What is the N-Heptane Market Size?

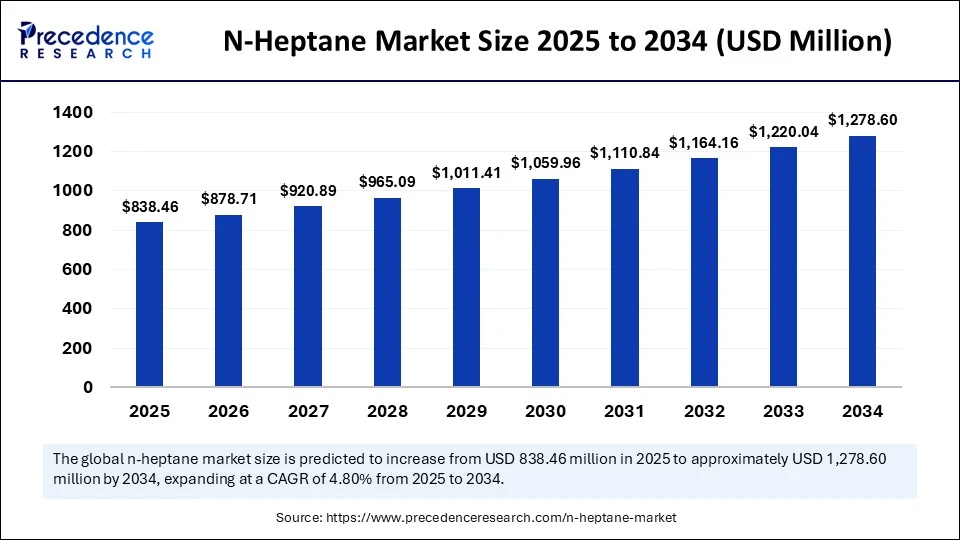

The global n-heptane market size is accounted at USD 838.46 million in 2025 and predicted to increase from USD 878.71 million in 2026 to approximately USD 1,278.60 million by 2034, expanding at a CAGR of 4.80% from 2025 to 2034. The demand for high-purity solvents has increased in the pharmaceutical, automotive, and electronics industries, driving the global market. The growing industrial reliance on n-heptane is fostering the market growth.

N-Heptane Market Key Takeaways

- In terms of revenue, the global n-heptane market was valued at USD 800.06 million in 2024.

- It is projected to reach USD 1,278.60 million by 2034.

- The market is expected to grow at a CAGR of 4.80% from 2025 to 2034.

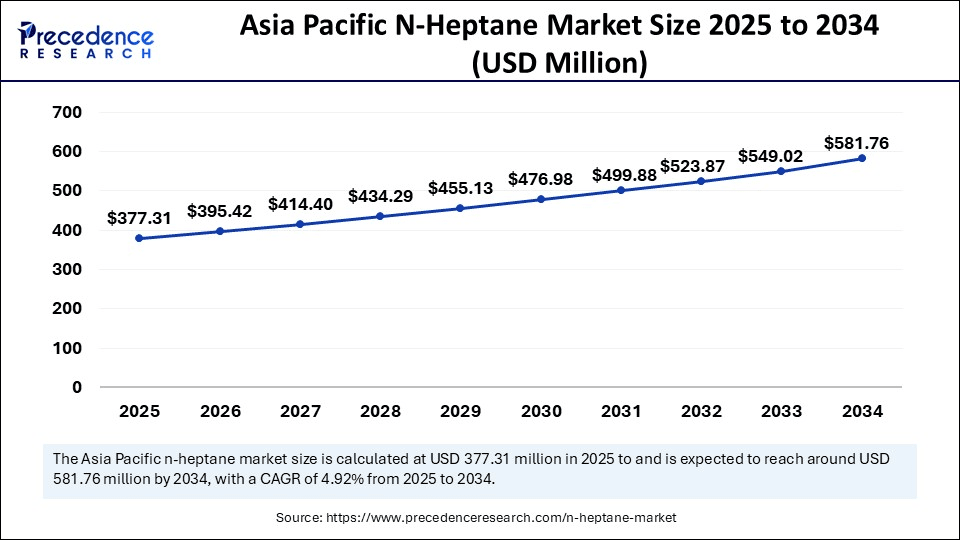

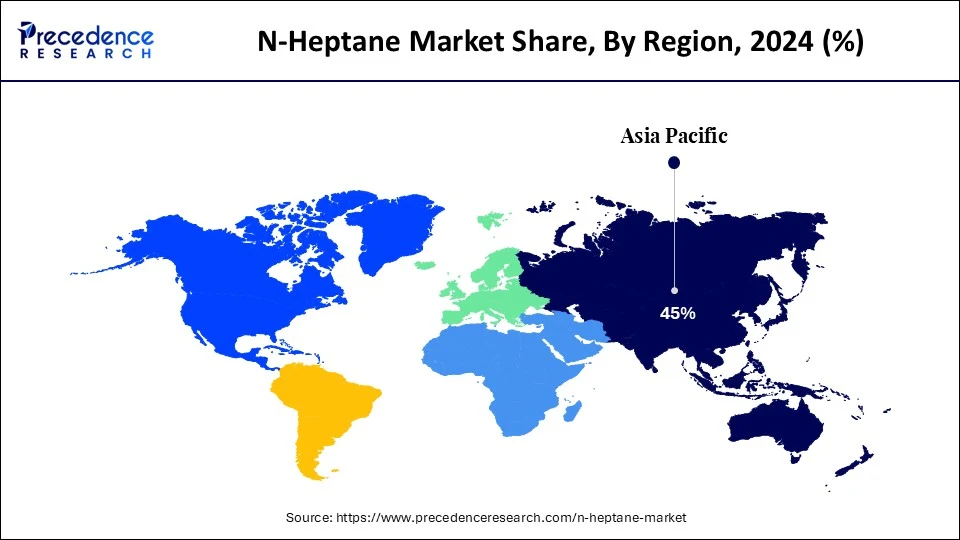

- Asia Pacific dominated the global n-heptane market with the largest share of 45% in 2024.

- North America is expected to grow at a significant CAGR from 2025 to 2034.

- Latin America is a notable player in the global market.

- By purity grade, the ≥99% (high purity/HPLC grade) segment captured the biggest market share of 42% in 2024.

- By purity grade, the <95% (technical/industrial grade) segment will grow at a CAGR between 2025 and 2034.

- By production method, the petroleum-based extraction segment contributed the highest market share of 76% in 2024 and is expected to grow fastest over the forecast period.

- By production method, the synthetic production segment is expected to grow at a notable CAGR between 2025 and 2034.

- By packaging type, the bulk (drums, IBCs) segment generated the major market share of 60% in 2024.

- By packaging type, the bottles & small containers segment will expand at a significant CAGR between 2025 and 2034.

- By application, the solvent segment held the largest market share of 38% in 2024.

- By application, the cleaning agent segment will grow at a considerable CAGR between 2025 and 2034.

- By end-use industry, the pharmaceuticals segment captured the maximum market share of 31% in 2024.

- By end-use industry, the paints & coatings segment will grow at a CAGR between 2025 and 2034.

- By distribution channel, the direct sales (manufacturers to industrial buyers) segment accounted for the remarkable market share of 65% in 2024.

- By distribution channel, the distributors/wholesalers segment will expand at a significant CAGR between 2025 and 2034.

How is Artificial Intelligence Transforming the N-Heptane Market?

Artificial Intelligenceis transforming the n-heptane by enhancing the optimization process, efficiency, and product quality. AI's role in streamlining applications like logistics, packaging, and labelling enhances supply chain distribution and accuracy. AI-powered tools help to reduce waste and production costs by enabling predictive maintenance and yield optimizations. AI-powered crystallization solvent system optimizations, like 2-MeTHF/n-heptane are enabling practical attribution in size and bulk density. Additionally, AI integration to enhance chemical processes on deposition and asphaltenes destabilization by using n-heptane, enhancing the process in oil & gas applications.

What is N-Heptane?

The n-heptane market refers to the global trade and industrial use of n-heptane, a straight-chain alkane hydrocarbon (C?H??) primarily used as a non-polar solvent in a variety of industries includingpharmaceuticals, paints & coatings, adhesives, rubber, and electronics. N-heptane is also used as a reference fuel in octane rating determination and combustion studies. Derived either from petroleum refining or through synthetic processes, it is preferred for its high purity, low reactivity, and volatility. The market is segmented by application, purity grade, production method, end-use industry, and region, reflecting its diverse industrial usage and global distribution dynamics.

Researchers are continually innovating n-heptane to advance its potential in combustion technologies like HCCI (Homogeneous Charge Compression Ignition). N-heptane has the potential to advance combustion technologies, particularly in fuels like ethanol. Additionally, the ongoing research for enhancing the role of n-heptane in biofuel and ammonia-based energy systems is bringing significant innovative opportunities for the market.

What Are the Key Trends of the N-Heptane Market?

- Pharmaceutical Adoption: The adoption of n-heptane has increased due to its growing use in the pharmaceutical industry for its complex role in high-purity solvents in drug discovery and manufacturing.

- Automotive Demand: The demand for n-heptane has increased in automotive applications, including fuel testing and calibration. The growing urbanization and industrialization are boosting the need for n-heptane in the automotive sector.

- Growing Chemical Synthesis: The growing research and development are driving the chemical synthesis, leading to an increased use of n-heptane due to its unique properties, like non-polar nature, to form reaction media and separate complex compounds.

- Adhesive and Coating Industry:The increased demand for high-quality and durable coatings and the expanding automotive industry have boosted demand for n-heptane in adhesive and coatings.

- Green Solvent Alternatives: The growing need for low-toxic solvents to meet strict environmental regulation requirements is driving demand for n-heptane for its green solvent alternative properties.

N-Heptane Market Outlook

- Industry Growth Overview: The N-Heptane market is expected to grow steadily throughout the period from 2025 to 2030, in part due to the increasing demand from end-use markets including pharmaceuticals, paints, adhesives, and laboratory applications. The demand is reinforced by an increasing demand for high-purity solvents and expansion of manufacturing or chemical designation in the African and North American regions.

- Sustainability Trends: Sustainability is pressing producers to adopt cleaner solvent technologies, lower toxicity formulations, and energy-efficient refining. Companies are seeking greener extraction and purification methods, given the expanding rules and regulations across Europe and developed Asian markets.

- Global Expansion: Leading participants have expanded their presence seemingly randomly across Southeast Asia, the Middle East, and Latin America for reasons including securing feedstock supply and expanding their capacity to serve high-growth end-uses. Several companies have expanded capacity near petrochemical clusters to maintain reliability in supplying feedstock.

Market scope

| Report Coverage | Details |

| Market Size by 2034 | USD 1,278.60 Million |

| Market Size in 2025 | USD 838.46 Million |

| Market Size in 2026 | USD 878.71 Million |

| Market Growth Rate from 2025 to 2034 | CAGR of 4.80% |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Purity Grade, Production Method, Packaging Type, Application, End-Use Industry, Distribution Channel, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and the Middle East & Africa |

Market Dynamics

Drivers

Advancements in Production Technologies

The advancements in production technologies of n-heptane enable higher efficiency and cost reduction. Technological advancements like refining methods and catalytic processes are playing a crucial role in meeting with demand for ultra-high purity solvents in industries like electronics, automotive, and pharmaceuticals. Advanced distillation and extraction methods are enabling efficient production of n-heptane. Additionally, the growing innovations in green chemistry and emission reduction technologies are enabling n-heptane production with more eco-friendly and sustainable practices.

Restraint

Regulatory Challenges

The environmental regulations on volatile organic compounds (VOCs) are the major restraint for the global n-heptane market. Rising environmental concerns have led to regulations to implement tighter restrictions on volatile organic compounds (VOCs), creating a barrier for n-heptane consumption. Additionally, the regulatory challenges and security in applications such as large-scale printing and paint formulation operations further hamper n-heptane due to its VOC emission.

Opportunity

Growing Focus on Sustainable Practices

The growing industrial focus on sustainable practices is fostering demand for greener solvents and the need to meet strict environmental regulatory requirements. Environmental regulations are driving developments in bio-based n-heptane food stop industries are investing heavily in research and development for innovations in the production process of n-heptane to reduce its environmental impact. The growing focus on sustainable practices is driving demand for green chemicals, unsustainable production methods like low-VOC n-heptane, and eco-friendly alternatives.

Purity Grade Insights

Why the ≥99% (High Purity/HPLC Grade) Segment Dominated the N-Heptane Market in 2024?

The ≥99% (high purity/HPLC grade) segment dominated the market in 2024, due to its increased adoption in pharmaceutical and electronic applications. The growing need for high-purity n-heptane solvents and extraction agents in drug manufacturing for high-quality control, for drug safety, and efficacy. Pharmaceuticals, electronics, and paint & coating are the largest adopters for the ≥99% (high purity/HPLC grade).

The <95% (technical/industrial grade) segment is growing rapidly due to its increased use in less strict purity requirement applications. The use of <95% (technical/industrial grade) is high in adhesive processes and some polymer applications. The expanding local manufacturing capabilities in emerging markets are driving the adoption of <95% (technical/industrial grade), where purity is not a strict factor.

Production Method Insights

Which Production Method Led the N-Heptane Market in 2024?

In 2024, the petroleum-based extraction segment led the market due to the high dependence of n-heptane on crude oil. The crude oil is a primary raw material for n-heptane. The extensive production capabilities and distribution network for the development of petroleum-based n-heptane and its wide availability contribute to the segment's growth. Additionally, the cost-effectiveness of petroleum-based n-hexane over bio-based alternatives drives accessibility for various industries.

The synthetic production segment is expected to grow fastest over the forecast period, due to increased use for high-purity and control in the production of n-heptane. The growing demand for high-purity n-heptane in pharmaceutical manufacturing processes, including API purification, extraction, and crystallization, drives demand for a synthetic production method. Additionally, ongoing research and development of advanced synthetic production are fueling the segment's growth.

Packaging Type Insights

Which Packaging Type Led the N-Heptane Market in 2024?

In 2024, the bulk (drums, IBCs) segment led the market, due to the ability of bulk (drums, IBCs) to efficiently handle a large volume of n-heptane. The bulk (drums, IBCs) offers high effectiveness and safety to meet with demands from various industries like paints & coatings, chemicals, and pharmaceuticals. The cost-effectiveness of bulk (drums, IBCs) enables efficient transportation and storage of n-heptane solvents.

The bottles & small containers segment is expected to grow fastest over the forecast period, due to its effective role in the packaging and distribution of n-heptane. The demand for solvents in drug formulation and synthesis is expanding in pharmaceutical manufacturing, driving the need for bottles & small containers packaging based on n-hexane. The demand for bottles & small containers packaging for n-heptane is high in industries like automotive, chemical industry, pharmaceutical, and paints & coatings sector.

Application Insights

What Made Solvent Dominate the N-Heptane Market in 2024?

The solvent segment dominated the market in 2024, due to increased adoption of high-quality solvents in industries like pharmaceutical, automotive, paint, and coating applications. Strict environmental regulations are driving emphasis on the adoption of eco-friendly alternatives like n-heptane solvents. Ongoing technological advancements are enhancing production methods and product specifications.

The cleaning agent segment is expected to grow fastest over the forecast period, due to increased demand for non-polar solvents in degreasing and cleaning. The growing demand for safer and more environmentally friendly cleaning solutions is driving the adoption of n-heptane. Additionally, the rising bio-based alternatives are driving the need for n-heptane in cleaning agents.

End-Use Industry Insights

Why the Pharmaceuticals Segment Dominated the N-Heptane Market in 2024?

The pharmaceuticals segment dominated the market in 2024, due to increased adoption of n-heptane in pharmaceutical applications. N-heptane plays a crucial role as a high-purity solvent in drug manufacturing, helping to ensure drug safety and purity. The rising use of n-heptane in various processes such as surge extraction, synthesis, and formulation processes contributes to the segment growth.

The paints & coatings segment is the fastest-growing segment in the market, driven by high demand for n-heptane solvent and thinner in paints & coatings applications. N-heptane plays a crucial role in achieving optimal drying times, uniform surface finishing, and compatibility with different resins for industrial and specialty coatings. The expanding construction and automotive industry is driving growth paints & coatings sector, leading to a boost adoption of n-heptane.

Distribution Channel Insights

What Made Direct Sales Lead the N-Heptane Market in 2024?

The direct sales (manufacturers to industrial buyers) segment led the market in 2024, due to the emphasis of manufacturers to build strong relationships with consumers and achieve high throughput. Direct sales (manufacturers to industrial buyers) enable manufacturers to achieve high profitability and offer customization and technical support to customers. The direct sale of n-heptane is significant in specialized applications like high-purity solvents and pharmaceuticals.

The distributors/wholesalers segment is expected to grow fastest over the forecast period, due to the crucial role of distributors/wholesalers in ensuring efficient and widespread distribution of n-heptane in various industries. Distributors/wholesalers help manufacturers to reduce the burden and ensure the availability of n-heptane for customers. The key role of distributors/wholesalers is to establish a network and infrastructure to reach customers in diverse geographic locations and meet their needs in the n-heptane market.

Regional Insights

Asia Pacific N-Heptane Market Size and Growth 2025 to 2034

The Asia Pacific n-heptane market size is exhibited at USD 377.31 million in 2025 and is projected to be worth around USD 581.76 million by 2034, growing at a CAGR of 4.92% from 2025 to 2034.

Asia Pacific N-Heptane Market

Asia Pacific dominates the global n-heptane market, driven by the region's rapid urbanization, industrialization, growing automotive sector, large-scale chemical manufacturing activities, and expanding pharmaceutical industry. The adoption of n-heptane is high in Asian industries, including plastics & polymers, automotive, and coatings & paintings. The economic growth in emerging countries like China, India, and Japan, and companies' investments in research and development, for product developments and extractions, are driving the need for n-heptane high-performance and high-quality solvents in the region.

China Market Trends

China is a major player in the regional market, contributing to growth due to the country's well-established pharmaceutical and automotive industries. Growing strategic partnerships among industrial players and a focus on supply chain enhancements are contributing to this growth.

India Markets Trends

India is a significant player in the region, with growth driven by increased demand for n-heptane in the chemical and pharmaceutical industry. The expanding energy sector and government initiatives in promoting clean energy practices are fuelling the adoption of n-heptane solvent in Indian industries.

- In February 2025, Madhya Pradesh unveiled the Madhya Pradesh Electricity Supply Code 2021 (fifth amendment) (ARG-1(II)(v) of 2025), which includes changes like updating the applicant definition to include individuals or groups who apply for an electric supply, like developers, property owners, and consumer groups. (Source: https://www.csis.org)

North America N-Heptane Market

North America is the fastest-growing region in the global market, driven by the region's robust automotive industry, well-established pharmaceutical sector, and growing demand for high-purity solvents. North America has experienced higher demand for n-heptane in industrial applications like cleaning and degreasing. The strong presence of key market players and focus on sustainable practices are fostering this growth.

U.S. Market Trends

The U.S. is a major player in the regional market, growth driven by the country's strong industrial base and robust research and development infrastructure. Prance of strict environmental regulation and focus on technological advancements like AI integration in the production process, driving innovation and developments in n-heptane solvent.

Latin America N-Heptane Market

Latin America is a notable player in the global market, contributing to growth due to rapid urbanization and increased construction activities in the region. The strong shift toward the use of eco-friendly alternatives and the rise in technological advancements have boosted the region's investments in research and development. Additionally, well-established infrastructure and expanding pharmaceutical and automotive manufacturing activities are driving the adoption of n-heptane in the region. Countries like Brazil and Mexico are leading the regional market due to increased industrial demand for n-heptane solvent and growing focus on sustainable solutions.

Why did Europe expand significantly in the N-Heptane market?

The N-Heptane Market in Europe expanded significantly as a result of stringent regulations on solvent purity combined with the increasing demand for N-Heptane from major end-use industries, including pharmaceuticals, coatings, and specialty chemicals. Europe has placed particular importance on an increased focus on cleaner production and sustainable refining practices, which has led to increased investment in the production of high-purity N-heptane. Additionally, the demand growth from several emerging applications, such as lab testing, automotive coatings, and chemical synthesis, has created newer opportunities for the N-Heptane market, particularly in Europe.

Germany N-Heptane Market Trends

The N-Heptane Market in Germany held the largest share in Europe due to its advanced and developed chemical industry, supported by advanced production technologies in the manufacture of N-Heptane. Strong demand from the end-use industries of pharmaceuticals, automotive coatings, and research and development laboratories kept demand for N-Heptane in Germany strong.

Germany has also spent heavily in the area of cleaner refining processes to meet strict EU safety and environmental standards. Furthermore, Germany has a strong capacity for export and continued innovation in the use of specialty solvents, which are contributing to Germany's position as the largest contributor in the region.

Why did the Middle East and Africa region show steady growth in the N-Heptane market?

The Middle East and Africa region demonstrated steady growth driven by robust petrochemical capabilities, ease of access to feedstock, and increased demand for industrial solvents. Countries such as Saudi Arabia and the U.A.E. expanded refining projects; hence, N-Heptane supply grew. The demand for N-Heptane increased in the region's coatings, adhesives, and automotive sectors. Opportunities for the chemical distributors occurred in export diversification, new industrial zones, and greater demand for high-purity solvents for lab and manufacturing.

Saudi Arabia N-Heptane Market Trends

Saudi Arabia was the largest player in the region based on the size of the petrochemical industry and strong refining capacity. Saudi Arabia was also able to produce high-quality solvents at an advantageous price for domestic and export use. Demand in the coatings, adhesives, and chemical processing industries kept the markets vibrant. Further investment in new technology in the refining industry and implementing more industrial zones, for instance, will likely enable Saudi Arabia to continue being the largest all-in-one provider in the Middle East & Africa N-Heptane Markets.

N-Heptane Market Companies

- ExxonMobil Chemical

- Shell Chemicals

- Chevron Phillips Chemical

- Merck KGaA

- Haltermann Carless

- Thermo Fisher Scientific

- DHC Solvent Chemie GmbH

- SK Geo Centric

- Heptane Chemicals Pvt. Ltd.

- Prasol Chemicals Pvt. Ltd.

- Triveni Chemicals

- Tokyo Chemical Industry Co., Ltd. (TCI)

- GFS Chemicals Inc.

- Spectrum Chemical Manufacturing Corp.

- Sasol Limited

- Honeywell International Inc.

- Loba Chemie Pvt. Ltd.

- FUJIFILM Wako Pure Chemical Corporation

- Central Drug House (CDH)

- Avantor, Inc.

Latest Announcements by Industry Leaders

ExxonMobil is preparing to upgrade its project in Singapore to enhance the base stock industry, with construction well underway at the site of the project. Companies' project sites involving high-pressure reactors at more than 52 meters, with some as tall as an 18-story building. "We're reinforcing our commitment to the industry by working hand in hand with our customers," said Khalid Ashraf, Venture Executive and Project Director for ExxonMobil Asia Pacific Pte. Ltd.(Source: https://www.exxonmobil.com)

Recent Development

- In September 2023, LyondellBasell demonstrated its commitment to sustainability with the launch of +LC (Low Carbon) solutions. These low-carbon solutions will use renewable, bio-based, and recycled feedstocks that empower our customers to reduce their Scope 3 GHG emissions.(Source: https://www.lyondellbasell.com)

- Starting from 2025, China officially revised the Tariff Code for n-heptane for international trade and customs declarations. The model demonstrated China's commitment to streamlining chemical import and export and enhancing tariff data accuracy. (Source:https://junyuanpetroleumgroup.com)

Segment Covered in the Report

By Purity Grade

- ≥99% (High Purity/HPLC Grade)

- 95–99% (Laboratory/Analytical Grade)

- <95% (Technical/Industrial Grade)

- Others

By Production Method

- Petroleum-based Extraction

- Synthetic Production

By Packaging Type

- Bulk (Drums, IBCs)

- Bottles & Small Containers

- Others (Tanker shipments, customised containers)

By Application

- Solvent

- Blending Agent

- Cleaning Agent

- Reference Fuel (Octane Testing)

- Chromatography Reagent

- Chemical Intermediate

- Others

By End-Use Industry

- Pharmaceuticals

- Paints & Coatings

- Adhesives & Sealants

- Rubber & Plastics

- Electronics & Semiconductors

- Research & Academic Laboratories

- Petrochemicals

- Others (Food labs, Cleaning chemicals)

By Distribution Channel

- Direct Sales (Manufacturers to Industrial Buyers)

- Distributors/Wholesalers

- E-commerce/Online Chemical Portals

- Others (Custom chemical suppliers)

By Region

- Asia Pacific

- North America

- Europe

- Latin America

- Middle East & Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting