What is Personal Consumer Electronics Market Size?

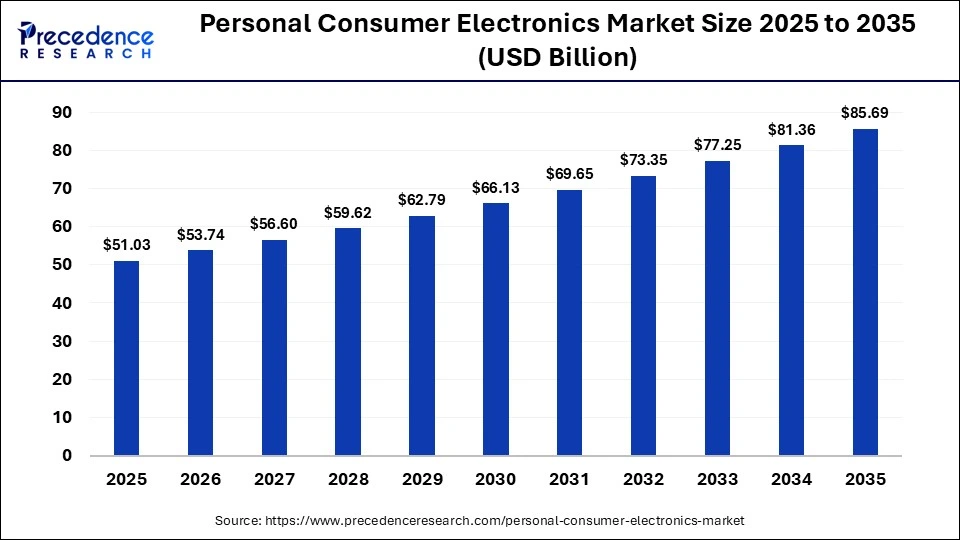

The global personal consumer electronics market size is calculated at USD 51.03billion in 2025 and is predicted to increase from USD 53.74 billion in 2026 to approximately USD 85.69 billion by 2035, expanding at a CAGR of 5.32% from 2026 to 2035. The personal consumer electronics market is experiencing unprecedented growth, driven by increasing adoption of personal consumer electronics and rapid innovation in mobile and smart technologies.

Market Highlights

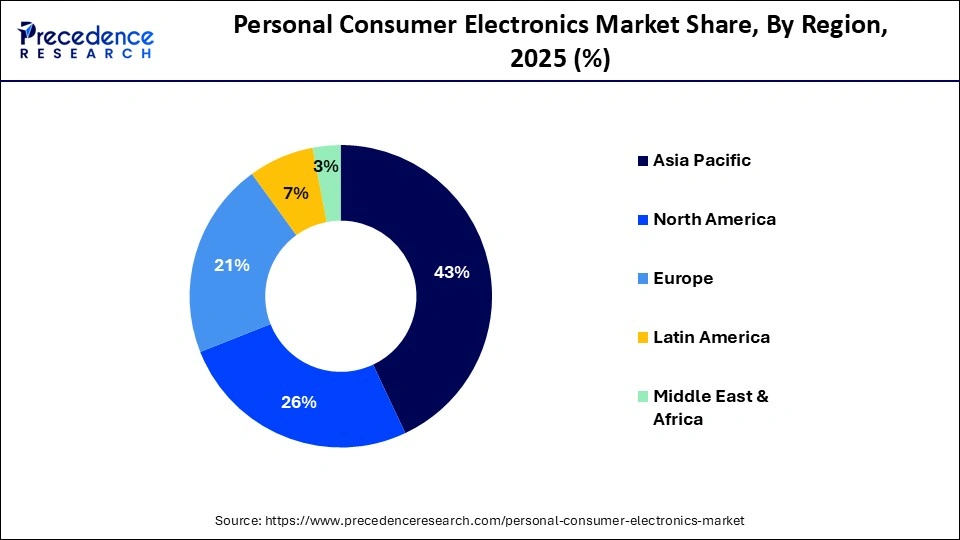

- Asia-Pacific dominated the market, holding the largest market share of approximately 43% in 2025.

- North America is expected to expand at the fastest CAGR between 2026 and 2035.

- By product type, the smartphones segment held the largest market share of approximately 43% in 2025.

- By product type, the wearables segment is expected to grow at a remarkable CAGR of 6.4% between 2026 and 2035.

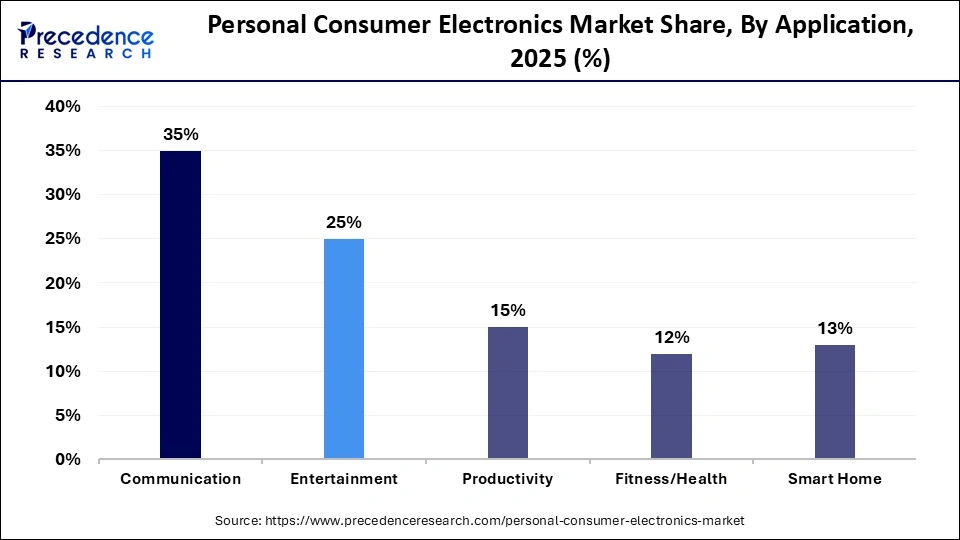

- By application, the communication segment contributed the biggest market share of in 35% in 2025.

- By application, the fitness/health segment is set to grow at a notable CAGR of 6.4% between 2026 and 2035.

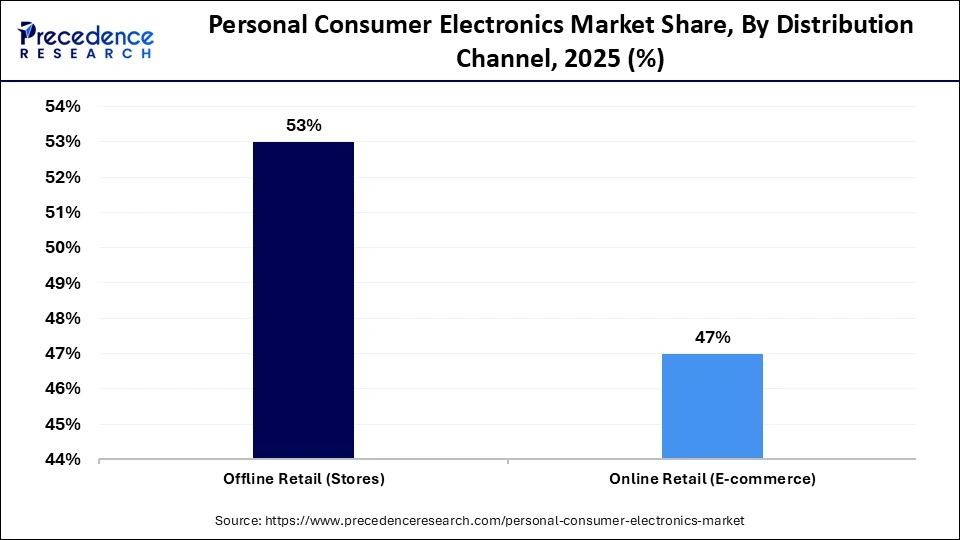

- By distribution channel, the offline retail (stores) segment accounted for the largest market share of 53% in 2025.

- By distribution channel, the online retail (e-commerce) segment is expected to experience a remarkable growth of 6.5% CAGR between 2026 and 2035.

What comes under the personal consumer electronics market?

The market encompasses electronic devices designed for individual use, including smartphones, wearables, laptops, tablets, headphones, and related personal gadgets. Personal consumer electronics have become indispensable components of daily life. These technologies have transformed human lives from basic lifestyles to modern lifestyles. These products enhance communication, entertainment, productivity, fitness, and smart living through 5G, IoT, augmented reality, VR, and AI & ML technology integration. The continuous growth of personal consumer electronics is reshaping human lives with better involvement of advanced technologies, leading to innovations and opportunities.

What are the emerging trends in the personal consumer electronics market?

- The rising digital adoption and increasing internet access (5G networks) are anticipated to accelerate the growth of the market during the forecast period.

- Digitalization enables smart features and seamless experiences, which increase the adoption of IoT devices, smart assistants, and connected home appliances.

- The rapid urbanization, rising disposable incomes, and growing need for convenience are expected to create significant growth opportunities for the prescription weight loss medications market during the forecast period.

- The expanding online/offline retail channels are anticipated to promote the market's growth during the forecast period.

- The growing demand for smart, connected devices like smartphones, wearables, smart home tech, and AI-integrated gadgets is expected to contribute to the overall growth of the personal consumer electronics market.

- The rapid economic growth in emerging nations and supportive government digital initiatives are bolstering the market's expansion in the coming years.

- The evolving consumer lifestyles, like remote work, virtual learning, and health consciousness, are likely to spur the demand for personal consumer electronics like laptops, smartphones, wearables, and telehealth devices.

How is AI impacting the growth of the personal consumer electronics market?

In today's interconnected world, the integration of Artificial Intelligence (AI) is accelerating the growth of the personal consumer electronics industry. Incorporating artificial intelligence (AI) into consumer electronics is significantly transforming everyday experiences, from simplifying household tasks to enhancing personal health management. AI technology promises to enrich human lives by transforming the human experience. The integration of machine learning (ML), deep learning (DL), and reinforcement learning (RL) allows devices to process and interpret massive amounts of data quickly and accurately. Therefore, the integration of AI in consumer electronics enhances convenience and transforms the interaction with technology daily.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 51.03 Billion |

| Market Size in 2026 | USD 53.74 Billion |

| Market Size by 2035 | USD 85.69 Billion |

| Market Growth Rate from 2026 to 2035 | CAGR of 11.24% |

| Dominating Region | Asia-Pacific |

| Fastest Growing Region | North America |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | Product tType, Application Insights,Distribution Channel Insights,Distribution Channel Insights, and region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Segmental Insights

Product type Insights

What causes the smartphones segment to dominate the personal consumer electronics market?

Smartphones

The smartphones segment held the largest market share of approximately 40–45% in 2025. Smartphones remain the dominant category in the market. Smartphones provide users with various benefits such as portability, convenience, and ease of use. The segment's growth is supported by the increasing spending on electronics, increasing internet penetration, and supportive government digital initiatives. Moreover, the rapid technological innovation in display tech, AI features, IoT, and premiumization is increasing the adoption of smartphones.

Wearables

On the other hand, the wearables segment is expected to grow at a remarkable CAGR of 6.4% between 2026 and 2035. The wearables include smartwatches, fitness trackers, smart rings, and smart clothing. The segment's growth is primarily driven by the rising consumer spending, particularly in both developed and emerging markets, and increasing consumer preference for connected lifestyles and health-centric features.

Application Insights

Which segment is dominated by the application in the personal consumer electronics market?

Communication

The communication segment is dominating the market by holding a majority share of approximately 35%. The segment strongly focuses on devices like smartphones, wearables, portable audio, tablets/laptops, and smart home devices for seamless interaction through calls and messaging. Moreover, the technological advancements, including AI and IoT, enhance device capabilities, while 5G connectivity supports faster communication.

Fitness/Health

On the other hand, the fitness/health segment is the fastest-growing segment in the personal consumer electronics market, and the segment is set to grow at a notable CAGR of 6.4% between 2026 and 2035, owing to the rising consumer focus on health consciousness, better smartphone connectivity, and increasing technological integration (AI/IoT). The rising trend of health & wellness is leading to increasing adoption of smartwatches, trackers, and health apps that monitor various metrics like heart rate, activity, stress, sleep, and others.

Distribution Channel Insights

What has led the offline retail (stores) segment to dominate the personal consumer electronics market?

Offline Retail (Stores)

The offline retail (stores) segment is dominating the market with the largest market share of approximately 50–55% in 2025. Offline retail (stores) remains the crucial distribution channel that offers a broader reach for personal consumer electronics devices. Offline retail (stores) provides a tangible experience by allowing customers to touch, test, and compare products before purchasing high-value items. These platforms also offer personalized assistance that provides expert advice to enhance the shopping experience. Offline stores are often trusted by customers for repairs, returns, and better after-sales service, which boosts loyalty.

Online Retail (E-Commerce)

On the other hand, the online retail (e-commerce) segment is a rapidly growing segment in the personal consumer electronics market and is expected to experience remarkable growth of 6.5% between 2026 and 2035. The increasing consumer shift towards the convenience of e-commerce is making online retail (e-commerce) a popular distribution channel. The growth of the segment is primarily driven by urbanization, rising disposable incomes, a surge in internet penetration, and increasing smartphone adoption. E-commerce platforms offer a vast reach, wide accessibility, and enable companies to connect with a large customer base by leveraging digital platforms for sales. The strong presence of major online retailers like Amazon, Flipkart, and specialized e-commerce sites is boosting the sales of personal consumer electronics in developed and developing regions.

Regional Insights

Asia-Pacific Personal Consumer Electronics Market Size and Growth 2026 to 2035

The Asia-Pacific personal consumer electronics market size is calculated at USD 21.94 billion in 2025 and is predicted to increase from USD 23.11 billion in 2026 to approximately USD 37.28 billion by 2035, expanding at a CAGR of 5.44% from 2026 to 2035.

Asia-Pacific Personal Consumer Electronics Market Analysis

Asia-Pacific dominates the market, holding the majority of the revenue share of 40–45% in 2025. Countries like China, South Korea, and Japan are major hubs for the personal consumer electronics industry in the region. The growth of the region is driven by the rapid urbanization, high purchasing power, growing health consciousness, the growing demand for smart and connected devices, rising consumer focus on health & fitness tracking, rapid e-commerce growth, and rapid technological advancements (5G, AI, IoT). Additionally, supportive government policies and initiatives, such as the "Make in India" initiative, aim to boost the growth of the manufacturing hub and reduce import dependence.

For instance, in January 2025, Cellecor Gadgets Private Limited, one of India's fastest-growing consumer electronics brands, announced its partnership with Zetwerk, a leading player in electronics manufacturing, to produce an advanced range of Google TV, QLED, and Mini LED Smart TVs. This collaboration aligns with Cellecor's vision of providing innovative, reliable, and technologically superior products that cater to the evolving needs of Indian households. Through this partnership, Cellecor reinforces its commitment to the "Make in India" initiative, strengthening local manufacturing while delivering high-quality consumer electronics.

According to the article published by Press Information Bureau (PIB), in January 2026, the Ministry of Electronics and Information Technology (MeitY) approved 22 proposals under the Electronics Components Manufacturing Scheme (ECMS) with a projected investment of INR 41,863 crore, projected production of INR 2,58,152 crore. These approvals are expected to generate 33,791 direct employment opportunities.

China's Personal Consumer Electronics Market Analysis

India leads the market. China is a major contributor to the market in the Asia Pacific region. The country holds a substantial market share in the market. The growth is largely driven by the strong presence of domestic brands, rapid expansion of online retail, growing consumer demand for personalized experiences, and rising disposable incomes. The rapid technological adoption, especially AI, IoT, and 5G, is anticipated to propel the demand for smartphones, smart home devices, wearables, laptops, tablets, and high-performance gadgets. In addition, favorable government initiatives focused on boosting domestic production, which reduces reliance on foreign countries and mitigates geopolitical risks, with rising efforts to build global leadership in innovative technology.

North America Personal Consumer Electronics Market Analysis

North America is the fastest-growing region in the market. The growth of the region is attributed to the early adoption of technology such as AI & IoT, growing consumer demand for personal consumer electronics, the rise of telemedicine & remote monitoring, rising awareness of personal health, and increasing popularity of connected devices. AI & IoT integration enables a smarter, personalized, and seamless experience in smart devices. The rapid technological integration is driving the demand for smartwatches, trackers, and health apps that offer personalized insights. Additionally, the supportive government framework and an increasing focus on innovation in connected health devices by key players like Apple, Fitbit, and others.

The U.S. Personal Consumer Electronics Market Analysis

The country is experiencing significant growth. The market growth is supported by the strong technological innovation, the rising trend of remote work and online education, high consumer disposable income, the increasing focus on preventative wellness, and rapid e-commerce growth. U.S. consumers increasingly prefer premium, energy-efficient, and high-value products. The growing consumer demand for connectivity and smart devices has significantly increased the adoption of smartphones, laptops, tablets, televisions, wearables (smartwatches and fitness trackers), smart home devices, and gaming equipment in the country. These collective factors are anticipated to accelerate the country's growth during the forecast period.

Value Chain Analysis: Personal Consumer Electronics Market

- Consumer Goods

The personal consumer electronics value chain begins with consumer goods planning, analyzing lifestyle needs, pricing, regulations, and sustainability expectations to define product categories, target segments, and competitive positioning in global markets today.

Companies involved: Samsung, Apple, Xiaomi, Sony, LG.

- Product Conceptualization and Design

Product conceptualization and design translate user insights into specifications, industrial design, hardware architecture, software experience, prototyping, testing, and design-for-manufacturing decisions, ensuring usability, aesthetics, cost efficiency, and regulatory compliance with worldwide standards.

Companies involved: Apple, IDEO, Samsung Design, Google, Microsoft.

- Manufacturing and Assembly

Manufacturing and assembly involve component sourcing, semiconductor fabrication, printed circuit board assembly, final integration, quality inspections, automation, labor management, yield optimization, and scaling production across global facilities efficiently, cost-effectively, and consistently.

Companies involved: Foxconn, Pegatron, TSMC, Flex, Jabil.

- Branding and Packaging

Branding and packaging create market differentiation through visual identity, messaging, sustainability materials, regulatory labeling, unboxing experience, and promotional alignment, reinforcing brand trust, premium perception, and purchase decisions among consumers globally.

Companies involved: Apple, Samsung, Sony, LG, Panasonic.

- Retail Distribution (Online/Offline)

Retail distribution connects products to consumers via e-commerce platforms, brand stores, distributors, and retailers, managing logistics, inventory, pricing, promotions, omnichannel experiences, and last-mile delivery efficiency across regions, markets, and channels worldwide.

Companies involved: Amazon, Flipkart, Alibaba, Best Buy, and Reliance Digital.

Customer Support and Feedback Loop

Customer support and feedback loops provide installation help, troubleshooting, warranties, repairs, updates, and data-driven insights, feeding continuous improvement, product upgrades, service personalization, and long-term customer loyalty through analytics, surveys, and communities.

Companies involved: Apple Care, Samsung Care, Dell, HP, Lenovo.

- End-of-Life Management

End-of-life management addresses product returns, refurbishment, recycling, safe disposal, material recovery, regulatory compliance, and circular economy initiatives, reducing environmental impact while responsibly, sustainably, globally, today.

Companies involved: Umicore, Sims Recycling, Apple Recycling, Dell Reconnect.

Who are the Major Players in the Personal Consumer Electronics Market?

The major players in the personal consumer electronics market include Apple Inc., Samsung Electronics Co., Ltd., Sony Corporation, LG Electronics Inc., Panasonic Corporation, Xiaomi Corporation, Huawei Technologies Co., Ltd., Lenovo Group Limited, Dell Technologies Inc., HP Inc., Microsoft Corporation, Bose Corporation, Canon Inc., Fitbit (Google), and Philips Electronics

Recent Developments in the Market

- In January 2026, Samsung Electronics announced the launch of “Help Me Choose,” a digital tool designed to guide consumers in selecting the ideal laundry solution based on their individual needs and lifestyle preferences. With just a few clicks, the tool evaluates suitability across product types, including washers, dryers, washer & dryer sets, and all-in-one combos, empowering users to make smarter decisions based on real-time product recommendations. (Source:https://news.samsung.com)

- In December 2025, Tata Group and Intel Corporation announced a strategic alliance to explore a collaboration focused on consumer and enterprise hardware enablement, and semiconductor and systems manufacturing to support India's domestic semiconductor ecosystem. This collaboration marks a pivotal step towards developing an India-based geo-resilient electronics and semiconductor supply chain. (Source:https://www.tataelectronics.com)

Segments Covered in the Report:

By Product Type

- Smartphones

- Wearables

- Laptops

- Tablets

- Headphones/Audio Devices

- Others (Gaming Devices, Accessories)

By Application

- Communication

- Entertainment

- Productivity

- Fitness/Health

- Smart Home

By Distribution Channel

- Offline Retail (Stores)

- Online Retail (E-commerce)

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting