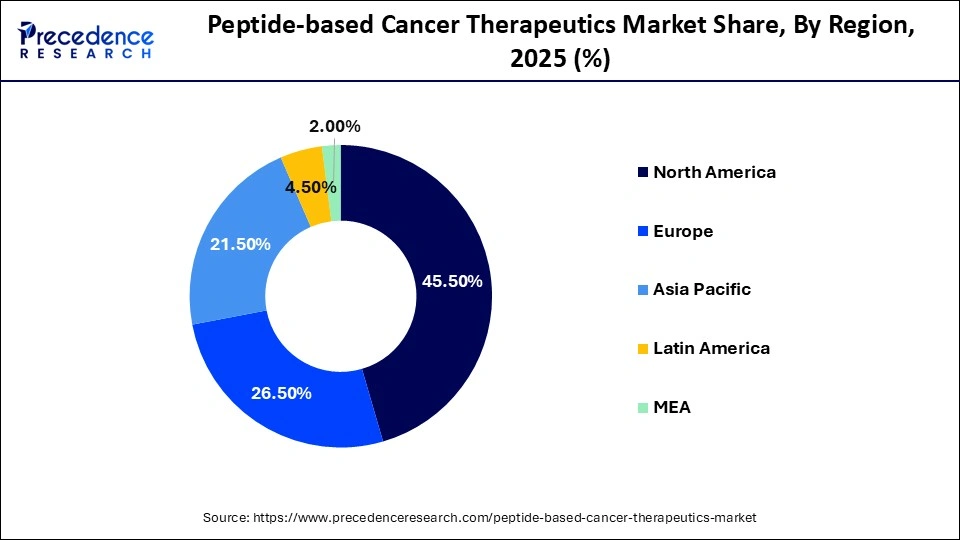

- North America dominated the market with 45.5% of the market share in 2025.

- The Asia Pacific is expected to grow at the fastest CAGR of 10.5% between 2026 and 2035.

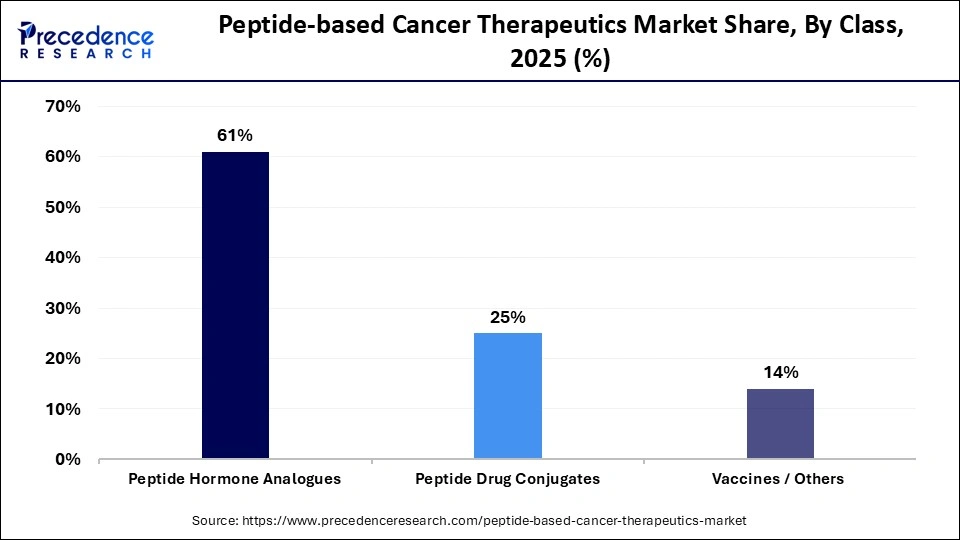

- By class, the peptide hormone analogues segment contributed the highest share of 61% in 2025.

- By class, the peptide drug conjugates segment is growing at a strong CAGR of 9.2% between 2026 and 2035.

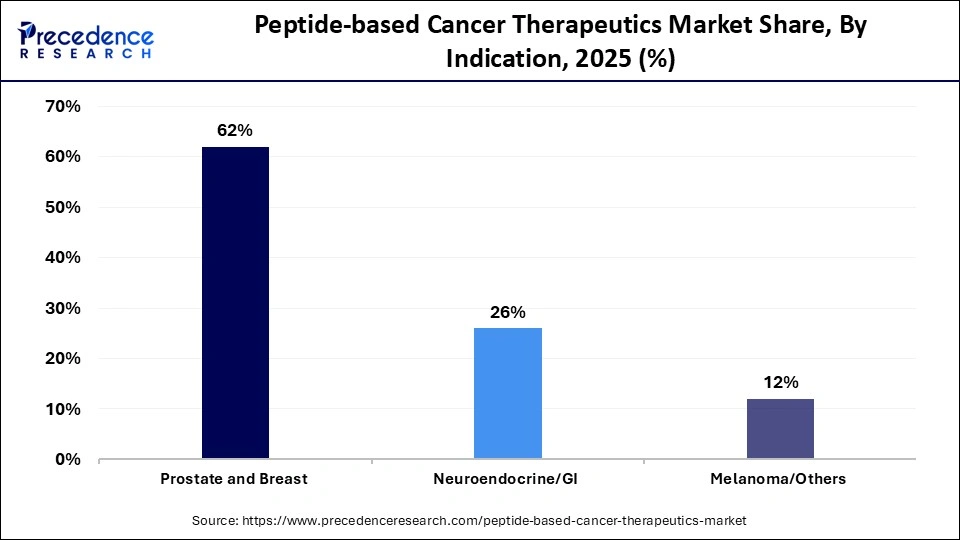

- By indication, the prostate & breast segment held a major market share of 62% in 2025.

- By indication, the neuroendocrine/GI segment is expected to expand at a notable CAGR of 9.3% from 2026 to 2035.

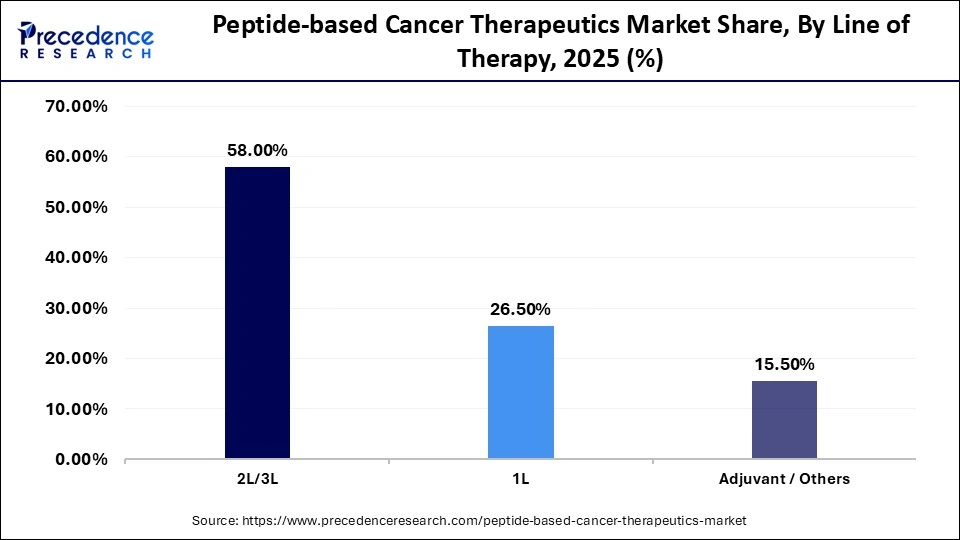

- By line of therapy, the 2L/3L segment captured the highest share of 58.0% in the peptide-based cancer therapeutics market during 2025.

- By line of therapy, the 1L segment is poised to grow at a healthy CAGR of 9.5% between 2026 and 2035.

What Is the Peptide-Based Cancer Therapeutics Market?

The peptide based cancer therapeutics market encompasses biologically active peptides used to treat cancer by targeting tumor cells with high specificity and lower systemic toxicity. Key therapeutic classes include peptide hormone analogues, peptide drug conjugates, and peptide vaccines. These therapeutics are applied across major cancer types such as prostate, breast, neuroendocrine, and melanoma, and span lines of therapy from first line to later line treatments. Growth is driven by rising cancer incidence, precision medicine adoption, and advancements in peptide design and delivery technologies.

How Will AI Transform the Peptide-Based Cancer Therapeutics Market?

Artificial intelligence (AI) is transforming the global peptide-based cancer therapeutics market by rapidly designing novel peptides, predicting their properties, optimizing sequences, identifying targets, and improving diagnostic sensors, significantly accelerating discovery and reducing costs. AI models quickly generate and screen millions of peptide sequences, identifying promising candidates more efficiently and cost-effectively than traditional methods. AI predicts potential toxicity and pharmacokinetics, reducing costly lab failures. AI designs peptides that act as molecular sensors, detecting cancer biomarkers for early diagnosis via simple tests, with improved binding affinity and drug-like properties.

Major Trends in the Peptide-based Cancer Therapeutics Market

- Enhanced Targeting and Delivery: Peptides are being conjugated with nanoparticles, liposomes, and small molecules to create targeted drug delivery systems, improving tumor penetration and reducing off-target effects.

- Shift towards Personalized Medicine: Peptides can be tailored to individual patient genotypes and tumor characteristics, aligning with personalized cancer treatment goals.

- Demand for Peptide-Based Vaccines: Significant focus on multi-epitope peptide vaccines to stimulate immune responses against tumor-associated antigens.

- Emerging Combination Therapies: Combining peptides with checkpoint inhibitors, chemotherapy, or radiation aims for synergistic effects and improved patient outcomes.

- Novel Peptide Design: Development of multifunctional peptides, cell-penetrating peptides, and peptide-drug conjugates to enhance functionality and overcome limitations for effective cancer treatments and favorable computing advancements.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 9.47 Billion |

| Market Size in 2026 | USD 10.43 Billion |

| Market Size by 2035 | USD 24.85 Billion |

| Market Growth Rate from 2026 to 2035 | CAGR of 10.13% |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | Class, Indication, Line of Therapy, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Segment Insights

Class Insights

How Will the Peptide Hormone Analogues Segment Lead the Peptide-Based Cancer Therapeutics Market in 2025?

The peptide hormone analogues segment led with 61% in the peptide-based cancer therapeutics market during 2025. This is mainly due to their precise targeting of hormone receptors overexpressed in cancers, offering high specificity, lower toxicity than chemo, and effective combination therapy potential with immunotherapies. They work synergistically with other treatments like chemo, radiation, and immunotherapies like checkpoint inhibitors to improve outcomes. These peptides bind directly to cancer cell receptors, reducing damage to healthy cells and leading to fewer severe side effects, demonstrating clinical efficacy.

The peptide drug conjugates segment is anticipated to have the fastest growth with a CAGR of 9.2%. This is mainly because they combine peptides' precise targeting with potent drug delivery, offering better efficacy with fewer side effects than traditional chemo. This growth is further fostered by advances in peptide engineering, increasing cancer cases, and strong clinical pipelines, with companies heavily investing in these next-gen therapies. Accelerated approvals and designations (like orphan drug) from the FDA and EMA boost industry confidence.

Indication Insights

What Made the Prostate & Breast Segment Dominate the Peptide-Based Cancer Therapeutics Market in 2025?

The prostate & breast segment dominated with 62% share in the peptide-based cancer therapeutics market during 2025. This dominance is mainly driven by high prevalence, strong research into tumor-specific targets, and success in personalized immunotherapy, leveraging peptides for fewer side effects. Prostate-specific membrane antigen (PSMA) is highly overexpressed, making PSMA-targeted radioligand therapies highly effective for both diagnosis and treatment. IL-4R is a promising target, with peptides like IL4RPep-1 enhancing nanoparticle delivery to tumors and tumor-associated macrophages.

The neuroendocrine/GI segment is expected to experience the fastest growth with a CAGR of 9.3%. This is mainly due to the success and increasing approvals of peptide-based drugs for gastroenteropancreatic neuroendocrine tumors. Peptide hormone analogues effectively target somatostatin receptors overexpressed on NETs, inhibiting hormone secretion and tumor growth, making them a cornerstone treatment. Integrating peptide therapies with traditional treatments like chemotherapy and checkpoint inhibitors shows promise for better patient outcomes.

Line of Therapy Insights

How Will the 2L/3L Segment Lead the Peptide-Based Cancer Therapeutics Market in 2025?

The 2L/3L segment held the largest market share of 58.0% in 2025. This is mainly due to cancers often becoming resistant to standard 1L therapies, creating a strong need for novel approaches in 2L/3L. Peptides also offer high specificity, targeting cancer cells directly with less collateral damage than traditional chemo, appealing for advanced stages where patients are more vulnerable. Thus, advances in peptide engineering and delivery systems enhance stability and tissue targeting, making them effective even in difficult-to-treat cancers.

The 1L segment is anticipated to have the fastest growth with a CAGR of 9.5% in the peptide-based cancer therapeutics market. This is mainly because peptides offer high specificity, low toxicity, and enhanced drug delivery, making them ideal for early-stage, personalized cancer treatment. Additionally, their ability to disrupt key cancer pathways and overcome drug resistance makes them effective in initial treatment phases, improving overall survival. Advances in peptide chemistry and drug delivery improve stability and absorption, making them viable for early-stage use.

Regional Insights

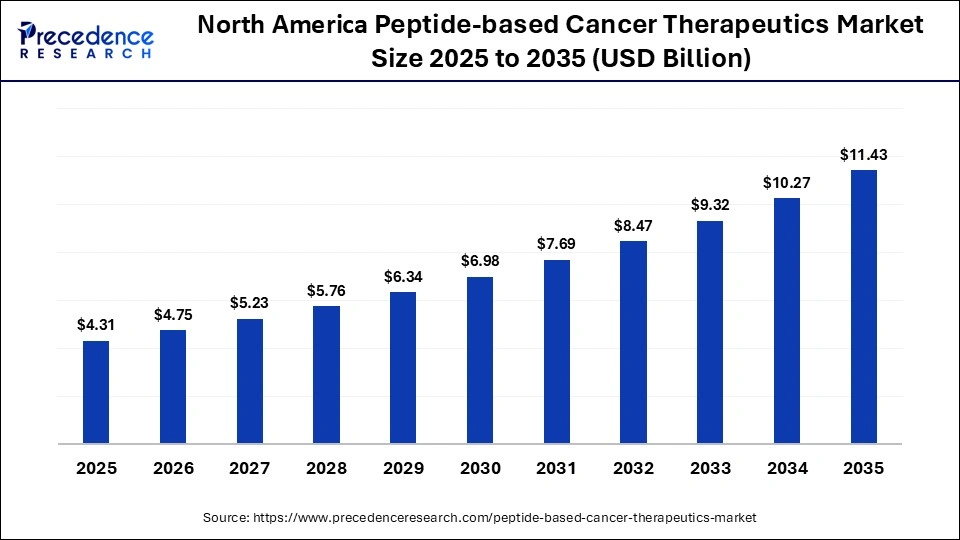

How Big is the North America Peptide-Based Cancer Therapeutics Market Size?

The North America peptide-based cancer therapeutics market size is estimated at USD 4.31 billion in 2025 and is projected to reach approximately USD 11.43 billion by 2035, with a 10.24 % CAGR from 2026 to 2035.

How Did North America Dominate the Peptide-Based Cancer Therapeutics Market in 2025?

North America accounted for 45.5% of the market share in 2025. This is mainly due to substantial R&D investment, advanced healthcare infrastructure, supportive regulatory policies, and a high prevalence of cancer. Agencies like the U.S. FDA provide supportive regulatory pathways, including fast-track and breakthrough therapy designations, which accelerate market entry for promising cancer treatments. This investment fuels the discovery and development of novel peptide drug candidates and advanced technologies focusing on personalized and precision medicine, aligning well with the high specificity of peptide-based therapies.

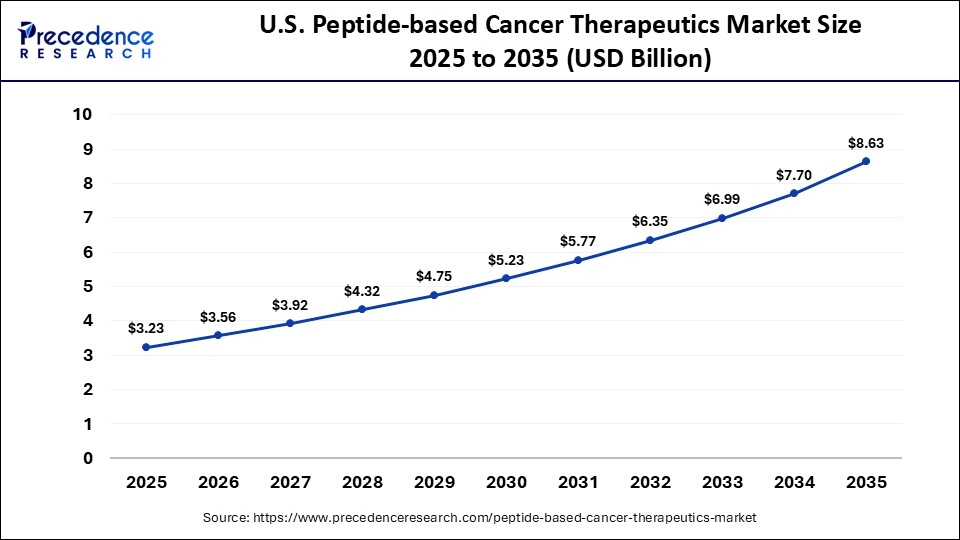

What is the Size of the U.S. Peptide-Based Cancer Therapeutics Market?

The U.S. peptide-based cancer therapeutics market size is calculated at USD 3.23 billion in 2025 and is expected to reach nearly USD 8.63 billion in 2035, accelerating at a strong CAGR of 10.33% between 2026 and 2035.

U.S. Peptide-based Cancer Therapeutics Market Trends

The U.S. plays a dominant role within peptide-based cancer therapeutics market for peptide-based cancer therapeutics This is mainly due to advanced healthcare, high R&D investment, and a strong biopharma industry. Additionally, it is home to major biotech firms and research institutions pioneering new peptide therapies, including peptide-based vesicles for immunotherapy. Favorable FDA support, streamlined approval pathways, and robust clinical trial infrastructure accelerate innovation. High concentration of comprehensive cancer centers and academic hospitals is supporting early-phase translational research and rapid enrollment into peptide-focused oncology trials. Strong venture capital participation and public research funding are enabling scale-up of peptide synthesis, formulation, and delivery technologies. In parallel, growing adoption of precision oncology approaches is reinforcing clinical demand for targeted peptide-based cancer therapeutics across the U.S. healthcare system.

How Will Asia Pacific Be Considered the Fastest-Growing Region in the Peptide-Based Cancer Therapeutics Market in 2025?

Asia Pacific region is anticipated to have the fastest growth with a CAGR of 10.5% in the peptide-based cancer therapeutics market. This is mainly due to the increasing prevalence of cancer, increasing healthcare expenditure and awareness, and significant advancements in local biopharmaceutical R&D and manufacturing capabilities. Economic development has led to increased healthcare spending by governments and private entities, improving access to advanced, specialty treatments like peptide-based cancer drugs across countries like China, India, and South Korea, making them more attractive options.

India Peptide-based Cancer Therapeutics Market Trends

India is an emerging peptide-based cancer therapeutics market, mainly due to a large patient base and rising healthcare spending, focusing on novel therapies along with moving from generic manufacturing to developing innovative, patient-centric peptide drugs, a relatively untapped area. Companies like Shilpa Medicare and Granules India are expanding peptide capabilities, focusing on oncology and global supply chains. Increasing government support for pharmaceutical innovation and clinical research is strengthening domestic development of peptide-based oncology candidates. Expansion of contract development and manufacturing organizations is improving local capacity for peptide synthesis, formulation, and scale-up to international quality standards. In parallel, growing collaboration between academic research institutes, hospitals, and biopharma companies is accelerating early-stage clinical evaluation and translational research in peptide-based cancer therapies across India.

Peptide-based Cancer Therapeutics Market Value Chain Analysis

- Research and Development

This focuses on the discovery and design of novel peptides with anti-cancer activities to assess safety and efficacy in lab and animal models.

Key Players: Novartis, Pfizer, AstraZeneca, Eli Lilly, Merck & Co., IQVIA, and Charles River Laboratories.

- Clinical Trials and Regulatory Approval

This involves rigorous human trials to prove the drug's safety and efficacy for specific cancer types, followed by extensive data submission and approval from regulatory bodies.

Key Players: Pfizer, Novartis, Eli Lilly, and Bristol-Myers Squibb.

- Manufacturing

This involves a complex and cost-intensive process involving either chemical synthesis or biological production methods.

Key Players: Lonza, Catalent, Bachem AG, PolyPeptide Group, Corden Pharma, and FUJIFILM Diosynth Biotechnologies.

- Logistics and Patient Delivery

This involves the specialized storage and transport of the often high-value and sensitive therapies.

Key Players: DHL Group, FedEx Logistics, UPS Healthcare, and Marken.

- Treatment and Commercialization

This involves the commercial launch, marketing, and administration of the therapy to patients in certified treatment centers.

Key Players: Novartis, Roche, Pfizer, and AstraZeneca.

Who are the Major Players in the Global Peptide-based Cancer Therapeutics Market?

The major players in the peptide-based cancer therapeutics market include Novartis AG, Ipsen SA, AbbVie Inc. Amgen Inc., AstraZeneca PLC, Bristol Myers Squibb Company (BMS), Takeda Pharmaceutical Company Ltd, Merck & Co., Inc., Roche Holding AG, Eli Lilly and Company, Pfizer Inc., BioNTech SE, Moderna, Inc., Sellas Life Sciences Group, Inc., BrightPath Biotherapeutics Co., Ltd.

Recent Developments

- In October 2025, Hanmi Pharmaceutical revealed its Selective EP300 Degrader at a major oncology conference, exciting interest in its innovative approach to cancer treatment. This anticancer candidate was developed using Hanmi's Targeted Protein Degradation (TPD) platform, selectively inducing cell death in EP300-dependent or CBP-mutant cancer cells through synthetic lethality.(Source:https://www.hanmipharm.com)

- In January 2025, Pepticom completed a $6.6 million Series A1 funding round to advance its oral IL-17 inhibitor program for autoimmune diseases. The funding will facilitate the design of synthetic peptidomimetic inhibitors with nanomolar activity targeting IL-17A and IL-17F, aiming to improve treatments for psoriasis and psoriatic arthritis. CEO Immanuel Lerner emphasized the transformative impact of their AI-driven approach on peptide drug discovery.(Source:https://www.prnewswire.com)

- In April 2025, Cyprumed GmbH and MSD entered a Non-Exclusive License Agreement for developing oral peptide formulations using Cyprumed's drug delivery technology. This partnership signifies a major advancement in peptide therapeutics, with potential for exclusive licensing on individual targets, according to Cyprumed's CEO, Florian Föger.(Source:https://www.cyprumed.net)

Segments Covered in the Report

By Class

- Peptide Hormone Analogues

- PeptideDrug Conjugates

- Vaccines / Others

By Indication

- Prostate & Breast

- Neuroendocrine/GI

- Melanoma / Others

By Line of Therapy

- 2L/3L

- 1L

- Adjuvant / Others

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting