What is the Heavy Metal Testing Market Size?

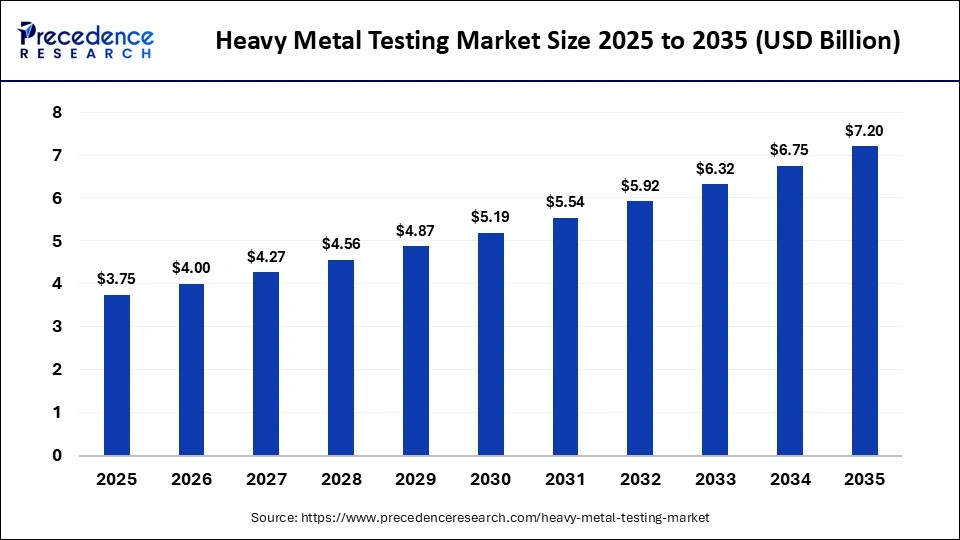

The global heavy metal testing market size accounted for USD 3.75 billion in 2025 and is predicted to increase from USD 4.00 billion in 2026 to approximately USD 7.20 billion by 2035, expanding at a CAGR of 6.75% from 2026 to 2035. The market is witnessing substantial growth driven by increasingly stringent environmental regulations, rising industrial pollution, and growing consumer awareness, with demand surging from food & beverage safety, water quality monitoring, and pharmaceutical quality control, supported by breakthroughs in ICP-MS and biosensor technologies enabling faster, more sensitive, and portable detection of toxic elements for better public health protection.

Market Highlights

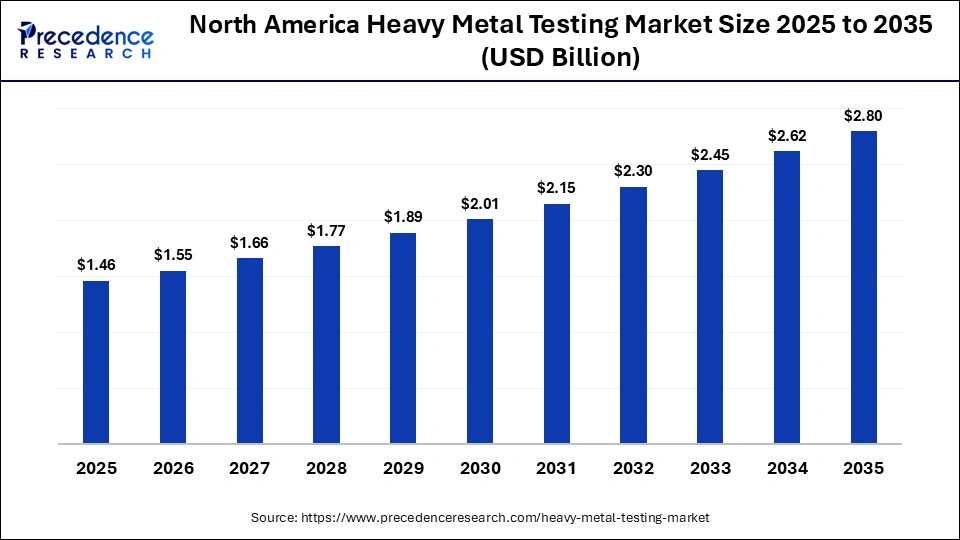

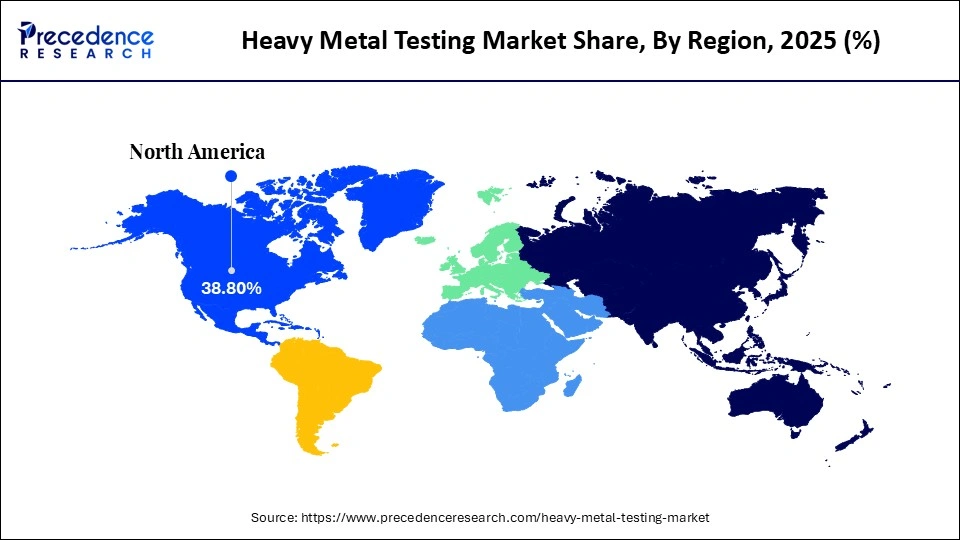

- North America accounted for the largest market share of 38.8% in 2025.

- The Asia Pacific is expected to grow at the fastest CAGR of 6.5% between 2026 and 2035.

- By type, the arsenic segment held a major share of 51.3% in 2025.

- By type, the mercury segment is growing at a solid CAGR of 5.5% from 2026 to 2035.

- By technology/method, the ICP-MS segment captured the biggest market share of 39.6% in 2025.

- By technology/method, the atomic absorption spectroscopy segment is poised to grow at a 5.8% CAGR from 2026 to 2035.

- By application, the food safety testing segment contributed the highest market share of 41.8% in 2025.

- By application, the environmental testing segment is growing at a CAGR of 5.6% from 2026 to 2035.

- By sample type, the food & beverages segment held the biggest market share of 45.4% in 2025.

- By sample type, the water segment is growing at a CAGR of 5.7% from 2026 to 2035.

- By end-user, the laboratories segment dominated with 40.4% market share in 2025.

- By end-user, the government segment is expected to witness the fastest CAGR of 5.8% from 2026 to 2035.

What is the Heavy Metal Testing and What Are Its Applications?

The heavy metal testing market comprises analytical services, instruments, and technologies used to detect and quantify toxic heavy metals such as arsenic, lead, mercury, and cadmium across environmental, food, water, clinical, and industrial samples. These testing solutions play a critical role in ensuring regulatory compliance, protecting public health, and maintaining environmental safety.

Advanced analytical techniques such as inductively coupled plasma mass spectrometry, atomic absorption spectroscopy, and X-ray fluorescence are widely used to deliver high sensitivity, accuracy, and trace-level detection. Testing is conducted across food and beverage supply chains, drinking water systems, soil and agricultural inputs, pharmaceuticals, cosmetics, and clinical diagnostics.

Market demand is driven by increasingly stringent global safety and environmental regulations, growing awareness of heavy metal contamination risks, and the expansion of routine testing programs. Rising concerns around food safety, water quality, occupational exposure, and long-term health impacts continue to support sustained growth of the heavy metal testing market worldwide.

How Is AI Influencing the Heavy Metal Testing Market?

Artificial intelligence plays a distinctive role in the heavy metal testing market by improving laboratory efficiency, analytical accuracy, and proactive contamination monitoring. AI-driven models optimize laboratory workflows by automating sample prioritization, instrument calibration checks, and data preprocessing, which reduces turnaround time and minimizes manual intervention across high-volume testing environments.

Machine learning algorithms enhance the sensitivity and selectivity of analytical methods and electrochemical sensors by identifying subtle signal patterns associated with specific heavy metals. This capability improves detection limits, reduces interference from complex sample matrices, and supports more reliable quantification at trace and ultra-trace levels, particularly in food, water, and environmental testing.

AI also enables predictive contamination assessment by analyzing historical testing data, geographic trends, and environmental variables to identify high-risk zones and anticipate potential contamination events. In large-scale laboratories, AI-driven optimization of testing parameters for multi-sample runs reduces operational costs, lowers error rates, and increases overall sample throughput, accelerating result delivery while maintaining regulatory-grade accuracy.

Heavy Metal Testing Market Outlook

- Industry Growth Overview: The market is expanding significantly from 2026 to 2035. This expansion is primarily driven by stricter government mandates for controlling heavy metals in the environment and especially food products, along with greater public awareness of metal toxicity from sources of emerging contaminants like microplastics and industrial waste.

- Integration of Advanced Technologies: This trend includes integration of AI and portable devices, increasing emphasis on supply chain transparency and sustainability, and a rise in demand driven by stricter government regulations and heightened consumer health awareness.

- Global Expansion: Rapid growth in Asia-Pacific and Latin America due to mining, water contamination, and increasing demand in North America, Europe, the Middle East, and Africa for environmental monitoring and consumer product safety, expanding the worldwide market.

- Major Investors: Many companies like Thermo Fisher Scientific, Agilent Technologies, PerkinElmer, Shimadzu, and Metrohm focus on expanding product portfolios and R&D for automation and miniaturization for AI-powered analysis and IoT-enabled sensors, along with continuous monitoring.

- Startup Ecosystem: Vibrant innovation in the developing field of portable devices, disposable sensors, and AI-powered data interpretation for faster, cheaper, and more accessible heavy metal screening for continuous monitoring.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 3.75 Billion |

| Market Size in 2026 | USD 4.00 Billion |

| Market Size by 2035 | USD 7.20 Billion |

| Market Growth Rate from 2026 to 2035 | CAGR of 6.75% |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | Type, Technology/Method, Application, Sample Type, End-User, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Segment Insights

Type Insights

What Made the Arsenic Segment Dominate the Heavy Metal Testing Market in 2025?

The Arsenic segment dominated with 51.3% in 2025, mainly due to the element's high toxicity, widespread presence in the environment, stringent global regulations, and its use across various industrial and consumer applications. Arsenic is classified as a Group 1 human carcinogen by the International Agency for Research on Cancer (IARC), necessitating rigorous testing to protect public health. Governments and regulatory bodies worldwide, such as the EPA and FDA, are continuously implementing and tightening strict maximum allowable limits for arsenic in critical areas like drinking water, food products, soil, and consumer goods.

This Mercury segment is anticipated to have the fastest growth with a CAGR of 5.5% during the forecasted period, due to strict regulations, rising consumer awareness of contamination, significant use in healthcare and electronics that require monitoring, and the need to test for its various forms in water, soil, and biological samples, driving demand for precise, advanced testing methods. Its unique properties and forms, plus the global trade emphasis on safety, make it a key focus in the expanding market. Innovations in spectroscopy and robotics allow for faster, more accurate detection in complex samples, expanding testing capabilities.

Technology/Method Insights

Why Did the ICP-MS Segment Lead the Heavy Metal Testing Market in 2025?

The ICP-MS segment led with 39.6% market share in 2025, due to its superior sensitivity, including ultra-low detection limits, the ability to test many elements, high throughput, and versatility across complex matrices like food, water, and pharma. ICP-MS offers lower detection limits (ppb/ppt levels) than traditional methods like AAS, which is crucial for meeting stringent regulatory limits for toxic metals like Pb, Cd, Hg, and As, allowing labs to process many samples quickly, which is essential for quality control, and pushing industries to adopt more sensitive ICP-MS technology.

The atomic absorption spectroscopy (AAS) segment is expected to have the fastest growth with a CAGR of 5.8%, due to its cost-effectiveness, simplicity, portability, and increasing integration with portable and automated systems, meeting demand in environmental monitoring and food safety. Additionally, innovations in portable AAS systems expand their use beyond traditional labs into environmental monitoring, including air, water, soil, and industrial settings, further boosting the demand for cost-effective testing solutions.

Application Insights

Why Did the Food Safety Testing Segment Dominate the Heavy Metal Testing Market in 2025?

The food safety testing segment dominated the heavy metal testing market with a 41.8% share in 2025, as stringent government regulations, rising consumer awareness of health risks, and the widespread potential for contamination throughout the food supply chain are gaining traction. There is increased awareness among consumers about the serious health hazards associated with heavy metal exposure, which can lead to chronic diseases, neurological damage, and developmental issues. Heavy metals can enter the food supply, necessitating rigorous testing at various stages to ensure safety across different regions with varying standards.

The environmental testing segment is expected to experience the fastest growth with a CAGR of 5.6%, due to the growing awareness about the health and environmental effects of arsenic, lead, and mercury, rising pollution from industry and agriculture, and high public health awareness of risks in drinking water, driving demand for reliable, tech-driven monitoring and ensuring compliance. Modern methods like ICP-MS offer faster, multi-element detection, and portable sensors enable on-site testing, boosting efficiency. Governments worldwide are enforcing stricter limits on heavy metals, compelling industries to test regularly.

Sample Type Insights

Why Did the Food & Beverages Segment Dominate the Heavy Metal Testing Market in 2025?

The food & beverages segment dominated with 45.4% market share in 2025. This is mainly due to stringent global regulations and heightened consumer awareness of health risks from metals like Arsenic, Lead, Cadmium, and Mercury, and contamination in staples like grains, seafood, and dairy, driving massive demand for consistent, accurate detection using technologies like ICP-MS for compliance and safety across the supply chain. Growing public concern over health impacts and organ damage further drives demand for safe food products, pushing brands to test, necessitating extensive and frequent testing.

The water segment is anticipated to have the fastest growth with a CAGR of 5.7%, due to rising industrialization contaminating water sources, and growing awareness of heavy metals like lead, mercury, and arsenic in drinking and irrigation water, driving demand for advanced testing like ICP-MS to ensure safety and compliance. This growth further spans municipal, agricultural, and wastewater sectors, with demand for rapid, accurate, and portable solutions increasing for both environmental protection and public health.

End-User Insights

Why did the Laboratories Segment Lead the Heavy Metal Testing Market in 2025?

The laboratories segment led with 40.4% in 2025, due to their specialized capabilities, the need for stringent regulatory compliance, and the high cost and complexity of the required analytical equipment. Regulatory bodies, such as the EPA and FDA, impose strict, legally mandated limits on heavy metals in food, water, soil, and pharmaceuticals. Compliance with these detailed, evolving standards requires certified and accredited laboratory analysis and reporting. The advanced analytical instruments and infrastructure required for comprehensive heavy metal testing involve significant investment and require specialized personnel to operate and maintain.

The government segment is anticipated to have the fastest growth with a CAGR of 5.8%, mainly because of stringent regulatory mandates, increased focus on public health and environmental safety, and growing awareness of health risks from contaminated water, food, and air. Additionally, governments worldwide are enacting stricter rules, such as EPA and WHO standards for heavy metal limits, along with agencies' focus on monitoring air, soil, and water quality to combat industrial pollution. Mandates for workplace health monitoring in industries with heavy metal exposure also drive government-related testing.

Regional Insights

How Big is the North America Heavy Metal Testing Market Size?

The North America heavy metal testing market size is estimated at USD 1.46 billion in 2025 and is projected to reach approximately USD 2.80 billion by 2035, with a 6.73% CAGR from 2026 to 2035.

What Made North America Dominate the Heavy Metal Testing Market in 2025?

North America held a dominant position in the market with a 38.8% share in 2025. This dominance is primarily attributed to stringent regulatory enforcement, advanced analytical infrastructure, and sustained institutional focus on health and environmental risk mitigation. In the United States, regulatory oversight by the U.S. Environmental Protection Agency and the Food and Drug Administration translates into legally binding testing requirements across multiple sample matrices, including drinking water, packaged food, pharmaceuticals, dietary supplements, cosmetics, and consumer goods. These requirements are not advisory in nature. They are embedded in enforceable frameworks such as the Safe Drinking Water Act, FDA action levels for toxic elements in foods, and pharmaceutical quality standards aligned with USP chapters on elemental impurities.

From an operational perspective, compliance obligations in North America drive routine and repeat testing rather than one-time certification. Municipal water utilities conduct scheduled heavy metal monitoring under EPA-mandated sampling cycles. Food and beverage manufacturers perform batch-level and supplier-level testing to meet FDA preventive controls. Pharmaceutical manufacturers integrate elemental impurity testing into quality control and release testing workflows under ICH Q3D-aligned practices enforced by the FDA. These mechanisms create structurally stable demand for high-sensitivity analytical services rather than discretionary testing spending.

The region's dominance is further reinforced by its laboratory ecosystem. North America hosts a dense concentration of accredited analytical laboratories equipped with inductively coupled plasma mass spectrometry, atomic absorption spectroscopy, and X-ray fluorescence platforms capable of detecting metals at parts-per-billion and parts-per-trillion thresholds. These laboratories operate under ISO and FDA-recognized quality systems, enabling legally defensible data generation for regulatory submissions, recalls, and enforcement actions. The availability of trained analytical chemists, method validation expertise, and inter-laboratory proficiency testing programs enhances result reliability and turnaround times, which is critical for industries operating under strict release schedules.

What is the Size of the U.S. Heavy Metal Testing Market?

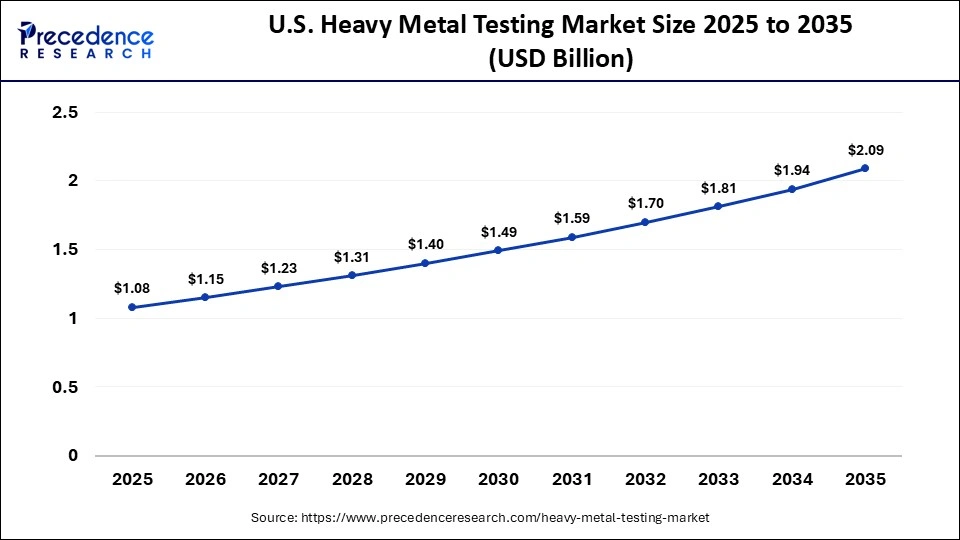

The U.S. heavy metal testing market size is calculated at USD 1.08 billion in 2025 and is expected to reach nearly USD 2.09 billion in 2035, accelerating at a strong CAGR of 6.82% between 2026 and 2035.

U.S. Heavy Metal Testing Market Trends

The U.S. is the leading country in the global market, largely due to its robust regulatory framework enforced by the U.S. Environmental Protection Agency and the Food and Drug Administration, which set de facto global benchmarks for permissible heavy metal limits and testing methodologies. High public awareness of contamination-related health risks, combined with strict compliance obligations, sustained public and private R&D investment, and advanced laboratory deployment of ICP-MS and AAS technologies, reinforces the country's position as the primary reference market for regulatory-grade heavy metal testing worldwide.

Why Is Asia Pacific Expected to Be the Fastest-Growing in the Heavy Metal Testing Market in the Coming Years?

Asia Pacific is expected to experience the fastest growth, with a CAGR of 6.5%, supported by rapid industrialization, accelerating urban population growth, and expanding regulatory oversight of environmental and public health risks. Manufacturing intensity across metals, chemicals, electronics, textiles, and pharmaceuticals has materially increased the probability of heavy metal release into water bodies, agricultural soils, and ambient air, prompting governments to tighten monitoring and enforcement mechanisms. In countries such as China and India, large-scale industrial clusters and high-density urban centers have made routine heavy metal surveillance a regulatory necessity rather than a discretionary practice.

Stricter policy implementation across drinking water safety, food contamination limits, and industrial effluent discharge standards is translating into higher testing volumes across environmental, food, and pharmaceutical matrices. China's expanded environmental inspection regimes and India's strengthening of water and food safety compliance frameworks have increased demand for accredited analytical testing, particularly for lead, mercury, cadmium, and arsenic in high-risk regions. This regulatory momentum is complemented by sustained public-sector and private-sector investment in laboratory infrastructure, method development, and analyst training.

Capacity expansion is further supported by the rollout of advanced analytical platforms, including inductively coupled plasma mass spectrometry and atomic absorption spectroscopy, across both government laboratories and private testing providers. Increased funding for R&D and technology upgrades is improving detection sensitivity, sample throughput, and data reliability, enabling laboratories in the region to meet international testing standards for export-oriented industries.

India Heavy Metal Testing Market Trends

India stands out as the fastest-growing market within the Asia-Pacific region, driven by the need to comply with international trade requirements and the tightening of domestic regulatory oversight. Enforcement by the Food Safety and Standards Authority of India has expanded routine heavy metal testing across packaged foods, nutraceuticals, and raw agricultural inputs, while parallel monitoring of drinking water and industrial effluents has increased under state and central pollution control authorities. Rising middle-class health awareness, combined with sustained investment in public and private laboratory infrastructure and the adoption of high-sensitivity analytical techniques, is structurally expanding India's testing capacity and long-term market demand.

How Will Europe Contribute to the Heavy Metal Testing Market in the Coming Years?

In Europe, the market is projected to grow at a notable rate in the foreseeable future due to a combination of regulatory, institutional, and consumer-driven factors. Growth is primarily anchored in the region's stringent and harmonized regulatory framework, advanced laboratory infrastructure, and sustained public demand for product and environmental safety. European consumers and institutional buyers place a high premium on traceability and compliance, which translates into routine heavy metal testing across food, consumer goods, industrial materials, and environmental samples rather than episodic testing.

The region hosts several globally influential testing, inspection, and certification providers, including Eurofins Scientific, SGS S.A., Intertek Group plc, and TÜV SÜD. These organizations operate extensive laboratory networks across EU member states, offering accredited heavy metal testing services for regulatory compliance, product certification, and cross-border trade. Their close integration with regulatory authorities and industry associations reinforces Europe's role as a reference region for compliance-grade analytical testing.

At the policy level, the European Union enforces legally binding instruments such as the REACH Regulation and the RoHS Directive, which impose strict limits on hazardous substances, including heavy metals, across chemicals, electronics, industrial components, and consumer products. Compliance with these regulations is mandatory for market access, compelling manufacturers and importers to conduct systematic heavy metal testing at multiple stages of production and supply chains. This regulatory architecture ensures structurally consistent demand for high-precision analytical services, supporting steady market expansion across Europe driven by enforcement, standardization, and public health protection.

Germany Heavy Metal Testing Market Trends

Germany plays a key role in the global market for heavy metal testing, underpinned by strict product quality and safety standards and a highly developed testing infrastructure aligned with broader European Union requirements. National enforcement by authorities such as the Federal Institute for Risk Assessment supports rigorous assessment of heavy metal risks in food, consumer products, and industrial materials, reinforcing compliance discipline across supply chains. Continued investment in analytical innovation, accreditation, and laboratory automation, combined with strong export-oriented manufacturing and a regulatory culture centered on consumer protection, sustains Germany's influence as a benchmark market within Europe.

What Has Caused the Emergence of Latin America in the Heavy Metal Testing Market?

Latin America is a significant region in the global heavy metal testing market, with growth driven by accelerating industrial activity, tightening regulatory oversight, rising public awareness of contamination-related health risks, and gradual upgrades in analytical capability. Expansion of mining, metallurgy, agribusiness, food processing, and petrochemical operations has increased the risk of heavy metal release into water sources, soils, and food supply chains, prompting governments to strengthen monitoring and enforcement mechanisms. As a result, testing demand is increasingly compliance-led rather than voluntary, particularly in high-risk industrial corridors.

Rising consumer awareness across urban populations is also reshaping manufacturer behavior. Greater public attention to lead, mercury, arsenic, and cadmium exposure has increased pressure on food producers, beverage companies, and consumer goods manufacturers to demonstrate contaminant-free sourcing and production. This has translated into higher volumes of routine batch testing, supplier qualification testing, and import-export verification, especially for products destined for international markets with strict safety requirements.

At the regulatory level, national authorities across the region are reinforcing permissible heavy metal limits and inspection protocols for food, drinking water, and consumer products. In countries such as Brazil and Argentina, food safety agencies and environmental regulators have expanded surveillance programs and laboratory accreditation requirements to align more closely with international standards. These measures are supported by ongoing investment in laboratory modernization, including the adoption of higher-sensitivity analytical techniques and improved quality systems, which together are strengthening Latin America's capacity to support sustained growth in regulatory-grade heavy metal testing.

Brazil Heavy Metal Testing Market Trends

Brazil is a notable player in Latin America, with steady growth driven by regulatory compliance requirements in mining, agriculture, and export-oriented manufacturing. Oversight and accreditation reforms led by the INMETRO have strengthened laboratory certification, calibration traceability, and conformity assessment, improving the credibility of heavy metal testing results for domestic enforcement and international trade. Demand is further reinforced by EU-bound export mandates for agricultural commodities and mineral products, alongside heightened public health scrutiny linked to water and soil contamination from illegal and small-scale mining activities, which has expanded routine environmental and food testing across affected regions.

How Will the Middle East and Africa Surge in the Heavy Metal Testing Market in the Forecasted Period?

The Middle East and Africa (MEA) is a key contributing region to the global heavy metal testing market, supported by accelerating industrial activity, large-scale mining and agricultural operations, mounting environmental contamination risks, and rising awareness of product safety. Expansion of extractive industries, oil and gas processing, fertilizer production, and irrigated agriculture has increased the likelihood of heavy metal presence in water sources, soils, and downstream food chains, making systematic testing an operational and regulatory necessity rather than a voluntary measure.

Governments across the region are strengthening enforcement of environmental protection and public health regulations, mandating routine testing of drinking water, industrial effluents, food products, and personal care items. National regulators and standards bodies are increasingly aligning permissible heavy metal limits with international benchmarks to support export competitiveness and reduce public health risks. These regulatory measures are driving demand for accredited laboratory services capable of delivering defensible, compliance-grade analytical results.

Saudi Arabia Heavy Metal Testing Market Trends

Saudi Arabia is part of the growing market within the Middle East and Africa, with demand anchored in formal regulatory enforcement rather than general awareness alone. Oversight by the Saudi Food and Drug Authority has expanded mandatory heavy metal testing across imported and domestically produced foods, bottled water, dietary supplements, and personal care products, with compliance tied directly to product registration and market access. Parallel monitoring of drinking water quality and industrial effluents under national environmental regulations, combined with industrial wastewater scrutiny linked to desalination, petrochemicals, and mining activities, is structurally increasing routine heavy metal testing volumes across the country.

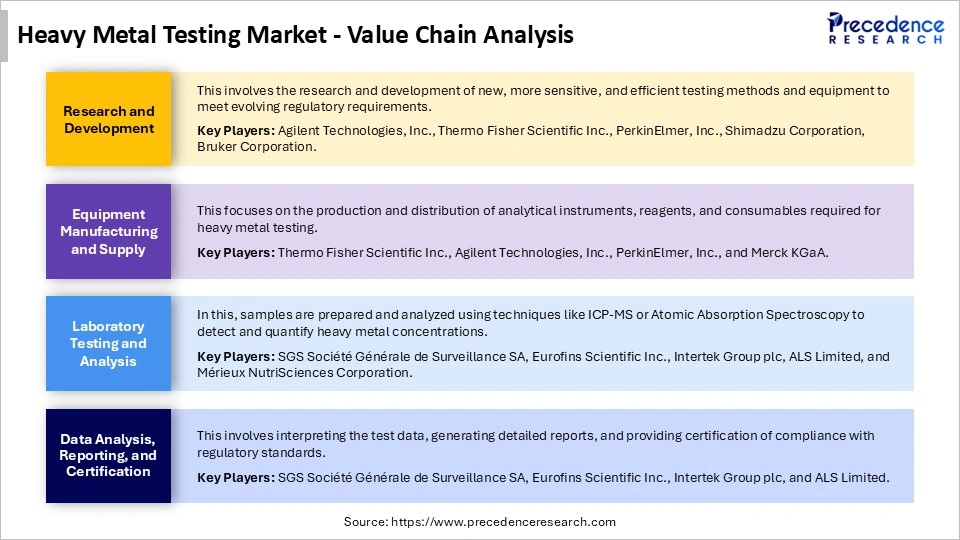

Heavy Metal Testing Market Value Chain

Top Companies for the Heavy Metal Testing Market and Their Offerings

- SGS S.A.

- Eurofins Scientific SE

- Intertek Group plc

- Bureau Veritas SA

- ALS Limited

- TUV SUD AG

- Mérieux NutriSciences

- LGC Group

- AsureQuality Limited

- Microbac Laboratories, Inc.

- EMSL Analytical, Inc.

- OMIC USA Inc.

- R J Hill Laboratories Limited

- Pace Analytical Services, LLC

- NSF International

Recent Developments

- In October 2024, Agilent Technologies launched its next-generation InfinityLab LC Series, featuring the 1290 Infinity III LC, 1260 Infinity III Prime LC, and 1260 Infinity III LC systems, all available in biocompatible versions. These HPLC systems introduce Agilent InfinityLab Assist Technology, enhancing automation, connectivity, and error reduction, while improving sample tracking through barcoding and camera technologies to reduce training time and boost confidence in results.(Source: https://analyticalscience.wiley.com)

- In February 2025, Axiom Foods debuted Oryzatein 2.0, a rice protein free from detectable heavy metals, available in isolate and organic versions. This launch responds to concerns about heavy metal contamination in plant-based proteins, supported by independent testing. Food scientist Rick Ray noted that while plants naturally contain trace heavy metals, Axiom Foods ensures they remain below toxic levels.(Source: https://vegconomist.com)

Segments Covered in the Report

By Type

- Arsenic

- Lead

- Cadmium

- Mercury

- Others

By Technology/Method

- ICP-MS

- AAS

- ICP-OES

- XRF

- Others

By Application

- Food Safety Testing

- Environmental Testing

- Clinical Diagnostics

- Industrial Quality Control

- Others

By Sample Type

- Food & Beverages

- Water

- Soil

- Blood & Biological

- Others

By End-User

- Laboratories

- Government

- Industrial

- Environmental Agencies

- Others

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting