What is the PFAS Testing Market Size?

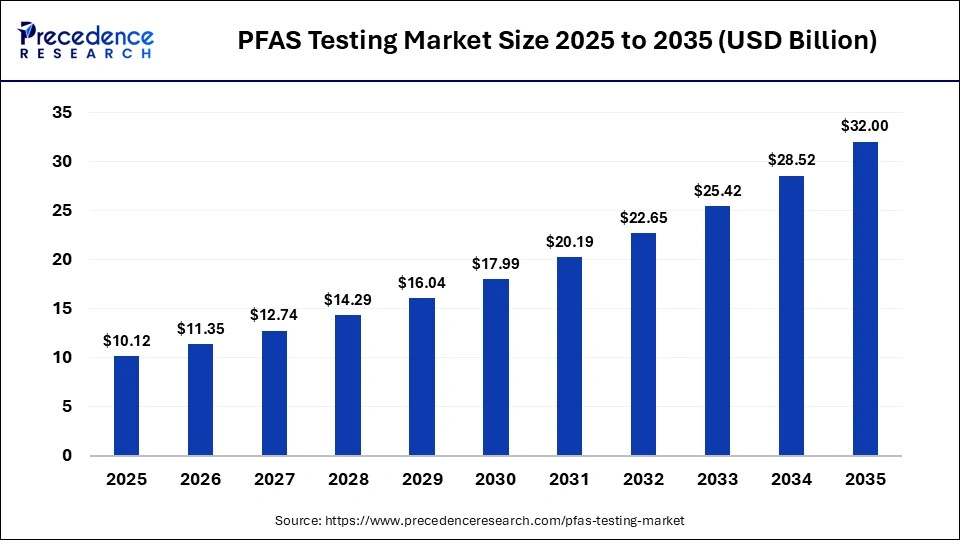

The global PFAS testing market size was calculated at USD 10.12 billion in 2025 and is predicted to increase from USD 11.35 billion in 2026 to approximately USD 32.00 billion by 2035, expanding at a CAGR of 12.2% from 2026 to 2035. The PFAS testing market is driven by rapid investment from market players in developing portable PFAS testing kits, alongside the increasing cases of environmental pollution in various parts of the world. Additionally, the surging adoption of laboratory-based testing by the agricultural companies, as well as technological advancements in the water testing sector, is playing a crucial role in shaping the industrial landscape.

Market Highlights

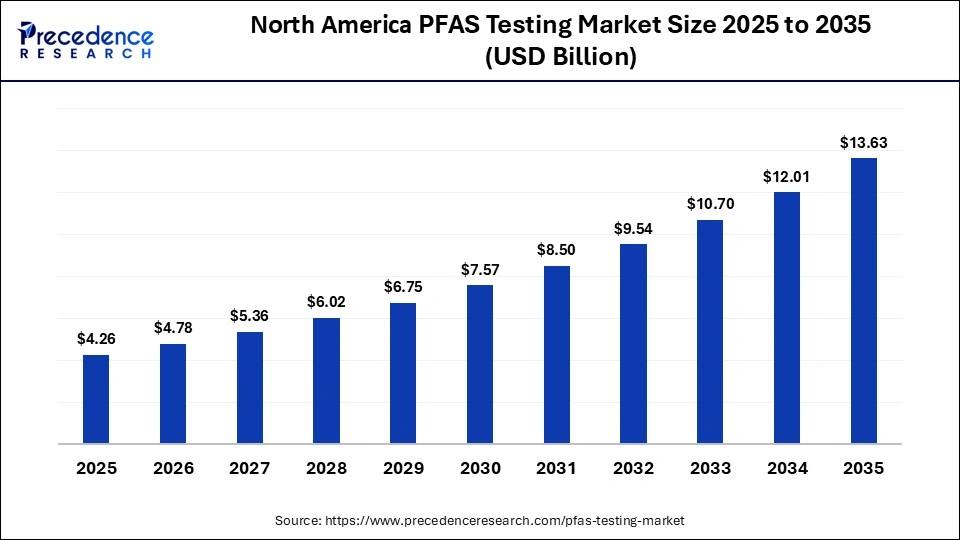

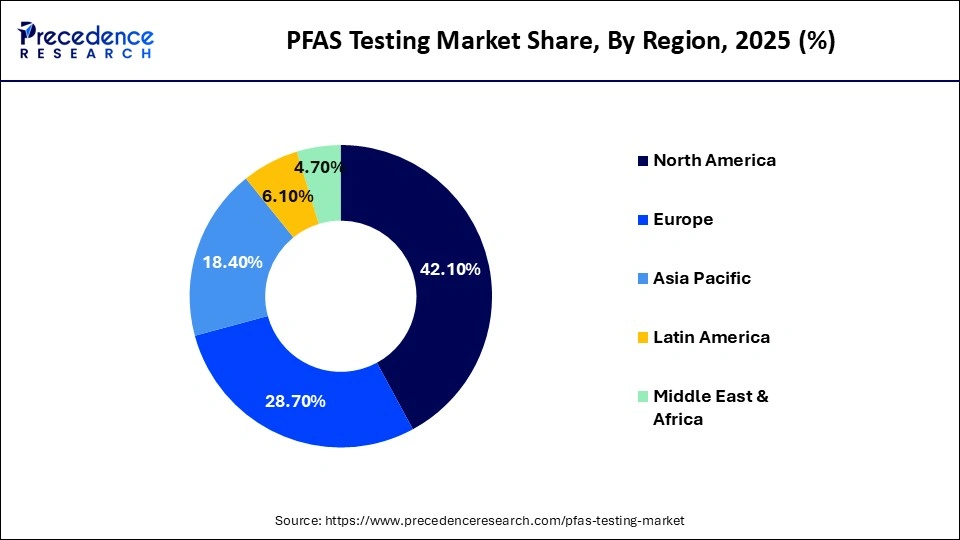

- North America dominated the PFAS testing market, holding a share of 42.10% in 2025.

- Asia Pacific is expected to expand with the highest CAGR of 12.70% during the forecast period.

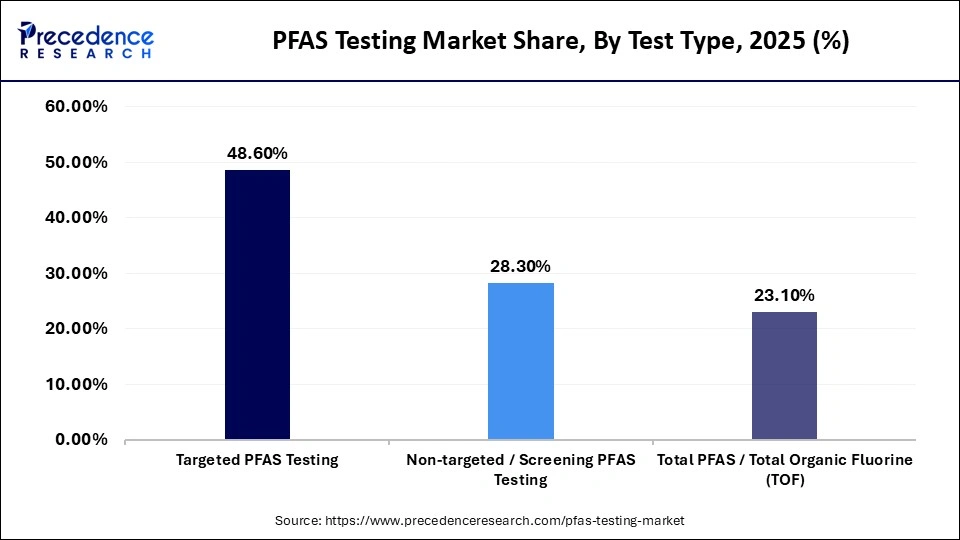

- By test type, the targeted PFAS testing segment held the largest market share, accounting for 48.60% in 2025.

- By test type, the total PFAS/total organic fluorine (TOF) testing segment is expected to grow at a remarkable CAGR of 12.40% between 2026 and 2035.

- By sample type, the water (drinking water, groundwater, wastewater) segment dominated the market with a share of 46.90% in 2025.

- By sample type, the biological samples (blood, serum) segment is expected to rise with a considerable CAGR of 12.10% during the forecast period.

- By technology, the liquid chromatography–mass spectrometry (LC-MS/MS) segment held the largest share with 55.20% of the market in 2025.

- By technology, the combustion ion chromatography segment is expected to grow with the highest CAGR of 12.90% between 2026 and 2035.

- By application, the drinking water quality monitoring segment held the largest share of 36.70% in the industry.

- By application, the human health & biomonitoring segment is expected to grow with the highest CAGR of 12.30% between 2026 and 2035.

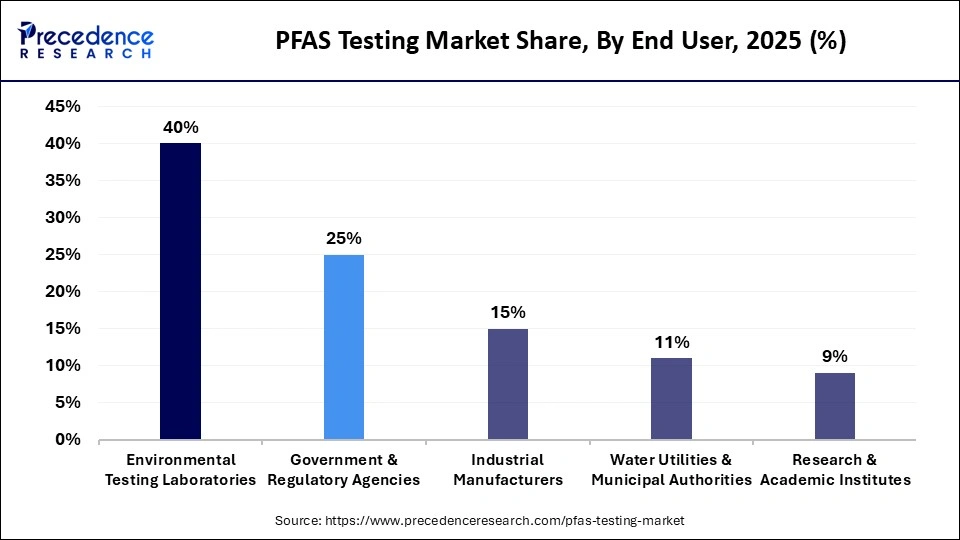

- By end user, the environmental testing laboratories segment dominated the PFAS testing market.

- By end user, the water utilities & municipal authorities segment is expected to expand with the fastest CAGR of 11.70% between 2026 and 2035.

What is PFAS Testing?

The PFAS testing market is an important branch of the chemical and environmental testing industry, focused on the development, validation, and deployment of analytical solutions for detecting per- and polyfluoroalkyl substances across multiple matrices. PFAS testing solutions are widely used to identify and quantify trace-level contamination in drinking water, groundwater, soil, food packaging, and personal care products using advanced techniques such as LC-MS/MS and high-resolution mass spectrometry. Market growth is driven by stringent government regulations on PFAS discharge and exposure limits, along with rapid investment by testing laboratories and service providers to expand certified testing capacity globally.

Rising implementation of national monitoring programs for drinking water and environmental remediation is increasing routine PFAS testing volumes. Growing scrutiny of PFAS use in cosmetics, textiles, and food-contact materials is expanding testing beyond environmental applications. In parallel, advancements in sample preparation, detection sensitivity, and multi-analyte testing methods are improving accuracy and throughput for large-scale compliance testing.

What is the Significance of AI in the PFAS Testing Market?

AI has played a prominent role in shaping the chemicals and analytical testing industry. In recent times, PFAS testing providers have started integrating AI into their solutions to predict the behavior of PFAS compounds under different pH conditions and to analyze complex datasets generated by mass spectrometry platforms. In addition, several technology companies are investing in advanced AI-enabled PFAS screening tools to improve detection accuracy and operational efficiency for end users.

AI-driven pattern recognition is improving identification of trace-level PFAS compounds within complex environmental and biological samples. Machine learning models are also accelerating method development by optimizing calibration, peak identification, and data interpretation. In parallel, AI-enabled automation is increasing laboratory throughput and reducing manual analysis time for large-scale PFAS monitoring programs.

- In June 2025, IBM launched an AI-powered PFAS screener tool. This screener tool is designed to eliminate and identify fluorochemicals from different media.

PFAS Testing Market Trends

- Partnerships: Numerous PFAS solution providers are partnering with defense forces to develop advanced PFAS solutions. For instance, in July 2025, Puraffinity partnered with the U.S. Army Corps of Engineers. This partnership is aimed at advancing research of Puratech G400 in the treatment of PFAS-contaminated waters.

- Opening of New Laboratories: The governments of several countries are investing rapidly in opening new food testing labs across the world. For instance, in March 2025, the Union Minister of State for Railways and Food Processing Industries, India, announced an investment of Rs 503.47 crores. This investment is made under the Pradhan Mantri Kisan Sampada Yojana (PMKSY) for opening 205 laboratories in India by 2026.

- Product Launches: Several market players are engaged in launching advanced PFAS testing solutions for the end-user industries. For instance, in April 2025, Arvia Technology launched Nyex Florenox. Nyex Florenox is an electrochemical oxidation reactor designed for destroying polyfluoroalkyl substances (PFAS) from concentrates.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 10.12Billion |

| Market Size in 2026 | USD 11.35 Billion |

| Market Size by 2035 | USD 32.00Billion |

| Market Growth Rate from 2026 to 2035 | CAGR of 12.2% |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | Test Type,Sample Type,Technology, Application, End User, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Segmental Insights

Test Type Insights

Why did the Targeted PFAS Testing Segment Dominate the PFAS Testing Market?

The targeted PFAS testing segment dominated the PFAS testing market, accounting for 48.60% in 2025, as the rising application of targeted PFAS testing in the environmental monitoring sector for detecting the quantity of pollutants in the air has boosted the market growth. Also, numerous advantages of targeted PFAS testing, including high sensitivity, quantitative accuracy, and cost-effectiveness, are expected to boost the growth of the PFAS testing industry.

The total PFAS/total organic fluorine (TOF) testing segment is expected to expand at a remarkable CAGR of 12.40% between 2026 and 2035, owing to the growing use of total organic fluorine (TOF) testing for detecting the presence or absence of Per- and Polyfluoroalkyl Substances (PFAS) in the textile industry, which has boosted the market expansion. Additionally, the rapid investment by the government for opening new TOF testing centers is expected to foster the growth of the PFAS testing market.

Sample Type Insights

What Made the Water (Drinking Water, Groundwater, Wastewater) Segment Lead the PFAS Testing Market?

The water (drinking water, groundwater, wastewater) segment leads the market with a share of 46.90% in 2025 because of the growing use of high-resolution mass spectrometry technology for testing the quality of drinking water has boosted the market expansion. Also, numerous government initiatives aimed at providing fresh water in rural areas are expected to drive the growth of the PFAS testing sector.

The biological samples (blood, serum) segment is expected to grow with a considerable CAGR of 12.10% during the forecast period. The rising focus of healthcare providers on opening new laboratories for testing blood samples has driven the market expansion. Additionally, the rapid investment by the government for integrating AI-based testing solutions in public laboratories is expected to foster the growth of the PFAS testing industry.

Technology Insights

Why Did the LC-MS/MS Segment Hold the Largest Share of the PFAS Testing Market in 2025?

The liquid chromatography–mass spectrometry (LC-MS/MS) segment held the largest share of the PFAS testing market with 55.20% in 2025. The increasing usage of liquid chromatography-mass spectrometry (LC-MS) for quantifying different compounds in food products has boosted the market expansion. Additionally, numerous advantages of liquid chromatography-mass spectrometry (LC-MS), such as high sensitivity, versatility, and specificity, are expected to drive the growth of the PFAS testing sector.

The combustion ion chromatography segment is expected to rise at the highest CAGR of 12.90% between 2026 and 2035. The surging application of combustion ion chromatography (C-IC) for analyzing the quantity of PFAS in the environment has boosted the market expansion. Also, several advantages of combustion ion chromatography, including high accuracy, advanced sensitivity, low contamination risk, and others, are expected to boost the growth of the PFAS testing industry.

Application Insights

What Made the Drinking Water Quality Monitoring Segment Lead the PFAS Testing Industry?

The drinking water quality monitoring segment leads the PFAS testing industry with a share of 36.70%, due to the growing emphasis of the governments in several nations to deliver drinking water to the rural population, which has boosted the market expansion. Also, the rising adoption of EPA Method 537.1 for checking the quality of drinking water is expected to accelerate the growth of the PFAS testing industry.

The human health & biomonitoring segment is expected to expand with the highest CAGR of 12.30% between 2026 and 2035, especially due to the rising application of screening PFAS testing for testing blood samples in human beings has boosted the market expansion. Also, several government initiatives aimed at deploying advanced technologies for enhancing biomonitoring capabilities are expected to propel the growth of the PFAS testing market.

End-User Insights

Why Did the Environmental Testing Laboratories Segment Hold the Largest Share of the PFAS Testing Market?

The environmental testing laboratories segment held the largest share of the PFAS testing market. The growing cases of environmental pollution in different parts of the world have increased the demand for advanced testing solutions, thereby driving the market expansion. Also, the rapid investment by the government for opening new environmental testing laboratories is expected to propel the growth of the PFAS testing industry.

The water utilities & municipal authorities segment is expected to grow with the highest CAGR of 11.70% during the forecast period. The growing investment by the municipal corporations in adopting advanced PFAS testing solutions for testing the quality of water has boosted the market expansion. Additionally, the growing use of total organic fluorine (TOF) testing solutions by the water utilities sector is expected to accelerate the growth of the PFAS testing market.

Regional Insights

How Big is the North America PFAS Testing Market Size?

The North America PFAS testing market size is estimated at USD 4.26 billion in 2025 and is projected to reach approximately USD 13.63 billion by 2035, with a 12.33% CAGR from 2026 to 2035.

Why Did North America Dominate the PFAS Testing Market in 2025?

North America dominated the PFAS testing market with a share of 42.10 % in 2025. The rise in the number of research laboratories across the U.S., Canada, and Mexico has boosted the market expansion. Also, numerous government initiatives aimed at developing the food and agricultural sector, as well as the rapid investment by the environmental agencies for opening new laboratories, are playing a prominent role in shaping the industrial landscape. Moreover, the presence of various market players such as Agilent Technologies, Pace Analytical Services, and Thermo Fisher Scientific is expected to accelerate the growth of the PFAS testing market in this region.

- In October 2025, Thermo Fisher Scientific launched the Thermo Scientific Orbitrap Exploris EFOX Mass Detector. This mass detector system is designed to remove polyfluoroalkyl substances (PFAS) from the environment and food products.

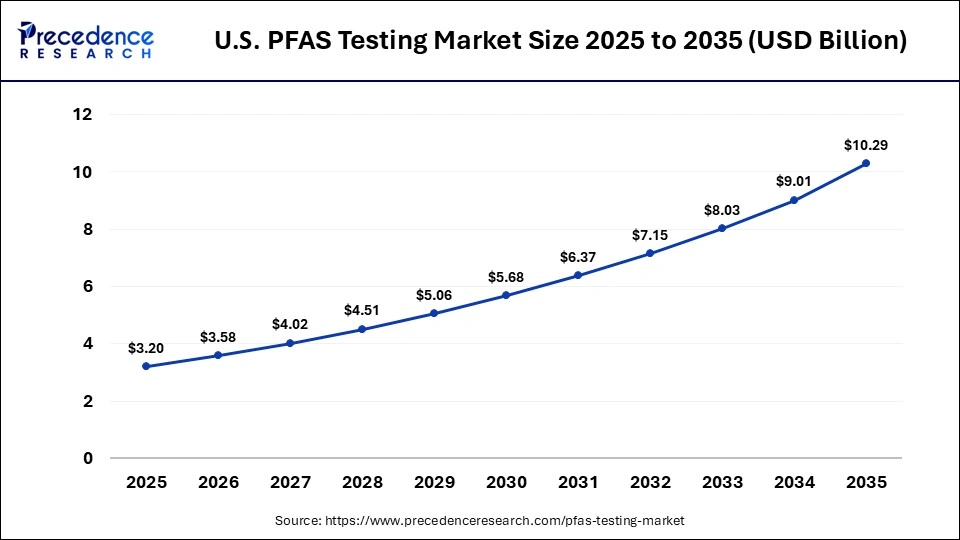

What is the Size of the U.S. PFAS Testing Market?

The U.S. PFAS testing market size is calculated at USD 3.20 billion in 2025 and is expected to reach nearly USD 10.29 billion in 2035, accelerating at a strong CAGR of 12.39% between 2026 and 2035.

U.S. PFAS Testing Market Analysis

The surging cases of food adulteration, as well as rapid government investment in establishing new analytical laboratories, have driven market growth. Additionally, rising demand for portable PFAS testing kits among field engineers, coupled with growing adoption of the total oxidizable precursor assay in environmental testing centers, is playing a crucial role in shaping the industrial landscape.

Tightening federal and state-level drinking water standards are increasing routine PFAS monitoring requirements for utilities and remediation projects. In parallel, expansion of certified laboratory capacity and method validation for low-ppt detection is strengthening nationwide compliance testing capabilities.

Why Is the Asia Pacific Growing With the Highest CAGR in the PFAS Testing Market?

Asia Pacific is expected to grow with the highest CAGR of 12.70% during the forecast period. The growing adoption of portable PFAS testing kits by agricultural companies in several countries, such as India, China, South Korea, and Japan, has boosted the market expansion. Also, the rapid investment by the government for deploying advanced testing solutions in the manufacturing sector, coupled with technological advancements in the industrial sector, is positively contributing to the industry. Moreover, the presence of several market players, such as HQTS, ALS Global, AWTA Product Testing, C&K Testing, and FARE Labs, is expected to propel the growth of the PFAS testing industry in this region.

- In April 2025, AWTA Product Testing announced the opening of a PFAS testing unit in China. This new PFAS testing unit was inaugurated in a joint venture of AWTA Product Testing with JinAo.

China PFAS Testing Market Trends

The surging focus of the government on delivering clean drinking water, coupled with rapid deployment of targeted PFAS testing by regulatory agencies, has driven market expansion. Moreover, rising investment by packaging manufacturers to integrate AI-based PFAS testing tools for assessing migration and material safety is positively impacting the industry.

Expansion of municipal water treatment upgrades is increasing routine PFAS screening across surface water and groundwater sources. Growth in domestic analytical instrument manufacturing is improving access to high-sensitivity LC-MS/MS systems for accredited laboratories. In parallel, tighter oversight of food-contact materials and export-oriented packaging is reinforcing sustained demand for standardized PFAS compliance testing across China.

Who are the Major Players in the Global PFAS Testing Market?

The major players in the PFAS testing market include Agilent Technologies, Inc., Thermo Fisher Scientific Inc., SGS S.A., LGC Limited, PerkinElmer, Inc., Intertek Group plc, Pace Analytical Services, Merck KGaA, Waters Corporation, Eurofins Scientific

Recent Developments

- In January 2026, DOD Technologies Inc. launched DOD Labs. DOD Labs is a new testing division designed for enhancing PFAS testing capabilities.(Source: https://eponline.com)

- In December 2025, Eurofins launched a new range of PFAS testing solutions. These testing solutions are designed to check the efficacy of medical devices.(Source: https://www.innovationnewsnetwork.com)

- In November 2025, Saur Group launched PFAS Resolve. PFAS Resolve is a high-performance solution designed for detecting PFAS in chemicals industry across the world.(Source: https://asianwater.com)

- In October 2025, Rice University launched an eco-friendly PFAS removal technology. This technology is designed in collaboration with South Korean institutions.(Source: https://www.innovationnewsnetwork.com)

Segments Covered in the Report

By Test Type

- Targeted PFAS Testing

- Non-targeted / Screening PFAS Testing

- Total PFAS / Total Organic Fluorine (TOF) Testing

By Sample Type

- Water (Drinking Water, Groundwater, Wastewater)

- Soil & Sediment

- Air

- Food & Packaging Materials

- Biological Samples (Blood, Serum)

By Technology

- Liquid Chromatography–Mass Spectrometry (LC-MS/MS)

- Gas Chromatography–Mass Spectrometry (GC-MS)

- Total Oxidizable Precursor (TOP) Assay

- Combustion Ion Chromatography

By Application

- Drinking Water Quality Monitoring

- Environmental Remediation & Site Assessment

- Food Safety & Packaging Compliance

- Industrial Emissions & Waste Monitoring

- Human Health & Biomonitoring

By End User

- Environmental Testing Laboratories

- Government & Regulatory Agencies

- Industrial Manufacturers

- Water Utilities & Municipal Authorities

- Research & Academic Institutes

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Tags

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting