What is the Pharmaceutical Intermediates MarketSize?

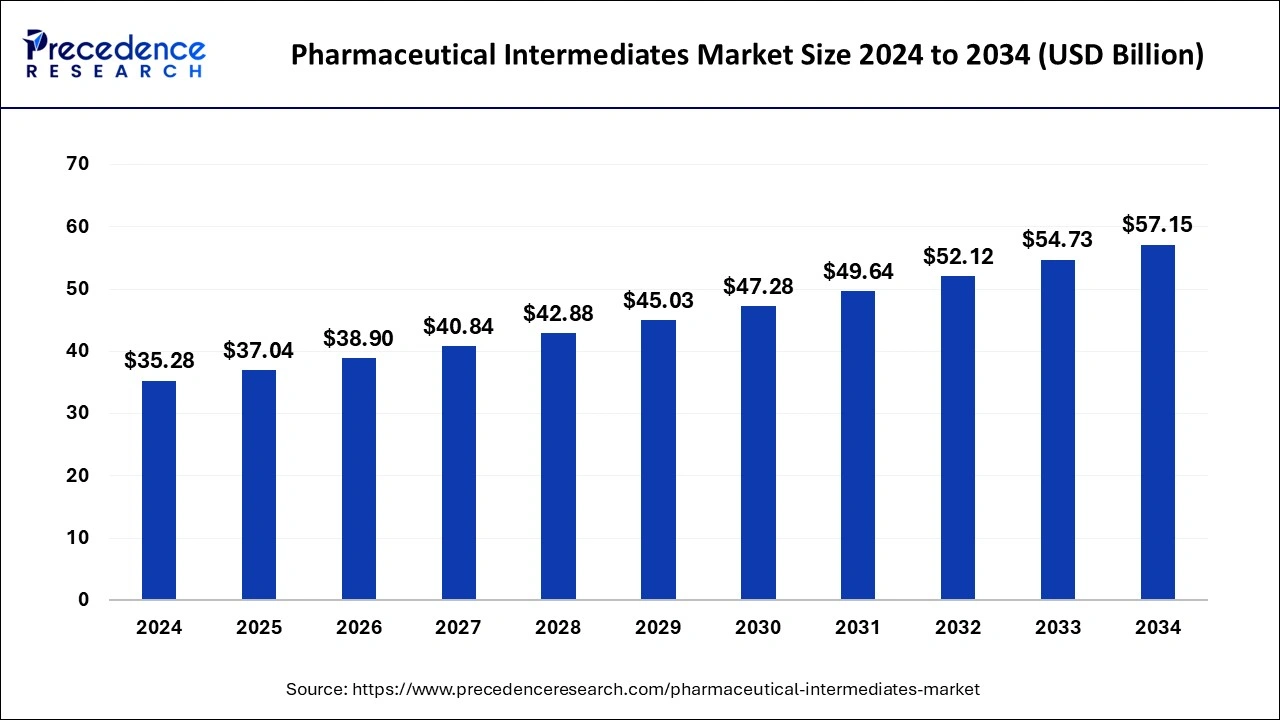

The global pharmaceutical intermediates market size is calculated at USD 37.04 billion in 2025 and is predicted to increase from USD 38.90 billion in 2026 to approximately USD 59.70 billion by 2035, expanding at a CAGR of 4.89% from 2026 to 2035. The pharmaceutical intermediates market is driven by the growing global burden of chronic diseases, fueling the need for drugs; the aging population, rising medication needs, and even significant R&D investment in novel therapies, mainly personalized medicine.

Market Highlights

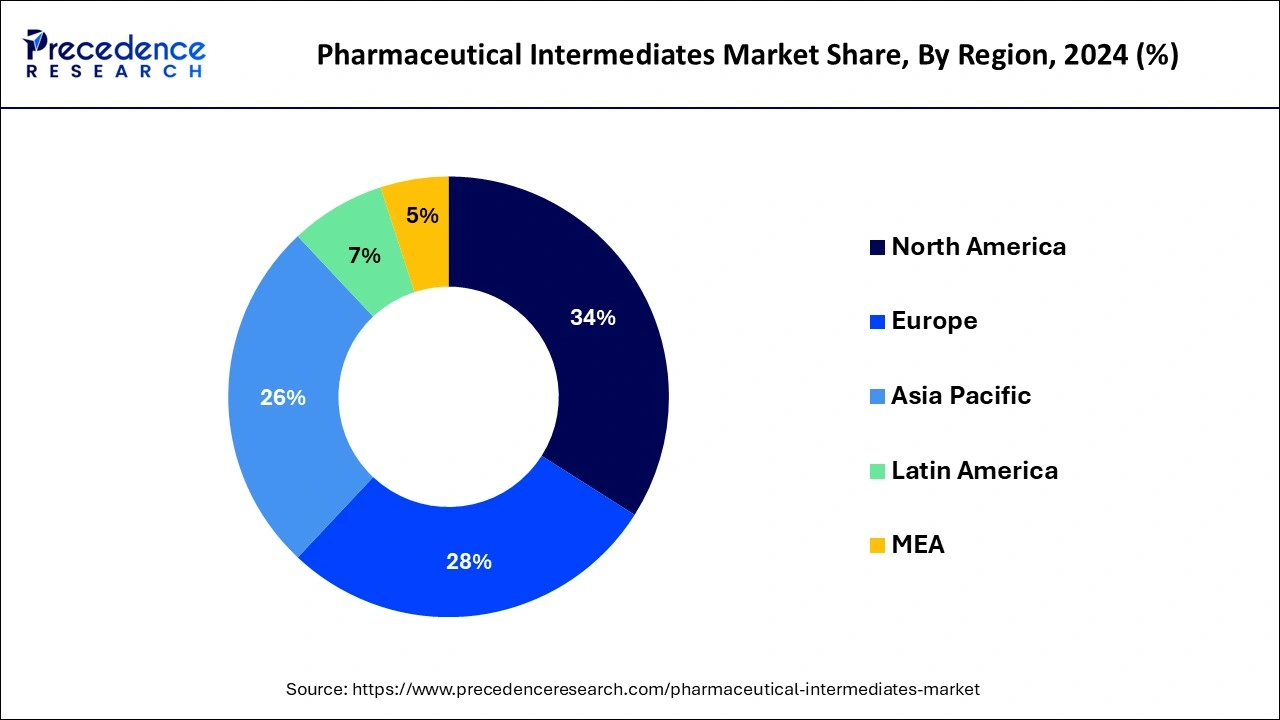

- North America held market share of 33.14% in 2025.

- By product, the bulk drug intermediates segment is expected to capture the biggest revenue share in 2025.

- By application, the analgesics segment is expected to acquire the largest share in 2025.

- By end user, the CROs/CMOs segment registered the maximum market share in 2025.

What are Pharmaceutical Intermediates?

Pharmaceutical intermediates are vital chemical compounds, or molecular building blocks, manufactured during the multi-step synthesis of the Active Pharmaceutical Ingredient (API), which is the actual therapeutic section of a medicine.

Key AI Integration in the Pharmaceutical Intermediates Industry

Artificial intelligence is profoundly implemented into the pharmaceutical industry, mainly within the pharmaceutical intermediates market, by rising efficiency, reducing expenses, and accelerating innovation over the entire value chain from R&D to manufacturing, along with supply chain management. Machine learning models improve the supply chain by managing inventory levels, forecasting demand patterns, and even streamlining logistics more effectively. This enhances resilience and assists in avoiding stock shortages or overstocking, especially vital for sensitive materials such as drug intermediates.

Pharmaceutical Intermediates Market Growth Factors

The rising prevalence of chronic disease and growing geriatric population are the primary factors that drive the demand for the drug development intermediates for the treatment of various chronic diseases. According to the World Health Organization, diabetes is a major cause of stroke, heart attacks, and kidney failure. Further, the geriatric population is expected to reach closer to 2 million by the year 2050. These factors drive the demand for the pharmaceutical intermediates across the globe. Moreover, the rising investments and government support in the developed nations like US, to develop and expand the biopharmaceutical industry to develop biologics and gene-targeted drugs for the treatment of various chronic diseases like cancer and leukemia are among the significant factors that contributes towards the growth of the global pharmaceutical intermediates market. Furthermore, the demand for the branded drugs and generic drugs is rising exponentially all over the globe owing to the rising burden of chronic diseases among the population that propels the growth of the market.

The rapid growth of the biopharmaceutical industry, which accounts for around 20% of the global pharmaceutical industry is expected to be one of the major growth drivers in the forthcoming years. The biopharmaceutical industry is gaining rapid traction owing to the development of various life-saving drugs that can cure cancer, tumors, and various other chronic diseases with minimal side effects. Thereby, people are increasingly adopting the biotechnological pharmaceutical products across the globe, especially in the developed regions like North America and Europe. Moreover, the rising adoption of the pharmaceutical intermediates across various research centers and institutes is expected to provide various growth prospects to the market players in the upcoming future. Further, the strict government regulations regarding the standardization and implementation of good manufacturing practices is playing a crucial role in boosting the credibility of the pharmaceutical companies across the globe.

Pharmaceutical Intermediates Market Outlook

- Industry Growth Overview: The market is driven by the rising need for generic/specialty drugs, R&D in biopharma, along outsourcing to CDMOs. Key trends involve adopting advanced tech such as green synthesis, continuous flow chemistry, and AI, alongside a strategic aim on high-potency or chiral intermediates for oncology, while handling supply chain risks and geopolitical impacts.

- Major Investors:It involves large chemical/pharma giants such as BASF, Evonik, Lonza, Merck KGaA, and specialized CDMOs like WuXi AppTec, Cambrex, and Dishman Carbogen Amcis.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 37.04 Billion |

| Market Size in 2026 | USD 38.90 Billion |

| Market Size by 2035 | USD 59.70 Billion |

| Growth Rate from 2026 to 2035 | CAGR of 4.89% |

| Largest Market | North America |

| Fastest Growing Market | Asia Pacific |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | Product, Application, and End User |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Segment Insights

Product Insights

Based on product, the bulk drug intermediates segment accounted largest revenue share in 2024. Bulk drug intermediates are extensively used for making active pharmaceutical ingredient (API). API is the key ingredient used in the manufacturing of drugs that gives the desired therapeutic effect. Moreover, government initiatives to promote and develop bulk drug parks is estimated to drive the growth of this segment. For instance, the Department of Pharmaceuticals prioritizes a list of 56 APIs under Make-in-India initiative.

On the other hand, the custom intermediates is expected to be the fastest-growing segment during the forecast period. Custom drug intermediates means customization of specific molecule up to a certain scale to get the desired therapeutic affect or results. This segment is slowly gaining traction in the market.

Application Insights

Based on application, the analgesics segment accounted for around 30% of the global pharmaceutical intermediates market and is expected to sustain its dominance in near future. Analgesics are extensively used for the pain relief. The rising prevalence of chronic ailments such as arthritis, cancer, and cardiovascular diseases is boosting the growth of this segment.

On the other hand, the anti cancer drugs is expected to grow at a rapid rate during the forecast period. This is owing to the rising prevalence of cancer among the global population. According to the International Agency for Research on Cancer, in 2020, around 19.3 million new cancer cases and 10 million cancer deaths were reported across the globe. Therefore, this segment is estimated to be the fastest-growing segment.

End User Insights

Based on end user, the CROs/CMOs segment lead the global pharmaceutical intermediates market in 2023, in terms of revenue and is estimated to sustain its dominance during the forecast period. The rising penetration and rapid growth of the contract manufacturing organizations and contract research organizations have significantly boosted the demand for the pharmaceutical intermediates for the production and research purposes of drugs.

On the other hand, research laboratories are expected to grow at a rapid rate during the forecast period. The rising private investments in the research activities in the pharmaceutical industry for the development of new drugs is estimated to drive the growth of this segment.

Key Companies & Market Share Insights

The market is moderately fragmented with the presence of several local companies. These market players are striving to gain higher market share by adopting strategies, such as investments, partnerships, and acquisitions & mergers. Companies are also spending on the development of improved products. Moreover, they are also focusing on maintaining competitive pricing.

The various developmental strategies like acquisitions and mergers fosters market growth and offers lucrative growth opportunities to the market players.

Regional Insights

What is the U.S. Pharmaceutical Intermediates Market Size?

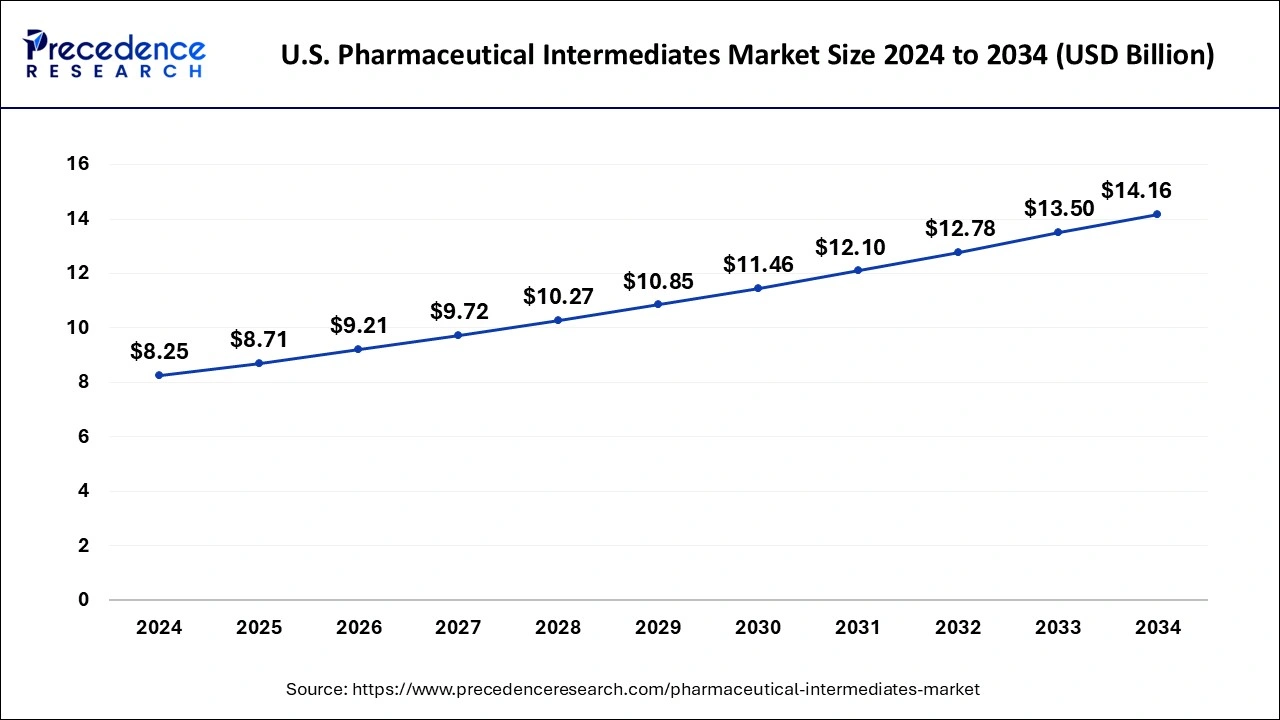

The U.S. pharmaceutical intermediates market size is exhibited at USD 8.71 billion in 2025 and is projected to be worth around USD 14.86 billion by 2035, growing at a CAGR of 5.49% from 2026 to 2035.

U.S. Pharmaceutical Intermediates Market Trends

The U.S. market is driven by rising chronic diseases, the need for high-purity and specialized APIs (especially oncology), and even shifts towards sustainable, along with efficient manufacturing (AI, biocatalysis, continuous flow).

Based on region, the North America dominated the global pharmaceutical intermediates market in 2024, in terms of revenue and is estimated to sustain its dominance during the forecast period. North America is dominating market due to the presence of numerous pharmaceutical companies, research centers and laboratories, and rapidly growing CMOs & CROs in the US and Canada. Further, rising investments by the government and private players to boost the growth of the biopharmaceutical industry is expected to sustain the dominating position of North America throughout the forecast period.

On the other hand, Asia Pacific is estimated to be the most opportunistic market during the forecast period. The rising investments by the market players to set up manufacturing facilities in the nations like China, India, Japan, South Korea, and Singapore owing to the easy and cheap availability of factors of production and favorable government policies is boosting the growth of the pharmaceutical intermediates market during the forecast period.

China Pharmaceutical Intermediates Market Trends

China's pharma intermediates market is growing, shifting from basic production to innovation, driven by cost-effectiveness, rising domestic demand, advanced tech (flow chemistry), and stricter green/quality regulations (GMP).

Value Chain Analysis of the Pharmaceutical Intermediates Market

- R&D

They focus on developing efficient, high-quality, and even scalable methods for synthesizing the chemical building blocks (intermediates) required to manufacture Active Pharmaceutical Ingredients (APIs). It mainly involves chemical process development and even optimization rather than the wider clinical trials of the final drug product. - Formulation and Final Dosage Preparation

In the pharmaceutical supply chain, formulation and final dosage preparation are more distinct from the manufacturing of pharmaceutical intermediates. Intermediates are the precursor chemical compounds utilized to synthesize the Active Pharmaceutical Ingredient (API), which is then utilized in the final formulation process.

Top Companies in Pharmaceutical Intermediates Market & Their Offerings

- Green Vision Life Sciences: Green Vision Life Sciences provides comprehensive solutions for the pharma intermediates market, aiming at custom synthesis, process R&D, contract manufacturing, and scale-up, from lab grams to metric tons, and then leveraging green chemistry principles along with advanced R&D for high-quality, sustainable manufacturing of complex chemical entities, which includes API intermediates.

- Midas Pharma GmbH: Midas Pharma GmbH provides a comprehensive suite of products along with services for the pharmaceutical intermediates market, aiming to source, develop, and even supply key building blocks along with advanced intermediates for small molecule APIs and biopharma.

Pharmaceutical Intermediates Market Companies

- Aceto Corporation

- BASF SE

- Chiracon GmbH

- Yin-sheng Bio-tech Co. Ltd.

- Dishman Group

- Sanofi SAIS

- Vertellus Holdings LLC.

- Lonza Group

Segments Covered in the Report

By Product

- Chemical Intermediates

- Bulk Drug Intermediates

- Custom Intermediates

By Application

- Analgesics

- Ant-inflammatory Drug

- Cardiovascular Drugs

- Anti-Diabetic Drugs

- Anti-Cancer Drugs

- Others

By End User

- Biotech and Pharma Companies

- Research Laboratory

- CMO/CRO

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting